|

Financial

Management MGT201

VU

Lesson

31

OPERATING

LEVERAGE, FINANCIAL LEVERAGE,

ROE, BREAK EVEN POINT

AND

BUSINESS

RISK

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

topics:

·

Operating

Leverage

·

Financial

Leverage

·

Concepts

of Return on Equity, Break-Even Point

and Business

Risks

In

this lecture we will

continue our discussion of

capital structure and specifically we

will discuss

Operating

Leverage, Financial Leverage and the

concepts related to Return on

Equity, Break-Even

Points

and Business Risks. In the last lecture we

mentioned that

total

stand alone

risk

faced by a firm

=

Business Risk + Financial

Risk

Now,

first we focus business risk

then later we shall discuss

financial risk.

Business

Risk (from Operations except

Debt):

Business

risk stems from the

operation and the assets of the firm.

These may be caused

by:

Uncertainty & fluctuations in

prices & costs.

Specific business & Market

Causes.

Higher operating leverage

(OL = Fixed Cost / Total

Cost) that results

in:

·

Higher breakeven

point

·

Higher but riskier expected

return on equity

(ROE)

Application

of Operating Leverage to Capital

Budgeting:

Operating

Leverage is the impact of a small

change in the sales on the returns on

equity. In

other

words small decline in sales

can cause large decline in

ROE (when sales are below

breakeven

point).

Its formula is

Operating

Leverage = Fixed Costs /

Total Costs

High

operating leverage increases

risk due to higher percentage of

fixed costs. There are

many

industries

which are prone to high

operating leverage. These

are Capital Intensive

Industries (i.e. Power

Plant,

Cement, Steel, and Textile Spinning),

New Product Development, and Research

& Development

High

Cost Industries (i.e.

Pharma, Auto) and industries

that need Highly Specialized

& Skilled Workers

(i.e.

Information Technology, Software House,

Semiconductor and Microprocessor,

Manufacturers).

Now

let us have a look at the sensitivity of

Return on Equity to changes in

sales. Recall from

the

previous lectures, ROE is a measure of

overall return of a firm. In

case of 100% equity firm the

ROE

is

the measure of the overall return

and any changes or variation

in ROE is a measure of risk for

that

firm.

First

concept that comes within

Operating Leverage is Break-even.

Break-even represents the

quantity

of sales at which operating

revenues exactly cover

operating costs. In other words

the

Breakeven

Point is the point or quantity of

sales at which Earnings before

Interest and Taxes (EBIT) =

0.

Now

EBIT

= Operating Revenue - Operating

Costs

Recall

accounting concepts. Operating

costs consists of fixed

costs and variable costs.

So

EBIT

= Operating Revenue - Variable Costs -

Fixed Costs

=

(PQ) (VQ) F,

where

P=

Product Price (Rs.),

Q=

Quantity or Number of Units

Sold of product,

V=

Variable Cost of product per

unit (Rs.),

Operating

Revenue= Product Price multiplied by Number of

Units Sold of product

Variable

Costs= Variable Cost of

product per unit multiplied by

Number of Units Sold of

product

F=

Fixed Cost (Rs).

As

at breakeven point

EBIT

= 0

and

we have just seen

EBIT

= (PQ)-(VQ)-F

so

EBIT=

(PQ) (VQ) F = 0.

From

this by solving equation we

can derive

133

Financial

Management MGT201

VU

Q

= F / (P - V).

This

equation represents the

minimum number of units the company must

sell in order to cover

its

operating

costs. We are discussing breakeven as

changes in operating leverage

will have an impact and

change

in breakeven quantity and also will have

impact on the likelihood of the company

making great

losses.

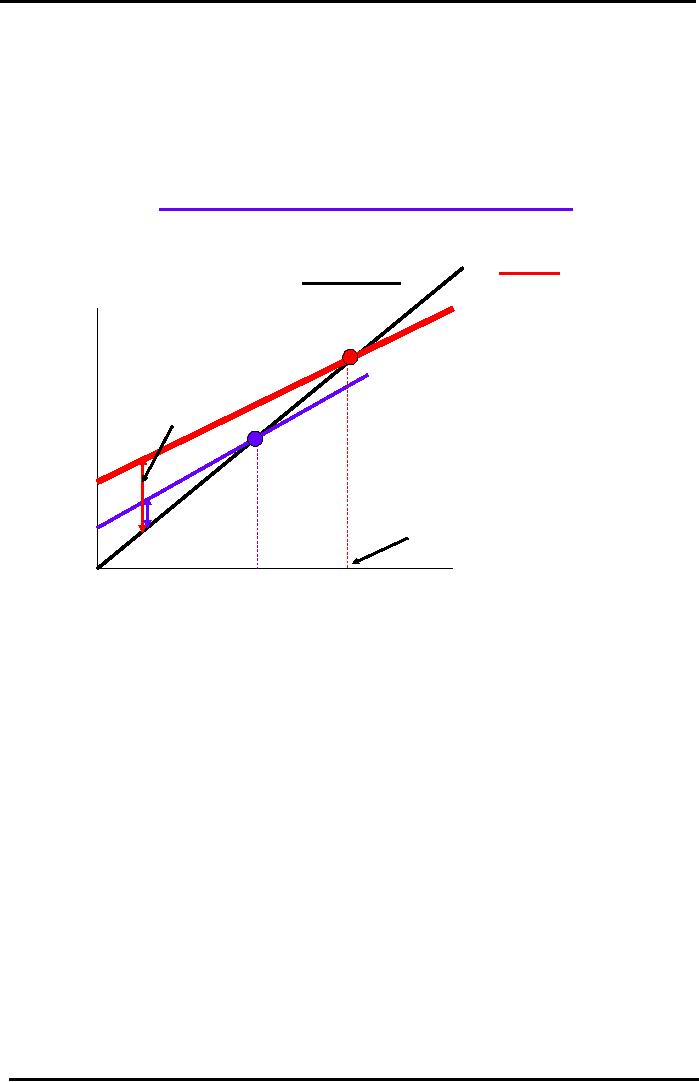

To understand the sensitivity and impact

of small changes in sales on ROE,

let us have look at a

diagram:

Visualizing

Operating Leverage

(OL)

Impact

on Breakeven Point & Capital

Budgeting

Sales

REVENUE Line Total

COST Line

Revenues

&

Technology

A:

Costs

(Rupees)

Higher

OL

Technology

A: Larger

OPERATING

LOSS

(Cost

> Revenue).

Total

COST Line

More

Risky

Technology

B

Fixed

Costs A

Fixed

Costs B

Breakeven

A: Higher.

More

Risky

Sales

Quantity

(#

of Units)

QB*

QA*

Here

operating leverage has been

graphed. On the Y-axis we have the revenues

and costs in

rupees

and on X-axis the sales quantity in

number of units. Line passing

through the origin

represents

sales

revenue (PQ). Total cost line

for two different

technologies have also been

drawn. Technology A

total

cost is represented by a line

which is higher up showing

higher operating leverage and

the

Technology

B total cost line is lower

with a high slope. Two

important consequences to note

from this

graph

are:

1-

For

Technology A fixed costs are

high so it has higher

operating leverage assuming

lines shown on

the

graph are representatives of total

costs of technologies. Impact of

technology A with high

operating

leverage

on EBIT is that technology A

has larger operating loss as

shown by the left hand side of

the

graph.

This loss is due to higher

total cost than the sales

revenue. A company with higher

operational

leverage

means it has higher % of

fixed costs. Whether the company

has high or low sales due

to

higher

% of fixed costs it has high

risks of operational losses. That's

why companies,

businesses,

projects

and technologies with higher

operating leverages are perceived as more

risky as they have more

chances

to incur operating losses

due to their unavoidable

high fixed costs. Higher

operating leverage

means

greater reduction in EBIT as shown in

graph.

2-

As

operating leverage increases

breakeven point also

increases i.e. breakeven shifts to the

right. In

other

words, companies with high

operating leverage require more

units to be sold to cover

their

operating

costs.

These

are the two ways operating

leverage affects the level of risk

for a company. The

above

discussion

of impact of operating leverage on

capital budgeting indicate

operating leverage affects

EBIT.

So,

higher operating leverage

means chances of falling ROE

drastically are higher. Hence,

companies

134

Financial

Management MGT201

VU

with

higher operating leverage

are more risky, their

required rate of return is higher,

discount rate in

NPV

formula is higher and NPV

for these companies will be

lower calculated for investment

decision.

Operating

Leverage Application to Capital

Structure:

Operating

leverage also affects Capital Structure.

Companies and technologies with high

operating

leverage

have higher risks that means

they have

·

Higher Betas (CAPM

Approach to Cost of Equity

Capital)

·

Higher Weighted Average

Cost of Capital

·

Also higher average

overall rate of return

measured in terms of return on

equity. This is possible

in

case of sales of companies

are higher than breakeven

point. In this case

companies with higher

operating

leverages earn higher

EBIT.

Therefore,

overall impact of operating

leverage must consider higher

risk and higher return

both

provided

by companies with high

operating leverage. Have a

look on the following graph to

visualize

the

effect of Operating Leverage on

risk and return of a particular

technology:

Visualizing

Operating Leverage

(OL)

Impact

on ROE & Capital

Structure

Technology

B: Lower

OL:

Low

Risk & Low ROE

Technology

A: High

OL,

High

Risk & High

ROE.

Risk

B

Higher

WACC

Risk

A

Expected

ROE

Expected

ROE

=

<ROE>B

=

<ROE>A

Return

on Equity ( ROE)%

On

the Y-axis we have the probability and on

X-axis the ROE. There are

two probability

distributions.

One on the left side is tall

sharp peak probability distribution

that represents technology

B

with

lower Operating Leverage. It

has lower risk and lower

average ROE. Other on the right

side is

short

and flatter that represents

technology A with higher OL.

It has high risk and higher

average ROE.

It

also has higher WACC as it

has higher required rate of

return. Recall probability

distribution and risk

theory

discussion that risks can be

visualized as width or range of

probability distributions

curves.

Shorter

and flatter curve of A shows

higher risk. Its average or

mean ROE to that of right of B,

shows

higher

ROE of A.

Now

we come to the other component of a firm

risk i.e. financial

risk.

Financial

Risk:

·

Created when Firm

takes Loan or Debt or issues

Bonds this is Financial

Leverage

FL

= Debt / Total Assets

·

Increase in Risk faced by Common

Stock Holders (or Equity

Holders or Owners) when a

Firm

takes

on more Debt or Financial

Leverage.

·

Increase in debt shifts more

risk on common stock holders and risk per

share increases.

·

Example:

Suppose

a Firm ABC has Total

Assets of Rs.1000 and is 100%

Equity based (i.e.

Un-levered).

There were 10 equal Owners and 5 of them

want to leave. So the Firm

takes a

Bank

Loan of Rs.500 (at 10%pa

Mark-up) and pays back the Equity

Capital to the 5 Owners

135

Financial

Management MGT201

VU

who

are leaving. Now, half of

the Equity Capital has been

replaced with a Loan from a

Bank

(i.e.

Debt). What impact does

this have on ROE?

·

Assuming Business Risk is

unchanged, and then risk per share

rises because Equity is

halved.

So,

more Risk is transferred to Common

Shareholders.

·

Debt

Investors (i.e.

Lenders and Bond Holders) face

minimal risk because

(1)

Guaranteed Regular Interest Income

and

(2)

1st Claim on Assets in event

of Bankruptcy

Financial

Leverage (Debt) Increases

ROE Risk:

FL

is the degree or extent to which a

company's total capital is

composed of debt. So a company

with

80%

debt is highly leveraged.

Let us take an example of a company

moving from 100% equity to

50%

equity

and 50% debt to see Impact

of Financial Leverage (Loan) on Balance

Sheet.

Impact

of Financial Leverage (Loan) on

Balance Sheet

Un-Levered

Firm

Levered

Firm

(100%

Equity)

(50%

Equity - 50%

Debt)

Liabilities

Assets

Liabilities

Assets

Debt:

500

Equity:

1000

Equity:

500

Total:

1000

Total:

1000

Total:

100

Total:

1000

Note:

Total Assets = Total

Liabilities = Debt + Equity

This

table shows the capital structure of the

firm under the conditions of

leverage and no leverage.

Under

no leverage its Assets=Equity=1000.

But after leverage it has

500 as debt and 500 as

equity. It

has

converted 500 of equity into

debt by taking loan.

·

Increase in Debt increases

chances of net loss if seasonal

dip causes EBIT to fall

below interest

payment.

·

Increase in Debt increases

uncertainty in ROE. Range or Spread of

Possible future values of

ROE

increases. Risk faced by Common Stock

Holders Increases.

This

can be illustrated by the following

example:

Impact

of Financial Leverage (Loan) on

Income Statement & ROE

Un-Levered

Levered

(100%

Equity)

(50%

Equity)

Expected

EBIT

300

300

Interest

(10% of 500)

0

50

EBT

300

250

Tax

(30% of EBIT)

90

75

Net

Income (NI)

210

175

Expected

ROE (=NI/Equity)

210/1000=

21%

175/500=35%

Total

Return

210

175+50=225

·

Increase

in Debt Improved or Leveraged Up the ROE

to 35%

·

Increase

in Debt also Increased the Total

Return to Investors = NI + Interest.

Increased from

Rs.210

to 225 (175+50)

·

So,

why not keep adding more Debt?

Because, Debt has increased

the risk i.e. The

Standard

Deviation

or Uncertainty of ROE.

·

Total

Stand Alone Risk of Firm =

Business Risk + Financial

Risk

Total Stand Alone Risk

= Standard Deviation of ROE of Levered

Firm

Business Risk = Standard Deviation

of ROE for Un-levered

Firm

Financial

Leverage (FL) & Operating

Leverage (OL):

Effect

of Financial Leverage & Operating

Leverage on ROE is Similar:

136

Financial

Management MGT201

VU

High

Operating Leverage: High

Fixed Costs so small changes

in Quantity Sold cause

larger

changes

in Net Income & ROE

·

Risky

if Firm's Sales < Breakeven

Point BUT

·

Multiplies

Increase in Mean ROE when

Sales > Breakeven

High Financial Leverage:

High Debt & Interest

Payments so small changes in

EBIT cause large

changes

in Net Income & ROE

·

Risky

if Firm's Overall Return is

low and can not

pay Interest on time

but

·

Multiplies

Increase in Mean ROE and Total

Return (to Equity & Debt

Holders) when

Firm's

Overall Return is Higher

than Cost of Debt

The

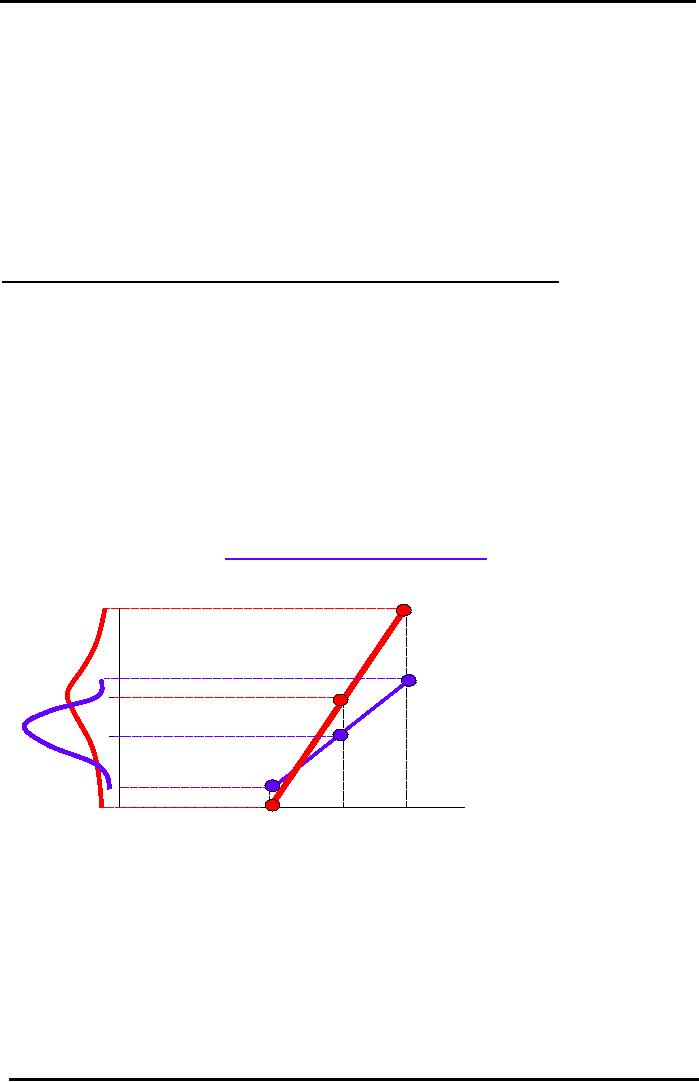

impact of leverage debt on ROE

can be visualized in a graph.

For this purpose we need

to

consider

the following table:

EBIT

Interest

EBT

Tax

Net

Income ROE

(Rs.50)

(30%)

(=NI/Equity)

Un-Levered

600

0

600

180

420

42%

Firm

with

300

0

300

90

210

21%

no

debt or 100%

50

0

50

15

35

3.5%

equity

Levered

firm

600

50

550

165

385

77%

with

debt

300

50

250

75

175

35%

50

50

0

0

0

0%

You

see for a levered firm range

of ROE is high from 0 to 77%

for level of earnings from 50

to

600.

For un levered firm this

range is very short from 3.5% to

42% for same level of

earnings. So for a

company

whose sales are low un

levered capital structure is safer

than a levered one while for

a

company

with healthy sales growth,

levered capital structure provides an

opportunity of high ROE.

Visualizing

Financial Leverage (FL)

Impact

on ROE & Capital Structure

LEVERED

(Debt

ROE

(%)

&

Equity) Firm:

77%

Higher

Slope.

ROE

more

sensitive

to

changes

in EBIT

42%

35%

= <ROE>L

UN-LEVERED

(100%

Equity)

21%

= <ROE>UL

Firm.

Safer

Capital

Structure

3.5%

at

Low EBIT's

0%

EBIT

(Rs)

50

300

600

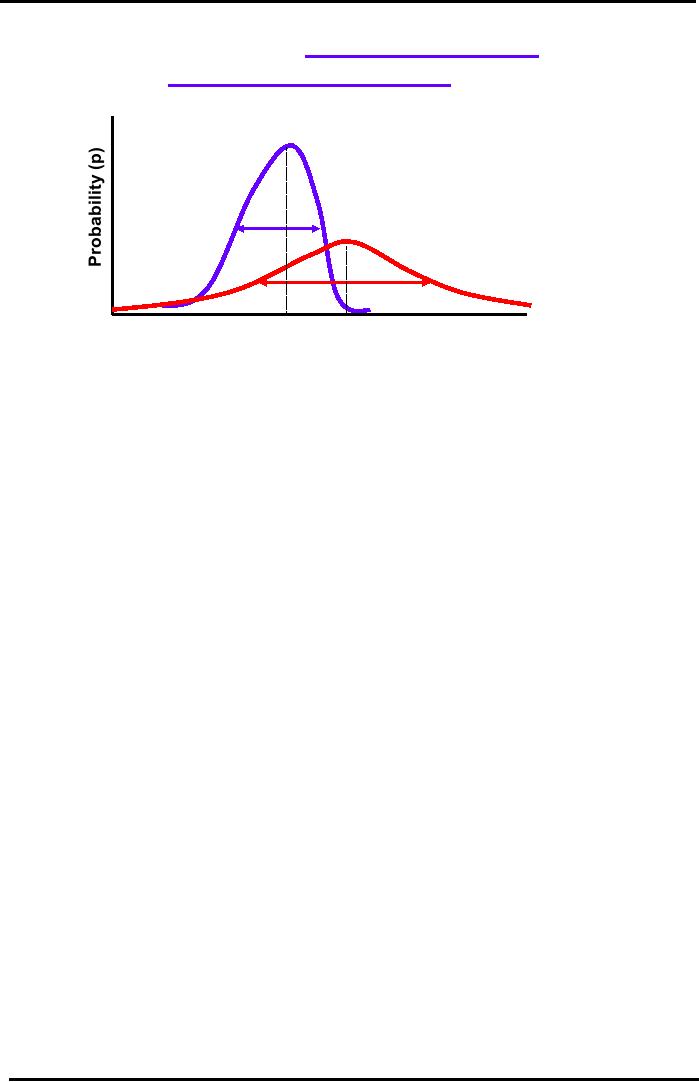

The

impact of leverage debt on ROE

can also be shown in a graph

based on probability

distributions:

137

Financial

Management MGT201

VU

Visualizing

Impact of Financial Leverage

on

ROE & Capital Structure

Un-Levered

(100% Equity):

Lower

ROE and Lower Risk.

Levered

(Debt & Equity):

Higher

ROE but Higher

Risk

Risk

also.

Risk

Expected

ROE

Expected

ROE

<ROE>Un-Levered

<ROE>Levered =

35%

=

21%

Return

on Equity ( ROE)%

On

the Y-axis we have the probability and on

X-axis the ROE. There are

two probability

distributions.

One on the left side is tall

sharp peak probability distribution

that represents un

levered

firm.

It has lower risk and

lower average ROE. Other on the

right side is short and flatter

that represents

levered

firm with higher OL. It

has high risk and

higher average ROE. Recall

probability distribution

and

risk theory discussion that

risks can be visualized as width or range

of probability distributions

curves.

We shall discuss these

graphs and financial leverage in

detail in next

lecture.

138

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios