|

NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES |

| << THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI |

| NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…) >> |

Macroeconomics

ECO 403

VU

LESSON

07

NATIONAL

INCOME: WHERE IT COMES FROM AND WHERE IT

GOES

Key

Questions to be addressed

·

What

determines the economy's

total output/income

·

How

the prices of the factors of

production are

determined

·

How

total income is

distributed

·

What

determines the demand for

goods and services

·

How

equilibrium in the goods

market is achieved

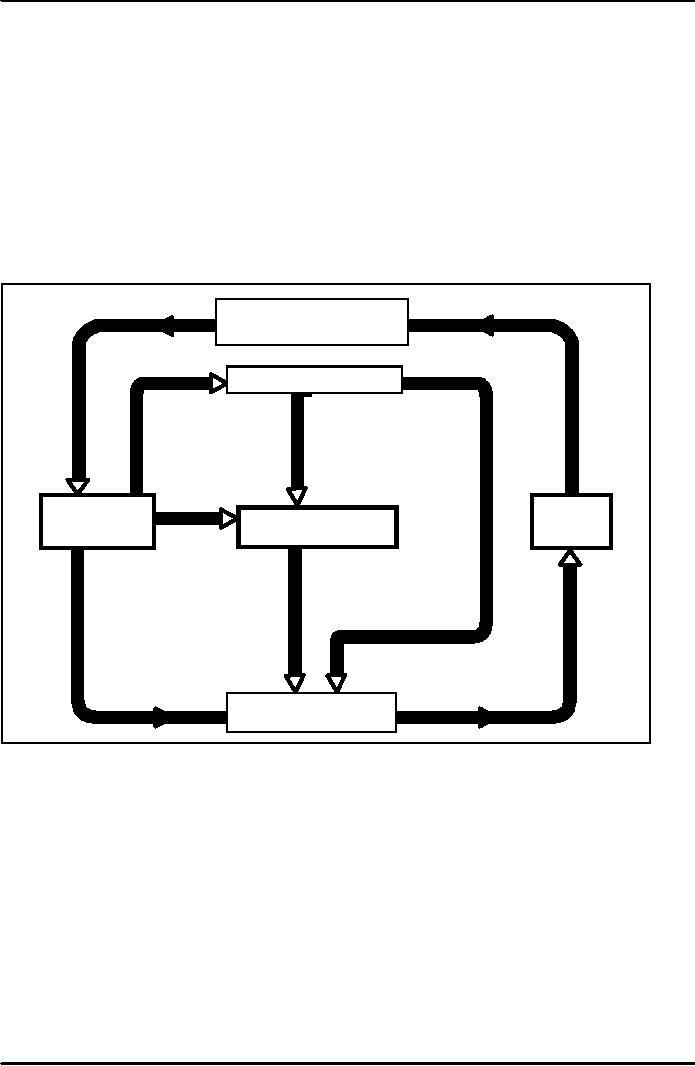

Income

Factor

payments

Markets

for Factors of

Production

Financial

Markets

Private

Savings

Govt.

Deficit

Taxes

Households

Firms

Government

Govt.

Purchases

Investments

Consumption

Firm

revenues

Markets

for Goods

and

Services

OUTLINE

OF MODEL

(A

closed economy, market-clearing

model)

Supply

side

·

factor

markets (supply, demand,

price)

·

determination

of output/income

Demand

side

·

determinants

of C,

I,

and G

19

Macroeconomics

ECO 403

VU

Equilibrium

·

goods

market

·

loanable

funds market

Factors

of production

K

= capital, tools, machines,

and structures used in

production

L

= labor, the physical and

mental efforts of

workers

The

production function

·

denoted

Y = F (K, L)

·

shows

how much output (Y ) the

economy can produce

from

K

units of capital and L units

of labor.

·

reflects

the economy's level of

technology.

·

exhibits

constant returns to

scale.

Assumptions

of the model

Technology

is fixed.

The

economy's supplies of capital

and labor are fixed

at

K=K

and

L=L

Determining

GDP

Output

is determined by the fixed

factor supplies and the

fixed state

of

technology:

Y

= F (K, L)

The

distribution of national

income

·

determined

by factor

prices,

the

prices per unit that

firms pay for the

factors of production.

·

The

wage

is

the price of L,

the

rental

rate is the

price of K.

Notation

W

= Nominal

Wage

R

= Nominal

Rental Rate

P

= Price

of Output

W

/P

=

Real Wage (Measured in Units

of Output)

R

/P

=

Real Rental Rate

20

Macroeconomics

ECO 403

VU

How

factor prices are

determined

·

Factor

prices are determined by

supply and demand in factor

markets.

·

Recall:

Supply of each factor is

fixed.

·

What

about demand?

Demand

for labor

·

Assume

markets are

competitive:

each

firm takes W, R, and P as

given

·

Basic

idea:

A

firm hires each unit of

labor

if

the cost does not

exceed the benefit.

Cost

=

real wage

Benefit

= marginal product of

labor

Marginal

product of labor (MPL)

def:

The

extra output the firm

can produce using an

additional unit of labor

(holding other inputs

fixed):

MPL

= F

(K,

L

+1)

F (K,

L)

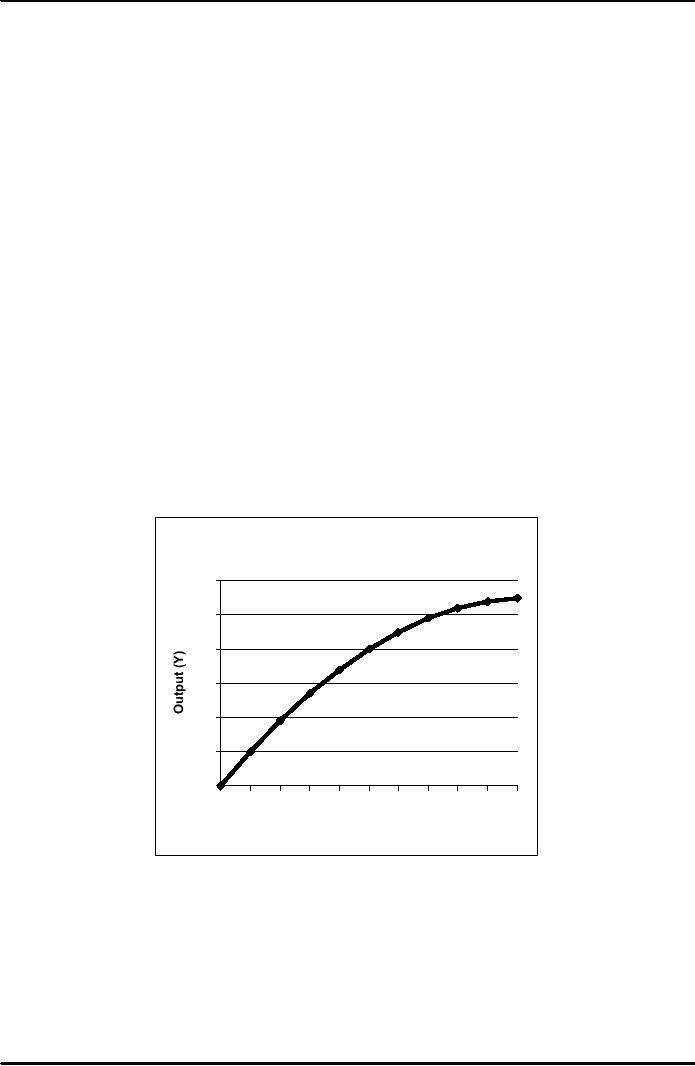

Production

Function

Production

function

60

50

40

30

20

10

0

0

1

2

3

4

5

6

7

8

9

10

Labor

(L)

21

Macroeconomics

ECO 403

VU

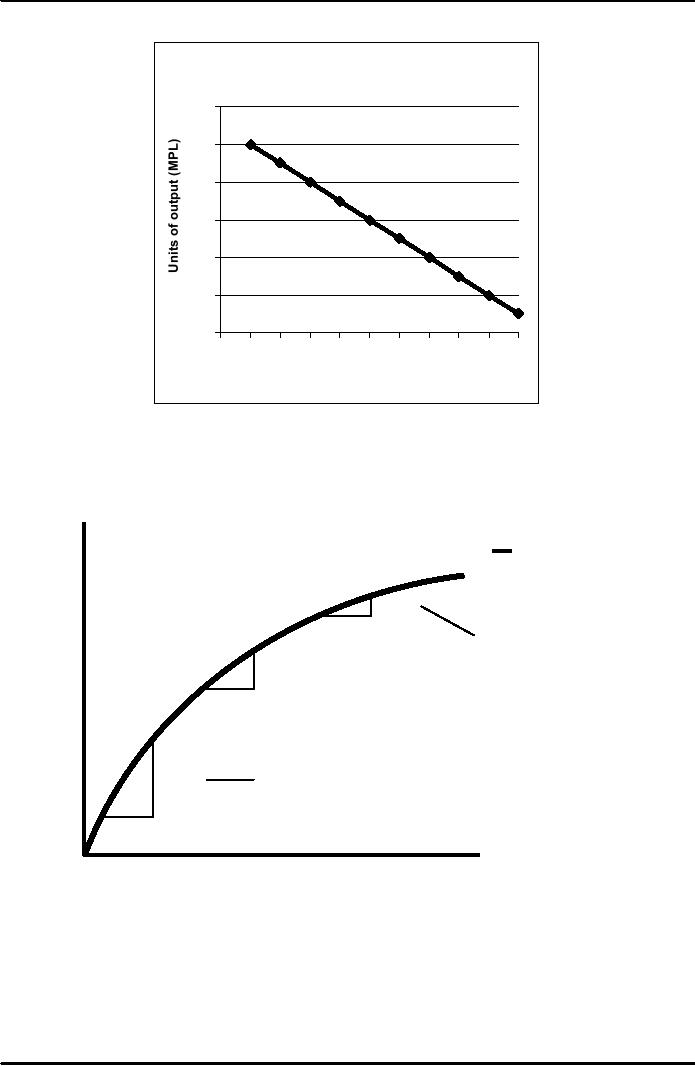

Marginal

Product of Labor

M

arginal Product of Labor (M

PL)

12

10

8

6

4

2

0

0

1

2

3

4

5

6

7

8

9

10

Labor

(L)

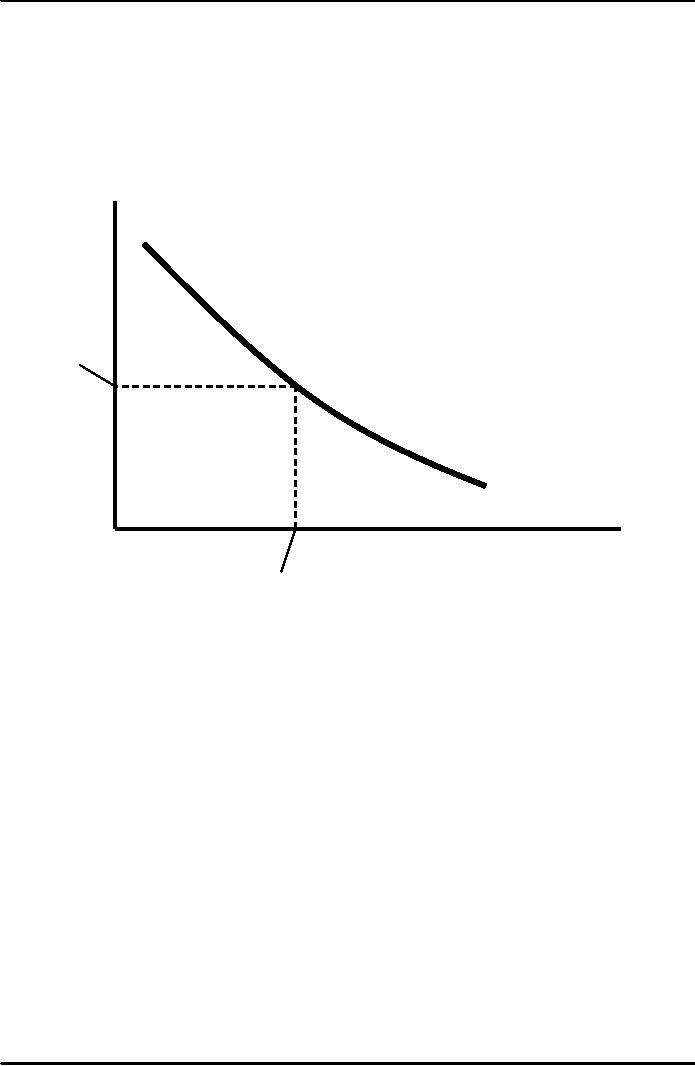

The

MPL and the production

function

Y

Output

F(K,L)

MPL

1

As

more labor is

added,

MPL

↓

MPL

1

Slope

of the production

MPL

function

equals MPL

1

L

Labor

22

Macroeconomics

ECO 403

VU

Diminishing

marginal returns

·

As

a factor input is increased,

its marginal product falls

(other things equal).

·

Intuition:

↑L while

holding K fixed

⇒

Fewer

machines per worker

⇒

Lower

productivity

MPL

and

the demand for

labor

Units

of

output

Each

firm hires labor up to the

point

where

MPL =

W/P

Real

wage

MPL,

Labor

demand

Units

of labor, L

Quantity

of labor

demanded

Determining

the rental rate

We

have just seen that MPL =

W/P

The

same logic shows that MPK =

R/P :

·

Diminishing

returns to capital: MPK ↓

as K

↑

·

MPK

curve is the firm's demand

curve for renting

capital.

·

Firms

maximize profits by choosing K

such that MPK = R/P .

23

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand