|

Introduction

To Public

AdministrationMGT111

VU

LESSON

31

AUDIT

At the

end of lecture the students

will be able to:

-

Understand

the concept of audit and

audit in government

-

Understand

the concept of Performance

Audit

-

Understand

Audit as control tool

Audit

is a specialized area of financial

management and control.

Their instruments of control

are

governments

rules, regulations and

procedures which must

adhered to when making financial

transactions.

Definitions

of Audit

Following

are some of the definitions of

audit:

It

is an examination and verification of a

company's financial and accounting

records and

supporting

documents by a professional,

It

is a formal examination of an organization's accounts

or financial situation. An audit may

also

include

examination of compliance with applicable

award terms, laws,

regulations and policies

after

transactions

are made.

It

is the examination of some or all of the

following items: documents,

records, reports, systems

of

internal

control, accounting procedures,

and other evidence, for

one or more of the

following

purposes:

An

examination and verification of a

company's financial and accounting

records and

supporting

documents

by a professional

A

formal examination of an organization's individual

accounts or financial situation. An audit

may

also

include examination of compliance with

applicable award terms,

laws, regulations and

policies.

The

examination of some or all of the

following items: documents,

records, reports, systems

of

internal

control, accounting procedures,

and other evidence, for

one or more of the

following

purposes:

(a) determining the propriety, legality,

and mathematical accuracy of

proposed or

consummated

transactions; (b) ascertaining whether

all transactions have been

recorded; and (c)

determining

whether transactions are accurately

reflected in the accounts and in the

statements

drawn

there from in accordance

with accepted accounting

principles.

Article

169 of the Constitution gives the

functions of the Auditor General, who

heads the Audit &

Accounts

organization of Government of Pakistan. This

organization, under the Audit & Accounts

Order

1973

ensures that the public

money is spent and

transactions are made in

accordance with the financial

rules.

The

accounts of federation and of provinces

will be kept according to the principles

and methods

given

by the Audit & Accounts Order and

rules and procedures. All

the accounts will have to be

submitted

to

the President in the case of federation

and to the Governors in case of the

Provinces who will put

before

the

respective assemblies.

Use

of Public Money

Public

money is the money from tax

and non tax revenue and

borrowed money. This money

has to

be

spent according to the laid

down procedures (Drawing and

disbursing Handbook). The

fundamental

principle

of spending public money is to

spend public money in a

manner as one would spend

ones own

money.

Definition

of Performance Audit and Value

for Money

While

audit is like a "post

mortem", after the event or financial transaction

has taken place it

verifies

whether rules were adhered

to. In performance audit the

whole working of the organization

is

analyzed.

111

Introduction

To Public

AdministrationMGT111

VU

Performance

audits are value for

money audit and the use of

resources by public

sector

organizations

in relation to its achievement of

goals. Although performance

audit can be very wide-ranging,

in

broad terms, it can be applied

to:

-

Those

activities involving a considerable level of

resources

-

Projects

that are at risk of failing in

their objectives

-

Issues

which are of concern to Parliament or the

Public Accounts Committee, (Public

Accounts

Committee is a committee of parliament which reviews

the accounts of all

government

organization every year).

The

term "value for money"

refers to the way in which

resources (financial, human or

physical)

have

been allocated and utilized

by the entity (organization).

Following

definition has been used

for performance audit:

"A

performance audit "is an objective

and systematic examination of a

public

sector organization's programme,

activity, function or

management

systems

and procedures to provide an

assessment of whether the entity,

in

the

pursuit of predetermined goals, has

achieved economy, efficiency

and

effectiveness

in the utilization of its

resources".

Performance

audit, therefore, involves an independent assessment

of whether economy, efficiency

and

effectiveness have been

achieved by organization. Now let us

see each of the word used in

definition to

have

better understanding of performance audit.

Economy

Economy

is concerned with minimizing the

cost of resources used (staff,

materials and equipment)

for

an activity in the pursuit of its

objectives and whether they are in

accordance with sound

administrative

principles

and practices and management

policies. An economical organization

acquires its input

resources,

of

the appropriate quality and quantity, at

the lowest cost. In summary,

economy means minimizing the

cost

of

resources used for an

activity, having regard to quality

i.e. spending economically, whilst

maintaining

quality.

Example:

Where standard items such as

school or hospital supplies of a given

quality are purchased at

the

best

possible price.

Example:

Cost of a vehicle in comparison with

another model of similar quality.

Efficiency

Efficiency

is concerned with the relationship

between goods and services

produced (the outputs)

and

the resources used to produce them (the

inputs). An efficient entity produces the

maximum output

from

any given set of inputs. Alternatively,

it may require minimum input. This

will be reflected in

increased

productivity

and lower unit costs. In

summary, efficiency means ensuring

that maximum output of

goods

and

services has been gained

from the resources used in

their production i.e.

spending well.

Example:

Efficiency has improved when

the unit cost of teaching

children or providing hospital

treatment

has

been reduced over time; or

where more children have

been taught or hospital beds

provided,

without

additional resources.

Example:

Reduction in repairs and maintenance

cost of equipment, for example,

vehicles, computers or

photocopiers,

is a measure of efficiency

Effectiveness

Effectiveness

is concerned with achieving predetermined

objectives (specific planned

achievements)

or goals and with actual

impact (the output achieved)

compared with the intended

impact

(the

objectives). Using a range of performance

measures and indicators, it is possible

to assess an entity's

effectiveness.

In summary, effectiveness means

ensuring that the desired

results, objectives, targets

or

policies

have been successfully

achieved i.e. spending

wisely.

112

Introduction

To Public

AdministrationMGT111

VU

Example:

Where there has been an

improvement in school examination results

or where sickness rates

have

fallen

as a result of medical

care.

Example:

Whether the purchased item or service

provided was "fit for

purpose".

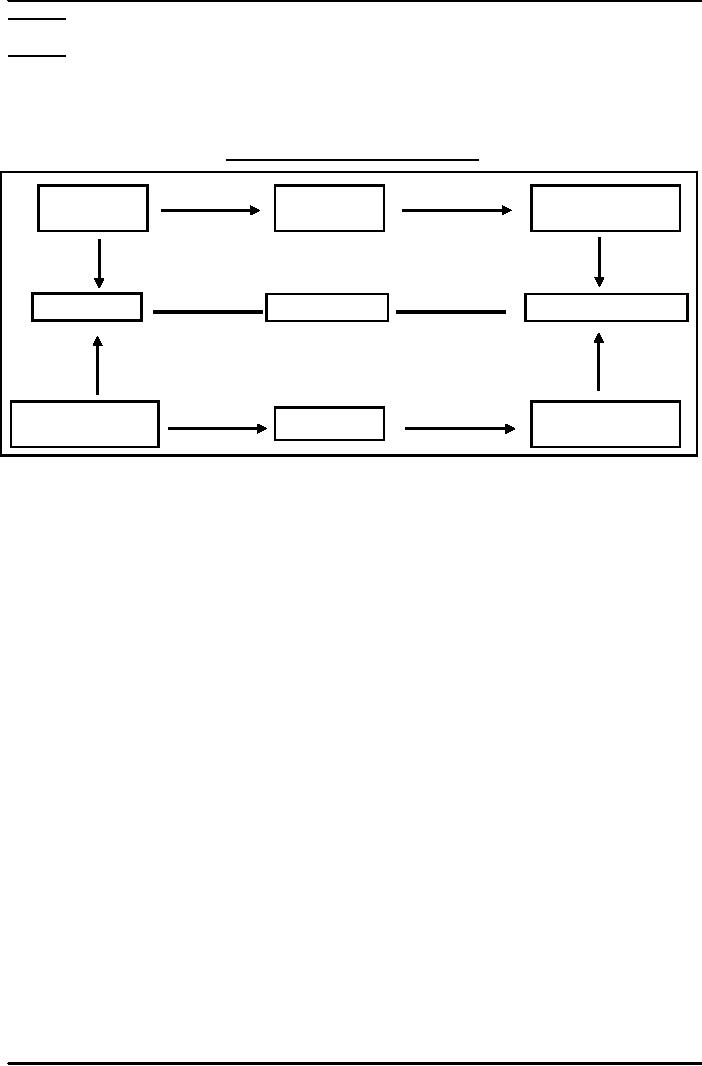

The

following model presented in Figure 1,

illustrates the relationships between inputs,

processes

and

outputs and between economy, efficiency

and effectiveness:

Figure

1

Economy,

Efficiency and

Effectiveness

Planned

Planned

Planned

Inputs

Inputs

Inputs

(Policy

Objectives)

Economy

Efficiency

Effectiveness

Actual

Inputs

Actual

Outputs

Process

(Resources

Used)

(Output

Achieved)

The

figure 1 illustrates that

economy is related to plan inputs

and actual input use

which is

processed

and it is what the actual outputs are. So

there should be economy in use of

resources, these

resources

should be efficiently processed and

should also be able to achieve/realize outputs,

which will

show

effectiveness in use of

resources.

In

practice, the boundaries between

economy, efficiency and effectiveness

are seldom clear-cut.

Examinations

of Value For Money (VFM),

therefore, normally pursue these

various aspects of

performance

simultaneously

as part of the same

exercise.

Objectives

of Performance Audit

The

primary objective of performance audit is to

provide parliament with independent

information,

assurance

and opinion about economy,

efficiency and effectiveness in major fields of

revenue, expenditure

and

the management of resources.

A

secondary objective of performance audit

is to identify ways of improving

value for money

and

to

encourage and assist audit

bodies to take the necessary action to

improve systems and controls.

Areas of

Performance

Audit are that Performance

reviews can be used to cover

all types of management

activities,

which

must be audited for better use of

resources.

Concepts

Audit:

it

is the examination of financial records of an organization

after

transactions

have taken place at the end

of financial year. It

reviews

whether the rules of accounts were

applied or not.

Performance

audit:

it

is the examination and analysis of all

the activities of the

organization

and it is seen that the

money used has been

able to

achieve

objectives/goals economically, efficiently and

effectively.

113

Table of Contents:

- INTRODUCTION:Institutions of State, Individualism

- EVOLUTION OF PUBLIC ADMINISTRATION:Classical School, The Shovelling Experiment

- CLASSICAL SCHOOL OF THOUGHTS – I:Theory of Bureaucracy, Human Relation Approach

- CLASSICAL SCHOOL OF THOUGHTS – II:Contributors of This Approach

- HUMAN RELATIONS SCHOOLS:Behavioural School, System Schools

- POWER AND POLITICS:Conflict- as Positive and Negative, Reactions of Managers, Three Dimensional Typology

- HISTORY OF PUBLIC ADMINISTRATION – I:Moghul Period, British Period

- HISTORY OF PUBLIC ADMINISTRATION – II

- CIVIL SERVICE:What are the Functions Performed by the Government?

- CIVIL SERVICE REFORMS:Implementation of the Reforms, Categories of the Civil Service

- 1973 CONSTITUTION OF PAKISTAN:The Republic of Pakistan, Definition of the State

- STRUCTURE OF GOVERNMENT:Rules of Business, Conclusion

- PUBLIC AND PRIVATE ADMINISTRATION:The Public Interest, Ambiguity, Less Efficient

- ORGANIZATION:Formal Organizations, Departmentalization

- DEPARTMENTALIZATION:Departmentalization by Enterprise Function, Departments by Product

- POWER AND AUTHORITY:Nature of Relationship, Delegation of Functional Authority

- DELEGATION OF AUTHORITY:The Art of Delegation, Coordination

- PLANNING – I:Four Major Aspects of Planning, Types of Plans

- PLANNING – II:Planning ProcessThree principles of plans

- PLANNING COMMISSION AND PLANNING DEVELOPMENT:Functions, Approval Authority

- DECISION MAKING:Theories on Decision Making, Steps in Rational Decision Making

- HUMAN RESOURCE MANAGEMENT (HRM):Importance of Human Resource, Recruitment

- SELECTION PROCESS AND TRAINING:Levels at Which Selection takes Place, Training and Development

- PERFORMANCE APPRAISAL:Formal Appraisals, Informal Appraisals

- SELECTION AND TRAINING AND PUBLIC ORGANIZATIONS:Performance Evaluation,

- PUBLIC FINANCE:Background, Components of Public Finance, Dissimilarities

- BUDGET:Components of Public Income, Use of Taxes, Types of Taxation

- PUBLIC BUDGET:Incremental Budget, Annual Budget Statement, Budget Preparation

- NATIONAL FINANCE COMMISSION:Fiscal Federalism Defined, Multiple Criteria

- ADMINISTRATIVE CONTROL:Types of Accountability, Internal Control, External Control

- AUDIT:Economy, Effectiveness, Objectives of Performance Audit, Concepts

- MOTIVATION:Assumptions about Motivation, Early ViewsThree Needs

- MOTIVATION AND LEADERSHIP:Reinforcement Theory, Leadership, The Trait Approach

- LEADERSHIP:Contingency Approaches, Personal Characteristics of Employees

- TEAM – I:Formal & Informal teams, Functions of Informal Groups, Characteristics of Teams

- TEAM – II:Team Cohesiveness, Four ways to Cohesiveness, Communication

- COMMUNICATION – I:Types of Communication, How to Improve Communication

- COMMUNICATION – II:Factors in Organizational Communication, Negotiating To Manage Conflicts

- DISTRICT ADMINISTRATION:The British Period, After Independence, The Issues

- DEVOLUTION PLAN – I:Country Information, Tiers or Level of Government

- DEVOLUTION PLAN – II:Aim of Devolution Plan, Administrative Reforms, Separation of powers

- POLITICAL REFORMS:District, Tehsil, Functions of Union Council, Fiscal Reforms

- NEW PUBLIC MANAGEMENT (NPM):Strategy, Beginning of Management Approach

- MANAGERIAL PROGRAMME AGENDA – I

- MANAGERIAL PROGRAMME AGENDA – II:Theoretical Bases of Management, Critique on Management