|

RECAP |

| << Banking transactions, Bank reconciliation statements |

| Accounting Examples with Solutions >> |

Financial

Accounting (Mgt-101)

VU

Lesson-23

RECAP

In the

last lecture we studied, what is Bank

Statement and how does it

differ from our Bank Book.

We told

you

that money lying in our bank

account is our asset. Therefore, it

usually has a DEBIT BALANCE.

Also,

when

we deposit cash in our Bank, we DEBIT the

Bank Book / Bank Account. Whereas,

for Bank, the

money

lying in our Bank Account is a

liability that bank has to

return to us. Therefore, in Bank

Statement

which

is a ledger account for bank

normally has a CREDIT

BALANCE. When we deposit cash in

our bank

account

the liability of the bank to pay us

increases. Therefore, our account in

Books of Bank is

CREDITED.

Bank Statement is, therefore, a MIRROR

IMAGE of our bank book.

Then,

we studied about the reasons that

create differences between

our bank book and bank

statement. Such

as:

· Bank

Charges debited to our bank account by

the bank without our knowledge.

· Profit

credited to our bank

account.

· Payments

made on our behalf by the bank,

through our standing instructions,

that we did not

record

in our

books.

· Money

paid in our account by our

customers, dealers, agents,

etc. without our

knowledge.

· Un-presented

cheques.

· Un-cleared

cheques.

The

last two arise because we

record payment or receipt in

our books when we receive / issue a

cheque. But

the bank

records the transaction in our

account at the time of actual receipt or

payment. These

differences

are

included in the bank reconciliation statement.

The first four items

are either adjusted in the bank book

or

shown

in the reconciliation statement, depending

upon whether we have closed

our books for the period

or

not.

If we have closed our books of

accounts, these differences

will be presented in the bank

reconciliation

statement.

If our books of accounts are

not closed as yet, we will

adjust our bank book and

give effect of all

these

adjustments in the bank

book.

The

main idea behind bank

reconciliation is that we adjust

our bank book for the

transactions, that

remain

untraced,

either through a Voucher (charges,

profit, standing instruction) or

through a Reconciliation

Statement

(un-presented, un-credited

cheques).

EXAMPLE

# 1

From

the following particulars, prepare Bank

reconciliation statement of Mr. Naveed as

on June 30, 2002.

·

Balance

as per bank book

Dr.

32,000

·

Cheques

deposited but not yet

collected by bank

20,200

·

Cheques

issued but not yet paid by

bank

13,000

·

Dividend

credited by bank on June 30,

but the intimation

was

received later.

2,000

· Interest

credited by bank

250

· Bank

charges debited by bank

50

It is

assumed that books of accounts

are not closed as

yet.

SOLUTION

As books of

accounts are not closed, we

will find out the adjusted

balance first:

Rs.

Balance

as per bank book

Dr.

32,000

Add/Debit

Dividend credited by bank

Dr.

2,000

160

Financial

Accounting (Mgt-101)

VU

Add/Debit

Interest credited by bank

Dr.

250

Less/Credit

Bank charges

Cr.

(50)

Adjusted

balance as per bank

book

Dr.

34,200

These

adjustments in the ledger account of bank

will look like as

follows:

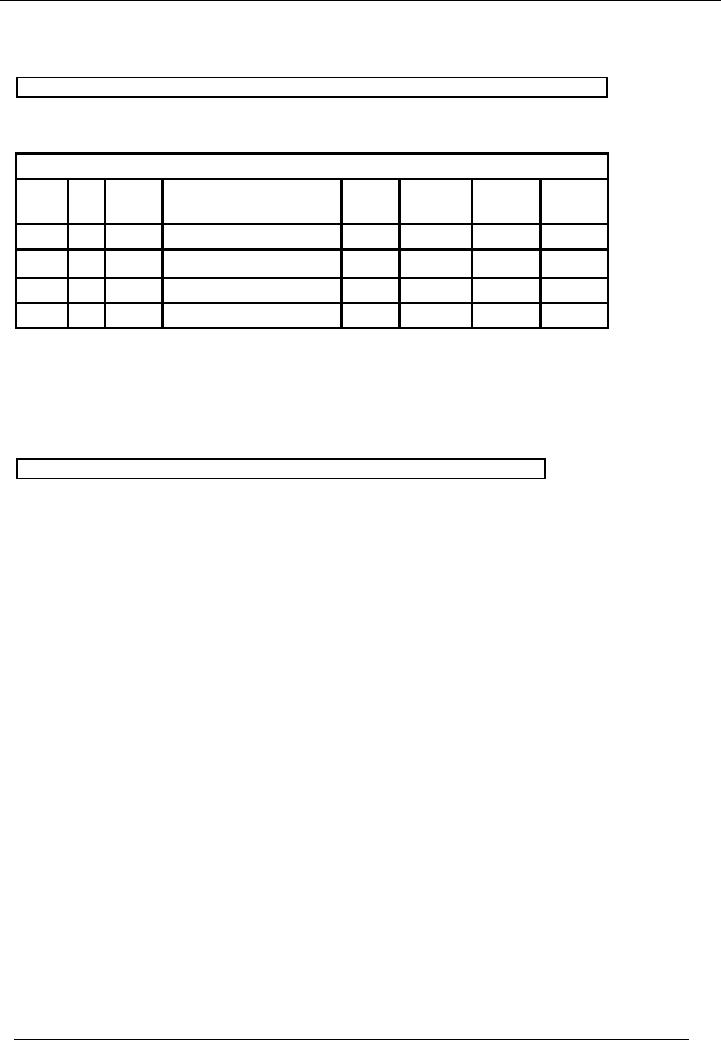

Mr.

Naveed

Bank

Book (Bank Account

Number)

Account

Code --

Date

Vr.

Chq.

Narration

/

Ledger

Receipt

Payment

Balance

20--

#

No.

Particulars

Code

Amount

Amount

Dr/(Cr)

Jun30

Balance

B/f

32,000

32,000

Jun30

Dividend

received

2,000

34,000

Jun30

Interest

received

250

34,250

Jun30

Bank

charges

50

34,200

BANK

RECONCILIATION STATEMENT

Rs.

Balance

as per bank book

Dr.

34,200

Add:

Un-presented cheques

Dr.

13,000

Less:

Un-credited cheques

(Cr.)

(20,200)

Balance

as per bank statement

Cr.

27,000

In this

example, books of accounts are

not closed, all other

transactions except un-presented

cheques and

un-credited

cheques, will be recorded in the bank

book by passing journal

entries and adjusted balance

of

bank

book will be presented in the bank

reconciliation statement.

To this

point, we have considered a favourable

balance i.e. Debit in bank

book and Credit in bank

statement.

But

there is a possibility that we may

have an unfavourable balance. This can

happen if we have taken a

loan

from

our bank.We can also

call it an overdraft i.e. we

have drawn more money from

our bank than we had

deposited

in it. The reconciliation

procedure would be the same as

before.

161

Financial

Accounting (Mgt-101)

VU

The

solution of above example

will show the following

picture:

SOLUTION

As books of

accounts are not closed, we

will find out the adjusted

balance first:

Rs.

Balance

as per bank book

Cr.

(32,000)

Add/Debit

Dividend credited by bank

Dr.

2,000

Add/Debit

Interest credited by bank

Dr.

250

Less/Credit

Bank charges

Cr.

(50)

Adjusted

balance as per bank

book

Dr.

(34,200)

These

adjustments in the ledger account of bank

will look like as

follows:

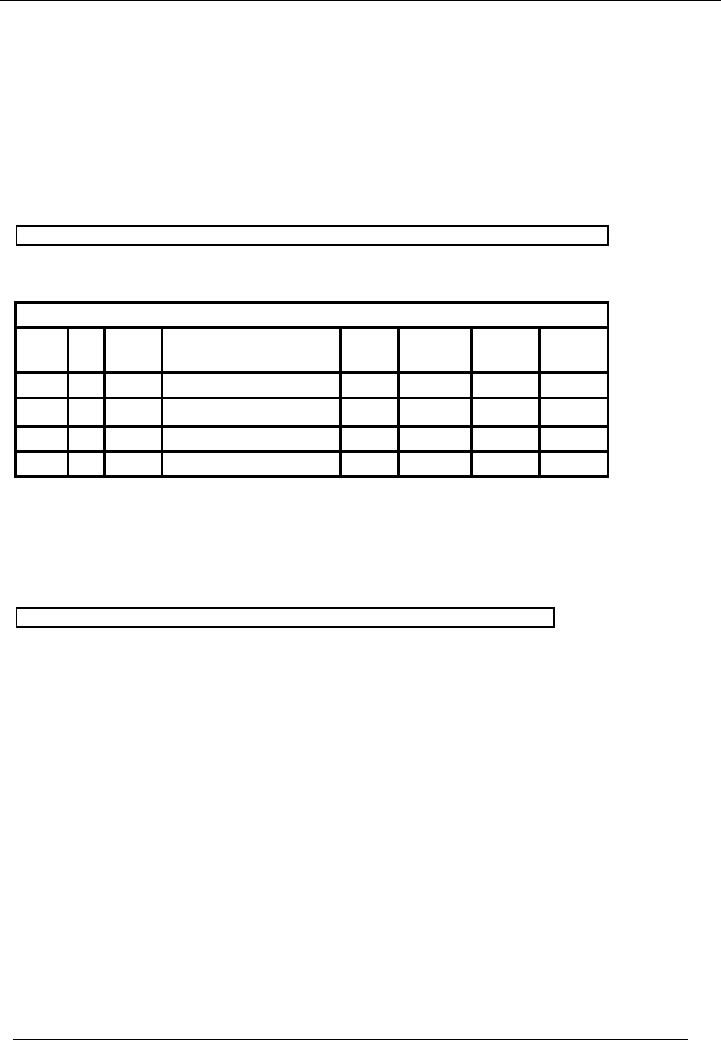

Mr.

Naveed

Bank

Book (Bank Account

Number)

Account

Code --

Date

Vr.

Chq.

Narration

/

Ledger

Receipt

Payment

Balance

20--

#

No.

Particulars

Code

Amount

Amount

Dr/(Cr)

Jun30

Balance

B/f

32,000

(32,000)

Jun30

Dividend

received

2,000

(34,000)

Jun30

Interest

received

250

(34,250)

Jun30

Bank

charges

50

(34,200)

BANK

RECONCILIATION STATEMENT

Rs.

Balance

as per bank book

Cr.

(34,200)

Add:

Un-presented cheques

Dr.

13,000

Less:

Un-credited cheques

(Cr.)

(20,200)

Balance

as per bank statement

Dr.

(41,400)

In this

case the balance of bank statement is

debit because this amount is receivable

by bank; it is an asset of

the bank. On the

other hand, this balance is a credit

balance in bank book, it is

payable to bank by the

business.

So, it is a liability of the business.

Balance of bank statement in the first

case does not match

with

the

balance calculated above.

The reason being, the

balance in the first solution

was debit, i-e. balance

was

our

asset and drawing more money

from bank reduced our asset.

On the other hand, balance in this

case is

credit,

i-e. we have already drawn

more than what we have

deposited in the bank. So, it is our

liability. This

balance

is shown with negative sign.

So, when we add/debit any

amount, it will reduce our

liability and when

we less/credit

any amount from bank, it will

enhance our liability. This

difference in treatment will result in

a

different

balance of bank statement.

162

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES