|

Financial Statements of Limited Companies |

| << Financial Statements of Limited Companies |

| CASH FLOW STATEMENT 1 >> |

Financial

Accounting (Mgt-101)

VU

Lesson-40

Financial

Statements of Limited

Companies

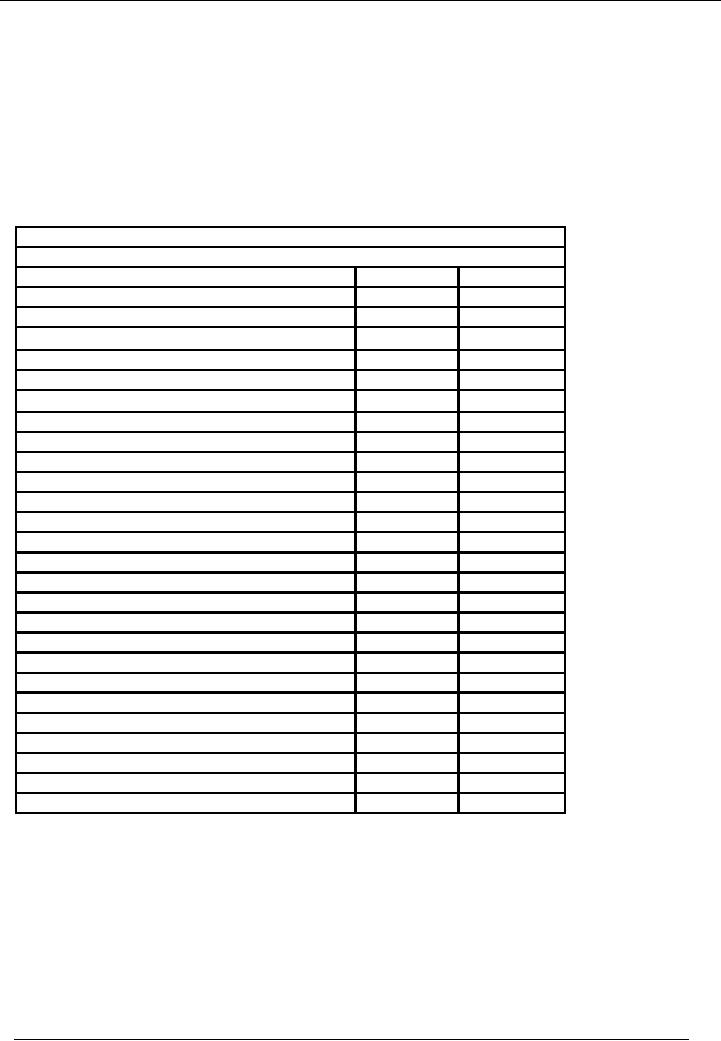

QUESTION

Following

trial balance has been

extracted from the books of Alpha

Ltd. as on June 30,

2002.

You

are required to prepare the profit

and loss account for the

year and the Balance Sheet

as at June 30,

2002.

Alpha

Limited

Trial

Balance as at June 30,

2002

Title

of Account

Dr.

Rs.

Cr.

Rs.

Paid

up capital

175,000

10 %

Debentures

75,000

Building

at Cost

237,500

Equipment

at Cost

20,000

Vehicles

at Cost

43,000

Accumulated

Dep. Building

11,250

Equipment

6,000

Vehicles

12,900

Stock

Opening Balance

56,725

Sales

245,500

Purchases

134,775

Carriage

Inward

4,050

Salaries

and Wages

23,100

Directors

Remuneration

15,750

Vehicle

Running Expenses

20,300

Insurance

7,325

Miscellaneous

Expenses

1,400

Markup

on Debentures

3,750

Debtors

46,525

Creditors

28,425

Bank

20,975

General

Reserve

12,500

Share

Premium Account

35,000

Interim

Dividend Paid

8,750

Accumulated

Profit and Loss

account

42,350

TOTAL

643,925

643,925

Additional

Information:

· Closing

stock Rs. 68,050.

· Depreciation

Building 5,000, Vehicles Rs

7,500, Equipment

3,000.

· Six

months Debenture markup is to be accrued.

· 10%

final dividend is to be paid in addition

to interim dividend.

· Transfer

Rs. 5,000 to general

reserve.

· Authorised

share capital is Rs. 250,000

divided in to 25,000 shares of

Rs. 10 each.

· Provision

for Income Tax to be made

Rs. 12,500.

257

Financial

Accounting (Mgt-101)

VU

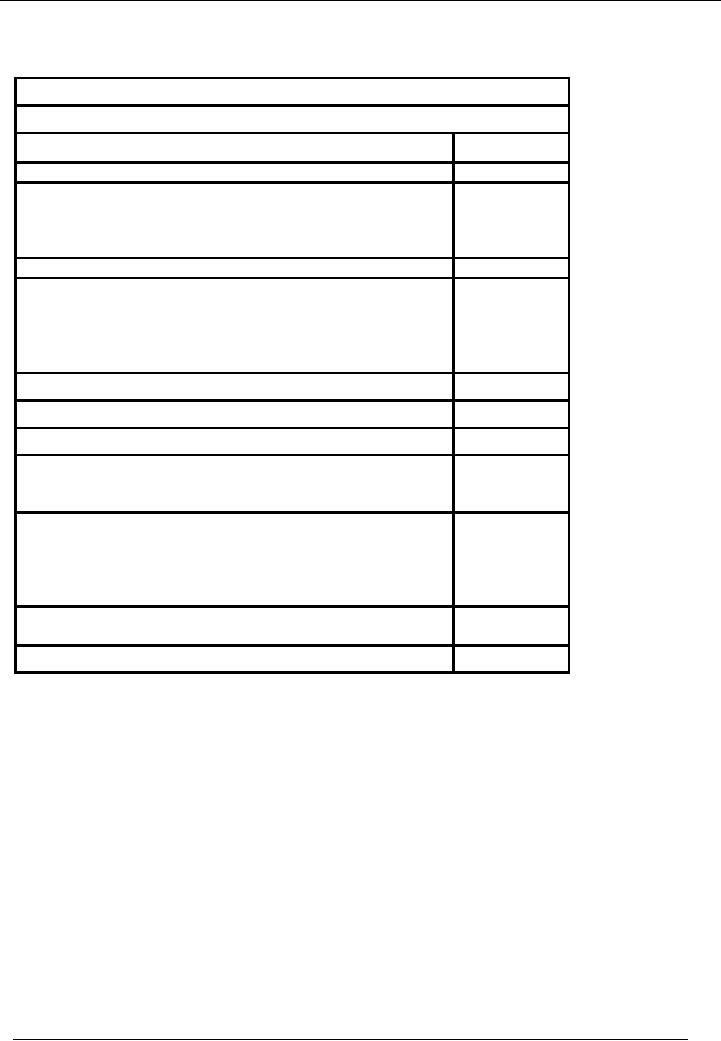

BALANCE

SHEET

Alpha

Ltd.

Balance

Sheet As At June 30,

2002

Particulars

Note

Amount

Rs.

Fixed

Assets at WDV

1

254,850

Current

Assets

Debtors

46,525

Stock

in Trade

68,050

Bank

Balance

20,975

135,550

Current

Liabilities

Creditors

28,425

Proposed

Dividend

17,500

Debenture

Markup Payable

3,750

Provision

for Tax

12,500

62,175

Working

Capital

73,375

Net

Assets Employed

328,225

Financed

By:

Authorized

Capital

25,000

Shares of Rs. 10 each

250,000

Paid

Up Capital

17,500

shares of Rs. 10 each

175,000

Share

Premium

35,000

General

Reserve (12,500 + 5,000

transferred from P & L)

17,500

Accumulated

Profit and Loss

Account

25,725

Share

Holders' Equity

253,225

Debentures

75,000

Total

328,225

258

Financial

Accounting (Mgt-101)

VU

PROFIT

& LOSS ACCOUNT

Alpha

Ltd

Profit and

Loss Account for the

Year Ended June 30

2002

Particulars

Note

RS.

Sales

245,500

Less:

Cost of Goods Sold

2

127,500

Gross

Profit

118,000

Less:

Administrative Expenses

Directors

Remuneration

15,750

Salaries

and Wages

23,100

Vehicle

Running Expenses

20,300

Insurance

7,325

Depreciation

1

15,500

Miscellaneous

Expenses

1,400

83,375

Operating

Profit

34,625

Less:

Debenture Markup

3

7,500

Net

Profit Before Tax

27,125

Less:

Provision for Tax

12,500

Net

Profit after tax

14,625

Add:

Accumulated Profit Brought

Forward

42,350

56,975

Less:

Appropriation

General

Reserve

5,000

Interim

dividend

8,750

Proposed

Final Dividend (10% of

175,000)

17,500

31,250

Accumulated

Profit Carried Forward

25,725

259

Financial

Accounting (Mgt-101)

VU

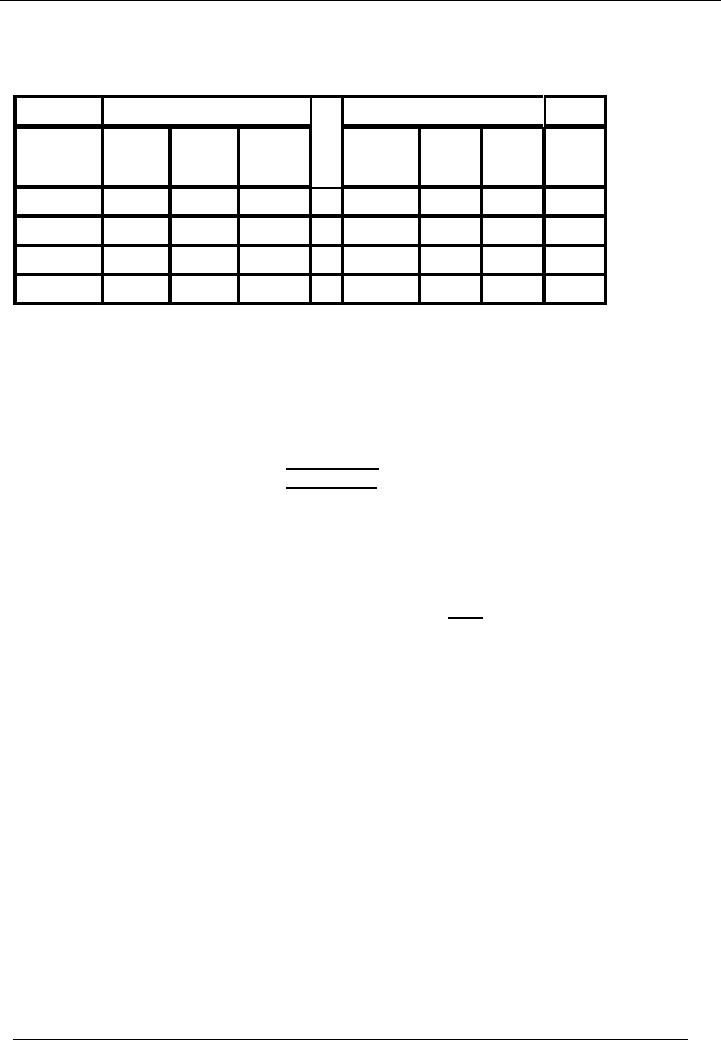

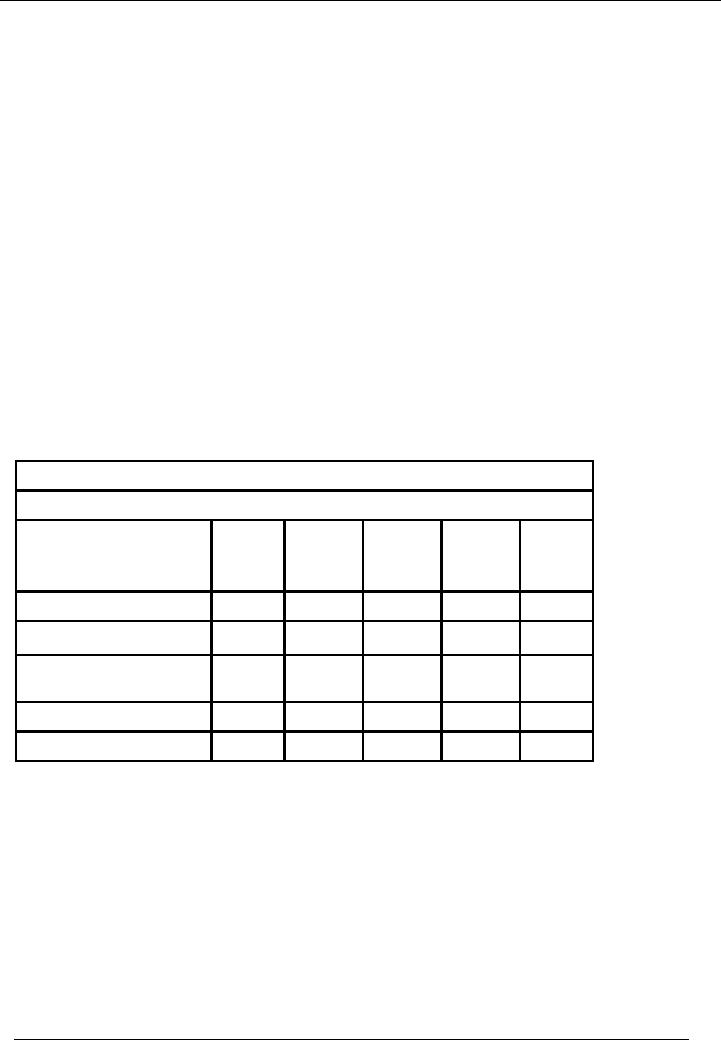

NOTE #

1

Fixed

Assets at WDV

Particulars

Cost

Acc.

Dep.

WDV

R

A

As

At

For

The As At As At

As At

Addition/ As At

T

1-7-01

Deletion 30-6-02

1-7-01

Year

30-6-02 30-6-02

E

Building

237,500

0

237,500

11,250

5,000

16,250

221,250

Equipment

20,000

0

20,000

6,000

3,000

9,000

11,000

Vehicles

43,000

0

43,000

12,900

7,500

20,400

22,600

TOTAL

300,500

0

300,500

30,150

15,500

45,650

254,850

NOTE #

2

Cost

of Goods Sold

Opening

Stock

56,725

Add:

Purchases

134,775

Add:

Carriage inward

4,050

(68,050)

Less:

Closing Stock

127,500

NOTE #

3

Mark

up on Debentures

Mark

up given in trial

3,750

Add:

Accrued Mark up for six

months

(75,000

x 10% x 6/12)

3,750

Total

Mark Up

7,500

STATEMENT

OF CHANGES IN EQUITY

·

Statement

of changes in equity shows movement in

share holders' equity during the reported

period.

·

Share

holders equity includes:

o Share

Capital

o Share

Premium Reserve

o General

Reserve

o Accumulated

Profit & Loss

Account

Reserves

are of two types:

· Distributable

Reserve

· Non

Distributable Reserve

DISTRIBUTABLE

RESERVE

260

Financial

Accounting (Mgt-101)

VU

Distributable

reserves are those reserves

which are distributable among the

share holders of the

company,

for

Example, General Reserve, Accumulated Profit &

loss etc.

NON

DISTRIBUTABLE RESERVE

Non

Distributable reserves are

those reserves which are

created for a specific

purpose. These can not

be

distributed

among share holders. These

can be utilized for that

particular purpose, for which, these

are

created.

For example, Share Premium

Reserve, Revaluation Reserve.

PROCEDURE

FOR PREPARING STATEMENT OF

CHANGE IN EQUITY

·

All

the opening balances of share holders'

equity are listed down

first.

·

Movement

during the year in share holders' equity

is recorded.

·

After

adding/reducing the share holders' equity,

closing balances are

calculated.

·

All

information regarding share holders'

equity is collected from balance

sheet of the company.

·

According

to International Accounting Standards,

fixed assets revaluation reserve is

included in the

statement

of changes in equity. But The

Companies Ordinance does not

allow revaluation reserve to

become

a part of statement of changes in equity.

As Companies Ordinance prevails

over

International

Accounting Standards, so we do not

show Revaluation reserve in the statement

of

changes

in equity.

STATEMENT

OF CHANGE IN EQUITY

Alpha

Ltd

Statement

of Changes in Equity for

Year Ended June 30,

2002

Share

Share

General

Profit

&

Total

Capital

Premium

Reserve

Loss

A/c

Account

Balance

On Jun 30, 2001

175,000

35,000

12,500

42,350

264,850

Net

Profit for the Period

14,625

14,625

Transfer to General

Reserve

5,000

(5,000)

0

Dividend

(26,250)

(26,250)

Balance

On June 30, 2002

175,000

35,000

17,500

25,725

253,225

NOTES

TO THE ACCOUNTS

Notes

to the accounts are explanatory notes on

financial statements of the company.

These include all the

information,

from formation of company to the

calculation of figures, arrived at,

during the preparation of

financial

statements.

261

Financial

Accounting (Mgt-101)

VU

Notes of

Alpha Ltd. are as

follows:

·

Company

and Its operations

o Company

was formed in the year

--------

o The

company trades in electronic consumer

items.

Significant

Accounting Policies

Historical

Cost Convention

These

accounts have been prepared

under the historical cost

convention.

o

Revenue

Recognition

Sales

are recorded on dispatch of

goods to customers.

o

Fixed

Assets

Fixed

Assets are recorded at cost

less accumulated depreciation.

o

Stock

Valuation

Method

of stock valuation is

--------

o

Taxation

Provision

for Taxation is calculated on the

basis of -------

o

262

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES