|

INTEREST ON CAPITAL AND DRAWINGS |

| << Financial Statements of Partnership firms |

| DISADVANTAGES OF A PARTNERSHIP FIRM >> |

Financial

Accounting (Mgt-101)

VU

Lesson-35

INTEREST

ON CAPITAL AND DRAWINGS

The

partnership agreement may include one or

both of the following

clauses:

o

o Partners

are charged interest on

drawings (this may be on the total amount

of the current

account

balance or on the amount exceeding a

specific limit, depending upon the

terms of

agreement).

o Partners

are given interest on their

capital (again this can be on the

total amount of the

capital

or the amount exceeding a specific

figure).

REASONS

FOR INTEREST ON

CAPITAL

The

profit/loss sharing ratio

may not be equal despite the

fact that partners have

contributed equal

o

capital,

depending upon the partnership

agreement.

Take

the following example:

o

o Two

partners start a business

and contribute equal capital

and decide to share equal

profits.

o But

they also realize that in

future the business may need

further capital and at that

time

both

partners may not be able to

contribute equally.

o So,

instead of revising the contract every time, they

include a clause in the agreement,

whereby,

the partners are allowed an interest on

the capital contributed.

o This

interest can be on the whole amount of

both partners or only of one

partner on the

amount

contributed in excess of the other

partner.

o This

way a partner, who provides capital in

excess of his profit sharing

ratio, can be

compensated.

o One

may say that the same

results can be achieved by

saying that profit and

loss sharing will

be

proportionate to the amount of capital

invested.

o But,

as we have said that in partnership

everything depends on the Partnership

Agreement.

REASONS

FOR INTEREST ON

DRAWINGS

Drawings

are opposite to capital invested

i.e. these are the funds drawn by

partners from the

o

business.

Therefore, in

order to keep the distribution of

profit fair, a clause may be

inserted in the agreement,

o

where

an interest is charged on the drawings of

the partners.

Again,

this can be on the total amount or on an amount

exceeding a specific

limit.

o

Both

of the above things depend upon the

agreement between

partners.

o

ACCOUNTING

TREATMENT

One

may think that as Interest

on Capital is paid to the partners, so it should be

treated as business

o

expense

and Interest on Drawings is charged

from the partners, therefore, it should be

treated as

income.

But

this is not the case.

o

Just

like partners salaries, both

these items will be included in the

Profit and Loss

Appropriation

o

Account.

Partners'

salaries, interests etc. are

never treated as expense or

income of the business. They

are a

o

part

of DISTRIBUTION OF PROFIT.

EXCEPTIONS

235

Financial

Accounting (Mgt-101)

VU

Rent

paid to partner for use of his

premises, purchase of stocks,

assets or other items for

use in

o

business,

Markup on loan from partner are the

exceptions. All these

expenses are charged

to

profit

& loss account of the partnership

firm.

ACCOUNTING

ENTRIES

Interest

on Capital

o

Debit:

Profit

and Loss Appropriation

Account

Credit:

Partner

A's Current Account

Credit:

Partner

B's Current Account

Credit:

Partner

C's Current Account

Interest

on Drawings

o

Debit:

Partner

A's Current Account

Debit:

Partner

B's Current Account

Debit:

Partner

C's Current Account

Credit:

Profit

and Loss Appropriation

Account

Example

# 1

Mr.

Abid is a partner in a partnership firm.

His capital on July 1, 2001

was Rs. 200,000. He invested

further

capital

of Rs. 100,000 on March 1,

2002.

You

are required to calculate his

mark up. Mark up rate is 5%.

The financial year is from

July to June.

SOLUTION

Rs.

200,000 was invested in the

beginning of the year and

extra capital was invested

on 1st March. So,

from

March

onward, the capital is Rs. 300,000

(200,000 + 100,000). We will

calculate mark up on Rs.

200,000 for

12

months, i.e., from July to

June. Mark up on 100,000

will be for 4 months, i.e.,

from March to June.

Mark

up is calculated as follows:

200,000

x 5% = 10,000

=

10,000.00

100,000

x 5% = 15,000 x 4/12 =

1666.67

Total

Mark Up

11,666.67

236

Financial

Accounting (Mgt-101)

VU

Example

# 2

Mr.

Naeem is a partner in a partnership firm. He

drew following amount during the

financial year:

Rs.

September

1

3,000

November

1

5,000

January

1

4,000

March

1

5,000

June

1

2,000

You

are required to calculate Mark up on

his drawings, if the rate of

mark up is 5%. The financial year

is

from

July to June,

SOLUTION

3,000

x 5% = 150 x 10/12 =

125.00

5,000

x 5% = 250 x 8/12 =

166.67

4,000

x 5% = 200 x 6/12 =

100.00

5,000

x 5% = 250 x 4/12 =

83.33

2,000

x 5% = 100 x 1/12 =

8.33

Total

Mark Up

483.33

EXAMPLE

# 3

Atif,

Babar and Dawar are

three partners sharing

profits equally.

You

are required to prepare profit

and loss appropriation

account and extract from

balance sheet,

showing

partners

capital and current accounts

from the following

information:

·

Net

profit for the year Rs.

558,000

·

Opening

balance of Capital accounts Atif

Rs. 500,000, Babar Rs.

600,000, Dawar Rs.

400,000

·

Opening

balance of Current Account Atif

Rs. 55,800, Babar Rs.

63,820, Dawar Rs.

20,555.

·

Salaries

to be paid to Babar Rs. 10,000,

Dawar Rs. 12,000.

·

Drawings

during the year Atif Rs.

180,000, Babar Rs. 220,000

Dawar Rs. 151,000

·

Mark

up on Capital @ 5% and Mark up on

drawings are: Atif Rs.

9,000, Babar Rs. 11,000

and

Dawar

Rs. 7,550.

237

Financial

Accounting (Mgt-101)

VU

SOLUTION

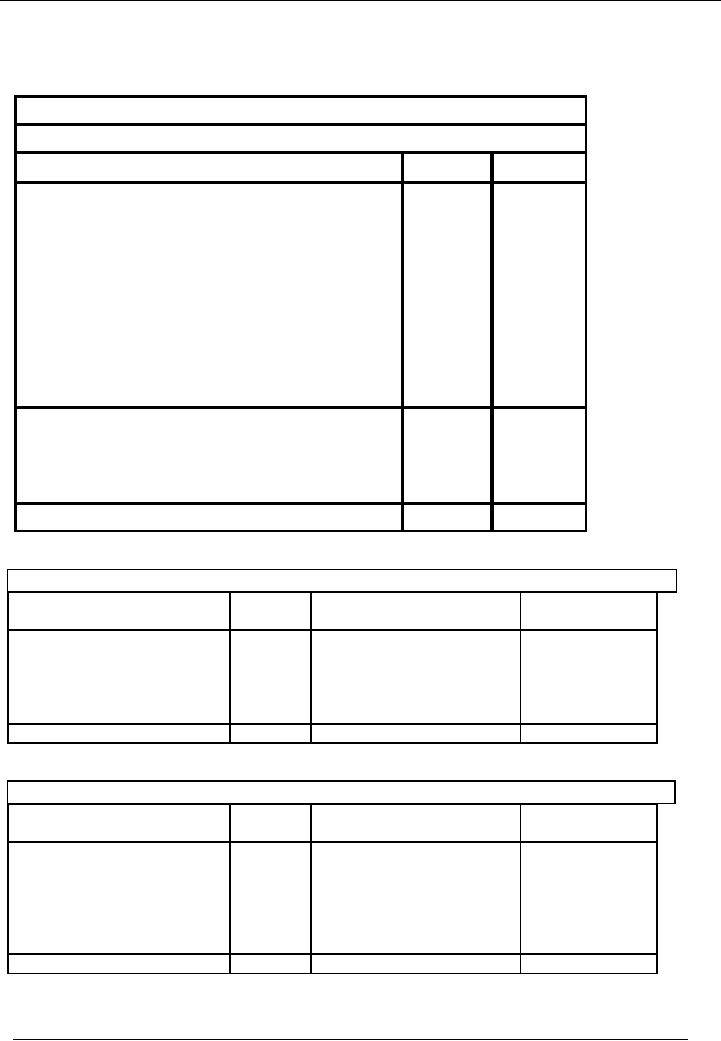

PROFIT

& LOSS APPROPRIATION

ACCOUNT

Atif,

Babar, Dawar & Co

Profit

Distribution Account

Particulars

Note

Amount

Rs. Amount Rs.

Net

Profit

558,000

Less:

Partner's Salary

Babar

10,000

Dawar

12,000

(22,000)

Less:

Interest on capital Atif (5% of

500,000)

25,000

Babar

(5% of 600,000)

30,000

Dawar(5% of

400,000)

20,000

(75,000)

Add:

Interest on Drawings Atif

9,000

Babar

11,000

Dawar

7,550

27,550

Distributable

Profit

488,550

Less:

Partner's Share in

Profit

Atif

(1/3of 488,550)

162,850

162,850

Amir

(1/3 of 488,550)

Babar

(1/3 of 488,550)

162,850

(488,550)

0

Atif's

Current Account

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Drawings

180,000

Opening Balance

55,800

Interest

on Drawings

9,000

Interest on Capital

25,000

Profit

for the year

162,850

Balance

c/d

54,650

Total

243,650

Total

243,650

Babar's

Current Account

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Drawings

220,000

Opening Balance

63,820

Interest

on Drawings

11,000

Salary

10,000

Interest

on Capital

30,000

Profit

for the year

162,850

Balance

c/d

35,670

Total

266,670

Total

266,670

238

Financial

Accounting (Mgt-101)

VU

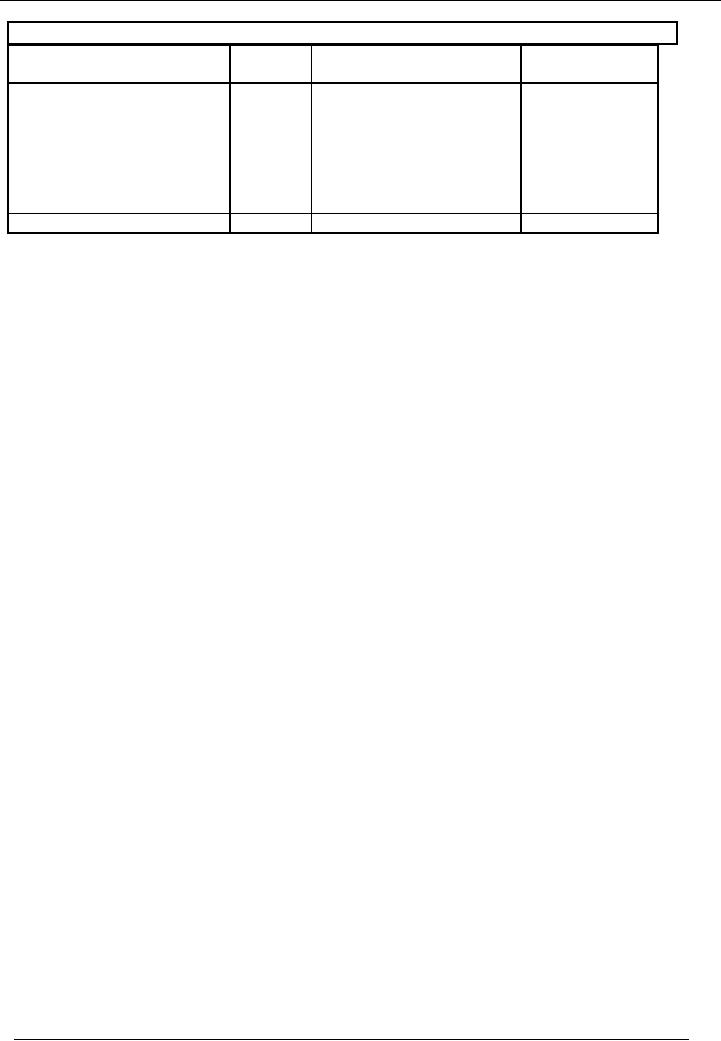

Dawar's

Current Account

Account

Code --------

Particulars

Amount

Particulars

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Drawings

151,000

Opening Balance

20,555

Interest

on Drawings

7,550

Salary

12,000

Interest

on Capital

20,000

Profit

for the year

162,850

Balance

c/d

56,855

Total

215,405

Total

215,405

ADMISSION

OF A PARTNER

When a

new partner join the business,

old agreement of partnership is modified

or a new agreement is

prepared.

This new agreement contains

new ratios in which partners

share profit and loss in

new set up. At

the

admission of a new partner, all the

assets and liabilities of the

old business are revalued in

order to know

the

exact worth of the business.

Goodwill of the business is also

revalued. The value (in

monetary terms) of

the

reputation of the business is called

GOODWILL. It is an intangible

asset.

DISSOLUTION

OF A FIRM

When a

partnership is dissolved, all the

liabilities of the firm are paid,

out of the assets of the firm,

available

at the time of

dissolution. The remaining amount after paying all the

liabilities, if available, will be

distributed

among

the partners in their profit

loss sharing ratios. If

assets of the firm are not

sufficient to pay all

the

liabilities

of the firm, the partners will

contribute the balance amount in their

profit/loss sharing ratios

to

meet

the liabilities of the firm.

239

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES