|

STATEMENT OF CHANGES IN EQUITY |

| << SHARE CAPITAL |

| Financial Statements of Limited Companies >> |

Financial

Accounting (Mgt-101)

VU

Lesson-38

STATEMENT

OF CHANGES IN EQUITY

·

Statement

of changes in equity shows the movement

in:

o Share

Capital (issued share

capital)

o Share

Premium

o Nature

of Reserves created

o Un-appropriated

Profit / Loss

o Dividend

Distributed

SHARE

PREMIUM

·

Share

Premium is the amount received in excess

of the face value of the share. Example:

if a Rs. 10

share

is sold for Rs, 12 then

Rs. 2 is share premium.

·

Share

Premium can not be

distributed among the share

holders.

·

It can

be utilized:

o To

issue Bonus Shares

o To

write off Preliminary

Expenses

o To

meet the difference of face value

and cash received in case of

shares issued at discount

o To

meet the expenses of issue of

shares

o For

payment of premium on redemption of

debentures.

RESERVES

·

Capital

Reserve and Fixed Asset

Replacement Reserve are used

for specific purpose. These

are not

distributed

among share holders.

·

General

Reserve and undistributed

profit` can be distributed

among share holders.

·

Revaluation

Reserve is created when an

asset is re-valued from cost

to market value.

·

Revaluation

Reserve can not be

distributed among the share

holders.

·

It can

be utilized for:

o Setting

off any loss on

revaluation

o At the time

of disposal of asset, the reserve

relating to that asset is transferred to

profit &

loss

account.

CASH

FLOW STATEMENT

Cash

Flow Statement shows the movement of

cash resources during the

year. It gives

information

o

about

sources of income and

account heads on which this amount is

spent.

It is an integral

part of financial

statements.

o

NOTES

TO THE ACCOUNTS

Notes

to the accounts are the explanatory notes

of all the items shown in the

profit and loss

account

o

and

the balance sheet.

It is the

requirement of the Companies Ordinance and the

International Accounting

Standards.

o

Following

are explained in Notes to the

accounts:

o

o Nature

of business of the company

o Accounting

Policies of the company

o Details

and explanation of items given in the

Profit and Loss Account

and Balance Sheet.

DEBENTURES

246

Financial

Accounting (Mgt-101)

VU

·

Debentures

are acknowledgement of debt, owed by the

company to the public at large

for a defined

period

of time, and has a mark up

(profit) rate attached to

it.

·

Debentures

are issued under the common seal

(Stamp) of the company.

·

Debenture is an

instrument for obtaining loan from

general public.

·

Mark

up is paid on Debentures which is

generally equal to the market

rate.

TERM

FINANCE CERTIFICATE

·

Term

Finance Certificates are

issued for a defined

period.

·

These

are also issued to obtain

loan from public at

large.

·

Both

Debentures and Term Finance

Certificates are usually

issued by Public Companies.

ILLUSTRATION

ABC

Limted

Trial

balance as on June 30,

2002

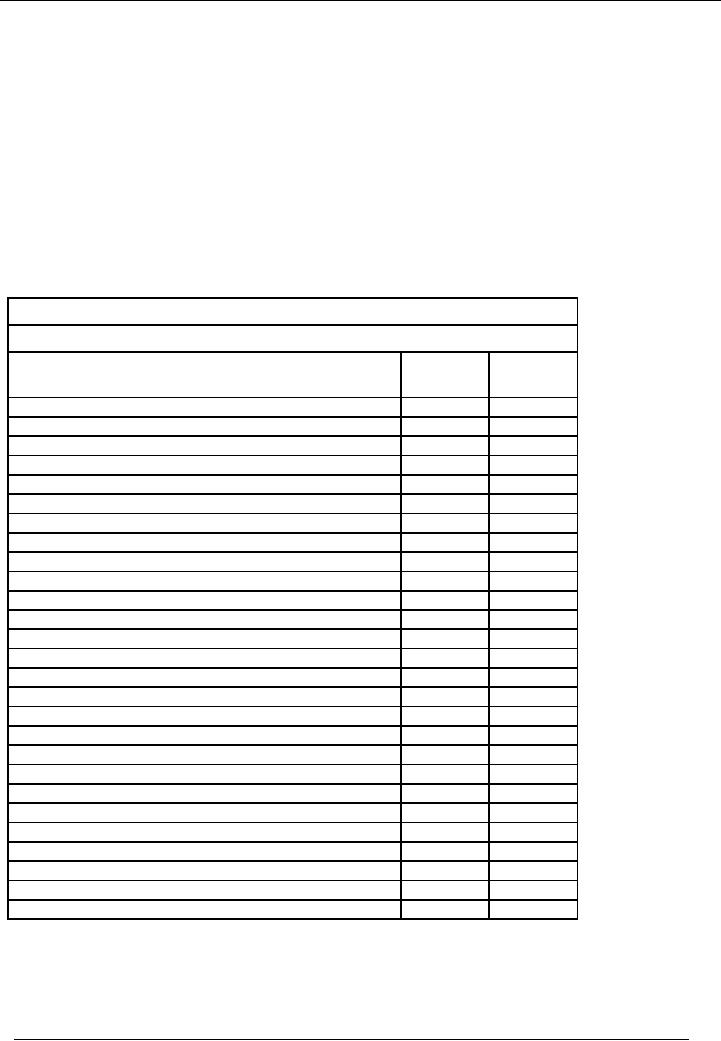

Particulars

Amount

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Authorized

Share Capital (Face value

Rs. 10 each)

1,500,000

Paid

up Capital

1,000,000

Share

Premium

120,000

General

Reserve

48,000

Accumulated

profit brought

forward

139,750

Opening

Stock

336,720

Sales

4,715,370

Purchases

2,475,910

Return

outward

121,220

Return

inward

136,200

Carriage

inward

6,340

Carriage

outward

43,790

Wages

410,240

Salesmen

Salaries

305,110

Admin.

Wages & salaries

277,190

Plant

And Machinery

610,000

Motor

vehicle hire

84,770

Provision

for Depreciation: Plant &

Machinery

216,290

General

Selling Expenses

27,130

General

admin. expenses

47,990

Directors'

Remuneration

195,140

Rent

received

37,150

Trade

Debtors

1,623,570

Cash

and Bank balances

179,250

Trade

Creditors

304,570

Bills

Payable

57,000

Total

6,759,350

6,759,350

ADDITIONAL

INFORMATION

· Closing

stock is valued at Rs.

412,780.

· Accrue

Auditors' remuneration Rs.

71,000.

· Dividend

is proposed @37.5% for the

year.

247

Financial

Accounting (Mgt-101)

VU

·

Depreciate

plant & machinery @20% on

cost.

·

Of the

motor hire, Rs. 55,000 are

for selling purposes.

·

Directors'

remuneration has been as

follows:

o Chairman

46,640

o Managing

Director

51,500

o Finance

Director

46,000

o Marketing

Director

51,000

· 195,140

You

are required to prepare profit &

loss account as on June 30,

2002 and balance sheet

for the reported

period

SOLUTION

While

presenting the financial Statements of

the company, balance sheet is

presented first and profit

&

loss

account is presented later,

but we cannot prepare balance

sheet without preparing profit

and loss

account.

So we will prepare profit

and loss account

first.

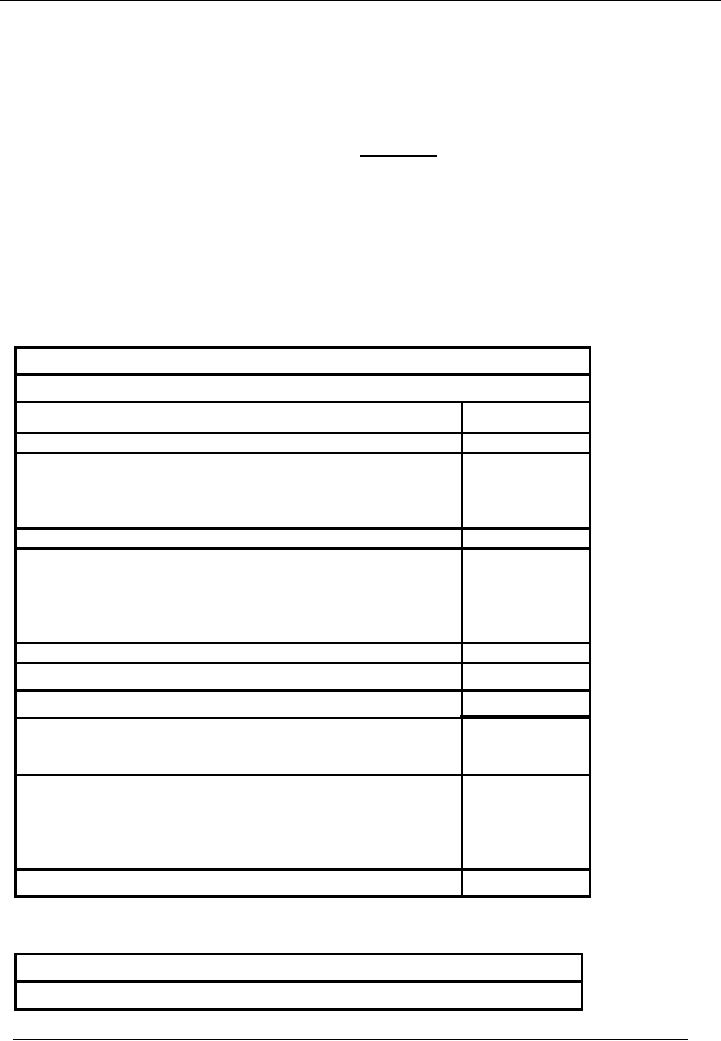

Balance

Sheet

ABC

Limted

Balance

Sheet As At June 30,

2002

Particulars

Note

Fixed

Assets at WDV

3-a

271,710

Current

Assets

Debtors

1,623,570

Stock

in Trade

412,780

Cash

& Bank Balance

179,250

2,215,600

Current

Liabilities

Creditors

304,570

Bills

Payable

57,000

Auditors

Remuneration Payable

71,000

375,000

Proposed

Dividend

807,570

Working

Capital

1,783,030

Net

Assets Employed

1,679,740

Financed

By:

Authorized

Capital

50,000

Shares of Rs. 10 each

1,500,000

Paid

Up Capital

30,000

Shares of Rs. 10 each

1,000,000

Share

Premium

120,000

General

Reserve

48,000

Accumulated

Profit and Loss

Account

511,740

Total

1,679,740

PROFIT

AND LOSS ACCOUNT

ABC

Limted

Profit and

Loss Account for the

Year Ending June 30,

20-2

248

Financial

Accounting (Mgt-101)

VU

Particulars

Note

Amount

Rs.

Amount

Rs

Sales

1

4,579,170

Less:

Cost of Goods Sold

2

(2,695,210)

Gross

Profit

1,883,960

Add:

other income (rent

received)

37,150

Less:

Administrative Expenses

3

692,090

Less:

Selling Expenses

4

482,030

(1,174,120)

746,990

Profit

before tax

0

Less:

Tax for the year

746,990

Profit

after tax

139,750

Add:

Accumulated Profit b/f

886,740

375,000

Less:

Proposed Dividend @

37.5%

5

Net

Profit Carried Forward

511,740

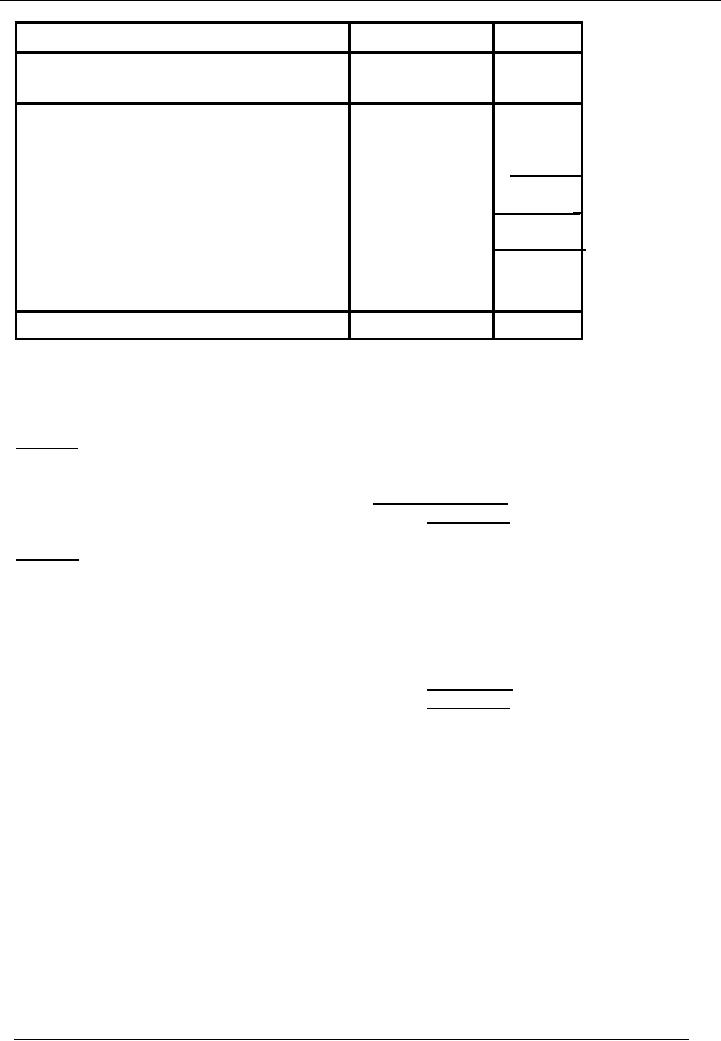

Notes

Sales

Note

# 1

Sales

4,715,370

Less:

Return in

(136,200)

Net

Sales

4,579,170

Cost

of goods sold

Note

# 2

Opening

Stock

336,720

Add:

Purchases

2,475,910

Wages

410,240

Less:

Returns out

(121,220)

Add:

Carriage in

6,340

Less:

Closing Stock

(412,780)

Total

2,695,210

249

Financial

Accounting (Mgt-101)

VU

Note

# 3

Administrative

Expenses

Wages

& salaries

277,190

Motor

Hire

29,770

General

Expenses

47,990

Directors

Remuneration:

Chairman

46,640

Managing

Director

51,500

144,140

Director

Finance

46,000

Auditors

Remuneration

71,000

Depreciation Plant

& Machinery (Note #

3-a)

122,000

Total

692,090

Note

# 3-a

Fixed

Assets

Acc.

Dep.

WDV

Cost

Rate

Opening

For the Yr. Closing

Plant &

Machinery

610,000

20%

216,290

122,000

338,290

271,710

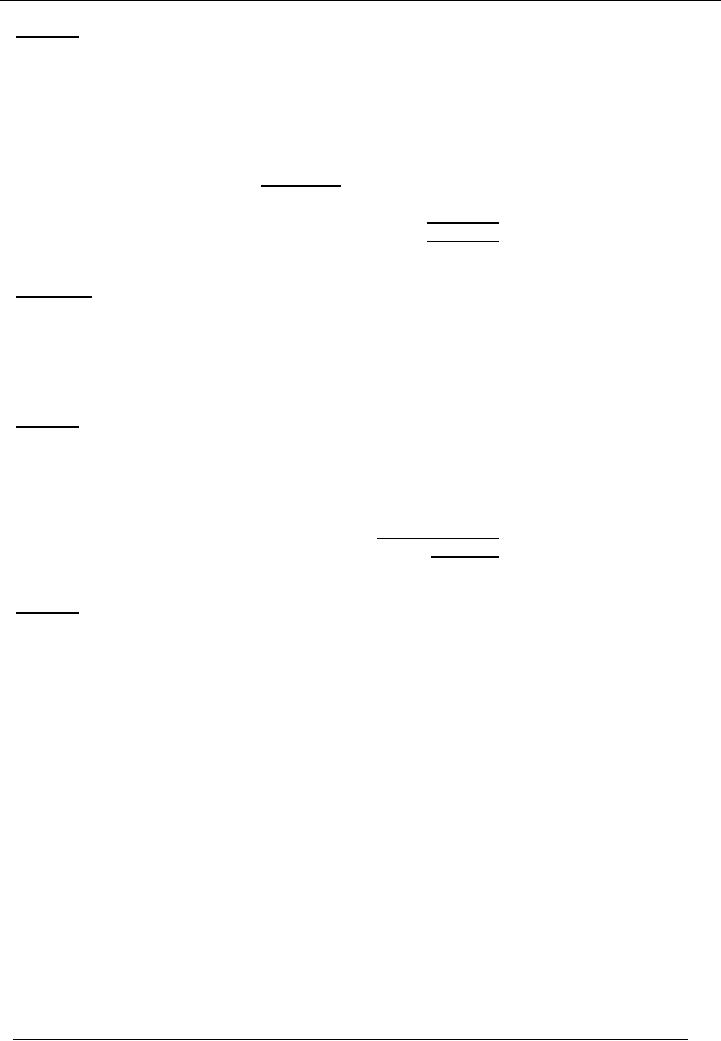

Selling

Expenses

Note

# 4

Salesmen

salaries

305,110

Carriage

out

43,790

General

Expenses

27,130

Motor

Hire

55,000

Marketing

Director's Remuneration

51,000

Total

482,030

Note

# 5

Proposed

Dividend

37.5%

of 1,000,000 (issued

capital)

375,000

250

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES