|

WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets |

| << BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts |

| Production & Sales Budget:Rolling budget, Sales budget >> |

Cost

& Management Accounting

(MGT-402)

VU

LESSON-33

WHAT

IS A BUDGET?

A budget is a

plan expressed in quantitative,

usually monetary terms, covering a

specific period of

time,

usually one year. In other

words, a budget is a systematic plan

for the utilization

of

manpower

and material resources. In a business

organization a budget represents an

estimate of

future

costs and revenues. Budgets

may be divided into two

basic classes; Capital

Budgets and

Operating

Budgets, Capital budgets are

directed towards proposed expenditures

for new projects

and

often require special financing

(this topic is discussed in

the next Unit). The

operating budgets

are

directed towards achieving short-term operational

goals of the organization,

for instance,

production

or profit goals in a business

firm. Operating budgets may

be sub-divided into various

departmental

or functional budgets. The

main characteristics of a budget

are:

It

is prepared in advance and is derived

from the long, term

strategy of the

organization.

It

relates to future period for

which objectives or goals have

already been laid

down.

It

is expressed in quantitative form,

physical or monetary units, or

both.

Different

types of budgets are

prepared for different

purposes e.g. Sales. Budget,

Production

Budget.

Administrative Expense Budget, Raw

material Budget, etc. All these

sectional budgets are

afterwards

integrated into a master budget- which

represents an overall plan of

the organization. A

budget

helps us in the following

ways:

1.

It brings about efficiency and

improvement in the working of

the organization.

2.

It is a way of communicating the plans to

various units of the organization. By

establishing

the

divisional, departmental, sectional

budgets, exact responsibilities

are assigned. It thus

minimizes

the possibilities of buck-passing if

the budget figures are not

met.

3.

It is a way or motivating managers to

achieve the goals set

for the units.

4.

It serves as a benchmark for

controlling on going. Operations.

5.

It helps in developing a team spirit

where participation in budgeting is

encouraged.

6.

It helps in reducing wastage's and

losses by revealing them in time

for corrective action.

7.

It serves as a basis for evaluating

the performance of

managers.

8.

It serves as a means of educating

the managers.

Budgetary

control

No

system .of planning can be

successful without having an

effective and efficient

system of

control.

Budgeting is closely connected with control.

The exercise of control in

the organization

with

the help of budgets is known

as budgetary control. The process of

budgetary control includes

(i)

preparation of various budgets (ii)

continuous comparison of actual

performance with budgetary

performance

and (iii) revision of

budgets in the light of

changed circumstances.

A

system of budgetary control should

not become rigid. There

should be enough scope

for

flexibility

to provide for individual

initiative and drive. Budgetary

control is an important device

for

making

the organization more

efficient on all fronts. It is an

important tool for

controlling costs

and

achieving the overall objectives.

Installing

a budgetary control system

Having

understood the meaning and

significance of budgetary control in an

organization, it will be

useful

for you to know how a

budgetary control system can be installed

in the organization.

This

requires,

first of all, finding

answers to the following

questions in the context of an

organization:

201

Cost

& Management Accounting

(MGT-402)

VU

What

is likely to happen?

What

can be made to

happen?

What

are the objectives to be

achieved?

What

are the constraints and to

what extent their effects

can be minimized?

Having

found answers to the above

questions, the following

steps may be taken for

installing an

effective

system of budgetary control in an

organization.

Organization

for budgeting

The

setting up of a definite plan of

organization is the first

step towards installing budgetary

control

system in an organization. A Budget

Manual should, be prepared

giving details of the

powers,

duties, responsibilities and

areas of operation of each executive in

the organization.

Responsibility

for budgeting

The

responsibility for preparation and

implementation of the budgets

may be fixed as

under:

Budget

controller

Although

the Chief Executive is

finally responsible for the

budget programme, it is better if a

large

part

of the supervisory responsibility is

delegated to an official designated as

Budget Controller or

Budget

Director. Such a person should

have knowledge of the technical details

of the business and

should

report directly to the

President or the Chief

Executive of the

organization.

Budget

committee

The

Budget Controller is assisted 'in his

work by the Budget Committee. The

Committee may

consist

of Heads of various departments, viz.,

Production, Sales. Finance Personnel,

Purchase, etc.

with

the Budget Controller as its Chairman. It is generally

the responsibility of the.

Budget

Committee

to submit discusses and

finally approves the budget figures. Each

head of the

department

should have his own Sub-committee

with executives working

under him as its

members.

Fixation

of the Budget Period

Budget

period' means the period for

which a budget is prepared and employed.

The budget period

depends

upon the nature of the

business and the control

techniques. For example, a

seasonal

industry

will budget for each season,

while an industry requiring

long periods to complete

work

will

budget for four, five or

even larger number, of

years. However, it is necessary

for control

purposes

to prepare budgets both for

long as well as short

periods.

Budget

procedures

Having

established the budget organization

and fixed the budget period,

the actual work or

budgetary

control can be taken upon

the following

pattern:

Key

factor

It

is also termed as limiting factor.

The extent of influence of

this factor must first be

assessed in

order

to ensure that the budget

targets are met It would be

desirable to prepare first

the budget

relating

to this particular factor,

and then prepare the

other budgets. We are giving

below an

illustrative

list of key factors in certain

industries.

202

Cost

& Management Accounting

(MGT-402)

VU

Industry

Key

factor

Motor

Car

Sales

demand

Aluminum

Power

Petroleum

Refinery

Supply

of crude oil

Electro-optics

Skilled

technicians

Hydral

Power generation

Monsoon

The

key factors should be

correctly identified and

examined. The key factors

need not be a

permanent

nature. In the long run,

the management may overcome

the key factors by

introducing

new

products, by changing material mix or by

working overtime or extra shifts

etc.

Making

a Forecast

A

forecast is an estimate of the

future financial conditions or operating

results. Any estimation is

based

on consideration of probabilities. An estimate differs

from a budget in that the

latter

embodies

an operating plan or an organization. A budget

envisages a commitment to certain

objectives

or targets, which the

management seeks to attain on the

basis of the forecasts

prepared.

A

forecast on the other hand

is an estimate based on probabilities of an

event. A forecast may

be

prepared

in financial or physical terms for sales,

production cost, or other

resources required for

business.

Instead of just one forecast a

number of alternative forecasts may be

considered with a

view

to obtaining the most

realistic overall

plan.

Preparing

budgets

After

the forecasts have been

finalized the preparation of budgets

follows. The budget

activity

starts

with the preparation of the

said budget. Then, production budget is

prepared on the basis

of

sales

budget and the production

capacity available. Financial budget

(i.e. cash or working

capital

budget)

will be prepared on the

basis of sale forecast and

production budget. All these

budgets are

combined

and coordinated into -a master budget-

The budgets may be revised

in the course of the

financial

period if it becomes necessary to do so in

view of the unexpected developments,

which

have

already taken place or are

likely to take place.

Choice

between Fixed and Flexible

Budgets

A

budget may be fixed or flexible. A

fixed budget is based on a fixed

volume of activity, 11

may

lose

its effectiveness in planning and

controlling if the actual

capacity utilization is different

from

what

was planned for any particular

unit of time e.g. a month or

a quarter. The flexible budget

is

more

useful for changing levels of

activity, as it considers fixed

and variable costs

separately. Fixed

costs,

as you are aware, remain unchanged

over a certain range of output such

costs change when

there

is a change in capacity level.

The variable costs change in

direct proportion to output if

flexible

budgeting approach is adopted, the budget

controller can analyze the

variance between

actual

costs and budgeted costs

depending upon the actual

level of activity attained

during a period

of

time.

203

Cost

& Management Accounting

(MGT-402)

VU

Objective

of Budget

Profit

maximization.

Maximization

of sales.

Volume

growth.

To

compete with the

competitors.

Development

of new areas of operation.

Quality

of service.

Work-force

efficiency.

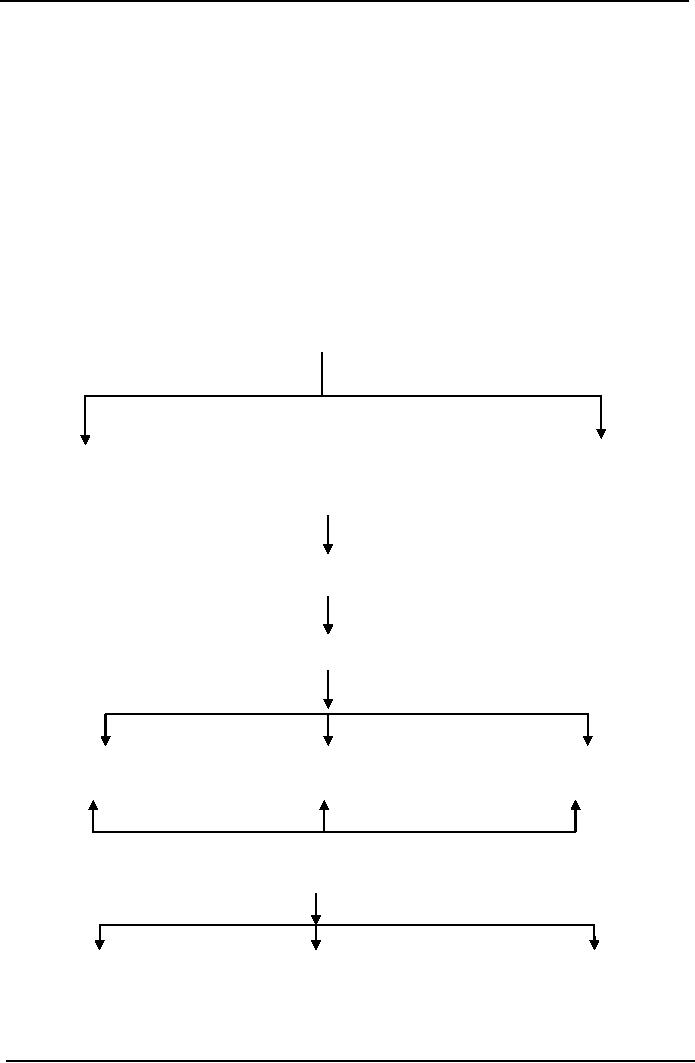

Divisions

of Budget

Division

of Budgets

Functional

Budget

Master

Budget

Functional

Budget

Sales

Budget

Production

Budget

Raw

material

Labor

Factory

overhead

Cost

of goods

sold

Selling

&

General

&

Financial

distribution

Administrative

charges

expenses

expenses

budget

budget

budget

204

Table of Contents:

- COST CLASSIFICATION AND COST BEHAVIOR INTRODUCTION:COST CLASSIFICATION,

- IMPORTANT TERMINOLOGIES:Cost Center, Profit Centre, Differential Cost or Incremental cost

- FINANCIAL STATEMENTS:Inventory, Direct Material Consumed, Total Factory Cost

- FINANCIAL STATEMENTS:Adjustment in the Entire Production, Adjustment in the Income Statement

- PROBLEMS IN PREPARATION OF FINANCIAL STATEMENTS:Gross Profit Margin Rate, Net Profit Ratio

- MORE ABOUT PREPARATION OF FINANCIAL STATEMENTS:Conversion Cost

- MATERIAL:Inventory, Perpetual Inventory System, Weighted Average Method (W.Avg)

- CONTROL OVER MATERIAL:Order Level, Maximum Stock Level, Danger Level

- ECONOMIC ORDERING QUANTITY:EOQ Graph, PROBLEMS

- ACCOUNTING FOR LOSSES:Spoiled output, Accounting treatment, Inventory Turnover Ratio

- LABOR:Direct Labor Cost, Mechanical Methods, MAKING PAYMENTS TO EMPLOYEES

- PAYROLL AND INCENTIVES:Systems of Wages, Premium Plans

- PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS

- LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST

- ALLOCATION AND APPORTIONMENT OF FOH COST

- FACTORY OVERHEAD COST:Marketing, Research and development

- FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance

- JOB ORDER COSTING SYSTEM:Direct Materials, Direct Labor, Factory Overhead

- PROCESS COSTING SYSTEM:Data Collection, Cost of Completed Output

- PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule

- PROCESS COSTING SYSTEM:Normal Loss at the End of Process

- PROCESS COSTING SYSTEM:PRACTICE QUESTION

- PROCESS COSTING SYSTEM:Partially-processed units, Equivalent units

- PROCESS COSTING SYSTEM:Weighted average method, Cost of Production Report

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Accounting for joint products

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Problems of common costs

- MARGINAL AND ABSORPTION COSTING:Contribution Margin, Marginal cost per unit

- MARGINAL AND ABSORPTION COSTING:Contribution and profit

- COST – VOLUME – PROFIT ANALYSIS:Contribution Margin Approach & CVP Analysis

- COST – VOLUME – PROFIT ANALYSIS:Target Contribution Margin

- BREAK EVEN ANALYSIS – MARGIN OF SAFETY:Margin of Safety (MOS), Using Budget profit

- BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts

- WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets

- Production & Sales Budget:Rolling budget, Sales budget

- Production & Sales Budget:Illustration 1, Production budget

- FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity

- FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses

- TYPES OF BUDGET:Format of Cash Budget,

- Complex Cash Budget & Flexible Budget:Comparing actual with original budget

- FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting

- DECISION MAKING IN MANAGEMENT ACCOUNTING:Spare capacity costs, Sunk cost

- DECISION MAKING:Size of fund, Income statement

- DECISION MAKING:Avoidable Costs, Non-Relevant Variable Costs, Absorbed Overhead

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS