|

INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure, |

| OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond >> |

Financial

Management MGT201

VU

Lesson

01

INTRODUCTION

TO FINANCIAL MANAGEMENT

Learning

objectives:

The

purpose of this lecture is to

provide you with an overview

of financial management.

After

finishing

this lecture, you would be

able to have a better understanding of

the following.

·

Definition

of financial management

·

Significance

of financial management for

non-finance students and

professionals

·

Important

concepts and areas in financial

management

·

The

position of financial managers in

organizational hierarchy and

their respective work

domains.

·

Different

business legal entities,

their advantages and

limitations.

·

The

external and internal business

environments and their relevance to

financial management.

·

Different

types of financial and real

assets markets.

What

is FM?

FM

is the management of financial resources

how to best find and

use investments and

financing

opportunities in an ever-changing and

increasingly complex

environment.

Why

should CS majors study

FM?

First

of all, financial management is a

core life skill; almost

every one needs to understand

some

concepts

of finance to manage his/her

business & personal finances.

It

is generally and quite rightfully said,

"Money makes the world go

round". Finance is like a

life-blood

for a company. Even the

best of the companies and

CEOs go out of the business

because of

poor

financial management

policies.

Management

Information Systems (MIS) and

Information Technology (IT)

are just a part of

the

overall

corporate strategy which runs on finances, the

major resource. So the computer

sciences

professionals

need to have an understanding of the

financial concepts to understand and

contribute to

the

overall corporate strategy.

Financial

Engineering is an upcoming field

that requires people with

CS, math/science, and

finance

background. Financial engineering is the

application of engineering methods to

finance. One

important

area of study is the design, analysis,

and construction of financial

contracts to meet the

needs

of

enterprises. This field is

experiencing an increased demand

for professionals, especially those

who

are

trained in both the underlying

mathematics/computer technologies and

finance.

Definitions

Finance:

Finance

is the science of managing financial

resources in an optimal pattern

i.e. the best use of

available

financial sources. Finance consists of

three interrelated areas:

1)

Money & Capital markets, which

deals with securities markets &

financial institutions.

2)

Investments, which focuses on the decisions of

both individual and

institutional investors as

they

choose assets for their

investment portfolios.

3)

Financial Management, or business

finance which involves the actual

management of firms.

Major

Areas & Concepts of Financial

Management

Following

are some of the important

areas and concepts of

financial management, which

would

be

discussed in detail in the lectures to

come.

Analysis

of Financial Statements:

Analysis

of financial statement is one of the

most common techniques of financial analysis,

in

which

the financial performance and financial

health of a company are analyzed based on

its past

performance.`

The

following financial statements

are used in the analysis

process.

·

Profit

& Loss Statement or Income

Statement

Income

statement reflects the operating

efficiency or profitability of a company as a

result

of

its operations along with the net

profit available to the shareholders

for a given year

(usually

one accounting period). This

statement provides the analyst

with some insight

into

the

financial performance of the

company.

·

Balance

Sheet

Balance

Sheet is a snap-shot of an organization's

financial health at a particular

time. It

shows

what assets are owned by the

business and the sources of

acquiring these

assets.

1

Financial

Management MGT201

VU

·

Statement

of Shareholders' equity

Statement

of shareholders' equity provides the

share of the owners in the

business.

·

Statement

of Cash Flows

Statement

of cash flows explicitly reflects the

cash movement (inflows and

outflows)

during

the operations in an accounting

period.

Taken

together, these statements

give an accounting picture of the

firm's operations and

financial

position. Financial statements

report what has actually

happened to the assets, earnings,

and

dividends over the years.

The analysis of the information contained

in these statements

help

management

of the organization to evaluate the performance

and activities of the concern; it

also

helps

the investors and creditors to have an idea of the

profitability potential and

creditworthiness of

the

business.

Investment

Decisions & Capital

Budgeting:

Investment

decisions are the most critical as

they usually involve huge

sums of money and

these

decisions are likely to bring

prosperity or doom to a business. A

company's future

income

depends

on how much investment is

made, in what type of

assets, and how these

assets add to the

overall

value of the company.

Capital

budgeting is a term strictly related to

investment in fixed assets;

here, the term

capital

refers to the fixed assets that

are used in production,

while budget is a plan which

details

projected

cash inflows and outflows

over some future period.

The following concepts

and

techniques

are employed while analyzing

investment decisions.

Interest

rate formulas

o

Time

Value of Money

o

Discounted

Cash Flows

o

Net

Present Value

o

Internal

Rate of Return

o

Risk

& Return:

Investors,

individual or institutional, invest

their money with the expectations of

earning a

return

on their investment. While investors

wish and attempt to earn maximum

return, they are

constrained

by risk. How the risks and returns

are related and how do

investors make a choice of

their

portfolios is important for

investment decision making.

Following concepts and theories

would

be

discussed while discussing the

risk-return choices of the

investor:

Uncertainty

o

Risk

o

Portfolio

Theory

o

Capital

Asset Pricing Model

o

Corporate

Financing & Capital

Structure:

When

a firm plans to expand, it needs

capital or funds. Acquisition of

funds is considered to

be

a primary responsibility of a finance

department in an organization. There are

numerous ways to

acquire

funds, i.e., finances can be

raised in the form of debt or

equity. The proportion of

debt and

equity

constitutes the capital structure of the firm.

Financial experts attempt to find a

combination of

debt

and equity that could

increase the overall value of the

company, i.e., they try to

find the

optimal

capital structure. The following

concepts would be used to understand

how an optimal

capital

structure could be attained.

Cost

of Capital

o

Leverage

o

Dividend

Policy

o

Debt

Instruments

o

Valuation:

Asset

or company valuation is important not

only for financial managers,

but also for

creditors

and investors. It is important to know the

value of the company or its assets to

make

2

Financial

Management MGT201

VU

important

financing and investment

choices. Different valuation techniques

and factors that

influence

the value of a company or its financial

instruments would be discussed in this

section.

Share

o

Bond

o

Option

o

Corporate

o

Working

Capital & Inventory

Management:

Working

capital and inventory management pertains

to the effective management of

current

assets.

As we will see, an optimal and

effective utilization of working

capital and inventory

increases

the operating efficiency of the

firm.

International

Finance & Foreign Exchange:

With

the increasing importance of international trade and

global markets, the role

of

international

finance has increased

manifold. In a global environment, the

finance managers have

more

choices pertaining to investing

and financing than ever

before. However, it is important

to

understand

the implications of working in a global

environment, since fluctuations in the

currency

rates

can convert a good financing

or investment decision into a

bad one. This section of the

course

would

discuss the international financial

environment and the financial

implications of working in a

global

environment.

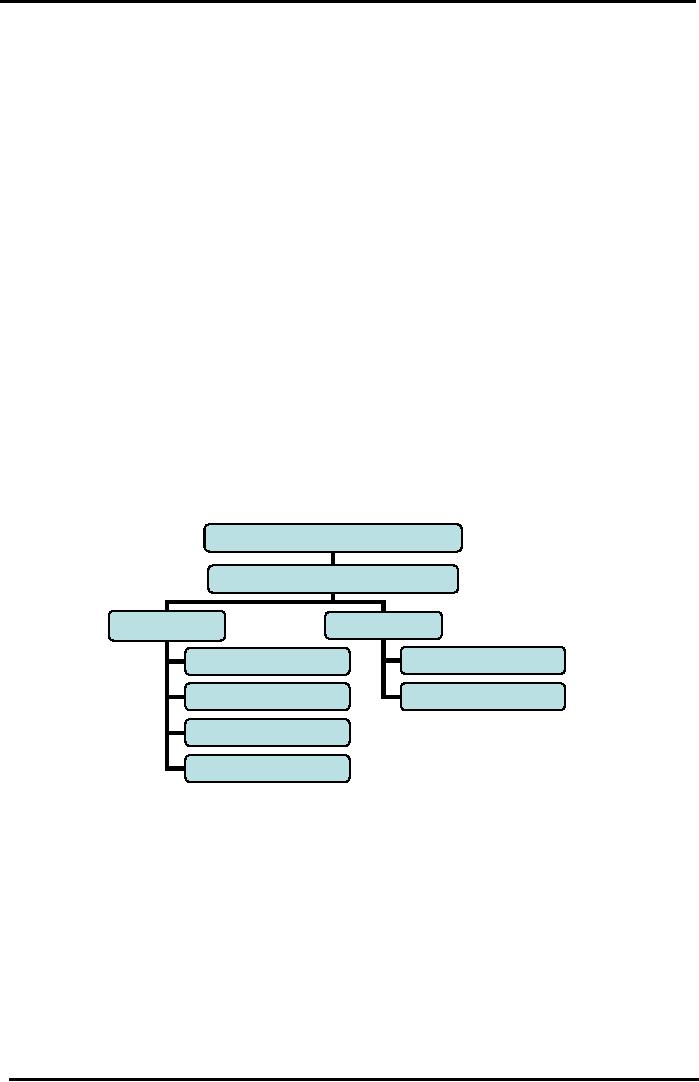

Organizational

Structure

(Who

does the FM

work?)

Chief

Executive Officer

(CEO)

Chief

Financial Officer

(CFO)

Treasurer

Controller

Accounts

Cash

& Investment

Capital

Budgeting

Audit

Capital

Structure

Inventory

Business

Legal Entities

·

Sole

Proprietorship :

It

is an unincorporated business owned by

one individual. Going into a

business as a sole

proprietor

is simple one merely has to

begin business operations. Proprietorship

consists of 80%of

the

total number of businesses

worldwide.

Advantages:

i.

It

is easily & inexpensively

formed.

ii.

It

is subject to few government

regulations.

iii.

The

business pays no corporate income tax;

only personal income tax is paid by

the

proprietor.

3

Financial

Management MGT201

VU

Limitations:

i.

It

is difficult for a proprietorship to

obtain large sums of

capital.

ii.

The

proprietor has unlimited personal

liability for the business

debts, which can

result

in losses hat exceed the

money invested by him in the

business.

iii.

The

life of the business

organized as proprietorship is limited to

the life of the

individual

who created it.

Partnership:

A

partnership exists whenever two or more

persons associate to conduct a

non-corporate

business.

It could be registered or unregistered.

Advantages:

i.

Low

cost involved

ii.

Ease

of formation.

Limitations:

i.

Unlimited

Liability.

ii.

Limited

life of the organization.

iii.

Difficulty

of transferring ownership.

iv.

Difficulty

of raising large amounts of

capital.

Corporation:

A

corporation is a limited company and a

separate legal entity registered by the

government. It

is

separate & distinct from

its owners & managers. It Can be

Private Limited (Pvt. Ltd.)

or Public

Limited

(which may be listed on

Stock Exchange). The businesses in the

form of corporations

control

80%

of global sales of products and

services.

Advantages:

i-

Unlimited life:

A

corporation can continue even

after the death of its original

owners.

ii-

Easy transferability of ownership

interest:

Ownership

interests can be divided

into shares of stock, which in

turn can be transferred

far

more

easily than can

proprietorship & partnership

interests.

iii-

Limited Liability:

The

liability of the shareholders is limited

up to the extent of nominal value of

shares held by

them.

Creditors and banks cannot confiscate personal

properties of director & shareholders

in case of its

bankruptcy.

Limitations:

i.

Double

Taxation:

Corporate

earnings may be subject to double

taxation the earnings of the

corporation

are taxed at corporate level, and

then any earnings paid out

as

dividends

are taxed again as income to

the stockholders.

ii.

Legal

Formalities:

Setting

up a corporation, and filing many

official documents, is more

complex

and

time consuming than for a

proprietor ship or a

partnership

·

Hybrids

(Mixed):

Hybrid

organizations are specialized types of partnerships,

which combine the

limited

liability advantage of a corporation with

the tax advantages of a

partnership.

S-Type

Corporation:

S-

Type corporations are

Limited Liability Corporations

without double

taxation.

In a regular corporation, the company

itself is taxed on

business

profits.

In addition, the owners pay individual

income tax on money that

they

draw

from the corporation as

salaries, bonuses, or dividends. In

contrast, in an

4

Financial

Management MGT201

VU

S

corporation, all business

profits "pass through" to the owners,

who report

them

on their personal tax returns (as in

sole proprietorships, partnerships,

and

Limited

Liability Companies). The S corporation

itself does not pay

any

income

tax, although a co-owned S

corporation must file an

informational tax

return

like a partnership or Limited

Liability Companies to tell the

tax

authorities

what each shareholder's

portion of the corporate income

is.

LLP:

Limited

Liability Partnership (LLP) is also a

form of partnership with

allows

limited

liability to the owners and avoids double

taxation. These

organizations

are

similar in many ways to the S

Corporations; however, LLPs

offer more

flexibility

and benefits to the owners.

PC:

Personal

Corporations (PC) or Professional Corporations

are generally formed

by

professionals to protect them against litigations.

Professionals like doctors,

lawyers

and accountants prefer to register

their business as Professional

Corporations.

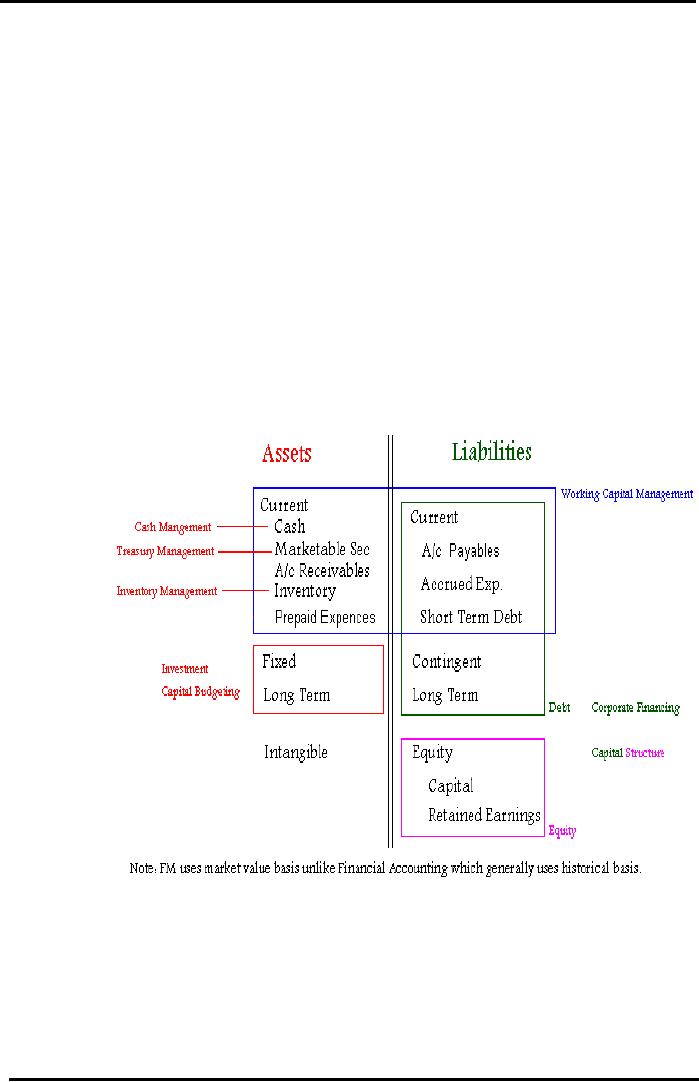

Balance

Sheet An FM Perspective

5

Financial

Management MGT201

VU

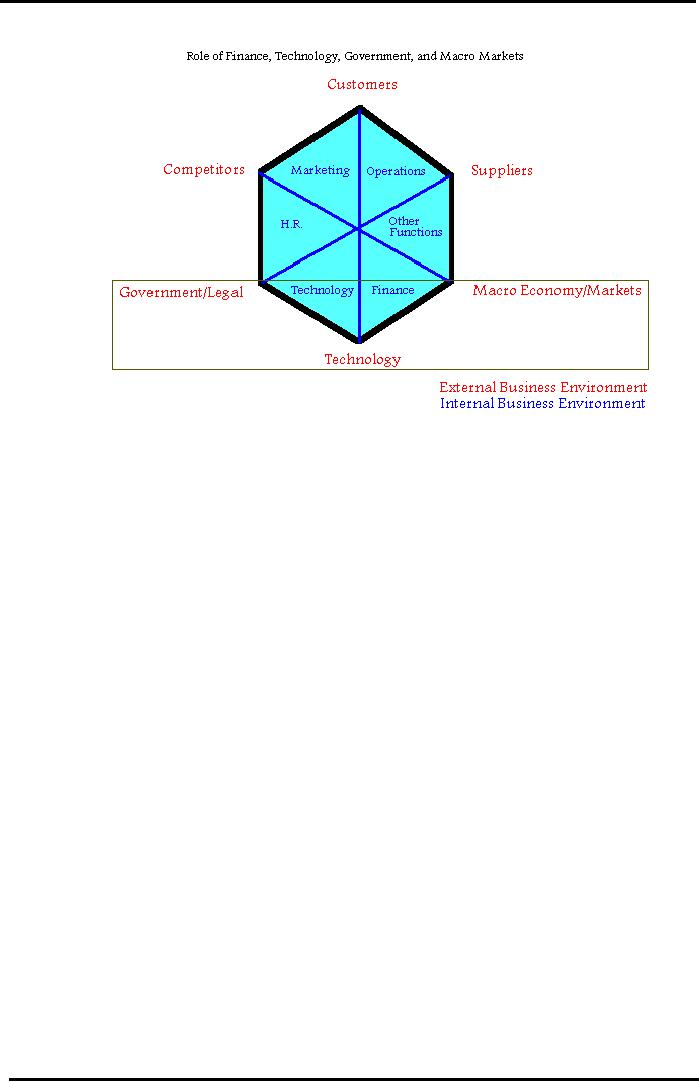

Internal

and External Business

Environment

Internal

Business Environment:

Internal

environment of business normally

consists of the following.

i.

Finance

ii.

Marketing

iii.

Human

Resources

iv.

Operations

(Production, Manufacturing)

v.

Technology

vi.

Other

Functions (Logistics,

Communications)

External

Business Environment:

The

following business environment factors

outside an organization have a profound

effect on

the

functions and operations of an

organization.

i.

Customers

ii.

Suppliers

iii.

Competitors

iv.

Government/Legal

Agencies & Regulations

v.

Macro

Economy/Markets:

vi.

Technological

Revolution

An

analysis which is used in a business is

called SWOT

Analysis.

SWOT is an acronym where

S

stands

for Strengths

W

stands

for Weaknesses

O

stands

for Opportunities

T

stands

for Threats

Strengths

and weaknesses are within an

organization, i.e., they

pertain to the internal

environment

of the organization.

Opportunities

and threats, on the other hand, pertain

to the external environment, i.e.,

outside

the

organization.

6

Financial

Management MGT201

VU

Financial

Markets

·

Capital

Markets:

These

are the markets for the

long term debt & corporate

stocks.

Stock

Exchange:

A

stock exchange is a place where the listed

shares, Term finance

certificates (TFC)

and

national investment trust units

(NIT) are exchanged and traded between buyers

and

sellers.

Long

term bonds:

Long

term government & corporate bonds are

also traded in capital markets.

·

Money

Markets

Money

market generally is a market where there

is buying and selling of short term

liquid

debt

instruments. (Short term means one year

or less). Liquid means something

which is

easily

en-cashable; an instrument that

can be easily exchanged for

cash. Following

financial

instruments

are traded in money markets.

Short

term Bonds

Government

of Pakistan: Federal Investment Bonds (FIB),

Treasury-Bills (T-

o

Bills)

Private

Sector: Corporate Bonds,

Debentures

o

Call

Money, Inter-bank short-term and

overnight lending &

borrowing

Loans,

Leases, Insurance policies, Certificate

of Deposits (CD's)

Badlah

(money lending against shares), Road-side

money lenders

·

Real

Assets or Physical Asset

Markets

Following

are the active markets of

real and physical assets in

Pakistan

Cotton

Exchange, Gold Market, Kapra

Market

o

Property

(land, house, apartment,

warehouse)

o

Computer

hardware, Used Cars, Wheat, Sugar,

Vegetables, etc.

o

7

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios