|

IASBíS FRAMEWORK |

| << RETURNS ON FINANCIAL SOURCES |

| ELEMENTS OF FINANCIAL STATEMENTS >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 25

IASB'S

FRAMEWORK

IASB

stands for International Accounting

Standard Board; it is an

independent,

privately

funded accounting standard setter

organization. IASB develops

Accounting

Standards

that harmonize the

accounting practices

globally.

Objective:

Main

objective of the framework is to

provide a rational and sensible

guide for

preparing

accounting standards and applying them

accordingly. This framework

is

used

preparation and preparation of financial

statements.

Purpose

of IASB's Framework:

It

provides assistance in:

∑ Development

of new IFRS (International Financial

Reporting Standards)

∑ Review

of existing IAS (International Accounting

Standards)

∑ Promoting

Harmonization

∑ Developing

National Standards

Components

of Financial Statements and

their objectives

The

framework is concerned with "general

purpose financial

statements".

Components

of financial statements

include:

1.

Balance Sheet

Balance

sheet is prepared to know the

financial position

2.

Income Statement

Income

statement shows financial

performance/profitability

3.

Statement of Changes in

Equity

This

statement is prepared to show the

movement in different

heads

of owners' equity

4.

Cash Flow Statement

It is

prepared to know the cash

inflows and outflows during

the

year

divided into operating, investing and

financing activities

5.

Notes

Notes

are prepared to disclose

significant accounting

policies

selected

and applied in preparing the

financial statement. It

also

contains

some imperative disclosures to

make financial

statements

understandable.

125

Advance

Financial Accounting

(FIN-611)

VU

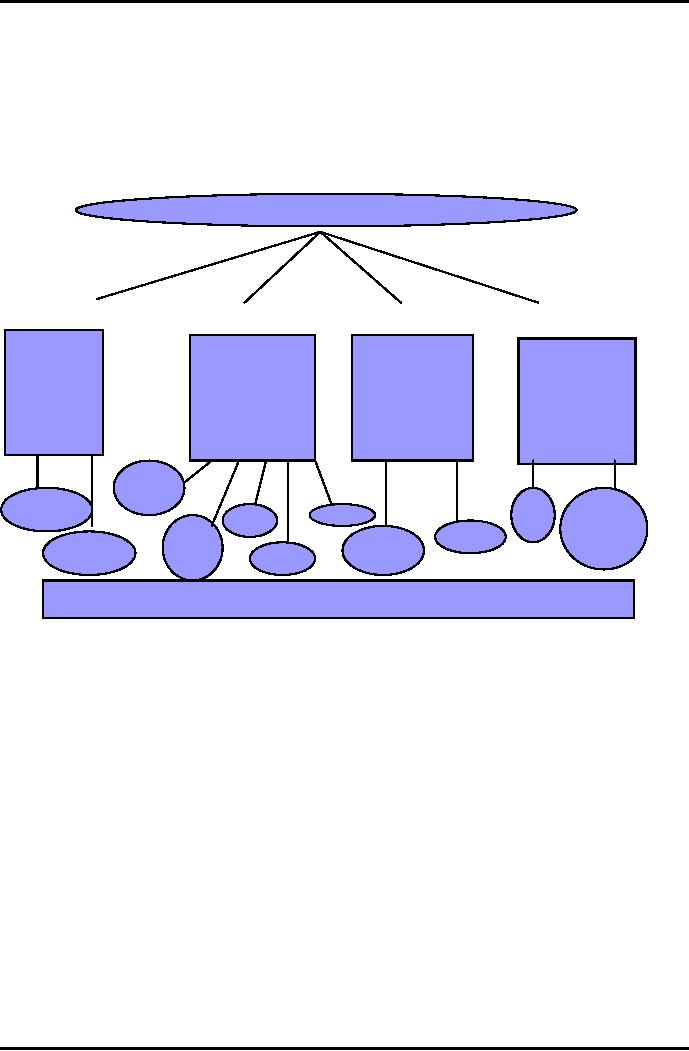

Users

of the financial

statements

Communication

of the financial information flows

towards the users of the

financial

statements.

∑

Shareholders

(assess the ability of

enterprise to pay the

dividend)

∑

Lenders

(determine the ability of

enterprise to pay their loan and

interest)

∑

Employees

(concerned about their pay,

retirement benefits

etc.)

∑

Govt.

agencies (determine tax,

regulate the activities

)

∑

Public

(enterprises make substantial

contribution to the local

economy)

∑

Suppliers

(evaluate whether the entity

will be fine as a customer and pay

its

dues)

∑

Customers

(decide whether the company

will be able to continue

producing

and

supplying goods with the

same quality)

Underlying

Assumptions

1)

Accrual Basis

Accrual

concept is used to measure

the incomes and expenses of

the entity. According

to

the accrual concept incomes

and expenses are not measured at

the amount of cash

received

or paid during the year but for

incomes the measurement

basis are earnings

and for

expenses measurement basis

are incurrence.

2)

Going Concern

Going

concern means that the

entity will continue its

operations for the

foreseeable

future and

there is no intention to liquidate it or

to significantly curtail its

operations.

Qualitative

Characteristics of Financial

Statements

Qualitative

characteristics are the

attributes that make the

information provided in

financial

statements useful to the

users.

Qualitative

characteristics that make

the financial information

useful

Materiality

It is

threshold quality which must be checked

before studying the further

qualitative

characteristics.

Information

is material if its omission/misstatement

could influence the

economic

decisions

of users taken on the basis

of financial statements.

1)

Relevance

Information

must be relevant to the decision

making needs of users. It

helps users to

evaluate

past, present or future events. It

also helps users to confirm

or correct past

evaluations.

126

Advance

Financial Accounting

(FIN-611)

VU

What

makes financial information

relevant?

Predictive

role

Current

level/structure of asset holding

issued to predict the

ability of the

entity

to take advantages of opportunities and

its ability to react to

adverse

situation.

Confirmative

role

Some

information plays confirmatory

role as outcome of the

planned

operations.

Information about financial

position and past financial

performance

is

used as predicting future financial

position and performance.

2)

Reliability

Information

may be relevant but so unreliable in

nature that its recognition

may be

potentially

misleading.

What

makes financial information

reliable?

Faithful

representation

Information

must represent faithfully the

transactions it purport to represent

in

order

to be reliable.

Substance

over form

It is

the principle that

transactions and other events

are accounted for and

presented

in accordance with their economic

substance (economic reality)

and

not

merely their legal

form.

Neutrality

Information

must be free from bias and should not be

focused on

predetermined

results.

Prudence

Financial

information presented in the

financial statements relating to

the assets

and

incomes should not be overstated and

relating to the liabilities

and

expenses

should not be understated.

Completeness

Financial

information must be complete in terms of

cost measurement and

documentation.

Omission may cause information to be

misleading.

127

Advance

Financial Accounting

(FIN-611)

VU

Qualitative

characteristics that make

the presentation

useful

1)

Comparability

Users

should be able to compare an

entity's performance over

time and to compare

one

entity's performance with

other.

Consistency

To

make the financial

statements comparable accounting

policies and

classification

should be consistent over

the years. Requirements of

the

applicable

accounting standards should

also be applied

consistently.

Disclosure

of accounting policies

Significant

accounting policies should be

disclosed in the notes this

makes the

financial

statements comparable with financial

statements of other

entities.

2)

Understandability

Financial

statements should be presented in

such a way that these are

understood by a

user

having average knowledge of

commerce and business.

Readily

understandable by users

Users

are assumed to have basic

knowledge of accounting to understand

the

published

financial statements.

Aggregation

and classification

Presentation

of financial information in the

financial statements should

be

aggregated

if these are not material.

Information relating to the

same class

should

be classified in one

group.

Constraints

to relevancy and reliability of

financial information

Quality of

relevancy and reliability depends upon

three constrains:

1)

Balance between qualitative

characteristics

Relevance

and reliability are often in

conflict. For example;

market values of

fixed

tangible

assets more relevant than historical

cost, but these are less

reliable.

2)

Timeliness

If

there is unjustified delay in

the reporting of information it may

lose its relevancy.

Information

may be reported on a timely basis when all

aspects of the transaction

are

not known, thus

compromising reliability.

128

Advance

Financial Accounting

(FIN-611)

VU

3)

Balance between cost and

benefit

When

information is provided, its

benefits must exceed the

costs of obtaining and

presenting

it.

What makes

financial information

useful?

Materiality

Relevance

Reliability

Comparability

Understandability

Information

Information

Similarities

The

that

has the

that is

a

and

significance

of

ability

to

complete

and

differences

the

influence

faithful

can

be

information

decisions

representation

discerned

and

can

be

evaluated

perceived

Substance

over -

form

Users

Predictive

Aggregation

Prudence

ability

Value

Neutral

and

Faithful

Disclosure

Classification

Confirmative

Consistency

represe

Complete

Value

-ntation

What

limits the application of

the qualitative

characteristics?

∑

Balance

Between the

Qualitative

Characteristics

∑

Balance

between the Benefit and

Cost

∑

Timeliness

129

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASBíS FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet