|

Measurement and Review of the Entityís Financial Performance |

| << Risk Assessment Procedures & Sources of Information |

| Definition & Components of Internal Control >> |

Fundamentals

of Auditing ACC 311

VU

Lesson

14

UNDERSTANDING

THE ENTITY AND ITS ENVIRONMENT

AND

ASSESSING THE RISKS OF MATERIAL

MISSTATEMENT

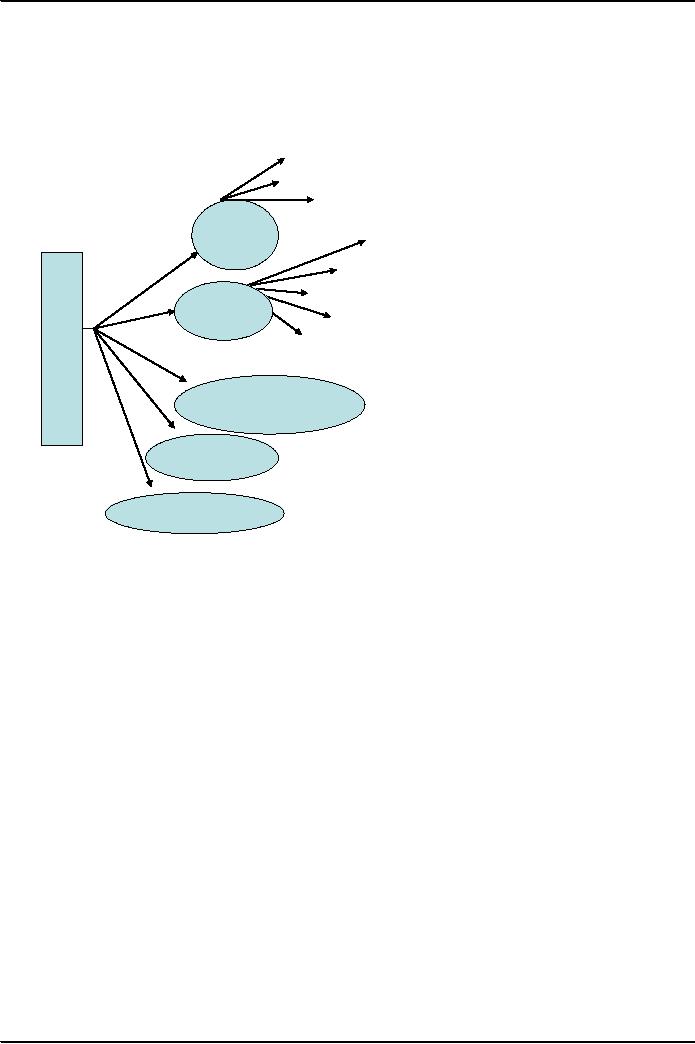

Inquiries

Analytical

procedures

Observation &

Inspection

Risk

assessment

External

Factors

procedures

How

Nature of

entity

to

Objectives

and strategies and the

related business

risks

Understanding

obta

Measurement &

review of financial performance

consists

of:

in

Internal

Control

und

erst

andi

Assessing

the risk of material

misstatement

ng

Communication

Documentation

d)

Measurement

and Review of the Entity's

Financial Performance

The

auditor should obtain an understanding of the

measurement and review of the entity's

financial

performance.

Performance measures, internal

and external, some times

create pressures on the

entity

and motivate management to

misstate the financial

statements.

Internally

generated information may

highlight entity's position vis-ŗ-vis,

its competitors and

reports

from credit rating agencies

and analysts may provide

information useful to the auditors

understanding

of the entity and its

environments.

Examples

of matters an auditor may

consider include the following:

∑ Key

ratios and operating

statistics

∑ Key

performance indicators

∑ Employee

performance measures and incentive

compensation policies.

∑ Trends

∑ Use

of forecasts, budgets and

variance analysis

∑ Analyst

reports and credit rating reports

∑ Competitor

analysis

∑ Period

on-period financial performance

(revenue growth, profitability

leverage)

e)

Internal

Control

Understanding of

Internal Control is used by the

auditor to identify types of

potential

misstatements

and to consider factors that

affect the risks of material

misstatements and design

the

nature,

timing and extent of further

audit procedures.

50

Fundamentals

of Auditing ACC 311

VU

Definition

of internal control

Internal

controls is the process designed and

effected by those charged

with governance,

management,

and other personnel to

provide reasonable assurance about the

achievement of the

entity's

objectives with regard to

reliability of financial reporting,

effectiveness and efficiency of

operations

and compliance with

applicable laws and

regulations. It follows that

internal control is

designed

and implemented to address identified

business risks that threaten the

achievement of any

of

these objectives.

Components of

internal control

(a)

The

control environment

(b)

The

entity's risk assessment process

(c)

The

information system, including the

related business processes relevant to

financial

reporting

and communication.

(d)

Control

activities

(e)

Monitoring

of controls

51

Table of Contents:

- AN INTRODUCTION

- AUDITORSí REPORT

- Advantages and Disadvantages of Auditing

- OBJECTIVE AND GENERAL PRINCIPLES GOVERNING AN AUDIT OF FINANCIAL STATEMENTS

- What is Reasonable Assurance

- LEGAL CONSIDERATION REGARDING AUDITING

- Appointment, Duties, Rights and Liabilities of Auditor

- LIABILITIES OF AN AUDITOR

- BOOKS OF ACCOUNT & FINANCIAL STATEMENTS

- Contents of Balance Sheet

- ENTITY AND ITS ENVIRONMENT AND ASSESSING THE RISKS OF MATERIAL MISSTATEMENT

- Business Operations

- Risk Assessment Procedures & Sources of Information

- Measurement and Review of the Entityís Financial Performance

- Definition & Components of Internal Control

- Auditing ASSIGNMENT

- Benefits of Internal Control to the entity

- Flow Charts and Internal Control Questionnaires

- Construction of an ICQ

- Audit evidence through Audit Procedures

- SUBSTANTIVE PROCEDURES

- Concept of Audit Evidence

- SUFFICIENT APPROPRIATE AUDIT EVIDENCE AND TESTING THE SALES SYSTEM

- Control Procedures over Sales and Debtors

- Control Procedures over Purchases and Payables

- TESTING THE PURCHASES SYSTEM

- TESTING THE PAYROLL SYSTEM

- TESTING THE CASH SYSTEM

- Controls over Banking of Receipts

- Control Procedures over Inventory

- TESTING THE NON-CURRENT ASSETS

- VERIFICATION APPROACH OF AUDIT

- VERIFICATION OF ASSETS

- LETTER OF REPRESENTATION VERIFICATION OF LIABILITIES

- VERIFICATION OF EQUITY

- VERIFICATION OF BANK BALANCES

- VERIFICATION OF STOCK-IN-TRADE AND STORE & SPARES

- AUDIT SAMPLING

- STATISTICAL SAMPLING

- CONSIDERING THE WORK OF INTERNAL AUDITING

- AUDIT PLANNING

- PLANNING AN AUDIT OF FINANCIAL STATEMENTS

- Audits of Small Entities

- AUDITORíS REPORT ON A COMPLETE SET OF GENERAL PURPOSE FINANCIALSTATEMENTS

- MODIFIED AUDITORíS REPORT