|

VU

Lesson

25

LETTER

WRITING

Collection

Letters

No

matter how carefully a company

chooses its credit customers,

there will be times when a

bill goes

unpaid

and steps to collect must be

taken. The problem when

writing a collection letter is

how to get

payment

and at the same time keep a

customer. The writer of a

collection letter wants to

get the money

owed

and maintain goodwill.

Collection

letters, therefore, should be persuasive

rather

than forceful, firm

rather

than demanding. A

fair

and

tactful letter gets better

results than a sarcastic or

abusive one. In fact,

collection letters should be

"you-

oriented";

courteous, considerate, and

concerned about the customer's best

interest.

The

purpose of collection letters

is:

1.

To get the money.

2.

To keep the customer and

future business.

3.

To build goodwill.

2.

The purpose of the collection

process is to maintain Goodwill while

collecting what is owed

3.

Collection is a sensitive

issue

4.

The following practices may

be avoided

1.

Falsely implying that a

lawsuit has been

filed

2.

Contact the debtor's employer or relatives about the

debt

3.

Communication to the other persons that

the person is in debt.

4.

Harassing the debtor

5.

Using abusive or observe

language

6.

Using defamatory language

7.

Intentionally causing mental

stress

8.

Threatening violence

9.

Communicating by postcard (not

confidential enough)

10.

Misrepresenting the legal status of the

debt

11.

Communicating in such a way as to make

the receiver physically

ill

12.

Misrepresenting the message as a government or court

document

13.

Communicating by postcard (not

confidential enough)

14.

Misrepresenting the legal status of the

debt

15.

Communicating in such a way as to make

the receiver physically

ill

16.

Misrepresenting the message as a government or court

document

Right

attitude for successful

collections

∑

Any

emotional reaction on the part of the

debtor may reduce the

chances of recovery.

∑

Successful

collection depends to on the following

factors

∑

Understanding

of Human Nature

∑

Knowledge

of collection policies and

laws

∑

Using

persuasive / positive appeals

effectively

i)

Appeal to fairness &

justice

ii)

Appeal to pride

iii)

Appeal to Goodwill

iv)

Appeal to sympathy

Begin

with assumption that most

people will pay

∑

Give

no impression that you doubt

the honesty of the debtor

∑

Use

a courteous, reasonable tone

but become firmer

∑

And

more demanding during the later

stages of the series

∑

Remain

with the law, don't

harass

∑

Show

understanding and flexibility while

writing delinquent

accounts

∑

Send

collection notices quickly

and regularly

∑

Never

imply in you messages that

payment can be avoid or

postponed.

∑

Retain

goodwill throughout the

series

100

VU

∑

Present

you evidence and stick to

the facts

∑

Persuade

the debtors of the benefit he will

receive by paying

∑

State

clearly the specific action the debtor

must take

Collection

Letter Series

Collection

letters are usually sent in

a series. The first is

mildest and most

understanding, with the

letters

getting gradually more insistent.

The final letter in this

series, when all efforts

have failed, threatens to

turn

the matter over to a lawyer or collection

agency or court of law. Of course, the

tone of any letter in

the

series

will vary, from positive

and mild to negative and

strong, depending upon the past

payment record of

the

particular customer. The intervals

between the letters may also

vary, from ten days to a

month at the

start,

from one to two weeks

later on.

Every

letter

in a collection series should contain

certain information.

1.

The amount owed;

2.

How long the bill is

overdue;

3.

A specific action the customer may

take.

Some

companies also like to include a SALES

APPEAL, even late in the

series, as an extra incentive

for

payment.

The

majority of bills are paid

within ten days of receipt,

with nearly all the rest

being paid within the

month.

Therefore, when a bill is a month

overdue, action is called for.

Still, the collection process

must

begin

gently.

Statement

of Account / Reminder

(The

1st Step)

The

monthly statement reminds the

customer of outstanding bills. If it is ignored, it should be

followed

(about

a week or ten days later) by a

second statement. The second

statement should contain a notice

(in

the

form of a rubber stamp or

sticker) stating "Past Due"

or "Please Remit". An alternative is to include

a

card

or slip with the statement, alerting the

customer to the overdue bill. The notice

could be phrased in

formal,

possibly even simple

language; it is an objective reminder that

does not embarrass the

customer with

too

early a personal

appeal:

Our

records indicate that the balance of

Rs. 4000/- on your account

is now past due. Payment is

requested.

(OR)

Our

records show that your

September payment is more

than a week over-due. If you

have recently

mailed

your cheque for Rs.1548700/- we

thank you. If not, please

send it in quickly.

Stage

2

If

the objective statement and reminder fail

to get results, the collection

process must gradually

become

more

emotional and personal. The

second collection message, however,

should still be friendly. It

should

seek

to excuse the unpaid bill as an

oversight; the tone should convey the

assumption that the

customer

intends

to pay. At this stage, too,

stress on future sales, rather

than on payment.

Consider

the following letter:

Dear

Mr. Bilal,

Enclosed

is a duplicate list of your credit

charges from December

200--. It is sent to you as

a

friendly

reminder that the balance on your

account with us is past due.

Please take a few minutes today

to

send

us your cheque for Rs.

224760.Use the postpaid addressed envelope

provided for your

use.

Yours

truly,

When

a credit customer does not

respond to personal reminder messages,

you can assume that

something is

preventing

the customer from paying. It

may be that the customer is unhappy

with the purchased

merchandise

or is facing financial difficulty.

Whatever the reason may be

for holding up payment, you

want

the

customer to (1) explain why the

payment hasn't been made or

(2) settle the

account.

101

VU

The

following letter illustrates the

approach generally used in

requesting an explanation:

Dear

Mr. Javed,

We

are concerned about your

overdue account. Several reminder notices

have been mailed to

you,

and

we expected to receive your

Rs. 38400/- cheque in the

mail. But so far we

haven't.

There

may be a circumstance beyond your

control that prevents you

from settling this account. If

so,

please

write me about it. I'm

certain we can work out a

payment arrangement after we know what

your

situation

is.

Just

think how good you

will feel, Mr. Javed,

when your account with us

has been paid in

full.

Yours

truly,

Appeal(s)

for Payment

Step

3

The

next collection message is an

appeal to the credit customer to pay.

This is a stern letter, but

calmly

written.

Typical appeals

are to the customer's pride or sense of

fair play.

Your

appeal for payment should

not threaten to take the debtor to

court unless you actually

plan to.

Give

the person another chance to save a

good credit standing by sending

payment before the deadline

usually

10 to 12 days from the date of the

letter. The following letter

is an example of a courteous

request

for

payment which appeals to

both the customer's pride

and his sense of fair

play.

This

letter should stress the customer's

self-interest by pointing out the

importance of prompt payment

and

the dangers of losing credit standing.

The letter should convey the

urgency and seriousness of

the

situation.

Dear

Mr. Naeem,

Your

good credit reputation enabled

you to purchase a Rs.

15000.00 suit from us over

three months

ago.

We were glad to place your

name on our credit list at

that time, and we made it

clear that accounts

are

due

on the 15th of the month following the

purchase. When you bought

the suit, you accepted those

terms.

Your

credit reputation is a valuable asset. We

want you to keep it that way

because of the advantages it

gives

you. You have enjoyed a liberal

extension of time, but to be fair to

our other customers, you

must pay

the

amount that is past due by

March 2.

Won't

you please send us your

check for the said amount

today?

Sincerely,

Dear

Mr. Naeem,

We

are truly at a loss. We cannot

understand why you still

have not cleared your

balance of Rs.

5000/-,

which is now three months

overdue.

Although

you have been a reliable

customer for 5 years, we are

afraid you are placing your

credit

standing

in jeopardy. Only you, by sending us a

check today, can ensure

your reputation and secure

the

continued

convenience of buying on credit.

We

would not like to lose a

valued friend, Mr. Naeem.

Please allow us to keep

serving you.

Sincerely,

Stage

4

Finally,

payment must be demanded.

The threat of legal action or the

intervention of a collection

agency

is sometimes all that will

induce a customer to pay. In

some companies; moreover, an

executive

other

than the credit manager signs this

last letter as a means of

impressing the customer with the

finality of

the

situation. Still, the fourth collection

letter should allow the customer

one last chance to pay

before steps

are

taken.

102

VU

Final

Collection Letter

Dear

Mr. Naeem,

Our

Collection Department has informed me of

their intention to file suit

as you have failed to

answer

any

of our requests for payment

of Rs.5000/-, which is now 4 months

overdue.

Before

taking this action, however, I would like

to make a personal appeal to

your sound business

judgment.

I feel certain that, if you telephone me,

we can devise some means to

settle this matter out

of

court.

Therefore,

I ask that you get in

touch with me by the 25th of the

month so that I may avoid

taking

steps

which neither of us would

like.

Truly

yours,

A

customer may, for example,

offer an excuse or promise

payment; he may make a

partial payment or

request

special arrangements. At this point, the

series would be

inappropriate.

For

instance, if your customer

has owed Rs. 6000/- on

account for two months and

sends you a

cheque

for Rs. 1500/-, you

may send a letter such as

the following:

Dear

Mr. Naeem,

Thank

you for your cheque

for Rs. 1500/-. The

balance remaining on your account is

now Rs. 4500/-

.

Since

you have requested an

extension, we offer you the

following payment plan: Rs.

1500/- by the

15th

of the month for the next

three months.

If

you have another plan in

mind, please telephone my office so

that we may discuss it.

Otherwise, we

will

expect your next cheque

for Rs. 1500/- on September

15.

Sincerely

yours,

First

Reminder after Monthly

Statement

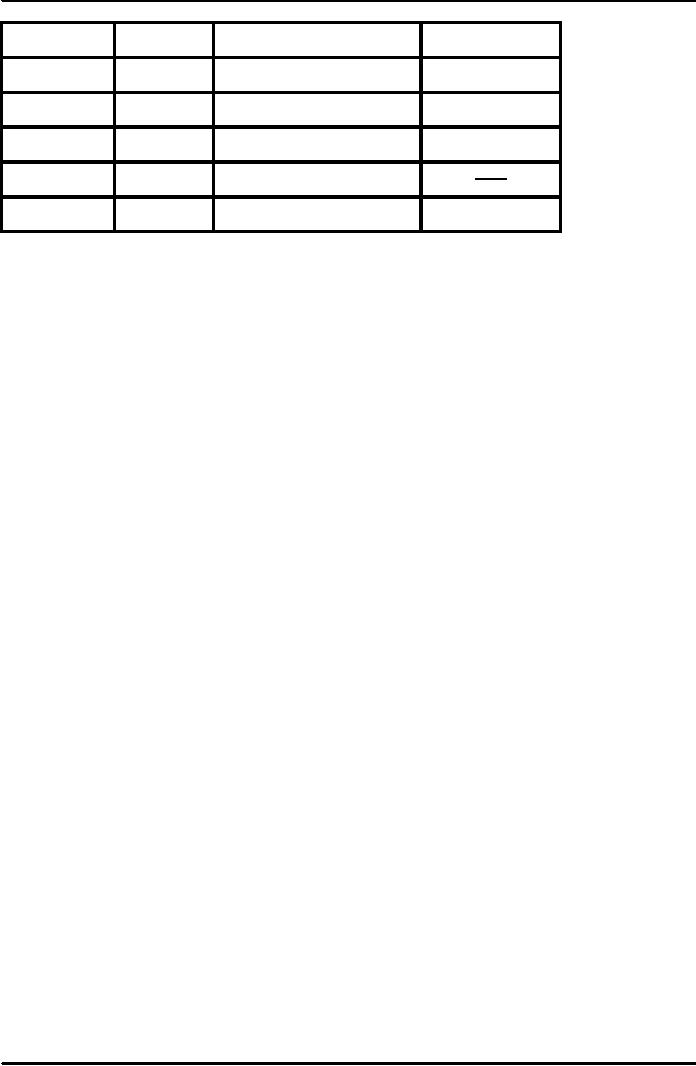

Situation

On

February 3, Nursing Home

purchases supplies and equipment

from Medix. Hospital

Supply

Company

on thirty-day credit terms. Although the

nursing home has been in

operation only a short time,

the

information concerning the enterprise

has been favorable and credit

was granted. A regular

statement is

mailed

on March 10. When no

response is received by March

20, a second statement is

sent.

First

Reminder

MEDIX

HOSPITAL SUPPLY

COMPANY

CUSTOMERSTATEMENT

Nursing

Home

P.OBox888

Lahore

Please

send your cheque.

103

VU

Date

Invoice

#

Items

Amount

February

6

Y-200

Wheel

Chairs

6333

Walkers

2432

Hospital

garments

1800

Blood

Pressure units

2000

Total

Rs.12565

Second

Reminder

Situation

Nursing

Home makes no response to the

first reminder. Ten days later a

second reminder is sent.

Second

Reminder

This

is a copy of the regular statement on

which the following message

appears at the bottom:

Mr.

Jameel: To date, no payments have been received from

you, and we're curious to

know why? Perhaps it is merely

an

oversight.

If there are other reasons we should be

aware of, please let us

know. Otherwise, may we have your cheque

for

Rs.50000?

Third

Reminder

Situation

Nursing

Home still has not

responded to the previous reminders. A

third reminder is sent ten

days

after

the second one went

out.

Third

Reminder

This

is a copy of the regular statement on

which the following message appears at

the bottom:

Mr.

Jameel: Is there some reason we have not

heard from you? The amount

you owe us is now long past due

and is

beginning

to concern us. Don't you think we are

entitled to an explanation? Please let us

hear from you at once.

Fourth

Reminder-Telephone Call

Situation

The

Credit Manager at Medix

Hospital Supply Company has

heard nothing from Nursing

Home and,

on

April 3, decides to telephone the owner,

Mr. Jameel.

The

Telephone Call

When

the Credit Manager, reaches Mr.

Jameel he may start off

something like this:

"Hello,

Mr. Jameel. I'm Kamran at

Hospital Supply Company, and

I'm calling to ask about

your plans for

paying

your

account, which, as you know, is

now over 30 days past

due."

Jameel

is given an opportunity to tell his

side of the story (he has

just been so busy putting

the

nursing

home in operation that he

had to let some of his

paperwork slide.) At the end of the

conversation,

Jameel

promises to send his cheque

right away.

104

VU

Fifth

Reminder-Telegram

Situation

A

week has passed since the

credit manager spoke on the telephone

with Jameel, and no payment

has

been

received. She decides that

the next step is to send a

telegram.

The

Telegram

DURING

OUR TELEPHONE CONVERSATION ON

APRIL 3, YOU PROMISED

IMMEDIATE

PAYMENT OF YOUR ACCOUNT. YOUR

CHECK HAS NOT ARRIVED, AND IF

IT

IS

NOT ALREADY IN THE MAIL, I URGE YOU TO

SEND IT TODAY.

When

The Buyer Is At Fault

Dear

Mr. Faheem:

Your

balance with Murray's

Furniture Warehouse is 120

days past due. Our

efforts to collect from

you

by

mail, fax, and telephone have

been fruitless. You still

owe Rs. 50,000 of the

original Rs. 75000 in

purchases

you made on June 8. The

last check we received from

you was on August 8.

If

we do not receive a payment

within 10 days, your account

will be turned over to

Collection Agency

for

further handling.

Sincerely,

When

The Buyer Is At Fault

Dear

Mr. Rashid,

Despite

our numerous attempts by

letter, telephone, and numerous

onsite visits to your

restaurant to

collect

your past due balance,

you have neglected to make

any effort in making payments to

Florists. Your

restaurant

is now Rs. 5000 in arrears.

Having broken a series of

promises to pay, we cannot trust your

word

any

longer and must take more

serious action.

We

have turned your account

over to our collection

service. They are authorized to

use any and all

legal

means

deemed appropriate to collect your

payment.

Sincerely,

105

Table of Contents:

- COMMUNICATION:Definition of Communication, Communication & Global Market

- FLOW OF COMMUNICATION:Internal Communication, External Communication

- THEORIES OF COMMUNICATION:Electronic Theory, Rhetorical Theory

- THE PROCESS OF COMMUNICATION & MISCOMMUNICATION:Message

- BARRIERS IN EFFECTIVE COMMUNICATION /COMMUNICATION FALLOFF

- NON- VERBAL COMMUNICATION:Analysing Nonverbal Communication

- NON- VERBAL COMMUNICATION:Environmental Factors

- TRAITS OF GOOD COMMUNICATORS:Careful Creation of the Message

- PRINCIPLES OF BUSINESS COMMUNICATION:Clarity

- CORRECTNESS:Conciseness, Conciseness Checklist, Correct words

- CONSIDERATION:Completeness

- INTERCULTURAL COMMUNICATION

- INTERCULTURAL COMMUNICATION:Education, Law and Regulations, Economics

- INDIVIDUAL CULTURAL VARIABLES:Acceptable Dress, Manners

- PROCESS OF PREPARING EFFECTIVE BUSINESS MESSAGES

- Composing the Messages:THE APPEARANCE AND DESIGN OF BUSINESS MESSAGES

- THE APPEARANCE AND DESIGN OF BUSINESS MESSAGES:Punctuation Styles

- COMMUNICATING THROUGH TECHNOLOGY:Email Etiquette, Electronic Media

- BASIC ORGANIZATIONAL PLANS:Writing Goodwill Letters

- LETTER WRITING:Direct Requests, Inquiries and General Requests

- LETTER WRITING:Replies to Inquiries, Model Letters

- LETTER WRITING:Placing Orders, Give the Information in a Clear Format

- LETTER WRITING:Claim and Adjustment Requests, Warm, Courteous Close

- LETTER WRITING:When The Buyer Is At Fault, Writing Credit Letters

- LETTER WRITING:Collection Letters, Collection Letter Series

- LETTER WRITING:Sales Letters, Know your Buyer, Prepare a List of Buyers

- MEMORANDUM & CIRCULAR:Purpose of Memo, Tone of Memorandums

- MINUTES OF THE MEETING:Committee Membersí Roles, Producing the Minutes

- BUSINESS REPORTS:A Model Report, Definition, Purpose of report

- BUSINESS REPORTS:Main Features of the Report, INTRODUCTION

- BUSINESS REPORTS:Prefatory Parts, Place of Title Page Items

- MARKET REPORTS:Classification of Markets, Wholesale Market

- JOB SEARCH AND EMPLOYMENT:Planning Your Career

- RESUME WRITING:The Chronological Resume, The Combination Resume

- RESUME & APPLICATION LETTER:Personal Details, Two Types of Job Letters

- JOB INQUIRY LETTER AND INTERVIEW:Understanding the Interview Process

- PROCESS OF PREPARING THE INTERVIEW:Planning for a Successful Interview

- ORAL PRESENTATION:Planning Oral Presentation, To Motivate

- ORAL PRESENTATION:Overcoming anxiety, Body Language

- LANGUAGE PRACTICE AND NEGOTIATION SKILLS:Psychological barriers

- NEGOTIATION AND LISTENING:Gather information that helps you

- THESIS WRITING AND PRESENTATION:Write down your ideas

- THESIS WRITING AND PRESENTATION:Sections of a Thesis (Format)

- RESEARCH METHODOLOGY:Studies Primarily Qualitative in Nature

- RESEARCH METHODOLOGY:Basic Rules, Basic Form, Basic Format for Books