|

Money

& Banking MGT411

VU

Lesson

37

WHY

DO WE CARE ABOUT MONETARY

AGGREGATES?

Every

country with high inflation

has high money growth;

thus to avoid sustained

episodes of

high

inflation, a central bank

must be concerned with money

growth.

It

is impossible to have high, sustained

inflation without monetary

accommodation.

Monetary

Aggregates

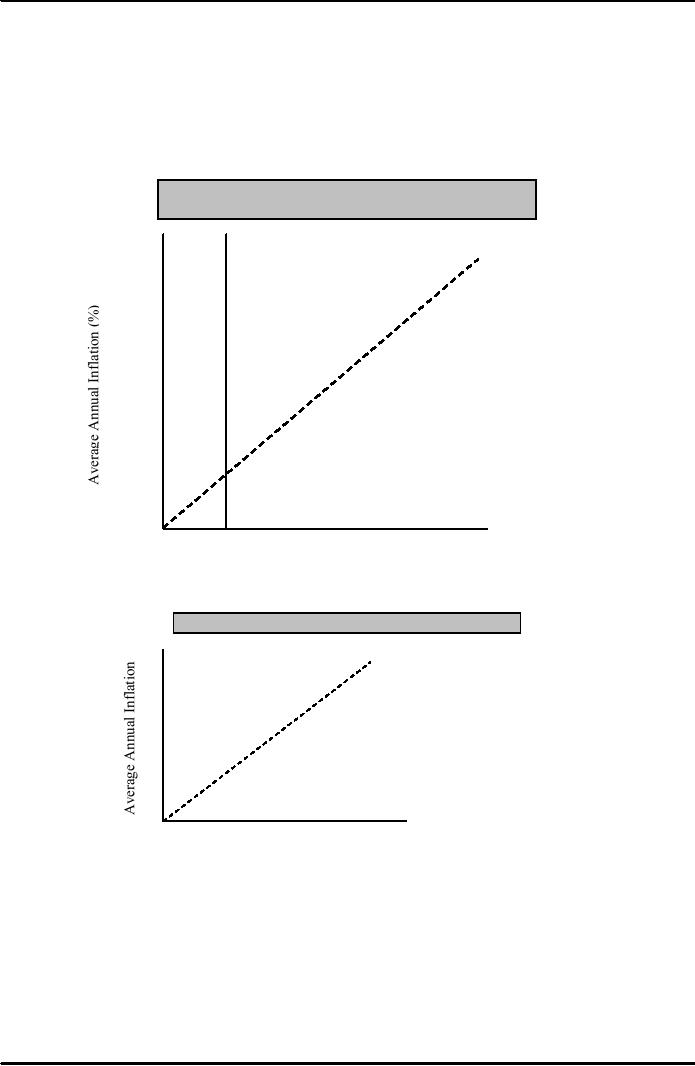

Figure:

Inflation and Money

Growth:

Moderate-Inflation

Countries, 1981-2003

50

45° Line

·

40

·

·

·

30

·

·

·

·

20

·

·

·

·

·

·

·

·

·

·

··

10

·

·

·

·

0

10

20

30

40

50

Average

Annual Money Growth

(%)

Figure:

Money, Growth and

Inflation

45° Line

Inflation>Money

Growth

Money

Growth <Inflation

Average

Annual Money Growth

When

the currency that people are

holding loses value much

rapidly, they will work to

spend

what

they have as quickly as possible

This

will have the same effect on

inflation as an increase in money

growth

It

is impossible to have high, sustained

inflation without monetary

accommodation.

Something

beyond just differences in

money growth accounts for

the differences in inflation

across

countries.

116

Money

& Banking MGT411

VU

Velocity

and the Equation of

Exchange

To

understand the relationship between inflation and

money growth we need to focus on

money

as

a means of payment.

Consider

an example of four

students

Ali

has Rs. 100 in

cash

Bilal

has a Rs. 100

calculator

Chohan

has 2 tickets worth Rs. 50

each for a cricket

match

Dilawer

has a set of 25 drawing

pencils worth Rs. 4

each

Ali

needs a calculator which he buys

from Bilal.

Bilal

wishes to see the match so he buys the

tickets from Chohan

Chohan

uses the proceeds to purchase the

drawing pencils from

Dilawer

Total

Value of the transactions is

(Rs.

100 x 1 calculator) + (Rs. 50 x 2

tickets) + (Rs. 4 x 25 pencils) =

Rs. 300

Generally

No.

of Rupees x No. of time each

Re is used = Rs. Value of

Transactions

The

number of times each rupee is used (per

unit of time) in making

payments is called

the

velocity

of money; the more frequently each

rupee is used, the higher the

velocity of money

Applying

to economy wide transactions:

Quantity

of Money x Velocity of Money =

Nominal GDP

Using

data on the quantity of money

and nominal GDP we can

compute the velocity of money;

each

monetary aggregate has its

own velocity

If

we represent

Money

with M

Velocity

with V

Price

level with P

Real

GDP with Y

Nominal

GDP = P x Y

Substituting,

we get

MxV=PxY

The

equation of exchange, MV=PY provides the

link between money and prices if we

rewrite it

in

terms of percentage

changes

The

Quantity Theory and the

Velocity of Money

MV

=

PY

or

%

ΔM

+

% ΔV =

% ΔP +

% ΔY

Money

Growth + Velocity Growth =

Inflation + Output

Growth

In

the early 20th century,

Irving Fisher wrote down the

equation of exchange and derived

the

implication

that

Money

growth + velocity growth =

inflation + real

growth

Assuming

No

important changes occur in payment

methods or the cost of holding

money,

Real

output is determined solely by economic

resources and production

technology,

Then

changes in the aggregate price

level are caused solely by

changes in the quantity of

money.

In

other words

Assume

that %ΔV = 0 and

%ΔY =

0.

Doubling

the quantity of money doubles the price

level.

Inflation

is a monetary phenomenon (Milton

Friedman).

117

Money

& Banking MGT411

VU

In

our example of four

students, number of rupees needed equaled

total rupee value of

the

transaction

divided by no. of times each rupee

was used

Money

demand = Total value of

transaction

Velocity

of Money

For

the economy as a whole,

Money

demand = Nominal GDP

Velocity

Md =

1/V x PY

Money

Supply (Ms)

is determined by central bank

and the behavior of the banking

system

Equilibrium

means Md =

Ms = M

Rearranging

the Money demand function

gives MV = PY

The

quantity theory of money

tells us why high inflation

and high money growth go

together,

and

explains why countries can have

money growth that is higher

than inflation (because

they

are

experiencing real

growth).

The

Facts about Velocity

Fisher's

logic led Milton Friedman to

conclude that central banks

should simply set

money

growth

at a constant rate.

Policymakers

should strive to ensure that

the monetary aggregates grow at a rate

equal to the

rate

of real growth plus the desired

level of inflation.

118

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY