|

ILLUSTRATIONS: Ccarrying Forward of Balances |

| << types of vouchers, Carrying forward the balance of an account |

| Opening Stock, Closing Stock >> |

Financial

Accounting (Mgt-101)

VU

Lesson-14

We

have demonstrated the carrying

forward of balances in lecture-13.

Another solved example is

given

below:

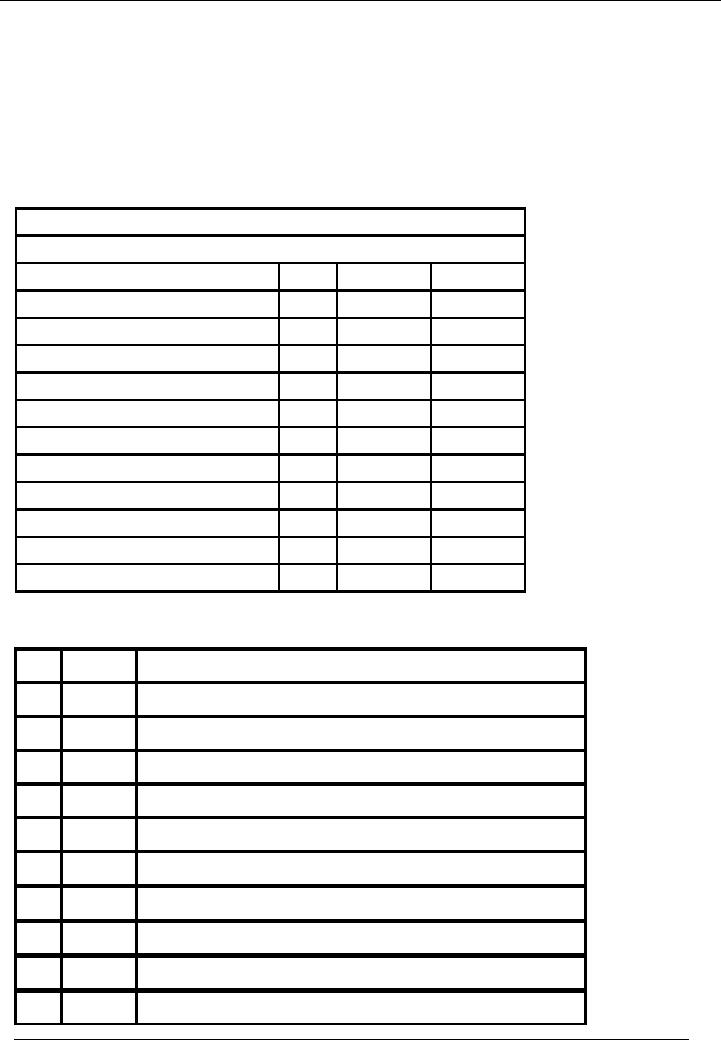

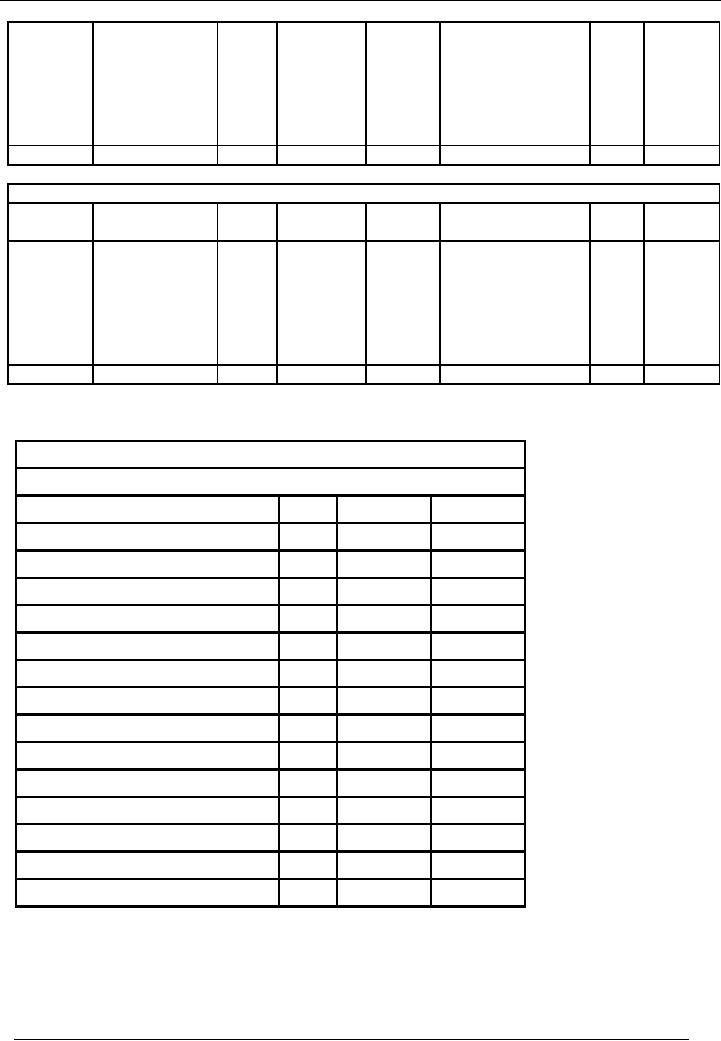

ILLUSTRATION

Following

is the trial balance of Rahil & co.

for the month ended January

31, 2002.

Rahil &

co..

Trial

Balance As On ( January 31,

2002)

Title

of Account

Code

Dr.

Rs.

Cr.

Rs.

Cash

Account

01

30,000

Accrued

expense Account

02

10,000

Bank

Account

03

50,000

Loan

Account

04

100,000

Furniture

Account

05

20,000

Office

Equipment

06

10,000

Debtors

account

07

12,000

Creditors

account

08

10,000

Sales

account

09

20,000

Purchase

account

10

18,000

Total

140,000

140,000

During

the month, following entries

took place:

No.

Date

Particulars

01

Feb

07

They

purchased stationery worth of Rs.

3,000

02

Feb

10

They paid

their first installment of loan Rs.

12,000

03

Feb

12

They

received a cheque from a

customer of Rs. 5,000

04

Feb

13

They paid a

cheque of Rs. 8,000 to a

creditor

05

Feb

15

Purchased

goods of Rs 6,000 & paid through

cheque

06

Feb

17

Accrued

expenses of Rs. 5,000 are

paid.

07

Feb

20

They

purchased furniture of Rs.

2,000

08

Feb

21

Sold

goods for cash

Rs.5,000

09

Feb

22

Purchased

goods on credit Rs.

5,000

10

Feb

23

Office

equipment of Rs. 5,000 is

Purchased

101

Financial

Accounting (Mgt-101)

VU

11

Feb

25

Staff

salaries are paid by cheque

Rs. 15,000

12

Feb

28

Utility

expenses of Rs. 3,000 are

accrued.

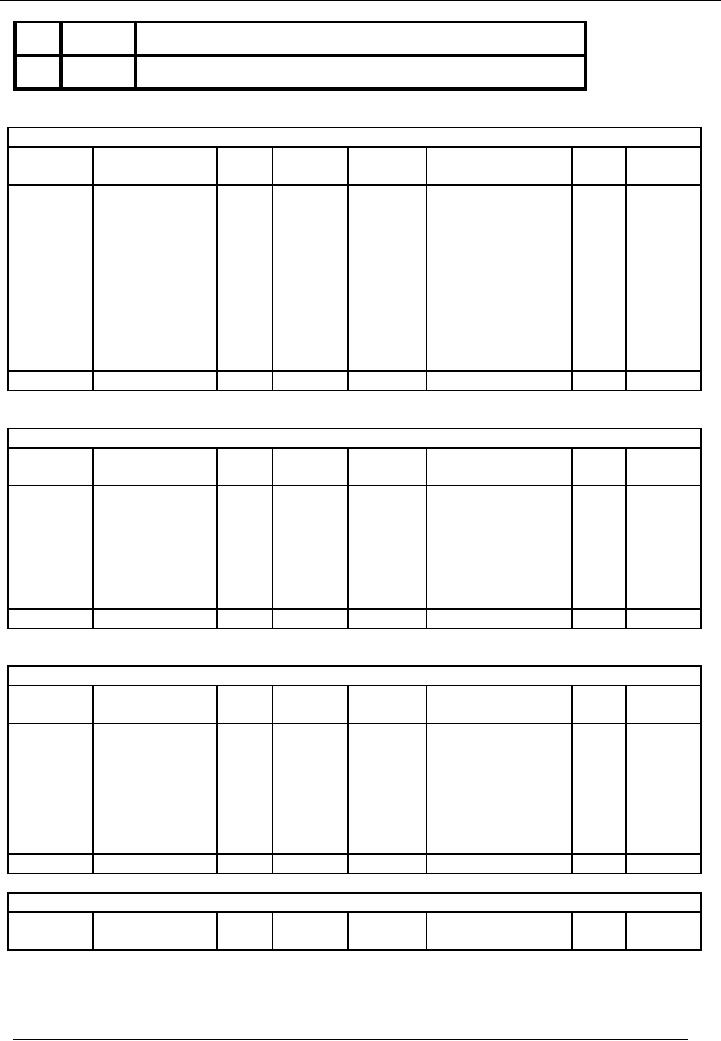

Leger

accounts of Rahil & co. during the

month will show following

picture:

Cash

Account

Account

code # 1

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

1-2-02

Balance

c/f

01

30,000

7-2-02

Stationery

10

3,000

21-2-02

Sold

goods

09

5,000

purchased

10-2-02

Loan

paid

04

12,000

17-2-02

Accrued

expenses

02

paid

5,000

Furniture

05

2,000

purchased

23-2-02

Office

equipment

06

5,000

purchased

Balance

c/d

8,000

Total

35,000

Total

35,000

Accrued

Expenses Account

Account

code # 2

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

17-2-02

Accrued

01

5,000

1-1-02

Balance

c/f

10,000

expenses

paid

Expenses

accrued

3,000

Balance

c/d

8,000

Total

13,000

Total

13,000

Bank

Account Account code #

3

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

Balance

c/f

50,000

13-2-02

Paid

to creditors

08

8,000

12-2-02

Cheque

received

15-2-02

Goods

purchased

10

6,000

07

5,000

25-2-02

Salaries

paid

11

15,000

Balance

c/d

26,000

Total

55,000

Total

55,000

Loan

Account Account code #

4

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

102

Financial

Accounting (Mgt-101)

VU

10-2-02

Installment

paid

01

12,000

Balance

c/f

100,000

Balance

c/d

88,000

Total

100,000

Total

100,000

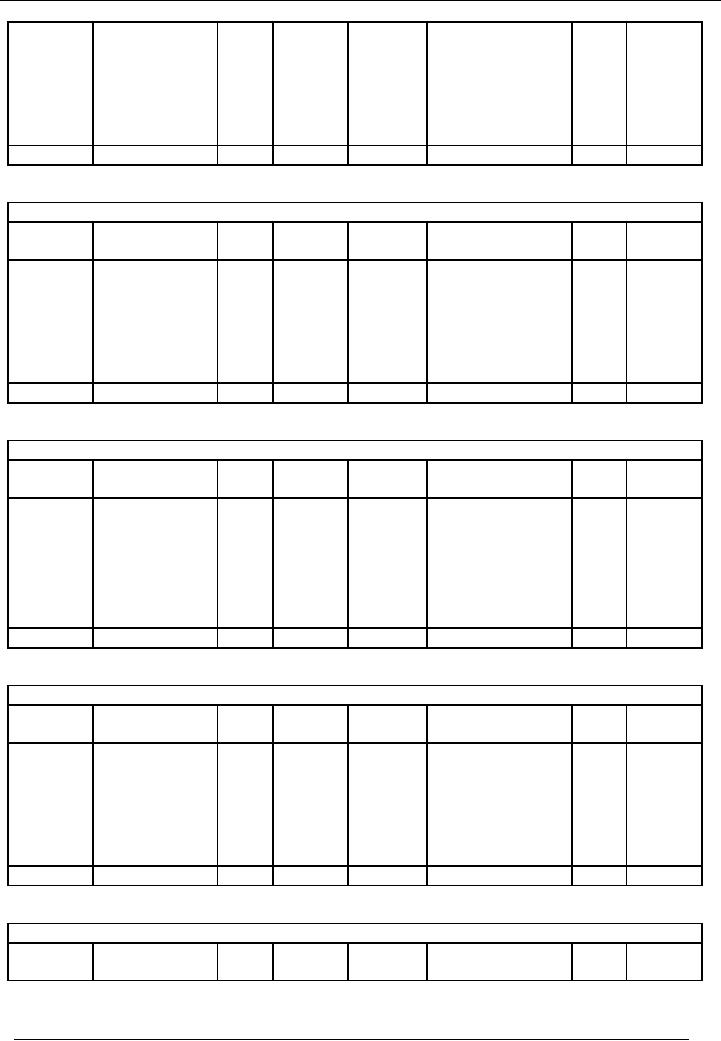

Furniture

Account

Account

code # 5

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

10-2-02

Balance

c/f

20,000

23-2-02

20-2-02

Furniture

01

2,000

purchased

Balance

c/d

22,000

Total

22,000

Total

22,000

Office

Equipment Account

Account

code # 6

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

Balance

c/f

10,000

23-2-02

Office

01

5,000

Equipment

purchased

Balance

c/d

15,000

Total

15,000

Total

15,000

Debtors

Account

Account

code # 7

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

Balance

c/f

12,000

12-2-02

Cheque received

03

5,000

Balance

c/d

7,000

Total

12,000

Total

12,000

Creditors

Account

Account

code # 8

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

103

Financial

Accounting (Mgt-101)

VU

13-2-02

Paid

to creditors

03

8,000

Balance

c/f

10,000

22-2-02

Goods

purchased

10

5,000

Balance

c/d

7,000

Total

15,000

Total

15,000

Sales

Account Account code #

9

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

Balance

c/f

20,000

21-2-02

Goods

sold

01

5,000

Balance

c/d

25,000

Total

25,000

Total

25,000

Purchases

Account

Account

code # 10

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

Balance

c/f

18,000

15-2-02

Goods

03

6,000

purchased

07

5,000

22-2-02

Goods

purchased

Balance

c/d

29,000

Total

29,000

Total

29,000

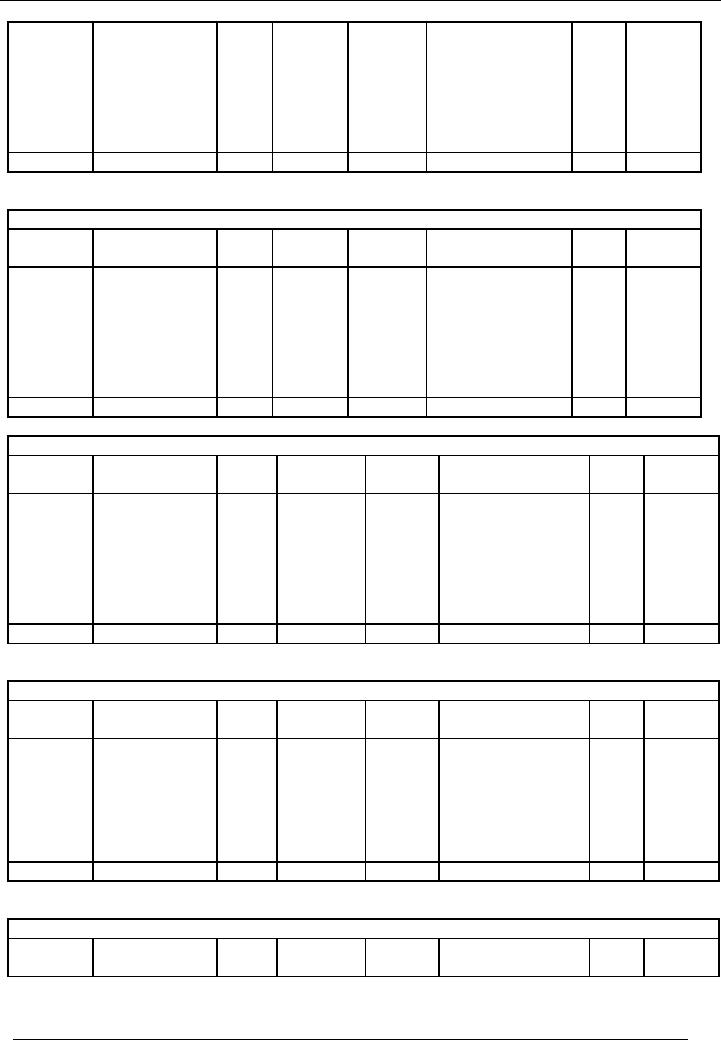

Salaries

Account

Account

code # 11

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

25-2-02

Salaries

paid

03

15,000

Balance

c/d

15,000

Total

15,000

Total

15,000

Stationery

Account

Account

code # 12

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

104

Financial

Accounting (Mgt-101)

VU

25-2-02

Stationery

01

3,000

purchased

Balance

c/d

3,000

Total

3,000

Total

3,000

Utility

Expenses Account

Account

code # 13

Date

Particulars

Code

Amount

Date

Particulars

Code

Amount

#

Rs.

(Dr.)

#

Rs.

(Cr.)

Accrued

utility

02

3,000

28-2-02

expenses

Balance

c/d

3,000

Total

3,000

Total

3,000

The

trial balance at the end of the

month is as follows:

Rahil &

co..

Trial

Balance As On ( January 31,

2002)

Title

of Account

Code

Dr.

Rs.

Cr.

Rs.

Cash

Account

01

8,000

Accrued

expense Account

02

8,000

Bank

Account

03

26,000

Loan

Account

04

88,000

Furniture

Account

05

22,000

Office

Equipment

06

15,000

Debtors

account

07

7,000

Creditors

account

08

7,000

Sales

account

09

25,000

Purchase

account

10

29,000

Salaries

Account

11

15,000

Stationery

Account

12

3,000

Utility

Expenses Account

13

3,000

Total

128,000

128,000

Difference

between expenses &

Purchases

· If

business purchases items for

its own use (items

that are not meant to be

resold) are charged

to

expense

account.

· If

business purchases items for

resale purposes are charged

to purchases account.

STOCK

105

Financial

Accounting (Mgt-101)

VU

·

Stock

is the quantity of unutilized or unsold

goods lying with the

organization.

·

Stock

is termed as "the value of

goods available to the business

that are ready for

sale". For

accounting

purposes, stock is of two

types

Type

of Stock

·

In

trading concern, Stock

consists of goods that are

purchased for the purpose of

resale, but not

sold

in that accounting period.

Trading concern is that organization,

which purchases items

for

resale

purposes.

·

In manufacturing

concern(an organization that converts

raw material into finished

product by

putting

it in a process), stock consists

of:

o Raw

material

o Work

in process

o Finished

goods

Raw

material

Raw

material is the basic part of an item,

which is processed to make a

complete item.

Work

in process

In manufacturing

concern, raw material is put

in a process to convert it into

finished goods. At the end

of

the

year, some part of raw

material remains under process.

i-e. it is neither in shape of raw

material nor in

shape

of finished goods. Such

items are taken in stock as

work in process.

Finished

goods

Finished

goods contain items that are

ready for sale, but could

not be sold in that

accounting period.

Stock

Account

·

Stock

Account is Debited

with

the Value

of the Goods

Purchased

·

Stock

account is Credited

with

the Purchase

Price of the Goods Sold /

Issued for Production.

·

Stock

Account shows the cost /

purchase value of unsold

goods.

106

Financial

Accounting (Mgt-101)

VU

In

manufacturing concern, entries

for stock are:

Purchase

of stock

Debit:

Stock

Account

Credit:

Cash/Supplier

/Creditors Account

When

the stock is purchased, stock

account gets the benefit, so it is

debited & cash or supplier

account

provides the

benefit, so it is credited.

Payment

to creditors

Debit:

`

Supplier /

Creditors account

Credit:

Cash

account

Consumption

of goods

Debit:

Cost

of goods sold

Credit:

Stock

Account

Cost

of goods sold

Cost

of goods sold is different in

both form of organization

· In

trading concern, cost of

goods sold is the value of

goods unsold(goods stands

for the items

purchased

for resale purpose)

· In

manufacturing concern, cost of goods

sold is the value of raw

material consumed plus any

other

manufacturing

cost. e.g., salaries of

labour cost of machinery

etc.

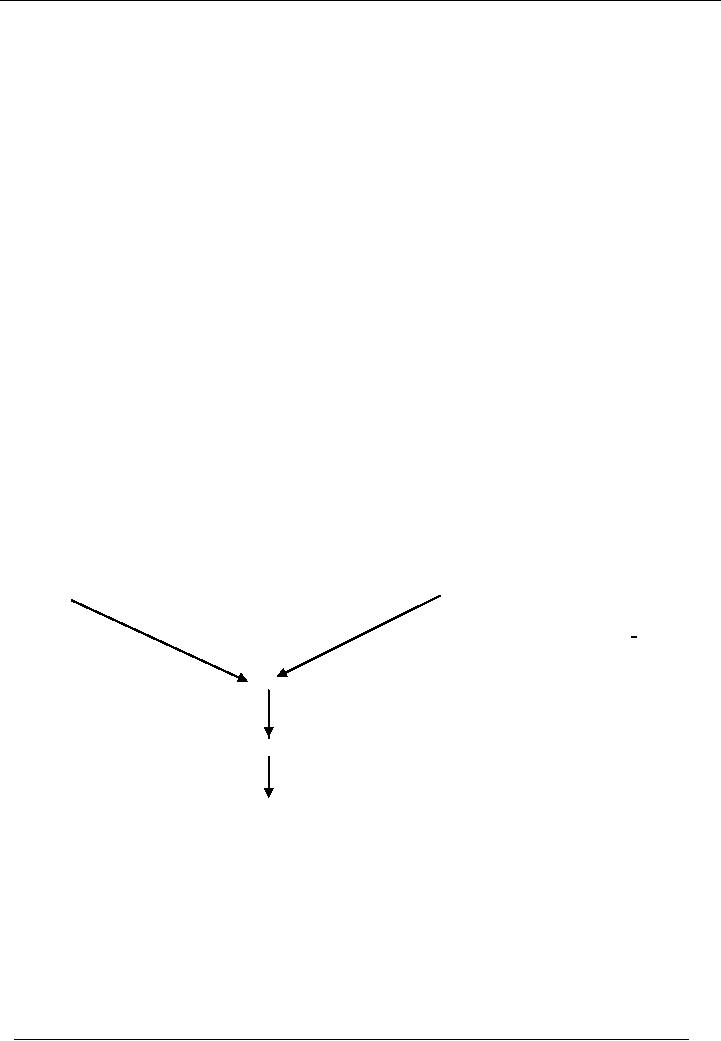

Stock

and cost of goods sold in

manufacturing concern

Raw

Material Stock

Other

Costs Accounts

Work

in Process Account

Finished

Goods Account

Cost

of Goods Sold

Account

In manufacturing

concern, Raw material stock

is put into process. For

accounting purposes, all

value of

stock

and other manufacturing costs

are charged to work in

process account. When the

process is completed

and

the goods are prepared, all

the value of work in process is

charged to finished goods

account. The

business

sells finished goods for the

whole accounting year. At the

end of the year, goods that

are unsold are

deducted

from cost of goods sold

account.

107

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES