|

Money

& Banking MGT411

VU

Lesson

25

BANK

RISK

Bank

Risk

Liquidity

Risk

Credit

Risk

Interest

Rate Risk

Trading

Risk

Other

Risks

Bank

Risk

Banking

is risky because depository

institutions are highly

leveraged and because what

they do

In

all the lines of banking

trades, the goal of every

bank is to pay less for the

deposits the bank

receives

than for the loan it makes

and the securities it buys.

Liquidity

Risk

Liquidity

risk is the risk of a sudden

demand for funds and it can

come from both sides of

a

bank's

balance sheet (deposit

withdrawal on one side and the

funds needed for its

off-balance

sheet

activities on the liabilities

side

If

a bank cannot meet customers' requests

for immediate funds it runs

the risk of failure; even

with

a positive net worth, illiquidity

can drive it out of

business

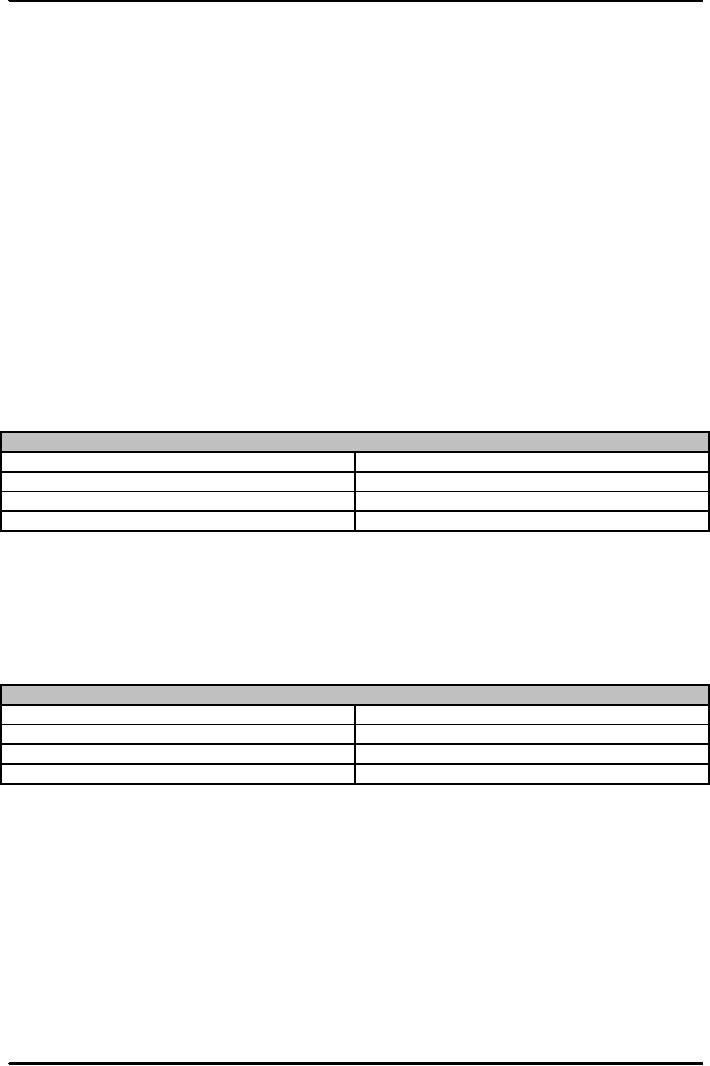

Table:

Balance sheet of a bank holding $5

million in excess

reserves

Assets

Liabilities

Reserves

$15million

Deposits

$100million

Loans

$100million

Borrowed

funds

$30million

Securities

$35million

Bank

capital

$20million

One

way to manage liquidity risk

is to hold sufficient excess

reserves (beyond the

required

reserves

mandated by the central bank) to

accommodate customers'

withdrawals.

However,

this is expensive (interest is

foregone)

Two

other ways to manage liquidity

risk are:

Adjusting

assets

Adjusting

liabilities

Table:

Balance sheet of a bank holding no

excess reserves

Assets

Liabilities

Reserves

$10million

Deposits

$100

million

Loans

$100

million

Borrowed

funds

$30

million

Securities

$40

million

Bank

capital

$20

million

If

a customer makes a $5 million

withdrawal, the bank can't

simply deduct it from

reserves.

Rather

it will adjust another part of balance

sheet

A

bank can adjust its assets

by

Selling

a portion of its securities

portfolio,

Or

by selling some of its

loans,

Or

by refusing to renew a customer loan

that has come due

81

Money

& Banking MGT411

VU

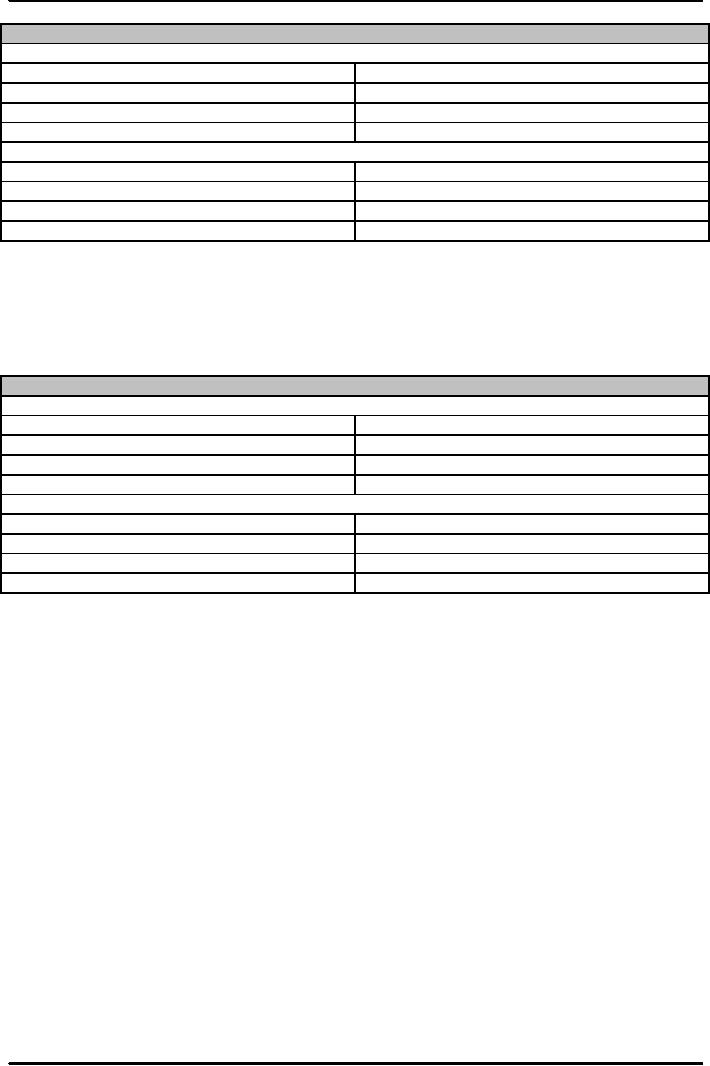

Table:

Balance sheet of a bank

following a $5 million withdrawal

and asset

adjustment

Withdrawal

is met by selling securities

Assets

Liabilities

Reserves

$10million

Deposits

$95

million

Loans

$100

million

Borrowed

funds

$30

million

Securities

$35

million

Bank

capital

$20

million

Withdrawal

is met by reducing loans

Assets

liabilities

Reserves

$10

million

Deposits

$95

million

Loans

$95

million

Borrowed

funds

$30

million

Securities

$40

million

Bank

capital

$20

million

Banks

do not like to meet their

deposit outflows by contracting the

asset side of the

balance

sheet

because doing so shrinks the

size of the bank

Banks

can use liability management

to obtain additional funds

by

Borrowing

(from the central bank or

from another bank) or

By

attracting additional deposits

(by issuing large

CDs)

Table:

Balance sheet of a bank

following a $5 million withdrawal

and liability

adjustment

Withdrawal

is met by borrowing

Assets

Liabilities

Reserves

$10million

Deposits

$95

million

Loans

$100

million

Borrowed

funds

$35

million

Securities

$40

million

Bank

capital

$20

million

Withdrawal

is met by attracting

deposits

Assets

liabilities

Reserves

$10

million

Deposits

$100

million

Loans

$100million

Borrowed

funds

$30

million

Securities

$40

million

Bank

capital

$20

million

Credit

Risk

This

is the risk that loans will

not be repaid and it can be

managed through diversification

and

credit-risk

analysis

Diversification

can be difficult for banks,

especially those that focus on

certain kinds of

lending

Credit-risk

analysis produces information that is

very similar to the

bond-rating systems and is

done

using a combination of statistical models

and information specific to the loan

applicant

Lending

is plagued by adverse selection and moral

hazard, and financial institutions

use a

variety

of methods to mitigate these

problems

Screen

loan application

Monitor

borrowers after they have

received loan

Collateral

or high net-worth

demand

Developing

long term relationships

Interest-Rate

Risk

The

two sides of a bank's

balance sheet often do not

match up because liabilities

tend to be

short-term

while assets tend to be

long-term; this creates interest-rate

risk

In

order to manage interest-rate risk, the

bank must determine how

sensitive its balance

sheet

(assets

and liabilities) is to a change in

interest rates;

If

we think of bank's assets and

liabilities as bonds, the change in interest rate

will affect the

value

of these bonds, more importantly

due to the term of bonds

So

if interest rate rises, the bank face the

risk that the value of their

assets may fall more

than

the

value of their liabilities

(reducing the bank's

capital)

82

Money

& Banking MGT411

VU

Suppose

20% of bank's assets fall

into the category of assets

sensitive to changes in the

interest

rate.

While rest of 80%are not sensitive to

changes in interest rate

If

interest rate is stable 5%, then

each $100 yields $5 in

interest

Now

suppose 50% of bank's

deposits (liabilities) are interest rate

sensitive and 50% are

not

Half

of the liabilities are deposits

that earn variable returns so

costs vary with market

rate

For

making profit, interest rate on

liabilities must be lower

than the interest rate on assets.

The

difference is the bank's

margin!

Assuming

interest rate on liabilities is 3%, the net interest

margin is 5 3 = 2%

What

happens as interest rate rises by

1%

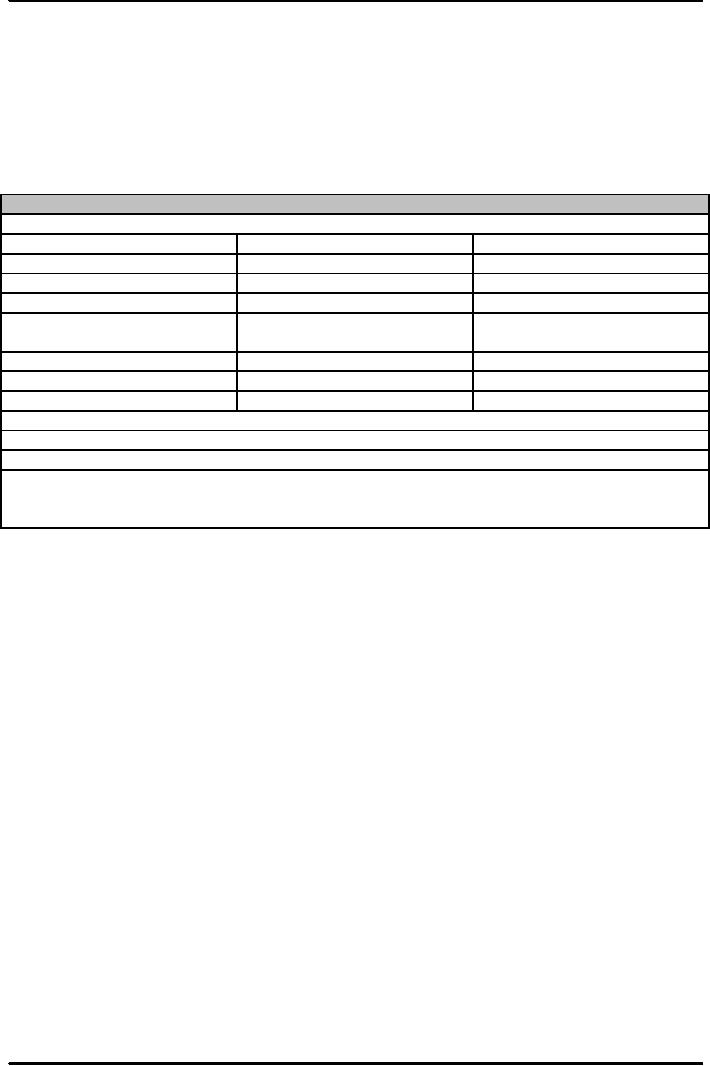

Table:

An example of interest rate

risk

The

impact of an interest rate increase on

bank profits (per $100 of

assets)

Items

Assets

Liabilities

Interest

rate sensitive

$20

$50

Not

interest rate sensitive

$80

$50

Initial

interest rate

5%

3%

New

interest rate on interest rate

6%

4%

sensitive

assets and

liabilities

Revenue

from assets

Cost

of liabilities

At

initial interest rate

(0.05×$20)+(0.05×$80)=$5.00

(0.03×$50)+(0.03×$50)=$3.00

After

interest rate change

(0.06×$20)+(0.05×$80)=$5.20

(0.04×$50)+(0.03×$50)=$3.50

Profits

at initial interest

rate:

($5.00)

($3.00) = $2.00 per $100 in

assets

Profits

after interest rate change:

($5.20)

($3.50) = $1.70 per $100 in

assets

Gap

analysis

Gap

between interest rate sensitive assets

and interest rate sensitive

liabilities:

(Interest

rate sensitive assets of $20)

(Interest rate sensitive liabilities of

$50)

=(Gap

of -$30)

When

bank has more interest rate sensitive

liabilities than does interest rate

assets, an increase

in

interest rate will cut into the bank's

profits.

83

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY