|

Microeconomics

ECO402

VU

Lesson

38

Bundling

Mixed

Bundling

Selling

both as a bundle and

separately

Pure

Bundling

Selling

only a package

Mixed

Versus Pure

Bundling

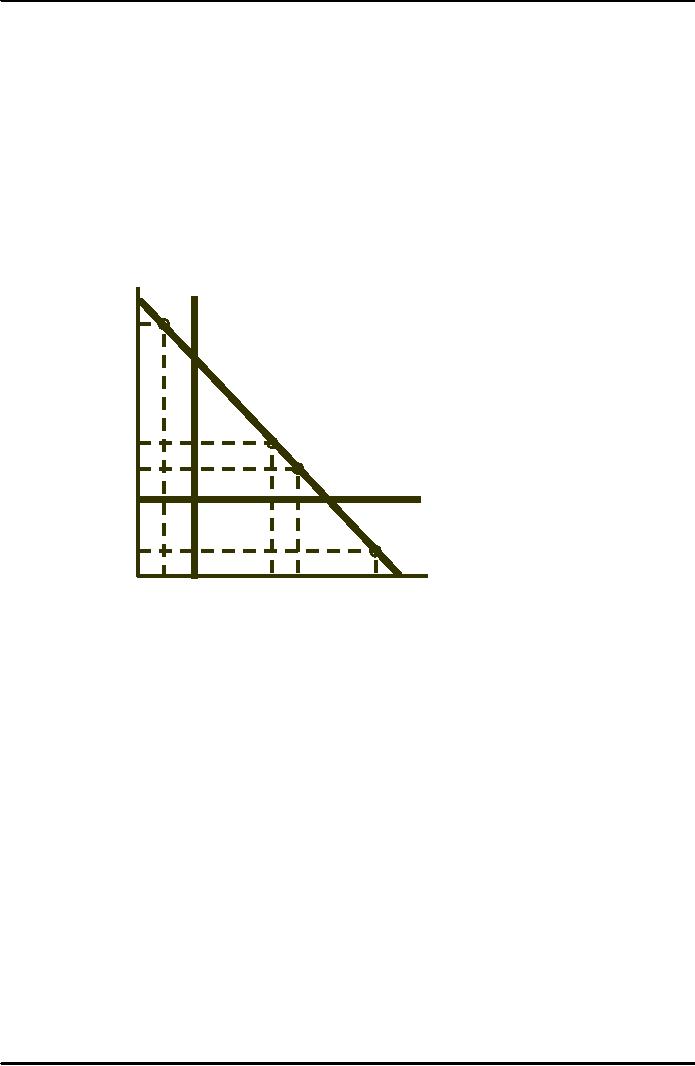

C1 =

MC1

r2

C1 =

20

With

positive marginal

costs,

mixed bundling

100

A

may

be more profitable

than

pure bundling.

90

80

Consumer

A, for

example, has

70

a

reservation price for good

1

that

is below marginal cost

c1.

With

mixed bundling, consumer

A

60

B

is

induced to buy only good 2,

while

consumer

D is

induced to buy only good

1,

50

C

reducing

the firm's cost.

40

C2 =

MC2

30

C2 =

30

20

D

10

r1

10

20 30 40 50 60 70 80 90 100

Mixed

vs. Pure Bundling

Scenario

Perfect

negative correlation

Significant

marginal cost

Observations

Reservation

price is below MC for some

consumers

Mixed

bundling induces the

consumers to buy only goods

for which their

reservation

price

is greater than MC

Bundling

Example

Sell

Separately

Consumers

B,C,

and

D buy

1 and A

buys

2

Pure

Bundling

Consumers

A,

B, C, and

D buy

the bundle

Mixed

Bundling

Consumer

D

buys

1, A

buys

2, and B

& C buys

the bundle

174

Microeconomics

ECO402

VU

P1

P2

PB

Profit

Sell

separately

$50

$90

----

$150

Pure

bundling

----

----

$100

$200

Mixed

bundling

$89.95

$89.95

$100

$229.90

C1 =

$20

C2 =

$30

Sell

Separately

3($50 -

$20) + 1($90 - $30) =

$150

Pure

Bundling

4($100 -

$20 - $30) = $200

Mixed

Bundling

($89.95 -

$20) + ($89.95 - $30) -

2($100 - $20 - $30) =

$229.90

C1 =

$20

C2 =

$30

Question

If MC = 0, would

mixed bundling still be the

most profitable strategy

with perfect negative

correlation?

Mixed

Bundling with Zero Marginal

Costs

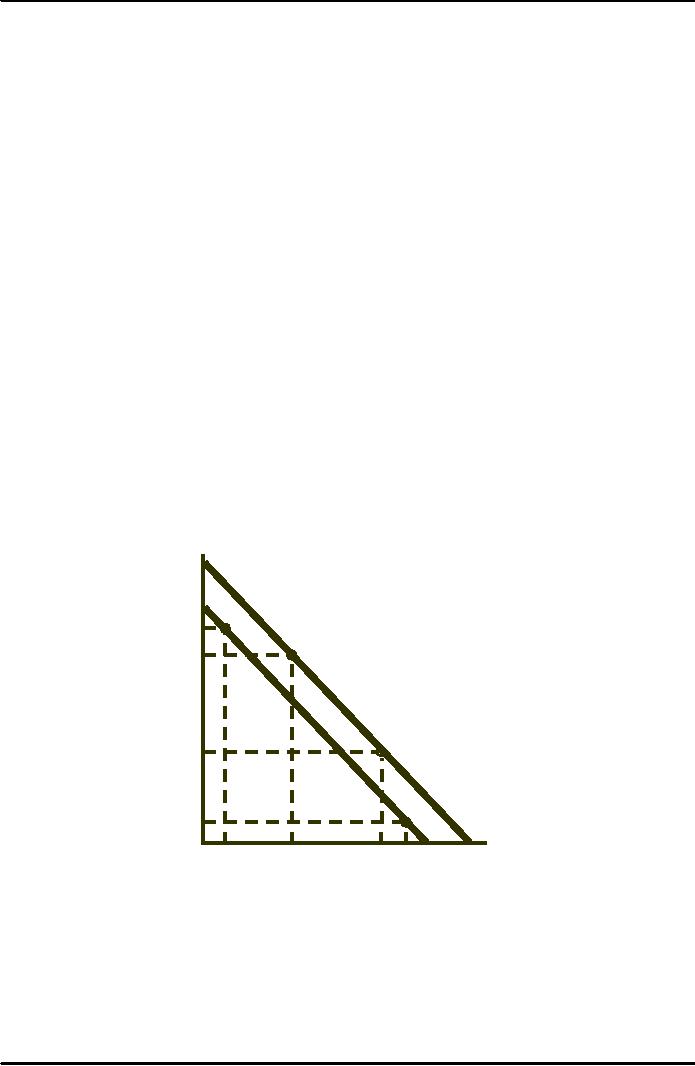

r2 120

In

this example, consumers

B and

C

are

willing to pay $20 more for

the bundle

than

are consumers A

and

D.

With

100

mixed

bundling, the price of the

bundle

A

can

be increased to $120. A

& D can

be

9

B

charged

$90 for a single

good.

80

60

C

40

20

D

1

r1

1

80

9

20

40

60

100

120

P1

P2

PB

Profit

Sell

separately

$80

$80

----

$320

Pure

bundling

----

----

$100

$400

Mixed

bundling

$90

$90

$120

$420

175

Microeconomics

ECO402

VU

Bundling

in Practice

Automobile

option packages

Vacation

travel

Cable

television

Mixed

Bundling in Practice

Use of

market surveys to determine

reservation prices

Design a

pricing strategy from the

survey results

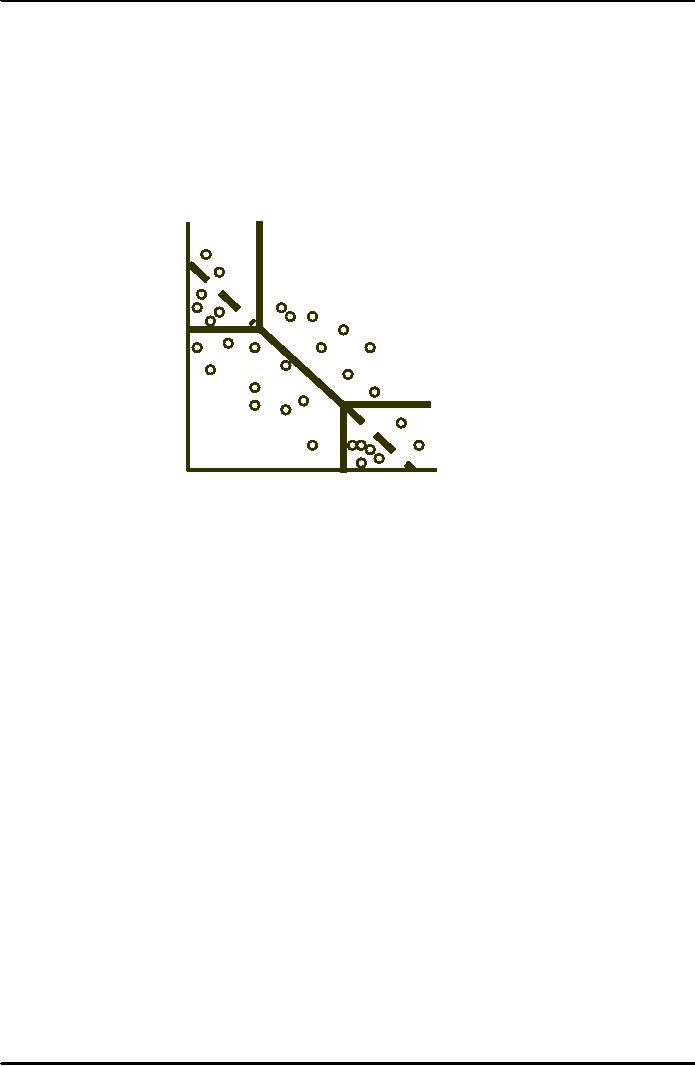

r2

The

dots are estimates of

reservation

prices for a

PB

representative

sample of

consumers.

The

firm can first choose a

price

for

the bundle and then

try individual

P2

prices

P1 and

P2 until

total profit

is

roughly maximized.

r1

P1

PB

The

Complete Dinner vs. a la

Carte:

A

Restaurant's Pricing

Problem

Pricing

to match consumer preferences

for various

selections

Mixed

bundling allows the customer

to get maximum utility from

a given expenditure by

allowing

a greater number of

choices.

Bundling

Tying

Practice of

requiring a customer to purchase

one good in order to

purchase another.

Examples

Xerox

machines and the

paper

IBM

mainframe and computer

cards

Allows

the seller to meter the

customer and use a two-part

tariff to discriminate

against

the

heavy user

McDonald's

Allows

them to protect their brand

name.

Advertising

Assumptions

Firm

sets only one

price

Firm

knows Q(P,A)

How

quantity demanded depends on

price and advertising

176

Microeconomics

ECO402

VU

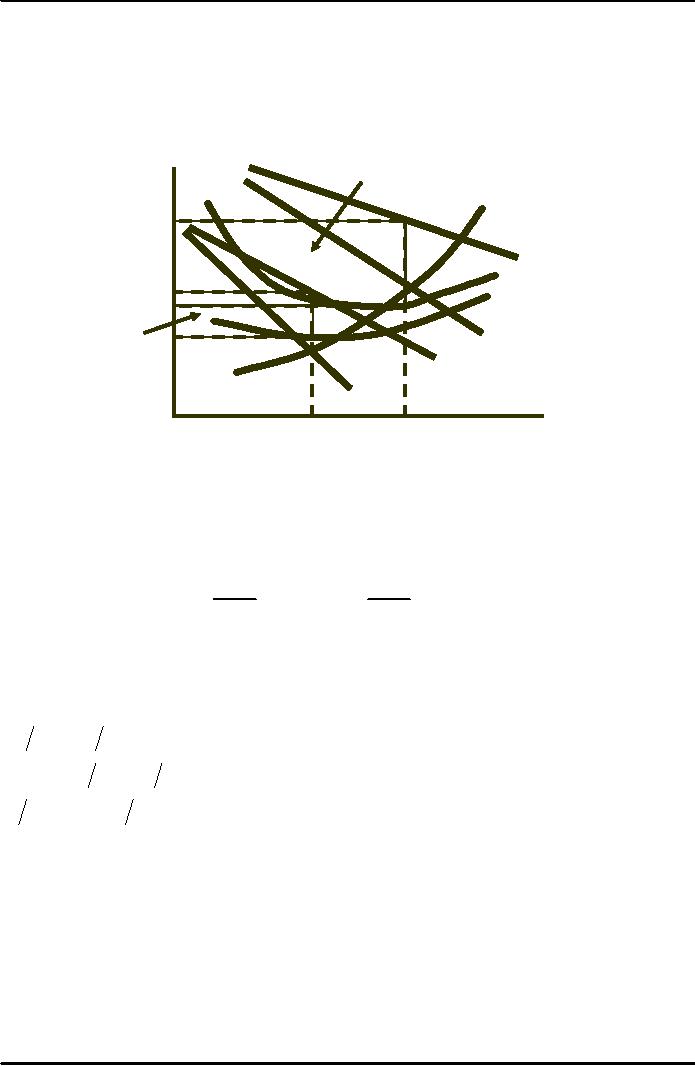

Effects

of Advertising

AR

and MR are

If

the firm advertises, its

average

average

and marginal

and

marginal revenue curves

shift

revenue

when the firm

to

the right -- average

costs

doesn't

advertise.

rise,

but marginal cost

does

not.

ö1

$/Q

MC

P1

AR'

AC'

P0

AC

ö0

MR'

AR

MR

Quantity

Q0

Q1

Advertising

ö

= PQ

(

P

,

A

) -

C

(

Q

) -

A

ΔQ

ΔQ

MR

Ads =

P

=

1

+

MC

=

full

MC of adv.

ΔA

ΔA

Choosing

Price and Advertising

Expenditure

A

Rule of Thumb for

Advertising

(

A

Q)(ΔQ

ΔA) =

EA = Adv.

elasticity of demand

(P

-

MC

)

P

= -1

EP

A

PQ = -(EA EP ) = Rule

of Thumb

To maximize

profit, the firm's

advertising-to-sales ratio should be

equal to minus the

ratio

of the advertising and price

elasticities of demand.

R(Q) = $1

million/yr

$10,000

budget for A (advertising--1% of

revenues)

EA = .2

(increase budget $20,000,

sales increase by 20%

EP = -4

(markup price over MC is

substantial)

Question

Should

the firm increase

advertising?

177

Microeconomics

ECO402

VU

YES

A/PQ =

-(2/-.4) = 5%

Increase

budget to $50,000

Questions

When EA is

large, do you advertise more

or less?

When EP is

large, do you advertise more

or less?

Advertising:

In Practice

Estimate

the level of advertising for

each of the firms

Supermarkets

EP=

-10; EA

= 0.1 to

0.3

Convenience

stores

EP=

-5; EA

= very

small

Designer

jeans

EP=

-3 to -4;

EA=

0.3 to

1

Laundry

detergents

EP=

-3 to -4;

EA=

very

large

178

Table of Contents:

- ECONOMICS:Themes of Microeconomics, Theories and Models

- Economics: Another Perspective, Factors of Production

- REAL VERSUS NOMINAL PRICES:SUPPLY AND DEMAND, The Demand Curve

- Changes in Market Equilibrium:Market for College Education

- Elasticities of supply and demand:The Demand for Gasoline

- Consumer Behavior:Consumer Preferences, Indifference curves

- CONSUMER PREFERENCES:Budget Constraints, Consumer Choice

- Note it is repeated:Consumer Preferences, Revealed Preferences

- MARGINAL UTILITY AND CONSUMER CHOICE:COST-OF-LIVING INDEXES

- Review of Consumer Equilibrium:INDIVIDUAL DEMAND, An Inferior Good

- Income & Substitution Effects:Determining the Market Demand Curve

- The Aggregate Demand For Wheat:NETWORK EXTERNALITIES

- Describing Risk:Unequal Probability Outcomes

- PREFERENCES TOWARD RISK:Risk Premium, Indifference Curve

- PREFERENCES TOWARD RISK:Reducing Risk, The Demand for Risky Assets

- The Technology of Production:Production Function for Food

- Production with Two Variable Inputs:Returns to Scale

- Measuring Cost: Which Costs Matter?:Cost in the Short Run

- A Firmís Short-Run Costs ($):The Effect of Effluent Fees on Firmsí Input Choices

- Cost in the Long Run:Long-Run Cost with Economies & Diseconomies of Scale

- Production with Two Outputs--Economies of Scope:Cubic Cost Function

- Perfectly Competitive Markets:Choosing Output in Short Run

- A Competitive Firm Incurring Losses:Industry Supply in Short Run

- Elasticity of Market Supply:Producer Surplus for a Market

- Elasticity of Market Supply:Long-Run Competitive Equilibrium

- Elasticity of Market Supply:The Industryís Long-Run Supply Curve

- Elasticity of Market Supply:Welfare loss if price is held below market-clearing level

- Price Supports:Supply Restrictions, Import Quotas and Tariffs

- The Sugar Quota:The Impact of a Tax or Subsidy, Subsidy

- Perfect Competition:Total, Marginal, and Average Revenue

- Perfect Competition:Effect of Excise Tax on Monopolist

- Monopoly:Elasticity of Demand and Price Markup, Sources of Monopoly Power

- The Social Costs of Monopoly Power:Price Regulation, Monopsony

- Monopsony Power:Pricing With Market Power, Capturing Consumer Surplus

- Monopsony Power:THE ECONOMICS OF COUPONS AND REBATES

- Airline Fares:Elasticities of Demand for Air Travel, The Two-Part Tariff

- Bundling:Consumption Decisions When Products are Bundled

- Bundling:Mixed Versus Pure Bundling, Effects of Advertising

- MONOPOLISTIC COMPETITION:Monopolistic Competition in the Market for Colas and Coffee

- OLIGOPOLY:Duopoly Example, Price Competition

- Competition Versus Collusion:The Prisonersí Dilemma, Implications of the Prisoners

- COMPETITIVE FACTOR MARKETS:Marginal Revenue Product

- Competitive Factor Markets:The Demand for Jet Fuel

- Equilibrium in a Competitive Factor Market:Labor Market Equilibrium

- Factor Markets with Monopoly Power:Monopoly Power of Sellers of Labor