|

Principles

of Marketing MGT301

VU

Lesson

24

Lesson

overview and learning

objectives:

Price

goes by many names in our

economy. In the narrowest

sense, price is the amount

of money

charged

for a product or service.

Price is the only element in

the marketing mix that

produces

revenue;

all other elements represent

costs. Price is also one of

the most flexible elements

of the

marketing

mix. Unlike product features

and channel commitments,

price can be changed

quickly.

At

the same time, pricing

and price competition is the

number-one problem facing

many

marketing

executives. Yet, many

companies do not handle pricing

well. The most

common

mistakes

are pricing that is too

cost oriented rather than

customer-value oriented; prices that

are

not

revised often enough to

reflect market changes; pricing

that does not take

the rest of the

marketing

mix into account; and prices

that are not varied

enough for different

products, market

segments,

and purchase occasions. This

Lesson looks at the factors

marketers must consider

when

setting

prices so our today's topic

is:

Price

the 2nd P of Marketing

Mix.

A.

Introduction

All

profit and nonprofit organizations

must set prices on their

products and services.

Price

goes

by

many

names (rent, tuition, fee,

fare, rate, interest, toll,

premium, et cetera). Price is

the amount of

money

charged for a product or

service or the sum of the

values that consumers exchange

for the

benefits

of having or using the product or

service. Historically, price

has been the major

factor

affecting

buyer choice. Recently,

however, nonprice factors

have become increasingly important

in

buyer-choice

behavior. Throughout history,

prices were set by

negotiation between buyers

and

sellers.

Fixed

price policies--setting

one price for all buyers--is a

relatively modern idea that

arose

with

the development of large-scale retailing

at the end of the nineteenth

century. Today, we

may

be

returning to dynamic

pricing--charging

different prices depending on

the individual customers

and

situations. The Internet is helping to

tailor products and prices.

It should be remembered

that

price

is the only element in the marketing

mix that produces revenue;

all other elements

represent

costs.

Price is also one of the

most flexible of elements of

the marketing mix. It has

been stated

that

pricing and price

competition is the number-one

problem facing many marketing

executives.

Many

companies do not handle pricing

well. Common mistakes that

they make are:

1.

Pricing is too cost-oriented.

2.

Prices are not revised

often enough to reflect market

changes.

3.

Prices do not take

into account the other

elements of the marketing

mix.

4.

Prices are not varied

for different products, market

segments, and purchase

occasions.

All

profit organizations and many

nonprofit organizations must set

prices on their products

or

services.

Price goes by many names

Price is all around us. You

pay rent for your apartment,

tuition

for

your education, and a fee to

your physician or dentist. The airline,

railway, taxi, and

bus

companies

charge you a fare; the local

utilities call their price a

rate; and the local bank

charges you

interest

for the money you

borrow.

In

the narrowest sense, price

is the amount of money

charged for a product or

service. More

broadly,

price is the sum of all

the values that consumers

exchange for the benefits of

having or

using

the product or service.

Historically, price has been

the major factor affecting

buyer choice.

This

is still true in poorer

nations, among poorer groups, and

with commodity products.

However,

non-price

factors have become more

important in buyer-choice behavior in recent

decades.

Throughout

most of history, prices were

set by negotiation between buyers

and sellers. Fixed

price

policies--setting

one price for all buyers--is

a relatively modern idea

that arose with

the

development

of large-scale retailing at the end of

the nineteenth century. Now,

some one hundred

years

later, the Internet promises

to reverse the fixed pricing

trend and take us back to an

era of

112

Principles

of Marketing MGT301

VU

dynamic

pricing--charging different prices

depending on individual customers and

situations. The

Internet,

corporate networks, and wireless

setups are connecting

sellers and buyers as never

before.

New

technologies allow sellers to collect

detailed data about customers'

buying habits,

preferences--even

spending limits--so they can

tailor their products and

prices.

B.

Factors to Consider When Setting

Prices

A

company's

Extternall

Ex

erna

pricing

decisions

IIntternall

n

erna

Facttors

Fac

ors

are

affected by

Facttors

Fac

ors

both

internal

Natturre off tthe

Na u e o

he

company

factors

marrket a

nd

ma

ket

a

nd

Marrketing

Ma keti

ng

and

external

de

ma nd

Objecttives

Objec

ives

Prrcing

P

iicing

environmental

de

ma nd

Decisions

factors

Decisions

Co mpettition

Co mpe ition

Marrketing Miix

Ma keti

ng M

x

Sttrategy

S

rategy

Otther

O

her

enviironmenttall

env

ronme

n

a

Costts

Cos s

ffactors ((economy,,

actors

econo my

Orrganiizattionall

O

gan za io na

rreselerrs,

esel

le

s,

consiiderations

cons derations

goverrnmentt)

gove

nme

n

)

a)

Internal Factors Affecting

Pricing Decision

Internal

factors affecting pricing

include the company's marketing

objectives, marketing mix

strategy,

costs, and organizational

considerations.

I.

Marketing Objectives

Before

setting price, the company

must decide on its strategy

for the product. If the

company has

selected

its target market and positioning

carefully, then its marketing

mix strategy, including

price,

will

be fairly straightforward. Pricing

strategy is largely determined by decisions on

market

positioning.

At the same time, the

company may seek additional objectives.

The clearer a firm is

about

its objectives, the easier it is to set

price. Examples of common objectives are

survival,

current

profit maximization, market share

leadership, and product

quality leadership.

Companies

set survival

as

their major objective if they

are troubled by too much

capacity, heavy

competition,

or changing customers' wants. To keep a plant going, a

company may set a low

price,

hoping

to increase demand. In this

case, profits are less

important than survival. As

long as their

prices

cover variable costs and

some fixed costs, they

can stay in business.

However, survival is

only

a short-term objective. In the long

run, the firm must learn

how to add value that

consumers

will

pay for or face

extinction.

Many

companies use current

profit

maximization as

their pricing goal. They

estimate what

demand

and costs will be at

different prices and choose

the price that will produce

the maximum

current

profit, cash flow, or return

on investment. In all cases,

the company wants current

financial

results

rather than long-run performance.

Other companies want to

obtain market share

leadership.

They believe that the

company with the largest

market share will enjoy the

lowest costs

and

highest long-run profit. To become

the market share leader,

these firms set prices as

low as

possible.

A

company might decide that it

wants to achieve product

quality leadership. This

normally

calls

for charging a high price to

cover higher performance

quality and the high

cost of R&D. A

company

might also use price to

attain other, more specific objectives.

It can set prices low

to

prevent

competition from entering

the market or set prices at

competitors' levels to stabilize

the

market.

Prices can be set to keep

the loyalty and support of

resellers or to avoid government

intervention.

Prices can be reduced

temporarily to create excitement

for a product or to draw

more

113

Principles

of Marketing MGT301

VU

customers

into a retail store. One

product may be priced to

help the sales of other

products in the

company's

line. Thus, pricing may play

an important role in helping to

accomplish the company's

objectives

at many levels.

Nonprofit

and public organizations may adopt a

number of other pricing objectives. A

university

aims

for partial cost recovery,

knowing that it must rely on

private gifts and public

grants to cover

the

remaining costs. A nonprofit hospital

may aim for full

cost recovery in its pricing.

Marketing

Mix

Strategy: Price is only one of

the marketing mix tools that

a company uses to achieve

its

marketing

objectives. Price decisions must be

coordinated with product design,

distribution, and

promotion

decisions to form a consistent and

effective marketing program. Decisions

made for

other

marketing mix variables may

affect pricing decisions.

For example, producers using

many

resellers

who are expected to support

and promote their products

may have to build larger

reseller

margins

into their prices. The

decision to position the

product on high-performance quality

will

mean

that the seller must

charge a higher price to

cover higher costs.

Companies

often position their

products on price and then

base other marketing mix

decisions on

the

prices they want to charge.

Here, price is a crucial

product-positioning factor that

defines the

product's

market, competition, and design.

Many firms support such

price-positioning strategies

with

a technique called target costing, a

potent strategic weapon.

Target costing reverses the

usual

process

of first designing a new

product, determining its cost,

and then asking, "Can we

sell it for

that?"

Instead, it starts with an

ideal selling price based on

customer considerations, and

then

targets

costs that will ensure

that the price is

met.

Other

companies de emphasize price

and use other marketing mix

tools to create

nonprice

positions.

Often, the best strategy is

not to charge the lowest

price, but rather to

differentiate the

marketing

offer to make it worth a

higher price. Thus, the

marketer must consider the

total

marketing

mix when setting prices. If

the product is positioned on nonprice

factors, then decisions

about

quality, promotion, and

distribution will strongly

affect price. If price is a crucial

positioning

factor,

then price will strongly

affect decisions made about

the other marketing mix

elements.

However,

even when featuring price,

marketers need to remember that customers

rarely buy on

price

alone. Instead, they seek

products that give them

the best value in terms of benefits

received

for

the price paid. Thus, in

most cases, the company

will consider price along

with all the

other

marketing-mix

elements when developing the marketing

program.

II.

Costs

Costs

set the floor for

the price that the

company can charge for its

product. The company

wants

to

charge a price that both

covers all its costs for

producing, distributing, and selling

the product

and

delivers a fair rate of

return for its effort and

risk. A company's costs may be an

important

element

in its pricing strategy. Companies with

lower costs can set

lower prices that result

in

greater

sales and profits.

�

Types

of Costs

A

company's costs take two

forms, fixed and variable.

Fixed costs (also known as overhead)

are

costs

that do not vary with

production or sales level.

For example, a company must

pay each

month's

bills for rent, heat,

interest, and executive salaries,

whatever the company's

output.

Variable

costs vary directly with

the level of production. Each

personal computer produced

involves

a cost of computer chips,

wires, plastic, packaging,

and other inputs. These

costs tend to

be

the same for each

unit produced. They are

called variable because

their total varies with

the

number

of units produced. Total costs

are the sum of the

fixed and variable costs

for any given

level

of production. Management wants to charge a

price that will at least

cover the total

production

costs at a given level of production.

The company must watch its

costs carefully. If it

costs

the company more than

competitors to produce and sell its

product, the company will

have

to

charge a higher price or

make less profit, putting it

at a competitive disadvantage.

114

Principles

of Marketing MGT301

VU

�

Costs

at Different Levels of

Production

To

price wisely, management

needs to know how its costs

vary with different levels

of production.

This

is because fixed costs are

spread over more units,

with each one bearing a smaller

share of the

fixed

cost.

III.

Organizational

Considerations

Management

must decide who within

the organization should set

prices. Companies handle

pricing

in

a variety of ways. In small companies,

prices are often set by

top management rather than

by the

marketing

or sales departments. In large companies,

pricing is typically handled by

divisional or

product

line managers. In industrial

markets, salespeople may be allowed to

negotiate with

customers

within certain price ranges.

Even so, top management

sets the pricing objectives

and

policies,

and it often approves the

prices proposed by lower-level

management or salespeople. In

industries

in which pricing is a key

factor (aerospace, railroads,

oil companies), companies

often

have

a pricing department to set

the best prices or help

others in setting them. This

department

reports

to the marketing department or top

management. Others who have

an influence on pricing

include

sales managers, production

managers, finance managers, and

accountants.

b)

External Factors Affecting

Pricing Decisions

External

factors that affect pricing

decisions include the nature

of the market and

demand,

competition,

and other environmental

elements.

I.

The Market and

Demand

Whereas

costs set the lower

limit of prices, the market

and demand set the

upper limit. Both

consumer

and industrial buyers balance

the price of a product or

service against the benefits

of

owning

it. Thus, before setting prices,

the marketer must understand the

relationship between

price

and

demand for its product. In

this section, we explain how

the pricedemand relationship

varies

for

different types of markets

and how buyer perceptions of

price affect the pricing

decision. We

then

discuss methods for measuring

the pricedemand

relationship.

�

Pricing in

Different Types of Markets

The

seller's pricing freedom

varies with different types

of markets. Economists recognize

four

types

of markets, each presenting a different

pricing challenge.

Under

pure competition, the market

consists of many buyers and

sellers trading in a

uniform

commodity

such as wheat, copper. No single buyer or

seller has much effect on

the going market

price.

A seller cannot charge more

than the going price because

buyers can obtain as much as

they

need

at the going price. Nor

would sellers charge less

than the market price

because they can

sell

all

they want at this price. If

price and profits rise,

new sellers can easily

enter the market. In a

purely

competitive market, marketing research,

product development, pricing,

advertising, and

sales

promotion play little or no role.

Thus, sellers in these

markets do not spend much

time on

marketing

strategy.

Under

monopolistic competition, the market

consists of many buyers and

sellers who trade over

a

range

of prices rather than a

single market price. A range of

prices occurs because sellers

can

differentiate

their offers to buyers. Either

the physical product can be

varied in quality, features,

or

style,

or the accompanying services can be

varied. Buyers see differences in

sellers' products and

will

pay different prices for

them. Sellers try to develop

differentiated offers for

different customer

segments

and, in addition to price,

freely use branding, advertising,

and personal selling to set

their

offers

apart. Because there are

many competitors in such markets,

each firm is less affected

by

competitors'

marketing strategies than in

oligopolistic markets.

Under

oligopolistic competition, the market

consists of a few sellers

who are highly sensitive

to

each

other's pricing and marketing

strategies. The product can

be uniform (steel, aluminum)

or

differentiated

(cars, computers). There are

few sellers because it is

difficult for new sellers to

enter

the

market. Each seller is alert to competitors'

strategies and moves. If a

steel company slashes

its

115

Principles

of Marketing MGT301

VU

price

by 10 percent, buyers will quickly switch

to this supplier. The other

steelmakers must respond

by

lowering their prices or

increasing their services. An

oligopolist is never sure

that it will gain

anything

permanent through a price

cut. In contrast, if an oligopolist

raises its price, its

competitors

might not follow this

lead. The oligopolist then

would have to retract its

price increase

or

risk losing customers to competitors.

In

a pure monopoly, the market

consists of one seller. Pricing is handled differently

in each case. A

government

monopoly can pursue a variety of

pricing objectives. It might set a

price below cost

because

the product is important to buyers

who cannot afford to pay

full cost. Or the price

might

be

set either to cover costs or

to produce good revenue. It can even be

set quite high to slow

down

consumption.

In a regulated monopoly, the

government permits the company to

set rates that

will

yield

a "fair return," one that

will let the company

maintain and expand its operations as

needed.

Unregulated

monopolies are free to price at

what the market will bear.

However, they do not

always

charge the full price

for a number of reasons: a

desire to not attract

competition, a desire to

penetrate

the market faster with a low

price, or a fear of government

regulation.

�

Consumer

Perceptions of Price and

Value

In

the end, the consumer will

decide whether a product's

price is right. Pricing decisions, like

other

marketing

mix decisions, must be buyer

oriented. When consumers buy a product,

they exchange

something

of value (the price) to get something of

value (the benefits of having or using

the

product).

Effective, buyer-oriented pricing

involves understanding how much value

consumers

place

on the benefits they receive

from the product and setting

a price that fits this

value.

A

company often finds it hard

to measure the values customers

will attach to its product.

For

example,

calculating the cost of ingredients in a

meal at a fancy restaurant is relatively

easy. But

assigning

a value to other satisfactions such as

taste, environment, relaxation,

conversation, and

status

is very hard. These values

will vary both for

different consumers and different

situations.

Still,

consumers will use these

values to evaluate a product's

price. If customers perceive that

the

price

is greater than the

product's value, they will

not buy the product. If

consumers perceive

that

the

price is below the product's

value, they will buy it,

but the seller loses

profit opportunities.

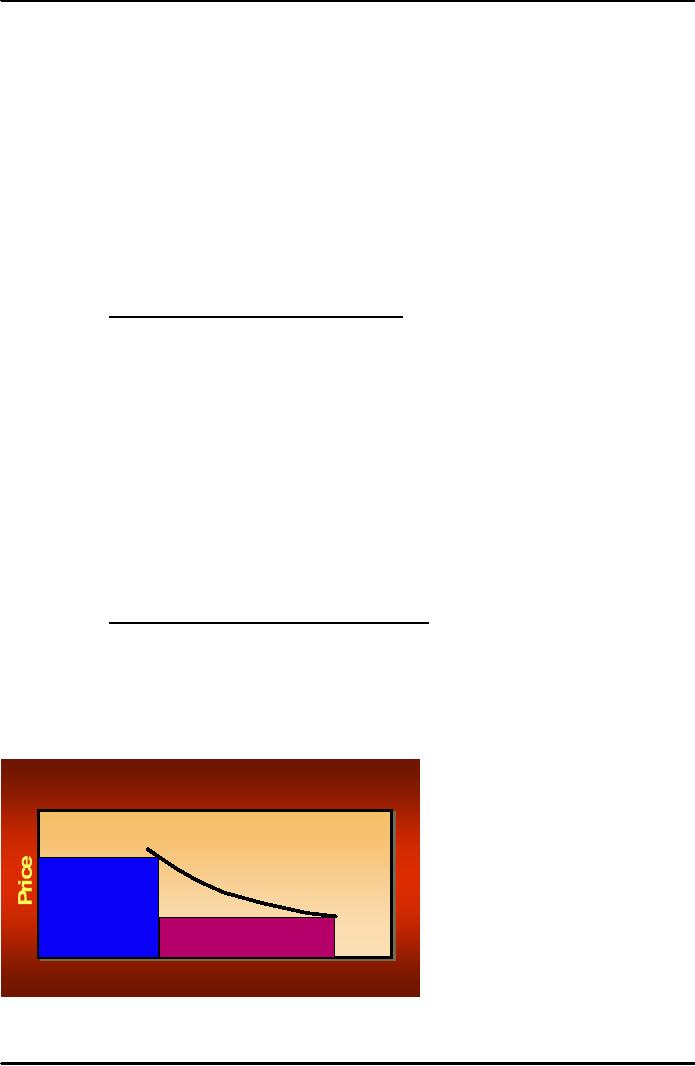

�

Analyzing

the PriceDemand Relationship

Each

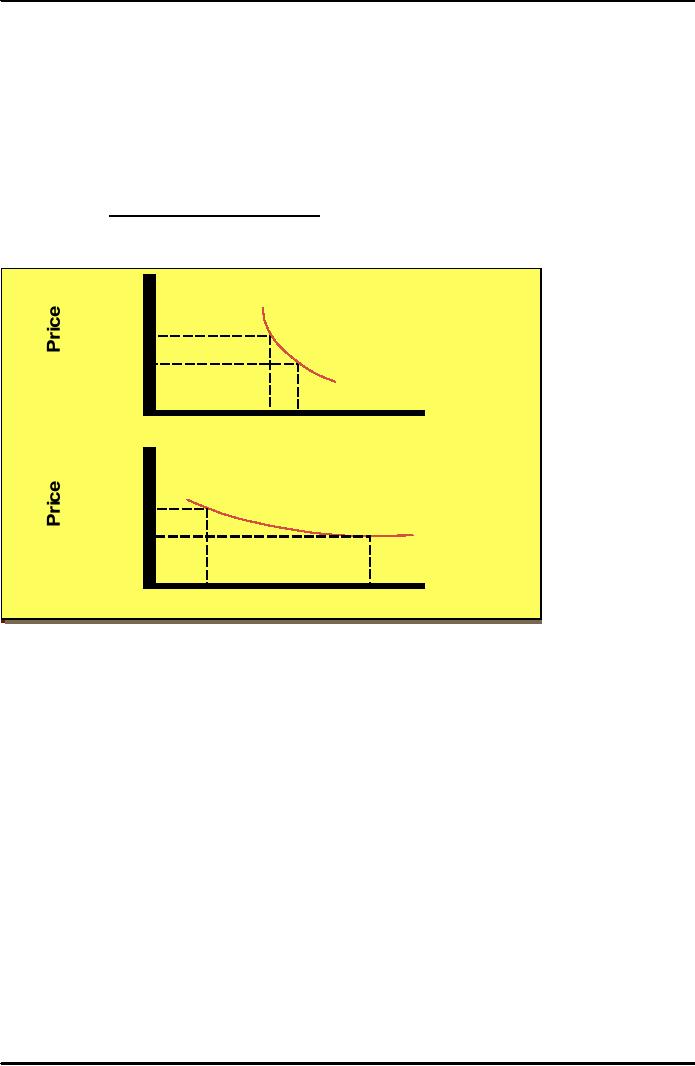

price the company might

charge will lead to a

different level of demand.

The relationship

between

the price charged and

the resulting demand level

is shown in the demand curve

in Figure.

The

demand curve shows the

number of units the market

will buy in a given time period

at

different

prices that might be

charged. In the normal case,

demand and price are

inversely related;

that

is, the higher the

price, the lower the

demand. Thus, the company

would sell less if it raised

its

price

from P1 to

P2. In short, consumers with

limited budgets probably

will buy less of

something

if

its price is too

high.

The

Demand Determ inant of Price In

the case of prestige goods,

the

demand

curve sometimes

slopes

upward.

Consumers think

that

higher

prices mean more

quality.

D

Most

companies try to measure

their

demand

curves by estimating

demand

at different prices. The

type

D

of

market makes a difference. In a

monopoly,

the demand curve

shows

the

total market demand

resulting

Quantity

from

different prices. If

the

company

faces competition,

its

116

Principles

of Marketing MGT301

VU

demand

at different prices will

depend on whether competitors'

prices stay constant or

change

with

the company's own

prices.

In

measuring the pricedemand

relationship, the market researcher

must not allow other

factors

affecting

demand to vary. For example,

if any company increases its advertising at

the same time

that

it lowers its product prices, we would

not know how much of

the increased demand was

due

to

the lower prices and

how much was due to

the increased advertising. Economists

show the

impact

of nonprice factors on demand through

shifts in the demand curve

rather than movements

along

it.

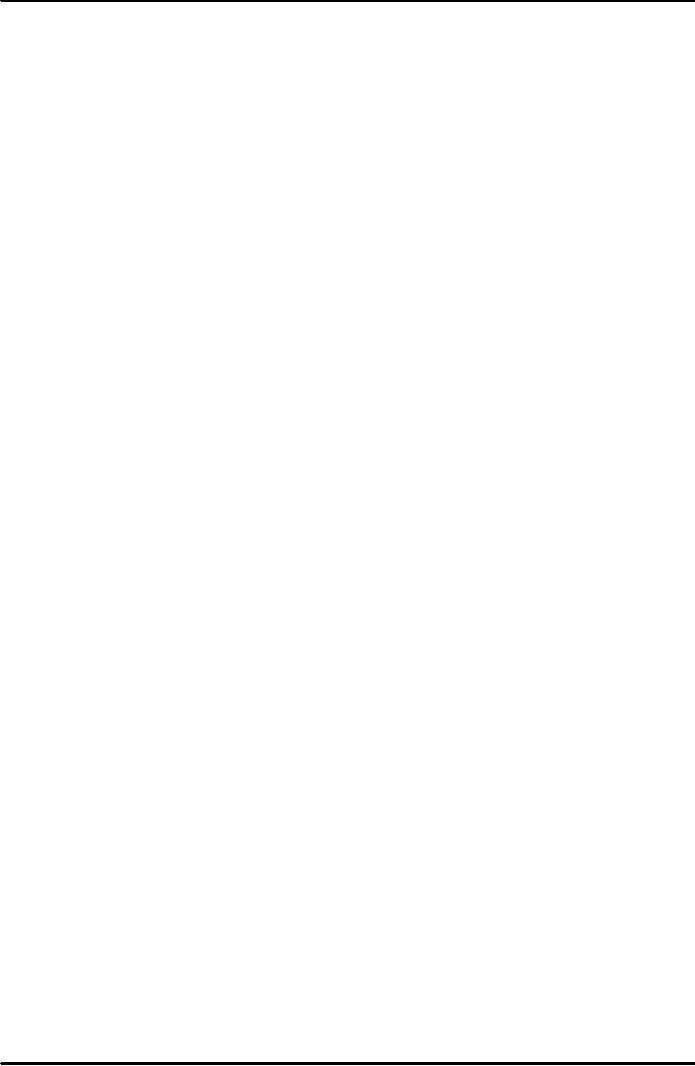

�

Price

Elasticity of Demand

Marketers

also need to know price

elasticity--how responsive demand

will be to a change in

price.

Consider

the two demand curves in Figure. In

Figure, a price increase from

P1 to

P2 leads to a

relatively

small

A.

Inelastic Demand -

drop

in demand

Demand

Hardly Changes

With

from

Q1 to

Q2. In

a

Small Change in

Price.

Figure

b, however,

P2

the

same price

P1

increase

leads to a

large

drop

in

demand

from Q′1

Q2 Q1

to

Q′2. If

demand

Quantit

y Demanded per

Period

hardly

changes

B.

Elastic Demand -

with

a small change

Demand

Changes Greatly

With

a

Small Change in

Price.

in

price, we say the

P'2

demand

is inelastic.

If

demand changes

P'1

greatly,

we say the

demand

is elastic.

The

price elasticity

Q2

Q1

of

demand is given

Quantit

y Demanded per

Period

by

the following

formula:

Price

Elasticity of Demand=

%change in Quantity demanded / %

change in Price

Suppose

demand falls by 10 percent when a

seller raises its price by 2 percent.

Price elasticity of

demand

is therefore 5 (the minus

sign confirms the inverse

relation between price and

demand)

and

demand is elastic. If demand

falls by 2 percent with a 2 percent

increase in price, then

elasticity

is

1. In this case, the

seller's total revenue stays

the same: The seller

sells fewer items but at

a

higher

price that preserves the

same total revenue. If demand

falls by 1 percent when price

is

increased

by 2 percent, then elasticity is � and

demand is inelastic. The

less elastic the

demand,

the

more it pays for the

seller to raise the

price.

What

determines the price elasticity of

demand? Buyers are less

price sensitive when the

product

they

are buying is unique or when

it is high in quality, prestige, or

exclusiveness. They are also

less

price

sensitive when substitute

products are hard to find or

when they cannot easily

compare the

quality

of substitutes. Finally, buyers are less

price sensitive when the

total expenditure for

a

product

is low relative to their income or when

the cost is shared by

another party.

If

demand is elastic rather

than inelastic, sellers will

consider lowering their

price. A lower price

will

produce

more total revenue. This

practice makes sense as long

as the extra costs of producing

and

selling

more do not exceed the extra

revenue. At the same time,

most firms want to avoid

pricing

that

turns their products into

commodities. In recent years, forces such as deregulation

and the

instant

price comparisons afforded by

the Internet and other

technologies have increased

consumer

price sensitivity, turning

products ranging from telephones and

computers to new

automobiles

into commodities in consumers' eyes. Marketers

need to work harder than

ever to

117

Principles

of Marketing MGT301

VU

differentiate

their offerings when a dozen

competitors are selling virtually

the same product at a

comparable

or lower price. More than

ever, companies need to understand the

price sensitivity of

their

customers and prospects and

the trade-offs people are

willing to make between

price and

product

characteristics.

II.

Competitors' Costs, Prices, and

Offers

Another

external factor affecting

the company's pricing decisions is

competitors' costs and

prices

and

possible competitor reactions to

the company's own pricing moves.

When setting prices,

the

company

also must consider other

factors in its external environment.

Economic conditions

can

have

a strong impact on the firm's

pricing strategies. Economic

factors such as boom or

recession,

inflation,

and interest rates affect

pricing decisions because

they affect both the

costs of producing

a

product and consumer perceptions of the

product's price and value.

The company must

also

consider

what impact its prices will

have on other parties in its

environment. How will

resellers

react

to various prices? The company

should set prices that

give resellers a fair

profit, encourage

their

support, and help them to

sell the product

effectively. The government is

another important

external

influence on pricing decisions.

Finally, social concerns may

have to be taken into account.

In

setting prices, a company's short-term

sales, market share, and

profit goals may have to

be

tempered

by broader societal

considerations.

118

Table of Contents:

- PRINCIPLES OF MARKETING:Introduction of Marketing, How is Marketing Done?

- ROAD MAP:UNDERSTANDING MARKETING AND MARKETING PROCESS

- MARKETING FUNCTIONS:CUSTOMER RELATIONSHIP MANAGEMENT

- MARKETING IN HISTORICAL PERSPECTIVE AND EVOLUTION OF MARKETING:End of the Mass Market

- MARKETING CHALLENGES IN THE 21st CENTURY:Connections with Customers

- STRATEGIC PLANNING AND MARKETING PROCESS:Setting Company Objectives and Goals

- PORTFOLIO ANALYSIS:MARKETING PROCESS,Marketing Strategy Planning Process

- MARKETING PROCESS:Analyzing marketing opportunities, Contents of Marketing Plan

- MARKETING ENVIRONMENT:The Company’s Microenvironment, Customers

- MARKETING MACRO ENVIRONMENT:Demographic Environment, Cultural Environment

- ANALYZING MARKETING OPPORTUNITIES AND DEVELOPING STRATEGIES:MIS, Marketing Research

- THE MARKETING RESEARCH PROCESS:Developing the Research Plan, Research Approaches

- THE MARKETING RESEARCH PROCESS (Continued):CONSUMER MARKET

- CONSUMER BUYING BEHAVIOR:Model of consumer behavior, Cultural Factors

- CONSUMER BUYING BEHAVIOR (CONTINUED):Personal Factors, Psychological Factors

- BUSINESS MARKETS AND BUYING BEHAVIOR:Market structure and demand

- MARKET SEGMENTATION:Steps in Target Marketing, Mass Marketing

- MARKET SEGMENTATION (CONTINUED):Market Targeting, How Many Differences to Promote

- Product:Marketing Mix, Levels of Product and Services, Consumer Products

- PRODUCT:Individual product decisions, Product Attributes, Branding

- PRODUCT:NEW PRODUCT DEVELOPMENT PROCESS, Idea generation, Test Marketing

- NEW PRODUCT DEVELOPMENT:PRODUCT LIFE- CYCLE STAGES AND STRATEGIES

- KEY TERMS:New-product development, Idea generation, Product development

- Price the 2nd P of Marketing Mix:Marketing Objectives, Costs, The Market and Demand

- PRICE THE 2ND P OF MARKETING MIX:General Pricing Approaches, Fixed Cost

- PRICE THE 2ND P OF MARKETING MIX:Discount and Allowance Pricing, Segmented Pricing

- PRICE THE 2ND P OF MARKETING MIX:Price Changes, Initiating Price Increases

- PLACE- THE 3RD P OF MARKETING MIX:Marketing Channel, Channel Behavior

- LOGISTIC MANAGEMENT:Push Versus Pull Strategy, Goals of the Logistics System

- RETAILING AND WHOLESALING:Customer Service, Product Line, Discount Stores

- KEY TERMS:Distribution channel, Franchise organization, Distribution center

- PROMOTION THE 4TH P OF MARKETING MIX:Integrated Marketing Communications

- ADVERTISING:The Five M’s of Advertising, Advertising decisions

- ADVERTISING:SALES PROMOTION, Evaluating Advertising, Sales Promotion

- PERSONAL SELLING:The Role of the Sales Force, Builds Relationships

- SALES FORCE MANAGEMENT:Managing the Sales Force, Compensating Salespeople

- SALES FORCE MANAGEMENT:DIRECT MARKETING, Forms of Direct Marketing

- DIRECT MARKETING:PUBLIC RELATIONS, Major Public Relations Decisions

- KEY TERMS:Public relations, Advertising, Catalog Marketing

- CREATING COMPETITIVE ADVANTAGE:Competitor Analysis, Competitive Strategies

- GLOBAL MARKETING:International Trade System, Economic Environment

- E-MARKETING:Internet Marketing, Electronic Commerce, Basic-Forms

- MARKETING AND SOCIETY:Social Criticisms of Marketing, Marketing Ethics

- MARKETING:BCG MATRIX, CONSUMER BEHAVIOR, PRODUCT AND SERVICES

- A NEW PRODUCT DEVELOPMENT:PRICING STRATEGIES, GLOBAL MARKET PLACE