|

DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations |

| << STANDARD FORMAT OF BALANCE SHEET |

| SOLE PROPRIETORSHIP >> |

Financial

Accounting (Mgt-101)

VU

Lesson-31

DIFFERENT

BUSINESS ENTITIES

There

are two types of

entities:

· Commercial

organizations

· Non-commercial

organizations

COMMERCIAL

ORGANIZATION

Commercial

organization is the entity that is

working to earn profit. At the

end of the financial year, the

profit

is distributed among the owners of the

business. Normally, commercial

organizations include:

· Sole

proprietorship

· Partnership,

and

· Limited

Company

NON

COMMERCIAL ORGANIZATION

Non

Commercial organization is the entity

that is not working to earn

profit. At the end of the financial

year,

the

profit is not distributed

among the owners, but is

used for the objective of the organization.

Normally,

commercial

organizations include:

· Co-operative

institutions

· NGO's

· Trusts

COMMERCIAL

ORGANIZATION

Sole

proprietorship business

It is a

business that is owned by an individual.

He may have employed any number of

persons to work for

him,

but he is the sole owner of the

business.

Partnership

Partnership

is the type of business where more

than one person (called

partners) enters into a

legal

agreement

to run a business on a profit

and loss sharing

basis.

Limited

Company

Limited

company is a legal entity,

separate from its owners

(called shareholders). The

basic difference

between

a partnership and a limited company is

the concept of limited

liability.

· If a

partnership business runs into

losses and is unable to pay

its liabilities, its partners

will have to

pay

the liabilities from their

own wealth.

· Whereas,

in case of limited company, the

shareholders don't lose

anything more than the amount

of

capital

they have contributed in the company.

i.e., their personal wealth is

not at stake and

their

liability

is limited to the amount of share capital

they have contributed.

The

concept of limited company is to

mobilize the resources of a large number

of people for a project,

which

they would not be able to

afford independently and then, get it

managed by experts.

201

Financial

Accounting (Mgt-101)

VU

ACCOUNTING

REQUIREMENTS

Sole

Proprietorship

In

case of sole proprietor, he is the

sole owner of the business. So,

there is no restriction on him for

drawing

money

for his personal

use.

For

accounting purposes, an account

titled Proprietor's Drawings is opened in

the General Ledger and

all

payments

and receipts, if any, from

the proprietor are recorded in this

account.

Accounting

Entries

Cash

Drawn by Proprietor

Debit

Proprietor's

drawing

Credit

Cash

Amount

paid in by proprietor through

cheque

Debit

Bank

Credit

Proprietor's

drawing

The

balance in drawings account is

transferred to Capital Account at the

year end.

The

sample of general ledger of Capital

account, in case of profit

earned by the business, is as

follows:

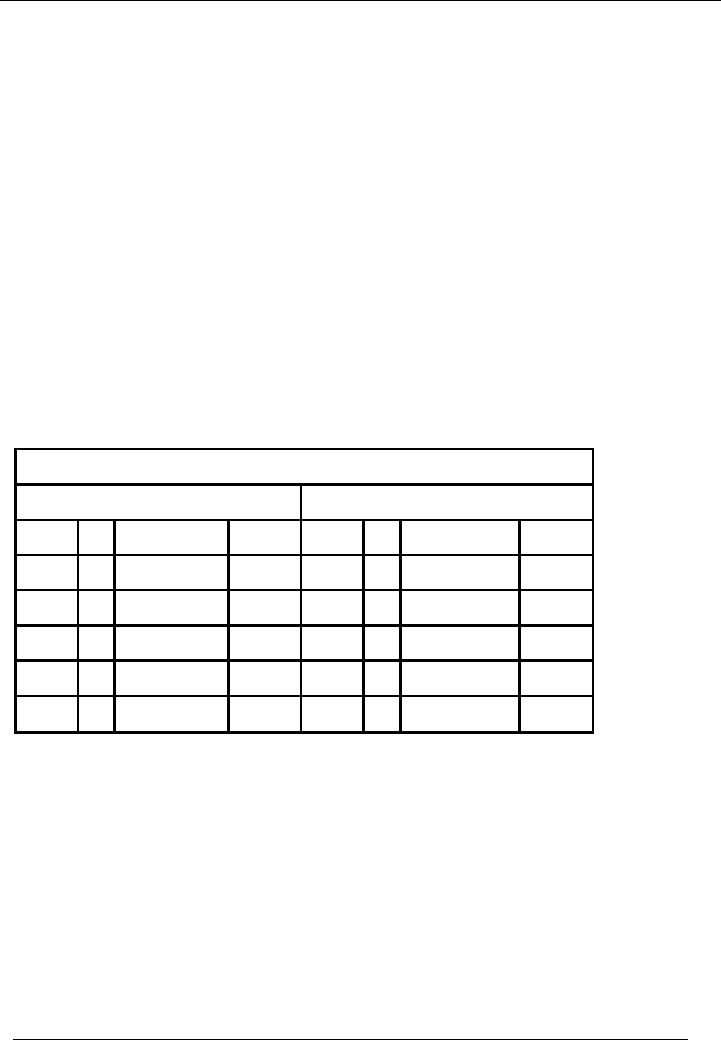

Capital

Account

Debit

Side

Credit

Side

Date

No

Narration

Dr.

Rs.

Date

No

Narration

Cr.

Rs.

Jun

30

Drawings

45,000

Jul 01

Balance

B/F

100,000

Jun

30

P & L

Account

50,000

Jun

30

Balance

C/F

105,000

Total

150,000

Total

150,000

202

Financial

Accounting (Mgt-101)

VU

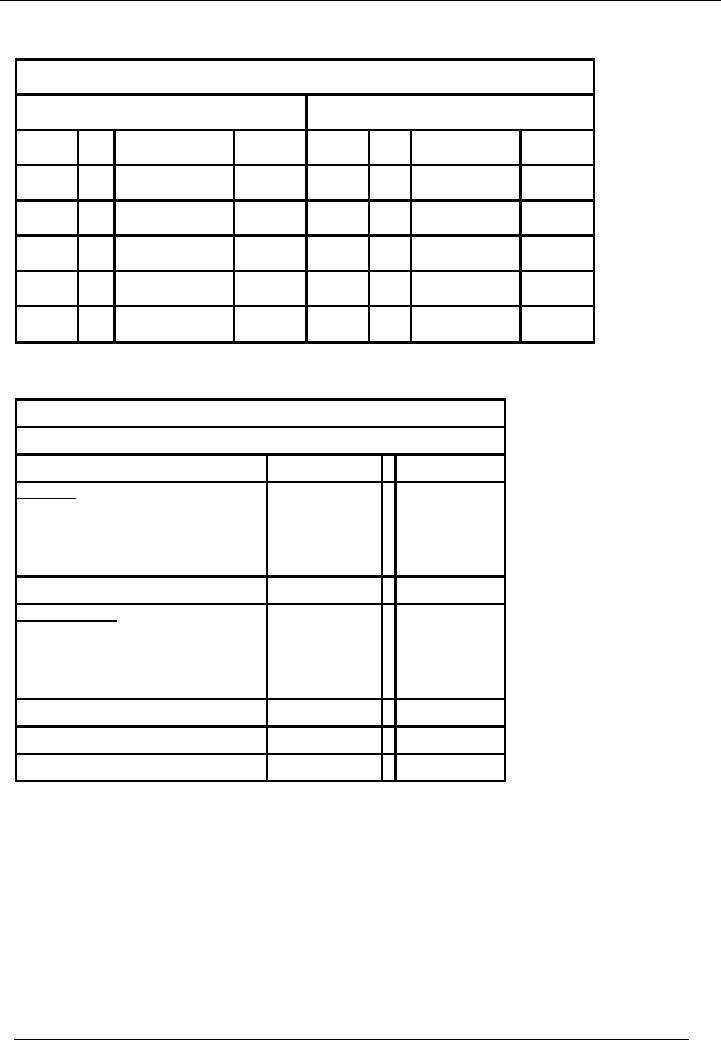

The

sample of general ledger of Capital

account, in case of loss

sustained by the business, is as

follows:

Capital

Account

Debit

Side

Credit

Side

Date

No

Narration

Dr.

Rs.

Date

No

Narration

Cr.

Rs.

Jun

30

P & L

Account

10,000

Jul 01

Balance

B/F

100,000

Jun

30

Drawings

45,000

Jun

30

Balance

C/F

45,000

Total

100,000

Total

100,000

The

balance sheet of sole

proprietor is as follows:

Name

of Business

Balance

Sheet As At ----

Particulars

Amount

Rs.

Amount

Rs.

ASSETS

Fixed

Assets

X

Long

Term Assets

X

Current

Assets

X

TOTAL

X

LIABILITIES

Capital

X

Add:

Profit / Loss For The

Year

X

Less:

Drawings

(X)

X

Long

Term Liabilities

X

Current

Liabilities

X

TOTAL

X

PARTNERSHIP

There

are two types of capital

accounts in partnership:

· Fixed

capital

· Fluctuating

capital

203

Financial

Accounting (Mgt-101)

VU

Fixed

Capital

In this

case, capital account shows

movement in capital only i.e.

actual increase or decrease in

capital, by

partners

and all other transactions,

such as Drawings and Profit

etc. are not recorded in

capital account.

Fluctuating

capital

In

fluctuating capital account,

all transactions relating to partners,

such as drawings, salaries

etc. are recorded

in

capital account, in addition to

entries relating to capital

account.

Current

Account

In

case of fixed capital

accounts, other transactions

such as Drawings and Profit

etc. are recorded in

a

separate

account called Current

Account.

JOURNAL

ENTRIES

·

Capital

Introduced by Partner

Debit

Cash /

Bank

Credit

Partner's

Capital Account

Separate

capital account is opened in

general ledger for each

partner.

·

Drawing

by Partner

Debit

Individual

Partner's Current

Account

Credit

Cash /

Bank

·

Excess

Drawn Amount Returned by

Partner

Debit

Bank /

cash

Credit

Individual

Partner's Current

Account

·

Profit

Distribution

Debit

Profit

and Loss Appropriation

Account

Credit

Partner

A's Current Account

Credit

Partner

B's Current Account

Credit

Partner

C's Current Account

204

Financial

Accounting (Mgt-101)

VU

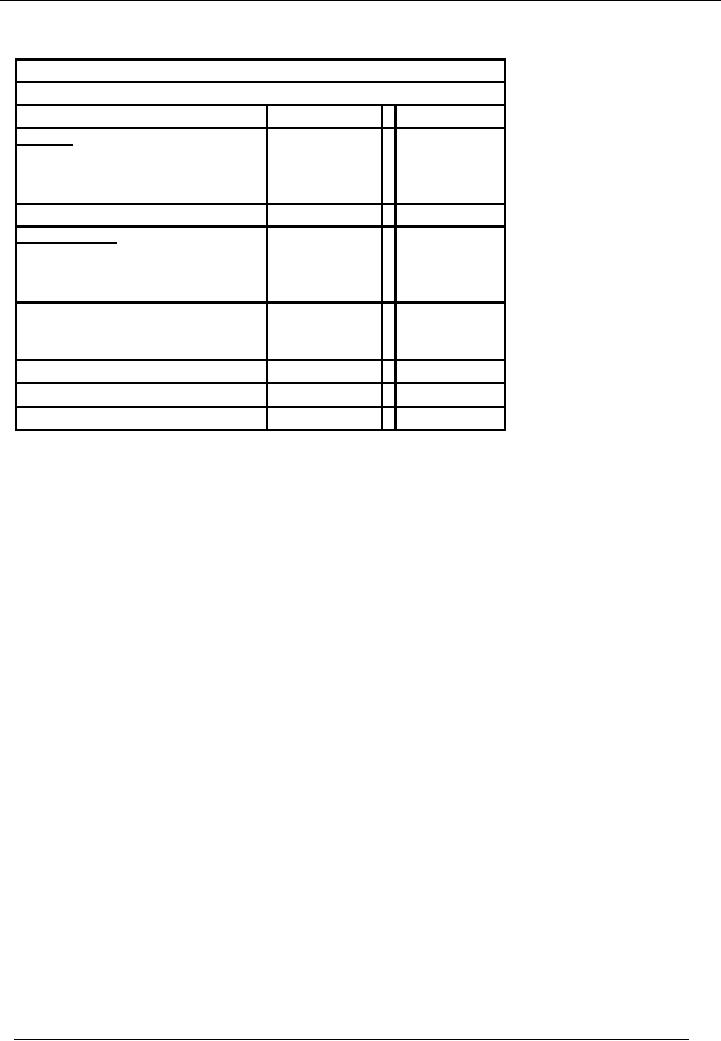

BALANCE

SHEET OF PARTNERSHIP

ACCOUNTS

Name

of Business

Balance

Sheet As At ----

Particulars

Amount

Rs.

Amount

Rs.

ASSETS

Fixed

Assets

X

Long

Term Assets

X

Current

Assets

X

TOTAL

X

LIABILITIES

Capital

A

X

B

X

C

X

X

Current

Account

A

X

B

X

C

X

X

Long

Term Liabilities

X

Current

Liabilities

X

TOTAL

X

LIMITED

COMPANIES

There

are two types of

companies:

· Public

Limited Companies

· Private

Limited Companies

Public

Limited Companies

In

public limited companies,

there is no restriction on number of persons to be

its members. There is

one

restriction.

i.e., there should be a minimum

of

three members

to form a public limited

company.

Private

Limited Companies

Two to

fifty persons can form a

private limited company.

Minimum two members are

elected to form a

board of

directors. This board is given the responsibility to

run day to day business of

the company.

SHARE

CAPITAL

Capital of the

company is divided into

small units / denominations. These units /

denominations are called

shares

and the capital is called

share capital. Owners

purchase these shares and

are, therefore, called

shareholders.

As, there are so many

shareholders in a company, profit is

distributed among the

members/shareholders

of the company on the basis of number of

shares held by each shareholder.

The

profit

distributed among shareholders is

called DIVIDEND.

205

Table of Contents:

- Introduction to Financial Accounting

- Basic Concepts of Business: capital, profit, budget

- Cash Accounting and Accrual Accounting

- Business entity, Single and double entry book-keeping, Debit and Credit

- Rules of Debit and Credit for Assets, Liabilities, Income and Expenses

- flow of transactions, books of accounts, General Ledger balance

- Cash book and bank book, Accounting Period, Trial Balance and its limitations

- Profit & Loss account from trial balance, Receipt & Payment, Income & Expenditure and Profit & Loss account

- Assets and Liabilities, Balance Sheet from trial balance

- Sample Transactions of a Company

- Sample Accounts of a Company

- THE ACCOUNTING EQUATION

- types of vouchers, Carrying forward the balance of an account

- ILLUSTRATIONS: Ccarrying Forward of Balances

- Opening Stock, Closing Stock

- COST OF GOODS SOLD STATEMENT

- DEPRECIATION

- GROUPINGS OF FIXED ASSETS

- CAPITAL WORK IN PROGRESS 1

- CAPITAL WORK IN PROGRESS 2

- REVALUATION OF FIXED ASSETS

- Banking transactions, Bank reconciliation statements

- RECAP

- Accounting Examples with Solutions

- RECORDING OF PROVISION FOR BAD DEBTS

- SUBSIDIARY BOOKS

- A PERSON IS BOTH DEBTOR AND CREDITOR

- RECTIFICATION OF ERROR

- STANDARD FORMAT OF PROFIT & LOSS ACCOUNT

- STANDARD FORMAT OF BALANCE SHEET

- DIFFERENT BUSINESS ENTITIES: Commercial, Non-commercial organizations

- SOLE PROPRIETORSHIP

- Financial Statements Of Manufacturing Concern

- Financial Statements of Partnership firms

- INTEREST ON CAPITAL AND DRAWINGS

- DISADVANTAGES OF A PARTNERSHIP FIRM

- SHARE CAPITAL

- STATEMENT OF CHANGES IN EQUITY

- Financial Statements of Limited Companies

- Financial Statements of Limited Companies

- CASH FLOW STATEMENT 1

- CASH FLOW STATEMENT 2

- FINANCIAL STATEMENTS OF LISTED, QUOTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES

- FINANCIAL STATEMENTS OF LISTED COMPANIES