|

Financial

Management MGT201

VU

Lesson

08

CAPITAL

BUDGETING AND CAPITAL BUDGETING

TECHNIQUES

Learning

Objective:

After

going through this lecture,

you would be able to have an

understanding of the following

concepts.

·

Capital

Budgeting

·

Techniques

of Capital Budgeting

Today,

we will discuss Capital

Budgeting--one of the most important

topics in financial

management.

Capital

budgeting is about investment in

fixed assets. In addition, another

type of investment

could

be

in working capital, which we

would study later. Fixed

assets are the part of

long-term assets in

the

balance

sheet and working capital is

net position of current assets

and current liabilities on the

balance

sheet.

We

need to understand why capital

budgeting is so important and why do we

have to invest in fixed

assets?

The answer is simple; the

equipment or machinery and

other fixed assets depreciate

over a

period,

they lose their productivity

and get obsolete after sometime.

These assets need to be

replaced

with

new assets. This replacement

involves investment in fixed

assets.

Moreover,

if a company intends to start a new

project, Capital Budgeting techniques

are employed

to

assess the financial viability of the

project. Suppose, for

instance, a company wants to introduce

a

new

soap and launching of the new

product demands changes in the

manufacturing process, the

company

will have to purchase new

equipment in the form of fixed

assets. Capital budgeting is

a

technique

used to evaluate the value of

investment and projects in fixed

assets. It is also used to

assess

the

working capital requirements. Combined

together it helps the company management

to decide

whether

the new venture should be

taken up or not.

Capital

budgeting is a decentralized function. In

big corporations, this

function is not an

individual's

job,

rather, different departments and

teams are assigned to work

on different aspects of

capital

budgeting.

Department managers prepare the budget

for fixed assets in coming

years, which is quite

helpful

in capital budgeting. Besides, there

are project managers who

make the budget for a new

project;

the

cost accountants `count the

cost' and assess the

expenses to be incurred; the market

researches

provide

their input about the

consumer psychology and

sales potential. There may be as

many

departments

involved in capital budgeting, as there

are present in an

organization.

The

biggest challenge in capital

budgeting is to keep finding the valuable

projects, i.e., projects that

may

add to the value of the firm. You

must be familiar with the

basic objective of financial

management

by

now, which is to maximize shareholders'

wealth. This is possible only by

investing in the projects,

which

have positive net present value,

which in effect will

increase the shareholders' wealth.

Most

of the developed companies operate in an

efficient market environment. We

will discuss

efficient

markets at length after

studying the concept of risk

akin to financial decisions. However,

to

give

you an idea, efficient

markets can

be described as highly competitive

markets where good

business

ideas are taken up

immediately.

For

instance, in Pakistan, about ten to

fifteen years ago there was

a video game craze. It was

initially

a

good business idea, as it

required a very low-level

investment, good profit margins, and

short payback

periods.

However, since the markets

in Pakistan are quite efficient, the

information about the

business

spread

quickly. More and more

people started entering into

the business and as a result, the

profit

margins

started shrinking and the lucrative

business opportunity faded

out in three or four

years.

The

same situation comes across

the departmental heads of different

companies. They may start

a

new

lucrative project, which may

sound more than feasible at a

given time. However, the

competitors

get

to know the new business

opportunity, and because of market

efficiency, those lucrative

profits do

not

remain lucrative

anymore.

39

Financial

Management MGT201

VU

Techniques

of capital budgeting:

Capital

budgeting is a mathematical concept in the

sense that we have to use

different

quantitative

investments criteria to evaluate whether

an opportunity is worth investing in or

not.

Some

of these techniques of capital budgeting

are as under

1.

Pay back period

2.

Return on investment

(ROI)

3.

Net Present Value

(NPV)

4.

Profitability Index

(PI)

5.

Internal Rate of Return

(IRR)

We

will assume that the interest rate, or

the discount rate, or the required of

return, which we use

in

calculating

the net present value is given,

later on, when we will

discuss the concept of risk, we

would

see

how the discount rate is calculated

.

For

now, let us talk about the

pay back period.

Pay

back period:

In

this technique, we try to

figure out how long it

would take to recover the invested

capital

through

positive cash flows of the

business.

Reverting

back to the cafe example, an initial

investment of Rs. 200,000 is

required to start the

business;

Rs 10,000 per month are expected to be

earned for the first year,

and Rs 20,000 would

be

earned

every month in the second

year.

Now

according to the aforementioned

assumptions, in the first year,

you earn Rs.10, 000

per

month,

which make Rs. 120,000 for

the year (twelve months). Since you had

invested Rs. 200,000

initially

of which Rs. 120,000 have

been recovered in the first year,

you are still Rs.80,

000 short of

recovering

your initial investment. In the

second year, you would be

earning Rs. 20,000 per

month, so

the

remaining Rs. 80,000 can be

recovered in the next four months. We can

say that the initial

invested

capital

can be recovered in 16 months, or the payback

period for this investment

is 16 months. The

shorter

the payback period of a project, the more

an investor would be willing to

invest his money in

the

project.

While

the payback period is a simple and

straightforward method for analyzing a

capital

budgeting

proposal, it has certain

limitations. First and the foremost

problem is that it does not

take into

account

the concept of time value of

money. The cash flows

are considered regardless of the time

in

which

they are occurring. You must

have noticed that we have not

used any interest rate while

making

calculation.

Now,

let us talk about the next

budgeting criteria called

return on investment.

Return

on Investments:

The

concept of return on investment

loosely defined, as there are a number of

ratios that can be

used

to analyze return on investment. However,

in capital budgeting it implies the

annual average cash

flow

a business is making as a percentage of

investment. In other words, it is an

average percentage of

investment

recovered in cash every

year.

The

formula for return on

investment is as follows:

ROI=

(∑CF/n)/IO

Dividing

the average annual cash flow

by the initial investment, we can

calculate the return on

investment.

Example:

Taking

the same example of a café, the

initial investment of Rs.200,000, Rs

10,000 per month

profit

in the 1st year in Rs 20,000 per month

profit for the second year,

we can easily calculate the

ROI.

40

Financial

Management MGT201

VU

ROI=

((120,000+240,000)/2)/200,000= 0.90 =

90%

Where,

Rs 120,000=cash flow for 1st year

at Rs 10,000 per month

Rs

240,000=cash flow for the 2nd year at Rs 20,000 per

month.

n=2

years

Return

on Investment is also very

easy to calculate, but like

payback period, it does not

take into

account

the time value of money

concept.

A

high ROI ratio is considered

better and 90% is a very

good rate of return but

before

deciding

whether or not this project

should be taken up, we

should compare this project

with the

alternative

opportunities on hand. It is also

important to take into

consideration the prevailing rate

of

inflation

in the country so that the returns could

be adjusted accordingly. However, we

would talk about

the

inflation rate and market interest rate

in more detail later.

The

next and the most important

criteria for evaluating a

capital budgeting proposal is net

present value.

Net

Present Value

(NPV):

NPV

is a mathematical tool which uses the

discounting process, something that we

have found

missing

in the aforementioned capital budgeting

techniques. Net Present Value is

defined as the value

today

of the Future

Incremental After-tax Net Cash Flows

less

the initial investment.

The

formula for calculating NPV

is as follows:

NPV=-IO+∑CFt/

(1+i) t

Where,CFt=cash flows occurring in

different time

periods

-IO=

Initial cash outflow

i=discount

/interest rate

t=year

in which the cash flow takes

place

Initial

cash outflow, being an

outflow, is always expressed as a

negative figure.

NPV

is considered one of the most popular

capital budgeting criteria.

The disadvantage with the

NPV

is that it is difficult to calculate

since these calculations are

based on too many

estimates.

In

order to calculate the NPV we need to

forecast the future cash

flows and sales; the discount

factor is

also

an estimate. If the NPV of a project is

more than zero, it should be

accepted. If two or more projects

under

contemplation, then the one with the

higher NPV, should be

accepted. When a company invests

in

projects

with positive NPV, they

raise the shareholders' wealth or

company's value. This would

also

increase

the market value added and the economic

value added for the

firm.

Example:

Taking

the same example of a café, an

initial investment of Rs.200, 000, Rs

10,000 per month

profit

in the 1st year in Rs 20,000 per month

profit for the second year.

However, for the calculation

of

the

NPV we would be requiring another

important input--the discount rate.

Assume the discount rate is

10

percent. Ten percent is what you at

least expect to earn from the

business. This is the rate of

return,

which

you can get by simply

putting your money with a

bank. If the business cannot yield more

than 10

percent,

then it is pointless to take unnecessary

headache of setting up a business and

running it, since

ten

percent can be earned with a

no-sweat-effort of placing the money

with a bank.

Where,CFt=cash flows occurring in

different time periods, i.e., Rs

120,000 in the first year and

Rs

240,000

in the second year

-IO=

Initial cash outflow =

-200,000

i=discount

/interest rate = 10 percent

t=

2 years

Putting

in the values in the formula

41

Financial

Management MGT201

VU

NPV=-IO+∑CF/i

=-200,000+120,000/(1+0.10)+240,000(1+0.10)2

=

- 200,000 +

109,091

+

198,347

=+Rs.107438

At

the end of 2nd year, the NPV is +ve,

you can also solve

this example by

monthly

compounding

if you want to have a more precise

answer.

The

cash flows at the end of the first

year and second year will

have to be brought back to the

present.

The

present value of the cash

flows occurring at the end of the first

year can be calculated by

dividing

the

cash flows by 1 plus

discount factor as

under.

120000/(1+0.10)

= 109,091

The

cash flow occurring at the end of the

second year can be calculated by

dividing the cash

flow

by one plus discount factor

squared.

240,000/1+(0.10)2 =

198,347

NPV=-2000000+120000/(1+0.10)+240000/(1+0.10)2

=-200000+109091+198347

=+Rs.107438

at the end of second year

NPVis +ve

In

other words, according to your

cash flow forecast and

required return, two years

of running this

business

is worth Rs 107,438 in cash to

you today. The following

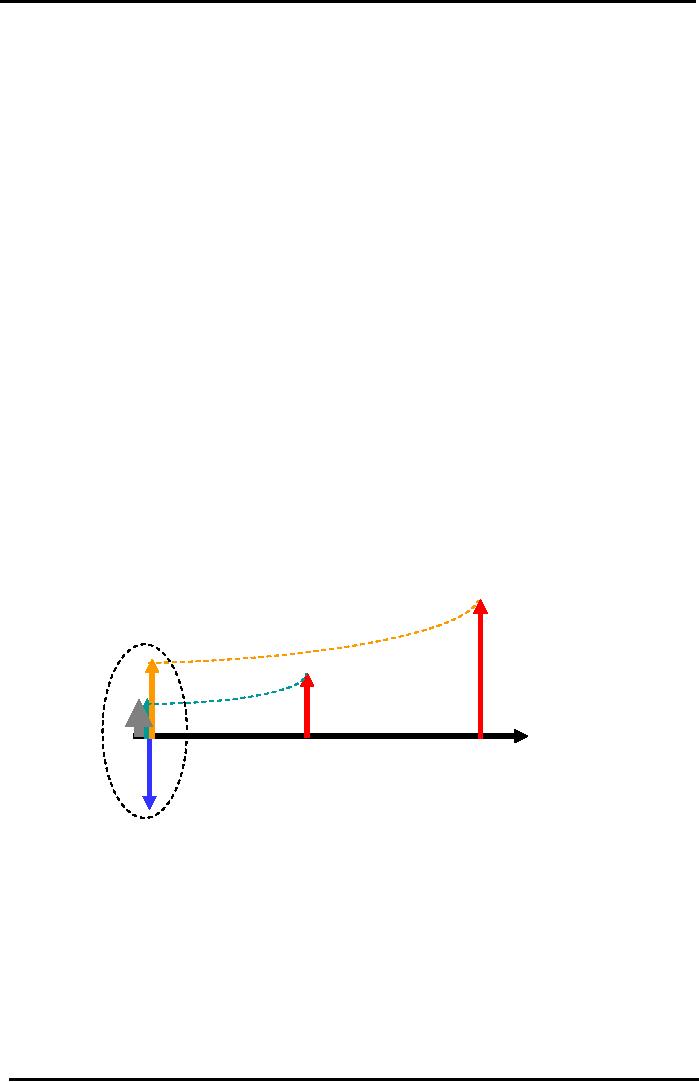

diagram can explain the

point further.

Investment

Criteria

N.P.V

(Café Example Cash Flow

Diagram)

CF2

= Rs

240,000

Rs

198,347

CF1=Rs

120,000

Rs

109,091

NPV

= Rs

107,438

i

= 10%

i

= 10%

Yr

0 (Today)

Yr

1

Yr

2

Io

= Rs

200,000

The

next criterion that we would

talk about here is the

profitability index, or the cost-benefit

ratio.

Probability

Index:

It

is quite similar to the NPV in

terms of concept and calculation.

Profitability index

may

be defined as the ratio of the present

value of future cash flows

to the initial investment.

The

profitability index can be

calculated using the following

formula.

PI

= [Σ

CFt /

(1+ i) t

]/

IO

42

Financial

Management MGT201

VU

Those

projects with a profitability index

ratio of more than one (PI

>= 1.0) are considered

acceptable.

Here it is important to mention

that those projects, which

are ranked as acceptable

using the

NPV

method, would also be

acceptable on the profitability index

criteria.

Example:

The

profitability index for the

café example can be

calculated as under.

PI

= [120,000]/ (1+ 0.1) +

[240,000 / (1+ 0.1)2]/200,000

=

(109,091 + 198,347) / 200,000 = 1.

54

PI

= 1.54 > 1.0

Therefore,

the project is acceptable. Notice

that we have taken into

consideration the annualized

return.

The same can be calculated

using the monthly returns with a

slight adjustment in the formula

as

we

have studied in the previous lectures. If there were

two or more projects that need

ranking, the one

with

the highest profitability index

would be acceptable.

Let

us now talk about the fifth

and the final capital budgeting

criteria of our course,

known as Internal

Rate

of Return (IRR).

Internal

Rate of Return (IRR):

IRR

is a widely used and an

important measure, which is more common

in practice than the

NPV.

IRR, unlike NPV that is

expressed in dollar amounts, is

always quoted in terms of

percentage,

which

makes it comparable to the other market

interest rates or the inflation

rate.

RR

calculation involves the same

equation that we have earlier

used for the calculation of

NPV.

The

only difference is that

while calculating IRR we

would set the value of NPV

equal to zero and

then

solve

the equation for the value if

`i'. In other words, the value of

`i', at which the net present

value of

the

project equals zero would be

considered as the internal rate of return of the

project.

his

is important to remember that

unlike NPV calculation, the

value of IRR is constant in

every

year

for the life of the project.

While working out the NPV,

we can change the discount

rate for every

single,

but for IRR you

would come up with a rate

that is constant and fixed

for every single year in

the

life

of the project. Another simplistic

explanation of IRR can be

that it is the break-even rate of

return.

In

other words, at this rate of return, we

would be able to recover the initial

investment in project's

lifetime.

RR

is calculated by a trial and error method

or iteration. Finding the value of an

unknown

variable

may involve solving of

higher degree polynomial equations and

the easiest way to go about it

is

to

use trial and error

method.

n

a trial-and-error method, we tryout a

value of `i', and see if the

equation comes to the value

of

zero;

if it does not, try another

value, even if the second value

does not bring the equation

down to zero

and

so on. The higher the IRR,

the better it is considered, however,

which value of the IRR can

be

considered

as acceptable is difficult to measure. We

would discuss more details of it in the

coming

lectures.

Another

important distinction needs to

clarification here is that the

internal rate of return is

different

from the discounting rate that we

use in the calculation of the NPV. In the

NPV formula, we

used

the discount rate as the required rate of

return that we expected the project to

generate. In case of

IRR,

we used the existing cash

flows to find the forecasted

return. These two different

interpretations of

`i'

should be kept in mind while

calculating NPV and

IRR.

We

can calculate the IRR for the

café project in the following manner.

Using the same formula of

NPV,

we

can put the values in the

formula

IRR

Equation:

NPV=

-IO +CF1/

(1+IRR) + CF2/

(1+IRR) 2

=

0= -200,000 + 120,000/ (1+0.1) +

240,000/ (1+0.1)2

Solving

the equation assuming IRR to be 10

percent, we have obtained a figure of

107,483, which was

calculated

as our NPV for the café

project. However, in order to

bring the NPV down to zero,

we need

43

Financial

Management MGT201

VU

to

apply a higher rate as an

assumed IRR. If we assume

IRR to be 50 percent the equation can be

solved

as

follows.

NPV=

-IO +CF1/

(1+IRR) + CF2/

(1+IRR) 2

=

0= -200,000 + 120,000/(1+0.5) +

240,000/(1+0.5)2

The

calculation gives us a figure of

-13,333, which is lesser

than zero. In order to bring

the value equal

to

zero we would use a rate

lesser than 50 percent.

Trying

out various IRR rates, we

can finally reach a rate of

43.6 percent at which the value

of

NPV

would come down to -48

which is close to zero. If we

try out IRR with more

decimal places, we

can

bring the value of NPV equal

to zero. However, with approximation,

43.6 percent is the actual IRR

of

the project.

Send

you query to

registrar.

More

details about the IRR and the

NPV would be discussed in the

next chapter.

44

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios