|

Brand

Management (MKT624)

VU

Lesson

30

CREATING

VALUE

Introduction

How

to create value through

building image and cost-efficiencies is

the starting point of

discussion

in this lecture. Having

known the fundamentals of

what lays the foundation

for

creating

the right channels for

the company, we shall take a

look at the amount of power

that

different

members of the channel enjoy. We

shall then see how

that affects the

negotiation

process

that goes on among different

members to make a channel system

function.

Value

thru image building

Companies

must be very careful in

choosing the channel that is

compatible with the

brand

picture.

They must pick up retailers

and dealers that are

compatible with the associations

the

brand

evokes and the persona the management

wants built.

Expensive

luggage, expensive perfumes,

race and mountain bikes,

expensive watches,

top-of-

the-line

consumer items like olive

oil, or those FMCGs that are

extended by selective

ingredients

are to be sold through

stores that have image

compatible with the persona

of the

products.

Selling these items at

stores incompatible in overall

appearance, inner d�cor,

and

retail

management practices will become difficult.

Actually, doing so may

damage the brand by

lowering

its image.

Value

thru cost-efficiency

A

company must establish a

channel system that assures

availability of products at the

locations

preferred

by customers. This holds

true for most of the

consumer items requiring an

extensive

outreach.

A widespread availability reduces cost;

the more you sell,

the lesser is the cost

of

transaction.

The more cost-efficient is

the system, the more

profitable is the business.

It

is the responsibility of the

business to develop channels

that are cost-efficient and at

the same

time

deliver all possible benefits to

customers.

Channel

power through brand power

Who

controls the channel is a

question that attracts

everyone's attention among

all members of

the

channel. Basically, it is the

ability of the brand to

offer value to customers

that drives power

all

along the channel. A brand

also accumulates power by offering

opportunities of growth to

intermediaries.

The source of power, mostly, is

the brand itself.

Members'

relationship with

brand

All

members of the channel have a

certain relationship with

the brand. Each one of

them

assumes

ownership of the brand that

dictates warehousing, selling, and

recovering the

investment

made on procuring the

brand.

It

is the job of management to identify

the value of relationships at

various stages of the

channel.

It is obvious that we are

considering an indirect channel

system that has

multiple

layers,

and it also goes without saying

that the more multi-layered

is the system the

more

diluted

would be power. The more

direct is the system, the

higher is the power for

the

manufacturer.

The

objective for the company

here is to make the right most decisions

for brand movement

through

different stages of the

channel without making

glaring mistakes that may

compromise

brand

value for customers.

118

Brand

Management (MKT624)

VU

Power

defined

"Social

scientists define power as the

ability to have others do

something that otherwise

would

not be done. In other words,

power is the ability to

cause a change1".

Power

in the context of distribution

channels is the ability of one

channel member to

influence

or

alter the behavior or

decision of the other

member2.

Example: A manufacturer may

influence

retailers

to acquire the most prime

space for its products.

Space acquired is power

exercised.

Inter-dependence

Because

of interdependence among all members, no one

member has the absolute

power. Some

have

more power and some have

less of it. For a new

manufacturer, distributors and

retailers

may

pose challenging demands

thus exercising their power

toward the pricing strategy.

It is

important

to view the relative degree

of power each member has and

weigh the advantage it

carries

before negotiating strategic

moves. Channel power,

therefore, is a function of

dependence

and a number of concepts and opportunities

emerge while we view

it.

Sources

of power

The

sources of power show us how

each member influences the

behavior of the other toward

its

goal

attainment. It is done in a few following

different ways3.

Rewards

Rewards

power is one member's ability to

give other something of

value.

Example:

A retailer offering shelf

space and point-of-sale support is of

value to a manufacturer.

By

offering these rewards, a

retailer may influence the

manufacturer's support, who in

turn,

may

promise better pricing,

promotional allowances, advertising,

extended payment terms

etc.

By

offering rewards in their

respective capacities, the two

are able to change each

other's

behavior.

If promises are fulfilled, the

relationships acquire more

credibility. Reward

power

becomes

a positive source of power.

Coercion

The

coercive power (compelling by

force) is exercised when one member

has the ability to

control

resources and change behavior of the

other. The member being

coerced knows that he

has

limited choice and therefore

accepts change of behavior; whenever,

what could have

been

rewards

are withheld.

Coercive

power ultimately leads to

channel conflict and therefore

should be avoided. It is

perceived

as force employed by the one

with an advantage. In other words, it is

exploitation.

There

is a natural tendency to resist

that.

Legitimate

power

It

is based on the belief that

one party is entitled to ask

for a certain behavior,

owing to its

reputation,

position, and role in the

market. Such beliefs are

held about manufacturers of

high

reputation

who are involved in the

development and production of goods

that surpass

customers'

expectations. Pharmaceutical companies

fall into this category. It

does not exclude

some

of the good consumer items companies and

any other that are

involved in scientific

developments.

This kind of power stems

also from the value systems of

other channel members

who

grant that status to the one of

power. It is highly

traditional.

Expert

power

This

power is based on a channel

member's superior knowledge and

information that he

has

about

his products. Example: A

manufacturer's sales force

may impart vital information

to

119

Brand

Management (MKT624)

VU

distributors

and retailers on merchandizing, inventory

control, promotional techniques,

and

latest

market trends etc. The

company wields power.

In

most of the cases power

results from a combination of

different factors of which

high brand

acceptance

and store acceptance are on top.

This implies that

manufacturers and retailers

are

generally

the ones who wield

power in most of the

cases.

How

do manufacturers and retailers end up

having more power in

proportion to other members

of

the trade is an interesting discussion

that gives the

answer.

Multi-brand

companies' power

Mega

brand companies and multi-brand

conglomerates are in a much

better position to

cut

better

deals with retailers. The

advantages of having different

brand portfolios come into

play

here

and offer the companies the

opportunity to deal from a position of

strength and, hence,

power.

Companies with lesser powerful brands

may not exert the

kind of influence wielded

by

multi-brand

companies.

Retailer

concentration and power

What

really should make businesses

prudent and pragmatic is the

mutual dependence.

This

dependence

is highlighted in case of growing

power of retailers. The balance of

power is

shifting

from manufacturers to

retailers4.

Retail store is the place where

final purchasing

action

takes

place. It has become a dynamic sector

which is uplifting itself in

appearance, growth,

intensity,

and innovation. The emergence of

chain stores is making

retail stores look more

and

more

credible. All those factors are

changing the landscape of

retailing with more power

to

retailers.

Because

of better management techniques and

marketing orientation, retailers can

give better

feedback

on buying patterns and criteria.

They can better measure the

sales relationship

with

shelf

space, location in the store,

effect of promotions etc., and

provide detailed and

minute

data

to manufacturers.

Companies

working very closely with

retailers can benefit from

that feedback that

provides

insights

into customer behavior and,

hence, can lead to improvements in the

brand-based

customer

model.

Convergence

of manufacturer and retailer

power

Manufacturers,

on the other hand, have a

better understanding of the

whole marketing

process

and

their product, which is a

result of extensive R&D and

investments. The perspectives of

both,

when converge, provide the

brand with better support,

which dictate that both

work

together

as partners, and not powerful

opponents.

Reaction

to retail power

Due

basically to the shift of balance of

power in retailers' favor,

manufacturers have started

thinking

of their own retail outlets.

Some are acting upon

this thought. By having your

own

outlets

the channel is not only

better controlled, it is owned. In

addition to better

profitability

and

power, the management process

becomes conflict-free offering

better opportunities

for

growth.

Retail

brand (store of the name)

becomes the product brand

and the brand-consumer

relationship

acquires a whole new

definition.

Take

a look at chain stores of

clothing (Hang Ten) and

shoes (Service and Urban

Sole) and you

will

notice the whole set-up is

created with brand

positioning, brand values, and

quality

proposition

in mind. Strategically, they

have a differentiation advantage. They

can express their

120

Brand

Management (MKT624)

VU

core

values in everything they

do, from d�cor to display of

the products. That is not

the case at

other

retail stores that sell

everybody else's brands.

Reaction

to distributor power

Manufacturers,

in certain cases, also decide to

become their own

distributors only to

avoid

being

subjected to established distributors'

power. The process could be

a little more

challenging

in the beginning owing to

high cost of learning. But, soon

after you are

comfortably

sitting on the learning

curve, you may be approached

by other manufacturers to

start

handling their distribution.

Distribution, in itself, becomes a

huge business line for

such

manufacturers.

If

you have a product meant

for an exclusive market,

getting into your own setup

makes more

sense

than if you want to

introduce a mass consumption

product.

Twin

focus and pragmatism

However,

it is obvious that retailers and

distributors play and will continue to

play well into

the

future

important roles. It is important

that manufacturers have a

twin focus both on

their

customers

(distributors and retailers) and

consumers (ultimate

consumers).

The

companies have got to be nimble and

quick in assessing changes

taking place in the

market

and

then deciding strategic

shifts. The objective here is to enhance

brand power, and use it

to

give

the company channel power

and sustain it.

Summary

- power

Power

basically stems from

the

value

of brand. It is shared by

all

Figure

38

members

of the trade. The

sharing,

however, is not

proportionate.

Depending on the

strategic

standing of various

members

stemming

from

different

reasons, different

levels

of

power are enjoyed by

those

members.

What is important is

that

all should work as

partners

and

see to it how the

power

wielded

by each of them can be

exercised

to enhance the value

of

the brand.

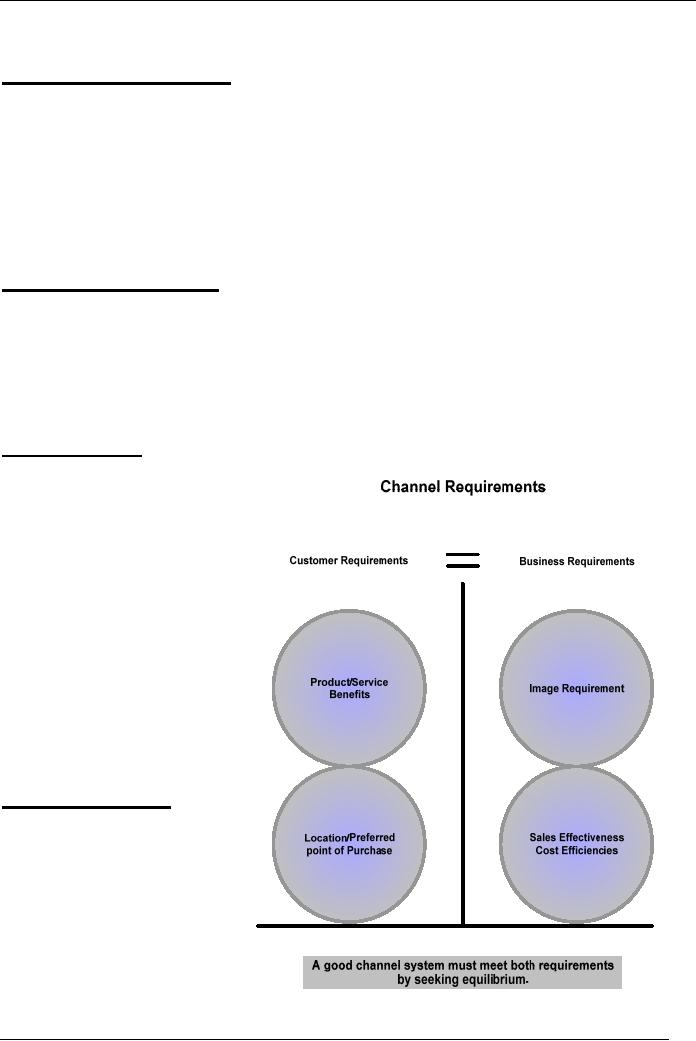

Channels

concluded

A

business may have

attractive

products

and services, but if it

cannot

deliver those to the

target

market

efficiently

and

effectively,

it will not succeed at

the

game of marketing.

Customers

have preferences for

products

and services in view of

benefits

along with

their

preference

for the place of purchase. Businesses

have the preference to

deliver effectively and

cost

efficiently; they also need to

build image.

121

Brand

Management (MKT624)

VU

Unless

there is an equilibrium between

the requirements of customers and

businesses, the

channel

system cannot be described as

optimal having potential to

leverage the brand. This

can

be

graphically illustrated.

Bibliography:

1.

Donald J. Bowersox and Bixby

Cooper: "Strategic Marketing Channel

Management";

McGraw-Hill

International Edition

(292)

2.

Punam Anand and Louis W. Stern: "A

Sociopsychological Explanation for

Why

Marketing

Channel Members Relinquish Control";

Journal of Marketing

Research,

22;4

November 1985 (365-376)

3.

Donald J. Bowersox and Bixby

Cooper: "Strategic Marketing Channel

Management";

McGraw-Hill

International Edition

(294-297)

4.

Geoffrey Randall: "Branding A

Practical Guide To Planning

Your Strategy";

Kogan

Page

(37)

Suggested

readings:

1.

Scot M. Davis: "Brand Asset

Management Driving Profitable

Growth through

Your

Brands;

Jossey-Bass, a Wiley Imprint

(181-197)

2.

Roger J. Best: "Market-Based Management

Strategies for Growing Customer

Value

and

Profitability"; Prentice Hall

(271-294)

122

Table of Contents:

- UNDERSTANDING BRANDS – INTRODUCTION:Functions of Brand Management, Sales forecast, Brand plan

- INTRODUCTION:Brand Value and Power, Generate Profits and Build Brand Equity

- BRAND MANIFESTATIONS/ FUNDAMENTALS:Brand identity, Communication, Differentiation

- BRAND MANIFESTATIONS/ FUNDAMENTALS:Layers/levels of brands, Commitment of top management

- BRAND CHALLENGES:Consumer Revolt, Media Cost and Fragmentation, Vision

- STRATEGIC BRAND MANAGEMENT:Setting Objectives, Crafting a Strategy, The Brand Mission

- BRAND VISION:Consensus among management, Vision Statement of a Fast Food Company, Glossary of terms

- BUILDING BRAND VISION:Seek senior management’s input, Determine the financial contribution gap

- BUILDING BRAND VISION:Collect industry data and create a brand vision starter, BRAND PICTURE,

- BRAND PICTURE:Brand Value Pyramid, Importance of being at pinnacle, From pinnacle to bottom

- BRAND PERSONA:Need-based segmentation research, Personality traits through research

- BRAND CONTRACT:The need to stay contemporary, Summary

- BRAND CONTRACT:How to create a brand contract?, Brand contract principles, Understand customers’ perspective

- BRAND CONTRACT:Translate into standards, Fulfill Good Promises, Uncover Bad Promises

- BRAND BASED CUSTOMER MODEL:Identify your competitors, Compare your brand with competition

- BRAND BASED CUSTOMER MODEL:POSITIONING, Product era, Image Era, An important factor

- POSITIONING:Strong Positioning, Understanding of components through an example

- POSITIONING:Clarity about target market, Clarity about point of difference

- POSITIONING – GUIDING PRINCIPLES:Uniqueness, Credibility, Fit

- POSITIONING – GUIDING PRINCIPLES:Communicating the actual positioning, Evaluation criteria, Coining the message

- BRAND EXTENSION:Leveraging, Leveraging, Line Extension in detail, Positive side of line extension

- LINE EXTENSION:Reaction to negative side of extensions, Immediate actions for better managing line extensions

- BRAND EXTENSION/ DIVERSIFICATION:Why extend/diversify the brand,

- POSITIONING – THE BASE OF EXTENSION:Extending your target market, Consistency with brand vision

- DEVELOPING THE MODEL OF BRAND EXTENSION:Limitations, Multi-brand portfolio, The question of portfolio size

- BRAND PORTFOLIO:Segment variance, Constraints, Developing the model – multi-brand portfolio

- BRAND ARCHITECTURE:Branding strategies, Drawbacks of the product brand strategy, The umbrella brand strategy

- BRAND ARCHITECTURE:Source brand strategy, Endorsing brand strategy, What strategy to choose?

- CHANNELS OF DISTRIBUTION:Components of channel performance, Value thru product benefits

- CREATING VALUE:Value thru cost-efficiency, Members’ relationship with brand, Power defined

- CO BRANDING:Bundling, Forms of communications, Advertising and Promotions

- CUSTOMER RESPONSE HIERARCHY:Brand-based strategy, Methods of appropriations

- ADVERTISING:Developing advertising, Major responsibilities

- ADVERTISING:Message Frequency and Customer Awareness, Message Reinforcement

- SALES PROMOTIONS:Involvement of sales staff, Effects of promotions, Duration should be short

- OTHER COMMUNICATION TOOLS:Public relations, Event marketing, Foundations of one-to-one relationship

- PRICING:Strong umbrella lets you charge premium, Factors that drive loyalty

- PRICING:Market-based pricing, Cost-based pricing

- RETURN ON BRAND INVESTMENT – ROBI:Brand dynamics, On the relevance dimension

- BRAND DYNAMICS:On the dimension of knowledge, The importance of measures

- BRAND – BASED ORGANIZATION:Benefits, Not just marketing but whole culture, Tools to effective communication

- SERVICE BRANDS:The difference, Hard side of service selling, Solutions

- BRAND PLANNING:Corporate strategy and brands, Brand chartering, Brand planning process

- BRAND PLANNING PROCESS:Driver for change (continued), Brand analysis

- BRAND PLAN:Objectives, Need, Source of volume, Media strategy, Management strategy