|

METHODS OF PROJECT EVALUATIONS 2 |

| << METHODS OF PROJECT EVALUATIONS, Net present value, Weighted Average Cost of Capital |

| METHODS OF PROJECT EVALUATIONS 3 >> |

Corporate

Finance FIN 622

VU

Lesson

10

METHODS

OF PROJECT EVALUATIONS

The

following topics will be

discussed in this hand out.

Methods

of Project evaluations:

Internal

Rate of Return IRR

Associated

topics to be covered:

NPV

vs. IRR

Criticism of

IRR

The

Internal Rate of Return

(IRR)

The

IRR is the discount rate at which the

NPV for a project equals

zero. This rate means that

the present

value

of the cash inflows for the

project would equal the

present value of its

outflows.

The

IRR is the break-even discount

rate.

The

IRR is found by trial and

error.

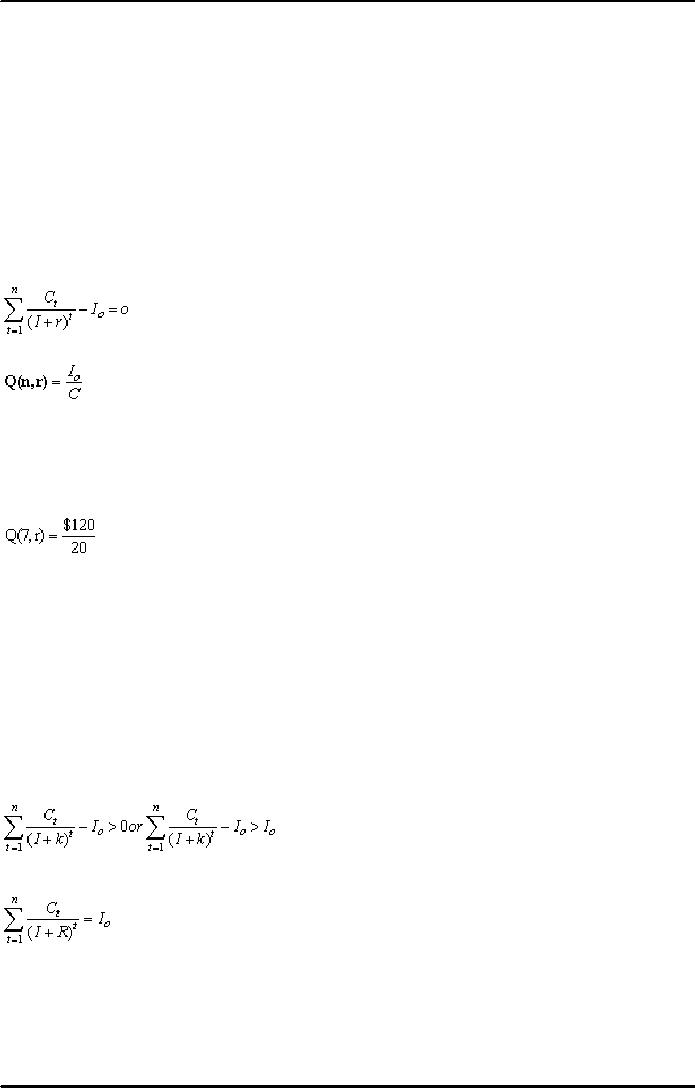

Where

r = IRR

IRR of

an annuity:

Where:

Q

(n, r) is the discount

factor

Io is the

initial outlay

C

is

the uniform annual receipt (C1 = C2 =....= Cn).

Example:

What

is the IRR of an equal annual

income of $20 per annum

which accrues for 7 years

and costs $120?

=6

Net

present value vs. Internal

rate of return:

Independent

vs. dependent

projects

NPV

and IRR methods are

closely related

because:

i)

both

are time-adjusted measures of

profitability, and

ii)

Their

mathematical formulas are almost

identical.

So,

which method leads to an

optimal decision: IRR or

NPV?

a) NPV

vs. IRR: Independent

projects

Independent

project: Selecting one project

does not preclude the

choosing of the other.

With

conventional cash flows (-|+|+) no

conflict in decision arises; in this

case both NPV and

IRR lead to

the

same accept/reject decisions.

Mathematical

proof: for a project to be

acceptable, the NPV must be positive,

i.e.

Similarly

for the same project to be

acceptable:

Where

R

is

the IRR.

Since

the numerators Ct

are identical

and positive in both

instances:

*

Implicitly/intuitively R must be greater

than k (R > k);

* If

NPV = 0 then R = k: the company is

indifferent to such a project;

*

Hence, IRR and NPV

lead to the same decision in this

case.

b) NPV

vs. IRR: Dependent

projects

NPV

clashes with IRR where

mutually exclusive projects

exist.

29

Corporate

Finance FIN 622

VU

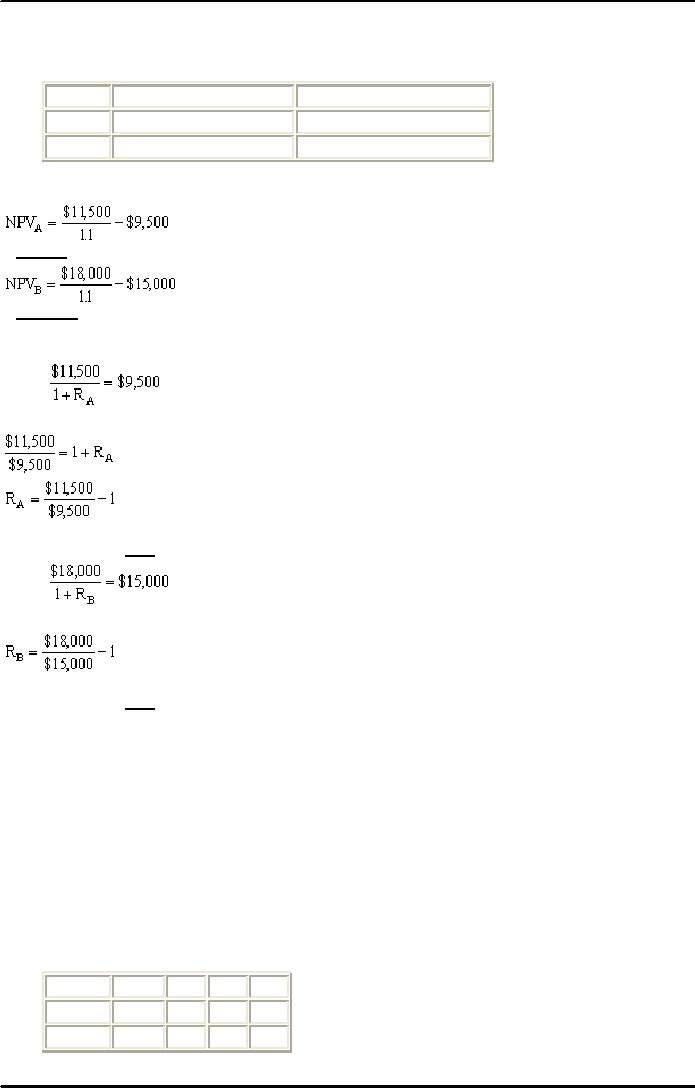

Example:

Agritex

is considering building either a

one-storey (Project A) or five-storey (Project B)

block of offices on a

prime

site. The following

information is available:

Initial

Investment Outlay Net Inflow at

the Year End

Project A

-9,500

11,500

Project B

-15,000

18,000

Assume

k = 10%, which project should

Agritex undertake?

=

$954.55

=

$1,363.64

Both

projects are of one-year

duration:

IRRA:

$11,500

= $9,500 (1 +RA)

=

1.21-1

Therefore

IRRA =

21%

IRRB:

$18,000

= $15,000(1 + RB)

=

1.2-1

Therefore

IRRB =

20%

Decision:

Assuming

that k = 10%, both projects

are acceptable

because:

NPVA and NPVB

are

both positive

IRRA > k AND IRRB >

k

Which

project is a "better option"

for Agritex?

If we

use the NPV method:

NPVB ($1,363.64) > NPVA ($954.55): Agritex should

choose Project B.

If we

use the IRR method:

IRRA (21%) > IRRB (20%): Agritex should choose

Project A.

Differences

in the scale of

investment

NPV

and IRR may give conflicting

decisions where projects

differ in their scale of investment.

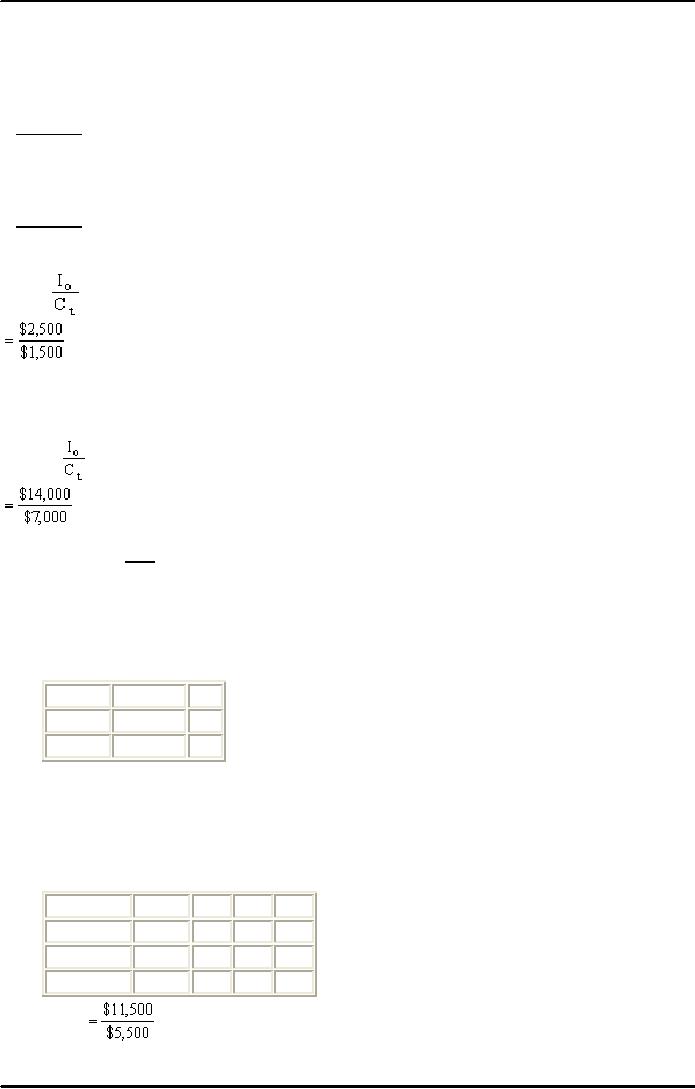

Example:

Years

0

1

2

3

Project A

-2,500 1,500 1,500

1,500

Project B

-14,000 7,000 7,000

7,000

30

Corporate

Finance FIN 622

VU

Assume

k= 10%.

NPVA =

$1,500 x PVFA at 10% for 3

years

=

$1,500 x 2.487

=

$3,730.50 - $2,500.00

=

$1,230.50.

NPVB ==

$7,000 x PVFA at 10% for 3

years

=

$7,000 x 2.487

=

$17,409 - $14,000

=

$3,409.00.

IRRA =

=

1.67.

Therefore

IRRA = 36%

(from the tables)

IRRB =

=

2.0

Therefore

IRRB =

21%

Decision:

Conflicting,

as:

· NPV

prefers B to A

· IRR

prefers A to B

NPV

IRR

Project A $

3,730.50 36%

Project B

$17,400.00 21%

To

show why:

i)

The

NPV prefers B, the larger project,

for a discount rate below

20%

ii)

The

NPV is superior to the IRR

a) Use

the incremental cash flow

approach, "B minus A"

approach

b)

Choosing project B is tantamount to

choosing a hypothetical project "B

minus A".

0

1

2

3

Project

B

-

14,000 7,000 7,000

7,000

Project

A

-

2,500 1,500 1,500

1,500

"B

minus A" - 11,500 5,500

5,500 5,500

IRR"B Minus A"

=

2.09

31

Corporate

Finance FIN 622

VU

=

20%

c)

Choosing B is equivalent to: A + (B - A) =

B

d)

Choosing the bigger project B

means choosing the smaller

project A plus an additional

outlay of

$11,500

of which $5,500 will be

realized each year for the

next 3 years.

e) The

IRR"B minus A"

on the incremental

cash flow is 20%.

f)

Given k of 10%, this is a profitable

opportunity, therefore must be

accepted.

g)

But, if k were greater than

the IRR (20%) on the incremental CF,

then reject project.

h) At the

point of intersection,

NPVA = NPVB or NPVA - NPVB

= 0, i.e.

indifferent to projects A and

B.

i) If k = 20%

(IRR of "B - A") the company should

accept project A.

This

justifies the use of NPV

criterion.

Advantage

of NPV:

It

ensures that the firm

reaches an optimal scale of

investment.

Disadvantage

of IRR:

· It

expresses the return in a percentage

form rather than in terms of

absolute dollar returns,

e.g. the

IRR

will prefer 500% of $1 to 20% return on

$100. However, most

companies set their goals

in

absolute

terms and not in % terms,

e.g. target sales figure of

$2.5 million.

The

timing of the cash

flow

The

IRR may give conflicting

decisions where the timing of

cash flows varies between

the 2 projects.

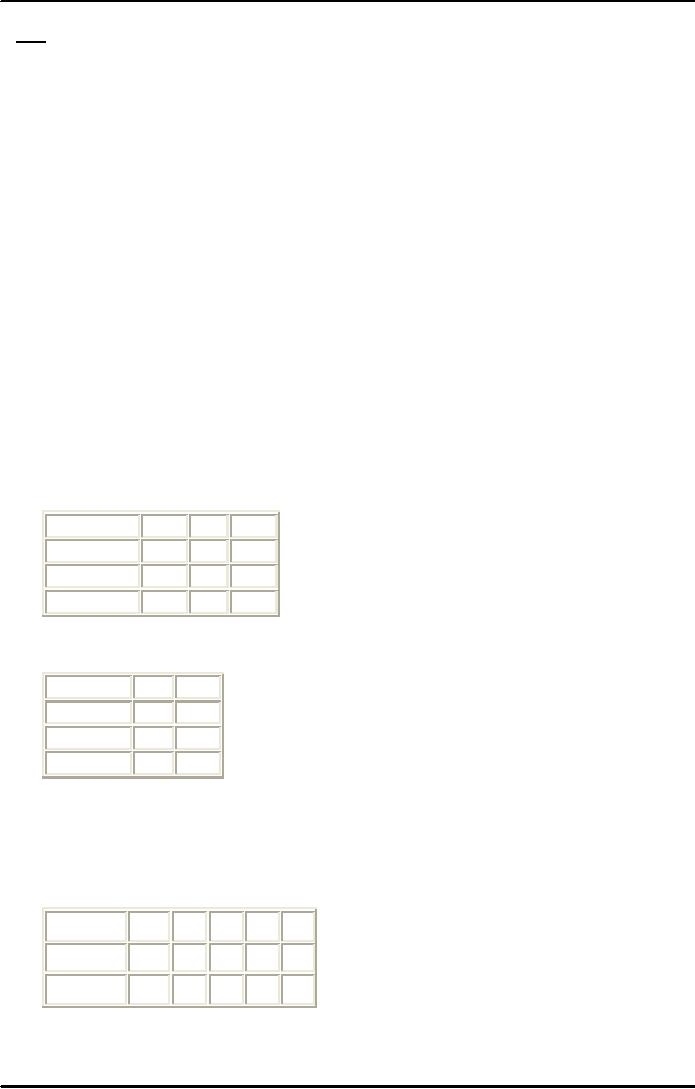

Note

that initial outlay Io is the same.

0

1

2

Project

A

- 100

20

125.00

Project

B

- 100

100

31.25

"A

minus B" 0

- 80

88.15

Assume

k = 10%

NPV

IRR

Project

A

17.3

20.0%

Project

B

16.7

25.0%

"A

minus B" 0.6

10.9%

IRR

prefers B to A even though

both projects have identical

initial outlays. So, the

decision is to accept A,

that

is B + (A - B) = A.

The horizon

problem

NPV

and IRR rankings are

contradictory. Project A earns $120 at the

end of the first year while

project B

earns

$174 at the end of the fourth

year.

0

1

2

3

4

Project

A

-100

120 -

-

-

Project

B

-100

-

-

-

174

Assume

k = 10%

32

Corporate

Finance FIN 622

VU

NPV

IRR

Project A

9

20%

Project B

19

15%

Decision:

NPV

prefers B to A.

IRR

prefers A to B.

33

Table of Contents:

- INTRODUCTION TO SUBJECT

- COMPARISON OF FINANCIAL STATEMENTS

- TIME VALUE OF MONEY

- Discounted Cash Flow, Effective Annual Interest Bond Valuation - introduction

- Features of Bond, Coupon Interest, Face value, Coupon rate, Duration or maturity date

- TERM STRUCTURE OF INTEREST RATES

- COMMON STOCK VALUATION

- Capital Budgeting Definition and Process

- METHODS OF PROJECT EVALUATIONS, Net present value, Weighted Average Cost of Capital

- METHODS OF PROJECT EVALUATIONS 2

- METHODS OF PROJECT EVALUATIONS 3

- ADVANCE EVALUATION METHODS: Sensitivity analysis, Profitability analysis, Break even accounting, Break even - economic

- Economic Break Even, Operating Leverage, Capital Rationing, Hard & Soft Rationing, Single & Multi Period Rationing

- Single period, Multi-period capital rationing, Linear programming

- Risk and Uncertainty, Measuring risk, Variability of return–Historical Return, Variance of return, Standard Deviation

- Portfolio and Diversification, Portfolio and Variance, Risk–Systematic & Unsystematic, Beta – Measure of systematic risk, Aggressive & defensive stocks

- Security Market Line, Capital Asset Pricing Model – CAPM Calculating Over, Under valued stocks

- Cost of Capital & Capital Structure, Components of Capital, Cost of Equity, Estimating g or growth rate, Dividend growth model, Cost of Debt, Bonds, Cost of Preferred Stocks

- Venture Capital, Cost of Debt & Bond, Weighted average cost of debt, Tax and cost of debt, Cost of Loans & Leases, Overall cost of capital – WACC, WACC & Capital Budgeting

- When to use WACC, Pure Play, Capital Structure and Financial Leverage

- Home made leverage, Modigliani & Miller Model, How WACC remains constant, Business & Financial Risk, M & M model with taxes

- Problems associated with high gearing, Bankruptcy costs, Optimal capital structure, Dividend policy

- Dividend and value of firm, Dividend relevance, Residual dividend policy, Financial planning process and control

- Budgeting process, Purpose, functions of budgets, Cash budgets–Preparation & interpretation

- Cash flow statement Direct method Indirect method, Working capital management, Cash and operating cycle

- Working capital management, Risk, Profitability and Liquidity - Working capital policies, Conservative, Aggressive, Moderate

- Classification of working capital, Current Assets Financing – Hedging approach, Short term Vs long term financing

- Overtrading – Indications & remedies, Cash management, Motives for Cash holding, Cash flow problems and remedies, Investing surplus cash

- Miller-Orr Model of cash management, Inventory management, Inventory costs, Economic order quantity, Reorder level, Discounts and EOQ

- Inventory cost – Stock out cost, Economic Order Point, Just in time (JIT), Debtors Management, Credit Control Policy

- Cash discounts, Cost of discount, Shortening average collection period, Credit instrument, Analyzing credit policy, Revenue effect, Cost effect, Cost of debt o Probability of default

- Effects of discounts–Not effecting volume, Extension of credit, Factoring, Management of creditors, Mergers & Acquisitions

- Synergies, Types of mergers, Why mergers fail, Merger process, Acquisition consideration

- Acquisition Consideration, Valuation of shares

- Assets Based Share Valuations, Hybrid Valuation methods, Procedure for public, private takeover

- Corporate Restructuring, Divestment, Purpose of divestment, Buyouts, Types of buyouts, Financial distress

- Sources of financial distress, Effects of financial distress, Reorganization

- Currency Risks, Transaction exposure, Translation exposure, Economic exposure

- Future payment situation – hedging, Currency futures – features, CF – future payment in FCY

- CF–future receipt in FCY, Forward contract vs. currency futures, Interest rate risk, Hedging against interest rate, Forward rate agreements, Decision rule

- Interest rate future, Prices in futures, Hedging–short term interest rate (STIR), Scenario–Borrowing in ST and risk of rising interest, Scenario–deposit and risk of lowering interest rates on deposits, Options and Swaps, Features of opti

- FOREIGN EXCHANGE MARKET’S OPTIONS

- Calculating financial benefit–Interest rate Option, Interest rate caps and floor, Swaps, Interest rate swaps, Currency swaps

- Exchange rate determination, Purchasing power parity theory, PPP model, International fisher effect, Exchange rate system, Fixed, Floating

- FOREIGN INVESTMENT: Motives, International operations, Export, Branch, Subsidiary, Joint venture, Licensing agreements, Political risk