|

Microeconomics

ECO402

VU

Lesson

40

OLIGOPOLY

Characteristics

Small number of

firms

Product

differentiation may or may

not exist

Barriers to

entry

Examples

Automobiles

Steel

Aluminum

Petrochemicals

Electrical

equipment

Computers

The

barriers to entry

are:

Natural

∑

Scale

economies

∑

Patents

∑

Technology

∑

Name

recognition

Strategic

action

∑

Flooding

the market

∑

Controlling an

essential input

Management

Challenges

Strategic

actions

Rival

behavior

Question

What are

the possible rival responses

to a 10% price cut by an

automobile company?

Equilibrium

in an Oligopolistic Market

In perfect

competition, monopoly, and

monopolistic competition the

producers did not

have

to consider a rival's response

when choosing output and

price.

In oligopoly

the producers must consider

the response of competitors

when choosing

output

and price.

Defining

Equilibrium

∑

Firms

doing the best they

can and have no incentive to

change their output or

price

∑

All firms

assume competitors are

taking rival decisions into

account.

Nash

Equilibrium

Each firm is

doing the best it can

given what its competitors

are doing.

The

Cournot Model

Duopoly

∑

Two

firms competing with each

other

∑

Homogenous

good

182

Microeconomics

ECO402

VU

∑

The output

of the other firm is assumed

to be fixed

Firm

1's Output

Decision

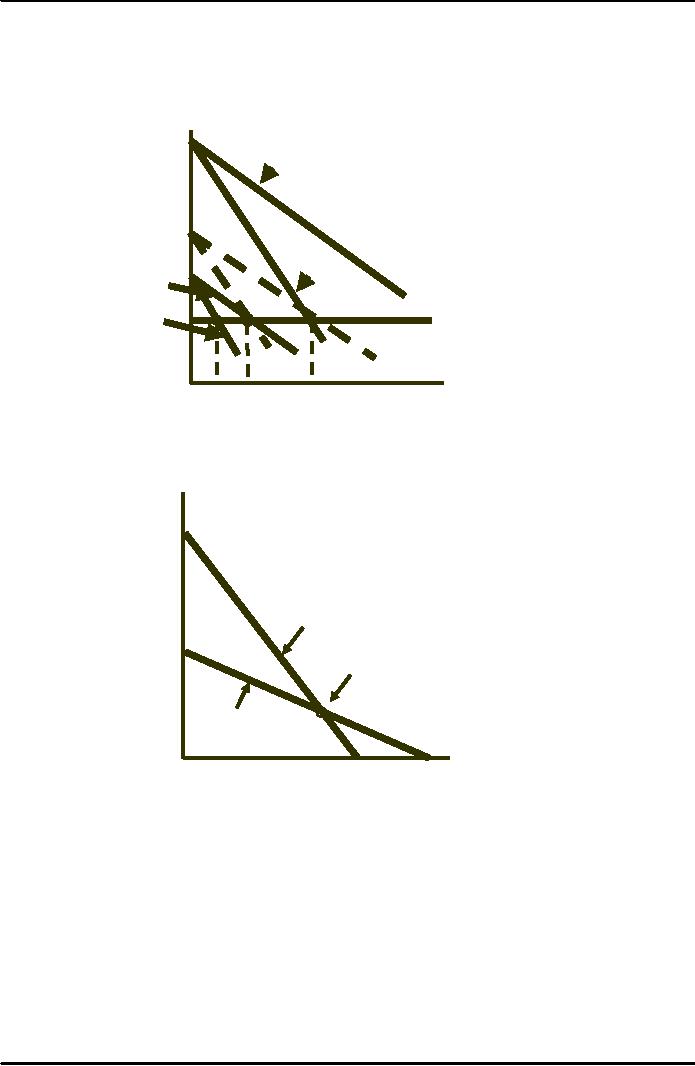

If

Firm 1 thinks Firm 2

will

produce

nothing, its demand

P1

D1(0)

curve,

D1(0),

is the market

demand

curve.

If

Firm 1 thinks Firm 2 will

produce

50

units, its demand curve

is

shifted

to the left by this

amount.

If

Firm 1 thinks Firm 2 will

produce

75

units, its demand curve

is

MR1(0)

shifted

to the left by this

amount.

D1(75)

MR1(75)

MC1

What

is the output of Firm

1

MR1(50)

D1(50)

if

Firm 2 produces 100

units?

12.

5

25

Q1

The

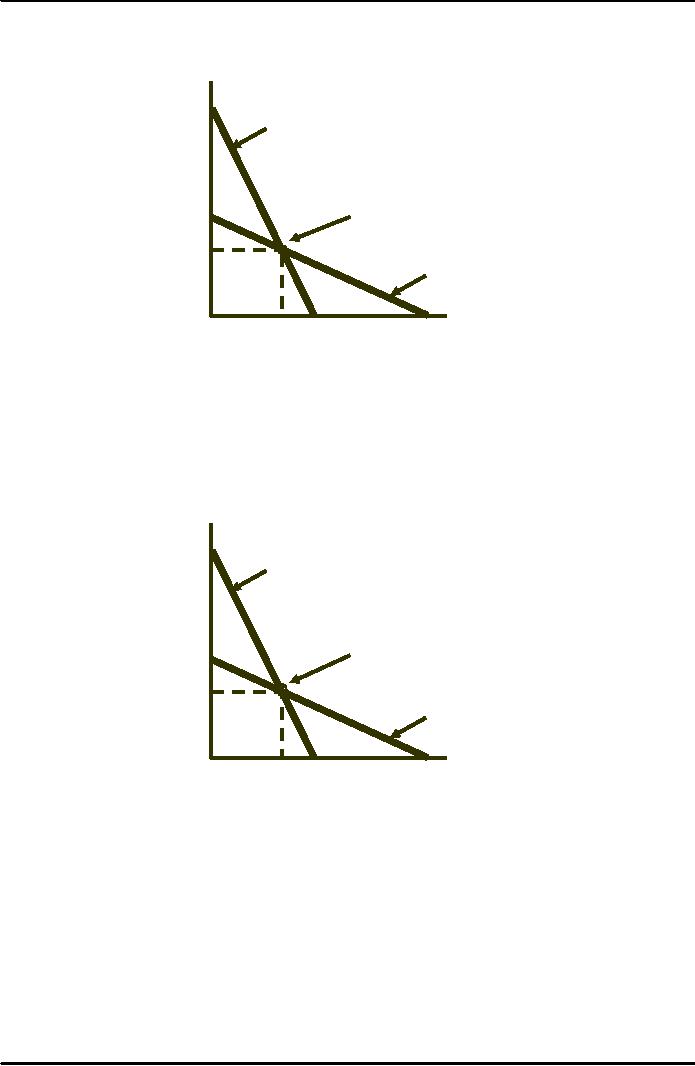

Reaction Curve

A firm's

profit-maximizing output is a decreasing

schedule of the expected

output of Firm

2.

Firm

1's reaction curve shows

how much

Q1

it

will produce as a function of

how much

it

thinks Firm 2 will produce.

The x's

100

correspond

to the previous

model.

Firm

2's reaction curve shows

how

much

itwill produce as a function

of

75

how

much

Firm

2's Reaction

Curve

Q*2(Q2)

In

Cournot equilibrium,

50

x

each

firm correctly

Cournot

assumes

how much its

Equilibrium

competitors

will produce

x

and

thereby maximize its

25

Firm

1's Reaction

own

profits.

x

Curve

Q*1(Q2)

x

Q2

25

50

75

100

Questions

1)

If the firms are not

producing at the Cournot

equilibrium, will they

adjust until the

Cournot

equilibrium

is reached?

2)

When is it rational to assume

that its competitor's output

is fixed?

The

linear Demand Curve

An Example of

the Cournot

Equilibrium

∑

Duopoly

Market

demand is P

= 30

- Q

where

Q =

Q1 +

Q2

MC1

= MC2 = 0

183

Microeconomics

ECO402

VU

Duopoly

Example

The

demand curve is P

= 30

-

3

Q

and

Q1

Firm

2's

both

firms have 0 marginal

Reaction

cost.

Curve

Cournot

1

1

Firm

1's

Reaction

Q2

1

1

3

Profit

Maximization with

Collusion

Collusion

Curve

∑

Q1 +

Q2 = 15

Shows all pairs of

output Q

and

Q2 that

maximizes total

profits

1

∑

Q1 =

Q2 = 7.5

Less output and

higher profits than the

Cournot equilibrium

The

demand curve is P

= 30

-

3

Q

and

Q1

Firm

2's

both

firms have 0 marginal

Reaction

Curve

cost.

Cournot

1

E

ilib

i

1

Firm

1's

Reaction

Curve

Q2

1

1

3

0

First

Mover Advantage- The

Stackelberg Model

Assumptions

One firm

can set output

first

MC = 0

Market demand

is P = 30 - Q where Q = total

output

Firm 1 sets

output first and Firm 2

then makes an output

decision

Firm

1

Must consider

the reaction of Firm

2

Firm

2

184

Microeconomics

ECO402

VU

Takes

Firm 1's output as fixed

and therefore determines

output with the

Cournot

reaction

curve

Firm

1

Choose

Q1 so

that:

MR

=

MC,

MC = 0

therefore MR =

0

R1 =

PQ1 =

30Q1 -

Q12 -

Q2Q1

Conclusion

Firm 1's

output is twice as large

as

firm

2's

Firm 1's

profit is twice as large

as

firm

2's

Price

Competition

Competition

in an oligopolistic industry may

occur with price instead of

output.

The

Bertrand Model is used to

illustrate price competition in an

oligopolistic industry

with

homogenous

goods.

Bertrand

Model

Assumptions

∑

Homogenous

good

Market

demand is P = 30 - Q where

Q

= Q1 +

Q2

∑

∑

MC

= $3 for both firms and

MC1 =

MC2 = $3

Assumptions

∑

The Cournot

equilibrium:

P

=

$12

ö

for

both firms = $81

∑

Assume the

firms compete with price,

not quantity.

How will

consumers respond to a price

differential?

∑

The Nash

equilibrium:

P = MC; P = P = $3

1

2

Q = 27;

Q

& Q = 13.5

1

2

ö

=

0

Price

Competition with Differentiated

Products

Market shares

are now determined not

just by prices, but by

differences in the

design,

performance,

and durability of each

firm's product.

Differentiated

Products

Assumptions

∑

Duopoly

∑

FC =

$20

∑

VC = 0

Firm

1's demand is Q1 = 12 - 2P1

+ P2

∑

∑

Firm 2's

demand is Q2

= 12 - 2P1 + P1

P

and

P2 are prices firms 1

and 2 charge

respectively

1

185

Microeconomics

ECO402

VU

Q

and

Q2 are

the resulting quantities

they sell

1

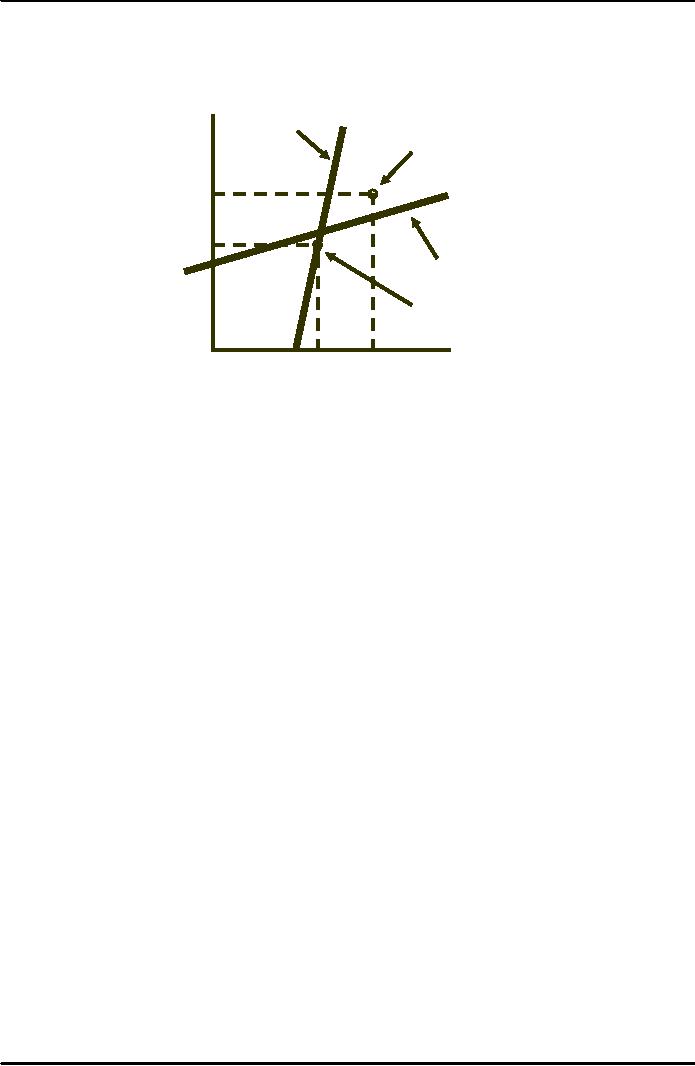

Nash

Equilibrium in Prices

P1

Firm

2's Reaction

Curve

Collusive

Equilibrium

$6

$4

Firm

1's Reaction

Curve

Nash

Equilibrium

P2

$6

$4

186

Table of Contents:

- ECONOMICS:Themes of Microeconomics, Theories and Models

- Economics: Another Perspective, Factors of Production

- REAL VERSUS NOMINAL PRICES:SUPPLY AND DEMAND, The Demand Curve

- Changes in Market Equilibrium:Market for College Education

- Elasticities of supply and demand:The Demand for Gasoline

- Consumer Behavior:Consumer Preferences, Indifference curves

- CONSUMER PREFERENCES:Budget Constraints, Consumer Choice

- Note it is repeated:Consumer Preferences, Revealed Preferences

- MARGINAL UTILITY AND CONSUMER CHOICE:COST-OF-LIVING INDEXES

- Review of Consumer Equilibrium:INDIVIDUAL DEMAND, An Inferior Good

- Income & Substitution Effects:Determining the Market Demand Curve

- The Aggregate Demand For Wheat:NETWORK EXTERNALITIES

- Describing Risk:Unequal Probability Outcomes

- PREFERENCES TOWARD RISK:Risk Premium, Indifference Curve

- PREFERENCES TOWARD RISK:Reducing Risk, The Demand for Risky Assets

- The Technology of Production:Production Function for Food

- Production with Two Variable Inputs:Returns to Scale

- Measuring Cost: Which Costs Matter?:Cost in the Short Run

- A Firmís Short-Run Costs ($):The Effect of Effluent Fees on Firmsí Input Choices

- Cost in the Long Run:Long-Run Cost with Economies & Diseconomies of Scale

- Production with Two Outputs--Economies of Scope:Cubic Cost Function

- Perfectly Competitive Markets:Choosing Output in Short Run

- A Competitive Firm Incurring Losses:Industry Supply in Short Run

- Elasticity of Market Supply:Producer Surplus for a Market

- Elasticity of Market Supply:Long-Run Competitive Equilibrium

- Elasticity of Market Supply:The Industryís Long-Run Supply Curve

- Elasticity of Market Supply:Welfare loss if price is held below market-clearing level

- Price Supports:Supply Restrictions, Import Quotas and Tariffs

- The Sugar Quota:The Impact of a Tax or Subsidy, Subsidy

- Perfect Competition:Total, Marginal, and Average Revenue

- Perfect Competition:Effect of Excise Tax on Monopolist

- Monopoly:Elasticity of Demand and Price Markup, Sources of Monopoly Power

- The Social Costs of Monopoly Power:Price Regulation, Monopsony

- Monopsony Power:Pricing With Market Power, Capturing Consumer Surplus

- Monopsony Power:THE ECONOMICS OF COUPONS AND REBATES

- Airline Fares:Elasticities of Demand for Air Travel, The Two-Part Tariff

- Bundling:Consumption Decisions When Products are Bundled

- Bundling:Mixed Versus Pure Bundling, Effects of Advertising

- MONOPOLISTIC COMPETITION:Monopolistic Competition in the Market for Colas and Coffee

- OLIGOPOLY:Duopoly Example, Price Competition

- Competition Versus Collusion:The Prisonersí Dilemma, Implications of the Prisoners

- COMPETITIVE FACTOR MARKETS:Marginal Revenue Product

- Competitive Factor Markets:The Demand for Jet Fuel

- Equilibrium in a Competitive Factor Market:Labor Market Equilibrium

- Factor Markets with Monopoly Power:Monopoly Power of Sellers of Labor