|

CAPITAL WORK IN PROGRESS 1 |

| << GROUPINGS OF FIXED ASSETS |

| CAPITAL WORK IN PROGRESS 2 >> |

Financial

Accounting (Mgt-101)

VU

Lesson-19

CAPITAL

WORK IN PROGRESS

If an

asset is not completed at

that time when balance sheet

is prepared, all costs incurred on

that asset up to

the

balance sheet date are

transferred to an account called

Capital

Work in Progress Account.

This

account

is shown separately in the balance

sheet below the fixed asset.

Capital work in progress

account

contains

all expenses incurred on the asset

until it is converted into working

condition. All these

expenses

will

become part of the cost of

that asset. When an asset is

completed and it is ready to

work, all costs in

the

capital

work in progress account

will transfer to the relevant asset

account through the following

entry:

Debit:

Relevant

asset account

Credit:

Capital

work in progress

account

ILLUSTRATION

# 1

A

machine is purchased for Rs.

400,000. Its useful life is

estimated to be five years.

Its residual value is

Rs.

25,000.

After four years, it was

sold for Rs. 40,000.

For the purpose of WDV, its

depreciation rate is 40%.

You

are required to show calculation of depreciation

for four years. Also

calculate profit or loss on

disposal.

SOLUTION

Calculation of

depreciation and profit & loss on the

basis of straight line method:

Depreciation/year

= (400,000 25,000)/5 = 75,000

(Straight line method)

As,

machine was sold after four

years but its useful

life was estimated for

five years, when we

calculate

depreciation of the

asset under straight line method, we will

divide its WDV over

five years, not on

four

years.

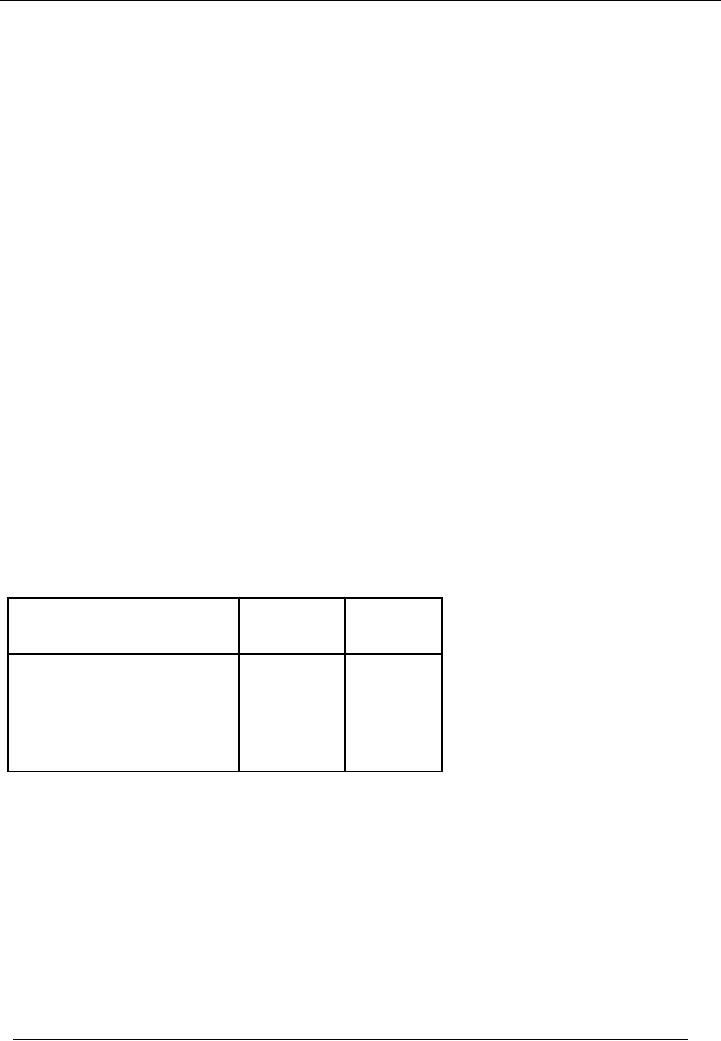

Particulars

Depreciation

Written

(Rs)

Down

Value

(Rs.)

375,000

Depreciable

cost

Dep.

Of the 1st year

(75,000)

300,000

Dep.

Of the 2nd year

(75,000)

225,000

(75,000)

150,000

Dep.

Of the 3rd year

Dep.

Of the 4th year

(75,000)

75,000

Book

value after four

years

Rs.

75,000

Sale

price

Rs.

40,000

Profit/(loss)

on sale

Rs.

(35,000) i-e.(40,000

75,000)

140

Financial

Accounting (Mgt-101)

VU

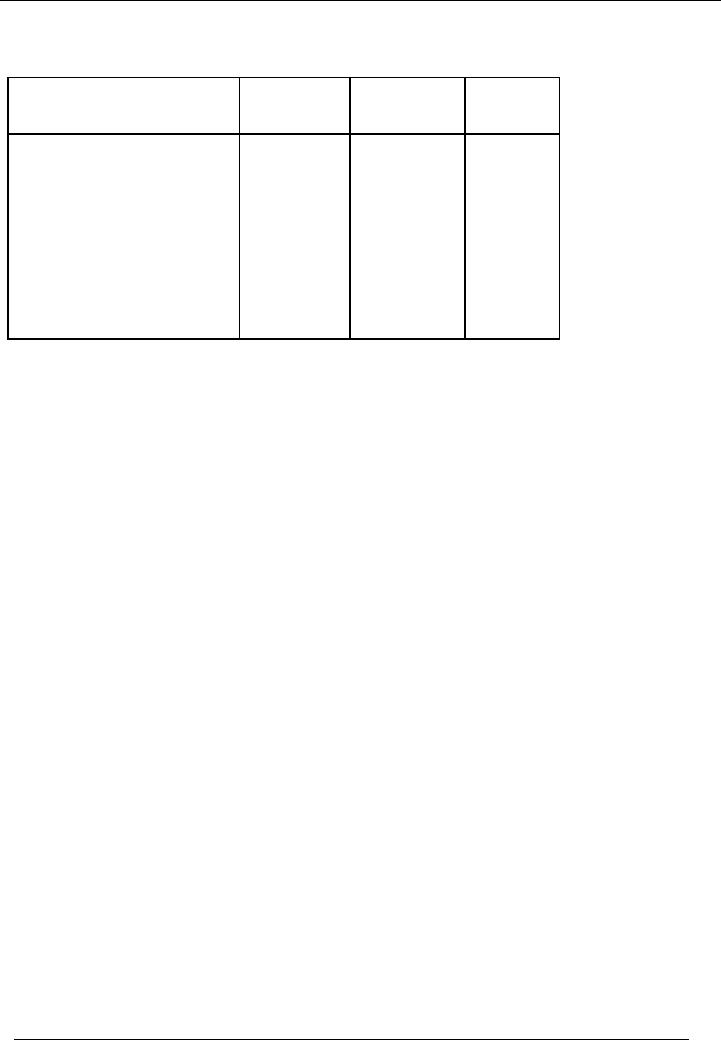

Calculation of

depreciation and profit & loss on the

basis of reducing balance

method:

Depreciation

rate = 40%

Particulars

Depreciation

Accumulated

Written

(Rs)

Depreciation

Down

(Rs.)

Value

(Rs.)

Depreciable

cost

400,000

Dep.

Of the 1st year

400,000

x 40%

160,000

160,000

240,000

Dep.

Of the 2nd year

96,000

256,000

144,000

240,000

x 40%

Dep.

Of the 3rd year

144,000

x 40%

57,600

313,600

86,400

Dep.

Of the 4th year

86,400

x 40%

34,560

348,160

51,840

Book

value after four

years

Rs.

51,840

Sale

price

Rs.

40,000

Profit/(loss)

on sale

Rs.

(11,840) i-e.(40,000

51,840)

ILLUSTRATION

# 2

Following

information of machinery account is

available in Year 2004:

· Machine

# 1 is purchased on September 1, 2000

for Rs. 100,000

· Machine

# 2 is purchased on January 31,

2002 for Rs.

200,000

· Machine

# 3 is purchased on July 1, 2003

for Rs. 50,000

· Machine

# 1 is disposed on March 31,

2004

Depreciation

is charged @ 25% reducing balance method.

Financial year is closed on June 30

every year.

Show

the calculation of depreciation on machinery for

four years using the

following policies:

· Depreciation

is charged on the basis of

use

· Full

depreciation is charged in the year of

purchase and no depreciation is charged

in the year of

disposal.

141

Financial

Accounting (Mgt-101)

VU

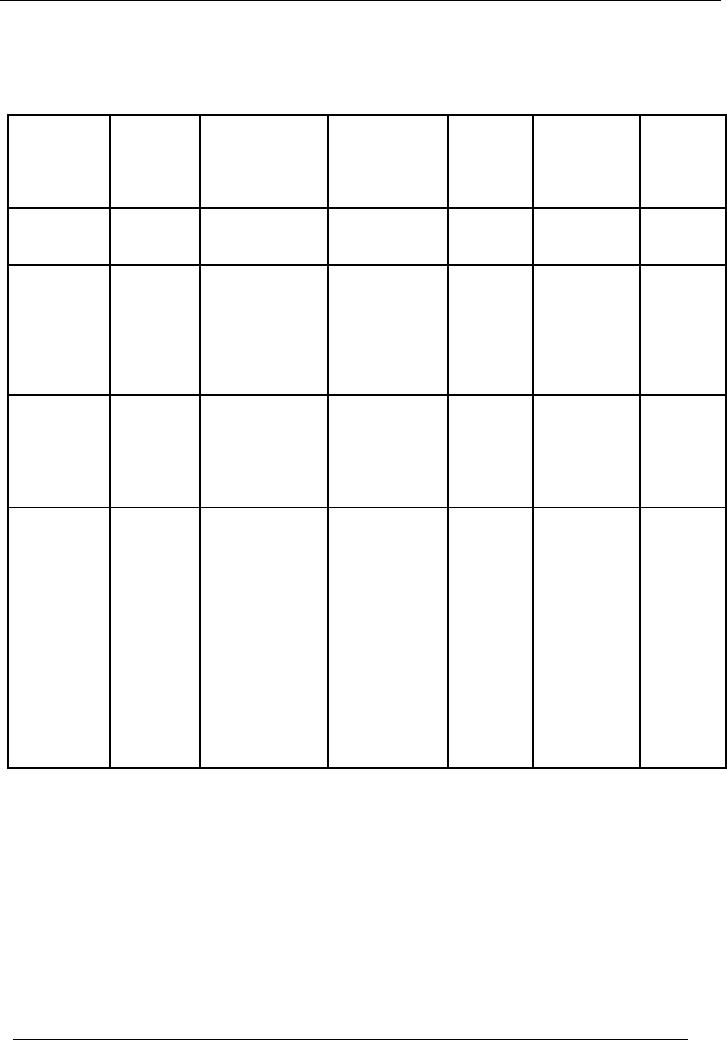

SOLUTION

Depreciation

on the basis of

use

Date

Purchase

Depreciation

Accumulated

Total

Written

Total

of

(Rs.)

depreciation

Accum.

Down

Value

Written

machine

(Rs.)

Dep.

(Rs.)

Down

(Rs.)

Value

(Rs.)

01-09-2000

100,000

Machine # 1

Machine

# 1

20,833

Machine

# 1

79,167

100,000

x 25%

20,833

79,167

x10/12=20,833

2001-2002

Machine

# 1

Machine

# 1

61,458

Machine

# 1

238,542

79,167x25%

40,625

59,375

= 19,792

31-01-2002

200,000

Machine # 2

Machine

# 2

Machine

# 2

200,000x25%x5/

20,833

179,167

12=20,833

2002-2003

Machine

# 1

Machine

# 1

121,094

Machine

# 1

178,906

59,375x25%

55,469

44,531

= 14,844

Machine

# 2

Machine

# 2

Machine

# 2

179,167x25%

65,625

134,375

=44,792

2003-2004

Machine

# 1

Machine

# 1

175,538

Machine

# 1

138,281

44,531x25%x

63,819

(36,181)

9/12=

8,350

(sold)

Machine

# 2

Machine

# 2

Machine

# 2

134,375x25%

99,219

100,781

= 33,594

01-07-2003

50,000

Machine # 3

Machine

# 3

Machine

# 3

50,000x25%

12,500

37,500

= 12,500

Figure in blue

color is the written down

value of machine # 1, which is

disposed of by the management.

142

Financial

Accounting (Mgt-101)

VU

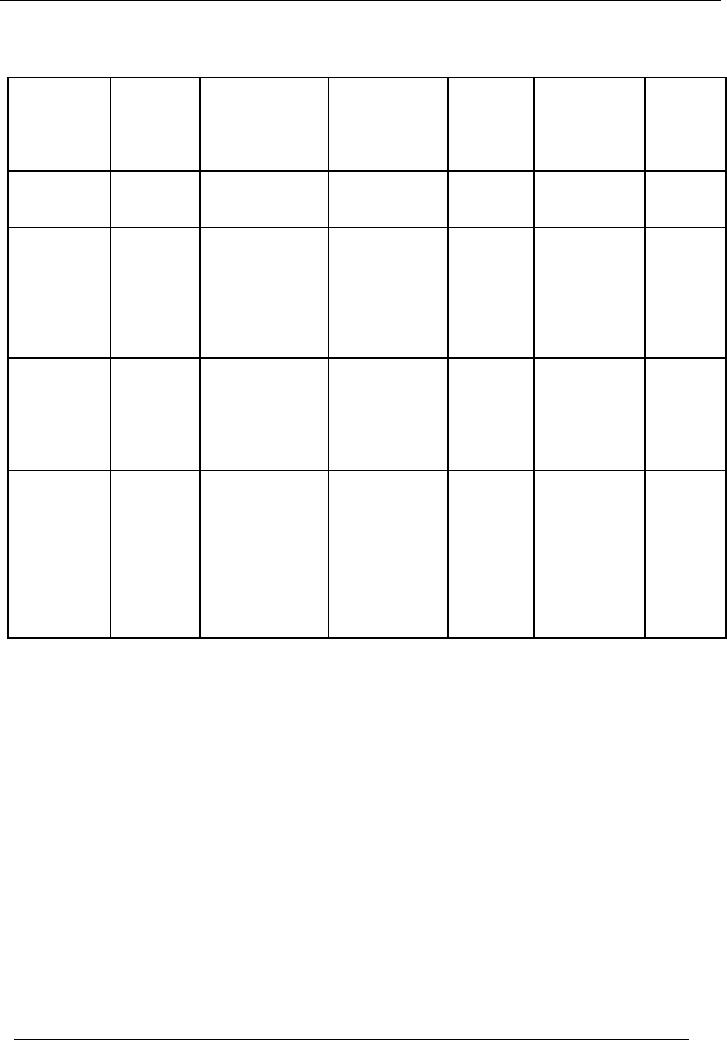

Full

year depreciation in the

year of purchase and no depreciation in

the year of sale:

Date

Purchase

Depreciation

Accumulated

Total

Written

Total

of

(Rs.)

depreciation

Accum.

Down

Value

Written

machine

(Rs.)

Dep.

(Rs.)

Down

(Rs.)

Value

(Rs.)

01-09-2000

100,000

Machine # 1

Machine

# 1

25,000

Machine

# 1

75,000

100,000

x 25%

25,000

75,000

=25,000

2001-2002

Machine

# 1

Machine

# 1

93,750

Machine

# 1

206,250

75,000x25%

43,750

56,250

= 18,750

31-01-2002

200,000

Machine # 2

Machine

# 2

Machine

# 2

200,000x25%

50,000

150,000

=50,000

2002-2003

Machine

# 1

Machine

# 1

145,313

Machine

# 1

154,687

56,250x25%

57,813

42,187

= 14,063

Machine

# 2

Machine

# 2

Machine

# 2

112,500

150,000x25%

87,500

=37,500

Machine

# 1 185,935

2003-2004

Machine

# 1

Machine

# 1

121,875

57,813

0

42,187

Machine

sold

(sold)

(sold)

Machine

# 2

Machine

# 2

Machine

# 2

112,500x25%

115,625

84,375

= 28,125

50,000

Machine # 3

Machine

# 3

01-07-2003

Machine

# 3

50,000x25%

12,500

37,500

= 12,500

143

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES