|

Financial

Management MGT201

VU

Lesson

06

PRESENT

VALUE AND DISCOUNTING

Learning

objectives:

After

studying this lecture, you

would be able to have a better

understanding of the following.

·

Present

Value and Discounting

The

Topics of this lecture are

covered in the chapter 6 of our text

book called Financial

Management

theory and practice by Eugene F. Brigham

& Louis C. Gapenski.

Objectives

of present value:

The

objective of calculating the present

value is to translate the future cash

flows in to present

terms.

The basic principle is to

compare apples with apples.

For instance, if you have Rs.10 in

your

pocket

today and then you have may

as many rupees ten years

after, how can you

compare the two. You

can

do it only by comparing both

amounts at the Present

time.

We

choose the present (today) as the

most convenient point in

time where we could compare

all

the

cash flows taking place at

various points in time in

future. We must compare

everything at the

SAME

point in time otherwise; we

would be neglecting the Time

Value of money concept.

For

example, Rs 105 is more than Rs

100 BUT; Rs105 after 1 year

may not necessarily be

more

than Rs100 today! We first

have to first bring all cash

flows to the Present, or Discount them,

and

then

compare them. The concept of

present value says that we

can compare both the amounts

in the date

of

today we will bring back

future cash flows to the

present

Discounting:

"Discounting

is defined as bringing the future

cash flow to the present

time".

Before

answering which amount is greater in the

aforementioned example, we need to

have

some

concept of interest rates or the cost of

money. An interest rate can also be

understood as an

opportunity

cost.

One

of the simple ways of estimating what

opportunity cost or interest rate should

be for our

discounting

calculations, we can use interest rate

given on the PLS accounts by the banks.

For example,

if

money is deposited in a bank and getting

10% per annum then it is interest or

opportunity cost for

you.

This

interest on PLS account becomes

minimum rate of return which

any investment should be

able to

generate.

Therefore, the investment project

should offer higher rate of

return than the returns on the

PLS

account.

Now

let's see the answer of the

question that Rs.105 will be

more one year later or Rs.100

today,

and

for this, we need interest or

opportunity cost. It is important to

understand why interest rate is

called

opportunity

cost? Because, opportunity

cost essentially means the

cost of taking up one option

while

sacrificing

the other. For instance,

when you deposit your

money in the bank and get interest,

you are

sacrificing

by

(1)

Not consuming the money to buy something

for yourself and

(2)

Not investing your money

elsewhere at a higher return

than the bank interest.

Usually

when an investment option is

taken up, investors forgo the

option of depositing the

money

in a bank account and earn interest on

that. The opportunity lost

in this case is the

opportunity

cost.

Now the question is that

what kind of interest rate should we

use? There are many interest

rates

quoted

in the schedules of the bank but

for discounting, the most

commonly used rate is the

nominal

interest

rate, or APR.

Interest

Rates for Discounting

Calculations

·

Nominal

(or APR) Interest Rate = i

nom

·

It is usually published in

newspapers .Annual Nominal

Interest Rate is quoted for

1

year

by Credit Card Companies and

Leasing Companies because it

understates the

actual

(or Effective) interest you have to

pay, these companies want to

create an

impression

that the interest charged by them is the

minimum in the market.

·

Periodic

Interest Rate = i per

Periodic

interest rate is used in FM for

Discounting and Present Value

(PV) calculations.

It

is defined as

iper =

( i nominal Interest rate) / m

Where

m

= no. of times compounding takes place in

1 year i.e.

If

semi-annual compounding then m = 2

29

Financial

Management MGT201

VU

·

Effective

Interest Rate = i eff

It

is very useful to compare securities

and investments with different

life or

compounding

cycles but not used

for Discounting and

PV.

i

eff = [1 + ( i nom / m )]m

1

Where

m = no. of times compounding takes place

in 1 year, the compounding cycle. The

shorter the

compounding

cycle more frequently money

compounded & faster the

money grows.

Coming

back to our earlier example

where we were trying to

figure out whether or not Rs

100 of

today

are worth more than Rs 105 a

year after, while the

periodic interest rate is 10

percent per annum.

The

interest

rate used here would be

the nominal interest rate,

i.e., 10 percent. When we are going to

solve for

the

present value we are

discounting from the future to the

present

PV=FV/(1+i)n

Where,

i=interest rate

N=no.

of years if we plug in the values

PV=105/(1+0.10)1=Rs.95.45

Now

we can see that if we

discount Rs.105 from future

to the present that is only the

worth of

Rs.95.45

which is less than Rs.100.

The amount offered in the future is

seemingly more but

when

converted

to present value, the worth it

has today, it come out to be

less than Rs 100. Thus, it is

clear

that

Rs100 today worth more to

Rs. 105 one year later.

This conclusion is drawn on the

assumption that

interest

rate is 10%, but if we change the

interest rate, the answer might be

different.

With

the help of the following diagram, we

can observe the effect of

discounting the cash

flows.

Now

the point to understand is that if we

discount back this money

from 2 years back we would

have

only

approximate Rs.87 in other words if Rs

105 are to be received after

two years, the present value

of

would

be even lesser

If

you discount Rs 105 two

years from now, you

will have lesser amount than

you have one

year

from today. It is clear from the

slide that as more future

cash flow occurs distant in

time, the more

its

present value

decreases.

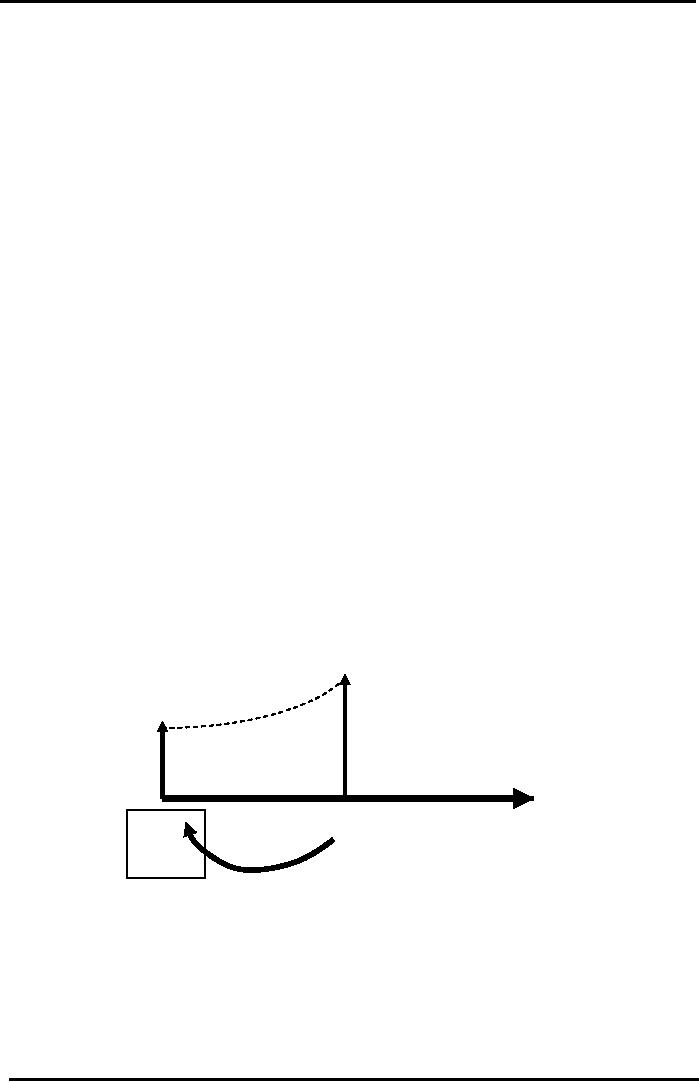

Time

& Arrow Diagram

1

Year Discounting of Future

Value

Time

& Arrow Diagrams are important in

visualizing the concept of

Discounting

FV

= Rs. 105

PV

= Rs 95.45

Interest:

10% pa

Time

(Years)

Yr

1

Yr

0

Today

Present

Discounting

30

Financial

Management MGT201

VU

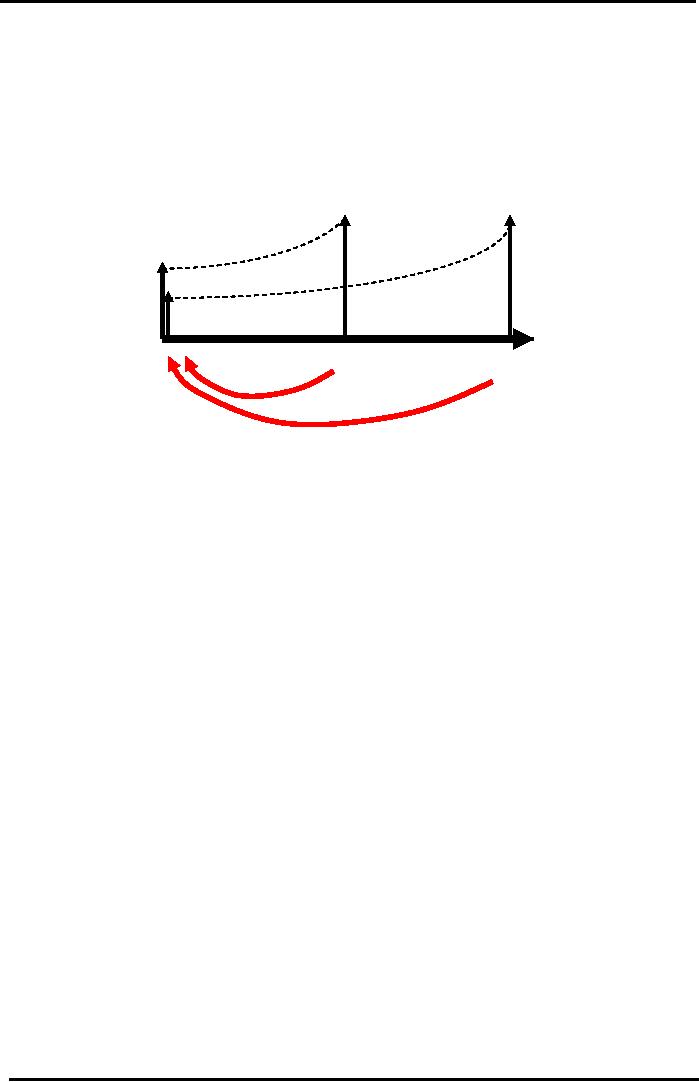

Time

& Arrow Diagram

2

Year Discounting of Future

Value

Notice

how Discounting Rs 105 (FV2)

from Year 2 gives a smaller

Present

Value

(PV2 = Rs 87) than

Discounting Rs 105 from Year

1

FV1

= Rs. 105

FV2

= Rs. 105

PV1=

Rs 95.45

PV2=

Rs 87

Interest:

10% pa

Interest:

10% pa

Time

(Years)

Yr

1

Yr

2

Yr

0

Today

Present

Discounting

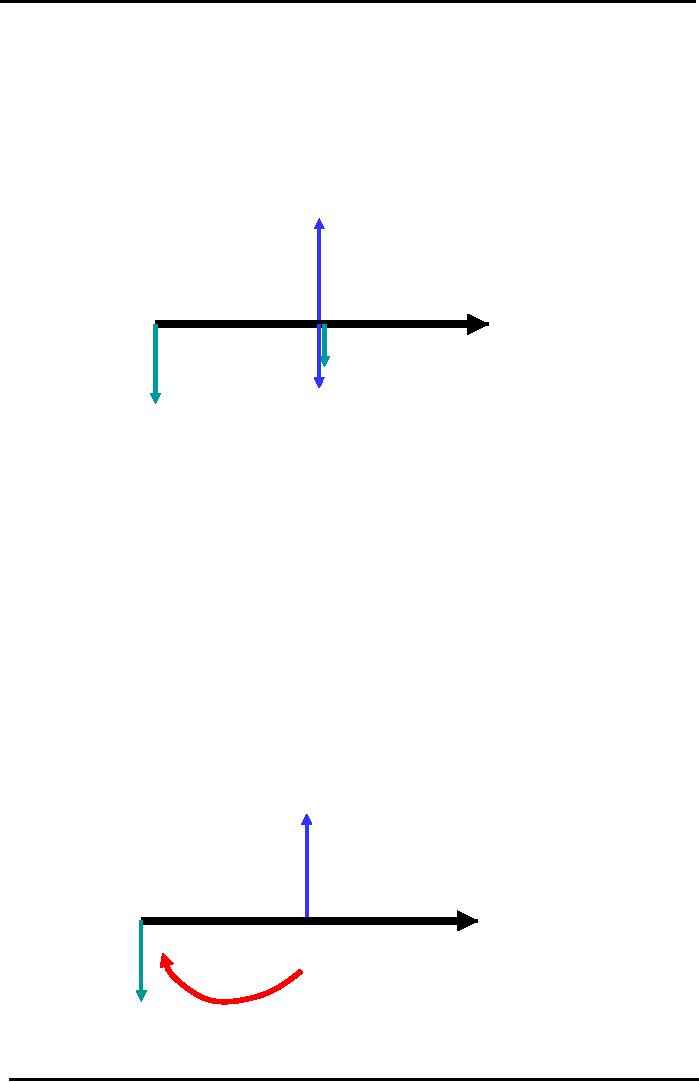

Cash

inflows (Income, other income &

cash profits) shown with

upward pointing arrow

Cash

outflows (expense) shown with

downward pointing

arrow

Discounting

Cash Flows of a Business, Investment, or

Project:

Let's

talk about the discounting

cash flow of the business as to

how we would estimate the

cash

flow

business can generate? How

can we calculate the market

value and intrinsic value of

a business or

working

asset? There are two

steps involved

1)

Forecast future cash flows

of any business, investment, or

project by using percent of

sales

method.

2)

Discount the net cash flows back to the

present time.

The

two-step process here can be

elaborated by the following hypothetical

example.

Cafe

Case Study:

Suppose

you are thinking about

starting a small café or

canteen inside a university

campus. You

make

a simple feasibility report

showing the estimated initial investment

and the forecasted cash

flows

for

the first Year (based on expected

cash receipts from sales

and cash payments for

expenses).

The

Key Financial Data is as

follows:

·

Initial Investment = Rs

100,000

·

Forecasted Cash Receipts (end

Year 1) = Rs 200,000

·

Forecasted Cash Payments

(end Year 1) = Rs

50,000

·

Forecasted Future Investment (end

Year 1)=Rs30,000

·

Periodic Interest Rate

(Opportunity Cost) = 10% p.a.

First

step is to represent the phenomenon

through a diagram in the form of

cash out flows.

31

Financial

Management MGT201

VU

Cash

Flow Diagram

Café

Example

Use

Downward

Pointing Arrows to

show Cash

Outflows (Cash

Payments

or Investments). Use Upward

Pointing Arrows to

show

Cash

Inflows (Cash

Receipts)

Receipts

= Rs. 200,000

Interest:

10% pa

Yr

0

Yr

1

Future

Investment = Rs 30,000

Payments

= Rs 50,000

Initial

Investment = Rs 100,000

First

of all, we can see the

initial investment represented by the

downward arrow. We have

also

forecasted

the sales one year from

now that is Rs.200, 000.

This is a cash inflow for

the business and is

represented

by an upward arrow; similarly, the

expenses and investments (cash

outflows) that we expect

in

future, will be shown by the downward

arrows. In the diagram there are three arrows, the

upward one

is

showing forecasted sales

(cash inflow) and two arrows

downward show expenses of Rs.50,

000 and

invest

outlay of Rs.30, 000

respectively. Now the combined

effect of the three arrows can be

represented

by a single arrow. We can

see that cash inflow of

Rs.200,000 is having a +ve sign

and

expenses

of Rs.50,000 and investment out

lay of Rs.30,000 have ve signs

and finally, by deducting

the

negative

signed figures from the positive

one we can arrive at the net

effect of the cash inflows

and

outflows,

which is given as

under

200,000-50,000-30,000

=Rs 120,000.

These

different arrows can be added or

subtracted because they are

occurring at the same

point

of

time and Rs.120, 000 can be shown by one

arrow sign. In order to calculate the

present value of

Rs.120,

000, rate of interest as discount factor

should be 10% per

year.

Simplified

Cash Flow Diagram

Café

Example

Net

Cash Receipts = CF1 =

FV1

=200,00050,00030,000

= Rs 120,000

Interest:

10% pa

Yr

1

Yr

0

After

combining all Cash

Flows

for

Year 2 into one Net

Cash

Flow

Figure (CF1), you

are

ready

to now Discount it to

the

Initial

Investment = Rs 100,000

Present...

32

Financial

Management MGT201

VU

Calculating

the NPV

of

the Café Business for 1st

Year:

NPV

= Net Present Value (taking

Investment outflows into

account)

NPV

= -Initial

Investment + Sum of Net Cash

Flows from Each Future

Year.

NPV

= -

Io

+PV

(CF1) + PV

(CF2) + PV

(CF3) + PV

(CF4) +

...+ ∞

Note

that PV (CF1)

means the Present Value of

Future Net Cash Flow

(CF) taking place at the

end

of Year 1. CF is like the FV in our

interest formulas. Our compounding

cycle is 1 year so the

Periodic

Interest Rate is 10%.

Present

Value of Net Cash Flow

from Year 1 =

PV

(CF1) =

CF1 / (1+ i) n

=

120,000 / (1+0.1)1 = Rs

109,000

The

value of money has shrink

from Rs.120, 000 to 109,000 as the

concept of time value of

the

money

suggests and now we are in

position to calculate the net present

value of the money:

NPV

= - Io

+ PV

(CF1) = -100,000

+ 109,000 = + Rs 9,000

The

NPV of our Business after 1

Year is Positive Rs 9,000

which is a good sign. We

will

discuss

this topic in more detail in

capital budgeting.

33

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios