|

Corporate

Finance FIN 622

VU

Lesson

18

COST

OF CAPITAL & CAPITAL

STRUCTURE

The

following topics will be

discussed in this lecture.

Cost

of Capital & Capital Structure

Components

of Capital

Cost

of Equity

Estimating g or

growth rate

Dividend

growth model

Cost

of Debt / Bonds

Cost

of Preferred Stocks

COST

OF CAPITAL

The

required return is necessary to make a

capital budgeting project such as

building a new

factory

worthwhile.

Cost of capital would include the

cost of debt and the cost of

equity.

The

cost of capital determines

how a company can raise

money (through a stock

issue, borrowing, or a

mix

of the

two). This is the rate of return

that a firm would receive if

it invested its money

someplace else with

similar

risk.

CAPITAL

STRUCTURE

Capital

structure of a typical company may

consist of ordinary shares,

preference stock, short term and

long

term loan,

bonds and leases. These

components in capital structure

have their own cost

and if we add all

the

individual components cost after

adjusting with the weight age of

each, the resultant value is

known as

weighted

cost of capital. As you have

already covered in your

earlier lessons that

normally we use WACC

as

discount

rate to find the present

value of future cash flows

emerging from a project, so it is of

immense

importance to

calculate the correct WACC. And

you are also aware

that if the WACC is incorrect it

may

lead

to serious consequences.

In

order to compute the WACC we

need to calculate the individual

components cost. First of all we

take up

the

Equity part of the capital

and will see how we can

compute the cost of equity.

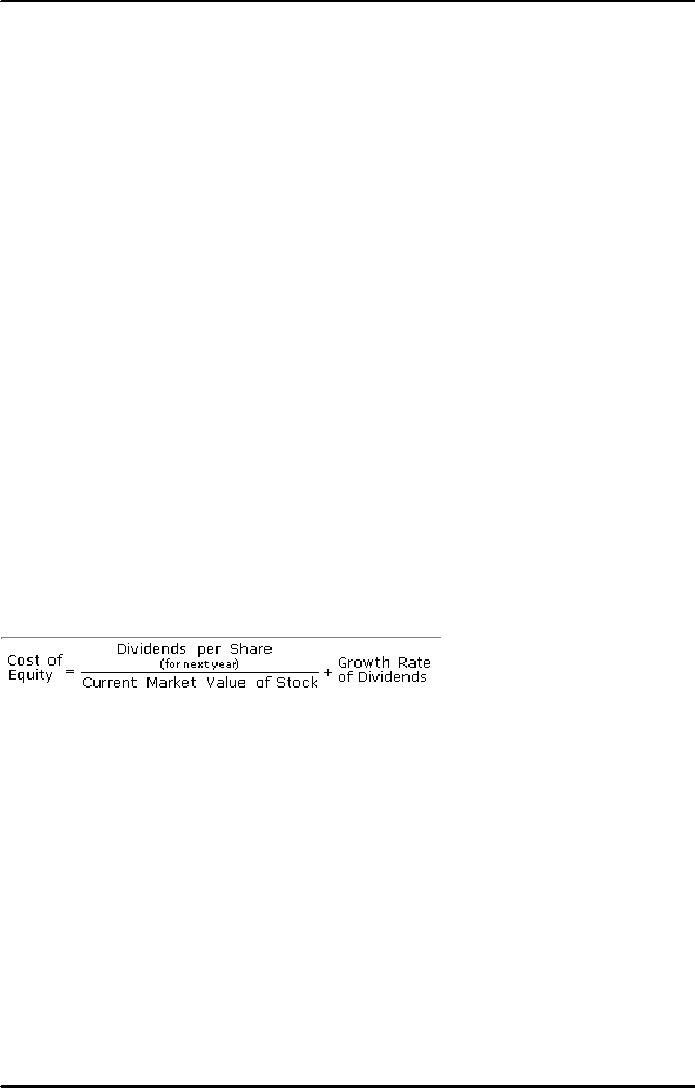

COST

OF EQUITY

In financial

theory, the return that stockholders

require for a company is called

cost of equity. The

traditional

formula is the dividend capitalization

model:

A firm's

cost of equity represents the

compensation that the market

demands in exchange for

owning the

asset

and bearing the risk of ownership.

Let's

look at a very simple example:

let's say you require a rate

of return of 10% on an investment in

stock

A. The

stock is currently trading at $10

and will pay a dividend of

$0.30. Through a combination

of

dividends

and share appreciation you require a

$1.00 return on your $10.00

investment. Therefore the stock

will

have to appreciate by $0.70, which,

combined with the $0.30 from dividends,

gives you your 10%

cost

of

equity.

We

shall discuss two methods we

can use to determine the

cost of equity.

First,

we'll take up dividend

growth models and then

security market line

approach to calculate the cost

of

equity.

Assuming

that dividends will grow at a constant

rate in future (growth rate

=g), price per share Po

(current

price)

can be found by the following

formula:

Po = Do x (1 + g) /

Re g

Or

Po = D1 / Re

g

Where

D1 is the dividend after period 1 and Re

represents return on equity.

We can

re-arrange this equation in order to

calculate the Re as under:

59

Corporate

Finance FIN 622

VU

Re = D1 / Po +

g

This

equation tells us that we need

three variables to work out

the cost of equity. These are current

price

Po,

dividend in period 0, and Do

and growth rate.

Most

complex variable in the above equation is to determine

the "g" variable. You can

obtain the Po and

Do very

easily from internal or external

sources. We can use some

statistical techniques to forecast g

using

the historical

data. More precisely using

trend and regression

analysis we can obtain the

value of g.

The

primary advantage of dividend growth

model is that it is very simple to

understand and use.

However,

there

are some problems also

associated with this

approach.

It is

only applicable to the firms which

pay dividend regularly if not

constantly. Therefore, a firm with

no

dividend

history will find it

useless.

The

other problem is an unrealistic

assumption of constant growth of

dividends. We may not find

any such

company

which has a history of

constant growth in dividends. These

two limitations make this model to

be

used

in selected scenarios, for

example, where the company

may have distributed the dividends

consistently

in the

past.

The

other problem is that the

estimated cost of equity is very

sensitive to the estimated growth

rate.

Finally,

this approach does not take

into account the risk level. There is no direct

adjustment for the risky-

ness

of the investment. For instance, there is

no adjustment for the degree of certainty

or uncertainty in

estimated

growth rate for

dividends

The

other way to compute the

cost of equity is SML

(security market line) which

tells us that the required

rate

of return on a risky investment depends on

three things.

i)

The

risk free rate, Rf

ii)

Market

risk premium, (Erm Rf)

iii)

Systematic

risk of the asset known as beta,

B

Using

SML we can write the equation as

under:

Ere = Rf + Be x

(Erm Rf)

Where

Ere = is

expected return on equity.

Be = is

Beta of equity.

This

method is also suffering from advantages

and disadvantages. First it

explicitly adjusts the risk

and

second,

it is applicable to companies other

than just those with

steady dividend growth. Thus

it may be

useful

in wider circumstances.

The

SML approach heavily relies on

two things the market risk premium

and beta coefficient. And if

our

estimates

are not very accurate then

the cost of equity number will be incorrect

and misleading as well.

The

demerit of both dividend model and

SML is that both consider

past data to predict the

future.

Economic

conditions and indicator in

future are not the same as

were in past. However, both

methods do

provide

us relative guidance in computing the

cost of equity.

Before we move

ahead to cost of debt, let's

take a look how we can

raise capital in the long

run. From a

firm's

perspective, followings are the

ways to build the

capital:

venture

capital

issuing

share to public

IPOS

subsequent

issue of share right

issue

private

placement of shares

60

Corporate

Finance FIN 622

VU

bank

loans

debt

instruments

leases

There

are some rules and

regulations for raising

capital for each of the

above categories. We shall

discuss

here

some of the issues relating to Equity

capital issuing shares

through IPOs and subsequent

issue of

shares

like right issue.

· company

must be listed on stock

exchange

· must

be registered with security &

exchange commission of Pakistan

SECP

· company

issues prospectus

· underwriting

the share issue

Underwriter

refers to a firm that acts

as intermediary between a company issuing

shares and

the

public.

underwriter

normally perform following

services

· devising

method for issuing

shares

· setting

the price of new

shares

· marketing /

selling of securities

Underwriters

may buy securities for

less than the price set by

the company and then

selling

them to

public. if any amount of shares

not subscribed by the public

then underwriter

takes

up the

under-subscribed shares.

Often

underwriter forms a group to share the

risk, known as

syndicate.

COST

OF DEBT:

Debt

component of capital may include several

line items like preferred

stocks, loans from various

financial

institutions

with varying terms and cost.

Some of the loans may be having

fixed or floating interest

rate. The

other

items in the debt are bonds

and leases.

The

effective rate that a company

pays on its current debt can

be measured in either before- or after-tax

returns;

however, because interest expense is

deductible, the after-tax cost is seen

most often. This is

one

part

of the company's capital structure,

which also includes the cost

of equity.

A

company will use various

bonds, loans and other forms

of debt, so this measure is useful for

giving an

idea

as to the overall rate being paid by the

company to use debt financing. The

measure can also give

investors

an idea as to the risky-ness of the

company compared to others,

because riskier companies

generally

have a higher cost of debt.

To get

the after-tax rate, you simply

multiply the before-tax rate by one

minus the marginal tax rate

(before-

tax

rate x (1-marginal tax)). If a

company's only debt were a

single bond in which it paid 5%, the

before-tax

cost

of debt would simply be 5%.

If, however, the company's marginal tax

rate were 40%, the

company's

after-tax

cost of debt would be only

3% (5% x (1-40%)).

Like

loans, bonds may have

several issues of varying terms,

carrying different interest

cost with wide gap

between

their cost and market

value. Leases may have the

same characteristics like

loans and debts.

To

find the cost of debt, we need to

calculate the cost of each

class of debt and then

finding the weighted

average

of the cost of debt. For example, if

there are five bond

issues outstanding at any time, we

will

calculate

the cost of each issue and

then move to weighted average of

cost of bond by using their

individual

weight in

total bond capital.

COST

OF PREFERRED STOCK:

To

start computing the cost of debt, we

take up the first item in debt

family preferred stock, which

is

fairly

straightforward calculation.

As we

know that preferred stocks

carry fixed dividend every

period. There's no variation in

dividend level.

This

means that dividend from

preferred stock is essentially

perpetuity.

· cost

of preferred stock can be calculated

from the following

· R = D/

Po

61

Corporate

Finance FIN 622

VU

·

for

example if the dividend is R 3.50/-

per share and current market

price is rs.40/-, then the

Rp

will

be:

· Rp =

3.50 / 40 = 8.75%

We

shall take up the two main

issues for calculating cost

of debt for loans and

leases in other hand outs

to

be delivered in

future.

62

Table of Contents:

- INTRODUCTION TO SUBJECT

- COMPARISON OF FINANCIAL STATEMENTS

- TIME VALUE OF MONEY

- Discounted Cash Flow, Effective Annual Interest Bond Valuation - introduction

- Features of Bond, Coupon Interest, Face value, Coupon rate, Duration or maturity date

- TERM STRUCTURE OF INTEREST RATES

- COMMON STOCK VALUATION

- Capital Budgeting Definition and Process

- METHODS OF PROJECT EVALUATIONS, Net present value, Weighted Average Cost of Capital

- METHODS OF PROJECT EVALUATIONS 2

- METHODS OF PROJECT EVALUATIONS 3

- ADVANCE EVALUATION METHODS: Sensitivity analysis, Profitability analysis, Break even accounting, Break even - economic

- Economic Break Even, Operating Leverage, Capital Rationing, Hard & Soft Rationing, Single & Multi Period Rationing

- Single period, Multi-period capital rationing, Linear programming

- Risk and Uncertainty, Measuring risk, Variability of return–Historical Return, Variance of return, Standard Deviation

- Portfolio and Diversification, Portfolio and Variance, Risk–Systematic & Unsystematic, Beta – Measure of systematic risk, Aggressive & defensive stocks

- Security Market Line, Capital Asset Pricing Model – CAPM Calculating Over, Under valued stocks

- Cost of Capital & Capital Structure, Components of Capital, Cost of Equity, Estimating g or growth rate, Dividend growth model, Cost of Debt, Bonds, Cost of Preferred Stocks

- Venture Capital, Cost of Debt & Bond, Weighted average cost of debt, Tax and cost of debt, Cost of Loans & Leases, Overall cost of capital – WACC, WACC & Capital Budgeting

- When to use WACC, Pure Play, Capital Structure and Financial Leverage

- Home made leverage, Modigliani & Miller Model, How WACC remains constant, Business & Financial Risk, M & M model with taxes

- Problems associated with high gearing, Bankruptcy costs, Optimal capital structure, Dividend policy

- Dividend and value of firm, Dividend relevance, Residual dividend policy, Financial planning process and control

- Budgeting process, Purpose, functions of budgets, Cash budgets–Preparation & interpretation

- Cash flow statement Direct method Indirect method, Working capital management, Cash and operating cycle

- Working capital management, Risk, Profitability and Liquidity - Working capital policies, Conservative, Aggressive, Moderate

- Classification of working capital, Current Assets Financing – Hedging approach, Short term Vs long term financing

- Overtrading – Indications & remedies, Cash management, Motives for Cash holding, Cash flow problems and remedies, Investing surplus cash

- Miller-Orr Model of cash management, Inventory management, Inventory costs, Economic order quantity, Reorder level, Discounts and EOQ

- Inventory cost – Stock out cost, Economic Order Point, Just in time (JIT), Debtors Management, Credit Control Policy

- Cash discounts, Cost of discount, Shortening average collection period, Credit instrument, Analyzing credit policy, Revenue effect, Cost effect, Cost of debt o Probability of default

- Effects of discounts–Not effecting volume, Extension of credit, Factoring, Management of creditors, Mergers & Acquisitions

- Synergies, Types of mergers, Why mergers fail, Merger process, Acquisition consideration

- Acquisition Consideration, Valuation of shares

- Assets Based Share Valuations, Hybrid Valuation methods, Procedure for public, private takeover

- Corporate Restructuring, Divestment, Purpose of divestment, Buyouts, Types of buyouts, Financial distress

- Sources of financial distress, Effects of financial distress, Reorganization

- Currency Risks, Transaction exposure, Translation exposure, Economic exposure

- Future payment situation – hedging, Currency futures – features, CF – future payment in FCY

- CF–future receipt in FCY, Forward contract vs. currency futures, Interest rate risk, Hedging against interest rate, Forward rate agreements, Decision rule

- Interest rate future, Prices in futures, Hedging–short term interest rate (STIR), Scenario–Borrowing in ST and risk of rising interest, Scenario–deposit and risk of lowering interest rates on deposits, Options and Swaps, Features of opti

- FOREIGN EXCHANGE MARKET’S OPTIONS

- Calculating financial benefit–Interest rate Option, Interest rate caps and floor, Swaps, Interest rate swaps, Currency swaps

- Exchange rate determination, Purchasing power parity theory, PPP model, International fisher effect, Exchange rate system, Fixed, Floating

- FOREIGN INVESTMENT: Motives, International operations, Export, Branch, Subsidiary, Joint venture, Licensing agreements, Political risk