|

ESSENTIALS OF PARTNERSHIP |

| << BRANCH ACCOUNTING 2 |

| Partnership Accounts Changes in partnership firm >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 18

ESSENTIALS

OF PARTNERSHIP

The

law governing partnership is contained in

the Partnership Act, 1932.

Section 4 of

the

Act defines partnership as "the relation

between persons who have

agreed to share

the

profits of a business carried on by all

or any of them acting for all".

The

following are the essential

elements of partnership:

1.

There must be an agreement entered into

by all the persons

concerned.

2.

The agreement must be to share

the profits of a

business.

3.

The business must be carried on by all or

any of them acting for all.

All these

elements must be present before a

partnership can come into existence. If

any of them

is not

present, there cannot be formed a

partnership.

Partnership

agreement

Partnership

is the result of an agreement.

The agreement among the

partners that sets

out

the terms on which they have

agreed to form a partnership is called

partnership

agreement.

It may be in writing or by words of mouth or be implied from

the course of

conduct

of the parties. It is desirable to

have the partnership

agreement in writing to

avoid

future disputes. The document in writing

containing the various terms

and

conditions

as to the relationship of the

partners to each other is

called the

`partnership

deed'.

The following clauses are normally

included in partnership

agreement.

1.

Name under which

business of the firm is to be carried

on.

2.

Nature

of partnership business.

3.

The

capital of the firm and the

proportion in which it is to be contributed

by

each

partner.

4.

Ratio

in which profits and losses are to be

shared by partners.

5.

Rate

at which interest is to be allowed on the

capital and charged on

the

drawings.

6.

Amount, which

each partner is allowed to withdraw in

anticipation of,

profits

from the business for private

expenses and the timing of

such

drawings.

7.

Amount of

salaries and other allowances if any

payable to partners.

8.

Commencement

and duration of partnership.

9.

Whether

the capital accounts are to

be fixed or fluctuating.

10.

Valuation

of goodwill at the time of

retirement or death of a

partner.

11.

The

method of ascertaining the amount due to

the retiring partner or

the

representative

of a deceased partner at the

time of retirement or death

and

the

manner in which the amount due will be

paid.

12.

Keeping

of proper books of accounts and

preparation of balance

sheet.

13.

Audit of

the accounts of the firm and

the manner of appointment of

auditor.

14.

Right

and duties of partners.

15.

Arbitration

clause, laying down the

procedure to be followed for

the

settlement

of disputes among the

partners.

84

Advance

Financial Accounting

(FIN-611)

VU

Question

X, Y and Z

set up a partnership firm on 1-1-2005.

They contributed Rs. 150,000,

Rs.

120,000 and

Rs. 90,000 respectively as their

Capitals and decided to share

Profit & Loss

in

the ratio of 3: 2: 1.

The

partnership deed provides

that A is to be paid a salary of

Rs. 3,000 per month

and

B a

commission of Rs. 15,000. It

also provides that interest

on Capital be allowed at 6%

per

annum. The drawings and Interest on

drawings for the year were

as follows:

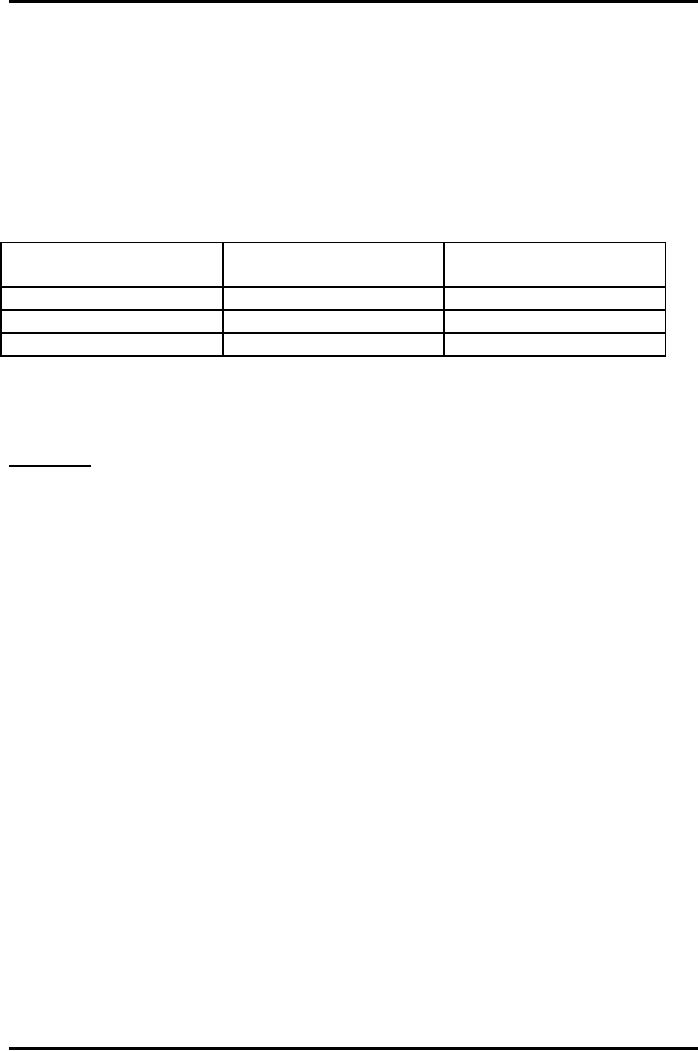

Partners

Drawings

(Rs.)

Interest

on drawings

(Rs.)

A

18,000

810

B

12,000

540

C

6,000

270

The

Net amount of Profit as per Profit &

Loss account for the year

2005 was Rs.

106,980.

Required:

You

are required to prepare a

Profit & Loss Appropriation

Account and Partner's

Capital

Account after passing

necessary Journal

entries.

85

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASBíS FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet