|

Changes in Market Equilibrium:Market for College Education |

| << REAL VERSUS NOMINAL PRICES:SUPPLY AND DEMAND, The Demand Curve |

| Elasticities of supply and demand:The Demand for Gasoline >> |

Microeconomics

ECO402

VU

Lesson

4

Changes in

Market Equilibrium

Equilibrium

prices are determined by the

relative level of supply and

demand.

Supply

and demand are determined by

particular values of supply

and demand

determining

variables.

Changes

in any one or combination of

these variables can cause a

change in the

equilibrium

price and/or

quantity.

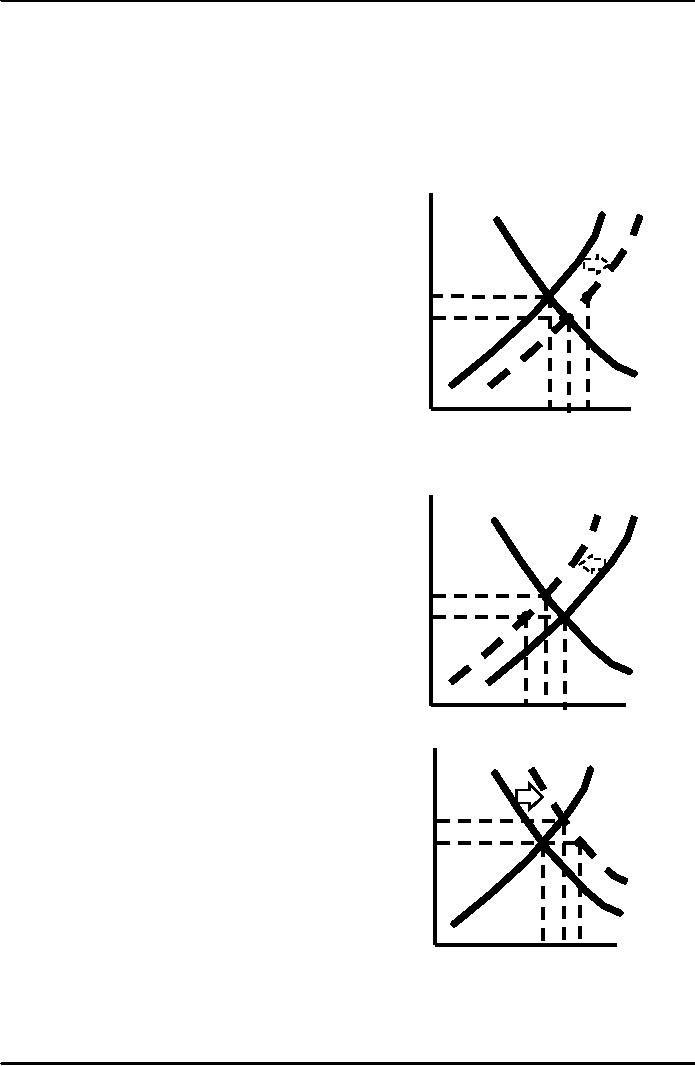

P

S

D

Raw

material prices fall

S'

S

shifts

to S'

Surplus @

P1 of

Q1,

Q2

Equilibrium

@ P3,

Q3

P1

P3

Q1 Q3 Q2

Q

P

S'

D

S

Raw

material prices Rise

S

shifts

to S'

Shortage @

P1 of

Q1,

Q2

Equilibrium

@ P3,

Q3

P3

P1

Q3

Q1

Q2

Q

Income

Increases

P

D

D'

S

Demand

shifts to D'

Shortage

@ P1

of

Q1,

Q2

Equilibrium

@ P3,

Q3

P3

P1

Q1 Q3

Q2

Q

9

Microeconomics

ECO402

VU

P

Income

Decreases

D

D'

S

Demand

shifts to D'

Surplus @

P1 of

Q1,

Q2

Equilibrium

@ P3,

Q3

P1

P3

Q2 Q3

Q1

Q

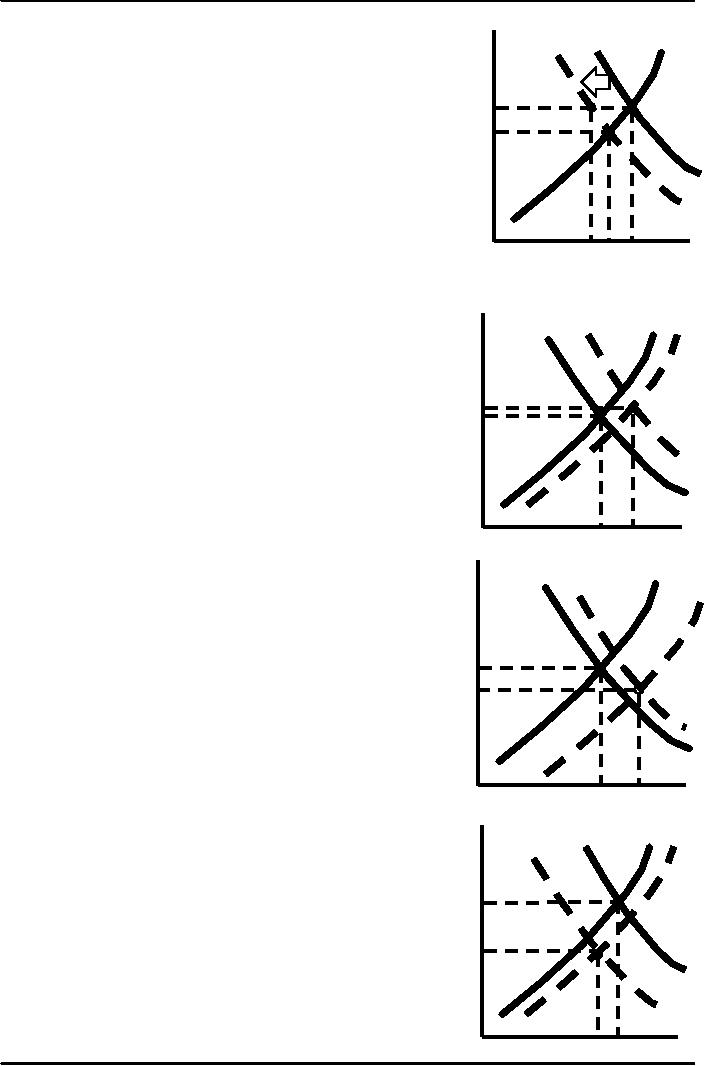

Income

Increases & raw material

prices fall

P

The

increase in D

is

greater than the

increase

D

D'

S

S'

in

S

Equilibrium

price and quantity increase

to P2,

Q2

P2

P1

Q

Q1

Q2

P

D

S

Income

Increases & raw material

prices fall

S'

D'

The

increase in D

is

less than the increase

in

S

Equilibrium

price decrease to P2and

quantity

increase

to Q2

P1

P2

Q

Q1

Q2

P

Income

Decreases & raw material

prices Fall

D

S

S'

D'

The

decrease in D

is

greater than the

increase

in S

Equilibrium

price and quantity decrease

to P2

P1

Q2

P2

Q

Q2 Q1

10

Microeconomics

ECO402

VU

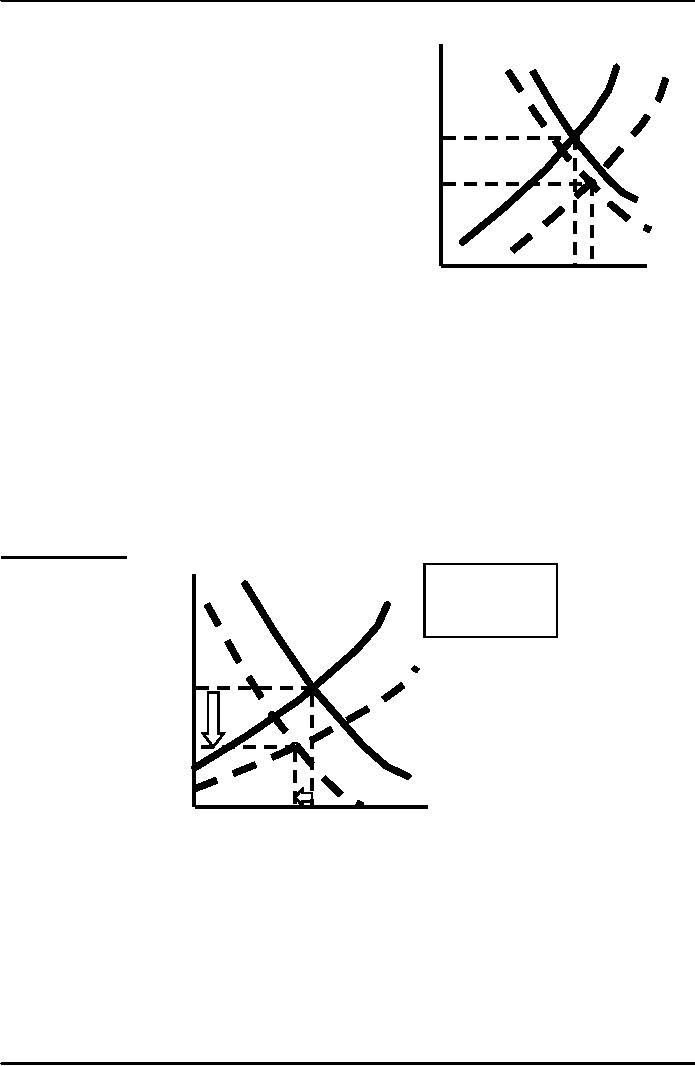

Income

decreases & raw material

prices fall

P

D'

S

D

The

decrease in D

is

less than the

S'

increase

in S

Equilibrium

price decrease to P2

and

quantity

increase to Q2

P1

P2

Q

Q1 Q2

Shifts

in Supply and

Demand

When

supply and demand change

simultaneously, the impact on

the equilibrium price

and

quantity is determined

by:

1)

The relative size and

direction of the

change

2)

The shape of the supply

and demand curves

The

Prices of Eggs & Education

Revisited

The

real price of eggs fell

59% from 1970 to

1998.

Supply

increased due to the

increased mechanization of poultry

farming and the

reduced

cost of production.

Demand

decreased due to the

increasing consumer concern

over the health

and

cholesterol

consequences of eating

eggs.

Market

for Eggs

Prices

fell until

P

a

new equilibrium

S1970

(1970

was

reached at $0.26

dollars

per

and

a quantity

dozen)

of

5,300 million

dozen

S1998

$0.61

$0.26

D1970

D1998

Q

(million dozens)

5,300

5,500

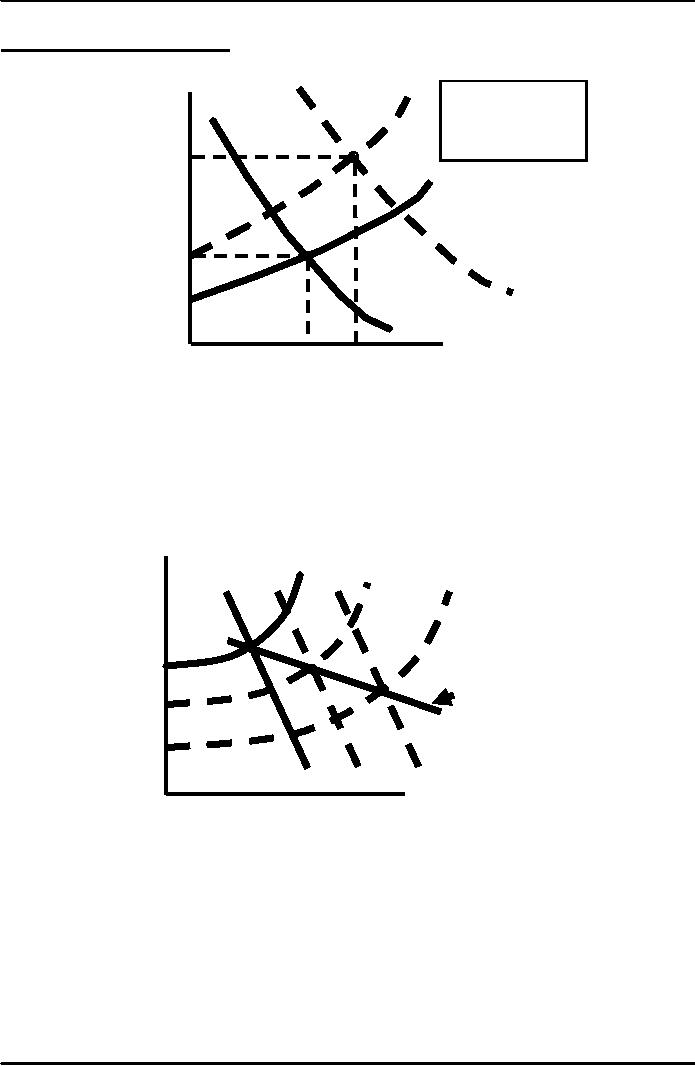

Price

of College Education

The

real price of a college

education rose 68 percent

from 1970 to 1995.

Supply

decreased due to higher

costs of equipping and

maintaining modern

classrooms,

laboratories and libraries,

and higher faculty

salaries.

Demand

increased due a larger

percentage of a larger number of

high school

graduates

attending college.

11

Microeconomics

ECO402

VU

Market

for College

Education

P

S1995

Prices

rose until

(annual

cost

in

1970

a

new equilibrium

dollars)

was

reached at $4,573

and

a quantity

of

12.3 million students

$4,573

S1970

$2,530

D1995

D1970

8.6

12.3

Q

(millions of students

enrolled)

The

Long-Run Behavior of Natural

Resource Prices

Observations

Consumption

of copper has increased

about a hundred fold from

1880 through

1998

indicating a large increase in

demand.

The

real price for copper

has remained relatively

constant.

Changes

in Market Equilibrium

Price

S1900

S1950

S1998

Long-Run

Path of

Price

and

D1900

D1950

D1998

Quantity

Conclusion

Decreases

in the costs of production

have increased the supply by

more than

enough

to offset the increase in

demand.

12

Microeconomics

ECO402

VU

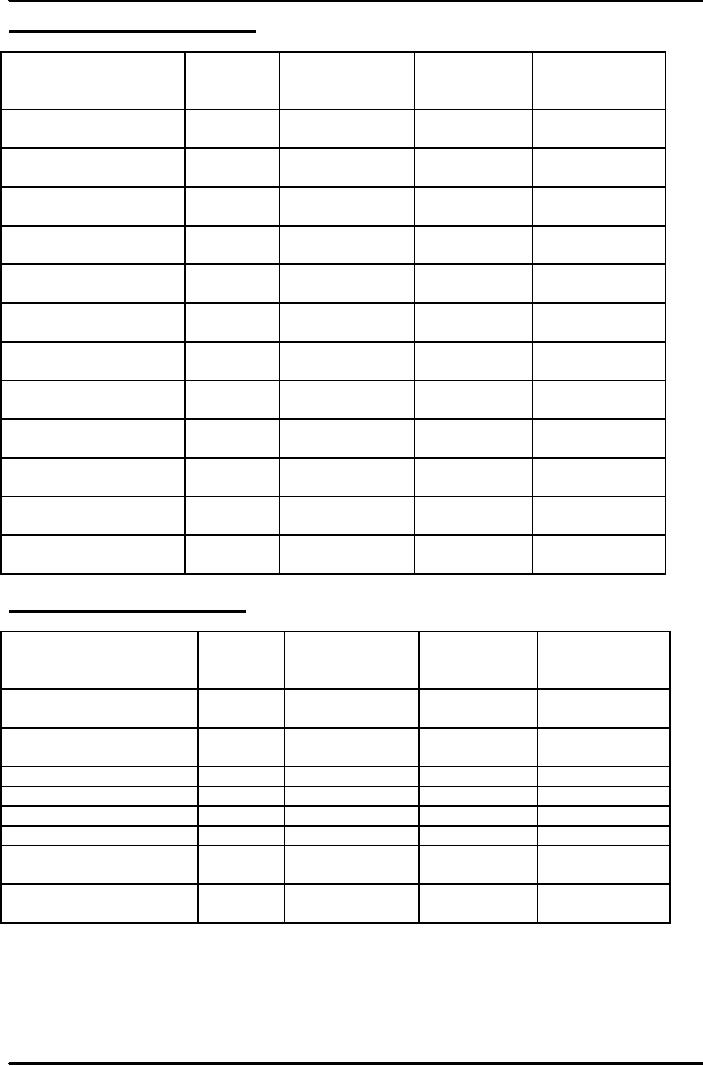

Factors

Shifting Demand

Curve

Factors

Changing

Effect

on

Direction

of

Effect

on

Effect

on

Demand

Demand

Shift

in

Equilibrium

Equilibrium

Demand

Curve

Price

Quantity

Increase

in income

Increase

Rightward

Increase

Increase

(normal

good)

Decrease

in

Decrease

Leftward

Decrease

Decrease

income(normal

good)

Increase

in income

Decrease

Rightward

Decrease

Decrease

(inferior

good)

Decrease

in

Increase

Rightward

Increase

Increase

income(inferior

good)

Increase

in price of

Increase

Rightward

Increase

Increase

Substitute

Decrease

in price of

Decrease

Rightward

Decrease

Decrease

substitute

Increase

in price of

Decrease

Leftward

Decrease

Decrease

complement

Decrease

in price of

Increase

Rightward

Increase

Increase

complement

Increase

in taste and

Increase

Rightward

Increase

Increase

preference

for good

Decrease

in taste and

Decrease

Leftward

Decrease

Decrease

preference

for good

Increase

in number of

Increase

Rightward

Increase

Increase

consumers

Decrease

in number of

Decrease

Leftward

Decrease

Decrease

consumers

Factors

Shifting Supply

Curve

Factors

Changing

Effect

on Direction of

Effect

on

Effect

on

Supply

Supply

Shift

in Supply

Equilibrium

Equilibrium

Curve

Price

Quantity

Increase

in resource

Decrease

Leftward

Increase

Decrease

price

Decrease

in resource

Increase

Rightward

Decrease

Increase

price

Improved

technology

Increase

Rightward

Decrease

Increase

Decline

in technology

Decrease

Leftward

Increase

Decrease

Expect

a price increase

Decrease

Leftward

Increase

Decrease

Expect

a price decrease

Increase

Rightward

Decrease

Increase

Increase

in number of

Increase

Rightward

Decrease

Increase

suppliers

Decrease

in number of

Decrease

Leftward

Increase

Decrease

suppliers

13

Microeconomics

ECO402

VU

ELASTICITIES

OF SUPPLY AND DEMAND

Generally,

elasticity is a measure of the

sensitivity of one variable to

another.

It

tells us the percentage

change in one variable in

response to a one percent

change

in

another variable.

Price

Elasticity of Demand

Measures

the sensitivity of quantity

demanded to price

changes.

It

measures the percentage

change in the quantity

demanded for a good

or

services

that results from a one

percent change in the price

of that good or

service.

The

price elasticity of demand

is:

Percentage

change in Quantity

Demanded

Percentage

change in Price

E

P =

(%

Δ

Q)/(%

Δ

P)

The

percentage change in a variable is

the absolute change in the

variable

divided

by the original level of the

variable.

So

the price elasticity of

demand is also:

Δ

Q

/Q

ΔQ

P

EP =

=

Δ

P

/P

Q

ΔP

Interpreting

Price Elasticity of Demand

Values

1)

Because of the inverse

relationship between P and Q; EP is

negative.

2)

If IEPI > 1, the percent

change in quantity is greater

than the percent

change

in price. We say the demand

is price elastic.

3)

If IEPI < 1, the percent

change in quantity is less

than the percent

change

in price. We say the demand

is price inelastic.

The

primary determinant of price

elasticity of demand is the

availability of substitutes.

Many

substitutes demand is price

elastic

Few

substitutes demand is price

inelastic

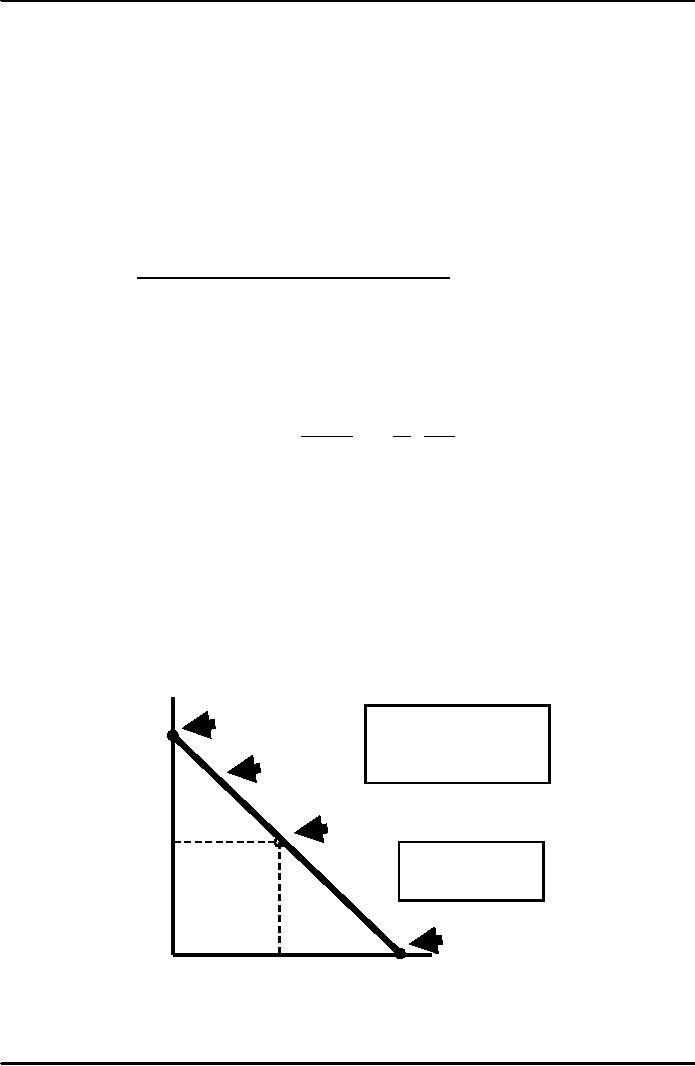

Price

Elasticities of Demand

Price

The

lower portion of a

Ep

= ∞

4

_

downward

sloping demand

curve

is less elastic than

the

upper

portion.

Q

= 8 - 2P

Ep =

-1

2

Linear

Demand Curve

Q

= a - bP

Q

= 8 - 2P

Ep =

0

Q

8

4

14

Microeconomics

ECO402

VU

Price

12

A

Ep

= -3

9

B

Ep

= -1

6

Ep

= -0.4

C

3

D

D

0

23

6

10

Q

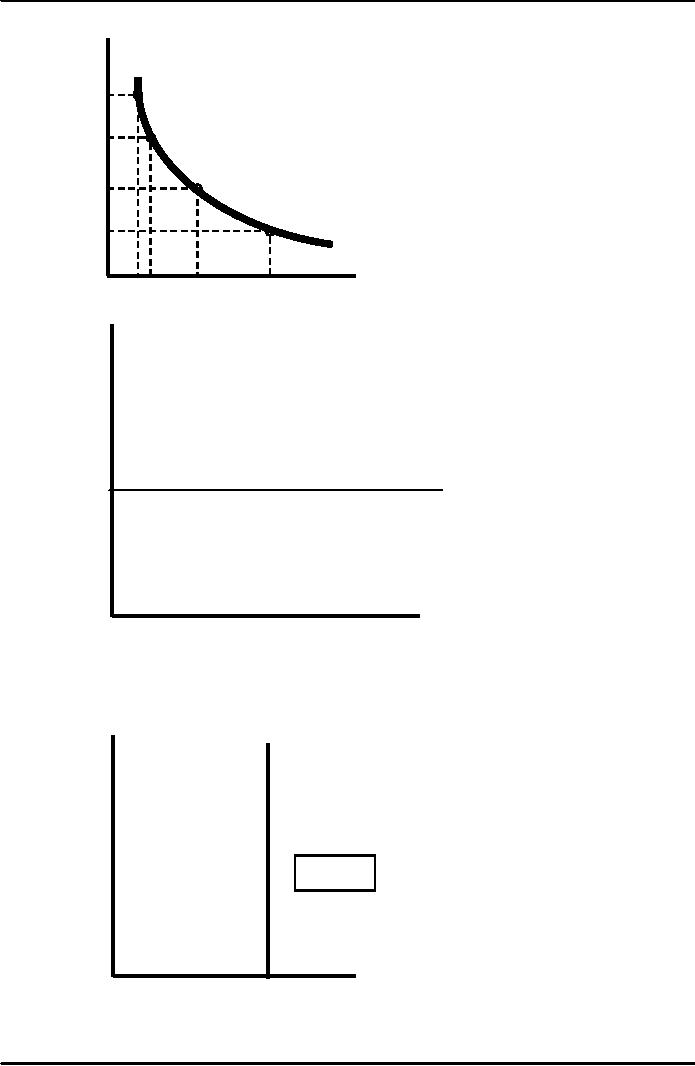

Price

Infinitely

Elastic Demand

Quantity

Completely

Inelastic Demand

Price

EP = 0

*

Q

Quantity

15

Table of Contents:

- ECONOMICS:Themes of Microeconomics, Theories and Models

- Economics: Another Perspective, Factors of Production

- REAL VERSUS NOMINAL PRICES:SUPPLY AND DEMAND, The Demand Curve

- Changes in Market Equilibrium:Market for College Education

- Elasticities of supply and demand:The Demand for Gasoline

- Consumer Behavior:Consumer Preferences, Indifference curves

- CONSUMER PREFERENCES:Budget Constraints, Consumer Choice

- Note it is repeated:Consumer Preferences, Revealed Preferences

- MARGINAL UTILITY AND CONSUMER CHOICE:COST-OF-LIVING INDEXES

- Review of Consumer Equilibrium:INDIVIDUAL DEMAND, An Inferior Good

- Income & Substitution Effects:Determining the Market Demand Curve

- The Aggregate Demand For Wheat:NETWORK EXTERNALITIES

- Describing Risk:Unequal Probability Outcomes

- PREFERENCES TOWARD RISK:Risk Premium, Indifference Curve

- PREFERENCES TOWARD RISK:Reducing Risk, The Demand for Risky Assets

- The Technology of Production:Production Function for Food

- Production with Two Variable Inputs:Returns to Scale

- Measuring Cost: Which Costs Matter?:Cost in the Short Run

- A Firmís Short-Run Costs ($):The Effect of Effluent Fees on Firmsí Input Choices

- Cost in the Long Run:Long-Run Cost with Economies & Diseconomies of Scale

- Production with Two Outputs--Economies of Scope:Cubic Cost Function

- Perfectly Competitive Markets:Choosing Output in Short Run

- A Competitive Firm Incurring Losses:Industry Supply in Short Run

- Elasticity of Market Supply:Producer Surplus for a Market

- Elasticity of Market Supply:Long-Run Competitive Equilibrium

- Elasticity of Market Supply:The Industryís Long-Run Supply Curve

- Elasticity of Market Supply:Welfare loss if price is held below market-clearing level

- Price Supports:Supply Restrictions, Import Quotas and Tariffs

- The Sugar Quota:The Impact of a Tax or Subsidy, Subsidy

- Perfect Competition:Total, Marginal, and Average Revenue

- Perfect Competition:Effect of Excise Tax on Monopolist

- Monopoly:Elasticity of Demand and Price Markup, Sources of Monopoly Power

- The Social Costs of Monopoly Power:Price Regulation, Monopsony

- Monopsony Power:Pricing With Market Power, Capturing Consumer Surplus

- Monopsony Power:THE ECONOMICS OF COUPONS AND REBATES

- Airline Fares:Elasticities of Demand for Air Travel, The Two-Part Tariff

- Bundling:Consumption Decisions When Products are Bundled

- Bundling:Mixed Versus Pure Bundling, Effects of Advertising

- MONOPOLISTIC COMPETITION:Monopolistic Competition in the Market for Colas and Coffee

- OLIGOPOLY:Duopoly Example, Price Competition

- Competition Versus Collusion:The Prisonersí Dilemma, Implications of the Prisoners

- COMPETITIVE FACTOR MARKETS:Marginal Revenue Product

- Competitive Factor Markets:The Demand for Jet Fuel

- Equilibrium in a Competitive Factor Market:Labor Market Equilibrium

- Factor Markets with Monopoly Power:Monopoly Power of Sellers of Labor