|

Production with Two Variable Inputs:Returns to Scale |

| << The Technology of Production:Production Function for Food |

| Measuring Cost: Which Costs Matter?:Cost in the Short Run >> |

Microeconomics

ECO402

VU

Lesson

17

Production

with Two Variable

Inputs

There is a

relationship between production

and productivity.

Long-run

production K& L are

variable.

Isoquants

analyze and compare the

different combinations of K & L and

output

The

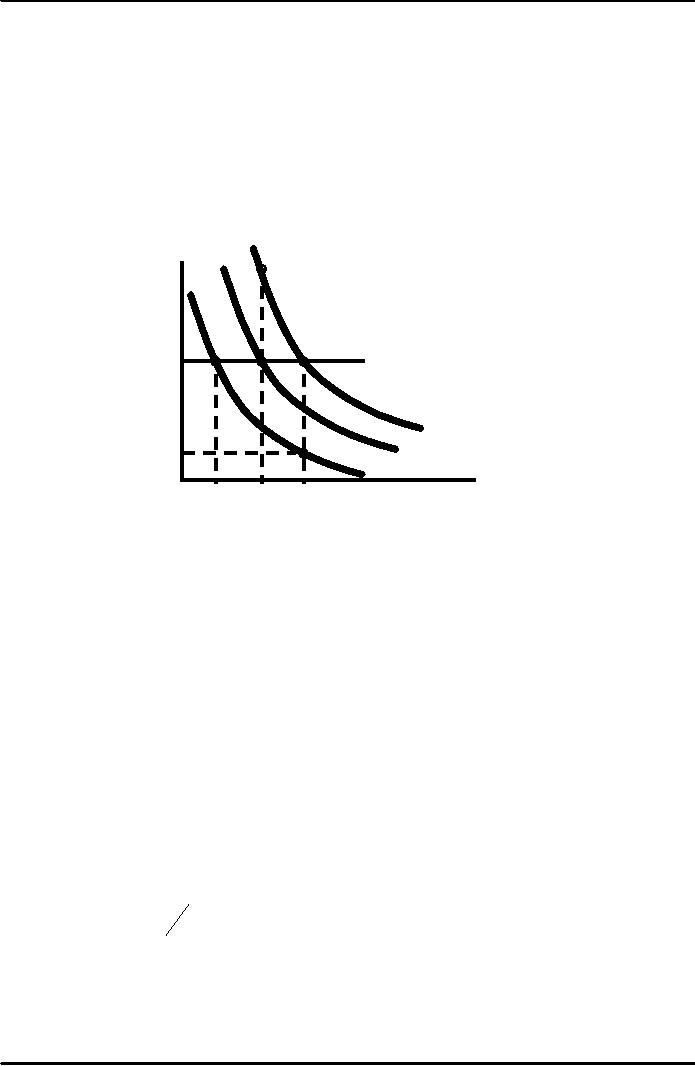

Shape of Isoquants

Capital

per

year

E

5

In

the long run

both

4

labor

and capital are

variable

and both

experience

diminishing

3

returns.

A

B

C

2

Q3 =

90

D

Q2 =

75

1

Q1 =

55

1

2

3

4

5

Labor

per year

Diminishing

Marginal Rate of

Substitution

Reading the

Isoquant Model

1)

Assume capital is 3 and

labor increases from 0 to 1 to 2 to

3.

Notice output

increases at a decreasing rate

(55, 20, 15) illustrating

diminishing

returns

from labor in the short-run

and long-run.

2)

Assume labor is 3 and

capital increases from 0 to 1 to 2 to

3.

Output also

increases at a decreasing rate

(55, 20, 15) due to

diminishing returns

from

capital.

Substituting

Among Inputs

Managers want

to determine what combination if

inputs to use.

They must

deal with the trade-off

between inputs.

The slope of

each isoquant gives the

trade-off between two inputs

while keeping output

constant.

The marginal

rate of technical substitution

equals:

MRTS

=

-

Changein

capital/Change in labor

input

MRTS

= -

ΔK

(for

a fixed level of Q)

ΔL

85

Microeconomics

ECO402

VU

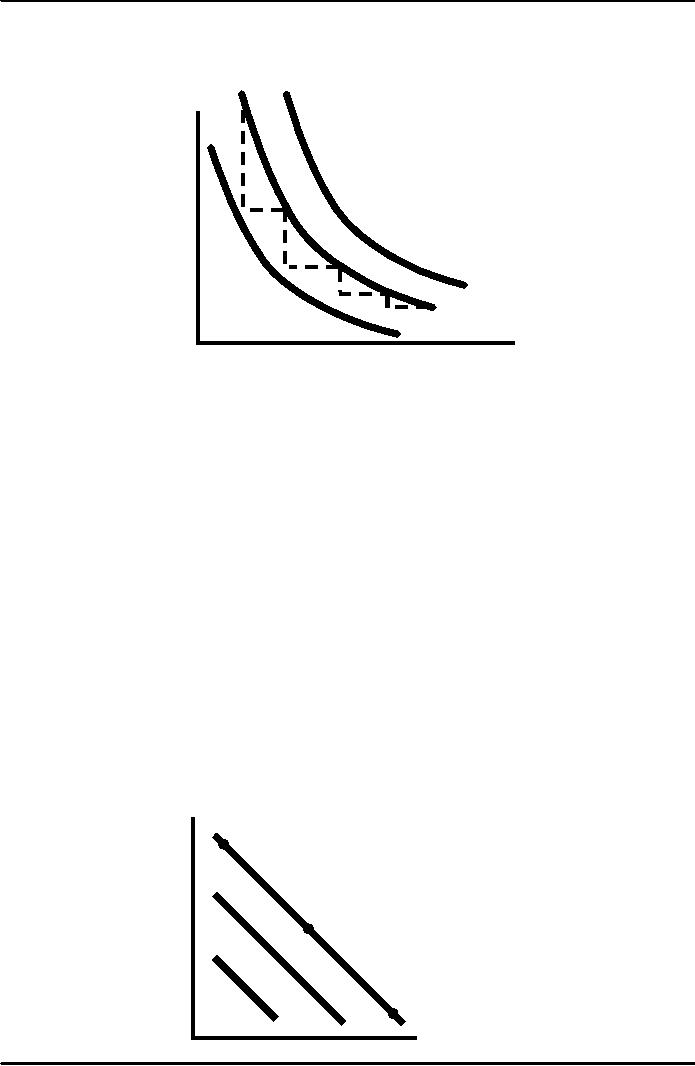

Marginal

Rate of Technical

Substitution

Capital

5

per

year

Isoquants

are downward

sloping

and convex

2

like

indifference

4

curves.

1

3

1

1

2

Q3 =90

2/

1

1/

Q2 =75

1

1

Q1 =55

5

Labor per

month

3

4

2

1

Observations:

1.

Increasing labor in one unit

increments from 1 to 5 results in a

decreasing MRTS from

1

to 1/2.

2.

Diminishing MRTS occurs

because of diminishing returns

and implies isoquants

are

convex.

MRTS

and Marginal

Productivity

∑

The change in

output from a change in

labor equals:

(MP

L )( Δ

L)

∑

The

change in output from a

change in capital

equals:

)(

Δ

K)

(MP

K

∑

If output is

constant and labor is

increased, then:

(MP

L )( Δ

L)

+

(MP

K )( Δ

K)

=

0

(MP

L )(MP K

) =

-

( Δ

K/

Δ

L)

=

MRTS

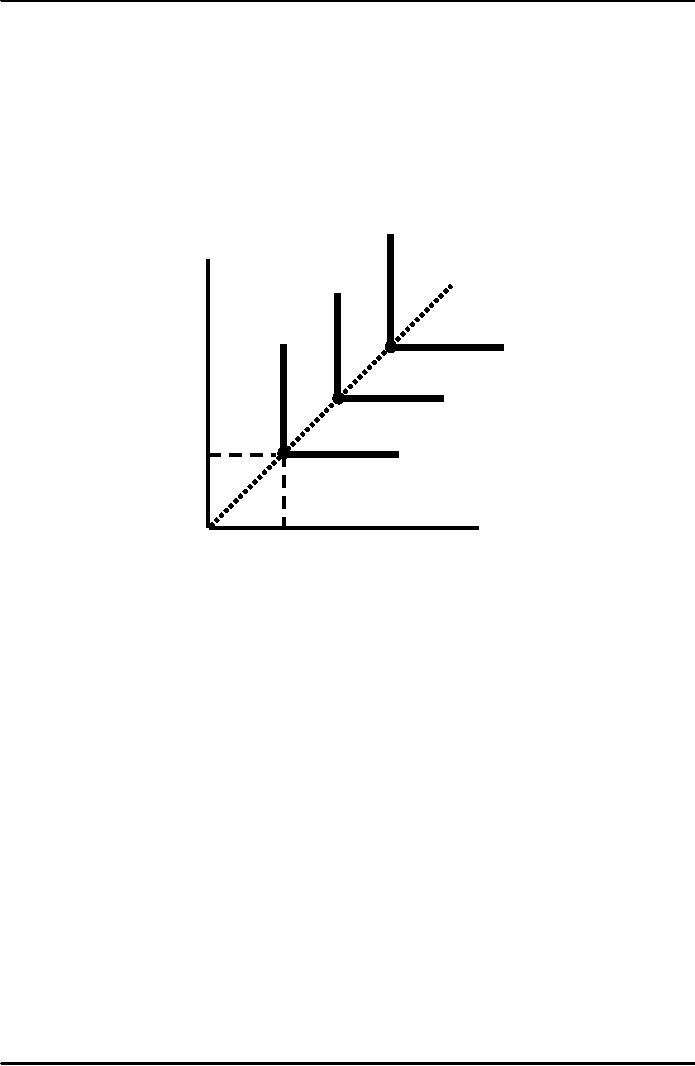

Isoquants

When Inputs are perfectly

substitutable

A

B

C

Q1

Q2

Q3

Labor

per month

86

Microeconomics

ECO402

VU

Perfect

Substitute

Observations

when inputs are perfectly

substitutable:

1)

The MRTS is constant at all

points on the

isoquant.

2)

For a given output, any

combination of inputs can be

chosen (A, B, or C) to

generate

the same level of output

(e.g. toll booths &

musical instruments).

Fixed-Proportions

Production Function

Capital

per

month

Q3

C

Q2

B

Q1

K1

A

Labor

per

month

L1

Fixed-Proportions

Production Function

Observations

when inputs must be in a

fixed-proportion:

1)

No substitution is possible. Each

output requires a specific

amount of each input

(e.g.

labor and

jackhammers).

2)To

increase output requires

more labor and capital

(i.e. moving from A to B to

C

which

is technically efficient).

A

Production Function for

Wheat

Farmers

must choose between a

capital intensive or labor

intensive technique of

production.

87

Microeconomics

ECO402

VU

Isoquant

Describing the Production of

Wheat

Capital

(Machine

Point

A is

more

hour

per

capital-intensive,

and

120

year)

B

is

more labor-intensive.

A

100

B

ĆK =

-10

90

ĆL =

260

80

Output

= 13,800 bushels

per

year

40

Labor

250

500

760

1000

(hours

per year)

Observations:

1)

Operating at A:

∑

L

= 500 hours and K = 100

machine hours.

2)

Operating at B

∑

Increase L to

760 and decrease K to 90 the

MRTS < 1:

MRTS

=

-ΔK

=

-(10 /

260) =

0.04

ΔL

3)

MRTS < 1, therefore the

cost of labor must be less

than capital in order for

the

farmer

substitute labor for

capital.

4)

If labor is expensive, the

farmer would use more

capital (e.g. U.S.).

5)

If labor is inexpensive, the

farmer would use more

labor (e.g. India).

88

Microeconomics

ECO402

VU

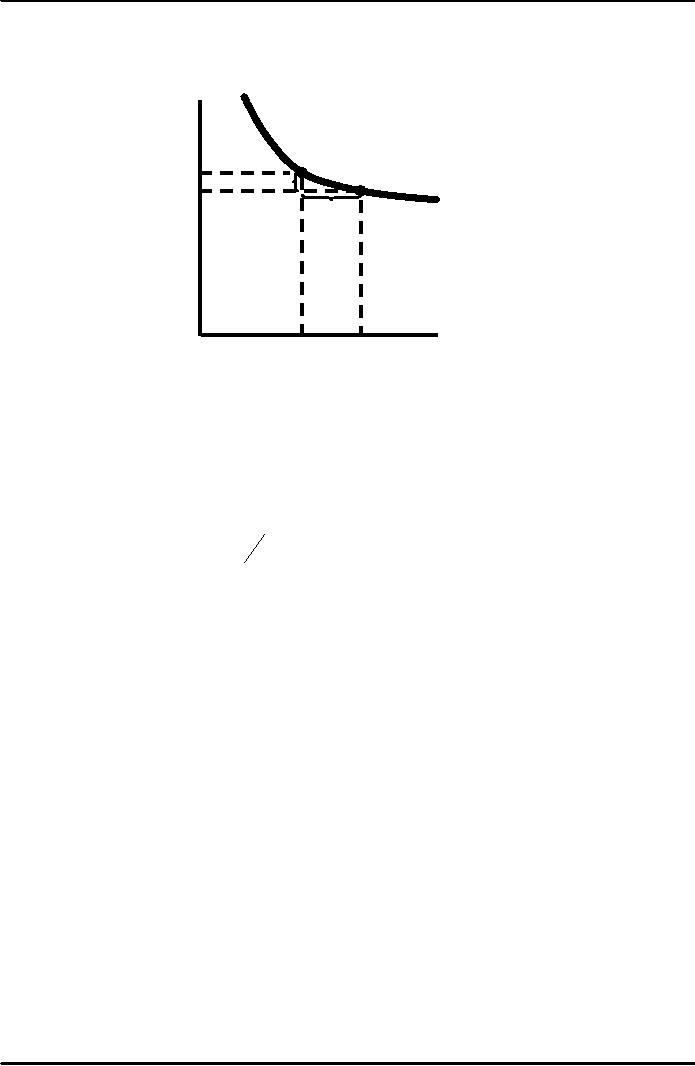

Returns

to Scale

Measuring

the relationship between the

scale (size) of a firm and

output

1.

Increasing returns to scale:

output

more than doubles when

all inputs are

doubled

Larger output

associated with lower cost

(autos)

One firm is

more efficient than many

(utilities)

The isoquants

get closer together

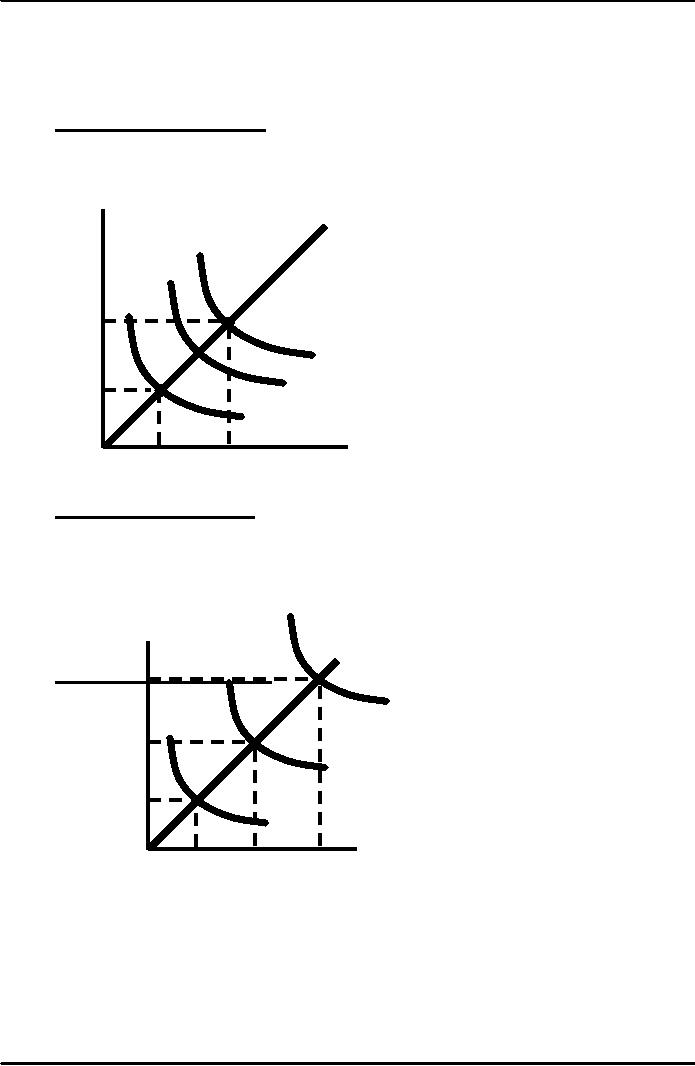

Increasing

Returns:

Capital

A

The

isoquants move closer

(machine

together

hours)

4

30

20

2

10

Labor

(hours)

0

5

10

2.

Constant returns to scale:

output

doubles when all inputs

are doubled.

∑

Size does

not affect

productivity

∑

May have a

large number of

producers

∑

Isoquants are

equidistant apart

Capital

(machine

hours)

A

Decreasing

returns to scale: output

less than doubles when

all inputs are

doubled

6

30

Constant

Returns:

4

Isoquants

are

20

equally spaced

2

10

Labor

(hours)

0

5

10

15

89

Microeconomics

ECO402

VU

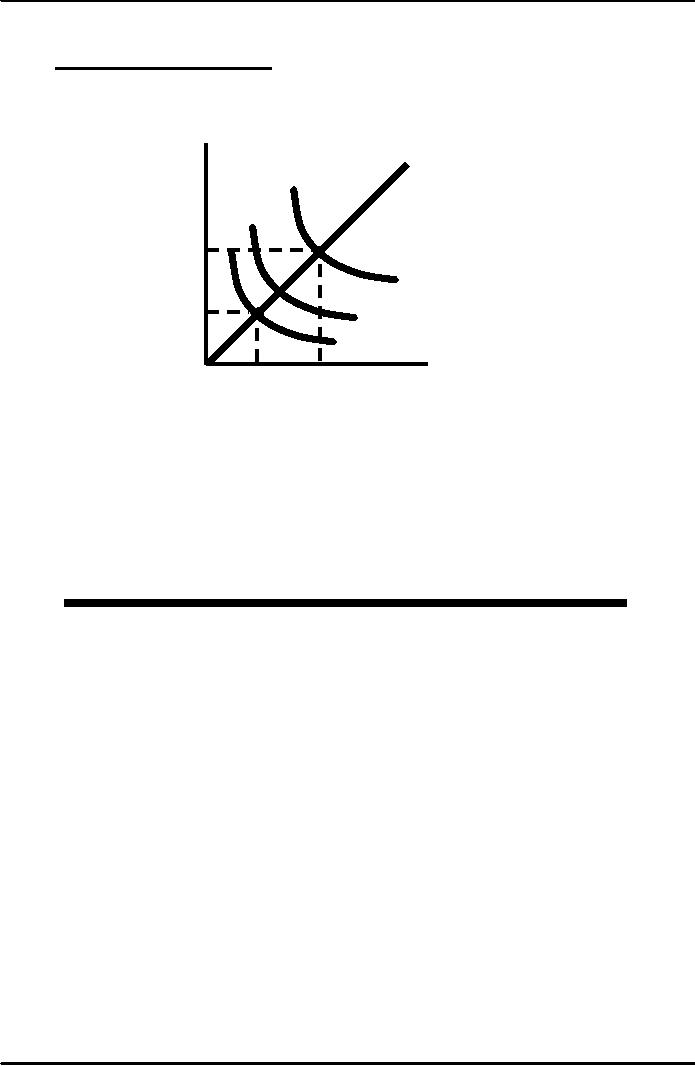

3.

Decreasing returns to scale:

output

less than doubles when

all inputs are

doubled

∑

Decreasing

efficiency with large

size

∑

Reduction of

entrepreneurial abilities

∑

Isoquants

become farther apart

A

Capital

(machine

hours)

Decreasing

Returns:

Isoquants

get further

apart

4

30

2

20

10

Labor

(hours)

0

5

10

Returns

to Scale in the Carpet

Industry

The

carpet industry has grown

from a small industry to a

large industry with some

very large

firms.

Question

Can the

growth be explained by the

presence of economies to

scale?

The

U.S. Carpet

Industry

Carpet

Shipments, 1996

(Millions

of Dollars per

Year)

1.

Shaw Industries

$3,202

6.

World Carpets

$475

2.

Mohawk Industries

1,795

7.

Burlington Industries

450

3.

Beaulieu of America

1,006

8.

Collins & Aikman

418

4.

Interface Flooring

820

9.

Masland Industries

380

5.

Queen Carpet

775

10.

Dixied Yarns

280

Are

there economies of

scale?

Costs (percent

of cost)

∑

Capital --

77%

∑

Labor --

23%

Large

Manufacturers

Increased in

machinery & labor

Doubling

inputs has more than

doubled output

Economies of

scale exist for large

producers

Small

Manufacturers

Small

increases in scale have

little or no impact on

output

Proportional

increases in inputs increase

output proportionally

90

Microeconomics

ECO402

VU

Constant returns

to scale for small

producers

91

Table of Contents:

- ECONOMICS:Themes of Microeconomics, Theories and Models

- Economics: Another Perspective, Factors of Production

- REAL VERSUS NOMINAL PRICES:SUPPLY AND DEMAND, The Demand Curve

- Changes in Market Equilibrium:Market for College Education

- Elasticities of supply and demand:The Demand for Gasoline

- Consumer Behavior:Consumer Preferences, Indifference curves

- CONSUMER PREFERENCES:Budget Constraints, Consumer Choice

- Note it is repeated:Consumer Preferences, Revealed Preferences

- MARGINAL UTILITY AND CONSUMER CHOICE:COST-OF-LIVING INDEXES

- Review of Consumer Equilibrium:INDIVIDUAL DEMAND, An Inferior Good

- Income & Substitution Effects:Determining the Market Demand Curve

- The Aggregate Demand For Wheat:NETWORK EXTERNALITIES

- Describing Risk:Unequal Probability Outcomes

- PREFERENCES TOWARD RISK:Risk Premium, Indifference Curve

- PREFERENCES TOWARD RISK:Reducing Risk, The Demand for Risky Assets

- The Technology of Production:Production Function for Food

- Production with Two Variable Inputs:Returns to Scale

- Measuring Cost: Which Costs Matter?:Cost in the Short Run

- A Firmís Short-Run Costs ($):The Effect of Effluent Fees on Firmsí Input Choices

- Cost in the Long Run:Long-Run Cost with Economies & Diseconomies of Scale

- Production with Two Outputs--Economies of Scope:Cubic Cost Function

- Perfectly Competitive Markets:Choosing Output in Short Run

- A Competitive Firm Incurring Losses:Industry Supply in Short Run

- Elasticity of Market Supply:Producer Surplus for a Market

- Elasticity of Market Supply:Long-Run Competitive Equilibrium

- Elasticity of Market Supply:The Industryís Long-Run Supply Curve

- Elasticity of Market Supply:Welfare loss if price is held below market-clearing level

- Price Supports:Supply Restrictions, Import Quotas and Tariffs

- The Sugar Quota:The Impact of a Tax or Subsidy, Subsidy

- Perfect Competition:Total, Marginal, and Average Revenue

- Perfect Competition:Effect of Excise Tax on Monopolist

- Monopoly:Elasticity of Demand and Price Markup, Sources of Monopoly Power

- The Social Costs of Monopoly Power:Price Regulation, Monopsony

- Monopsony Power:Pricing With Market Power, Capturing Consumer Surplus

- Monopsony Power:THE ECONOMICS OF COUPONS AND REBATES

- Airline Fares:Elasticities of Demand for Air Travel, The Two-Part Tariff

- Bundling:Consumption Decisions When Products are Bundled

- Bundling:Mixed Versus Pure Bundling, Effects of Advertising

- MONOPOLISTIC COMPETITION:Monopolistic Competition in the Market for Colas and Coffee

- OLIGOPOLY:Duopoly Example, Price Competition

- Competition Versus Collusion:The Prisonersí Dilemma, Implications of the Prisoners

- COMPETITIVE FACTOR MARKETS:Marginal Revenue Product

- Competitive Factor Markets:The Demand for Jet Fuel

- Equilibrium in a Competitive Factor Market:Labor Market Equilibrium

- Factor Markets with Monopoly Power:Monopoly Power of Sellers of Labor