|

Financial Statements Of Manufacturing Concern |

| << SOLE PROPRIETORSHIP |

| Financial Statements of Partnership firms >> |

Financial

Accounting (Mgt-101)

VU

Lesson-33

Financial

Statements Of Manufacturing

Concern

In this

lecture, we will discuss financial

statements of manufacturing concern. In manufacturing

concern,

cost

of goods sold statement is

also prepared.

ILLUSTRATION

#1

Following

trial balance has been

extracted from the books of Hassan

Manufacturing Concern on June

30,

2002.

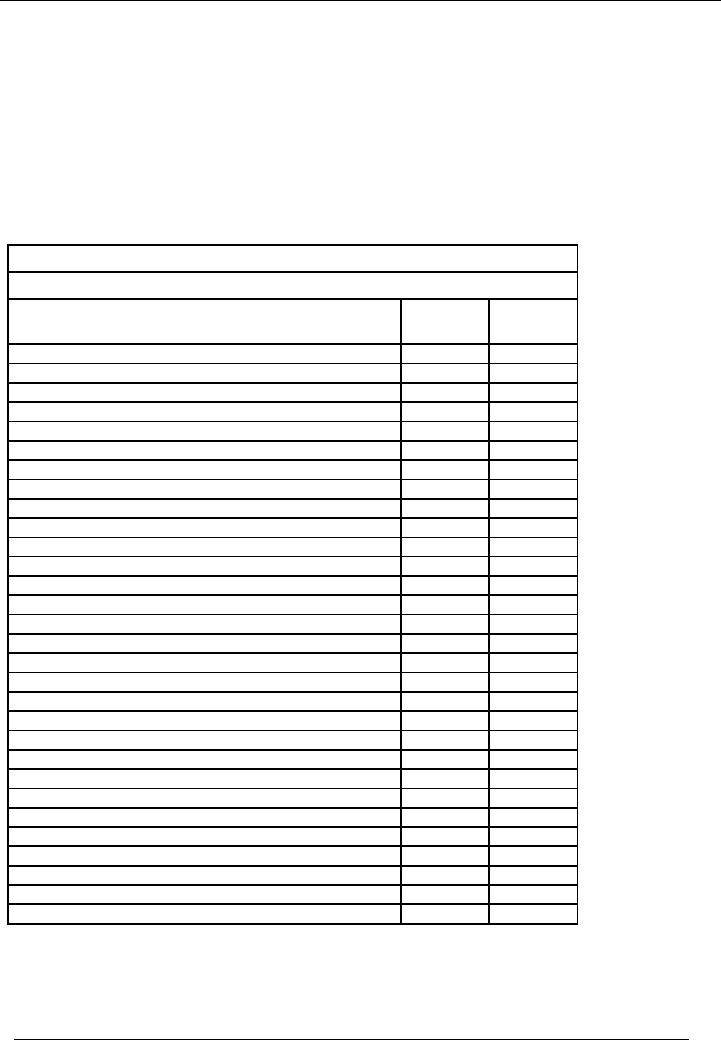

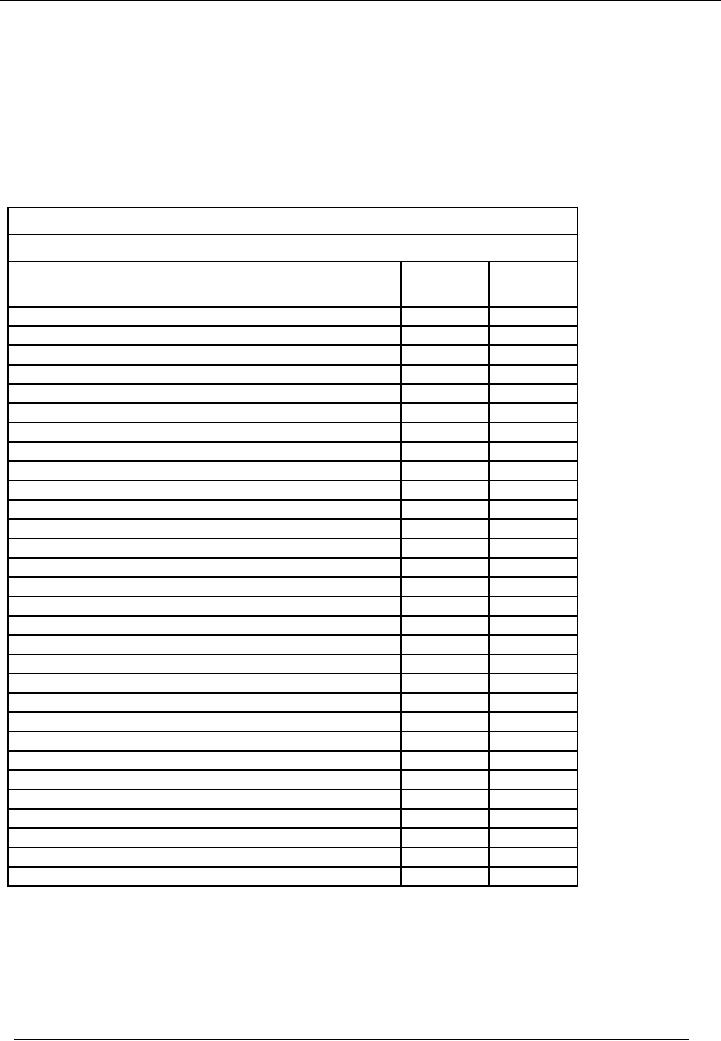

Hassan

Manufacturing Concern

Trial

balance as on June 30,

2002

Particulars

Amount

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Raw

Material stock Jul. 01,

2001

35,500

Work

in process Jul. 01,

2001

42,000

Finished

goods stock Jul. 01,

2001

85,000

Raw

material purchased

250,000

Wages

180,000

Freight

inward

12,000

Plant

and machinery

400,000

Office

equipment

45,000

Vehicles

200,000

Acc.

depreciation Plant

195,200

Acc.

depreciation Office equipment

12,195

Acc.

depreciation Vehicles

97,600

Factory

overheads

125,000

Electricity

80,000

Salaries

140,000

Salesman

commission

120,000

Rent

200,000

Insurance

150,000

General

Expense

60,000

Bank

Charges

8,500

Discounts

Allowed

20,000

Carriage

outward

35,000

Sales

1,500,000

Trade

Debtors

250,000

Trade

Creditors

220,000

Bank

165,000

Cash

110,000

Drawings

175,000

Capital

July 01, 2001

863,005

Total

2,888,000

2,888,000

217

Financial

Accounting (Mgt-101)

VU

Notes:

· Stock

on June 30, 2002.

o Raw

Material

42,000

o Work

in Process

56,500

o Finished

Goods

60,000

· 50% of

electricity, insurance and salaries

are charged to factory and

balance to office.

· Depreciation

to be charged on Plant & Machinery at 20%,

Office Equipment at 10% and

Vehicles

at

20%on WDV.

· Write

off bad debts Rs.

30,000.

· All

the wages are direct.

Required:

You

are required to prepare profit

and loss account for the

year and balance sheet as on

june30, 2002.

SOLUTION

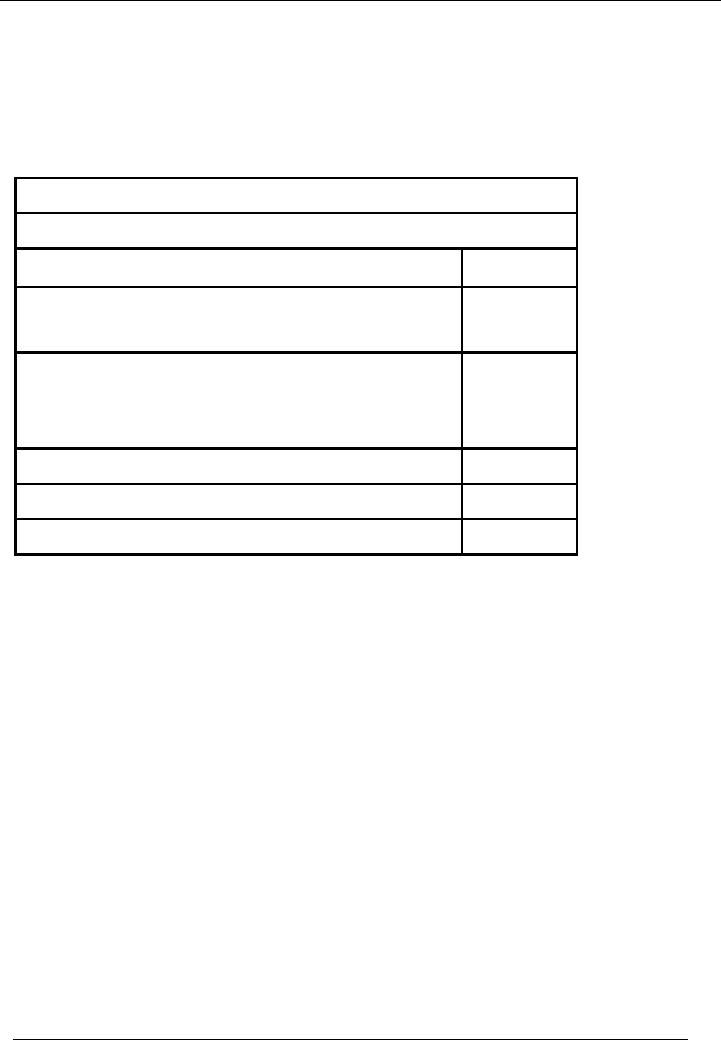

Profit &

Loss Account

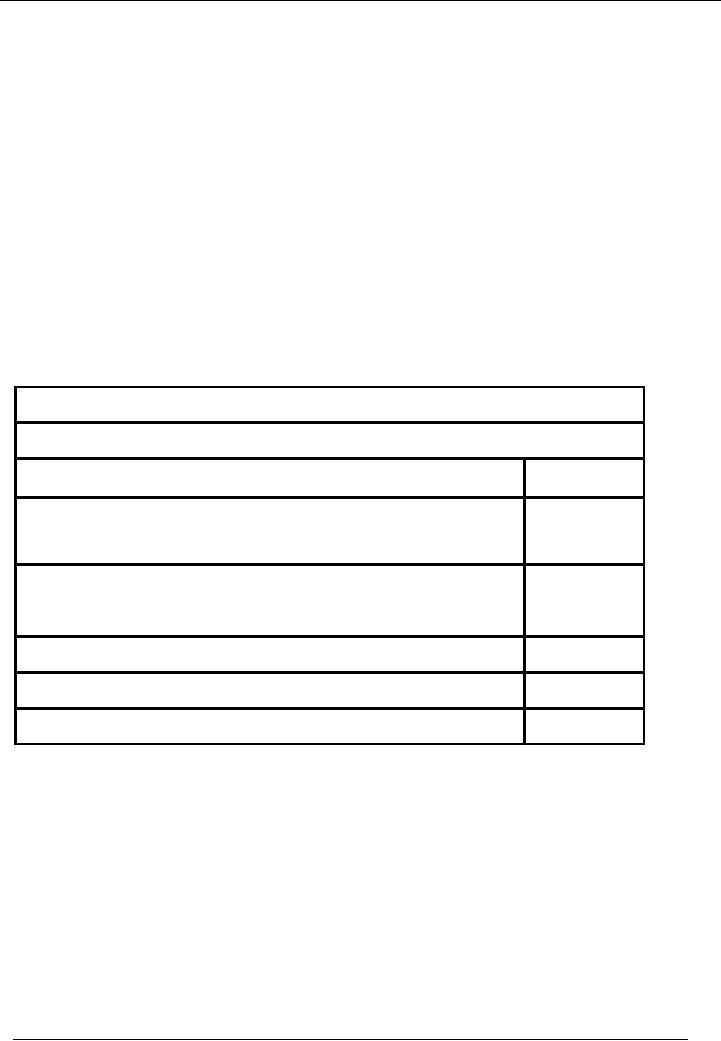

Hassan

Manufacturer Concern

Profit

and Loss Account for the

Year Ending June 30,

2002

Particulars

Note

Amount

Rs.

Sales

1,500,000

Less:

Cost of Goods Sold

1

796,960

Gross

Profit

703,040

Less:

Administrative Expenses

2

518,761

Less:

Selling Expenses

3

155,000

Operating

Profit

29,279

Less:

Bank Charges

8,500

Net

Profit Before Tax

20,779

218

Financial

Accounting (Mgt-101)

VU

Balance

Sheet

Hassan

Manufacturer Concern

Profit

and Loss Account for the

Year Ending June 30,

2002

Particulars

Note

Amount

Rs.

Fixed

Assets at WDV

4

275,284

Current

Assets

5

653,500

Current

Liabilities

6

(220,000)

Working

Capital

433,500

Total

Assets Employed

708,784

Financed

by:

Capital

863,005

Add:

Profit for the year

20,779

Less:

Drawings

(175,000)

Total

Liabilities

708,784

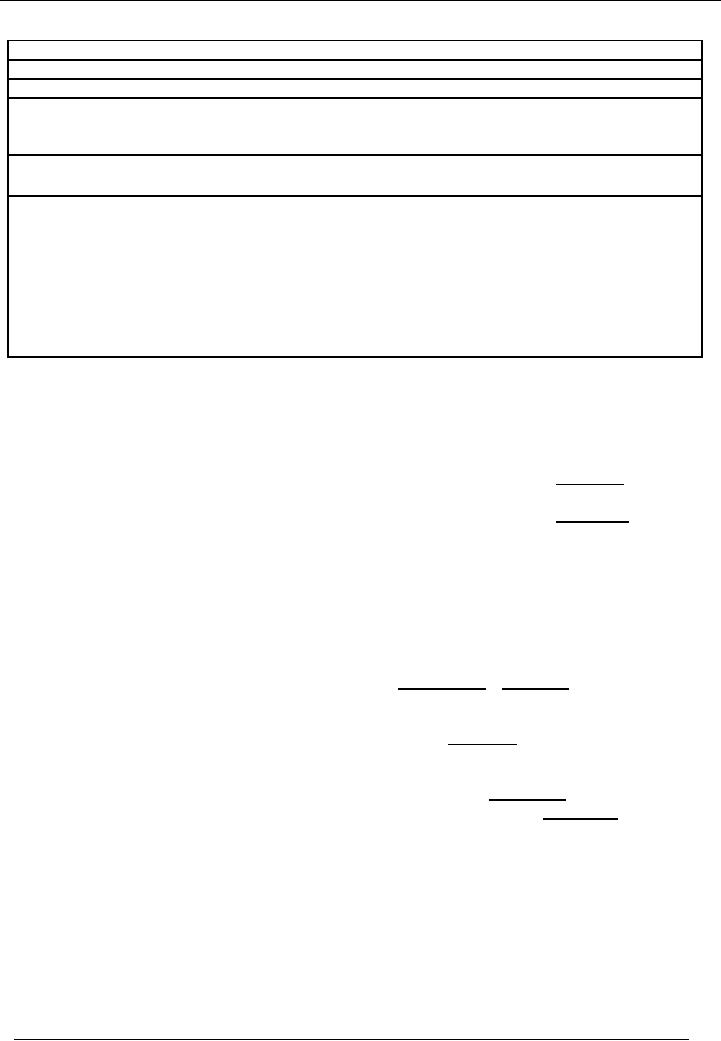

Notes to

the Accounts

Note

# 1

Cost

of Goods Sold

Stock

of Raw Material Jul 01,

2001

35,500

Add.

Purchases

250,000

Add.

Freight Inward

12,000

297,500

Less:

Closing Stock of Raw

Material

(42,000)

Raw

Material Consumed

255,500

Direct

labour

180,000

Factory

Overheads

Factory

Overheads

125,000

Electricity

(50% of 80,000)

40,000

Salaries

(50% of 140,000)

70,000

Insurance

(50% of 150,000)

75,000

350,960

Plant

Depreciation (Note 5)

40,960

Total

Factory Cost

786,460

Add:

Work in Process Jul 01,

2001

42,000

Less:

Work in Process Jun 30,

2002

(56,500)

Cost

of Goods Manufactured

771,960

Add:

Finished Goods Stock Jul 01,

2001

85,000

Less:

Finished Goods Stock Jun 30,

2002

(60,000)

Cost

of Goods Sold

796,960

219

Financial

Accounting (Mgt-101)

VU

Note

# 2

Administrative

Expenses

Salaries

(50% of 140,000)

70,000

General

Expenses

60,000

Rent

200,000

Insurance

(50% of 150,000)

75,000

Discount

Allowed

20,000

Bad

Debts

30,000

Office

Electricity (50% of 80,000)

40,000

Depreciation

Vehicles (Note 5)

20,480

Depreciation

Office Equip. (Note5)

3,281

Administrative

Expenses

518,761

Note

# 3

Selling

Expenses

Salesman

Commission

120,000

Carriage

Outward

35,000

Selling

Expenses

155,000

Note

# 4

Fixed

Assets at WDV

Acc.

Depreciation

WDV

Cost

Rate

Opening

For the

Closing

Year

Plant

and Mach.

400,000

20%

195,200

40,960

236,160

163,840

Vehicles

200,000

20%

97,600

20,480

118,080

81,920

15,476

29,524

Office

Equip.

45,000

10%

12,195

3,281

275,284

64,721

Note

# 5

Current

Assets

Stock

Raw

Material

42,000

Work

in Process

56,500

158,500

Finished

Goods

60,000

Debtors

250,000

Less:

Bad Debts

+

(30,000)

Bank

165,000

Cash

110,000

Current

Assets

653,500

Note

# 6

220

Financial

Accounting (Mgt-101)

VU

Current

Liabilities

Trade

Creditors

220,000

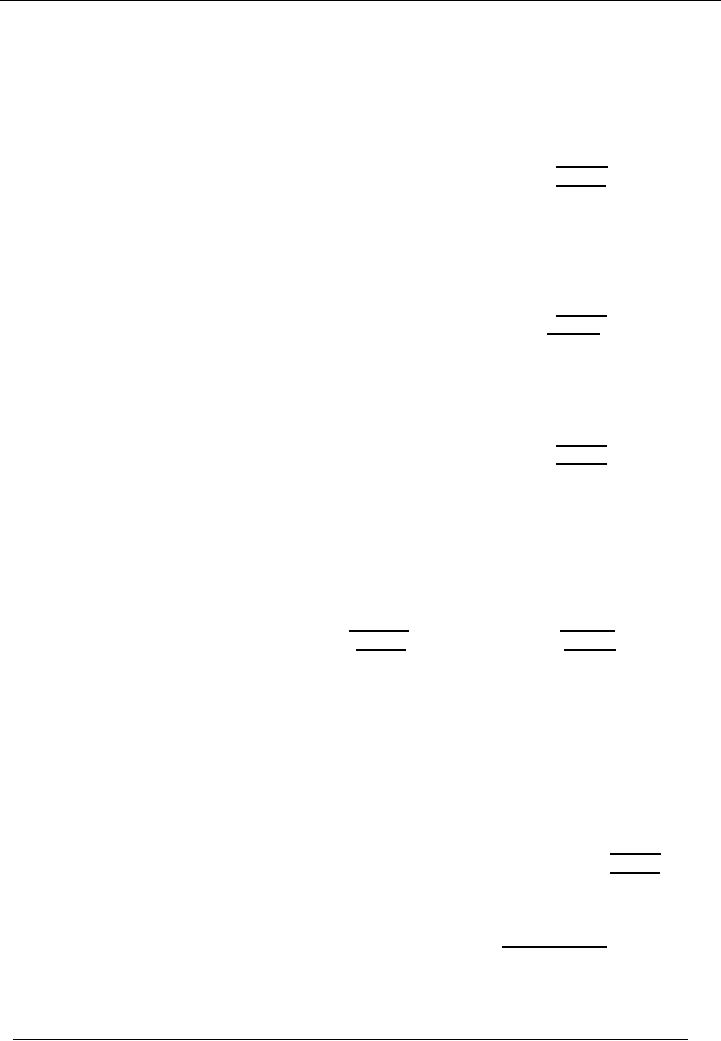

ILLUSTRATION

# 2

Following

trial balance has been

extracted from the books of Javed

Furniture Manufacturers on June

30,

2002.

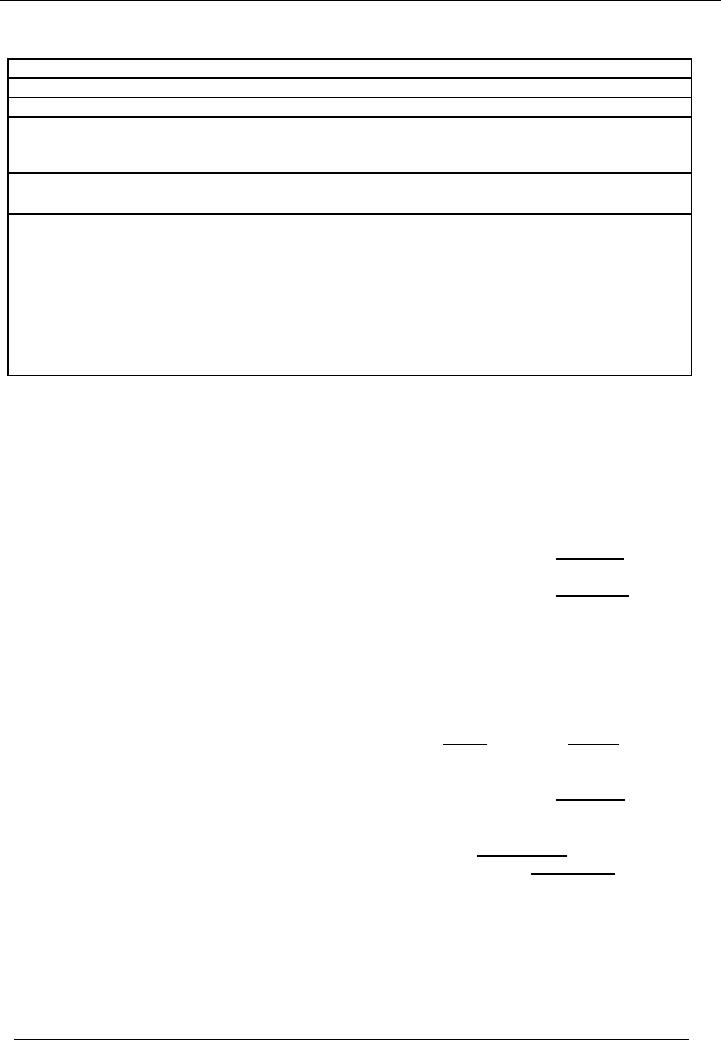

Javed

Furniture Manufacturers

Trial

balance as on June 30,

2002

Particulars

Amount

Amount

Dr.

(Rs.)

Cr.

(Rs.)

Raw

Material stock Jul. 01,

2001

52,500

Work

in process Jul. 01,

2001

97,250

Finished

goods stock Jul. 01,

2001

33,750

Raw

material purchased

925,000

Wages

812,500

Freight

inward

8,750

Plant

and machinery

700,000

Office

equipment

50,000

Acc.

depreciation Plant

125,000

Acc.

depreciation Office equipment

20,000

General factory

overheads

77,500

Office

electricity

18,750

Factory

power

34,250

Salaries

administrative staff

110,000

Salaries

sales staff

75,000

Salesman

commission

28,750

Rent

30,000

Insurance

10,500

General

Admin. Expense

33,500

Bank

Charges

5,750

Discounts

Allowed

12,000

Carriage

outward

14,750

Sales

2,500,000

Trade

Debtors

355,750

Trade

Creditors

312,500

Bank

142,000

Cash

21,250

Drawings

50,000

Capital

July 01, 2001

742,000

Total

3,699,500

3,699,500

Notes:

· Stocks

on June 30, 2002

o Raw

Material Rs. 60,000

o Finished

Goods Rs. 100,000

o Work

in Process Rs.

37,500.

221

Financial

Accounting (Mgt-101)

VU

·

Out of

total wages Rs. 450,000 is

direct and balance

indirect.

·

80% of

Rent and Insurance are to be

apportioned to factory and

balance to administrative office.

·

Depreciation

to be charged on Machinery at 20% and

Office Equipment at 10% on

cost.

You

are required to prepare profit

and loss account for the

year and balance sheet as on

june30, 2002.

SOLUTION

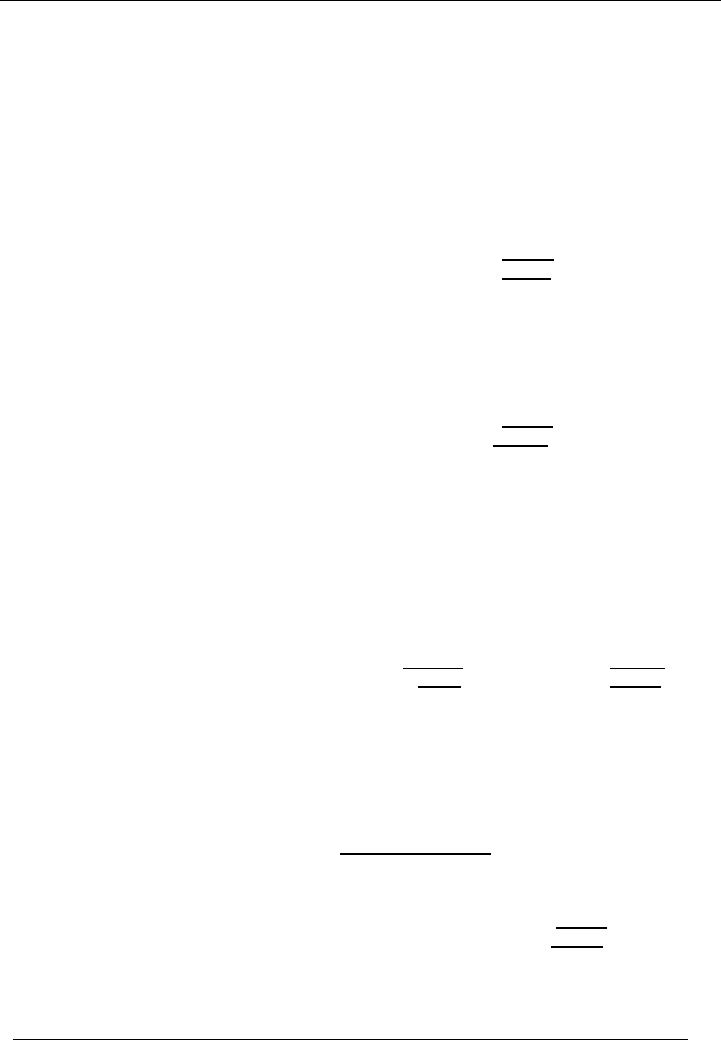

Javed

Furniture Manufacturer

Profit and

Loss Account for the

Year Ending June 30,

2002

Particulars

Note

Amount

Rs.

Sales

2,500,000

Less:

Cost of Goods Sold

1

2,016,400

Gross

Profit

483,600

Less:

Administrative Expenses

2

175,350

Less:

Selling Expenses

3

118,500

Operating

Profit

189,750

Less:

Financial Charges

4

17,750

Net

Profit Before Tax

172,000

222

Financial

Accounting (Mgt-101)

VU

Javed

Furniture Manufacturers

Profit

and Loss Account for the

Year Ending June 30,

2002

Particulars

Note

Amount

Rs.

Fixed

Assets at WDV

5

460,000

Current

Assets

6

716,500

Current

Liabilities

7

(312,500)

Working

Capital

404,000

Total

Assets Employed

864,000

Financed

by:

Capital

742,000

Add:

Profit for the year

172,000

Less:

Drawings(50,000)

Total

Liabilities

864,000

Working

1 Cost of Goods

Sold

Stock

of Raw Material Jul 01,

2001

52,500

Add.

Purchases

925,000

Add.

Carriage Inward

8,750

986,250

Less:

Closing Stock of Raw

Material

(60,000)

Raw

Material Consumed

926,250

Direct

labour

450,000

Factory

Overheads

General Factory

Overheads

77,500

Power

34,250

Rent

(80%

of

30,000)

24,000

Insurance

(80% of 10,500)

8,400

Plant

dep. On cost (Note 5)

140,000

646,650

Indirect

Labour

362,500

Total

Factory Cost

2,022,900

Add:

Work in Process Jul 01,

2001

97,250

Less:

Work

in Process Jun 30,

2002

(37,500)

Cost

of Goods Manufactured

2,082,650

Add:

Finished Goods Stock Jul 01,

2001

33,750

Less:

Finished Goods Stock Jun 30,

2002

(100,000)

Cost

of Goods Sold

2,016,400

223

Financial

Accounting (Mgt-101)

VU

Working

2 Administrative

Expenses

Administrative

Salaries

110,000

Rent

(20% of 30,000)

6,000

Insurance

(20% of 10,500)

2,100

General

Admin Expenses

33,500

Office

Electricity

18,750

Depreciation

Office Equip. (Note5)

5,000

Administrative

Expenses

175,350

Working

3 Selling Expenses

Salesman's

Salary

75,000

Commission

on Sales

28,750

Carriage

Outward

14,750

Selling

Expenses

118,500

Working

4 Financial Expenses

Bank

Charges

5,750

Discount

Allowed

12,000

Financial

Expenses

17,750

Working

5 Fixed Assets at WDV

Acc.

Depreciation

WDV

Cost

Rate

Opening For the

Closing

Year

Plant

and Mach.

700,000

20% 125,000 140,000

265,000

435,000

25,000

25,000

Office

equipment.

50,000

10% 20,000

5,000

460,000

145,000

Working

6 Current Assets

Stock

Raw

Material

60,000

Work

in Process

37,500

Finished

Goods

100,000

Debtors

355,750

Bank

142,000

Cash

21,250

Current

Assets

716,500

Working

7 Current Liabilities

Creditors

312,500

224

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES