|

Exercises on Determination of Income 1 |

| << Taxation of Foreign-Source Income of Residents |

| Exercises on Determination of Income 2 >> |

Taxation

Management FIN 623

VU

MODULE

5

LESSON

5.19

EXERCISES

ON RESIDENTIAL STATUS &

TAXATION

Exercises

on Determination of Income of Resident

Person and Non- Resident

Person

Exercise

1:

Determine

Gross total income of Mr. A

in the light of following particulars

information pertaining to tax

year

2006.

Mr. A,

employed in Pakistan, received

Rs. 400,000/ as Salary. His

income from other sources is

given

under:

a.

Dividends received in Tokyo on

20th Aug 2005 from a

Pakistani resident company: amounting

Rs.

10,000;

b.

Share of profit received in

Tokyo on 10th May, 2006

from a business situated in

Kuwait but

controlled

through PE in Pakistan: amounting

Rs. 60,000;

c.

Remittance from Tokyo on

March 10, 2006 out of

past profits earned and

received there

amounting

Rs.600,000;

d.

Profit on debt received and

earned in Pakistan on 1st

Aug, 2006 Rs. 50,000.

Calculate his gross

total

income, if he is

a.

Resident

and

b.

Non-Resident.

Solution

to Exercise 1:

Computation

of Gross total income of Mr. A

for tax year

2006

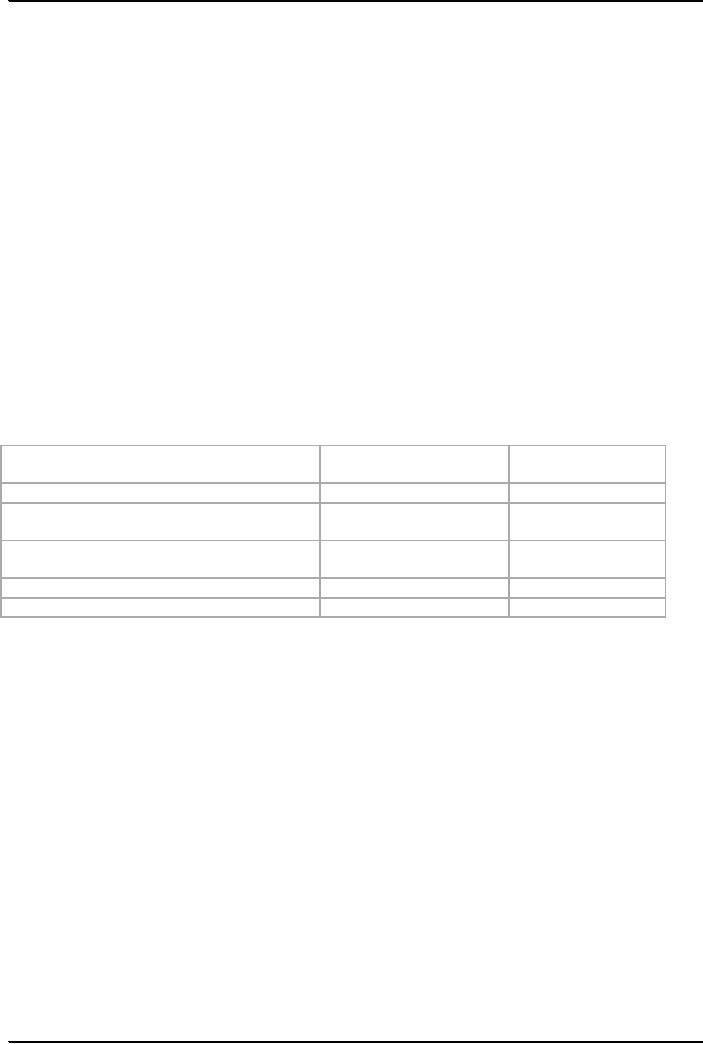

Particulars

Gross

total income if

Gross

total income

resident

if

non-resident

Dividend

received

10,000

10,000

Share

of profit received through PE of

non-

60,000

Nil

resident

Remittance

out of past profit

Nil

Nil

(Note1)

Profit

on debt (Note2)

Nil

Nil

Total

70,000

10,000

Note

1:

Since

remittance is not income,

hence it is not included.

Note

2:

Profit

on debt received on 1st Aug,

2006, the said date does

not pertain to tax year 2006

hence this amount

shall

not be added towards taxable

income for tax year

2006.

Exercise

2 Determine Gross total income of Mr. Z

in the light of following

particulars information

pertaining to

tax year 2006.

Royalty

earned in Pakistan but

received on April 01, 2006

in Sydney: Rs. 140,000:

dividend from a

foreign

company

received in London on May

10, 2006: Rs.150,000; share

of profit of business situated in

Sydney,

received

in Paris on Aug 14, 2005

but from PE in Pakistan: Rs.

250,000; and rent for tax

year 2006 of a

house

property situated in Sydney

and received there on

01-01-2006: Rs.1,000,000.

a) if Z is

resident

b) if Z is

nonresident

28

Taxation

Management FIN 623

VU

Solution

to Exercise 2:

Particulars

Gross

total income if

Gross

total income

resident

if

non-resident

a.

Royalty

140,000

140,000

b.

Dividend

150,000

Nil

c.

Share of profit from PE in

Pakistan

250,000

250,000

d.

Rent for tax year

2006

800,000

Nil

Rs.

1,000,000 200,000 (Allowance for

Repairs

being

1/5th of total rent

subtracted)

Total

1,340,000

390,000

29

Table of Contents:

- AN OVERVIEW OF TAXATION

- What is Fiscal Policy, Canons of Taxation

- Type of Taxes, Taxation Management

- BASIC FEATURES OF INCOME TAX

- STATUTORY DEFINITIONS

- IMPORTANT DEFINITIONS

- DETERMINATION OF LEGAL STATUS OF A PERSON

- HEADS OF INCOME

- Rules to Prevent Double Derivation of Income and Double Deductions

- Agricultural Income

- Computation of Income, partly Agricultural,

- Foreign Government Officials

- Exemptions and Tax Concessions

- RESIDENTIAL STATUS & TAXATION 1

- RESIDENTIAL STATUS & TAXATION 2

- Important Points Regarding Income

- Geographical Source of Income

- Taxation of Foreign-Source Income of Residents

- Exercises on Determination of Income 1

- Exercises on Determination of Income 2

- SALARY AND ITS COMPUTATION

- Definition of Salary

- Significant points regarding Salary

- Tax credits on Charitable Donations

- Investment in Shares

- SALARY AND ITS COMPUTATION EXERCISES 1

- SALARY AND ITS COMPUTATION EXERCISES 2

- SALARY AND ITS COMPUTATION EXERCISES 3

- Tax treatment of Gratuity

- Gratuity Exercise

- PROVIDENT FUND

- Exemptions on Business income, Treatment of Speculation Business

- Deductions Allowed & Not Allowed

- Deductions: Special Provisions, Depreciation

- Methods of Accounting

- Taxation of Resident Company

- Taxation of Companies: Exercises

- Computation of Capital Gain

- Disposals Not Chargeable To Tax

- TAX RETURNS & ASSESSMENT OF INCOME UNIVERSAL SELF ASSESSMENT SCHEME

- Normal Assessment, USAS, Provisional Assessment, Best Judgment Assessment

- ADVANCE TAX COLLECTION & RECOVERY OF TAX PENALTIES & PROSECUTION

- What is Value Added Tax (VAT)?

- SALES TAX

- SALES TAX RETURNS