|

Introduction

to Business MGT 211

VU

LESSON

9

JOINT

STOCK COMPANY

JOINT

STOCK COMPANY

Joint

Stock Company is the third

major form of business

organization. It has entirely

different

organizational

structure from sole

proprietorship and partnership.

There are two

advantages

of

Joint Stock Company. First

of all, it enjoys the

advantage of increased capital.

Secondly,

the

company offers the

protection of limited liability to

the investors.

The

law relating to Joint Stock

Company has been laid in

Companies Ordinance,

1984,

which

came into force on January

1, 1985 in Pakistan.

DEFINITION

Following

are some important

definition of Joint Stock

Company:

1.

Simple

Definition

"A

company may be defined as an

association of persons for

the purpose of making

profit."

2.

According

to Kimball,

"A

corporation by nature is an artificial

person, created or authorized by a

legal statue

for

some specific

purpose."

3.

According

o S.E. Thomas,

"

A company is an incorporated association

of persons formed usually

for the pursuit of

some

commercial purpose."

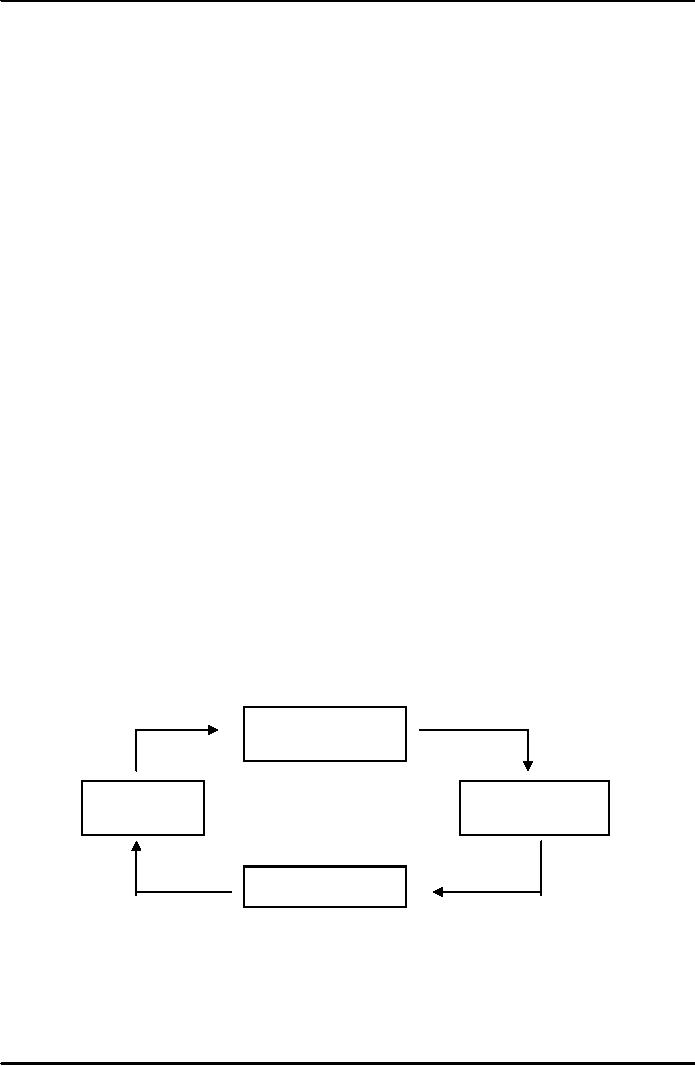

Structural

Diagram

Joint

Stock Company

Specific

Purpose

Association

of

Persons

Legal

Statute

FEATURES

OF JOINT STOCK

COMPANY

Following

are the main features of a

Joint Stock Company.

46

Introduction

to Business MGT 211

VU

1.

Creation of Law

A

joint stock company is the

creation of law or special

`Act' of the state. It is

formed and

governed

by the Companies Ordinance or by a

special Act of the

legislature. Pakistani

companies

are incorporated under the

Companies Ordinance,

1984.

2.

Capital Borrowing

The

company can borrow capital

in its own name to expand

the business.

3.

Separate Legal

Entity

A

Joint Stock Company has

separate legal entity, apart

from its members. It can

sue in a

court

of law in its own

name.

4.

Legal Person

A

Joint Stock Company, as a

legal person, has the

usual rights of any person

to carry on the

business

in its own name, to own

property, to borrow or lend

money and to enter into

contract.

5.

Long Life

A

joint stock company has

long life as compared to

other forms of business

organizations.

6.

Limited Liability

The

liability of the shareholder is

limited to the extent of the

face value of the shar4es

they

hold.

7.

Large Scale

Business

Because

of more members, a company

has larger capital as

compared to sole trade ship

and

partnership,

which helps in doing

business on large

scale.

8.

Management of Company

The

shareholders elect the Board

of Directors in the Annual

General Meeting and all

the

management

is selected by the Board of

Directors.

9.

Number of members

In

case of private limited

company, minimum number of

shareholders is `2' and

maximum is

`50';

but in case of public

limited company, minimum

number is `7' and there is

no limit for

maximum

number.

10.

Transferability of Shares

A

shareholder of a company can

easily transfer his shares

to other persons. There is

no

restriction

on the purchase and sale of

shares.

11.

Trade Agreement

A

joint stock company enjoys

separate existence, so it can

join the trade agreements

with

other

firms in its own

name.

12.

Purchases and Sale of

Property

A

joint stock company can

purchase and sale the

property in its own

name.

13.

Payment of Taxes

A

joint stock company pays

double taxes to the

government.

14.

Object

The

basic object of a joint

stock company is to earn

profit. Whole profit is not

distributed

among

the shareholders. Some

portion is transferred to General

Reserve for

emergencies.

47

Introduction

to Business MGT 211

VU

15.

Government Control

A

joint stock company has to

comply with the rules of

the government. It has to

audit its

accounts.

16.

Easy Mode of

Investment

The

capital of a joint stock

company is divided into the

shares of small value. So,

every

person

can purchase these shares

according to his income and

saving.

17.

Common Seal

Since

a company is an artificial person

created by law, therefore, it

cannot sign documents

for

itself.

The common seal, with

the name of the company is

used as a substitute for

its

signature.

ADVANTAGES

AND DISADVANTAGES OF JOINT STOCK

COMPANY

ADVATNAGES

OF JOINT STOCK

COMPANY

Following

are the advantages of Joint

Stock Company:

1.

Expansion of Business

A

joint stock company sells

the shares, debentures and

bond s on large scale. So, a

joint

stock

company can collect a large

amount of capital and can

expand its business.

2.

Easy Access to

Credit

A

joint stock company can

get a huge amount of capital

from banks and other

institutions.

3.

Easy to Exit

It

is easy to separate oneself

from a joint stock company

by selling his

shares.

4.

Experts' Services

Because

a joint stock company has a

strong financial position, so it

may hire the service

of

qualified

and technical

experts.

5.

Employment

Joint

stock companies are also

playing very important role

to provide employment to

unemployed

persons of the

country.

6.

Flexibility

There

is flexibility in such business

organizations.

7.

Limited Liability

The

liability of the owner is

limited. In case of loss,

the shareholders are not

required to pay

anything

more than the face

value of the shares.

8.

Large Scale

Production

Availability

of huge amounts of capital

makes possible for a joint

stock company to

produce

goods

on very large scale, at a

lower cost.

9.

Larger Capital

There

is no problem of capital in a joint

stock company because there

is not limit for

maximum

number

of members. So, a joint

stock company collects

capital from many

people.

10.

Long Life

A

joint stock company has a

permanent life. If one or

more than one shareholder

die, or sell

their

shares, it makes no difference to

the company. New

shareholders take their

place.

48

Introduction

to Business MGT 211

VU

11.

Long-term Projects

A

joint stock company has a

permanent and long life

and huge capital. Such

organizations

can

undertake the projects,

which may give profit

after many years.

12.

Spread of Risk

In

joint stock company, the

risk of business is spread

over a large number of

people. Such

organizations

can undertake risky

projects, which other types

or organization do not

take.

13.

Transfer of Shares

In

joint stock company, the

shares of public limited

company can be easily

transferred or

disposed

off. There is no restriction on

the transfer of shares in a

joint stock company.

14.

Increase in Saving and

Investment

The

shares are in large number

but their value is small.

The shares of a company may

have a

value

of Rs. 10, Rs. 100

etc. So, rich as well as

poor can purchase the

shares of a company.

This

leads to increase in savings

and investment.

15.

Better Management

Such

organization is administered by the

elected directors. These

directors are

generally

experienced

and qualified in business

field. This increases the

efficiency of the

company.

16.

Beneficial Advices

A

joint stock company can

take beneficial advices from

the government at the time

of need

which

reduces the chances of its

failure.

17.

Public Confidence

A

joint stock company is

created by law and is

supervised by legal authority.

So, a joint stock

company

can easily win the

public confidence.

18.

Higher Profits

With

the help of larger capital

and technical skill, the

cost of production is reduced,

which

increases

the rate of profit.

DISADVANTAGES

OF JOINT STOCK

COMPANY

Some

of the disadvantages of the

joint stock company are

given below:

1.

Initial Difficulties

It

is more difficult to establish a

joint stock company as

compared to other

business

organizations.

2.

Lack of Interest

Most

shareholders become relaxed

and leave all the

functions to be carried out by

the

directors.

This usually encourages the

directors to promote their

own interest at the cost of

the

company.

3.

Labor Disputes

In

such organization there is no

close contact of the workers

with the owners or

the

shareholders.

This leads to formation of

labor unions to fight

against the company's

management.

4.

Lack of Responsibility

There

is lack of personal interest

and responsibility in the

business of a joint stock

company. If

any

mistake occurs, everybody

tries to shift or transfer

his responsibilities to other

persons and

he

remains safe.

49

Introduction

to Business MGT 211

VU

5.

Lack of Secrecy

A

joint stock company cannot

maintain its secrecy due to

the reason that a company

has to

submit

various reports to the

registrar.

6.

Lack of Freedom

A

joint stock company cannot

perform its functions freely

because it has to submit

various

reports

to the registrar form time

to time.

7.

Monopoly

Due

to larger size and

resources, a joint stock

company is in a position to create

monopoly.

Sometimes

a few customers make

agreement and exploit the

consumers.

8.

Speculation

Due

to free transfer of shares

and limited liability,

speculation in the stock

market takes place,

which

may affect the economy of

the country.

9.

Corruption

The

directors of the company do

not show the picture of

the company to the public

and

encourage

corruption by changing the

policies for their personal

interest.

10.

Complicated Process

The

formation of a joint stock

company is a complicated process

due to many legal

formalities.

11.

Centralization of Power

In

joint stock company, all

the powers have in a few

hands and due to this, an

ordinary

shareholder

cannot participate in the

affairs of a company.

12.

Double Taxes

A

joint stock company has to

pay double taxes to the

government. Firstly, company

pays tax

on

the whole profit of the

company. Secondly, every

shareholder pays tax on his

individual

income.

13.

Exploitation

Ordinary

shareholders do not have

full information about the

affairs of their company.

So, they

are

exploited.

14.

Problem of Large-Scale

Production

Since

joint stock company produces

on large-scale, so many problems

arise in the economy.

15.

Nepotism

In

a joint stock company, the

directors of company employ

their inefficient and

incapable

relatives

and friends and give

key jobs to them. As a

result, the company suffers

a loss.

16.

Late Decision

In

joint stock company, the

decision making process in

time consuming because a

meeting is

necessary

to solve the business

problems and matters.

Distinguish

between Public Limited

Company and Private Limited

Company.

PUBLIC

COMPANY

It

is a company which is formed by a

least `7' members, and

there are no

restrictions:

for

the transfer of

shares.

for

maximum numbers, and

for

subscription of shares and

debentures.

50

Introduction

to Business MGT 211

VU

PRIVATE

COMPANY

It

is a company which is formed by at

least `2' members and

has certain

restrictions:

for

the transfer of

shares

for

maximum number of

members,

for

subscription of shares and

debentures.

DISTINCTION

BETWEEN PUBLIC

LIMITED

COMPANY

AND PRIVATE LIMITED

COMPANY

________________________________________________________________________

Public

Limited Company

Private

Limited Company

________________________________________________________________________

1.

Number of Members

Minimum

number of members

There

must be at least `2'

should

be `7' and there is

no

members

and maximum

restriction

for the maximum

number

should not exceed

number

of members

`50'.

2.

Number of Directors

Minimum

number of directors

Its

shareholders may elect

at

Is

`7' and maximum

number

least

`2' directors and

of

directors is appointed

maximum

number of directors

according

to its Articles of

is

appointed according to

its

Association.

Articles

of Association.

3.

Issue of Security

It

can invite the public

for

It

cannot invite the public

for

subscription

of its shares and

subscription

of any type of

debentures.

security.

4.

Prospectus

It

is compulsory for

public

It

is not compulsory to file

the

company

by law of file the

prospectus

with registrar's

prospectus

with the registrar's

office.

office.

5.

Certificate of Incorporation

It

cannot start the

business

It

can commence business

after

receiving the

certificate

soon

after it receives the

of

incorporation, unless it

certificate

of incorporation.

receive

the certificate of

commencement.

6.

Certificate of Commencement

It

is necessary for

public

It

is not compulsory by law

to

limited

company to obtain the

obtain

the certificate of

certificate

of commencement

commencement

of business

of

business.

7.

Title

Every

public company has to

Every

private company has

to

use

the word "limited after

its

use

the word "Private

limited"

name.

after

its name.

51

Introduction

to Business MGT 211

VU

8.

Publication

Public

company must publish

There

is no restriction for

its

annual performance

report.

publication

of annual report.

9.

Shares Transferability

It

shares can be transferred

to

Its

shares cannot be

others

without restriction.

transferred

and disposed off to

others

without any

restriction.

10.

Statutory Meeting

It

has to hold a

statutory

It

is not required by law

to

meeting

within prescribed

hold

statutory meeting

limited.

11.

Submission of Report

It

is required by law to

submit

It

is not required by law

to

various

types of reports to

the

fulfill

the conditions of

registrar's

office, i.e.

minimum

subscription before

Auditors'

Report, Profit and

its

incorporation.

Loss

Account, Balance

Sheet.

12.

Minimum Subscription

It

cannot obtain the

certificate

It

is not required by law

to

of

commencement of business

fulfill

the conditions of

without

fulfilling the condi-

minimum

subscription before

tion

of minimum subscription.

its

incorporation.

13.

Written Consent of

Directors

In

public company

directors

he

directors of private

have

to give written

consent

company

are not required to

that

they are ready to act

as

give

their consent for

directorship.

the

directors of the

company.

14.

Tax Payment

Public

company has to pay

Private

company only pays

tax

double

tax to the

government.

on

its whole profit.

15.

Dissolution

Public

company is dissolved

A

separate legal procedure

is

according

to Companies

adopted

for the dissolution

of

Ordinance,

1984.

private

company.

________________________________________________________________________

PROCEDURE

OF FORMATION OF A JOINT STOCK

COMPANY IN PAKISTAN.

Joint

Stock Company is the third

major form of business

organization. It has entirely

different

organizational

structure from sole

proprietorship and partnership.

There are two

advantages

of

Joint Stock Company. First

of all, it enjoys the

advantage of increased capital.

Secondary,

the

company offers the

protection of limited liability to

the investors.

The

law relating to Joint Stock

Company has been laid in

Companies Ordinance,

1984,

which

came into force on January

1, 1985 in Pakistan.

Following

are the important stages or

steps for the formation of a

joint stock company:

52

Introduction

to Business MGT 211

VU

Formation

of joint Stock

Company

Promotion

Incorpo-

Capital

Certificate

Stage

ration

Subscription

of

Com-

Stage

Stage

mencement

PROMOTION

STAGE

The

promoters do the basic work

for the start of a

commercial or an industrial business

on

corporate

basis.

Promotion

is the discovery of ideas

and organization of funds,

property and skill, to run

the

business

for the purpose of earning

income. Following steps are

involved in the stage

of

promotion.

1.

Idea about

Business

Before

starting the business,

promoters have to think

about the nature and

production of

company's

business.

2.

Investigation

After

deciding the nature of

business, promoters go in preliminary

investigation and make

out

plans

as regard to the availability of

capital, means of transportation,

labour, electricity,

gas,

water

etc.

3.

Assembling various

Factors

After

making initial investigation,

the promoter starts

accumulating various factors in

order to

assemble

them. They arrange license,

copyrights, employment of necessary

employees etc.

4.

Financial Sources

The

promoters also decide the

capital sources of the

company and they work

out the ways

through

which capital can be

generated.

5.

Preparation of Essential

Documents

In

addition to above discussed

matters, the promoters also

prepare following

essential

documents

for the formation of

company:

Memorandum

of company

Articles

of company

Prospectus

of company

The

promoters carrying out these

various activities give the

company its physical form in

the

shape

of:

Giving

a name to the company

Sanctioning

of Capital Issue

INCORPORATION

STAGE

The

second stage for

establishment of a company is to get it

incorporated.

1.Filling

of Document

Following

documents are to be submitted by

the promoters in the

Registrar's office.

(a)

Memorandum of Association

A

document indicating name,

address, objects, authorized

capital etc. of a

company.

53

Introduction

to Business MGT 211

VU

(b)

Articles of Association

A

document containing laws and

rules for internal control

and management of a

company

(c)

List of Directors

A

list of the names,

occupations, addresses, along

with the declaration of

directors.

(d)

Written Consent of

Directors

A

written consent showing

their willingness to act at

directors, to be sent to the

Registrar.

(e)

Declaration of Qualifying

Shares

A

declaration certificate showing

that the directors have

taken up qualifying shares

and have

paid

up the money or pay it in

near future to the

registrar.

(f)

Prospectus

Promoters

have to file a prospectus

with the registrar.

(g)

Statutory Declaration

A

statutory declaration is to be sent to

the Registrar that all

legal formalities have

been

completed.

2.

Payment of Registration

Fee

For

the registration of company,

the registration fee is also

paid to the Registrar. For

example.

Application

and documents filing

fee

Registration

fee

Stamp

fee on Memorandum and

Articles

3.

Certificate of Incorporation

If

the registrar finds all

the documents right and

thinks that all formalities

have been fulfilled

then

he issues the certificate of

incorporation to promoters.

CAPITAL

SUBSCRIPTION STAGE

After

getting certificate of incorporation,

the next stage is to make

arrangement for

raising

capital.

For any kind of business,

the company raises its

capital through following

sources:

By

Issuing Shares

By

Issuing Debentures

By

Savings

CERTIFICATE

OF COMMENCEMENT

For

the commencement of business,

every public company has to

obtain the certificate

of

commencement,

which requires the

fulfillment of following

conditions:

1.

Issue of Prospectus

A

company has to issue

prospectus for selling

shares and debentures to

public.

2.

Allotment of Shares

The

shares and debentures are

allotted according to the

pro visions of memorandum,

when

applications

are received from the

public.

3.

Minimum Subscription

It

is also certified that the

shares have been allotted up

to an amount, not less than

the

minimum

subscription. After verifying

the foregoing documents, the

registrar issues a

certificate

of commencement of business to public

company.

54

Table of Contents:

- INTRODUCTION:CONCEPT OF BUSINESS, KINDS OF INDSTRY, TYPES OF TRADE

- ORGANIZATIONAL BOUNDARIES AND ENVIRONMENTS:THE ECONOMIC ENVIRONMENT

- BUSINESS ORGANIZATION:Sole Proprietorship, Joint Stock Company, Combination

- SOLE PROPRIETORSHIP AND ITS CHARACTERISTICS:ADVANTAGES OF SOLE PROPRIETORSHIP

- PARTNERSHIP AND ITS CHARACTERISTICS:ADVANTAGES AND DISADVANTAGES OF PARTNERSHIP

- PARTNERSHIP (Continued):KINDS OF PARTNERS, PARTNERSHIP AT WILL

- PARTNERSHIP (Continued):PARTNESHIP AGREEMENT, CONCLUSION, DUTIES OF PARTNERS

- ORGANIZATIONAL BOUNDARIES AND ENVIRONMENTS:ETHICS IN THE WORKPLACE, SOCIAL RESPONSIBILITY

- JOINT STOCK COMPANY:PRIVATE COMPANY, PROMOTION STAGE, INCORPORATION STAGE

- LEGAL DOCUMENTS ISSUED BY A COMPANY:MEMORANDUM OF ASSOCIATION, CONTENTS OF ARTICLES

- WINDING UP OF COMPANY:VOLUNTARY WIDNIGN UP, KINDS OF SHARE CAPITAL

- COOPERATIVE SOCIETY:ADVANTAGES OF COOPERATIVE SOCIETY

- WHO ARE MANAGERS?:THE MANAGEMENT PROCESS, BASIC MANAGEMENT SKILLS

- HUMAN RESOURCE MANAGEMENT:Human Resource Planning

- STAFFING:STAFFING THE ORGANIZATION

- STAFF TRAINING & DEVELOPMENT:Typical Topics of Employee Training, Training Methods

- BUSINESS MANAGERíS RESPONSIBILITY PROFILE:Accountability, Specific responsibilities

- COMPENSATION AND BENEFITS:THE LEGAL CONTEXT OF HR MANAGEMENT, DEALING WITH ORGANIZED LABOR

- COMPENSATION AND BENEFITS (Continued):MOTIVATION IN THE WORKPLACE

- STRATEGIES FOR ENHANCING JOB SATISFACTION AND MORALE

- MANAGERIAL STYLES AND LEADERSHIP:Changing Patterns of Leadership

- MARKETING:What Is Marketing?, Marketing: Providing Value and Satisfaction

- THE MARKETING ENVIRONMENT:THE MARKETING MIX, Product differentiation

- MARKET RESEARCH:Market information, Market Segmentation, Market Trends

- MARKET RESEARCH PROCESS:Select the research design, Collecting and analyzing data

- MARKETING RESEARCH:Data Warehousing and Data Mining

- LEARNING EXPERIENCES OF STUDENTS EARNING LOWER LEVEL CREDIT:Discussion Topics, Market Segmentation

- UNDERSTANDING CONSUMER BEHAVIOR:The Consumer Buying Process

- THE DISTRIBUTION MIX:Intermediaries and Distribution Channels, Distribution of Business Products

- PHYSICAL DISTRIBUTION:Transportation Operations, Distribution as a Marketing Strategy

- PROMOTION:Information and Exchange Values, Promotional Strategies

- ADVERTISING PROMOTION:Advertising Strategies, Advertising Media

- PERSONAL SELLING:Personal Selling Situations, The Personal Selling Process

- SALES PROMOTIONS:Publicity and Public Relations, Promotional Practices in Small Business

- THE PRODUCTIVITY:Responding to the Productivity Challenge, Domestic Productivity

- THE PLANNING PROCESS:Strengths, Weaknesses, Threats

- TOTAL QUALITY MANAGEMENT:Planning for Quality, Controlling for Quality

- TOTAL QUALITY MANAGEMENT (continued):Tools for Total Quality Management

- TOTAL QUALITY MANAGEMENT (continued):Process Re-engineering, Emphasizing Quality of Work Life

- BUSINESS IN DIGITAL AGE:Types of Information Systems, Telecommunications and Networks

- NON-VERBAL COMMUNICATION MODES:Body Movement, Facial Expressions

- BUSINESS ORGANIZATIONS:Organization as a System

- ACCOUNTING:Accounting Information System, Financial versus Managerial Accounting

- TOOLS OF THE ACCOUNTING TRADE:Double-Entry Accounting, Assets

- FINANCIAL MANAGEMENT:The Role of the Financial Manager, Short-Term (Operating) Expenditures