|

FINANCIAL STATEMENTS OF LISTED COMPANIES |

| << FINANCIAL STATEMENTS OF LISTED COMPANIES |

Financial

Accounting (Mgt-101)

VU

Lesson-45

FINANCIAL

STATEMENTS OF LISTED

COMPANIES

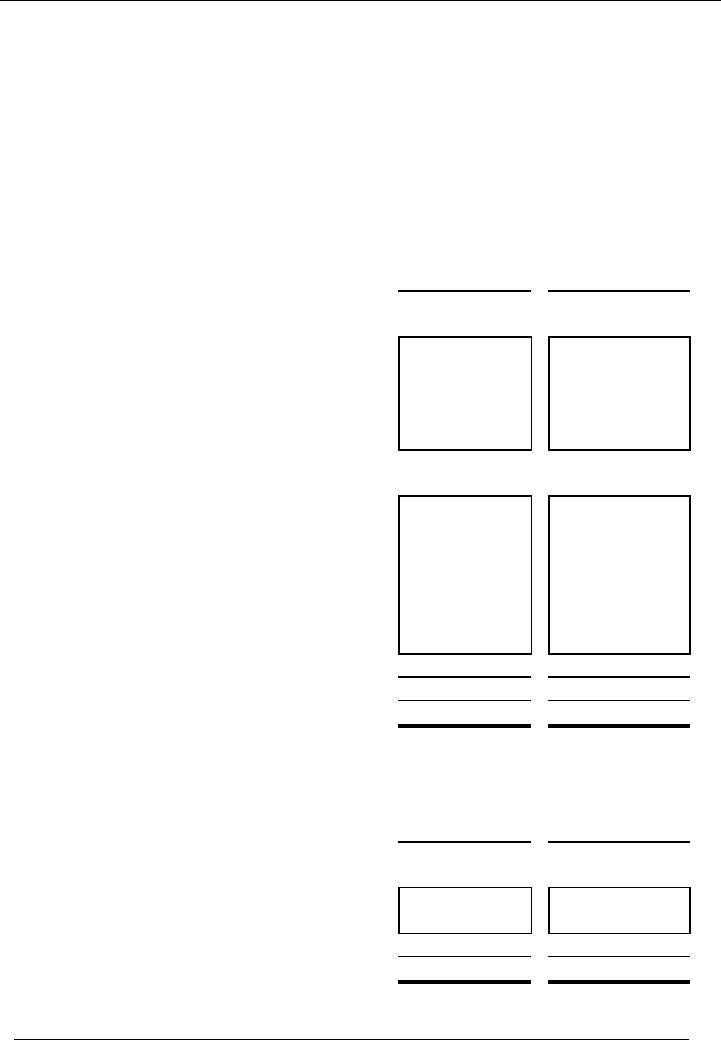

QUESTION

# 1

Following is

the trial balance of Sheraz Ltd. as on

June 30, 2002.

Sheraz

Ltd.

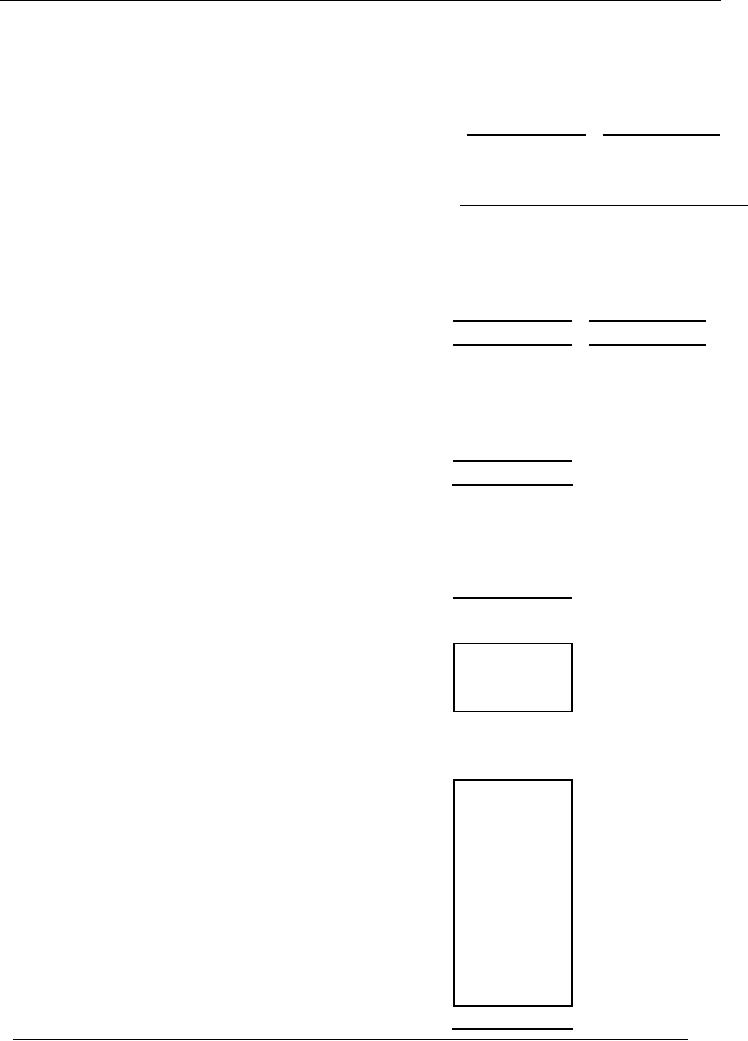

Trial

Balance as On June 30

2002

DEBIT

CREDIT

Rs'000

Rs'000

Tangible

Fixed Assets

Fixed

Assts At Cost

Freehold

Land

9,550

Building

15,815

Plant and

Machinery

54,636

Furniture

and Fixture

2,698

Motor

Vehicles

24,111

Leased

Vehicles

22,123

Accumulated

Dep.

Building

10,775

Plant and

Machinery

47,315

Furniture

and Fixture

2,474

Motor

Vehicles

12,347

Leased

Vehicles

12,186

Capital

Work in Progress

4,075

Long Term

Investments

Investment in

Shares of Co. A

20,000

Investment in

Shares of Co. B

2,500

Prov. For

Diminution in Value Co.

B

1,250

Long Term

Deposits

Long Term

Deposits

3,069

Current

Assets

Stores and

Spares

1,114

Stock in

Trade Jul 01 2001

-

Raw

Material

13,264

Packing

Material

42,189

Finished

goods

85,296

Trade

Debts

Trade

Debts

18,185

Provision

for Doubtful Debts

223

Adv. Dep.

& Prepayments

-

Advances

2,434

Deposits

816

292

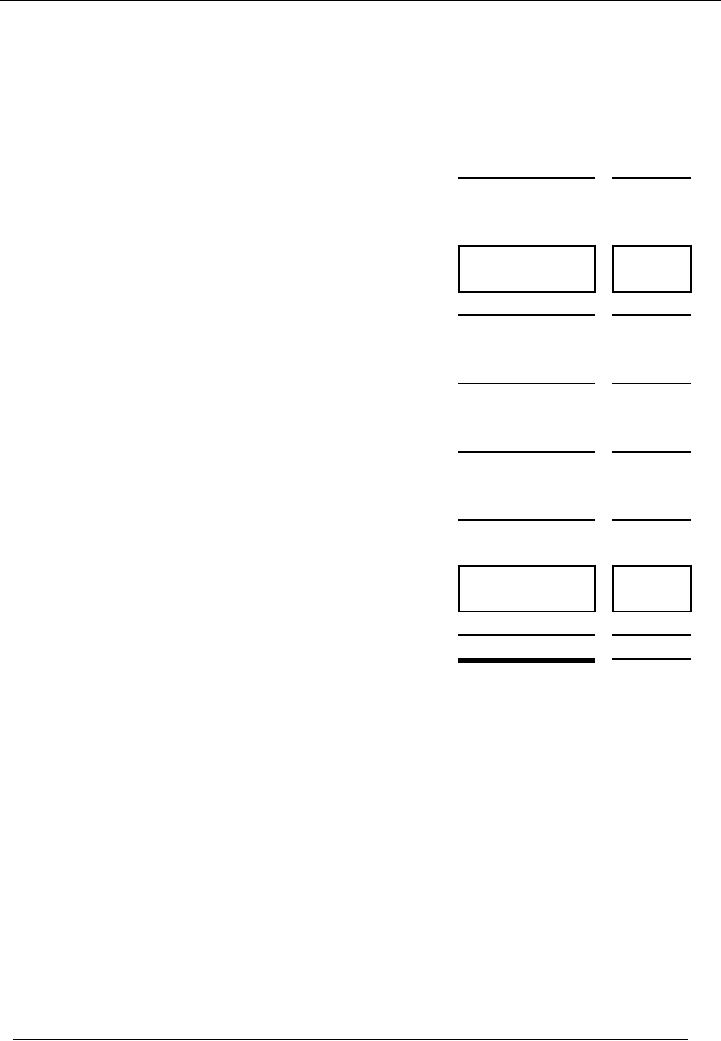

Financial

Accounting (Mgt-101)

VU

Prepayments

1,637

Accrued

Profit on Bank Dep

388

Advance

Excise Duty

2,601

Sales Tax

Refundable

8,492

Other

Receivables

375

Dividend

Receivable

25,000

Cash and

Bank

-

Cash in

Hand

3,330

Cash at

Bank - Current

25,024

Cash at

Bank - Savings

16,521

Current

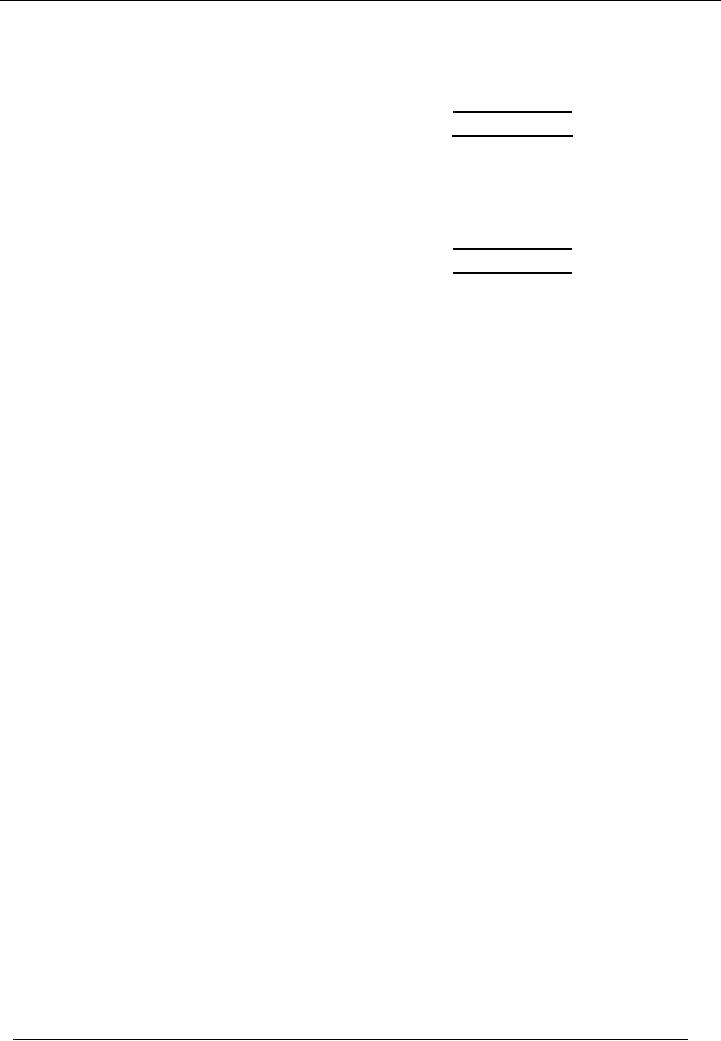

Liabilities

Short Term

Running Finance

5,257

Creditors,

Accrued & Other L.

-

Creditors

63,016

Customers

Deposits

22,571

Accrued

Exp.

22,448

Other

Liabilities

1,826

Tax

Payable

3,858

Dividends

200

Long Term

and Deff. Lia

Deff.

Tax

3,000

Oblig.

Under Lease Finance

15,282

Share

Capital

50,000

General

Reserve

104,000

Sales

-

Gross Sale

- Domestic

751,244

Gross Sale

- Export

93,305

Sales

Tax

106,158

Cost of

Sales

Purch.

During the Year Raw M

291,569

Purch.

During the Year Packing

M

190,295

Overheads

Wages

23,155

Stores

Consumed

7,922

Traveling

and Conv.

158

Repairs

and Maint.

10,267

Insurance

345

Fuel and

Power

23,339

Bottle

Breakage

6,552

Excise

Duty

49,671

Misc.

Expenses

7,412

Admin.

Expenses

-

Salaries

and Wages

36,117

Postage

and Telegram

1,652

Traveling

and Conveyance

1,075

293

Financial

Accounting (Mgt-101)

VU

Repairs

and Maint.

1,272

Insurance

1,179

Printing

and Stationery

1,121

Rent,

Rates and Taxes

1,155

Auditors'

Remuneration

161

Legal and

Professional

768

Donations

81

General

Expenses

400

Selling

and Distribution

Expenses

-

Salaries

and Wages

23,227

Postage

and Telegram

1,578

Traveling

and Conveyance

2,616

Repairs

and Maint.

6,168

Vehicle

Running

859

Printing

and Stationery

497

Rent,

Rates and Taxes

1,954

Advertising

19,254

Outward

Freight

9,628

Sales

Staff Incentives

1,642

Petrol,

Oil etc.

8,561

Misc.

Expenses

1,392

Financial

Charges

-

Markup on

Loans

282

Finance

Lease Charges

1,750

Bank

Charges

825

Other

Expenses and

Provisions

-

Other

Income

-

Profit on

Bank Deposits

974

Dividends

Income

25,100

Foreign

Exchange Gain

5,732

Gain on

Disposal of F. Assts.

692

Sale of

Scrap

1,470

Income Tax

for the year

14,800

Unappropriated

Profit B/F

5,555

1,262,100

1,262,100

294

Financial

Accounting (Mgt-101)

VU

Adjustments

1. Provision

for diminution in the value

of investments to be increased to

Rs.

1,875.

2. Long

term deposits maturing

during the year Rs.

291

3. Provision

for doubtful debts to be

increased by Rs. 987

4. 60%

Dividend declared.

5. Liability

against lease finance

payable in current year Rs.

6,643

6. Authorized

capital of 10,000,000 shares of

Rs. 10 each.

7. Transfer to

general reserve

21,000

8. Addition in

Fixed Assets, Plant and

Mach. 2,262

9. Furniture

989, Owned vehicles

1758

10. Cash

received on disposal of vehicles

Rs. 1,316

11. Dep.

Building 10% Plant and

Furniture 15% and

Vehicles

20% on written down

value.

12. No

depreciation on year of sale

and full dep in the

year of purchase.

13.

Distribution of Depreciation

Building

and Plant to Cost of

Sales

Furniture

and Owned Vehicles to Admin

Expenses

Leased

Vehicles to Selling

Expenses

14.

Closing Stocks

Raw

Material

27,545

Packing

Material

74,731

Finished

Goods

78,550

295

Financial

Accounting (Mgt-101)

VU

You are also

provided with the following

balance sheet as at June 30,

2001.

Sheraz

Ltd.

Balance

Sheet As At June 30,

2001

2001

Note

Rs'000

Tangible

Fixed Assets

Operating

Fixed Assets

39,451

Capital

Work in Progress

-

Long Term

Investments

21,250

Long Term

Deposits

2,004

62,705

Current

Assets

Stores and

Spares

1,405

Stock in

Trade

188,639

Trade

Debts

24,984

Adv. Dep.

And Prepayments

8,826

Cash and

Bank Balances

24,437

248,291

Current

Liabilities

Short Term

Running Finances

3,111

Current

Maturity of Obligation

under

lease finance

3,425

Creditors,

Accrued and Other

liabilities

99,109

Tax

Payable

5,472

Divided

Payable

30,164

141,281

Working

Capital

107,010

Total

Capital Employed

169,715

Financed

By

Share

Capital and Reserves

Share

Capital

50,000

General

Reserve

104,000

Unappropriated

Profit

5,555

Shareholders

Equity

159,555

Long Term

Liabilities

Deferred

Taxation

3,000

Obligation

under Lease Finance

7,160

10,160

TOTAL

169,715

Prepare a

set of financial statements as on

June 30,2002.

296

Financial

Accounting (Mgt-101)

VU

SOLUTION

Sheraz

Ltd.

Balance

Sheet As At June 30,

2002

2002

2001

Note

Rs'000

Rs'000

Tangible

Fixed Assets

Operating

Fixed Assets

3

37,859

39,451

Capital

Work in Progress

4,075

-

Long Term

Investments

4

20,625

21,250

Long Term

Deposits

5

2,778

2,004

65,337

62,705

Current

Assets

Stores and

Spares

1,114

1,405

Stock in

Trade

6

180,826

188,639

Trade

Debts

7

16,975

24,984

Adv. Dep.

And Prepayments

8

42,034

8,826

Cash and

Bank Balances

9

44,875

24,437

285,824

248,291

Current

Liabilities

Short Term

Running Finances

5,257

3,111

Current

Maturity of Obligation

under

lease finance

13

6,643

3,425

Creditors,

Accrued and Other

liabilities

10

109,861

99,109

Tax

Payable

3,858

5,472

Divided

Payable

11

30,200

30,164

155,819

141,281

Working

Capital

130,005

107,010

Total

Capital Employed

195,342

169,715

Financed

By

Share

Capital and Reserves

Share

Capital

12

50,000

50,000

General

Reserve

125,000

104,000

Un-appropriated

Profit

8,703

5,555

Shareholders

Equity

183,703

159,555

Long Term

Liabilities

Deferred

Taxation

3,000

3,000

Obligation

under Lease Finance

13

8,639

7,160

11,639

10,160

195,342

169,715

Sheraz

Ltd.

297

Financial

Accounting (Mgt-101)

VU

Profit

and Loss Account for

the Year Ended June

30, 2002

2002

2001

Note

Rs'000

Rs'000

Sales

14

738,391

X

Cost of

Sales

15

572,210

X

Gross

Profit

166,181

X

Other

Income

16

33,968

X

Less:

Administrative Expenses

17

48,980

X

Selling

and Distribution

Expenses

18

79,364

X

128,344

X

Profit

From Operations

71,805

X

Less:

Financial Charges

19

2,857

X

Net Profit

Before Taxation

68,948

X

Income Tax

for the Year

14,800

X

Profit

After Taxation

54,148

X

Un-appropriated

Profit Brought

Forward

5,555

X

59,703

X

Appropriation

Transfer to

Reserve

21,000

X

Proposed

dividend @ 60%

30,000

X

51,000

X

Un-appropriated

Profit Carried

Forward

8,703

X

298

Financial

Accounting (Mgt-101)

VU

Sheraz

Ltd.

Cash

Flow for the Year

Ended June 30,

2002

2002

2001

Note

Rs'000

Rs'000

Cash Flow

From Operating

Activities

Profit

Before Tax

68,948

Adjustment

for:

Depreciation

5,977

Provision

for Doubtful Debts

987

Provision

for Dimunition in Value

of

Investment

625

Profit on

Bank Deposits

(974)

Dividends

Income

(25,100)

Gain on

Disposal of F. Assts.

(692)

(19,177)

Operating

Profit Before Working

Capital

changes

49,771

(Increase) /

Decrease in C. Assets

Stores and

Spares

291

Stock in

Trade

7,813

Trade

Debts

7,122

Adv. Dep.

And Prepayments

(7,989)

7,237

Increase /

(Decrease) in C. Liabilities

Short Term

Running Finances

2,146

Creditors,

Accrued and Other

liabilities

10,752

12,898

Cash

Generated From

Operations

69,906

Profit on

Bank Deposits

(974)

Income Tax

Paid

(5,100)

Net Cash

Flow from Operations

63,832

299

Financial

Accounting (Mgt-101)

VU

Cash Flow

From Investing

Activities

Purchase of

Fixed Assets

(5,009)

Capital

Work in Progress

(4,075)

Sale

Proceeds Of Fixed

Assets

1,316

Dividend

Received

100

Long Term

Deposits

(1,065)

(8,733)

Cash Flow

from financing

Activities

Repayment of

Lease Liability

(4,697)

dividend

Paid

(29,964)

(34,661)

Net

Increase in Cash & Cash

Eq.

20,438

O/B of

Cash and Cash

Eq.

24,437

C/B of

Cash and Cash

Eq.

44,875

300

Financial

Accounting (Mgt-101)

VU

Sheraz

Ltd.

Statement of

Changes in Equity for the

Year Ended June 30,

2002

Share

General

Un-app.

Total

Capital

Reserve

Ptofit

Balance as on

June 30,

2000

50,000

104,000

4,119

158,119

Profit

after tax for the

year

31,436

31,436

Dividend

(30,000)

(30,000)

Balance as on

June 30,

2001

50,000

104,000

5,555

159,555

Profit

after tax for the

year

54,148

54,148

Transfer to

reserve

21,000

(21,000)

-

Dividend

(30,000)

(30,000)

Balance as on

June 30,

2002

50,000

125,000

8,703

183,703

301

Financial

Accounting (Mgt-101)

VU

NOTES

TO THE ACCOUNTS

1.

Company and its operations

· The

company is a public limited

company incorporated in Pakistan

and

manufacture

------------

2.

Significant accounting

policies

· These

account have been prepared

in accordance with the

requirements of the

Companies

Ordinance 1984 and International

accounting standards as

applicable

in

Pakistan.

Historical

costs

·

Historical costs are

used as a basis for valuing

transactions.

Revenue

Recognition

·

Sales are recorded upon

delivery of goods to the

customers. However

Exported

goods

are considered sold when shipped on

board.

Other

Policies

·

Income from bank deposits,

loans and advances are

recognized on accrual

basis.

·

Dividend income is recognized

when right to receive is

established.

·

Research and development casts

are expensed as and when

incurred.

·

Working of all figures,

Fixed assets schedule and

all agreements. i-e.

Lease

agreements

and agreements for obtaining

loan from banks are included

in the

notes to the

accounts.

302

Financial

Accounting (Mgt-101)

VU

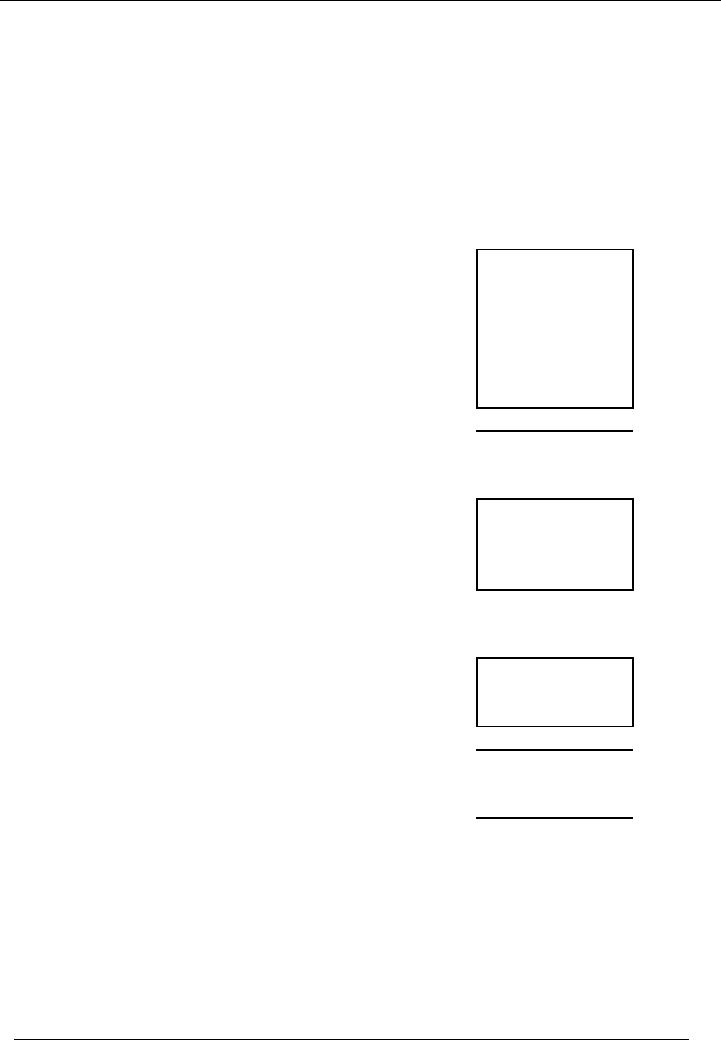

3.

FIXED ASSETS

SCHEDULE

Cost

R

Accumulated

Depreciation

WDV

Particulars

As

On

As

On

A

As On

On

For

As

On

As

On

Jul

01

Add.

Disp.

Jun

30

T

Jul

01

Disp.

The

Jun

01

Jun

01

2001

2002

E

2001

Year

2002

2002

Company

Owned

Assets

Freehold

-

9,550

-

-

-

9,550

Land

9,550

Building

15,815

15,815

10

10,775

-

504

11,279

4,536

Plant

and

48,413

6,223

47,315

-

2,262

1,098

54,636

15

Machinery

52,374

Furniture

and

Fixture

1,709

989

2,698

15

2,474

-

34

2,508

190

14,700

9,411

14,251

1,758

(2,528)

Vehicles

(1,904)

2,353

24,111

20

24,881

104,329

(2,528)

106,810

74,815

(1,904)

3,989

5,009

76,900

29,910

Leased

Assets

Vehicles

22,123

22,123

20

12,186

1,988

14,174

7,949

22,123

-

-

22,123

12,186

-

1,988

14,174

7,949

126,452

(2,528)

128,933

87,001

(1,904)

5,977

Total

2002

5,009

91,074

37,859

Total

2001

x

x

x

x

x

x

x

x

39,451

303

Financial

Accounting (Mgt-101)

VU

Distribution

of

Depreciation

WORKING

2002

2001

Land

=0

Rs'000

Rs'000

Building

= 15,818 - 10,775

=

5,040 x 10%

=

504

Cost

of

Goods

Sold

1,602

Plant

=

54,636 - 47,315

=

7,321 x 15%

=

1,098

Admin

Expenses

2,387

Furniture=

2,698

-

2,474

= 224

x 15%

=

34

Selling

Expenses

1,988

Vehicles

= 24,111 - 14,251 + 1904 =

11,764 x 20% =

2,353

5,977

x

Vehicles

= 22,123 - 12,186

=

9,937

x 20%

=

1,988

Note

2002

2001

Rs'000

Rs'000

4. Long Term

Investments

Investment in

Shares of Co. A

20,000

20,000

Investment in

Shares of Co. B

2,500

2,500

Less:

Prov. For Diminution in

Value Co. B

1,875

1,250

625

20,625

20,000

5. Long Term

Deposits

Long Term

Deposits

3,069

2,004

Less:

Current Maturity

291

2,778

2,004

6. Stock in

Trade

Raw

Material

27,545

31,799

Packing

Material

74,731

76,540

Finished

Goods

78,550

80,300

180,826

188,639

304

Financial

Accounting (Mgt-101)

VU

Trade

Debtors

7.

Trade

Debts

18,185

25,307

Less:

Provision for Doubtful

Debts

1,210

323

16,975

24,984

Advances

Deposits and

Prepayments

8.

Advances

2,434

1,379

Deposits

816

1,730

Prepayments

1,637

1,305

Advance

Excise Duty

2,601

2,192

Sales Tax

Refundable

8,492

1,366

Other

Receivables

375

394

Dividend

Receivable

25,000

-

Accrued

Profit on Bank Dep

388

460

Curent

Maturity of Long Term

Dep.

291

-

42,034

8,366

Cash and

Bank

9.

Cash in

Hand

3,330

Cash at

Bank - Current

Accounts

25,024

Cash at

Bank - Savings

Accounts

16,521

44,875

10.

Creditors,

Accrued & Other

Liabilities

Creditors

63,016

58,997

Customers

Deposits

22,571

19,866

Accrued

Exp.

22,448

17,534

Other

Liabilities

1,826

2,712

109,861

99,109

11.

Dividend

Payable

Payable

from Previous Year

200

164

Accrued

During the Year

30,000

30,000

30,200

30,164

305

Financial

Accounting (Mgt-101)

VU

12.

Share

Capital

Authorized

Capital

10,000,000

(2000: 10,000,000)

ordinary

shares of Rs. 10 each

100,000

100,000

Paid Up

Capital

5,000,000

(2000: 5,000,000)

ordinary

shares of Rs. 10 each

500,000

500,000

13.

Obligation

Under Lease Finance

Obligation.

Under Lease Finance

15,282

10,585

Less:

Current Maturity

6,643

3,425

8,639

7,160

14.

Sales

Gross Sale

- Domestic

751,244

Gross Sale

- Export

93,305

Less:

Sales Tax

106,158

738,391

15.

Cost

of Sales

Raw Material -

Opening Stock

13,264

Raw Material -

Purchases

291,569

Less : Raw

Material - Closing

Stock

27,545

Raw Material

Consumed

277,288

Packing

Material - Opening

Stock

42,189

Packing

Materila - Purchases

190,295

Less:

Packing Material - Closing

Stock

74,731

Packing

Material consumed

157,753

Overheads

Wages

23,155

Stores

Consumed

7,922

Traveling

and Conv.

158

Repairs

and Maint.

10,267

Insurance

345

Fuel and

Power

23,339

Bottle

Breakage

6,552

Excise

Duty

49,671

Misc.

Expenses

7,412

Depreciation

3.1

1,602

130,423

306

Financial

Accounting (Mgt-101)

VU

Cost of

Production

565,464

Finished

Goods - Opening Stock

85,296

Less:

Finished Goods -

Closing

Stock

78,550

Cost of

Goods Sold

572,210

16.

Other

Income

Profit on

Bank Deposits

974

Dividends

Income

25,100

Foreign

Exchange Gain

5,732

Gain on

Disposal of F. Assts.

692

Sale of

Scrap

1,470

33,968

17.

Administrative

Expenses

Salaries

and Wages

36,117

Postage

and Telegram

1,652

Traveling

and Conveyance

1,075

Repairs

and Maint.

1,272

Insurance

1,179

Printing

and Stationery

1,121

Rent,

Rates and Taxes

1,155

Auditors'

Remuneration

161

Legal and

Professional

768

Donations

81

General

Expenses

400

Depreciation

3.1

2,387

Provision

for Doubtful Debts

987

Provision

for Diminution in Value

of

Investment

625

48,980

18.

Selling

and Distribution

Expenses

Salaries

and Wages

23,227

Postage

and Telegram

1,578

Traveling

and Conveyance

2,616

Repairs

and Maint.

6,168

Vehicle

Running

859

Printing

and Stationery

497

Rent,

Rates and Taxes

1,954

Advertising

19,254

Outward

Freight

9,628

307

Financial

Accounting (Mgt-101)

VU

Sales

Staff Incentives

1,642

Petrol,

Oil etc.

8,561

Misc.

Expenses

1,392

Depreciation

3.1

1,988

79,364

19.

Financial

Charges

Markup on

Loans

282

Finance

Lease Charges

1,750

Bank

Charges

825

2,857

FINANCIAL

ANALYSIS

The

management of the business has to

analyze several things to

work out performance of

the

business. These analyses

help the management in decision

making. The management works

out

the

performance of the business by

calculating some ratios.

Following are some of the

important

ratios, a

management may calculate to get first

hand knowledge about

business's performance:

Profitability

Ratios

Profitability

ratios contain the following

ratios:

·

Gross Profit

Ratio

·

Net

Profit Ratio

Gross

Profit Ratio

The

Gross Profit ratio tells

the management of the

company about profitability of

the

company.

It helps the management of

the company to know about

cost of production

of

the company. When

management compares it with

previous year's ratios, it

came to know,

how

well the business has

performed and how to

improve its efficiency further.

Gross Profit

ratio also

gives information about

sales. It tells the management

whether sales has increased

or

decreased.

The management takes appropriate

steps accordingly. The

formula for

calculating

this

ratio is as follows:

Gross Profit

Ratio = (Gross Profit /

Sales) x 100

Net

profit ratio

The

benefit of net profit ratio

is same as that of gross

profit ratio. It helps the

management to

know

about net profit. If gross

profit ratio is greater as compared to

last year and net profit

ratio

is lesser, it

means that administrative and

selling expenses of the

company have increased.

The

management

takes appropriate steps to

control the expenses. The

formula for this ratio is

as

follows:

308

Financial

Accounting (Mgt-101)

VU

Net

Profit Ratio = (Net Profit /

Sales) x 100

Stock

Turnover Ratio

This

ratio tells us about sale of

stock. It can be calculated in days as

well as in number of

times.

It tells us

how many times in a year or

in a month, the stock is

sold or in how many days,

the

stock is

sold. If it is calculated in days and the

result is higher than that

of previous years.

This

means

that the stock takes

more days to be sold. That

means demand of the product of

the

company is

decreasing and vice versa. The

formula for the number of

days is as follows:

Stock

Turnover in days = (Average Stock / Cost

of goods sold) x 365

Average

stock is calculated as follows:

(Opening Stock + Closing

Stock) / 2

This

opening and closing stock

may be for a year or for a

month depending upon the

policy for

calculating

this ratio.

If this

ratio is calculated for

number of times, it means

that how many times in a

given period (

whether a

year or a month) the stock

is sold. The formula for

calculating this ratio is as

follows:

Stock

Turnover (Number of times) =

(Cost of goods sold /

Average stock)

Debtors

Turnover Ratio

This

ratio is used to get first

hand knowledge about payment

received from debtors. It is

evident

that a

company without receiving

cash from its customers

cannot meet its expenses. If

debtors

do not

pay on time, how would a

company pay its liabilities.

Consequently its reputation will

go

down and

nobody will place his trust on

that company. This ratio

helps management to identify

debtors who

do not pay on time and to

pursue them to pay. This

ratio is also calculated

for

number of

days and number of times. The

formulae for this ratio

are as follows:

Debtor

Turnover ( Number of days) =

(Average Debtors / Credit

Sales) x 365

Debtor

Turnover ( Number of times) =

Credit Sales / Average

Debtors

Creditors

Turnover Ratio

Creditors

turnover means how many

times or in how many days a

company pay to its

creditors.

As mentioned

above, if a company does not

collect its payment on time,

how would it be able to

pay

its creditors on time. If it

does not pay its debtors on

time, this situation will make

bad

impression

on its reputation. Like debtors

turnover, creditors turnover is also

calculated for

number of

days and number of times. The

formulae for this ratio

are as follows:

Creditor

Turnover ( Number of days) =

(Average Creditors / Credit

Purchases) x 365

Creditor

Turnover ( Number of times) =

Credit Purchases / Average

Creditors

309

Financial

Accounting (Mgt-101)

VU

Return

on Capital Employed Ratio

(ROCE)

This

ratio is calculated for the

share holders of the

company. As share holders

are concerned

with

profit paid by companies to its share

holders. This ratio gives us

the proportion of net

profit

before

tax to average capital

employed by the company. The

return rate of profit given to

its

members

should be higher than

current market rate. If

return rate is less than

current market rate

than

the share holders will

invest their money in the

market instead of investing in the

company.

The

formula for calculating this

ratio is as follows:

Return on

Capital Employed Ratio

(ROCE) = Net profit after

tax before appropriation

/

Average

Capital Employed

Earning

per share ratio

Earning per

share ratio indicates the

proportion of net profit, a

company is getting per

share.

Share

holders are always

interested to know the

proportionate rate, a company is

getting per

share. As

price is numerator and earning in

denominator, therefore lower

value means better

return.

The

formula for calculating this

ratio is as follows:

Earning per

share ratio = Net profit

after tax before

appropriation / Number of

shares

Price

Earning Ratio

This

ratio is calculated for those

share which have market

value. This ratio compares

earning

per share

with market value of that

share. The formula for

calculating this ratio is as

follows:

Price

Earning Ratio = Market value

per share / Earning per

share

Debt

Equity Ratio

This

ratio shows the composition

of finance that have funded

the asset of the company.

This

ratio

varies for different

projects. In Pakistan, maximum advised

ratio is 60: 40. i-e.

40% of the

assets

should be bought with

company, s investment and 60%

should be bought with the

loan

taken by

the company. This standard is

acceptable in Pakistan. If a company's

liquidity ratio is

more

than the above mentioned standard,

that means condition of the

company is not very

good.

If it has to

pat its liabilities, its

assets would not support it

to pay its liabilities. The

formula for

calculating

this ratio is as

follows:

Debt

Equity Ratio = Long term

Liabilities / Equity

Current

Ratio

Current

ratio shows the proportion

of current assets and current

liabilities. This ratio

should be

1:1.

i-e. For every liability of

one rupee, there should be an asset of

one rupee to pay it.

The

formula

for calculating this ratio

is as follows:

310

Financial

Accounting (Mgt-101)

VU

Current

Ratio = Current Assets /

Current Liabilities

Acid

Test Ratio

Acid test

ratio is the proportion of

current assets which are

convertible into cash and

current

liabilities.

The formula for calculating

this ratio is as

follows:

Acid

Test Ratio = (Current Assets

Stock) / Current

Liabilities

Mark up

Cover Ratio

This

ratio shows the proportion

of operating profit (Operating

Profit before financial

charges)

and

financial charges. This ratio is

useful for bankers. If a company

has taken loan and

its

financial

charges are so large that

all or a big part of profit

is absorbed by financial charges,

then

how

would a company repay its

loans. The formula for

calculating this ratio is as

follows:

Mark up

Cover Ratio = Operating

Profit before financial

charges / Financial

charges

311

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES