|

Financial

Management MGT201

VU

Lesson

19

INTRODUCTION

TO RISK, RISK AND RETURN FOR

A SINGLE STOCK

INVESTMENT

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

topics

·

Introduction

to Risk

·

Risk

and Return for Single

Stock Investment

Before

discussing this important

topic we should go through the

area of finance which we

have

studied

up till now.

Part

I (Introduction and Capital

budgeting)

FM

Markets, Concepts,

Definitions

Review

of Accounting

Interest

Rate Theory &

Calculations

Investment

Decisions: NPV (Valuation), IRR,

Payback

Capital

Budgeting: NPV &

DCF

Capital

Rationing (Budgeting for Real

Assets)

Part

II (Securities Valuation)

Valuation

of Stocks & Bonds (Direct Claim

Securities)

The

Chapter 4 and 5 of text book cover the

topics of risk and return. It is the

fundamental concept to

understand

the topics of portfolio theory and

Capital Asset pricing model

(CAPM).In the previous

lectures,

we are ignoring the origin of

required rate of return.

Risk:

Chinese

Definition of Risk:

It

is defined as the combination of danger and

opportunity. Risk is the combination of

both.

When

we talk about risk with the

reference to the investment we are

talking about risk in term

of the

uncertainty

in outcome of our investment. We are

talking about the variability,

spread, or volatility

that

can

take place in the expected future Value

(Cash Flows) or Returns. For

example, we are

asking

ourselves

if we invest Rs 1,000 for

buying a share today then

what will be the price of the

share one

year

from now. There is no

guarantee about the price of the

share after one year

therefore there is an

uncertainty

or risk we are taking

because we do not know the

final outcome. So, the difference

or

variation

in the possible outcomes of a particular

investment also represents the

risky ness of a

particular

investment.

As

we have studied earlier that there

are two major categories of

assets

1

Real Physical Assets 2 .Financial

Assets (Stock & bonds)

Risk

can be understood with reference to the

uncertainty of Future Cash

Flows produced by

Assets

(Physical & Financial Securities).

Businesses make forecasts based on

certain assumptions

which

we

have discussed in lecture 5 of your

course. These forecasts are

not 100% accurate and there

is

uncertainty

in the possible outcome. The actual cash

flows one or five years from

now may be very

different

from the forecasted and this to

represent risk. When we talk

about risk in investing in

direct

claim

securities then we need to keep in mind

the distinction between Stand Alone

Risk (or Single

Investment

Risk) as oppose to market or

Portfolio Risk (or

Collection of Investments Risk).which is

a

risk

of particular investment compare to

other investments you have made. In

Portfolio risk we are

interested

in overall risk of entire

collection of investments that made by

the company. We will

study

this

topic in the next lectures.

In

case of portfolio risk we

can further made distinction

between Diversifiable Risk and

Market

risk

Diversifiable

Risk: random

risk specific to one company,

can be virtually

eliminated.

Market

Risk: It is

defined as uncertainty caused by

broad movement in market or economy.

More

significant.

Causes

of Risk:

These

can be Company-Specific or General. It

may be because of Cash

Losses from operations

or

poor financial management of the

company. This is one possibility

but the real question is

that why

these

losses occurred. One of the reasons

for the losses might be the

company's Debt,

Inflation,

Economy,

Politics, War or Fate. Final

analysis of risk is that it is a game of

fate or chance.

84

Financial

Management MGT201

VU

Measurement

of Risk:

It

is important to attach different

numbers to the risk so that we

can rank different

investments.

Risk

is measured in terms of the standard

deviation or variance. You have studied

these terms in the

statistics.

Risk is still quite

subjective even after the numbers

you have calculated after

standard

deviation.

The reason is that you have

to keep in mind what kind of

risk you are talking

about. Are you

Stand

Alone Risk or Portfolio

Risk?

Market

Risk or Diversifiable

Risk?

Stock

Price Risk or Earnings Risk?

Another

important thing is Time

Horizon for which you

are measuring the risk. Are

you

investing

in Stocks over 1 Year or

over 30 Years?

The

level of risk might change

as time period of the investment

change.

Fundamental

Rule of Risk & Return:

This

rule can be summed up in

saying that No Pain - No

Gain. Investors will not

take on

additional

Market Risk unless they

expect to receive additional Return

which is common sense and

quite

logical. Most investors are

Risk Averse. Another

important principle that one

should to keep in

mind

is Diversification.

Diversification:

It

states that don't put

all your eggs in one basket.

Diversification can reduce

risk. By

spreading

your money across many

different Investments, Markets,

Industries, Countries you

can avoid

the

weakness of each. Make sure

that they are Uncorrelated

so that they don't suffer

from the same

bad

news.

Due to certain change in the interest

rates some of the investments in your

portfolio may go up

and

the others go downward.

Every

Day Examples of Risk-Return

Pairs:

Risk

Level

Return

·

Climbing Mount K2

High

??

·

Gambling on Cricket

Matches

High

High

·

Oil drilling in Badin

Block

High

High

·

Satta

/

Speculation in Shares

High

Med-High

·

Construction Commercial

Plaza

Medium

High

·

Investing "Blue Chip"

Stocks

Medium

Medium

·

Crossing Road at Peak

Traffic

Medium

??

·

Investing TFC's

Med-Low

Low

·

Depositing Money in Bank

A/c

Low

Low

·

Investing in T-Bills

Low

Low

Before

taking about the risk we

first see the different possible

outcomes of a particular

investment

by

analyzing the expected return. It is

mentioned earlier that once

we have an idea of the variation

then

we

can measure the risk of that

investment.

Range

of Possible Outcomes, Expected

Return:

Overall

Return on Stock = Dividend

Yield + Capital Gains Yield

(Gordon's Formula)

Simply,

Return is proportional to Capital

Gain which is proportional to

Selling Price. We can

use

Forecasted

Selling Price as measure of Return.

The wider the range of Possible

Outcomes that can

occur,

the

greater the Risk

The

chance that a future event

will actually occur is measured

using Probability

Expected

ROR = < r > =

pi

ri

Where

pi represents the Probability of Outcome "i"

taking place and ri represents the Rate

of Return

(ROR)

if Outcome "i" takes place. The

Probability gives weight age

to the return. The Expected or

Most

Likely ROR is the SUM of the weighted returns

for ALL possible Outcomes.

Now

let us take a look of case

of investing in the share of the

particular company.

Suppose

you are deciding whether to

invest in the Stock of Company

ABC. You're not

sure

because

the Future or Forecasted Price of the

Stock after 1 year could

reach any one of 3

Possible

Values

(or Outcomes). Before you

can estimate the most likely

or Mean or Expected Future Price,

you

need

to guess the Probability of Each

Possible Outcome

85

Financial

Management MGT201

VU

Outcomes

(After 1 Yr)

Probability

(%)

"Bull

Market" (Stock Price

P1*=140)

30%

or 0.3

"Normal

Market" (Stock Price

P1*=110)

40%

or 0.4

"Bear

Market" (Stock Price

P1*=80)

30%

or 0.3

100%

1.0

Po=

Present Market Price Rs100.

P1*=Forecasted Price.

The

Sum of Probabilities of all

Possible Outcomes MUST Add

Up to 100% (or 1.0).

Payoff

Table & Expected

ROR

Payoff

Table for Investment in

Stock

Outcomes

(1 Yr)

Prob

(p)

ROR

<r> = (P1*-Po)/Po)

Price

Rises (P1*=140)

0.3

+

40 % = (140-100)/100

Price

Same (P1*=110)

0.4

+

10 % = (110-100)/100

Price

Falls (P1*=80)

0.3

-

20 % = (80-100)/100

1.0

Expected

ROR of Investment in Stock

Most

Likely or Weighted Average or

Mean ROR Rate of Return < r

>

Expected

ROR = < r > =

pi

ri.

=

p1 (r1) + p2 (r2) + p3

(r3)

=

0.3(40%) + 0.4(10%) +

0.3(-20%)

=

12% + 4% - 6% = 10%

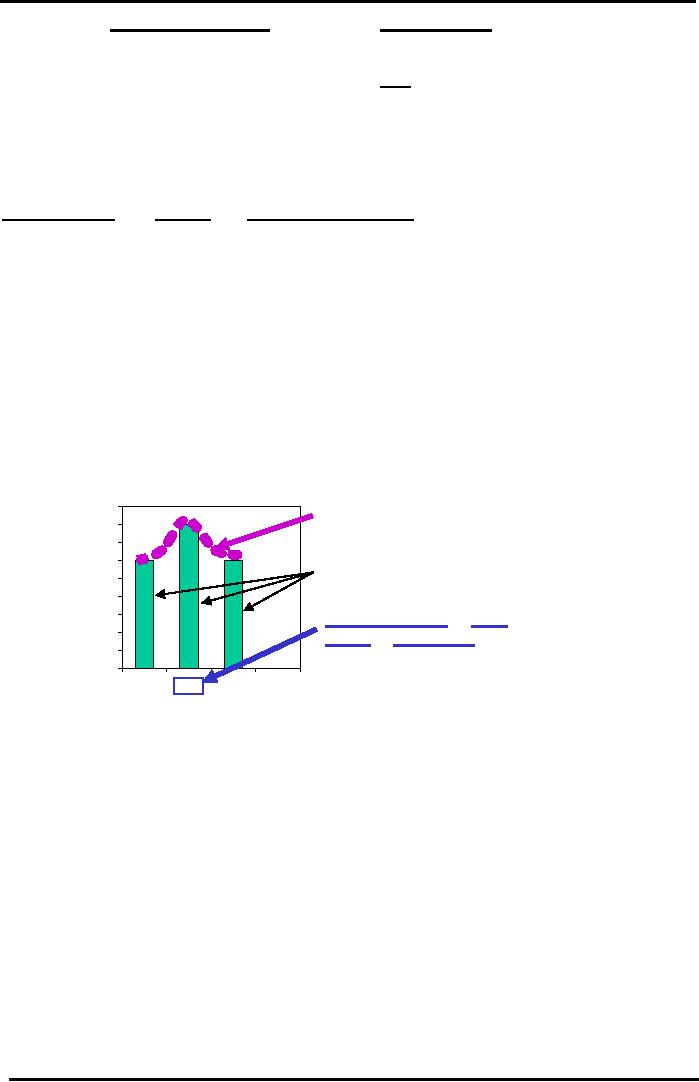

Probability

Distribution

Forecasted

Returns for Single Stock

Investment

"BELL"

0.45

Curve

0.4

Proba

0.35

bility

0.3

(p)

Possible

0.25

Outcomes

0.2

0.15

"Expected

ROR" or Most

0.1

Likely

or Mean ROR =

10%

0.05

0

-20

10

40

Rate

of Return after 1 Year < r

>

In

the diagram, the probability graphed on y

axis and the rate of return is graphed on x

axis. All

three

outcomes are shown in the form of the

bars. In this diagram the largest

probability takes place at

the

value of the expected rate of return

which is 10%. If the top of

each vertical bar is connected

then

the

bell curve is formed. It is

easy to calculate the risk after

calculating the expected rate of return.

We

simply

use the formula of standard

deviation to calculate the risk

Stand

Alone Risk of Single Stock

Investment:

The

wider the range of Possible

Outcomes (i.e. the greater the

variability in potential returns)

that

can occur, the greater the

Risk

Risk

Measured using Standard Deviation

(Note: Variance = Standard Deviation

2)

Risk

= Std Dev =

(

r i - < r i > )2 p i . =

Summed

over each possible outcome " i " with

return "r i " and probability of

occurrence "p i ." < r i

>

is the Expected (or weighted average)

Return

This

topic will be discussed in

detail in the next

lecture

86

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios