|

Financial

Management MGT201

VU

Lesson

44

INTERNATIONAL

FINANCE (MULTINATIONAL

FINANCE)

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

topics:

·

International

Finance (Multinational Finance)

In

the lecture we shall cover three

areas of International

Finance:

·

Multinational

Finance

·

Impact

of Globalization and International Finance on

different areas of financial

management

like

capital budgeting, capital structure and

Capital asset pricing

model

·

Foreign

Exchange (F/x)

First

we discuss the first area of

Multinational Finance.

Issues

of International Finance:

·

All

Finance has become

International

Financial Markets (Money and

Capital Markets) of all countries

are Linked by hi-speed

telecom

satellite links, computer, and

Internet

Butterfly Effect "When

New York Stock Exchange

Sneezes, the Tokyo

Stock

Exchange

catches a cold". It explains

the impact of capital

markets that are linked

all

over

the world. As all the financial

markets over the world are

linked due to

international

flow of money and international trade

and transactions. So any change

in

one

part of the world has its

affects on the other part of the

world.

·

All

Firms affected by International

Factors

Even 100% Domestic Firm is

affected by International Finance because

it competes

with

Importers and Foreign Franchises

substitutes and competing products whose

prices

change

with Foreign Exchange

Rate.

·

2

Fundamental Flows Determine a Country's Foreign

Exchange Rate

International Flow or Trade of Real

Physical Goods:

Trade

Surplus / Deficit = Imports -

Exports

International Flow of Capital or

Money Balance of Payments

(BOP)

=

Current Account + Capital

Account + Foreign Exchange Reserves.

Current

Account

includes

Trade of Goods and Services.

Capital

Account measures

Capital coming in (FDI and

Portfolio Investment) and

Going

Out.

Domestic Macroeconomic Factors

affecting Foreign Exchange:

1)

Inflation

2)

Fiscal Deficit (if government

expenditures exceed their

revenues through taxes

etc.)

Why

do Multinationals Do Business

Internationally?

To Expand Market Share:

USA and EU are about $ 10

Trillion Economies Each.

And

each

has about 300 million

people.

Get Closer to End Users /

Consumers i.e. Toyota of

Japan in USA

Lower Production Costs,

Shipping Costs, Raw Material

Costs i.e. British BAT

Tobacco

in

NWFP, Union Texas in

Badin

Bypass Trade Barriers

and Import Tariffs i.e.

Pakistanis set up textile units in

Srilanka,

UAE

and Mexico to legally bypass US

Textile quota for exports

from Pakistan.

Diversify and Reduce

Sovereign (Country-Specific Political)

Risk

·

Portfolio of Subsidiary Companies,

Divisions, Projects, Investments

diversified

across

different countries can reduce the

Sovereign (or

Country-Specific

Political)

Risk

·

Manage Foreign Exchange Rate

Exposure. If your home currency is very

weak

or

Depreciating (because of Inflation,

Deficits, Political Turmoil

etc. ) then

invest

abroad

·

Take advantage of Lower Costs of

Debt (interest rates) in

foreign countries or

lower

Taxes.

179

Financial

Management MGT201

VU

Major

Issues Faced by

Multinationals:

Foreign Exchange Risk i.e.

Turkish Lira, Russian Ruble.

Caused by Unexpectedly

high

Inflation,

Deficits, and Political Turmoil

etc.

Sovereign and Political Risk

i.e. South Africa,

Afghanistan, Rwanda - risk of War,

Civil

Unrest

Different Laws Business

Contract, Property, Companies, Capital

Flow & Different

Tax

Rates,

Different Government Involvement,

and Different Maturity of

Financial Markets

·

Saudi Arabia (Restricted property

rights)

·

USA (strict Monopoly

laws) vs. Bahamas (Lenient

Laws and Tax)

·

Japan (MITI supports Japanese

exporters abroad)

Different Cultures, Customer

Awareness about their rights

and Quality

Standards,

Credit

Cultures, and Business Practices and

Ethics

·

Japanese Kereitsu (Bank is

Business Partner and Shareholder) so in

Japan large

companies

like Sony have large of debt

in their capital.

·

Korean Chaebols (Conglomerates with

Monopoly power)

·

German Consumer Standards

·

Business Ethics i.e. Nigeria

vs. Singapore

·

Central Asia (Barter economy and

Long Credit Cycle)

Now

we move to the second area of

today discussion:

International

Financial Management:

·

International

Diversification

Bruno Solnik: These

two persons analyzed

INTERNATIONAL Portfolio of 20

Stocks

has

HALF as much risk as same

portfolio containing stocks of

just 1 country.

·

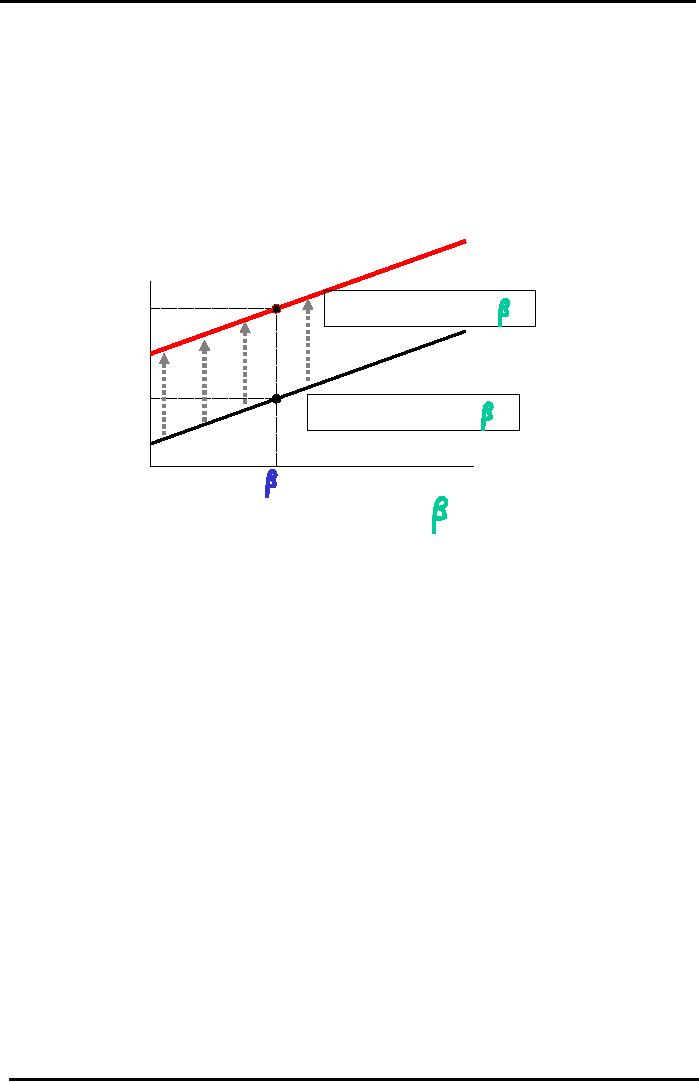

International

CAPM Model for Integrated

Global Market

r

P =

r RF + Beta (r W

- r RF )

r W is

the WORLD MARKET Required

Rate of Return expected by all investors

all

over

the world

Assets are priced in

LOCAL (or SEGMENTED) MARKETS

so if an Investor can

diversify

internationally, then he may

attain RISK-RETURN above the Local

Market

Capital

Market Line.

Global Efficient Frontier

(for Investment in World

Markets) offers higher

Risk-Return

combinations

than Local Segmented Market

Efficient Frontier.

Global

Investing Makes the

Efficient Frontier and

the

CML

(Capital Market Line) Rise

Up

Higher

Return for Same Level of

Risk

Efficient

Frontier (for

)

rP*

nts

Global

Investments)

e

stm

ve

In

al

s)

b

ent

lo

rG

tm

ves

(fo

In

L

y

ntr

CM

u

o

le

C

Efficient

Frontier

g

Sin

(for

Investment in

for

rRF

(

ML

Single

Country)

C

P

Risk

180

Financial

Management MGT201

VU

·

International

Corporate Financing

Raise capital in the country where

you can get the best price

and yield.

Euro equities Example

ADR's (American Depository receipts):

Non-US firms can be

listed

and traded on the NASDAQ Stock Exchange in

USA. So Pakistani firms

can

raise

equity capital in America.

Foreign firms can also be

listed on Luxembourg stock

exchange

to raise Equity capital in

Euro currency.

Eurobonds: Currency of bond

issue is different from the

country of issue.

Example:

Pakistani

company selling US$-denominated Bonds in

Luxembourg can raise

Debt

capital

in Euro currency.

·

International

Capital Budgeting

PV

= CF 1 / (1+r) + CF 2 / (1+r) 2

+ CF 3 /

(1+r) 3

+ ...

CF or Cash Flows in foreign

countries need to be converted into the

Home Currency of

the

Investor (or country where

Head Office is

located).

·

Transfer Pricing, Royalties, and

Foreign Country's Inflation

affect forecast of

cash

flows

·

Opportunity Cost of Foreign

Funds Blocked because of Remittance

Restriction

·

Different taxes in different

countries. Tax on Remitted

Income.

Discount rate "r"

·

Discount the foreign cash

flows in the nominal foreign

currency discount rate.

Then

convert the PV in foreign currency to

home currency.

·

Use High Discount Rate

if High Level of Country -

specific Political or

Sovereign

Risk

·

Impact of Concessionary Financing

can affect choice of "r"

·

International

Accounting Standards

Profit & Loss Statement

(or Income Statement) Convert

foreign expenses and

revenues

at the AVERAGE F/x Rate

prevailing during the Accounting

Period.

Balance Sheet Foreign FIXED

(Non-Financial) Asset values converted

at

HISTORICAL

F/x Rate prevailing at the

time of purchase. But,

Foreign FINANCIAL

Assets

converted at AVERAGE F/x

Rate prevailing during the

Accounting Period.

Foreign

Exchange Rate:

·

Currencies, like Goods, are bought

and sold in markets. The

price of a currency increases if

the

financial,

economic, and political health of that

Country becomes stronger.

Like price of cotton

from

Pakistan which is different from

China and Egypt and changes

with quality and

Supply/Demand.

·

Currencies or F/x are traded in

International F/x Markets

which is the largest Financial

Market

of

all with trading in

Trillions of Dollars. Banks, Firms, and

Individuals can trade in

Virtual

Electronic

F/x Markets from their

computer 24-hours a day. F/x rates

are changing every

second!

·

The Demand / Supply of F/x

affect the Value of the

Currency.

·

3 F/x Markets:

F/x Spot Market : "Current"

exchange rate for Delivery

within 2 Days

F/x Forwards Market: Make contract

today for Delivery in

future. Forward Price

Determined

by Interest Rate Yield Curve

and Spot Rate. Contract size and

delivery

date

negotiated privately with

banks.

F/x Futures Market: Derivative

securities whose value is derived

from Forward prices

and

"Mark-to-market" risk premium

for meeting minimum balance in

Margin Account

for

trading. Tradable in Exchanges

because of Standardized contract size and

fixed

future

delivery dates.

F/x Options Market:

Derivative securities. Spot Option values

derived from Spot

F/x

Rate.

Future Option values derived

from Futures F/x Rate.

Options (unlike Forwards

and

Futures) are not obligations. It is

cheaper to buy an Option to

buy a house than to

buy

the house! Same for F/x.

Also, you can decide not to

buy and let the option

expire.

181

Financial

Management MGT201

VU

·

Call

Option Right to Buy something at a

fixed Strike Price for a

limited time

in

the future

·

Put

Option Right to Sell something at a

fixed Strike Price for a

limited time in

the

future

·

Valuation

or Pricing of Options using

famous BLACK & SCHOLES

MODEL

or

simpler Binomial

Model

Relationship

between Foreign Exchange Rate, Interest Rate &

Inflation Rate:

·

Spot F/x Rate of 2 Countries

determined by Prices of Real

Goods:

Relative Prices of Same

Good Purchasing Power Parity Theorem

(PPP)

·

Spot price (Rs. / US$) = Price

(Pak) / Price (USA)

·

Example: Use Price of Levis

Jeans made in Pakistan and

USA to estimate the

theoretical

Spot F/x Rate. Price of Levis

501 is US$50 in USA and Rs.3100

in

Pakistan

so the Estimated Spot F/x Rate = S (Rs. /

US$) = Rs.3100 / US$50 =

Rs.62

/ US$1. This is close to the actual Spot

F/x rate in range of Rs.50-60.

·

Nominal Interest Rate

determined by Expected Inflation.

Relative Expected Inflation Rates (

g ) Fischer Effect

·

(1+ i Rs.)

/ (1+ i US$ )

= (1+ g Pak )

/ (1+g USA )

·

Forward F/x Rate

determined by Interest Rate

Yield Curve

Relative Interest Rates ( i ) -

Interest Rate Parity Theorem

(IRP)

·

F (Rs. /US$) / S (Rs.

/US$)

=

(1+ i RS)

/ (1+ i US$)

·

Example: Use 1 Year Estimate of

Interest Rates in Pakistan and USA

to

estimate

the 1 Year Forward F/x Rate.

Using Yield Curves, you know

that the

interest

on 1 Year Maturity in Pakistan is 10% and

in USA 2%. You know

that

the

current (or Spot) Rate is

Rs.60/US$1. So, the 1 Year

Forward Rate

=

F = S (Rs. /US$) (1+ i Rs.)

/ (1+ i US$)

=

(60) (1+0.1) /

(1+0.02)

=

Rs.64.7 / US$1.

In

other words, we have forecasted the F/x

Rate after 1 Year.

·

2 Conventions for Quotation of

F/x Rates used by Banks and

F/x Dealers:

American: US$ / FCY

i.e. US$0.9 / 1Euro (means

"Bid US$ 0.9 / Ask 1

Euro")

European: FCY / US$

i.e. JY100 / US$1, Rs.60 /

US$1.

Inverse Relationship: European = 1 /

American. So, Japanese

Yen (JY) under

American

Convention = 1 / 100 = US$0.01 /

1JY. Commonly written as

1.000.

In

Pakistan generally we follow European

convention.

·

PAIR

of Market Prices for Every

Currency in the F/x

Market

BID Rate = Buying Price for

Currency. Example: Bid Rs.60

/ US$1

Means

Bank

or

Money Changer will Buy (or

Bid) one US$ from you

for Rs.60. This also

means that

you

(the Customer) are Selling

Dollar to the Bank. Bid

Rs.60 / US$1 means Bid

Rs60 /

Ask

US$1

ASK Rate = Selling Price

for Currency. Example Ask

Rs.61 / US$1 Means Bank

or

Money

Changer will Sell (or Ask)

one US$ to you for Rs.61.

This also means that

you

(the

Customer) are Buying Dollar

from the Bank. Ex. If you

are going to travel

abroad

to

USA.

Fundamental Principle for F/x

Traders and "Money Changers": Buy

Low and Sell

High.

So, ASK > BID

Rate.

Standard Quotation Format: Bid

Rate / Ask Rate.

·

Ex 1. "US$ 60/61" means

Money Changer will Buy 1 US$

from you (the

customer)

for Rs.60 BUT they

will Sell 1 US$ to you

for Rs.61. Means a

Profit

of

Rs.1 for every US$

traded!

·

Ex2. If you see only 1

Quote i.e. "US$ 60" then it

generally refers to the

Bid

Quote

i.e. Bid Rs60 /

US$1.

·

Cross

Rates (Transitivity of F/x

Rates)

182

Financial

Management MGT201

VU

Example

with Either Bid OR Ask

Rates: Suppose you want to

convert your Euros

into

US

Dollars in Pakistan and you need to

estimate the E/US$ F/x rate.

Money Changers

and

Banks in Pakistan show Spot F/x Rates in

Rupee-Terms: Rs.60 / 1US$

and Rs.55 /

1Euro.

Then Spot US$ / Euro = ( US$

/ Rs. ) x ( Rs. / Euro) = (

1US$ / Rs. 60) x

(

Rs55 / 1 Euro) = US$ 0.9167

/ 1Euro

If

you are given Both

Bid and Ask Rates,

then Estimate the Cross Rate

RANGE.

·

Bid Euro / Ask US$

< ( Bid Euro / Ask Rs. )

x ( Bid Rs. / Ask

US$)

·

Ask Euro / Bid US$

> (Ask Euro / Bid Rs.) x

( Ask Rs. / Bid

US$)

Global

Investments

Make

SML (for Efficient Stocks)

Rise Up

Higher

Return for Same Level of

Risk

Required

nt)

Return

(r*)

tme

s

Inve

rW (Global

l

rA =

rRF +

(rW -

rRF )

.

oba

l

A

L

(G

Market)

SM

ent)

estm

rRF (Global

v

y

In

untr

Market)

Co

le

rM (Single

Sing

L(

rA =

rRF +

(rM -

rRF )

.

Market)

SM

A

rRF (Single

Market)

M

=+

1.0

Beta

Risk (

)

183

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios