|

THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures |

| << THE DATA OF MACROECONOMICS:Rules for computing GDP |

| THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI >> |

Macroeconomics

ECO 403

VU

LESSON

05

THE DATA OF

MACROECONOMICS (Continued...)

Nominal

vs. Real GDP

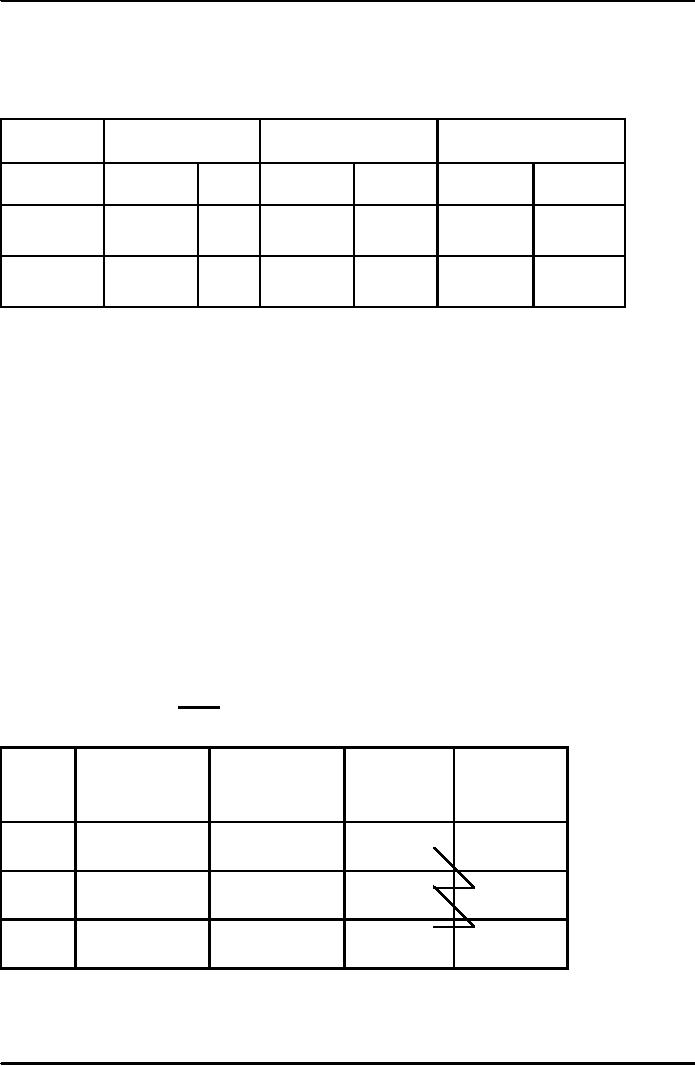

2001

2002

2003

P

Q

P

Q

P

Q

good

A

Rs30

900

Rs31

1,000

Rs36

1,050

good

B

Rs100

192

Rs102

200

Rs100

205

Compute

nominal GDP in each

year

·

Compute

real GDP in each year

using 2001 as the base

year.

·

Nominal

GDP

·

multiply

Ps & Qs from same

year

2001:

Rs46, 200 = $30 ×

900

+ $100 ×

192

2002:

Rs51, 400

2003:

Rs58, 300

·

Real

GDP

multiply

each year's Qs by 2001

Ps

2001:

Rs46, 300

2002:

Rs50,000

2003:

Rs52,000 = $30×1050 +

$100 ×

205

GDP

Deflator

The

GDP deflator, also called

the implicit price deflator

for GDP, measures the price

of output

relative

to its price in the base

year. It reflects what's

happening to the overall

level of prices in

the

economy

GDP

Deflator = Nominal

GDP

Real

GDP

GDP

inflation

Nom.

GDP

Real

GDP

deflator

rate

100.0

2001

Rs46,200

Rs46,200

n.a.

102.8

2002

51,400

50,000

2.8%

112.1

2003

58,300

52,000

9.1%

Chain-Weighted

Measures of GDP

·

In

some cases, it is misleading to

use base year prices

that prevailed 10 or 20

years

ago

(i.e. computers and

college). The base year

changes continuously over

time.

12

Macroeconomics

ECO 403

VU

New

chain-weighted measure is better

than the more traditional

measure because it

·

ensures

that prices will not be

too out of date.

Average

prices in 2001and 2002 are

used to measure real growth

from 2001 to 2002.

·

Average

prices in 2002 and 2003

are used to measure real

growth from 2002 to

2003

·

and

so on.

These

growth rates are united to

form a chain that is used to

compare output

between

·

any

two dates.

Components

of Expenditures

Y

= C + I + G + NX

Y

=> Total Demand for

domestic

C

=> Consumption Spending by

Households

I

=> Investment spending by businesses

and households

G

=> Govt. purchases of goods

and services

NX=>

Net exports or net foreign

demand

Consumption

(C)

Definition:

the value of all goods

and services bought by

households. Includes:

·

durable

goods last a

long time

ex:

cars, home appliances

·

non-durable

goods last a

short time

ex:

food, clothing

·

Services

work

done for consumers

ex:

dry cleaning, air

travel.

Investment

(I)

Definition

1: spending on [the factor of

production] capital.

Definition

2: spending on goods bought

for future use.

Includes:

·

Business

Fixed Investment spending on

plant and equipment that

firms will

use

to produce other goods &

services

·

Residential

Fixed Investment spending on

housing units by consumers

and

landlords

·

Inventory

Investment the change in the

value of all firms'

inventories

Investment

vs. Capital

Capital

is one of the factors of

production.

·

At

any given moment, the

economy has a certain

overall stock of

capital.

·

Investment

is spending on new

capital.

Example

(assumes no depreciation):

·

1/1/2002:

economy

has Rs500b worth of

capital

·

during

2002:

investment

= Rs37b

·

1/1/2003:

economy

will have Rs537b worth of

capital

13

Macroeconomics

ECO 403

VU

Stocks

vs. Flows

Flow

Stock

More

examples:

Stock

flow

a

person's wealth

a

person's saving

#

of people with college

degrees

#

of new college

graduates

the

govt. debt

the

govt. budget deficit

What

is Investment?

Ali

buys for himself a house (9

years old).

·

Saleem

built a brand-new

house.*

·

Baber

buys Rs10 million in ABC

stock from someone.

·

An

automobile company sells

Rs100 million in stock and

builds a new car factory

in

·

Lahore.*

Which

one is INVESTMENT included in

GDP? Why?

·

Government

spending (G)

G

includes

all government spending on

goods and services.

·

G

excludes

transfer payments

·

(e.g.

unemployment insurance payments),

because they do not

represent spending on

goods

and services.

Net

exports (NX = EX -

IM)

Definition:

The

value of total exports

(EX) minus

the value of total imports

(IM)

Recall

Y

= C + I + G + NX

Where

Y

= GDP = the value of total

output

C

+ I + G + NX = aggregate

expenditure

A

question for you:

Suppose

a firm

·

produces

Rs10 million worth of final

goods

·

but

only sells Rs9 million

worth.

Does

this violate the expenditure

= output

identity?

Why

output = expenditure

·

Unsold

output goes into

inventory,

and

is counted as "inventory

investment"...

...whether

the inventory buildup was

intentional or not.

14

Macroeconomics

ECO 403

VU

In

effect, we are assuming

that

·

firms

purchase their unsold

output.

GDP:

An important and versatile

concept

We

have now seen that

GDP measures

total

income

total

output

total

expenditure

the

sum of value-added at all

stages

in

the production of final

goods

GNP

vs. GDP

Gross

National Product

(GNP):

·

total

income earned by the

nation's factors of production,

regardless of where

located

Gross

Domestic Product

(GDP):

·

total

income earned by domestically-located

factors of production, regardless

of

nationality.

(GNPGDP)

= (factor payments from

abroad) minus (factor

payments to abroad)

In

Pakistan,

which

would you want

to

be bigger,

GDP

or GNP?

Why?

(GNPGDP)

as a % of GDP for selected

countries, 1997.

USA

0.1%

Bangladesh

3.3

Brazil

-2.0

Canada

-3.2

Chile

-8.8

Ireland

-16.2

Kuwait

20.8

Mexico

-3.2

Saudi

Arabia

3.3

Singapore

4.2

15

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand