|

Macroeconomics

ECO 403

VU

LESSON

10

NATIONAL

INCOME: WHERE IT COMES FROM AND WHERE IT

GOES

(Continued...)

The

Role of Govt.

·

If

the Government:

·

increases

defense

spending:

ΔG

> 0

·

big

tax cuts: ΔT < 0

·

According

to our model, both policies

reduce national

saving:

S

= Y C(Y - T) - G

↑

G

=> ↓

S

↓

T =>

↑ C => ↓

S

The

Role of Govt.

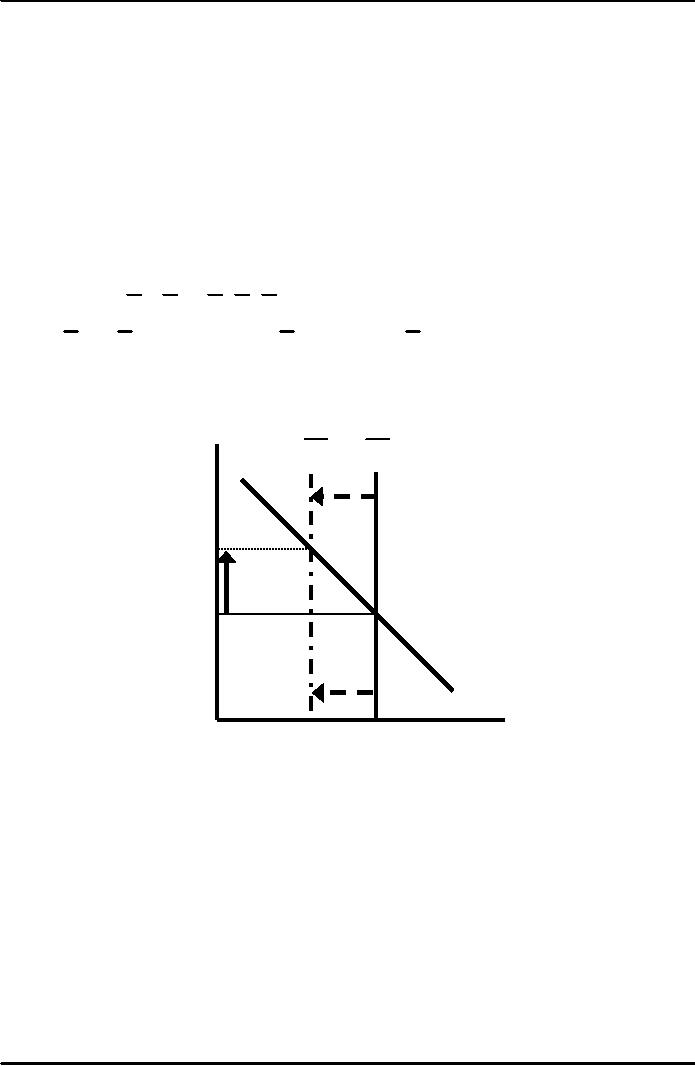

r

S2

S1

r2

r1

I

(r )

I2

I1

S,

I

1.

The increase in the deficit

reduces saving...

2.

...this causes the real

interest rate to

rise...

3.

...this reduces the level of

investment.

32

Macroeconomics

ECO 403

VU

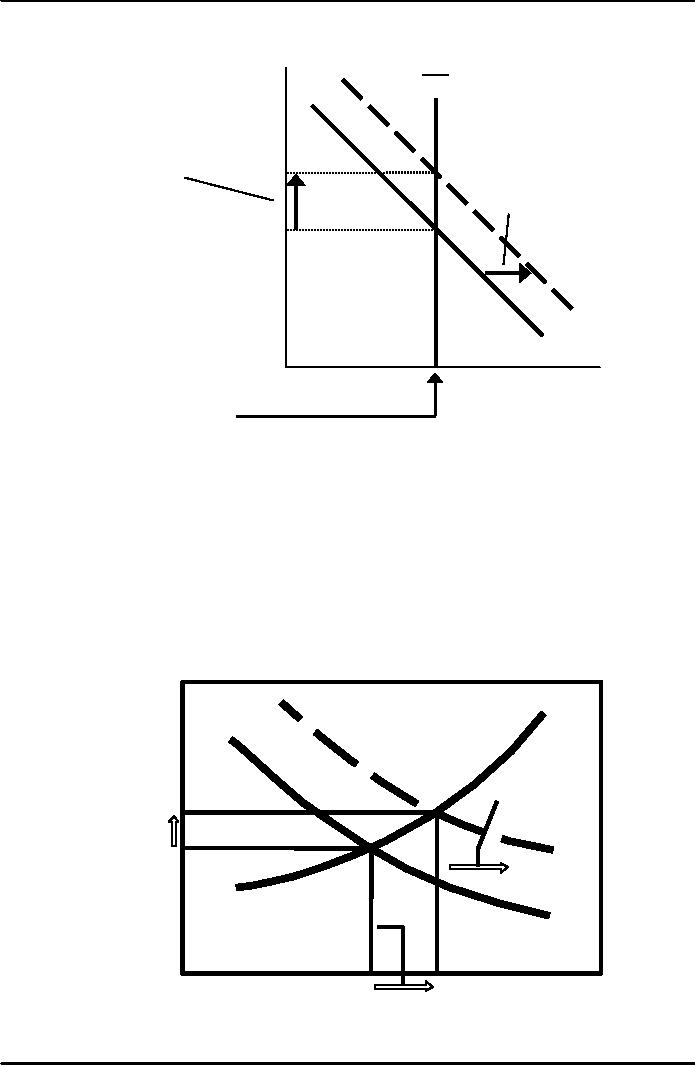

An

increase in investment

demand

r

S

An

increase

...raises

the

in

desired

interest

rate.

r2

investment...

r1

But

the equilibrium level

of

investment

cannot increase

I2

because

the supply of

I1

loanable

funds

is fixed.

S,

I

Saving

and the interest

rate

·

Why might

saving depend on r?

·

How would

the results of an increase in

investment demand be

different?

Would r

rise as much?

Would the

equilibrium value of I

change?

Rise

in investment demand when

saving depends on interest

rate

Real

interest

r

rate,

S

(r)

1.

An increase

in

desired

B

2.

.

. .

raises

investment

the

interest

A

rate

I2

3.

.

.

and raises

I1

equilibrium

investment

and

saving.

Investment,

Saving,

I,

S

33

Macroeconomics

ECO 403

VU

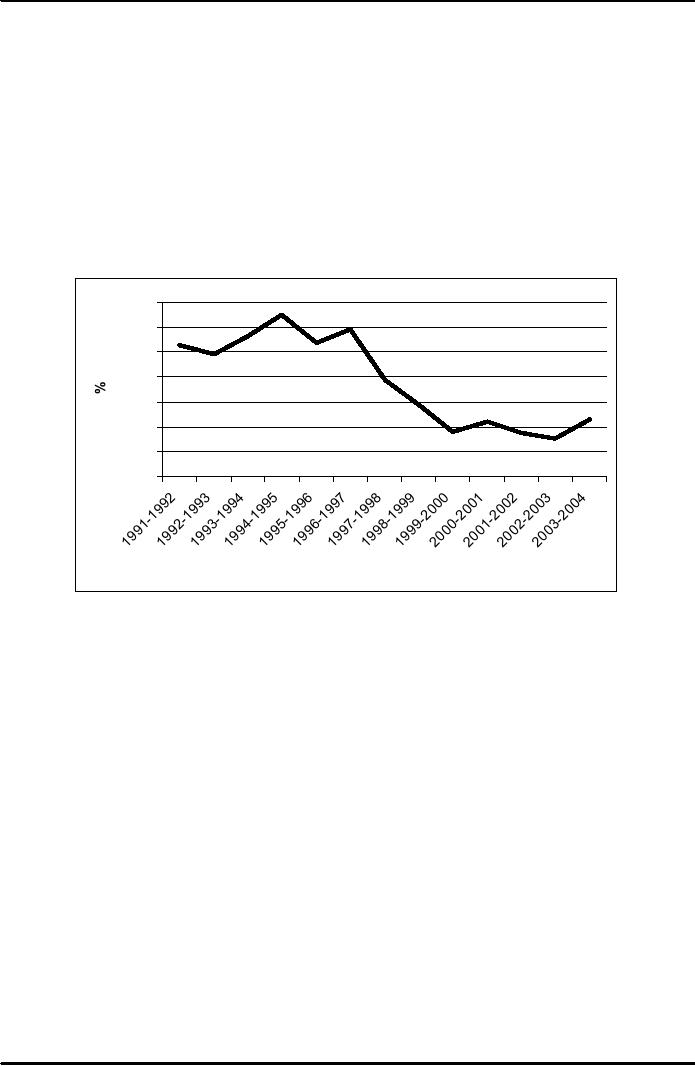

The

classical theory of

inflation

·

Inflation

Causes

Effects

Social

costs

·

"Classical" --

assumes prices are flexible

& markets clear.

·

Applies to the

long run.

Inflation

Rate in Pakistan

14

12

10

8

6

4

2

0

Years

The

connection between money and

prices

·

Inflation

rate = the percentage

increase

in

the average level of

prices.

·

Price

= amount of money required

to

buy

a good.

·

Because

prices are defined in terms

of money, we need to consider

the nature of

money,

the supply of money, and

how it is controlled.

MONEY:

definition

Money

is the stock of assets that

can be readily used to make

transactions.

Money:

functions

1.

Medium of exchange

we

use it to buy stuff

2.

Unit of account

the

common unit by which

everyone measures prices and

values

3.

Store of value

transfers

purchasing power from the

present to the future

34

Macroeconomics

ECO 403

VU

The

ease with which money is

converted into other

things-- goods and

services-- is sometimes

called

money's liquidity.

Money:

Types

1.

Fiat money

·

has

no intrinsic value

·

example:

the paper currency we

use

2.

Commodity money

·

has

intrinsic value

·

examples:

gold coins,

Which

of these is money?

a.

Currency

b.

Checks

c.

Deposits

in checking accounts (called

demand deposits)

d.

Credit

cards

e.

Certificates

of deposit (called time

deposits)

The

money supply & monetary

policy

·

The

money supply is the quantity

of money available in the

economy.

·

Monetary

policy is the control over

the money supply.

The

Central Bank

·

Monetary

policy is conducted by a country's

central bank.

·

In

Pakistan, the central bank

is called State Bank of

Pakistan (SBP).

To

expand the Money

Supply:

·

The

State Bank buys Treasury

Bills and

pays for them with

new money.

To

reduce the Money

Supply:

·

The

State Bank sells Treasury

Bills and

receives the existing

dollars and then

destroys

them.

State

Bank controls the money

supply in three ways.

·Open

Market Operations (buying

and selling Treasury

bills).

·Δ

Reserve

requirements.

·

Δ

Discount

rate which

commercial banks pay to

borrow from the

State

Bank.

35

Macroeconomics

ECO 403

VU

The

Quantity Theory of

Money

·

A

simple theory linking the

inflation rate to the growth

rate of the money

supply.

·

Begins

with a concept called

"velocity"...

Velocity

·

Basic

concept: the rate at which

money circulates

·

Definition:

the number of times the

average rupee bill changes

hands in a given time

period

·

Example:

·

Rs50

billion in transactions

·

Money

supply = Rs10 billion

·

The

average rupee is used in

five transactions

·

So,

velocity = 5

·

This

suggests the following

definition:

V=T/M

where

V

= velocity

T

= value of all

transactions

M

= money supply

Velocity

·

Use

nominal GDP as a proxy for

total transactions.

Then,

V

= (P x

Y) /

M

The

Quantity Equation

·

The

quantity equation

M

×V

= P ×Y

follows

from the preceding

definition of velocity.

It is an

identity:

it

holds by definition of the

variables.

36

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand