|

GROUPINGS OF FIXED ASSETS |

| << DEPRECIATION |

| CAPITAL WORK IN PROGRESS 1 >> |

Financial

Accounting (Mgt-101)

VU

Lesson-18

DEPRECIATION

It is a

systematic allocation of the cost of a

depreciable asset to expense

over its useful

life".

GROUPINGS

OF FIXED ASSETS

Major

groups of Fixed

Assets:

· Land

· Building

· Plant

and Machinery

· Furniture

and Fixtures

· Office

Equipment

· Vehicles

No depreciation is

charged for `Land'. In case of

`Leased Asset/Lease Hold

Land' the amount paid for it is

charged

over the life of the lease

and is called Amortization.

RECORDING

OF JOURNAL ENTRIES

Purchase

of fixed asset:

Debit:

Relevant

asset account

Credit:

Cash,

Bank or Payable Account

For

recording of depreciation, following two

heads of accounts are

used:

· Depreciation

Expense Account

· Accumulated

Depreciation Account

Depreciation

expense account contains the depreciation

of the current year. Accumulated depreciation

contains

the depreciation of the asset from the

financial year in which it

was bought. Depreciation of

the

following

years in which asset was

used, is added up in this account. In

other words, this head of

account

shows

the cost of usage of the asset up to the

current year. Depreciation account is

charged to profit &

loss

account

under the heading of Administrative

Expenses. In the balance sheet,

fixed assets are presented

at

written

down value. i-e.

WDV =

Actual cost of fixed asset

Accumulated Depreciation.

Journal

entry for the depreciation is given

below:

Debit:

Depreciation

Account

Credit:

Accumulated

Depreciation Account

METHODS

OF CALCULATING DEPRECIATION

There

are several

methods of calculating depreciation. At this

stage, we will discuss only

two of them

namely:

· Straight

line method

· Reducing

balance method

STRAIGHT

LINE METHOD

134

Financial

Accounting (Mgt-101)

VU

In this method, a

fixed amount is calculated by a formula.

That fixed amount is charged

every year

irrespective

of the written down value of the

asset. The formula for

calculating the depreciation is given

below:

Depreciation

= (cost Residual value) / Expected

useful life of the

asset

Residual

value is the

cost of the asset after the expiry of

its useful life.

REDUCING

BALANCE METHOD

In this method,

depreciation is calculated on written

down value. In the first

year, depreciation is calculated

on

cost. Afterwards written

down value is calculated by deducting

accumulated depreciation from the cost

of

that

asset(cost accumulated depreciation)

and depreciation is charged on that

value.

·

Cost

of Asset Price at which

the asset was initially

recorded.

·

Written

Down Value / Book Value

Cost minus Accumulated

Depreciation.

In

reducing balance method, a formula is

used for calculation of depreciation

rate. i e.

·

Rate =

1

n RV /

C

Where:

"RV" =

Residual Value

"C" =

Cost

"n" =

Life of Asset

Calculate

the rate if:

·

Cost

=

100,000

·

Residual

Value (RV)

=

20,000

·

Life

= 3

years

·

Rate =

1 3 20000/100000

=

42%

Year

1

Cost

100,000

Depreciation

100,000

x 42%

(42,000)

WDV

(Closing Balance)

58,000

Year

2

WDV

(Opening Balance)

58,000

Depreciation

58,000

x 42%

(24,360)

WDV

(Closing Balance)

33,640

Year

3

WDV

(Opening Balance)

33,640

Depreciation

33,640

x 42%

(14,128)

WDV

(Closing Balance)

19,511

Disposal of

Asset

Cost

of Asset

=

100,000

Life

of the Asset

= 5

Years

Depreciation

Method

=

Straight Line

135

Financial

Accounting (Mgt-101)

VU

Residual

Value

=

Rs.10000

Sale

Price after Five

Years

=

Rs.15000

Depreciation

per year = (100000-10000) /

5

=

Rs.5000 per year

Total

Depreciation in Five

Years

=

18,000 x 5

=

90,000

Book

Value after Five

Years

=

100,000- 90,000

=

10,000

Profit

on Disposal

=

15,000 10,000

=

Rs.5000

Recording

of Disposal

Debit

Fixed

Asset Disposal A/c

100,000

Credit

Fixed

Asset Cost A/c

100,000

(With

the cost of asset)

Debit

Accumulated

Dep. A/c

90,000

Credit

Fixed

Asset Disposal A/c

90,000

(With

the depreciation accumulated to

date)

Debit

Cash /

Bank / Receivable A/c 15,000

Credit

Fixed

Asset Disposal A/c

15,000

(With

the price at which asset is

sold)

[Note:

one group to appear at a

time]

Disposal of

Asset Account

Fixed

Asset Disposal Account

DEBIT

CREDIT

Cost

Account

100,000

Acc.

Dep. Account

90,000

Cash

/ Bank

15,000

P & L

Account

5000

( Balancing

Figure)

Total

105000

Total

105000

POLICY

FOR DEPRECIATION

The

management of the business selects the

policy for charging depreciation. There

is no law binding on the

management.

The management is free to

choose method of depreciation and policy

of charging

depreciation.

Normally two policies are

commonly used:

· Depreciation

on the basis of use

· In the

year of purchase, full

year's depreciation is charged; where

as, in the year of sale

no

depreciation is

charged.

Now it

is up to the management to decide, what method

and what policy is better and effective

for their

business.

136

Financial

Accounting (Mgt-101)

VU

DISPOSAL

OF FIXED ASSET

When

depreciable asset is disposed

off at any time during the

financial year, an entry should be

made to give

effect of the

disposal. Since, the residual

value of asset is only

estimated, it is common for asset to be

sold at

price

that differs from its

book value at the date of

disposal. When asset is

sold, any profit or loss

is

computed by

comparing book value with the amount

received from sale. As you

know, book value is

obtained by

deducting accumulated depreciation from

original cost of the asset. A

sale price in excess of

the

book

value produces profit; a

sale price below the book

value produces loss. This

profit or loss should be

shown

in the profit & loss

account.

ENTRIES

FOR RECORDING

DISPOSAL

Debit

Fixed

Asset Disposal A/c

Credit

Fixed

Asset Cost A/c

(With

the cost of asset)

Debit

Accumulated

Dep. A/c

Credit

Fixed

Asset Disposal A/c

(With

the depreciation accumulated to

date)

Debit

Cash /

Bank / Receivable A/c

Credit

Fixed

Asset Disposal A/c

(With

the price at which asset is

sold)

Example

·

An

asset is purchased for Rs.

500,000 on Nov. 01,

2001.

·

Depreciation

rate is 10% p.a.

·

The

Asset is sold on Apr. 30,

2004.

·

Financial

Year is July 1 to June

30

Question

· Calculate

the WDV For both

policies

137

Financial

Accounting (Mgt-101)

VU

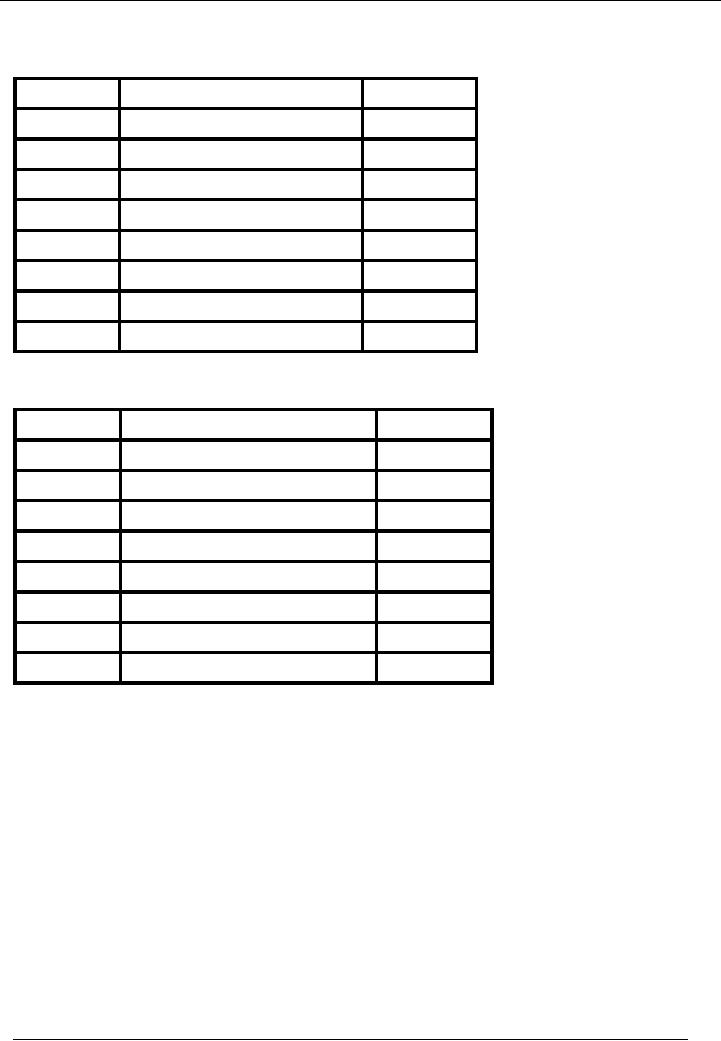

Depreciation

is Charged on the Basis of

USe

Year

On

the Basis of Use

Rs.

1-11-2001

Cost

500,000

2001-2002

Dep.

500,000 x 10% x 8 / 12

(33,333)

30-6-2002

WDV

466,667

2002-2003

Dep.

466,666 x 10%

(46,667)

30-6-2003

WDV

420,000

2003-2004

Dep.

420,000 x 10% x 10 / 12

(35,000)

30-4-2004

WDV

385,000

Full

Dep. In the Year of

Purchase

Year

Full

Dep. in year of

Purchase

Rs.

1-11-2001

Cost

500,000

2001-2002

Dep.

500,000 x 10%

(50,000)

30-6-2002

WDV

450,000

2002-2003

Dep.

450,000 x 10%

(45,000)

30-6-2003

WDV

405,000

2003-2004

Dep.

00 in the year of

sale

00

30-6-2004

WDV

405,000

Contents

of Fixed Assets

Register

· Different

record for each class of

assets

· Date

of purchase

· Detailed

particulars of asset

· Location

of asset

· Record

of depreciation

ILLUSTRATION

Cost

of asset

Rs.

200,000

Life

of the asset

5

years

Depreciation

method

Straight

line

Residual

value

Rs.

20,000

Sale

price after 5 years

30,000

Calculate

profit/Loss on the sale of the

asset?

SOLUTION

138

Financial

Accounting (Mgt-101)

VU

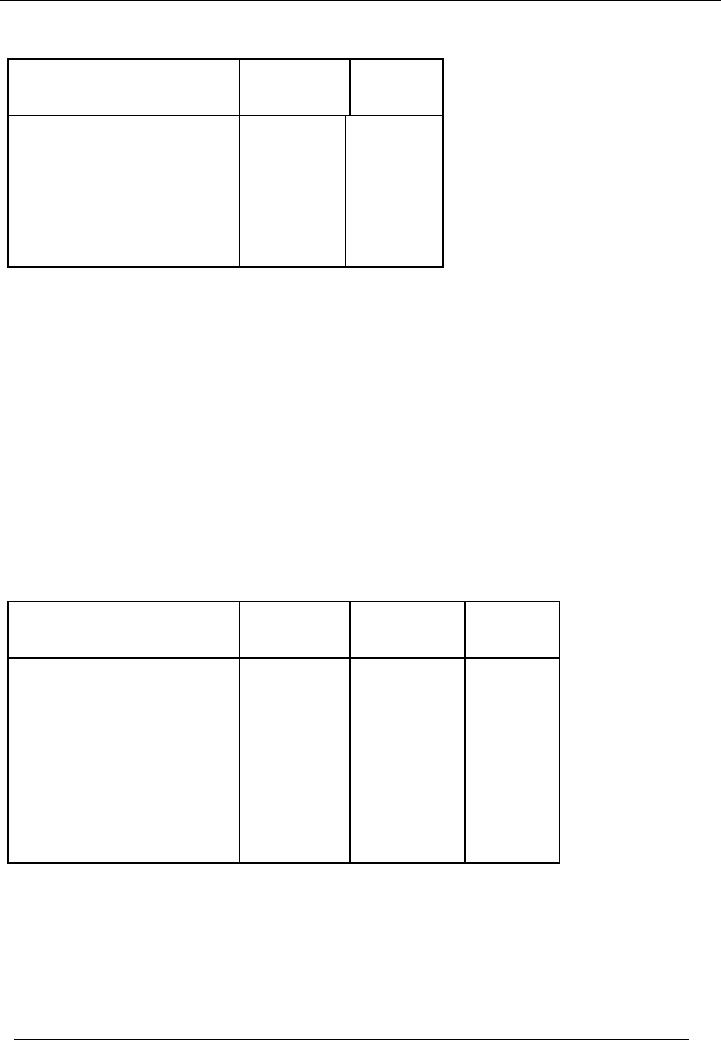

Written

down value = 200,000

20,000 = 180,000

Depreciation/year

= 180,000/5 = 36,000 (Straight

line method)

Particulars

Depreciation

Written

(Rs)

Down

Value

(Rs.)

200,000

Depreciable

cost

st year

(36,000)

164,000

Dep.

Of the 1

Dep.

Of the 2nd year

(36,000)

128,000

Dep.

Of the 3

(36,000)

92,000

rd year

(36,000)

56,000

Dep.

Of the 4th year

Dep.

Of the 5th year

(36,000)

20,000

Book

value after five

years

Rs.

20,000

Sale

price

Rs.

30,000

Profit

on sale

Rs.

10,000 (30,000

20,000)

Same

illustration is solved by reducing

balance method

Cost

of asset

Rs.

200,000

Residual

value

Rs.

20,000

Estimated

useful life

5

years

Calculation of

depreciation rate

____

Depreciation

Rate = 1 n√Rv/c

_____________

=1-

5√20,000/200,000

=

37%

Allocation

of depreciation is given below:

Particulars

Depreciation

Accumulated

Written

(Rs)

Depreciation

Down

(Rs.)

Value

(Rs.)

200,000

Depreciable

cost

Dep.

Of the 1st year

200,000

x 37%

74,000

74,000

126,000

Dep.

Of the 2nd year

126,000

x 37%

46,620

120,620

79,380

Dep.

Of the 3rd year

29,371

149,991

50,009

79,380

x 37%

Dep.

Of the 4th year

50,009

x 37%

18,503

168,494

31,506

Dep.

Of the 5th year

31,506

x 37%

11,657

180,151

19,849

Book

value after five

years

Rs.

19,849

Sale

price

Rs.

30,000

Profit

on sale

Rs.

10,151 (30,000

19,849)

139

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES