|

Financial

Management MGT201

VU

Lesson

33

MODIFICATIONS

IN MILLAR MODIGLIANI CAPITAL STRUCTURE

THEORY

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

topic:

·

Modifications

in Miller Modigliani Capital Structure

Theory

Modified

MM -

With

Taxes:

In

order to apply it in the real

world for its use,

Miller-Modigliani and some other

economists made

some

modifications. In order to make this

theory applicable in the real

world and to account for

the

effects

of corporate and personal taxes on investment

decision and on firm, the effect of

taxes was

included

in it.

·

Modigliani-Miller

(With Corporate

Tax)

In most countries, a Firm's

Interest Payments to Bond

Holders are NOT Taxed.

But

Dividend

Payments to Equity Holders

are taxed. This was

conclusion after study

of

different

countries. Most of the firms prefer

debt rather than

equity.

Based on CORPORATE TAXES,

FIRMS should prefer to raise

Capital using DEBT

Financing

rather than equity as there is saving

associated with capital

raised through

this

source.

From

firms point of view interest

payments are source of tax

savings.

·

Modigliani

-Miller (With Personal

Tax)

In most countries, INVESTORS

(bondholders and shareholders) pay a

higher Personal

Income

Tax on Interest Income from

Bonds than on Dividend Income

from Equity (or

Stocks).

Based on PERSONAL TAXES,

INVESTORS should prefer to

invest in STOCKS (or

Equity).

Uncertain

Conclusion:

Difficult to determine Net

Effect of taxes on optimal

capital structure. Effects

of

corporate taxes and personal taxes are

contradictory. But, practically speaking,

Corporate Tax Effect

is

generally stronger so Based on Taxes

alone, Firms should prefer

Debt.

Modified

MM - With Bankruptcy

Cost:

The

second major change in

MM-theory was to incorporate the

effect of bankruptcy costs. In

the

real

world companies face cash

problems, their sales might

drop, they face more

competition, the

interest

rate might go up, their debt

servicing charges might go

up, they start incurring

losses, making

operational

cash outflows and this may

lead the company to close down or go

bankrupt.

·

Bankruptcy: when a Firm is

forced to close down because

of continual Losses and Net

Cash

Outflows

or Default on Interest

Payments.

·

Bankruptcy Costs Real Money -

Companies Do Not Die in

Peace! There are costs

associated

with

bankruptcy companies have to pay.

Fees paid to Lawyers and

Accountants, possible

penalties

and Legal Claims by Suppliers,

Buyers, & Partner Firms, and Loss on

Sale of Assets

because

Firm is forced to quickly

Liquidate its Assets and

repay the Debt Holders (such

as

Banks)

first.

·

Even before bankruptcy the

THREAT or RUMOR of Bankruptcy

can create problems for

a

Firm.

Suppliers refuse to supply

raw materials and cancel

Trade Credit facilities. Banks

demand

higher

Interest Rates. Customers

cancel Purchase Orders so

sales fall.

·

If Firm is EXCESSIVELY LEVERAGED

(or has a Lot of Debt)

then there is a HIGHER

Chance

of Bankruptcy.

·

For Certain Types of Firms,

Debt is More Likely to Cause

Bankruptcy:

Firms with High Operating

Leverage or high Fixed

Costs

Firms with Non-Liquid

Assets that are difficult to

sell quickly for

cash

Firms whose EBIT (or

Earnings) Fluctuate a

Lot

Tradeoff

Theory of Capital Structure With

Tax & Bankruptcy:

Now

let us discuss trade off

theory. It mixes a couple of changes in

pure MM-theory by taking

into

consideration

both bankruptcy costs and

taxes. We will start with a

firm of 100% equity capital

and see

what

happens when a firm starts

taking debt and gradually

increases the percentage of debt in

its capital

143

Financial

Management MGT201

VU

structure.

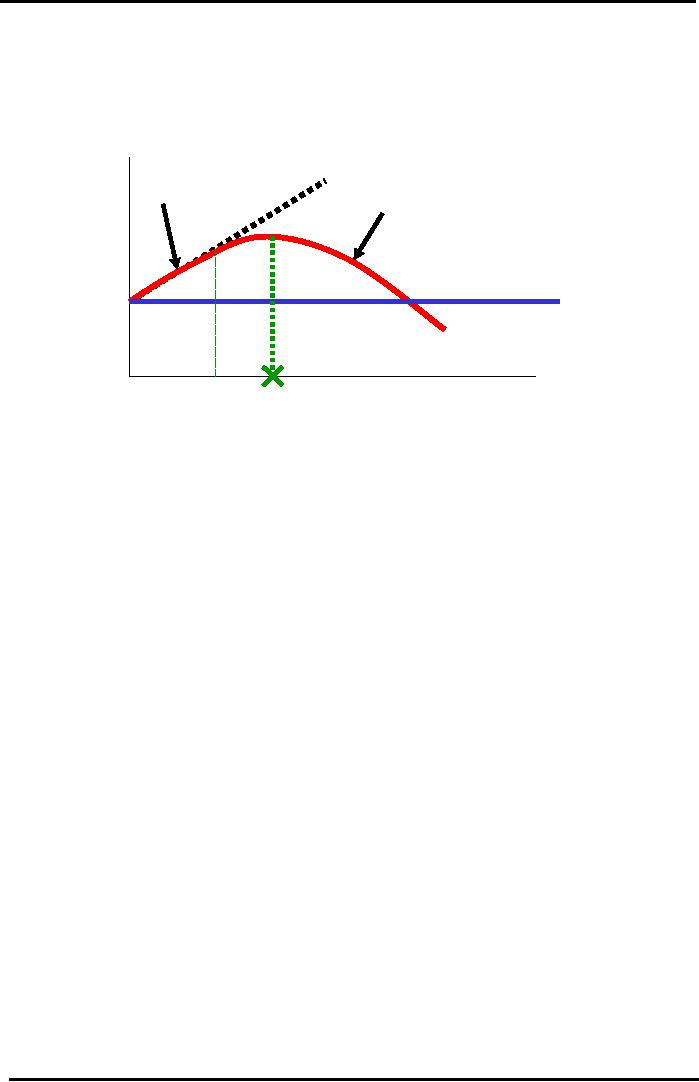

See the following graph to determine the

effect of increasing leverage on the

value of firm

measured

by its stock value to make trade

off theory concepts

clear:

Tradeoff

Theory Graph

Leverage

& Optimal Capital

Structure

Slightly

Leveraged Firm:

Interest Tax

Shield

Benefit. Total Return to

Investors

Excessively

Leveraged Firm:

Rises

so Stock Value Rises.

Total

Return

Threat

of Bankruptcy has Real

=

Net Income (paid to

Shareholders) +

Value

of

Costs.

Less Investor

Interest

(paid to Debt

Holders)

Firm

or

Confidence

and Lower Share

Price.

Price

of

Stock

Firm

Remains 100%

Equity

(Un-Levered)

Financial

Leverage =

OPTIMAL

Capital

Debt

/ Assets =

Structure

- MAXIMUM

D/(D+E)

VALUE

& MINIMUM

WACC

Keep

in mind,

Value

of Firm = Price of One Share x

Number of Shares

Outstanding

On

the Y-axis we have the Value of Firm or

Price of Stock and on X-axis the

Financial Leverage =

Debt

/

Assets = Debt/ (Debt +

Equity) in percentage. In the graph

1.0 shows 100% capital is

from debt at that

point.

Horizontal line represents the

case when a firm is 100%

equity. It is un levered firm.

Here firm

has

no debt so its stock value is

not sensitive to financial leverage.

Now let us take the case of

the same

firm

if it gradually adds debt to its

capital structure.

·

When 100% Equity Firm

adds a Small Amount of Debt,

the Value of its Stock Goes

Up at first

because

Total Return

Increases.

Total

Return

=

Net Income (paid to Equity

Holders) + Interest (paid to

Debt Holders).

The

line therefore rises

initially but then it

reaches a maximum point

which is the optimal

capital

structure. At this point value of

firm will be at its maximum.

This is the best debt

to

equity

ratio for this firm at

which WACC will be at

minimum. After this point

firms' debt gets

high

and it starts facing high interest

costs, chances of loosing creditors and

buyers and threats

of

bankruptcy. Investors' loose confidence

on the share of the firm and the

Chances of

Bankruptcy

will offset the Initial

Benefit and the Stock Value

will Fall.

·

Decision regarding how

much Debt (or Financial

Leverage) to take is based on

Tradeoff

between

the Advantage of Debt & Disadvantage of

Debt.

Advantage of Debt over

Equity: Interest Payments

are Not Taxed. Known as

Interest

Tax

Saving or Tax Shield or Tax

Shelter

Disadvantage of Too Much Debt:

Firm becomes more Risky so Lenders

and Banks

Charge

Higher Interest Rates and

Greater Chance of Bankruptcy

·

Trade theory tells there is

some optimal capital structure or there

is some percentage of debt

in

capital

structure for a firm at a particular

date. But it does not

give us the exact figure for

that. A

range

for the Optimal Capital Structure or

Debt/Equity Mix can be calculated in

theory. This is

where

the Firm has Maximum Value

and Minimum WACC.

Practically speaking it varies

across

industries and companies. Optimal

D/E can range from 20/80 to

70/30 and keeps

changing

with time depending on the

firm's financial health and

growth strategy.

Signaling

Theory of Capital Structure- An

Improvement on Tradeoff

Theory:

This

is another modification of the theory of

Miller Modigliani Capital

Structure.

144

Financial

Management MGT201

VU

·

This

theory takes into account

the practical fact of the world

that NOT all Investors have

equal

amount

of information. All investors are not

rational. A Firm's Owners &

Managers (Insiders)

know

more about it than Ordinary outside

Investors.

·

Signaling Theory: "Insiders

(Managers & Owners) Know

Better"

When Firm's Future

genuinely looks Good (i.e.

High forecasted Cash Flows,

Earnings,

NI,

and ROE) then Managers will

choose to raise financing

through Debt (or Bonds

or

Loan)

because they do not want to

share the Financial Gain

with More Shareholders.

Rather

They Prefer to Take on Debt

and pay a small interest to the

Debt Holders. There

is

almost no risk of Default.

When Firm's Outlook

looks bad, then Managers

will choose to raise capital

by Issuing

Equity

(or Stock) to be able to

share the Likely Losses

amongst more Shareholders

(Owners).

If they took Debt and

couldn't repay it, they

might Default and be forced

to

go

Bankrupt.

So

mangers are in a better

position to decide about the

firm.

Signaling

Theory Conclusions:

·

Practically speaking, Firms should

maintain LESS Leverage than

the Optimal Level

from

Tradeoff

Theory.

·

Firms Should Save Some

Reserve Debt Financing

Capacity in case they find a

Great Project or

Investment

Opportunity. They should

finance the Project using

Debt for 2 reasons:

they don't have to share the

Financial Gains with more

shareholders and

they give the Right

Signal to the Market of Investors

about the good health of

their

Firm

!

Debt Financing brings

Financial Discipline and tighter

cash control on some

Managers

that

waste Shareholders'

money

·

News of New Equity

Financing Signals bad news: It indicates

shortfall in cash flows

through

profit,

Investors will sell stock and

Market Price (Po) of Stock

will fall. Therefore,

Required

ROR

(r = DIV/ (Po + g)) will Rise

and WACC will Increase.

Now more difficult for

Projects

and

Investments to meet this Firm's

Capital Budgeting Criterion by

showing positive NPV

(=

Sum

of Cash Flows / (1+r) t).

145

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios