|

SHARE CAPITAL |

| << DISADVANTAGES OF A PARTNERSHIP FIRM |

| STATEMENT OF CHANGES IN EQUITY >> |

Financial

Accounting (Mgt-101)

VU

Lesson-37

SHARE

CAPITAL

·

The

maximum amount with which a

company gets registration/incorporation

is called authorized

share

capital of that

company.

·

This

capital can be increased

with the prior approval of

security and exchange

commission. This

capital

is further divided in to smaller

denominations called shares.

·

Each

share usually has a face

value equal to Rs. 10.

According to Companies Ordinance, this

face

value

can be increased but can

not be decreased.

·

The

value of share written on

its face is called face

value.

·

Shares

are issued for cash as

well as for any asset.

For example, if any member

of the company sell

his/her

land to the company. In return, company

issue him/her fully paid

shares instead of paying

cash.

Those shares are also

part of paid up capital because

company has received the

benefit of that

amount.

SHARE

CERTIFICATE

·

Share

Certificate is the evidence of ownership of the number of

shares held by a member of the

company.

When a company issue more

than one share to its

member, it does not issue

that number

of

shares to him/her. Instead, it issues a

certificate under the stamp of the company

that a particular

number of

shares are issued to

-------- member of the

company.

SHARES

ISSUED AT PREMIUM

When a

company has a good

reputation and earns huge

profits, the demand of its

shares increases in the

market.

In that case, the company is allowed by

the Companies Ordinance 1984, to issue

shares at a higher

price

than their face value.

Such an issue is called

Shares Issued at Premium.

The amount received; in

excess

of the

face value of the shares is

transferred to an account called

"Share Premium Account". This

account is

used

to:

· Write

off Preliminary Expenses of the

company.

· Write

off the balance amount, in issuing

shares on discount.

· Issue

fully paid Bonus

Shares.

SHARES

ISSUED ON DISCOUNT

When a

company is not making huge

profits, rather it is sustaining loss,

the demand of its shares

decreases in

the

market. If the company needs

extra funds, then it is allowed by the

Companies Ordinance 1984, to

issue

shares

at lesser price than their

face value. Such an issue is

called Shares Issued on

discount.

The

difference of face value and the amount

received is met by share premium

account, if available. If

there

is no

share premium account available, this

difference is shown in the profit and

loss account of that

period,

in

which shares are issued as

loss on issue of shares at

discount.

243

Financial

Accounting (Mgt-101)

VU

CERTIFICATE

OF INCORPORATION/REGISTRATION

When

Security and Exchange

Commission of Pakistan receives

application for registration of a company,

the

registrar

of SECP makes investigation in respect of

compliance with legal

requirements. When he is

satisfied

that

all legal requirements are

complied with. He issues a Certificate of

Incorporation/registration to the

company.

This certificate is evidence that a

separate legal entity has

formed. The company,

after

incorporation/Registration

has the right to sue and to

be sued in its own

name.

DIVIDEND

·

Profit

distributed to the share holders

for their investment in the company is

called Dividend.

·

Dividend

is approved by the share holders in the

annual general meeting at the

recommendation of

the

directors.

·

Dividend

is paid out of profits. If, in

any year, company could not

make any profit. No dividend

will

be paid to

share holders.

·

Dividend

is paid to registered share holders of

the company.

·

Registered

share holders are those

members of the company, who

are enlisted in the register

of

share

holders of the company.

SUBSCRIBERS

/ SPONSORS OF THE COMPANY

Subscribers

/ Sponsors are the persons

who sign articles and

memorandum of the company and

contribute

in the

initial share capital of the

company.

ISSUANCE

OF FURTHER CAPITAL

·

Where

a company wants to issue

further capital (called

raising the capital), shares

are first offered to

current

shareholders.

·

The

issuance of further capital to

Present Shareholders is called

Right

Issue.

·

This

issue is in proportion to current shares

held by the shareholders.

·

The

shareholders can accept or

reject the offer.

·

If

shareholders refuse to accept

these shares then these

are offered to other

people.

JOURNAL

ENTRIES

·

Shares

issued against cash

Debit:

Cash /

Bank Account

Credit:

Share

Capital Account

·

Shares

issued against transfer of

asset:

Debit:

Asset

Account

Credit:

Share

Capital Account

This

is called issuance of asset in

kind.

BONUS

SHARES

· This is

another way of distributing

dividend.

· When

a company decides, not to give

cash to the share holders as

dividend, it issued shares

called

bonus

shares, to the share holders

for which it receives no

cash.

· These

are fully paid

shares.

FINANCIAL

STATEMENTS OF LIMITED

COMPANIES

244

Financial

Accounting (Mgt-101)

VU

·

In

Pakistan, Financial Statements of limited

companies are prepared in

accordance with:

·

International

accounting standards adopted in

Pakistan.

·

Companies

Ordinance 1984.

·

In

case of conflict the requirements of

Companies Ordinance would prevail

over Accounting

Standards.

COMPONENTS

OF FINANCIAL STATEMENTS

Components

of companies' financial statements are as

follows:

· Balance

Sheet

· Profit

and Loss Account

· Cash

Flow Statement

· Statement

of Changes in Equity

· Notes

to the Accounts

· Comparative

figures of Previous Period

EQUITY

Equity

is the total of capital, reserves

and undistributed profit.

That means the amount contributed by

share

holders

plus accumulated profits of the

company. Equity, therefore, represents

the total of shareholders

fund

in the

company.

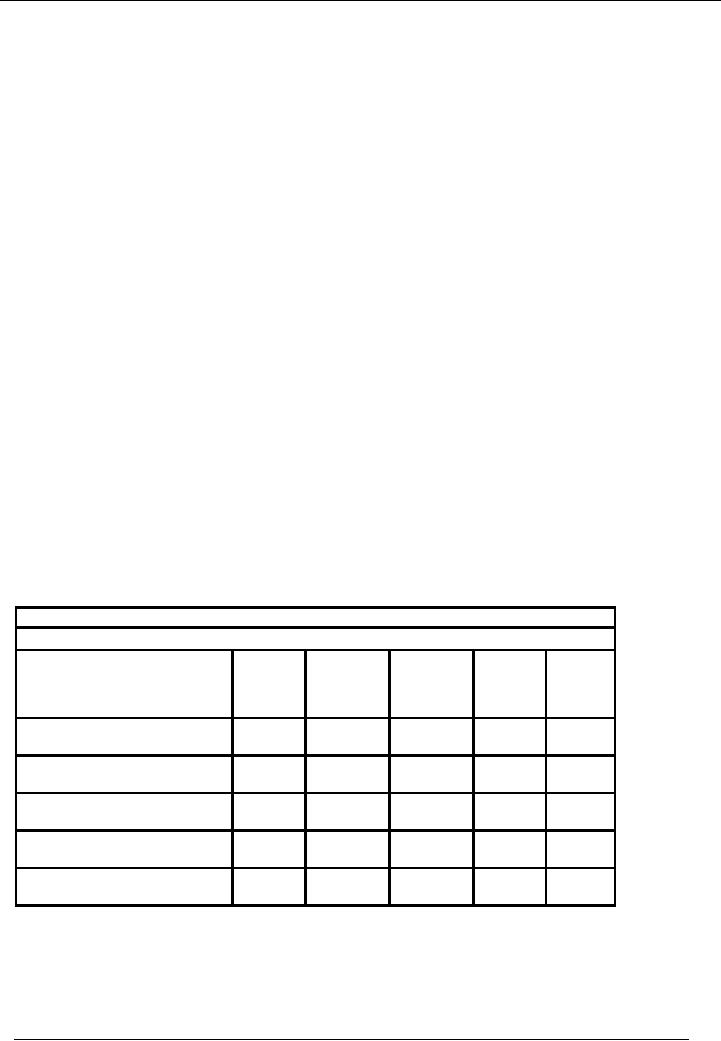

STATEMENT

OF CHANGES IN EQUITY

·

The

statement of changes in equity shows the

movement in the shareholders equity (capital

and

reserves)

during the year.

·

We can

say that it replaces profit

and loss appropriation

account of partnership business.

FORMAT

OF STATEMENT OF CHANGES IN

EQUITY

Name

of the Company

Statement

of Changes in Equity for

Year Ended June 30,

2002

Share

Share

Reserves

Profit

& Total

Capital

Premium

Loss

A/c

Account

Balance

On Jun 30, 2000

X

X

X

X

X

Movements

During the Year

X

X

Balance

On Jun 30, 2001

X

X

X

X

X

Movements

During the Year

X

X

Balance

On June 30, 2002

X

X

X

X

X

245

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES