|

Financial

Management MGT201

VU

Lesson

28

INTRODUCTION

TO DEBT, EFFICIENT MARKETS AND

COST OF CAPITAL

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

topics

·

Intro

to Debt, Efficient Markets & Cost of

Capital

In

today's lecture, we will

start our discussion on

capital structure and corporate financing.

The first

thing

which we study about the

capital structure is the over view of the

financial markets. We have

mentioned

that there are two main

sources of capital raising

i.e. debt and equity.

There are various

financial

markets where the money is

available.

Capital

Markets:

Stock

Exchange (listed shares, unit

trusts, TFC):

In

the case of capital market we have

study the stock exchange where the common or

preferred

stocks

of companies are traded. In these we have

the supply or availability of the equity

capital.

Money

Markets (Short-term liquid

debt market):

It

is the market for short term debt. and it

includes the debt instruments like

term finance

certificates

and bonds etc. bank loans

,leases from leasing company , mortgage

agreements from house

building

finance corporation insurance policy ,

credit cards and various

other things .it also

includes

bank

deposits certificates and inter

bank short term and over night

borrowing and lending Bonds

Real

Assets Markets:

The

real asset market where the

real or tangible asset or

physical asset change hand

.for

example,

you have cotton exchange where

raw bales of cotton change

hands .computer hardware and

many

other examples are

available. For example,

Cotton Exchange, Gold Market,

Kapra

Market

Property

(land, house, apartment, warehouse)

,Computer hardware, Used Cars, Wheat,

Sugar,

Vegetables,

etc.

Debt

and Equity

Markets:

Equity

Markets and

Institutions

Stock

Exchanges

Private

Placements

Private

Equity Investments

Venture

Capital

Islamic

Finance

Debt

Markets and

Institutions

Bond

Markets

Money

Markets & Call

Markets

Bank

Loans & Certificate of Deposits

(CD's)

Project

Financing

Running

Finance or Working Capital Finance

Hypothecation

and Pledge Financing for Inventory

Purchase

Bridge

Financing

Mortgage

Financing

Lease

Financing

Insurance

and Credit Card

In

previous lectures we have studied

about the efficient markets.

Efficient

Markets" Assumption:

We

assume that Financial

Markets are quick and Prices

are Right. There are

Lots of Rational

Investors

in every Financial Market.

They are all well-informed

and act quickly on information

related

to

the companies' operations, finances, risk and

return. So Prices of Securities (like

Stocks and Bonds)

adjust

(equilibrate) quickly to new

information. Pricing by the Market is

Efficient and Accurate.

Observed

Market Price is accurate reflection of

Fair Price (or Theoretical Price

based on Investors'

NPV

calculations).

All

Stocks have Optimal Risk-Return

Combinations, i.e. All Stocks

lie right ON the SML

Line!

Securities:

These

are pieces of legal

contractual paper that

represent claim against

assets

Direct

Claim Securities:

120

Financial

Management MGT201

VU

Stocks:

it is

equity paper representing ownership,

shareholding. Appears on Liabilities

side of

Balance

Sheet

Bonds:

it is

debt paper representing loan or

borrowing.

When

you are issuing Bonds (i.e.

borrowing money) then the

Value of Bonds

appears

under Liabilities side (as

Long Term Debt) of Balance

Sheet.

If

you are Investing (or

buying) Bonds of other

companies then their

Value

appears

under Assets side (as

Marketable Securities) of Balance

Sheet.

Value

of Direct Claim Security is

directly tied to the value of the

underlying Real Asset.

Why

Take Debt?

If

you do NOT have enough money to

meet your own or your

family's personal living

expenses,

then

you approach a friend or a Bank

for a Personal Loan.

If

you can NOT find

friends, family, or investors who

want to invest Equity into

your business

venture,

then you approach an Individual

Lender or Bank or Leasing

Company for a Business Loan.

In

an

Emergency or Crisis, the quickest way to

get money is generally to take a

Loan at a high interest rate.

Countries

that are short of money do

this too.

Debt

vs. Equity:

If

the Company raises money

using Debt or Bonds, then it

will have to pay a fixed amount

of

interest

(or mark-up) regularly for a

limited amount of time. Of course,

failure to pay interest

can

force

company to close down.

If

the Company raises money

using Equity, then it is

forced to bring in new

shareholders who are

Owners

& can interfere in the management and

will get a share of the net profits

(or dividends) for

as

long as the company is in

operation

Where

Do Bonds & Stocks Appear on

the

Balance

Sheet?

Stocks

&

Bonds

Purchased

as

Investment

Own

Bonds

Issued

by

Company

to Raise Cash

Own

Stock

Issued

by

Company

to Raise Cash

Capital

Structure:

Most

Firms keep a Mix of Both Debt and

Equity Capital. In other words

most Firms raise

money

from both Stockholders (and Shareholders)

and Bondholders (and

Banks).

The

Mixture or Proportion of Debt

Capital and Equity Capital

are known as the Capital

Structure.

This

Financial Policy Decision is

taken by the CEO, CFO, and Board of

Directors

Capital

Structure can Change With

Time depending on Firm's

Financing needs and strategy.

Some

Projects

like Power Plants and Cement

are so Capital Intensive and

large that initially the

sponsors need

Debt

Capital When a Running

Business reaches maturity,

some owners prefer to fix the Ratio of

Debt to

Equity

at 20/80 and only for

Running Finance. Some Muslim

Businessmen use 100% Equity

Capital

only

(No Debt).

121

Financial

Management MGT201

VU

Cost

of Capital: Firms

try to attract Debt and

Equity Investors to invest

their Capital (or money).

Firms

claim

that they are SAFE

and PROFITABLE investments. Therefore,

Firms try to Get

Investment

Capital

(or money) at the LOWEST possible

Cost of Capital.

Remember

that whenever you Borrow or

Rent or Buy anything (cycle,

house, money), it

Costs

You

Money in the form of a Rental,

Interest or Mark-up, Installment,

etc.

Stockholders

(Equity owners) expect to receive

Dividends

Bondholders

(Debt Holders and Banks) expect to

receive Interest

Cost

of Capital & Required ROR:

Required

ROR (or Opportunity Cost)

%:

CAPM

Theory (SML for Efficient

Markets) & NPV

Minimum

ROR required attracting investor

into buying a Security (i.e.

Stock or Bond ...)

Opportunity

Cost: Investor Sacrifices the ROR available

from the 2nd best

investment.

Cost

of Capital %:

Weighted

Average Cost of Capital

(WACC)

Combined

costs of all sources of

financing used by Firm (i.e.

Debt and Equity)

WACC

is Similar to Required ROR BUT

Takes into account some

Practical Factors:

Taxes:

Interest

Payments are P/L Expenses

and NOT Taxed.

Transaction

costs: Brokerage,

Underwriting, Legal, and

Flotation Costs

incurred

when

a Firm issues Stocks or Bond

Securities

WACC

%Weighted

Average Cost of

Capital

Assume

that Firm markets 3 Types of

Financial Products (or Securities or

Instruments) to attract

Investors'

Capital.

Bonds

(Debt):

Cost

= Coupon Interest

Common

Shares (Equity): Cost =

Variable Dividend

Preferred

Shares (Hybrid Equity): Cost

= Fixed Dividend

The

Firm Issues a Security or

Financial Instrument to the Investor and

Receives Capital (or

Money)

in

exchange. The Firm has to

pay a "Rental

Cost" for

using the Investors'

Capital.

WACC

% = Weighted % Cost of Debt +

Weighted

% Cost of Common Equity

+

Weighted

% Cost of Preferred Equity =

rDxD +

rExE +

rPxP

WACC

must take Taxes & Transaction

Costs into

account

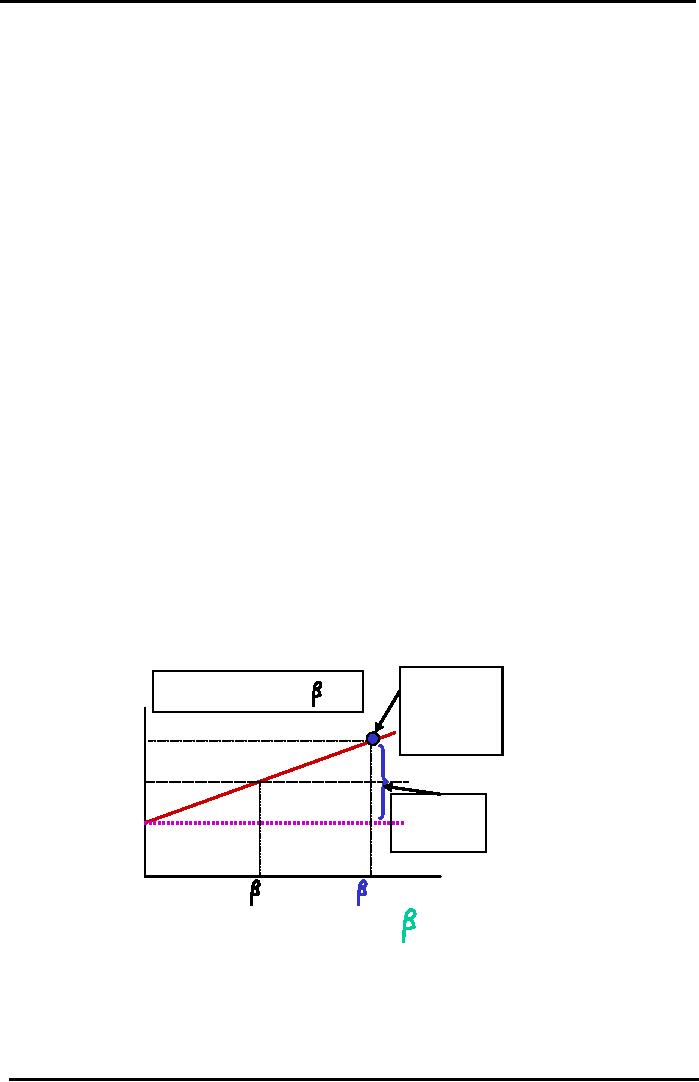

Security

Market Line (SML)

For

Market of Efficient

Stocks

Stock

A lies

rA =

rRF +

(rM -

rRF )

.

Required

A

ON

the

SML

Line.

Efficient

Return

(r*)

Risk-Return

rA= 30%

Combination

Security

Market Line

rM=

20%

Risky

Stock A's

rRF= 10%

Risk

Premium

=

30-10 = 20%

A

=+ 2.0

M

=+ 1.0

Beta

Risk (

)

122

Financial

Management MGT201

VU

Summary

of Formulas:

Total

risk=

market risk + company specific

risk

σ

2

+

β 2σ

2

+

σ 2

NPV

Bond Pricing

Equation:

Bond

Price = PV = C1/ (1+rD) + C2 (1+rD)

2 +

C3 / (1+rD)3

+

.....

+ PAR / (1+rD)3

Gordon's

Formula for Share

Pricing:

rCE = (DIV 1 /

Po) + g = Dividend Yield + Capital

Gains Yield

SML

Equation (CAPM

Theory)

r

= rRF + Beta (rM

- rRF)

123

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios