|

Cost

& Management Accounting

(MGT-402)

VU

Valuing

by-products and joint

products

By-products

Either

of the following methods may be

adopted when valuing

by-products:

(a)

The proceeds from the

sale of the by-product may

be treated as pure

profit

(b)

The proceeds from the

sale, less any handling and

selling expenses, may be applied in

reducing

the

cost of the main

products.

If

a by-product needs further

processing to improve its marketability,

such cost will be deducted

in

arriving

at net revenue, treated as in (a) or

(b) above.

Recorded

profits will be affected by the

method adopted if stocks of

the main product

are

maintained.

Accounting

for joint products

Joint

products are by definition, subject to

individual accounting procedures.

Joint costs may

require

apportionment between products if

only for joint valuation

purposes.

The

main bases for apportionment

are as follows:

Physical

measurement of joint

products

When

the unit of measurement is

different, e.g. liters and

kilos, some method should be

found of

expressing

them in a common unit. Some

joint costs are not

incurred strictly equally for

all Joint

products:

such costs can be separated

and apportioned by introducing

weighting factors.

Market

value

The

effect is to make each

product appear to be equally profitable.

Where certain products are

processed

after the point of

separation, further processing

costs must be deducted from

the market

values

before joint costs are

apportioned.

Technical

estimates of relative use of

common resources

Apportionment

is, of necessity, an arbitrary

calculation and product

costs which include such

an

apportionment

can be misleading if used as a

basis for decision-making.

Problems

of common costs

Even

if careful technical estimates are

made of relative benefits, common costs

apportionment will

inevitably

be an arbitrary calculation. When

providing information to assist

decision-making,

therefore,

the cost accountant will

emphasize cost revenue differences

arising from the

decision.

Here

are some examples of

decisions involving joint

products:

·

withdrawing, or adding, a

product

·

Special pricing

·

Economics of further

processing.

Apportioned

common costs are not

relevant to any of the above

decisions although a change

in

marketing

strategy may affect total

joint costs, e.g.

withdrawing a product may

allow capacity of the

joint

process to be reduced.

In

the short or medium term, it

is probably impractical and/or uneconomic

to alter the processing

structure.

The relative benefit derived by joint

products is, therefore,

irrelevant when considering

profitability

or marketing opportunities.

157

Cost

& Management Accounting

(MGT-402)

VU

PRACTICE

QUESTION

Q.

1

Physical

quantity method

Cost

Allocation at Split off

Point

1960

liter fresh milk put in

the process

Skim

Milk

1,000

Liter

Cream

500

Liter

Butter

200

Liter

Ghee

100

Liter

Yogurt

60

Liter

Miscellaneous

100 Liter

Cost

incurred for 1,960 liters of

milk is Rs. 15,680

Solution

Skim

Milk

=

15,680 / 1960 x 1000 =

8,000

Cream

=

15,680 / 1960 x 500 =

4,000

Butter

=

15,680 / 1960 x 200 =

1,600

Ghee

=

15,680 / 1960 x 100 =

800

Yogurt

=

15,680 / 1960 x 60 =

480

Miscellaneous

=

15,680 / 1960 x 100 =

800

Q.

2

Cost

incurred in the department Rs

70,000

Drum

sticks

Rs.

4 per gram

Breast

pieces

Rs.

6 per gram

Wings

Rs.

3 per gram

Miscellaneous

Rs. 2 per gram

Drum

stick

20,000

X 4

=

80,000

Breast

pieces

10,000

X 6

=

60,000

Wings

6,000

X 3

=

18,000

Miscellaneous

4,000

X 2

=

8,000

1,66,000

Solution

Drum

stick

=

70,000 / 1,66,000 x 80,000 =

33,735

Breast

pieces

=

70,000 / 1,66,000 x 60,000 =

25,300

Wings

=

70,000 / 1,66,000 x 18,000 =

7,590

Miscellaneous

=

70,000 / 1,66,000 x 8,000 =

3,375

70,000

Physical

Quantity Ratio

Total

quantity produced 40,000

grams

Drum

stick

20,000

Breast

pieces

10,000

Wings

6,000

Miscellaneous

4,000

40,000

158

Cost

& Management Accounting

(MGT-402)

VU

Drum

stick

=

70,000 / 40,000 x

20,000

=

35,000

Breast

pieces

=

70,000 / 40,000 x

10,000

=

17,500

Wings

=

70,000 / 40,000 x

6000

=

10,500

Miscellaneous

= 70,000 / 40,000 x

4000

=

7,000

70,000

Q.

3. ABC

limited produces three products O, P

and Q by the operation. Cost accumulated

during

the

operation.

Direct

Material 1000 kg @ Rs 2 =

Rs.

2,000

Direct

Labor

5,000

FOH

8,000

15,000

Output

O

500

Kg

Sold

at split off point for Rs 20

/ kg

P

300

kg

Enters

into a second process

Q

200

kg

Enters

into a second process

Second

process for product P

Cost

incurred: Total

Per

Unit

Direct

Labor cost

Rs.

6,000

Rs.

20

FOH

Rs.

3,000

Rs.

10

Product

P is 100% complete & sold for Rs 70 /

kg

Second

process for product Q

Cost

incurred: Total

Per

Unit

Direct

Labor cost

Rs.

1,400

Rs.

7

FOH

Rs.

600

Rs.

3

Product

Q is 100% complete & sold for Rs 30 /

kg

Solution

Method

# 1

Physical

Quantity Ratio

Process-1

Quantity

Schedule

Units

put in the process 1,000

kg

Completed

units of product "O"

500

kg

Transfer

to further process

Product

"P"

300

Product

"Q"

200

1000

Cost

Accumulated as follow:

Direct

Material

2,000

Direct

Labor

5,000

FOH

8,000

15,000

159

Cost

& Management Accounting

(MGT-402)

VU

Cost

Allocation / Accounting

Treatment

Product

O

=

15,000

x500 / 1000 = 7,500

Product

P

=

15,000

x 300 / 1000 = 4,500

Product

Q

=

15,000

x 200 / 1000 = 7,500

Product

O

No

further process is required

Completed

& Sold

Sold

500 x 20 = 10,000

Cost

500 x 15 = 7,500

Gross

Profit

2,500

Product

P

Cost

Accumulated

Cost

received from Process

1

Rs.

4,500

Direct

Labor

6,000

FOH

3,000

13,500

Unit

Cost = 13,500 / 300 = 45 /

Kg

Transfer

to finished goods = 300 x 45 =

13,500

Sales

300 x 70

=

21,000

Less

Cost 300 x 45

=

13,500

7,500

Product

Q

Cost

Accumulated

Cost

received from Process

1

Rs.

3,000

Direct

Labor

1,400

FOH

600

5,000

Unit

Cost

5,000

/ 200 = 25 / Kg

Transfer

to finished goods = 200 x 25 =

5,000

Sales

200 x 30

=

6,000

Less

Cost 200 x 25

=

5,000

1,000

Method

# 2 Hypothetical market Value

Basis

O

P

Q

Rs

Rs

Rs

Final

Price

20

70

30

Additional

Cost per kg

In

further processing

Direct

Labor

-

20

7

Factory

Overhead

-

10

3

Hypothetical

Market Value

At

split off point

20

40

20

160

Cost

& Management Accounting

(MGT-402)

VU

Cost

Allocation in the

Process-1

Product

O (Finished) 15,000 / 80 x 20

=

3,750

Product

P Transferred to process II 15,000 / 80 x

40

=

7,500

Product

Q Transferred to process II 15,000 / 80 x

20

=

3,750

15,000

Product

P

Process

-II

Quantity

Schedule

Received

From process-I

300

Completed

and transfer out

300

Cost

Accumulated

Cost

received from

process-1

7,500

Cost

added

Direct

Labor

6,000

FOH

3,000

9,000

16,500

Cost

Apportionment / Accounting

Treatment

Cost

transfer to finished

good

Rs

16,500

16,500

/ 300 = 55 per kg

300

x 55 = 16500

Sales

300

x 70

=

21,000

Less

Cost

300

x 55

=

16,500

Gross

Profit

4,500

Product

Q

Process

-II

Quantity

Schedule

Received

From process-I

200

Completed

and transferred out

200

Cost

Accumulated

Cost

received from

process-1

3,750

Cost

added

Direct

Labor

1,400

FOH

600

5,750

Cost

Apportionment / Accounting

Treatment

Cost

transfer to finished

good

Rs

5,750

5750

/ 200 = 28.75 per kg

200

x 28.75 = 5,750

Sales

200 x 30

=

6,000

Less

Cost 300 x 55

=

5,750

250

By

Products

Some

examples of by products are given

below:

161

Cost

& Management Accounting

(MGT-402)

VU

Main

Product

By

Product

Soap

Glycerin

Meat

Hides

& Fats

Flour

Bran

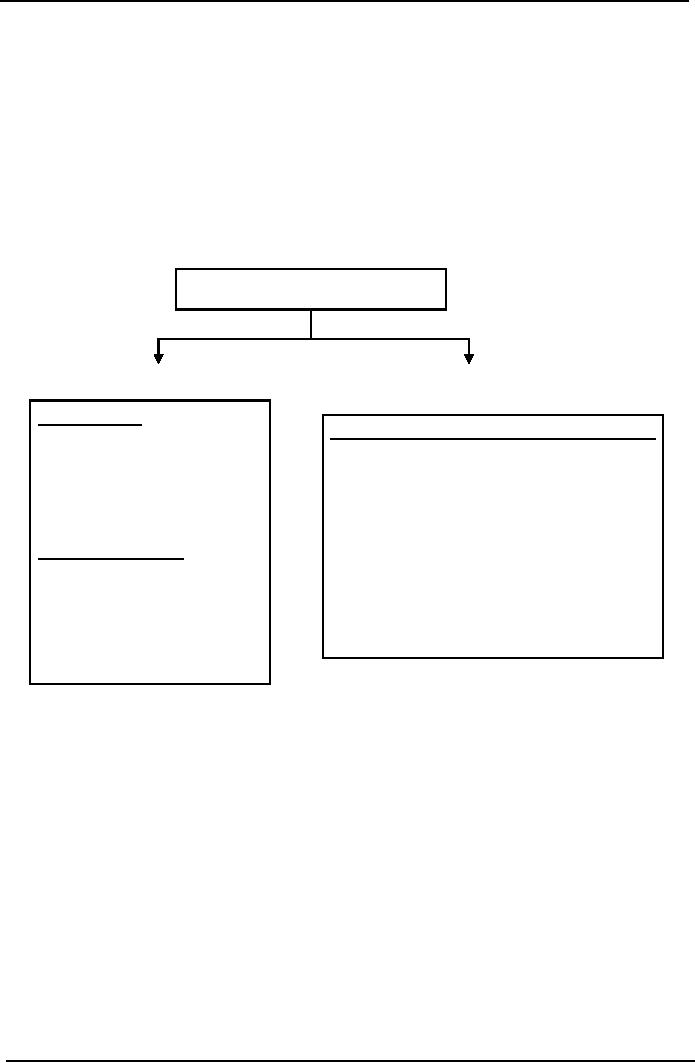

Classification

of by product

By

product can be classified

into two categories:

1.

Requiting no further process,

for example Bran

2.

Requiting further processing,

for example Hides

Accounting

for By Products

Income

Approach

Costing

Approach

Sales

Income

Credit

the cost of main product with

the:

1-

Treat as other income

1-

Replacement cost / Opportunity

2-

Treat as a deduction form

Cost

of By Product

Cost

goods sold

3-

Treat as a deduction form

2-

Predetermined price /

Standard

Cost

goods manufactured

Cost

Realizable

Income

1-

Treat as a deduction form

Cost

goods manufactured

162

Cost

& Management Accounting

(MGT-402)

VU

PRACTICE

QUESTION

Following

is a question on by product:

Main

product

By

product

Opening

stock

-----

-----

Production

during the year

4,000

800

Closing

stock

400

100

Cost

incurred

64,000

-----

Cost

of 3600 units (64,000/4000x3600)

57,600

-----

Sales

price (Per unit)

30

2.50

Further

processing cost

0.50

Solution

Method

# 1

Rupees

Treat

as an other income

Sales

(3600 x 30)

108,000

Less

Cost of goods sold

Opening

stock

----

Production

cost

64,000

Less

Closing stock (16 x 400)

(6,400)

57,600

Gross

Profit

50,400

Add

other income

1,400

51,800

Sales

of By Product

(700

x 2.5)

1,750

Less

Further Processing cost (700

x 0.5)

350

1,400

Method

# 2

Rupees

Treat

as a deduction from cost of

goods sold

Sales

(3600 x 30)

108,000

Less

Cost of goods sold

Opening

stock

----

Production

cost

64,000

Less

Closing stock (16 x 400)

6,400

57,600

Less

Sales value of By Product

(1,400)

56,200

Gross

Profit

51,800

Method

# 3

Rupees

Treat

as a deduction from cost of

goods manufactured

Sales

(3600 x 30)

108,000

Less

Cost of goods sold

Opening

stock

----

Production

cost (64,000

1,400)

62,600

Less

Closing stock (62,600 x 10%)

6,260

56,340

Gross

Profit

56,660

163

Cost

& Management Accounting

(MGT-402)

VU

Realizable

Value Basis

Production

cost on By Product

800

x 2.50 =

2,000

Additional

cost on By Product

800

x 0.50 =

400

Realizable

Value

1,600

Treat

as a deduction from cost of

goods manufactured

Sales

(3600 x 30)

108,000

Less

Cost of goods sold

Opening

stock

----

Production

cost (64,000

1,600)

62,400

Less

Closing stock

(62,400/4,000=15.6

x 400)

6,240

56,160

Gross

Profit

51,840

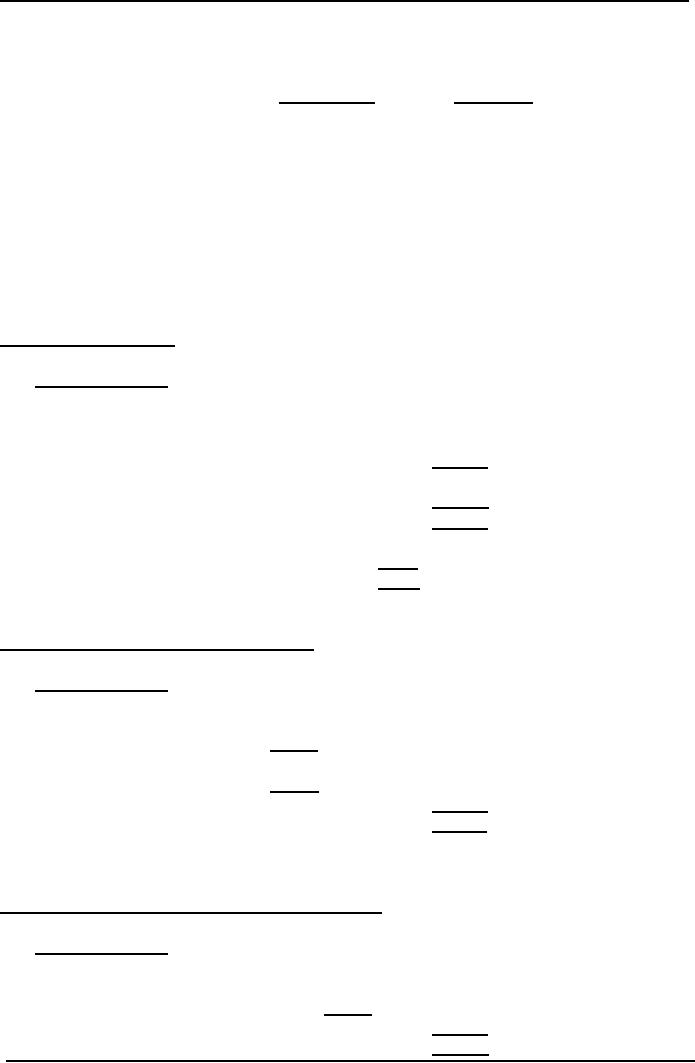

Further

example of by product

Joint

Cost Rs. 206,800

Further

Cost

Sales

Price Market Value

Incurred

per

pound

Grade

1

20,000

lb

1

5

(5-1)

= 4 x 20,000

80,000

Grade

2

40,000

0.2

4

(4-0.2)

= 3.8 x 40,000

152,000

Grade

3

60,000

0.5

3

(3-0.5)

= 2.5 x 60,000

150,000

Grade

4

80,000

0.2

2

(2-0.2)

= 1.8 x 80,000

144,000

Grade

5

50,000

0.1

1

(1-0.1)

= 0.9 x 50,000

45,000

Total

250,000

Multiple

Choice Questions

A

chemical compound is made by

raw material being processed

through two processes.

The

output

of Process A is passed to Process B where

further material is added to the

mix. The details

of

the process costs for

the financial period number 10

were as shown below:

Process

A

Direct

material

2,000

kilograms at Rs5 per kg

Direct

labor

Rs

7,200

Process

plant time 140 hours at

Rs60 per hour

Process

B

Direct

material

1,400

kilograms at Rs12 per kg

Direct

labor

Rs

4,200

Process

plant time 80 hours at

Rs72.50 per hour

The

departmental overhead for Period 10

was Rs 6,840 and is absorbed

into the costs of

each

164

Cost

& Management Accounting

(MGT-402)

VU

process

on direct labor cost.

Process

A

Process

B

Expected

output was

80%

of input

90%

of input

Actual

output was

1,400

kgs

2,620

kgs

Assume

no finished stock at the beginning of the

period and no work-in-progress at either

the

beginning

or the end of the

period.

Normal

loss is contaminated material which is sold as

scrap for Rs0.50 per kg

from Process A and

Rs1.825

per kg from Process B, for

both of which immediate

payment is received.

Q.

1

For

process A what is the scrap

value of the normal

loss?

A

Rs

200

B

Rs

2,000

C

Rs

1,000

D

Rs

0

Q.

2

What

is the abnormal loss for

process A in units?

A

100

B

200

C

300

D

400

Q.

3

What

is the cost per kg for

process A?

A

Rs 18,575

B

Rs 13,454

C

Rs 14.575

D

Rs 16,575

Problem

Question

Q.

1

Kong

CO. manufactures two products, one in

process A, the other in

process B. The

following

information

applies to the processes for

Period.

All

materials are input at the

start of each process, conversion

costs (labor and overhead)

are

incurred

evenly throughout the

process, and losses are

identified at the end of

process A and can

be

sold for 10p per liter.

The dosing work-in-progress is % of

the way through the

process.

Write

up the accounts for process A

and for process B

Process

A

Process

B

Material

input-1

4.000

liters costing

200

kg costing

Rs

3,000

Rs

2,000

Labor

and overhead

Rs

3,440

Rs

3,900

Transfers

to finished goods

13,000

liters

180

kg

Opening

work-in-progress

Nil

Nil

Closing

work-in-progress

Nil

20

kg

Normal

loss as % of input

10%

Nil

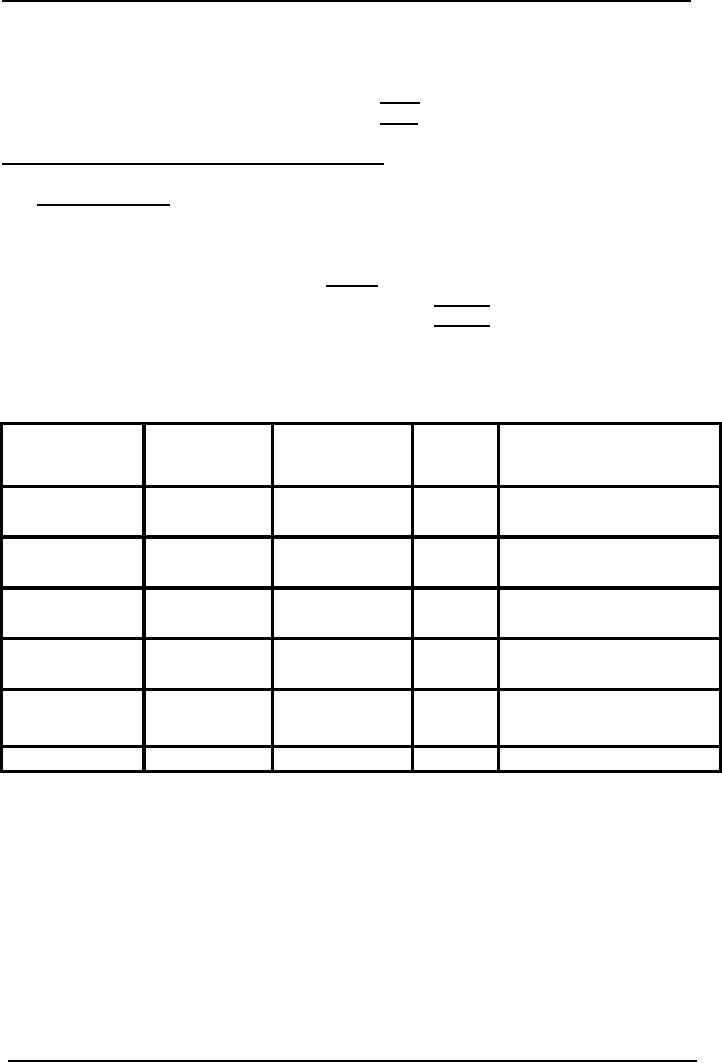

Q.

2

Mineral

Separators Ltd operates a

process which produces four

unrefined minerals known as W,

X.

Y and Z. The joint costs

for operating the process

for Period V were as

below.

Process

overhead is absorbed by adding

25% of the labor cost.

The output for Period V

was as

165

Cost

& Management Accounting

(MGT-402)

VU

shown

below.

There

were no stocks of unrefined

materials at the beginning of Period V,

and no work-in-

progress,

but the stocks shown

below were on hand at the

end of the period, although

there was

no

work-in-progress at that

date.

The

price received per ton of

unrefined mineral sold is shown

below and it is confidently

expected

that

these prices will be

maintained.

You

are required:

(a)

To calculate the cost value of

the closing stock, using sales value as

the basis of your

calculation.

(b)

To calculate the cost value of

dosing stock, using weight of output as

the basis of your

calculation.

166

Table of Contents:

- COST CLASSIFICATION AND COST BEHAVIOR INTRODUCTION:COST CLASSIFICATION,

- IMPORTANT TERMINOLOGIES:Cost Center, Profit Centre, Differential Cost or Incremental cost

- FINANCIAL STATEMENTS:Inventory, Direct Material Consumed, Total Factory Cost

- FINANCIAL STATEMENTS:Adjustment in the Entire Production, Adjustment in the Income Statement

- PROBLEMS IN PREPARATION OF FINANCIAL STATEMENTS:Gross Profit Margin Rate, Net Profit Ratio

- MORE ABOUT PREPARATION OF FINANCIAL STATEMENTS:Conversion Cost

- MATERIAL:Inventory, Perpetual Inventory System, Weighted Average Method (W.Avg)

- CONTROL OVER MATERIAL:Order Level, Maximum Stock Level, Danger Level

- ECONOMIC ORDERING QUANTITY:EOQ Graph, PROBLEMS

- ACCOUNTING FOR LOSSES:Spoiled output, Accounting treatment, Inventory Turnover Ratio

- LABOR:Direct Labor Cost, Mechanical Methods, MAKING PAYMENTS TO EMPLOYEES

- PAYROLL AND INCENTIVES:Systems of Wages, Premium Plans

- PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS

- LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST

- ALLOCATION AND APPORTIONMENT OF FOH COST

- FACTORY OVERHEAD COST:Marketing, Research and development

- FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance

- JOB ORDER COSTING SYSTEM:Direct Materials, Direct Labor, Factory Overhead

- PROCESS COSTING SYSTEM:Data Collection, Cost of Completed Output

- PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule

- PROCESS COSTING SYSTEM:Normal Loss at the End of Process

- PROCESS COSTING SYSTEM:PRACTICE QUESTION

- PROCESS COSTING SYSTEM:Partially-processed units, Equivalent units

- PROCESS COSTING SYSTEM:Weighted average method, Cost of Production Report

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Accounting for joint products

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Problems of common costs

- MARGINAL AND ABSORPTION COSTING:Contribution Margin, Marginal cost per unit

- MARGINAL AND ABSORPTION COSTING:Contribution and profit

- COST – VOLUME – PROFIT ANALYSIS:Contribution Margin Approach & CVP Analysis

- COST – VOLUME – PROFIT ANALYSIS:Target Contribution Margin

- BREAK EVEN ANALYSIS – MARGIN OF SAFETY:Margin of Safety (MOS), Using Budget profit

- BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts

- WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets

- Production & Sales Budget:Rolling budget, Sales budget

- Production & Sales Budget:Illustration 1, Production budget

- FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity

- FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses

- TYPES OF BUDGET:Format of Cash Budget,

- Complex Cash Budget & Flexible Budget:Comparing actual with original budget

- FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting

- DECISION MAKING IN MANAGEMENT ACCOUNTING:Spare capacity costs, Sunk cost

- DECISION MAKING:Size of fund, Income statement

- DECISION MAKING:Avoidable Costs, Non-Relevant Variable Costs, Absorbed Overhead

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS