|

Dow Theory |

| << Indicators with Economic Justification |

| VALUATION PHILOSOPHIES >> |

Investment

Analysis & Portfolio Management

(FIN630)

VU

Lesson

# 10

TECHNICAL

ANALYSIS Contd...

Dow

Theory:

Charles

Dow was one of the founders of

Dow Jones & Co. (DJ,

NYSE), publisher of

The

Wall

Street Journal. He is sometimes credited

with being the inventor of

the point and

figure

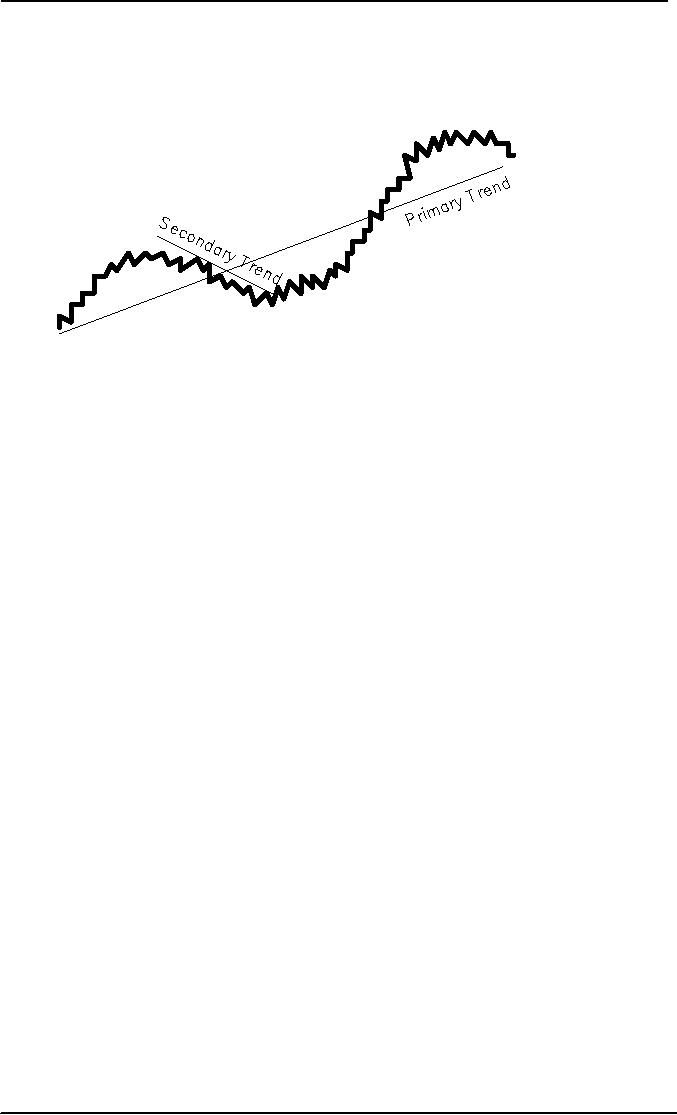

chart. The Dow

Theory holds

that there are three

components in the movement

of

stock

prices. The primary

trend is

the long-term direction of

the market and is the

most

important.

The terms bull and bear

originated with the

direction of Dow Theory

primary

trend.

The secondary

trend refers

to a temporary reversal in the

primary trend, one that

does

not

persist long enough to become

the primary trend. Finally,

daily fluctuations in the

stock

price

are meaningless and contain no useful

information.

The

Dow Theory is often

illustrated by an ocean analogy.

The tide is either is coming

in or

going

out the primary trend.

Even when the tide is

going out, waves still

wash ashore

the

secondary. And as everyone

who has ever spread a

blanket on the beach

knows,

sometimes

for no apparent reason ripples

from the waves reach far up

the sand and soak

your

belongings.

The

Dow Theory is based on the

price movement of the Dow

Jones Industrial

Average

(DJIA).

Changes in the primary trend

of the DJIA are confirmed by

the Dow Jones

Transportation

Average. The logic is that

industrial firms make products, and

transportation

companies

ship them. When both

averages are advancing, the

economy is in good shape. An

explanation

of the technical points of

this famous market technique

is available in the

most

public

libraries.

Surprising,

Charles Dow had little to do

with the development of this

theory. The Wall

Street

Journal, in fact, suggests

that the entire field of

technical analysis may

have

originated

from "the distortion and

selective editing of Mr. Dow's ideas."

While Dow were

believed

highly correlated with the

business cycle.

In

Charles H. Dow and the Dow

Theory, George W. Bishop, a financial

historian, states,

"there

is no evidence that Dow

looked upon the averages as

containing anything more

than

an

indication of statistical nature of

the trend." There is also no

evidence Dow ever

suggested

prices would be predicted by interpreting

charts. The term "Dow

Theory" appears

to

have first been used in a

1902 book by Samuel Armstrong

Nelson entitled the ABC

of

stock

speculation.

68

Investment

Analysis & Portfolio Management

(FIN630)

VU

OLD

PUZZLES & NEW DEVELOPMENT:

Fibonacci

Numbers:

Fibonacci

Numbers have

intrigued mathematics and scientist

for hundreds of years.

Leonard

Fibonacci (1170-1240) was a medieval

mathematician who discovered

the series of

numbers

while studying the

reproductive behavior of rabbits.

The beginning of the

Fibonacci

series is shown

below.

1,1,2,3,5,8,5,13,21,34,55,89,144,233,......

After

the initial pairs of ones,

each succeeding number is simply

the sum of the

previous

two.

The

remarkable thing about these

numbers is the frequency

with which they appear in

the

environment.

Sunflowers have seeds

spirals around the center of

the plant. Some

spirals

contain

seeds leaning counterclockwise,

with other spirals going

the other way. On

most

sunflowers,

the number of clockwise

spirals and the number of

counter clockwise spirals

are

adjacent

Fibonacci numbers. A blossom

might have 34 counterclockwise

spirals and 55

clockwise

spirals. The structure of

pine cones, the number of

chambers in a nautilus

seashell,

the topology of spiraling

galaxies, and the ancestry of

bees all reveal

Fibonacci

numbers.

Even a professional journal,

the Fibonacci quarterly, is

devoted to the study of

this

series.

Technical

Analyst who follows

Fibonacci numbers usually

makes use of the number

1.618.

This

number is called the golden

mean and appears in ancient writings and

architecture.

(The

golden mean features prominently in

the dimensions of the

Parthenon). After the

first

10 or so

numbers in the series, each

Fibonacci number divided by

its immediate

predecessor

equals

1.618. For example,

89/55=1.618; 134/89= 1.618 and so

on. This magic number

is

used

to calculate Fibonacci

ratios.

Many

Fibonacci advocates in the

investment business use the

first two ratios, 0.382

and

0.618,

to "compute retrenchment levels of a

previous move." For

instance, a stock that

falls

from

$50 to $35(a 30 percent drop) will

encounter resistance to further

advances after it

recoups

38.2 percent of its loss

(that is, after it rises to

$40.73).

Some

technical analysts keep close

tabs on resistance and support

levels as predicted by

the

Fibonacci

ratios. Even people who do

not subscribe to this business

know that many

other

people

do, and that when stock

prices approach important Fibonacci

levels, unusual

things

can

occur.

Fibonacci

numbers occur frequently and inexplicably in

nature.

Kondratev

Wave Theory:

Nikolay

Kondratev was a Russian economist and

statistician born in 1892. He

helped

develop

the first soviet five-year

plan. From 1920 to1928 he was

Director of the study

of

business

activity at the Timiriazev

Agriculture Academy. While

there he devoted his

attention

to the study of Western

capitalist economies. In the economies of

Great Bertain

and

United states, he identified

long term business cycles

with a period of 50 to 60

years.

He

became well known after

the U.S. crash of 1870. His

hypothesis of a long-term

business

cycle

is the called Kondratev

wave theory.

69

Investment

Analysis & Portfolio Management

(FIN630)

VU

Note

that the market crashof 1987

occurred 58 years after the crash of

1929, a period

consistent

with Kondratev's theory.

Some modern economists

believe that

significant

macroeconomics

changes, such as floating exchange

rates, the elimination of

the gold

standard, and

the reduction of barriers to

free trade, make the

business cycle less

predictable.

Still, many market analysts

consider Kondratev's work in

their assessment of

the

stock market and its

risks.

Nikolay

Kondratev made the mistake

of criticizing Stalin openly.

For his crimes, he

was

executed

in 1928. He was posthumously cleared of

all charges in 1987, the

year of the most

recent

market crash.

Kondratev

wave theory states there is

a 50- to 60-year business

cycle.

Chaos

Theory:

At

recent finance conferences, a

few researchers have

presented papers on chaos

theory

and

its application to the stock

market. In physics, chaos

theory is a growing field of

study

examining

instances in which apparently random

behavior is, in fact, quite

systematic or

even

deterministic. Scientists apply

this theory to weather

prediction, population

growth

estimates, and

fisheries biology.

As an

example of the later

application, a given volume of

ocean water, left free

from human

interference,

will not necessarily reach an equilibrium

population of the various

species that

inhibit

in it. As fish grow, they

consume the smaller fry (of

their own or different

species) in

increasing

numbers. Fewer young fish

are left to mature; this

couple with the natural

death

of

the older fish, eventually

results in a sudden drastic reduction in

fish population,

causing

dismay

to fisherman and excitement in the

local media. At the same

time, it results in

reduced

predation and food competition by

the surviving fry, so the

population begins to

grow

dramatically, and the cycle

continues. Interactions between

species add complexity

to

the

process.

Investment

analysts have sought a

pattern in stock market

behavior since the origin of

the

exchanges.

Many remains unknown about

how security prices are

determined and chaos

theory

may eventually provide some

partial answers. If the apparent randomness of

security

price

changes can be shown to be nonrandom,

much of the theory of

finance would need

revision.

Chaos

theory sees systematic

behavior amidst apparent

randomness.

Neural

Networks:

A

neural network is a trading

system in which a forecasting

model is trained to find

a

desired

output from past trading

data. By repeatedly cycling

through the data, the

neural net

work

eventually learns the

pattern that produces the

desired output. If the

desired output

remains

elusive, more data is

included until a pattern is

found. Neural networks may

also

include

a feedback mechanism whereby experience

is gained from past

errors.

This

topic is a hot one in the

investment community. National

conferences have been

organized

dealing exclusively with the

topic, and the trade literature

publishes many

articles

on

the topic. A problem with

the concept of a neural

network is that the stock

market is

seldom

deterministic. Situations constantly

change, and what may have

been true a few

years

ago will not necessarily

prevail tomorrow. Financial

academics are especially

leery of

backtests, or

research that tests a

hypothesis using past data.

Mining the data will

almost

70

Investment

Analysis & Portfolio Management

(FIN630)

VU

always

result in some apparent cause and

effect between past events

and stock market

performance.

Research that tests a

hypothesis using a subsequent data is

much more useful.

An

article in the popular press

describes Wall Street's

response to this

criticism:

One

way to get around this

hazard is to build something

called a genetic algorithm

into your

neural

network. A sexy term that

currently causes Wall Street

rocket scientists to

swoon,

genetic

algorithms enable neural nets to adapt to

the future by spawning

schools of baby

nets,

each of which is sent to swim against

the changing flow of data,

Where only the

fittest

survive

to take over the role of the

mother.

No

matter what someone's field

of study, they are

interested in the search for

a better

mousetrap.

Essentially, what all

security analysts seek to do is

find improvements in

their

methodology

for security

selection.

Indicators

of the Witchcraft Variety:

Even

in this era of political correctness,

some indicators are less

worthy than others. If

there

is no

logical connection between

what an indicator measures and

what it purports to

show,

the

indicator probably should

not receive much study

time. A few such indicators

are well

established in

market folklore, and while

they may have no logical

place in the investment

decision-making

process, an awareness of them is

helpful.

The

Super Bowl Indicator:

This

well-known market statistic will

bring a smile to the face of

many investment

professionals

when asked about it.

The super

bowl indicator states

that the stock

market

will advance

the following year if the

super bowl football game is

won by a team from

the

original

National Football League (NFL).

This indicator was correct 28 of 33

times over the

period

1967 through 1999. Such a

percentage might seem

unlikely to have occurred

by

chance.

There

is a statistical problem with

this indicator, however. For

one thing, there are

more

original

NFL teams that there

are teams in the other

conference, the American

Football

Conference

(AFC). The Indianapolis

Clots, Pittsburgh Steelers, and Cleveland

Browns (all

AFC

teams) are original NFL

teams. Couple this

information with the fact

that the stock

market

rises more often than it

falls and the odds favor

the indicator.

Few

people admit to being persuaded by

the super bowl indicator;

most will agree it is

unlikely

that any true cause-and

effect relationship exist

between the game and the

market.

Still,

many professional investment

managers and individual investors

alike subconsciously

root

for the NFL team, just in

case.

Sunspots:

The

public began to associate sunspots

with the stock market

through five works of

William

Stanley

Jevons published between 1862 and 1897.

While the notion of using

the eleven-year

solar

cycle as a forecasting device

has few advocates today, it

was the focus of much

discussion

100 years ago.

Jevons

found that rainfall and

temperature appeared to be related to

solar activity:

The

success of the harvest in

any year certainly depends

upon the weather, especially

that of

the

summer and autumn months.

Now if this weather depends

upon the solar period,

it

71

Investment

Analysis & Portfolio Management

(FIN630)

VU

follows

that the harvest and the

price of grain will depend

more or less the solar

period, and

will go

through periodic fluctuations in periods

of time equal to those of the

sun spots.

The

essence of his history is

that increased sunspot

activity leads to warmer

temperatures

and

more rain, leading to an

improved harvest and a stronger

economy, and finally to

higher

stock

prices. He tested this theory on

English grain prices between 1259 and

1400. Jevons

observed a

ten-to eleven-year cycle in

the money market and

believed this might be, at

least

in

part, because of the solar

influence on crops and the

economy.

Hemline

Indicator:

Like

the super bowl indicator,

the hemline indicator is

market folklore that few

people take

seriously,

but many like to talk

about it. The essence of

the hemline indicator is

this:

As

shorter dresses for women

become the fashion, the

market advances, and vice

versa.

Simultaneously

plotting skirt lengths and

market levels reveals a

remarkable correlation. In

the

1920s the market rose and so

did hemlines. During the

Great Depression, dresses

touched

the ground. There was

gradual rise in the market and in

hemlines through

World

War

II; the rest of the forties and

the fifties peaked in the

go-go days of 1960s

with

miniskirts.

The 1970s saw peasant

dresses and mixiskirts and an economic

recession.

During

the prosperity of the 1980s

things moved back up. During

one stretch in the

early

1990s

the market was nearly flat

for over a year. What was

the dress fashion? Slits on

the

side

of skirts presumably the

marked did not know

what to make of them.

All

these "indicators," of course, are

likely to be purely spurious

correlations. What

economic

cause and effect could

possibly be at work? The

lack of an economic

underpinning

is the reason technical

indicators of this type are

called witchcraft.

Breadth

Indicators:

The

Advance-Decline Line (Breadth of the

Market):

The

advance-decline line measures, on a

cumulative daily basis, the

net difference

between

the

number of stocks advancing in price and

those declining in price for

group of stocks

such

as those on the NYSE. Subtracting

the number of declines from

the number of

advances

produces the net advance for a

given day (which, of course, can be

negative). This

measure

may include thousands of

stocks.

The

advance-decline line, often

referred to as the breadth of

the market, results

from

plotting

a running of these numbers

across time. The line can be

based on daily or

weekly

figures,

which are readily available

from daily newspaper such as

The Wall Street

Journal.

The

advance-decline line is compared to a

stock average, in particular in DJIA in

order to

analyze

any divergence that is, to

determine whether movements in

the market indicator

have

also occurred in the market as a

whole. Technicians believe

that divergence can

signal

that

the trend is about to

change.

The

advance-decline line and the

market averages normally

move together. If both

are

rising

(declining), the overall

market is said to be technically

strong (weak). If the

advance-

decline

line is rising while the

market average is declining,

the decline in the

market

average

should reverse itself. Particular

attention is paid to a divergence between

the two

during

a bull market. If the market

rises while the line weakens

or declines to reverse itself

and

start declining.

72

Investment

Analysis & Portfolio Management

(FIN630)

VU

New

High and Lows:

Part of

the information reported for

the NYSE and other stocks is

the 52-week high and

low

prices

for each stock. Technicians

regard the market as bullish

when a significant number

of

stocks

each day hit 52-week

highs. On the other hand,

technicians see rising

market indexes

and

few stocks hitting new highs

as a troublesome sign.

Volume:

Volume

is an accepted part of technical

analysis. High trading

volume, other things

being

equal,

is generally regarded as a bullish

sign. Heavy volume combined

with rising prices is

even

more bullish.

Sentiment

Indicators:

Short-Interest

Ratio:

The

short interest for a

security is the number of

shares that have been

sold short but not

yet

bought

back. The short interest

ratio can be defined relative to

shares outstanding or

average

daily

volume, as in;

Short

interest ratio = Total

shares sold short / Average

daily trading volume

The

NYSE, Amex and NASDAQ report

the short interest monthly

for each stock.

The

NYSE

and Amex indicate those securities

where arbitrage or hedging

may be important, but

the

significant of these activities

cannot be determined. For

investors interested in th

short

interest,

each month. The Wall Street

Journal reports NYSE and

Amex issues for which

a

short

interest position of at least 100,000

shares existed or for which

a short position change

of 50,000

shares occurred from the

previous month. A list of stocks

with the largest

short

interest

ratios broken down by

exchange can be found at www.trading-ideas.com

In

effect, the ratio indicates

the number of days necessary to

"work off" the current

short

interest.

It is considered to be a measure of investor

sentiment, and many investors

continue

to

refer to it.

Investors

sell short when they

expect prices to decline; therefore, it

would appear the

higher

the

short interest, the more

investors are expecting a

decline. A large short

interest position

for

an individual stock should

indicate strong negative

sentiments against a stock.

Many

technical analysts interpret

this ratio in the opposite

manner as a contrarian

indicator

a

high short interest ratio is

taken as bullish sign,

because the large number of

shares sold

short

represents a large number o

shares that must be repurchased in

order to close out

the

short

sales. In effect, the short

seller must repurchase regardless of

whether or not his or

her

expectations

were correct. The larger

the short interest ratio,

the larger the potential

demand

that

is indicated. Therefore, an increase in

the ratio indicates more

"pent-up" demand for

the

shares

that have been

shorted.

The

short interest ratio for a

given method should be

interrupted in relation to

historical

boundaries,

which historically were in

the range of 1 to 2 for the

NYSE. The problem is

that

the

boundaries keep changing. In

the 1960s, 1970s and 1980s,

a ratio of 2 was bullish.

More

recently,

the ratio has been in

the 3 to 6 range regardless of the

market.

73

Investment

Analysis & Portfolio Management

(FIN630)

VU

Mutual

Fund Liquidity:

Several

indicators are based on the

theory of contrary investing.

The idea is to trade

contrary

to most investors, who

supposedly almost always

lose. This is an old idea on

Wall

Street, and

over the year technicians

have developed several

measures designed to

capitalize

on

this concept. As mentioned above,

the short interest is often

used as a contrarian

indicator,

with high short levels in a

stock viewed as being overly

pessimistic.

Mutual

fund liquidity can be used as a

contrary opinion technique.

Under this scenario,

mutual

funds are viewed I a manner

similar to odd - lotters, that

is, they are presumed to

act

incorrectly

before a market turning

point. Therefore, when

mutual fund liquidity is

low

because

the funds are fully

invested, contrarian believes

that the market is at, or

near a peak.

The

funds should be building up

cash (liquidity); instead, they

are extremely bullish and

are

fully

invested. Conversely, when

funds hold large liquid

reserves it suggests that

they are

bearish.

Contrarians would consider

this a good time to buy,

because the market may be

at,

or

near, its low

point.

The

Opinions of Investment Advisory

Newsletter:

Investors'

intelligence an investment advisory

service, samples weekly the

opinions of

about

150 investments advisory services and

calculates an index of investments

service

opinions.

It has found that on average,

these services are most bearish at

the market bottom

and

last bearish at the market

top. This index, published

since 1963, is now

available

weekly

and is widely quoted in the

investing community.

The

"bearish sentiment index" is

calculated as the ratio of

advisory services that are

bearish

to

the total number with an

opinion. When this index

approaches 55 or 60 percent,

this

would

indicate a bearish indicate a bearish

attitude on the part of

investment advisory

services. As

this ratio approaches 20

percent, the opposite occurs.

Thus, a contrarian

should

react in

the opposite direction of the

sentiment this ratio is

exhibiting. As the ratio

nears 60

percent,

the contrarian becomes

bullish, because a majority of

the investment

advisory

services

are bearish, and around 20 percent

the contrarian becomes bearish,

because most of

the

investment advisory services are

not bearish.

The

reason for this seeming

contradiction to logic that

investment advisory services

are

wrong

at the extremes is attributed to

the fact these services tend

to follow trends rather

than

forecast

them. Thus, they are

reporting and reacting to what

has happened rather

than

concentrating

on anticipating what is likely to

happen.

The

Future of Technical Analysis:

Although

there is much in finance

that we do not completely

understand, technical

analysis

has

persisted from more than 100

years, and it is not likely to

disappear from the

investment

scene

anytime soon. Improved

quantitative methods coupled

with improved

behaviorist

Werner

De Bondt, for instance,

recently reported substantial

evidence that the

public

expects

the continuation of past

price trends. That is,

they are bullish in bull

markets and

pessimistic

in bear markets.

Technical

analysis is a controversial topic.

While it currently has

little standing in

the

academic

literature, a great deal about price

movements has yet to be

discovered.

74

Investment

Analysis & Portfolio Management

(FIN630)

VU

Technical

analysts like to use charts.

They believe that supply and

demand determines

security

prices, that changes in supply and demand

cause prices to change, and that

charts

can be

used to predict changes in

supply and demand and in investor

behavior. Popular

types

of charts are the line

chart, bar chart point and

figure chart, and the

candlestick chart.

Technical

indicators are measure of

economic and non-economic activity

that purportedly

have

a relationship to subsequent market

behavior. Some of these

indicators, such as

the

mutual

fund cash position or short

interest ratio, have

economic underpinnings, while

others

(the

super bowl or hemline indicators) do

not. All are part of market

folklore.

Fibonacci

numbers are inexplicably

common in nature. Some people

believe that the

Fibonacci

series is helpful in predicting

changes in security trading

patterns. Popular

areas

of

research today among

technical analysts include

chaos theory (the search

for patterns in

randomness) and

neural networks (the notion

that computer algorithms can be

taught to look

for

optimum patterns).

Conclusions

about Technical Analysis:

Technical

analysis often appeals to those

who are beginning a study of

investments, because

it is

easy to believe tat stock

prices form repeatable patterns

over time or that

certain

indicators

should be related to future

market price movements. Most

people who look at a

chart

of a particular stock will immediately

see what they believe to be

patterns in the price

changes

and clear evidence of trends

that should have been

obvious to anyone studying

it.

On

the one hand, academicians are

highly skeptical of technical

analysis, to say the

least.

Most

academics discussions at the college

level dismiss, or seriously disparage,

this

concept.

A primary reason is that

thorough tests of technical

analysis techniques

typically

fail

to confirm their value,

given all costs and

considering an alternative, such as a

buy-and-

hold

strategy.

In

addition to these reasons,

other troubling features of

technical analysis remain.

First,

several

interpretations of each technical

tool and chart pattern are

not only possible but

usual.

One or more of the

interpreters will be correct (more or

less), but it is

virtually

impossible

to know beforehand who these

will be. After the fact, we

will know which

indicator

or chart or whose interpretations was

correct, but only those

investors who used

that

particular information will benefit.

Tools such as the Dow

Theory are well known

for

their

multiple interpretations by various

observers who disagree over

how the theory is to

be

interpreted.

75

Table of Contents:

- INTRODUCTION OF INVESTMENT

- THE ROLE OF THE CAPITAL MARKETS

- THE NASDAQ STOCK MARKET

- Blue Chip Stocks, Income Stock, Cyclical Stocks, Defensive Stocks

- MARKET MECHANICS

- FUNDAMENTAL STOCK ANALYSIS

- BEYOND FUNDAMENTAL ANALYSIS

- What is Technical Analysis

- Indicators with Economic Justification

- Dow Theory

- VALUATION PHILOSOPHIES

- Ratio Analysis

- INVESTMENT RATIOS

- Bottom-Up, Top-Down Approach to Fundamental Analysis

- The Industry Life Cycle

- COMPANY ANALYSIS

- Analyzing a Company’s Profitability

- Objective of Financial Statements

- RESEARCH PHILOSPHY

- What Is An Investment Company

- Exchange-Traded Funds (ETFs)

- COMMON STOCK: ANALYSIS AND STRATEGY

- THE EFFICIENT MARKET HYPOTHESIS (EMH)

- Behavioral Finance

- MARKET INDEXES

- POPULAR INDEXES

- BOND PRINCIPLES

- BOND PRICING AND RETURNS

- Accrued Interest

- BOND RISKS

- UNDERSTANDING RISK AND RETURN

- TYPES & SOURCES OF RISK

- Measuring Risk

- ANALYZING PORTFOLIO RISK

- Building a Portfolio Using Markowitz Principles

- Capital Market Theory: Assumptions, The Separation Theorem

- Risk-Free Asset, Estimating the SML

- Formulate an Appropriate Investment Policy

- EVALUATION OF INVESTMENT PERFORMANCE

- THE ROLE OF DERIVATIVE ASSETS

- THE FUTURES MARKET

- Using Futures Contracts: Hedgers

- Financial Futures: Short Hedges, Long Hedges

- Risk Management, Risk Transfer, Financial Leverage

- OVERVIEW