|

COST OF GOODS SOLD STATEMENT |

| << Opening Stock, Closing Stock |

| DEPRECIATION >> |

Financial

Accounting (Mgt-101)

VU

Lesson-16

COST

OF GOODS SOLD

STATEMENT

In manufacturing

concern, separate books are maintained to

keep the record of every

single work done in

manufacturing

process to ascertain cost incurred on

production of goods. This

record gives

information

about

total cost incurred on manufacturing

process and per unit

cost of goods manufactured.

When goods

are

produced, these are sold to

the customers of the business and

goods unsold are taken into

stock. At the

end of

the financial year, manufacturing concern

prepares a statement which gives the

brief summary of the

whole

process.

This

statement shows the value of

raw material consumed, amount

spent on labour and other

factory

expenses,

finished goods produced and

goods unsold (in stock).

Such statement is called `cost

of goods

sold

statement'. Manufacturing

concerns, while presenting financial

statements, also present

cost of goods

sold

statement.

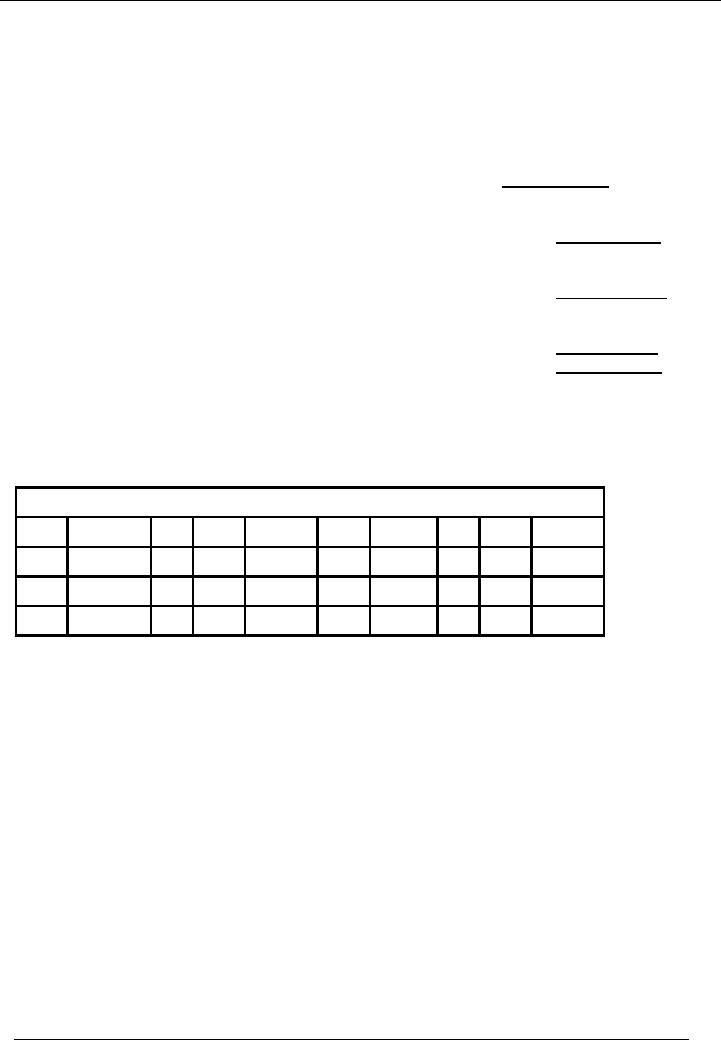

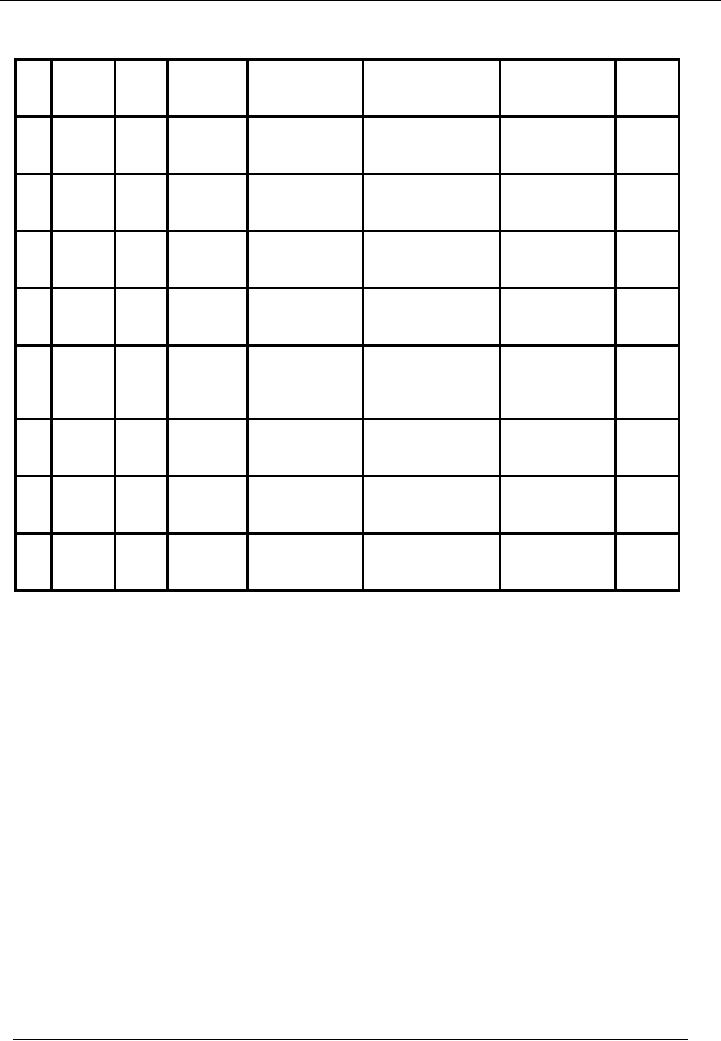

Standard

format of cost of goods sold

statement is given below:

Raw

Material:

O/S

Raw Material

+

Purchases

+ Cost

Incurred to Purchase RM

- C/S

Raw Material

Cost

of Material Consumed

Conversion

Cost:

+

Direct Labour Cost

+

Factory Overheads

Total

Factory Cost

Work

in Process

+ O/S

of WIP

- C/S

of WIP

Cost

of Goods Manufactured

Finished

Goods

+ O/S

of Finished Goods

- C/S

of Finished Goods

Cost

of Good Sold

Cost

of material consumed is the

cost of material used for

consumption that has been

put in the

production

process. This head shows the

raw material left unused

from the previous year(opening

stock),

raw

material purchased in the current year,

expenses incurred in bringing the

purchased material into

the

business

premises and raw material

that is not used in the current

year(closing stock).

Over

Heads are

the other costs incurred in relation of

manufacturing of goods.

Examples

are factory utilities, supervisor

salaries, equipment repairs

etc.

Total

factory cost is the

cost of material consumed

plus labour and over

heads. In other words it is

the

total

cost incurred in the factory.

Cost

of goods manufactured is

total factory cost plus

opening stock of work in

process less closing

stock

of

work in process.

Cost

of goods sold is the

cost of goods manufactured

plus opening stock of

finished goods less

closing

stock

of finished goods.

Prime/Basic

Cost = Cost

of Direct Material Consumed +

Direct Labour cost

121

Financial

Accounting (Mgt-101)

VU

Conversion

cost

it is

the cost incurred to convert

raw material to finished

goods.

Conversion

cost =

Labour cost + factory

overhead

Example

·

Using the

following data calculate the

Cost of Goods Sold of XYZ

Co.

Stock

levels

O/S

Rs.

C/S

Rs.

Raw

material

100,000

85,000

Work

in process

90,000

95,000

Finished

goods

150,000

140,000

Purchase

of raw material during the

period Rs. 200,000

Paid

to labour Rs. 180,000 out of

which Rs. 150,000 used on

production.

Other

production costs Rs.

50,000

Solution

XYZ

Co.

Cost

of Goods Sols

Statement

For

the period ended-------

Raw

Material:

Opening

Stock Raw Material

100000

+

Purchases

200000

+ Cost

Incurred to Purchase RM

0

-

Closing Stock Raw

Material

(85000)

Cost

of Material Consumed

215000

Conversion

Cost

+

Labour Cost

150000

+Factory

overhead

50000

200000

Total

Factory Costs

415000

Work

in process

+ O/S

of WIP

90000

+ C/S

of WIP

(95000)

Cost

of Goods Manufactured

410000

Finished

Goods

+ O/S

of Finished Goods

150000

+ C/S

of Finished Goods

(140000)

Cost

of Goods Sold

420000

ILLUSTRATION

Following

information of Ahmad & Company is

given. Prepare a cost of goods

sold statement.

Stock

levels

O/S

Rs.

C/S

Rs.

Raw

material

150,000

115,000

Work

in process

50,000

55,000

Finished

goods

120,000

100,000

Purchase

of raw material during the

period Rs. 100,000

Transportation

charges of items purchased

Rs. 5,000

122

Financial

Accounting (Mgt-101)

VU

Paid

to labour Rs.

100,000.

Other

production costs(FOH) Rs.

80,000

SOLUTION

Raw

Material:

Opening

Stock Raw Material

150,000

+

Purchases

100,000

+ Cost

Incurred to Purchase RM

5,000

-

Closing Stock Raw

Material

(115,000)

Cost

of Material Consumed

140,000

Conversion

Cost:

+

Labour

100,000

+

Factory Overheads

80,000

Total

Factory Cost

320,000

Work

in Process:

+ O/S

of WIP

50,000

- C/S

of WIP

(55,000)

Cost

of Goods Manufactured

315,000

Finished

Goods:

+ O/S

of Finished Goods

120,000

- C/S

of Finished Goods

(100,000)

Cost

of Good Sold

335,000

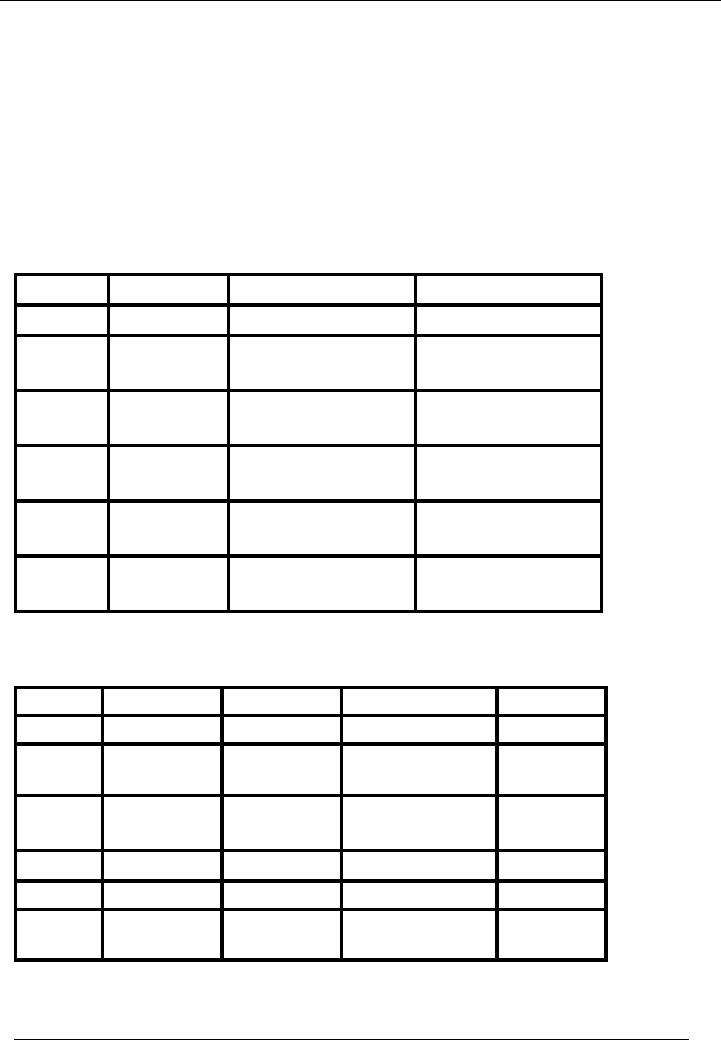

STOCK

CARD

Stock

card is used to keep the

record of what has come in

stock and what has gone

out of it. Standard

format

of stock card is given below:

Stock

Account Item 01

Date

Receipts

Qty

Rate

Amount

Date

Issues

Qty

Rate

Amount

Stock

card has two

parts.

· Receipt

side

· Issue

side

Both

sides have similar columns

that include:

· Nature

of item to be kept in stock

· Quantity

of items

· Rate

at which it was

purchased

· Total

value of items

Receipt

side is used to record data

of items coming in the stock

and issue side is used to

record information

of

goods issued for manufacturing

process.

VALUATION

OF STOCK

Any

manufacturing organization purchases different

material through out the

year. The prices of

purchases

may be

different due to inflationary

conditions of the economy. The question

is, what item should be issued

first

& what item should be issued later

for manufacturing. For this purpose, the

organization has to make a

123

Financial

Accounting (Mgt-101)

VU

policy

for issue of stock. All the

issues for manufacturing and

valuation of stock are

recorded according to

the

policy of the organization. Mostly these

three methods are used

for the valuation of

stock:

· First in

first out (FIFO)

· Last

in first out (LIFO)

· Weighted

average

FIRST

IN FIRST OUT

(FIFO)

The

FIFO method is based on the assumption

that the first merchandise

purchased is the first

merchandised

issued.

The FIFO uses actual

purchase cost. Thus, if

merchandise has been

purchased at several

different

costs,

the inventory (stock) will

have several different cost

prices. The cost of goods

sold for a given

sales

transaction

may involve several

different cost

prices.

CHARACTERISTICS

·

This

is widely used method for determining

values of cost of goods sold

and closing stock.

·

In the

FIFO method, oldest available

purchase costs are

transferred to cost of goods

sold. That

means

the cost if goods sold has a

lower value and the

profitability of the organization

becomes

higher.

·

As the current

stock is valued at recent

most prices, the current assets of the

company have the

latest

assessed values.

LAST

IN FIRST OUT

(LIFO)

As the

name suggests, the LIFO method is

based on the assumption that the

recently purchased

merchandise

is issued first. The LIFO

uses actual purchase cost.

Thus, if merchandise has

been purchased at

several

different costs, the inventory

(stock) will have several

different cost prices. The

cost of goods sold

for

a given

sales transaction may

involve several different

cost prices.

CHARACTERISTICS

·

This is

alternatively used method for determining

values of cost of goods sold

and closing stock.

·

In the

LIFO method recent available

purchase costs are

transferred to cost of goods

sold. That

means

the cost of goods sold has a

higher value and the profitability of the

organization becomes

lower.

·

As the current

stock is valued at oldest

prices, the current assets of the company

have the oldest

assessed

values.

WEIGHTED

AVERAGE METHOD

When

weighted average method is in use, the

average cost of all units in

inventory, is computed after every

purchase.

This average cost is computed by

dividing the total cost of

goods available for sale by

the number

of units in

inventory. Under the average

cost assumption, all items

in inventory are assigned the

same per

unit

cost. Hence, it does not

matter which units are sold;

the cost of goods sold is

always based on current

average

unit cost.

CHARACTERISTICS

·

Under

the average cost assumption,

all items in inventory are

assigned same per unit

cost (the

average

cost). Hence it does not

matter which units are sold

first. The cost of goods

sold is always

on the current

average unit cost.

124

Financial

Accounting (Mgt-101)

VU

·

Since

all inventories are assigned

same cost, this method does

not make any effect on

the

profitability

and does not

increase/decrease any asset in the

financial statements.

· This

is the alternatively used method for determining

values of cost of goods sold

and closing stock.

Example

· Receipts:

01 Jan

20--,

10 units @

Rs. 150 per

unit

02 Jan

20--,

15 units @

Rs. 200 per

unit

10 Jan

20--,

20 units @

Rs. 210 per

unit

· Issues:

05 Jan

20--,

05

units

06 Jan

20--,

10

units

15 Jan

20--,

15

FIFO

Method of Stock

Valuation

Date

Receipts

Issues

Value

of Stock

01-01-20--

10 @

Rs. 150

10 x

150 = 1500 1500

02-01-20--

15 @

Rs. 200

10 x

150 = 1500

15 x

200 = 3000 4500

05-01-20--

5 @

150 = 750

750

5 x

150 = 750

15 x

200 = 3000 3750

06-01-20--

5 @

150 = 750

0 x

150 =

0

5 @

200 = 1000 1750

10 x

200 = 2000 2000

10-01-20--

20 @

Rs. 210

10 x

200 = 2000

20 x

210 = 4200 6200

15-01-20--

10 @

200 = 2000

0 x

200 =

0

5 @

210 = 1050 3050

15 x

210 = 3150 3150

Weighted

Average Method of Stock

Valuation

Date

Receipts

Issues

Value

of Stock

Average

Cost

01-01-20--

10x150

= 1500

1500

1500/10=150

02-01-20--

15x200

= 3000

1500 +

3000 = 4500

4500/25=180

05-01-20--

5x180

= 900

4500

900 = 3600

3600/20=180

06-01-20--

10x180

= 1800

3600

1800 = 1800

1800/10=180

10-01-20--

20x210

= 4200

1800 +

4200 = 6000

6000/30=200

15-01-20--

15x200

= 3000

6000

3000 = 3000

3000/15=200

Effects

of Valuation Method on Profit

FIFO

Method

125

Financial

Accounting (Mgt-101)

VU

·

Cost

of Sales

= 750

+ 1750 + 3050 =

5,550

Gross

Profit

= 7500

5550

=

1,950

Weighted

Average Method

· Cost

of Sales

= 900

+ 1800 + 3000 =

5,700

Gross

Profit

= 7500

5700

=

1,300

ILLUSTRATION

Hamid

& company is a manufacturing concern.

Following is the receipts & issues

record for the month

of

May,

2002

Date

Receipts

Issues

May

7

200

units @ Rs. 50/unit

May

9

60

units

May

13

150

units @ Rs. 75/unit

May

18

100

units @ Rs. 60/unit

May

22

150

units

May

24

100

units

May

27

100

units @ Rs. 50/unit

May

30

200

units

Calculate

the value of closing stock

by

· FIFO

Method

· Average

Method

126

Financial

Accounting (Mgt-101)

VU

SOLUTION

Valuation

of stock by FIFO method

Date

Receipts

Issues

Value

of Stock

Total

Remaining Net

Amount

No. of

Balance

units

May

7

200

units @ Rs.

200 x

50 = 10,000

10,000

200

10,000

50/unit

May

9

60

units

@

Rs.

60 x 50 =

3,000

(3,000)

140

7,000

50/unit

May

13

150

units @ Rs.

75 x

150 = 11,250

11,250

290

18,250

75/unit

May

18

100

units @ Rs.

60 x

100 = 6,000

6,000

390

24,250

60/unit

May

22

140

units @ Rs.

50 x

140 = 7,000

(7,750)

240

16,500

50/unit

10 units

@ Rs.

10 x 75 =

750

75/unit

May

24

100

units @ Rs.

75 x

100 =7,500

(7,500)

140

9,000

75/unit

May

27

100

units @ Rs.

50 x

100 = 5,000

5,000

240

14,000

50/unit

May

30

40 units

@ Rs.

75 x 40 =

3,000

(12,000)

40

2,000

75/unit

100

units @ Rs.

60 x

100 = 6,000

60/unit

60 units

@ Rs.

50 x 60 =

3,000

50/unit

127

Financial

Accounting (Mgt-101)

VU

Valuation

of stock by weighted average

method:

Date

Receipts Issues

Value

of

Total

Total

Units

Average

Net

Stock

Amount(Rs.)

Cost(Rs.)/unit

Balance(

Rs.)

May

200 units

200 x

50

10,000

200

50

10,000

7 @

Rs.

=

50/unit

10,000

May

60 units 60 x

50

(3,000)

140

7,000

9

=

3,000

May

150 units

150 x

75

7,000+11250

140+150

18250/290

18,250

13

@

Rs.

=

=

=

=

75/unit

11,250

18250

290

62.9

May

100 units

100 x

60

18250+6000

290+100

24250/390

24,250

18

@

Rs.

=

=

=

=

60/unit

6,000

24250

390

62.2

May

150

150 x

62.2

(9,330)

390-150

14,920

22

units

=

=

9330

240

May

100

100 x

62.2

(6,220)

240-100

8,700

24

units

=

=

6220

140

May

100 units

100 x

50

8,700+5,000

140+100

13700/240

13,700

27

@

Rs.

=

=

=

=

50/unit

5,000

13,700

240

57.1

May

200

200 x

57.1

(11,420)

240-200

2,280

30

units

=

=

11,420

40

LIFO

METHOD WILL BE DISCUSSED AT SOME LATER

STAGE

128

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES