|

Strategic

Management MGT603

VU

Lesson

12

IFE

MATRIX

Objectives:

This

Lecture focuses on identifying and

evaluating a firm's strengths and

weaknesses in the functional

areas

of

business, including management,

marketing, finance/accounting, production/operations,

research and

development,

and computer information systems.

Relationships among these

areas of business are

examined.

Strategic implications of important

functional area concepts are

examined. The process

of

performing

an internal audit is described in

these lectures.

The

Nature of an Internal

Audit

Integrating

Strategy and Culture

Management

Marketing

Finance/Accounting

Production/Operations

Research

and Development

Management

Information Systems

The

Internal Factor Evaluation Matrix

(IFE)

The

Internal Factor Evaluation (IFE)

Matrix

Great

spirits have always encountered

violent opposition from mediocre

minds.

--

Albert

Einstein

A

summary step in conducting an internal

strategic-management audit is to

construct an Internal

Factor

Evaluation

(IFE) Matrix. This

strategy-formulation tool summarizes and

evaluates the major strengths

and

weaknesses

in the functional areas of a business,

and it also provides a basis

for identifying and

evaluating

relationships

among those areas. Intuitive

judgments are required in developing an

IFE Matrix, so the

appearance

of a scientific approach should not be

interpreted to mean this is an

all-powerful technique. A

thorough

understanding of the factors included is more

important than the actual

numbers. Similar to the

EFE

Matrix and Competitive

Profile Matrix, an IFE

Matrix can be developed in five

steps:

1.

List key internal factors as

identified in the internal-audit process.

Use total of from ten to

twenty

internal

factors, including both

strengths and weaknesses.

List strengths first and

then weaknesses.

Be

as specific as possible, using

percentages, ratios, and

comparative numbers.

2.

Assign a weight that ranges

from 0.0 (not important) to

1.0 (all-important) to each

factor. The

weight

assigned to a given factor indicates the

relative importance of the factor to being

successful

in

the firm's industry. Regardless of whether a

key factor is an internal

strength or weakness,

factors

considered

to have the greatest effect on organizational

performance should be assigned the

highest

weights.

The sum of all weights

must equal 1.0.

3.

Assign a 1-to-4 rating to

each factor to indicate whether that

factor represents a major

weakness

(rating

5 1), a minor weakness (rating 5

2), a minor strength (rating 5

3), or a major strength (rating

5

4). Note that strengths

must receive a 4 or 3 rating

and weaknesses must receive

a 1 or 2 rating.

Ratings

are, thus, company based,

whereas the weights in Step 2

are industry based.

4.

Multiply each factor's weight by

its rating to determine a weighted

score for each

variable.

5.

Sum the weighted scores for

each variable to determine the total

weighted score for the

organization.

Regardless

of how many factors are

included in an IFE Matrix, the total

weighted score can range

from a

low

of 1.0 to a high of 4.0,

with the average score being

2.5. Total weighted scores

well below 2.5

characterize

organizations that are weak

internally, whereas scores significantly

above 2.5 indicate a strong

internal

position. Like the EFE

Matrix, an IFE Matrix should include

from 10 to 20 key factors.

The

number

of factors has no effect upon the

range of total weighted scores

because the weights always

sum to

1.0.

When

a key internal factor is

both strength and weakness,

the factor should be included twice in the

IFE

Matrix,

and a weight and rating should be

assigned to each statement.

For example, the Playboy

logo both

helps

and hurts Playboy Enterprises; the

logo attracts customers to the

Playboy

magazine,

but it keeps the

Playboy

cable channel out of many

markets.

An

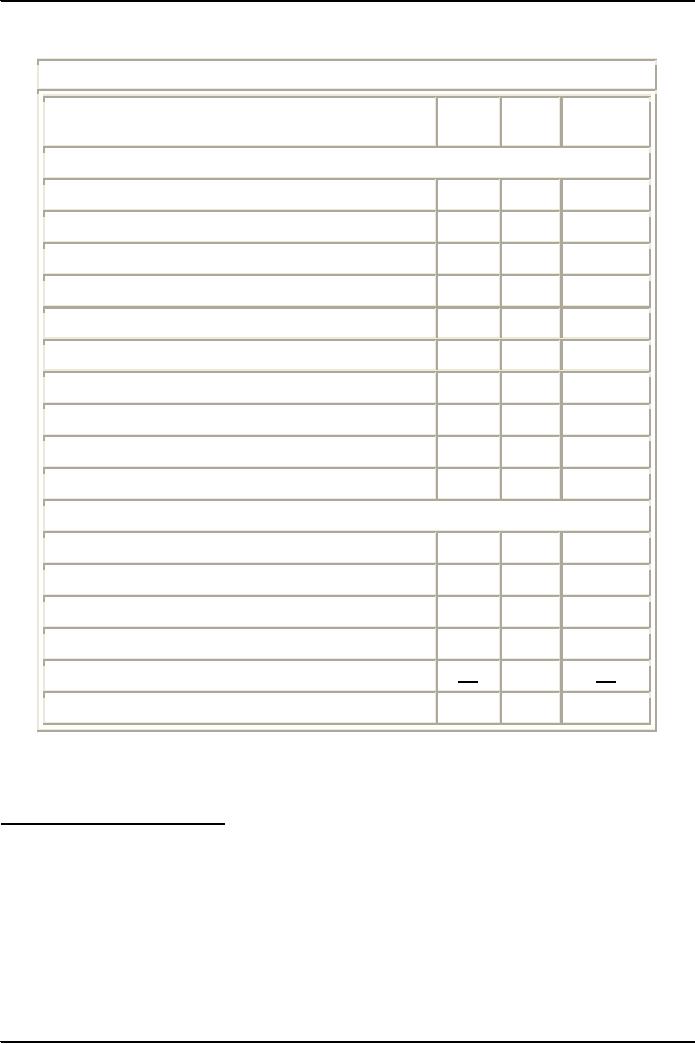

example of an IFE Matrix for

Circus Circus Enterprises is

provided in Table. Note that

the firm's major

strengths

are its size, occupancy

rates, property, and

long-range planning as indicated by the

rating of 4. The

47

Strategic

Management MGT603

VU

major

weaknesses are locations and

recent joint venture. The

total weighted score of 2.75

indicates that the

firm

is above average in its

overall internal

strength.

A

Sample Internal Factor Evaluation Matrix

for Circus Circus

Enterprises

Weighted

Key

Internal Factors

Weight

Rating

Score

Internal

Strengths

1.

Largest casino company in the

United States

.05

4

.20

2.

Room occupancy rates over 95% in

Las Vegas

.10

4

.40

3.

Increasing free cash

flows

.05

3

.15

4.

Owns one mile on Las Vegas

Strip

.15

4

.60

5.

Strong management

team

.05

3

.15

6.

Buffets at most facilities

.05

3

.15

7.

Minimal comps

provided

.05

3

.15

8.

Long-range planning

.05

4

.20

9.

Reputation as family-friendly

.05

3

.15

10.

Financial ratios

.05

3

.15

Internal

Weaknesses

1.

Most properties are located in

Las Vegas

.05

1

.05

2.

Little diversification

.05

2

.10

3.

Family reputation, not high

rollers

.05

2

.10

4.

Laughlin properties

.10

1

.10

5.

Recent loss of joint

ventures

.10

1

.10

TOTAL

1.00

2.75

In

multidivisional firms, each autonomous

division or strategic business

unit should construct an

IFE

Matrix.

Divisional matrices then can

be integrated to develop an overall corporate IFE

Matrix.

The

Nature of an Internal

Audit

Basis

for objectives &

strategies:

Internal

strengths/weaknesses

External

opportunities/threats

Clear

statement of mission

Functional

business areas:

Vary

by organization

Divisions

have differing strengths and

weaknesses

Distinctive

Competencies:

A

firm's strengths that cannot be

easily matched or imitated by

competitors

Building

competitive advantage involves

taking advantage of distinctive

competencies

Strategies

designed in part to improve on a

firm's weaknesses and turn

to strengths

48

Strategic

Management MGT603

VU

Internal

Audit is

Parallels process of external audit. It

gathers & assimilates information

from:

o

Management

o

Marketing

o

Finance/accounting

o

Production/operations

o

Research

& development

o

Management

information systems

Involvement

in performing an internal

strategic-management audit provides

vehicle for understanding

nature and effect of

decisions

in other functional business areas of the

firm.

All

organizations have strengths

and weaknesses in the functional

areas of business. No enterprise is

equally

strong

or weak in all areas. Maytag,

for example, is known for

excellent production and

product design,

whereas

Procter & Gamble is known for

superb marketing. Internal

strengths/weaknesses, coupled with

external

opportunities/threats and a clear

statement of mission, provide the

basis for establishing

objectives

and

strategies. Objectives and

strategies are established

with the intention of capitalizing upon

internal

strengths

and overcoming weaknesses. The

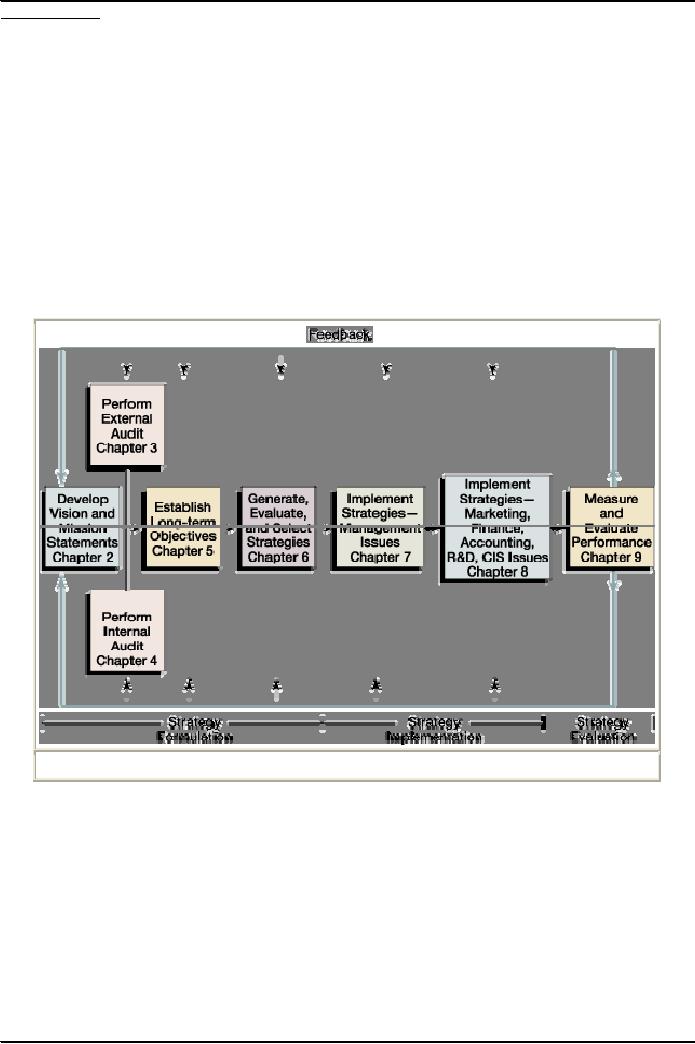

internal-audit part of the

strategic-management process is

illustrated

in Figure below.

A

Comprehensive Strategic-Management

Model

Key

to organizational success: Internal

audit creates an environment of

Coordination and understanding

among

managers from all functional

areas.

Key

Internal Forces

It

is not possible in a business

policy text to review in depth

all the material presented in

courses such as

marketing,

finance, accounting, management, computer

information systems, and

production/operations;

there

are many sub areas

within these functions, such as

customer service, warranties,

advertising,

packaging,

and pricing under marketing.

For

different types of organizations,

such as hospitals, universities,

and government agencies, the

functional

business

areas, of course, differ. In a hospital,

for example, functional

areas may include cardiology,

hematology,

nursing, maintenance, physician support,

and receivables. Functional

areas of a university can

include

athletic programs, placement services,

housing, fund raising,

academic research, counseling,

and

49

Strategic

Management MGT603

VU

intramural

programs. Within large

organizations, each division

has certain strengths and

weaknesses. For

example,

AT&T is strong in communications and

weak in computers.

A

firm's strengths that cannot be easily

matched or imitated by competitors are

called distinctive

competencies.

Building

competitive advantages involves

taking advantage of distinctive

competencies. For example,

3M

exploits

its distinctive competence in

research and development by producing a

wide range of innovative

products.

Strategies are designed in

part to improve on a firm's weaknesses,

turning them into

strengths,

and

maybe even into distinctive

competencies.

Some

researchers emphasize the importance of the

internal audit part of the

strategic-management process

by

comparing it to the external audit.

The

Process of Performing an Internal

Audit

Functional

relationships refer to the

Number and complexity

increases relative to organization

size.

The

process of performing an internal

audit closely

parallels the process of performing an

external audit.

Representative

Managers and employees from

throughout the firm need to be

involved in determining a

firm's

strengths and weaknesses.

The internal audit requires

gathering and assimilating information

about

the

firm's management, marketing, finance/accounting,

production/operations, research and

development

(R&D),

and computer information systems

operations.

Compared

to the external audit, the process of performing an

internal audit provides more

opportunity for

participants

to understand how their

jobs, departments, and divisions

fit into the whole organization. This

is

a

great benefit because

managers and employees

perform better when they understand how

their work

affects

other areas and activities of the

firm. For example, when

marketing and manufacturing

managers

jointly

discuss issues related to

internal strengths and

weaknesses, they gain a better appreciation of

issues,

problems,

concerns, and needs in all

the functional areas. In organizations

that do not use

strategic

management,

marketing, finance, and manufacturing

managers often do not interact

with each other in

significant

ways. Performing an internal audit,

thus, is an excellent vehicle or

forum for improving

the

process

of communication in the organization. Communication

may be

the most important word

in

management.

Performing

an internal audit requires

gathering, assimilating, and evaluating

information about the firm's

operations.

Critical success factors, consisting of

both strengths and

weaknesses, can be identified

and

prioritized

in the manner discussed later

chapters.

The

development of conclusions on the 10 to 20 most

important organizational strengths and

weaknesses

can

be, as any experienced

manager knows, a difficult

task, when it involves managers

representing various

organizational

interests and points of

view. Developing a 20-page

list of strengths and

weaknesses could be

accomplished

relatively easily, but a list of the 10

to 15 most important ones

involves significant analysis

and

negotiation.

This is true because of the judgments

that are required and the

impact which such a list

will

inevitably

have as it is used in the formulation,

implementation, and evaluation of

strategies.

Strategic

management is a highly interactive

process that requires effective

coordination among

management,

marketing, finance/accounting, production/operations,

R&D, and computer information

systems

managers. Although the

strategic-management process is overseen

by strategists, success

requires

that

managers and employees from

all functional areas work

together to provide ideas and

information.

Financial

managers, for example, may

need to restrict the number of feasible

options available to operations

managers,

or R&D managers may develop such

good products that marketing managers

need to set higher

objectives.

A key to organizational success is effective

coordination and understanding

among managers

from

all functional business

areas. Through involvement in

performing an internal

strategic-management

audit,

managers from different

departments and divisions of the firm

come to understand the nature

and

effect

of decisions in other functional

business areas in their

firm. Knowledge of these relationships

is

critical

for effectively establishing

objectives and

strategies.

A

failure to recognize and

understand relationships among the

functional areas of business

can be

detrimental

to strategic management, and the number

of those relationships that

must be managed

increases

dramatically

with a firm's size, diversity,

geographic dispersion, and the number of

products or services

offered.

Governmental and nonprofit

enterprises traditionally have

not placed sufficient

emphasis on

relationships

among the business functions. For

example, some state

governments, utilities, universities,

and

hospitals

only recently have begun to

establish marketing objectives and

policies that are consistent

with

their

financial capabilities and

limitations. Some firms place

too great an emphasis on one

function at the

expense

of others.

50

Strategic

Management MGT603

VU

Financial

Ratio Analysis:

Financial

ratio analysis exemplifies

the complexity of relationships among the

functional areas of business.

A

declining

return on investment or profit margin

ratio could be the result of ineffective

marketing, poor

management

policies, research and development

errors, or a weak computer information

system. The

effectiveness

of strategy formulation, implementation,

and evaluation activities hinges upon a

clear

understanding

of how major business functions affect

one another. For strategies

to succeed, a coordinated

effort

among all the functional

areas of business is

needed.

Integrating

Strategy and Culture

Organizational

Culture

Pattern

of behavior developed by an organization as it

learns to cope with its

problem of external adaptation

and internal

integration...is

considered valid and taught

to new members

Resistant

to change

May

represent a strength or weakness of the

firm

Relationships

among a firm's functional business

activities perhaps can be exemplified

best by focusing on

organizational

culture, an internal phenomenon that

permeates all departments

and divisions of an

organization.

Organizational

culture can be defined as "a

pattern of behavior developed by

an

organization

as it learns to cope with

its problem of external

adaptation and internal

integration

that

has worked well enough to be

considered valid and to be

taught to new members as

the

correct

way to perceive, think, and

feel." This

definition emphasizes the importance of

matching

external

with internal factors in making

strategic decisions.

Organizational

culture captures the subtle, elusive,

and largely unconscious

forces that shape a

workplace.

Remarkably

resistant to change, culture can

represent a major strength or weakness

for the firm. It can

be

an

underlying reason for

strengths or weaknesses in any of the

major business functions.

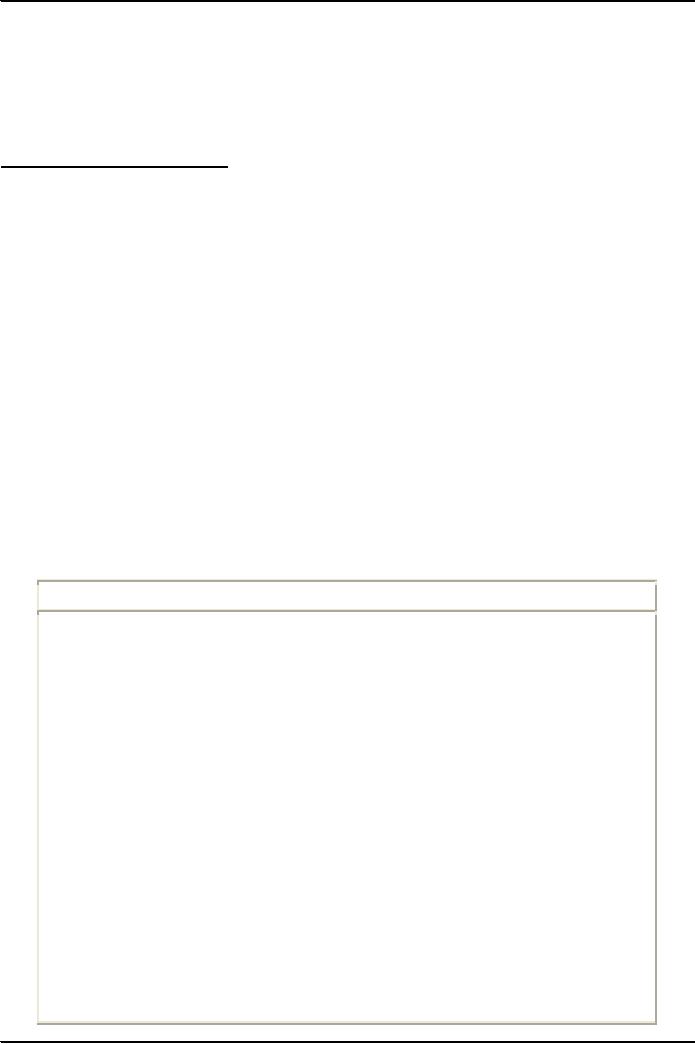

Defined

in Table below cultural

products include

values, beliefs, rites,

rituals, ceremonies, myths,

stories,

legends,

sagas, language, metaphors,

symbols, heroes, and

heroines. These products or dimensions

are

levers

that strategists can use to

influence and direct strategy

formulation, implementation, and

evaluation

activities.

An organization's culture compares to an

individual's personality in the sense

that no organization

has

the same culture and no individual

has the same personality. Both culture

and personality are

fairly

enduring

and can be warm, aggressive,

friendly, open, innovative, conservative,

liberal, harsh, or likable.

Cultural

Products and Associated

Definitions

Rites

Relatively

elaborate, dramatic, planned sets of

activities that

consolidate

various forms of cultural expressions

into one event,

carried

out through social interactions,

usually for the benefit

of

an

audience

Ceremonial

A

system of several rites

connected with a single

occasion or event

Ritual

A

standardized, detailed set of techniques

and behaviors that

manage

anxieties, but seldom produce intended,

technical

consequences

of practical importance

Myth

A

dramatic narrative of imagined events

usually used to

explain

origins

or transformations of something. Also, an

unquestioned

belief

about the practical benefits of certain

techniques and

behaviors

that is not supported by

facts

Saga

An

historical narrative describing the unique

accomplishments of

a

group and its leaders,

usually in heroic terms

Legend

A

handed-down narrative of some wonderful event

that is based

on

history but has been

embellished with fictional

details

Story

A

narrative based on true events, sometimes

a combination of

truth

and fiction

51

Strategic

Management MGT603

VU

Folktale

A

completely fictional narrative

Symbol

Any

object, act, event, quality, or

relation that serves as a

vehicle

for

conveying meaning, usually by

representing another thing

Language

A

particular form or manner in which

members of a group

use

sounds

and written signs to convey

meanings to each

other

Metaphors

Shorthand

words used to capture a

vision or to reinforce old or

new

values

Values

Life-directing

attitudes that serve as behavioral

guidelines

Belief

An

understanding of a particular phenomenon

Heroes/Heroines

Individuals

whom the organization has legitimized to

model

behavior

for others

Source:

Adapted

from H.M. Trice and

J.M. Beyer, "Studying Organizational

Cultures through

Rites

and Ceremonials," Academy

of Management Review 9, no.

4 (October 1984): 655.

Dimensions

of organizational culture permeate all the

functional areas of business. It is

something of an

art

to uncover the basic values and

beliefs that are buried

deeply in an organization's rich

collection of

stories,

language, heroes, and

rituals, but cultural products

can represent important

strengths and

weaknesses.

Culture is an aspect of organizations

that no longer can be taken

for granted in performing

an

internal

strategic-management audit because

culture and strategy must

work together.

Culture

can inhibit strategic

management:

Miss

changes in external environment because

they are blinded by strongly held

beliefs

When

a culture has been effective in the past,

natural tendency to stick with it in

future, even

during

times of major strategic

change

The

strategic-management process takes

place largely within a particular

organization's culture. An

organization's

culture must support the collective commitment of

its people to a common purpose. It

must

foster

competence and enthusiasm

among managers and

employees.

Organizational

culture significantly affects business

decisions and, thus, must be

evaluated during an

internal

strategic-management audit. If strategies

can capitalize on cultural strengths,

such as a strong work

ethic

or highly ethical beliefs,

then management often can

implement changes swiftly and

easily. However, if

the

firm's culture is not supportive, strategic

changes may be ineffective or

even counterproductive. A firm's

culture

can become antagonistic to

new strategies, with the

result being confusion and

disorientation. An

organization's

culture should infuse individuals with

enthusiasm for implementing

strategies.

Internal

strengths and weaknesses

associated with a firm's culture

sometimes are overlooked

because of the

inter

functional nature of this phenomenon. It is

important, therefore, for strategists to

understand their

firm

as a socio cultural system. Success is

often determined by linkages between a

firm's culture and

strategies.

The challenge of strategic

management today is to bring about the

changes in organizational

culture

and individual mind-sets

necessary to support the formulation,

implementation, and evaluation of

strategies.

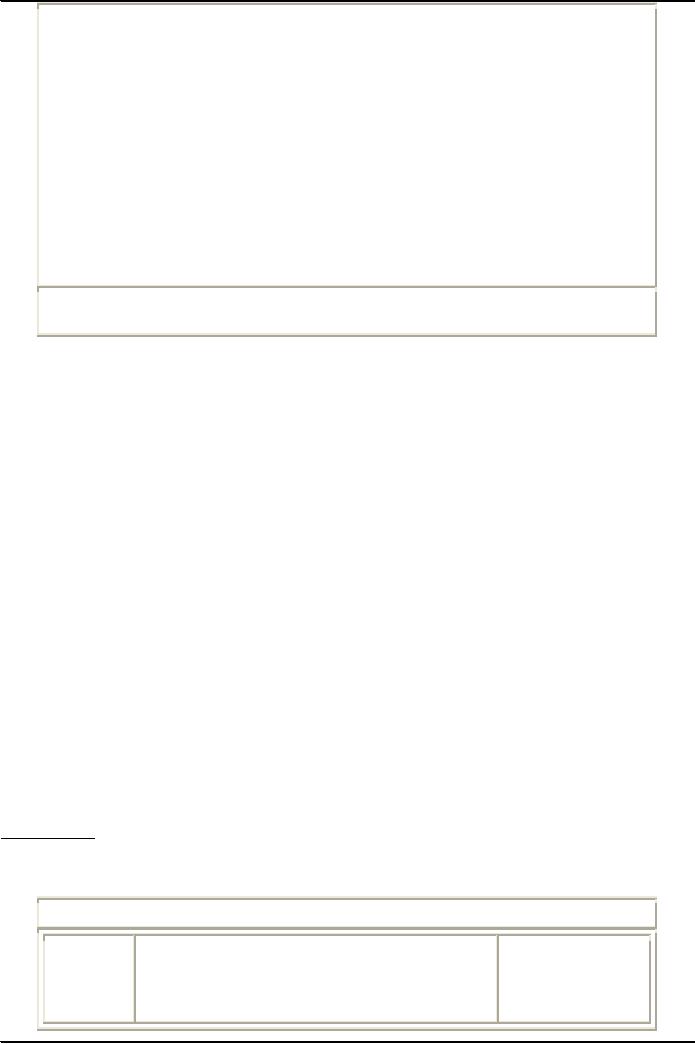

Management

The

functions

of management consist

of five basic activities:

planning, organizing, motivating, staffing,

and

controlling.

An overview of these activities is

provided in Table.

The

Basic Functions of Management

Stage

of Strategic-

Management

Process

When Most

Function

Description

Important

52

Strategic

Management MGT603

VU

Planning

Planning

consists of all those

managerial activities Strategy

Formulation

related

to preparing for the future. Specific

tasks

include

forecasting, establishing objectives,

devising

strategies,

developing policies, and

setting goals.

Organizing

Organizing

includes all those

managerial activities that

Strategy

result

in a structure of task and

authority relationships.

Implementation

Specific

areas include organizational design,

job

specialization,

job descriptions, job

specifications,

span

of the control, unity of command,

coordination,

job

design, and job

analysis.

Motivating

Motivating

involves efforts directed

toward shaping

Strategy

human

behavior. Specific topics include

leadership, Implementation

communication,

work groups, behavior

modification,

delegation

of authority, job enrichment,

job

satisfaction,

needs fulfillment, organizational

change,

employee

morale, and managerial

morale.

Staffing

Staffing

activities are centered on personnel or

human Strategy

resource

management. Included are

wage and salary

Implementation

administration,

employee benefits,

interviewing,

hiring,

firing, training, management

development,

employee

safety, affirmative action, equal

employment

opportunity,

union relations, career

development,

personnel

research, discipline policies,

grievance

procedures,

and public relations.

Controlling

Controlling

refers to all those

managerial activities Strategy

Evaluation

directed

toward ensuring that actual

results are

consistent

with planned results. Key

areas of concern

include

quality control, financial

control, sales

control,

inventory

control, and expense

control, analysis of

variances,

rewards, and

sanctions.

53

Table of Contents:

- NATURE OF STRATEGIC MANAGEMENT:Interpretation, Strategy evaluation

- KEY TERMS IN STRATEGIC MANAGEMENT:Adapting to change, Mission Statements

- INTERNAL FACTORS & LONG TERM GOALS:Strategies, Annual Objectives

- BENEFITS OF STRATEGIC MANAGEMENT:Non- financial Benefits, Nature of global competition

- COMPREHENSIVE STRATEGIC MODEL:Mission statement, Narrow Mission:

- CHARACTERISTICS OF A MISSION STATEMENT:A Declaration of Attitude

- EXTERNAL ASSESSMENT:The Nature of an External Audit, Economic Forces

- KEY EXTERNAL FACTORS:Economic Forces, Trends for the 2000ís USA

- EXTERNAL ASSESSMENT (KEY EXTERNAL FACTORS):Political, Governmental, and Legal Forces

- TECHNOLOGICAL FORCES:Technology-based issues

- INDUSTRY ANALYSIS:Global challenge, The Competitive Profile Matrix (CPM)

- IFE MATRIX:The Internal Factor Evaluation (IFE) Matrix, Internal Audit

- FUNCTIONS OF MANAGEMENT:Planning, Organizing, Motivating, Staffing

- FUNCTIONS OF MANAGEMENT:Customer Analysis, Product and Service Planning, Pricing

- INTERNAL ASSESSMENT (FINANCE/ACCOUNTING):Basic Types of Financial Ratios

- ANALYTICAL TOOLS:Research and Development, The functional support role

- THE INTERNAL FACTOR EVALUATION (IFE) MATRIX:Explanation

- TYPES OF STRATEGIES:The Nature of Long-Term Objectives, Integration Strategies

- TYPES OF STRATEGIES:Horizontal Integration, Michael Porterís Generic Strategies

- TYPES OF STRATEGIES:Intensive Strategies, Market Development, Product Development

- TYPES OF STRATEGIES:Diversification Strategies, Conglomerate Diversification

- TYPES OF STRATEGIES:Guidelines for Divestiture, Guidelines for Liquidation

- STRATEGY-FORMULATION FRAMEWORK:A Comprehensive Strategy-Formulation Framework

- THREATS-OPPORTUNITIES-WEAKNESSES-STRENGTHS (TOWS) MATRIX:WT Strategies

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- BOSTON CONSULTING GROUP (BCG) MATRIX:Cash cows, Question marks

- BOSTON CONSULTING GROUP (BCG) MATRIX:Steps for the development of IE matrix

- GRAND STRATEGY MATRIX:RAPID MARKET GROWTH, SLOW MARKET GROWTH

- GRAND STRATEGY MATRIX:Preparation of matrix, Key External Factors

- THE NATURE OF STRATEGY IMPLEMENTATION:Management Perspectives, The SMART criteria

- RESOURCE ALLOCATION

- ORGANIZATIONAL STRUCTURE:Divisional Structure, The Matrix Structure

- RESTRUCTURING:Characteristics, Results, Reengineering

- PRODUCTION/OPERATIONS CONCERNS WHEN IMPLEMENTING STRATEGIES:Philosophy

- MARKET SEGMENTATION:Demographic Segmentation, Behavioralistic Segmentation

- MARKET SEGMENTATION:Product Decisions, Distribution (Place) Decisions, Product Positioning

- FINANCE/ACCOUNTING ISSUES:DEBIT, USES OF PRO FORMA STATEMENTS

- RESEARCH AND DEVELOPMENT ISSUES

- STRATEGY REVIEW, EVALUATION AND CONTROL:Evaluation, The threat of new entrants

- PORTER SUPPLY CHAIN MODEL:The activities of the Value Chain, Support activities

- STRATEGY EVALUATION:Consistency, The process of evaluating Strategies

- REVIEWING BASES OF STRATEGY:Measuring Organizational Performance

- MEASURING ORGANIZATIONAL PERFORMANCE

- CHARACTERISTICS OF AN EFFECTIVE EVALUATION SYSTEM:Contingency Planning