|

BACKGROUND TO SUPPLY/COSTS (CONTINUED…………..):PROFIT MAXIMISATION |

| << BACKGROUND TO SUPPLY/COSTS (CONTINUED…………..):REVENUES |

| MARKET STRUCTURES:PERFECT COMPETITION, Allocative efficiency >> |

Introduction

to Economics ECO401

VU

Lesson

5.6

BACKGROUND

TO SUPPLY/COSTS

(CONTINUED..............)

PROFIT

MAXIMISATION

Economists

say that when firms

earn zero accounting

profits, they actually earn

normal

economic

profits because TC already

includes the normal profits

that owners of the firms

need

for

themselves to stay in the

business. Positive profits

are, for this reason,

called supernormal

profits

as they are over and

above what the owners

normally require as a return

for their

entrepreneurship.

Approaches

of Profit Maximization:

Profit

maximization can be studied

using the TR-TC approach

and the MR-MC

approach.

i.

In the TR-TC approach it is

assumed that firm is price

maker and firm is

operating

in

short run. Total profit is

the vertical distance

between TR and TC.

ii.

In the MR-MC approach, two

steps are followed to

identify maximum profit.

First:

the

profit-maximizing output is identified

this is the point

where MR cuts MC.

Second:

the size of maximum profit

is calculated using AC and AR

curves.

If

MR & AR remain same over

the long run, then

the profit maximizing output

will be obtained

where

MR intersects LRMC.

If

AC is always above AR, then

firms will never be able to

make a profit. In this case,

the point

where

MR=MC, represents the

loss-minimizing point.

When

MC and MR intersect at two

points, not one, then

Firms should produce at that

point of

intersection

of MR and MC beyond which, MC

exceeds MR.

If

a firm's AR is below its AVC, it

will shut down since it is

not covering any part of

its fixed

costs.

Profit

maximization using

calculus:

If

total revenue (TR) and

total cost equation are

given as follows:

TR

= 48q q2

TC

= 12 + 16q + 3Q2

Then

we can find out the

value of output at which

profit is maximized as

under:

Solution:

Profit

is maximized at the point

where

MC

= MR

MC

function can be found by

taking derivative of total

cost function. i.e.:

MC

= d TC / dQ

MC

= 16 + 6Q

MR

function can be found by

taking derivative of total

revenue (TR) function

i.e.:

MR

= d TR / dQ

=

48 2Q

As

profit is maximized at the

point where MR = MC, so by equating

values of MC and MR

function,

we get,

46

Introduction

to Economics ECO401

VU

MR

=MC

16

+ 6Q = 48 2Q

6Q

+ 2Q = 48 16

8Q

= 32

Q=4

The

equation for total profit

is,

Tń

= TR TC

=

48Q Q2 -

(12 + 16Q + 3Q2)

=

48Q Q2

12 16Q 3Q2

=

-4Q2 +

32Q 12

Putting

Q = 4, we get,

Tń

= - 4(4)2 +

32 (4) 12

=

-64 + 128 - 12

Tń

= 52

So

profit is maximized where

output is 4 and the maximum

profit is 52.

47

Introduction

to Economics ECO401

VU

END

OF UNIT 5 - EXERCISES

How

will the length of the

short run for a shipping

company depend on the state

of the

shipbuilding

industry?

If

the shipbuilding industry is in

recession, the short run

(and the long run)

may be shorter. It

will

take less time to acquire a

new ship if there is no

waiting list, or if there

are already ships

available

to purchase (with perhaps

only minimal modifications

necessary).

Up

to roughly how long is the

short run in the following

cases?

(a)

A mobile ice-cream firm. (b)

A small grocery. (c)

Electricity power

generation.

a)

2-3 days: the time

necessary to acquire new

bicycles, equipment and

workers.

b)

Several weeks: the time

taken to acquire additional

premises.

c)

3-5 years: the time

taken to plan and build a

new power station.

How

would you advise the

naanwaala (bread-maker) next

door as to whether he

should

(a)

employ an extra assistant on a

Sunday (which is a high

demand day); (b) extend

his

shop,

thereby allowing more

customers to be served on a

Sunday?

a)

If maximizing profit is the

sole aim, then he should

employ an additional assistant if

the

extra

revenue from the extra

customers that the assistant

can serve is greater than

the

costs

of employing the

assistant.

b)

Only if the extra revenue

from the extra customers

will more than cover

the costs of the

extension

plus the extra

staffing.

Given

that there is a fixed supply

of land in the world, what

implications can you

draw

from

about the effects of an

increase in world population

for food output per

head?

Other

things being equal,

diminishing returns would

cause food output per

head to decline (a

declining

MPP and APP of labour).

This, however, would be

offset (partly, completely or

more

than

completely) by improvements in

agricultural technology and by

increased amounts of

capital

devoted to agriculture: this

would have the effect of

shifting the APP curve

upwards.

The

following are some costs

incurred by a shoe manufacturer.

Decide whether

each

one

is a fixed cost or a variable

cost or has some element of

both.

(a)

The cost of leather. (b)

The fee paid to an

advertising agency. (c) Wear

and tear on

machinery.

(d) Business rates on the

factory. (e) Electricity for

heating and lighting.

(f)

Electricity

for running the machines.

(g) Basic minimum wages

agreed with the

union.

(h)

Overtime pay. (i)

Depreciation of machines as a result

purely of their

age

(irrespective

of their condition).

(a)

Variable. (b) Fixed (unless

the fee negotiated depends

on the success of the

campaign).

(c)

Variable (the more that is

produced, the more the

wear and tear). (d)

Fixed. (e) Fixed if

the

factory will be heated and

lit to the same extent

irrespective of output, but

variable if the

amount

of heating and lighting

depends on the amount of the

factory in operation, which

in

turn

depends on output. (f)

Variable. (g) Variable

(although the basic wage is

fixed per

worker,

the cost will still be

variable because the total

cost will increase with

output if the

number

of workers is increased). (h)

Variable. (i) Fixed (because

it does not depend on

output).

Assume

that a firm has 5 identical

machines, each operating

independently. Assume

that

with all 5 machines

operating normally, 100

units of output are produced

each day.

Below

what level of output will

AVC and MC rise?

20

units. Below this level,

the one remaining machine

left in operation will begin

to operate at a

level

below its optimum. (Note

that with 5 machines

producing 100 units of

output, minimum

AVC

could be achieved at 100,

80, 60, 40 and 20 units of

output, but between these

levels

some

machines may be working at

less than their optimum

and some at more than

their

48

Introduction

to Economics ECO401

VU

optimum.

Thus if the optimum level

for a machine is critical,

then the AVC curve may

look

`wavy'

rather than a smooth

line.

Why

is the minimum point of the

AVC curve (y) at a lower

level of output than

the

minimum

point of the AC curve

(z)?

Because

between points y and z

marginal cost is above AVC

(and thus AVC must be past

the

minimum

point) but below AC (and

thus AC cannot yet have

reached the minimum

point).

Even

though AVC is rising beyond

point y, the fall in AFC

initially more than offsets

the rise in

AVC

and thus AC still

falls.

What

economies of scale is a large

department store likely to

experience?

Specialized

staff for each department

(saving on training costs

and providing a more

efficient

service

for customers); being able

to reallocate space as demand

shifts from one product

to

another

and thereby reducing the

overall amount of space

required; full use of large

delivery

lorries

which would be able to carry

a range of different products;

bulk purchasing

discounts;

reduced

administrative overheads as a proportion

of total costs.

Why

are firms likely to

experience economies of scale up to a

certain size and

then

diseconomies

of scale after some point

beyond that?

Because

economies of scale, given

that most arise from

increasing returns to scale,

will be

fully

realized after a certain

level of output, whereas

diseconomies of scale, given

that they

largely

arise from the managerial

problems of running large

organizations, are only

likely to set

in

beyond a certain level of

output.

How

is the opening up of trade

and investment between, say

eastern and

western

Europe,

likely to affect the

location of industries within

Europe that have (a)

substantial

economies

of scale; (b) little or no

economies of scale?

a)

Given that production will

take place in only one or

two plants, new plants

will tend to

be

located near to the centre

of the new enlarged European

market.

b)

Plants will still tend to be

scattered round Europe,

given that the customers

are

scattered.

These

effects will be the result

of attempts to minimize transport

costs and thus will be

more

significant

the higher are transport

costs per kilometer.

Name

some industries where

external economies of scale

are gained. What are

the

specific

external economies in each

case?

Two

examples are:

·

Financial

services: pool of qualified

and experienced labour,

access to specialist

software,

one firm providing

specialist services to

another.

·

Various

parts of the engineering

industry: pool of qualified

and experienced

labour,

access

to specialist suppliers, possible

joint research, specialized

banking services.

Would

you expect external

economies to be associated with

the concentration of an

industry

in a particular region?

Yes.

There may be a common

transport and communications

infrastructure that can be

used;

there

is likely to be a pool of trained

and experienced labour in

the area; joint demand

may be

high

enough to allow economies of

scale to be experienced in the

supply of some

locally

extracted

raw material.

If

factor X costs twice as much

as factor Y (Px/Py = 2),

what can be said about

the

relationship

between the MPPs of the

two factors if the optimum

combination of factors

is

used?

MPPx/MPPy

= 2. The reason is that if

MPPx/Px = MPPy/Py, then, by

rearranging the terms

of

the

equation, MPPx/MPPy must

equal Px/Py (= 2).

49

Introduction

to Economics ECO401

VU

Could

isoquants ever

cross?

Not

for a given state of

technology, otherwise it would

mean that at one side of

the intersection

the

higher output isoquant would

be `south-west' of the lower

output isoquant. This

would

mean

that a higher output could

be achieved by using less of

both factors of

production!

Could

they ever slope upward to

the right?

Yes.

It would mean that one of

the two factors had a

negative marginal productivity

that was

greater

than the positive marginal

productivity of the other:

i.e. that MPPa/MPPb

(or

MPPb/MPPa)

was negative (a negative

marginal rate of factor

substitution).

This

situation will occur when so

much is used of one factor

that diminishing returns

have

become

so great as to produce substantial

negative marginal productivity:

isoquants will bend

back

on themselves beyond the

points where they become

vertical or horizontal. The

firm,

however,

will not produce along

this portion of an isoquant,

because the price ratio

(Pa/Pb) will

(virtually)

never be negative.

What

will happen to an isocost if

the prices of both factors

rise by the same

percentage?

It

will shift inwards parallel

to the old isocost.

Why

do the prices of cattle and

sheep prices fall so

drastically "on", or just

"after" the

first

day of Eid-ul-Azha?

The

supply curve for cattle

and sheep is fixed in the

short-run, i.e. a vertical

supply curve,

therefore

price will be determined by

demand. Since demand for

"cattle for sacrifice"

falls

drastically

after or on the first day of

Eid-ul-Azha, the price has

to come down drastically

as

well

for the market to

clear.

Explain

the shape of the LRMC

curve for a firm with a

typical U-shaped LRAC

curve.

At

first economies of scale

cause the LRMC to fall.

Then because of (marginal)

diseconomies

of

scale, additional units of

production begin to cost

more to produce than

previous units: the

LRMC

begins to slope upwards. But

the LRAC is still falling

because the LRMC is below

it

pulling

it down. It is not until the

LRMC crosses the LRAC

that the firm will

experience a rising

LRAC

and hence average

diseconomies of scale.

Will

the "envelope curve" be

tangential to the bottom of

each of the short-run

average

cost

curves? Explain why it should or

should not be.

No.

At the tangency points the

two curves must have

the same slope. Thus

the slope at the

tangency

point is not zero (the

slope at the turning point

or minima of the SRAC

curves).

What

would the isoquant map look

like if there were (a)

continuously increasing

returns

to

scale; (b) continuously

decreasing returns to

scale?

a)

The isoquants would get

progressively closer and

closer together.

b)

The isoquants would get

progressively further and

further apart.

What

can we say about the slope

of the TR and TC curves at

the maximum profit

point?

What

does this tell us about

marginal revenue and

marginal cost?

The

slopes are the same.

But given that the

slope of the total curve

gives the respective

marginal,

this means that marginal

revenue will be equal to

marginal cost.

50

Introduction

to Economics ECO401

VU

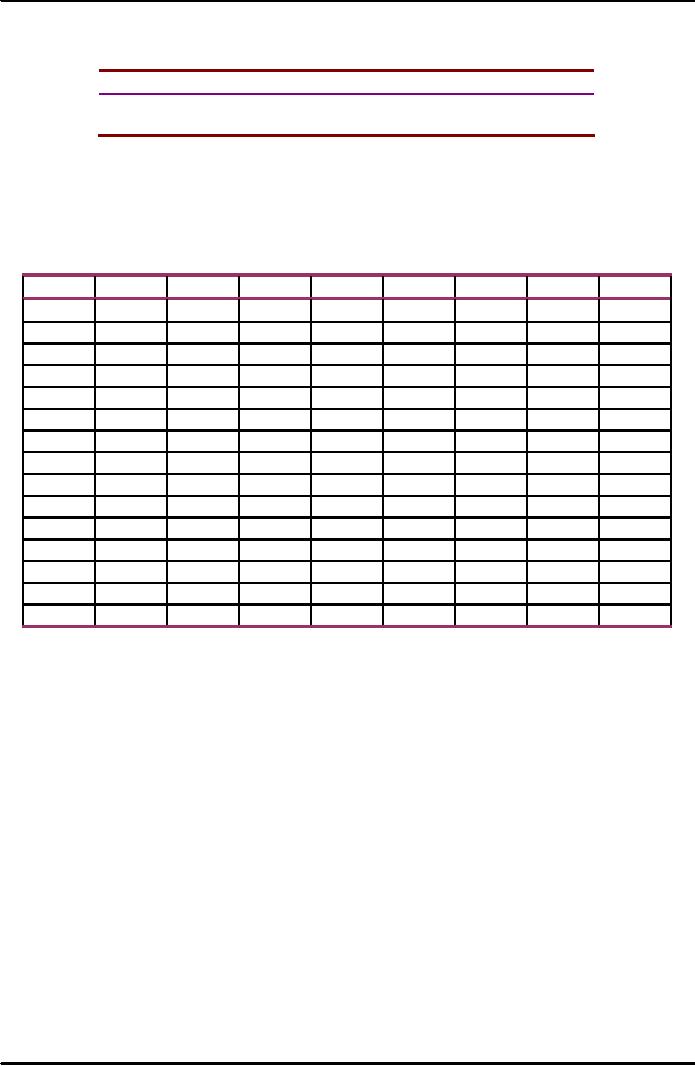

Fill

in the missing figures in

the table below.

TΠ

AΠ

Q

P=

TR

MR

TC

AC

MC

AR

0

9

6

1

8

10

2

7

12

3

6

14

4

5

18

5

4

25

6

3

36

7

2

56

TΠ

AΠ

Q

P

= AR

TR

MR

TC

AC

MC

0

9

0

6

6

8

4

1

8

8

10

10

2

2

6

2

2

7

14

12

6

2

1

4

2

3

6

18

14

4.3

4

1.3

2

4

4

5

20

18

4.5

2

0.5

0

6

5

4

20

25

5

5

1

2

9

6

3

18

36

6

18

3

4

16

7

2

14

56

8

42

6

Why

should the figures for MR

and MC be entered in the

spaces between the

lines?

Because

marginal revenue (or cost)

is the extra revenue (or

cost) from moving from

one quantity

to

another.

51

Introduction

to Economics ECO401

VU

You

are given the following

information for a

firm.

Q

0

1

2

3

4

5

6

7

P

12

11

10

9

8

7

6

5

TC

2

6

9

12

16

21

28

38

Construct

a detailed table like the

one you constructed in the

earlier question with TR,

AC,

MR,

TC, AC, MC, TΠ

and

AΠ.

Use your table to draw

"two" diagrams (one with

the marginal

revenue

and cost curves, and

one with the total

(or average) revenue and

cost curves) and

use

them to show the

"profit-maximising output" and

the "level of maximum

profit",

respectively.

Confirm your findings by

reference to the table you

construct.

TΠ

AΠ

Q

P

= AR

TR

MR

TC

AC

MC

0

12

0

2

2

11

4

1

11

11

6

6

5

5

9

3

2

10

20

9

4.5

11

5.5

7

3

3

9

27

12

4

15

5

5

4

4

8

32

16

4

16

4

3

5

5

7

35

21

4.2

14

2.8

1

7

6

6

36

28

4.7

8

1.3

1

10

7

5

35

38

5.4

3

0.4

The

curves will be a similar

shape to those discussed in

the lecture, and included in

the slides

handout.

The peak of the TΠ

curve

will be at Q = 4. This will be

the output where MR and

MC

intersect.

Will

the size of normal `profit'

vary with the general

state of the

economy?

Yes.

Normal

profit is the rate of profit

that can be earned elsewhere

(in industries

involving

similar

level of risk). When the

economy is booming, profits

will normally be higher than

when

the

economy is in recession. Thus

the `normal' profit that

must be earned in any one

industry

must

be higher to prevent capital

being attracted to other

industries.

Given

the following

equations:

TR

= 72Q 2Q˛; TC = 10 + 12Q +

4Q˛

Calculate

the maximum profit output

and the amount of profit at

that output using

both

methods.

(a)

TΠ

=

72Q 2Q˛ 10 12Q

4Q

=

10 + 60Q 6Q˛

(1)

∴

dTΠ /dQ = 60

12Q

Setting

this equal to zero

gives:

52

Introduction

to Economics ECO401

VU

60

12Q = 0

∴

12Q

= 60

∴

Q=5

(b)

MR = dTR/dQ = 72 4Q

MC

= dTC/dQ = 12 + 8Q

Setting

MR equal to MC gives:

72

4Q = 12 + 8Q

∴

12Q

= 60

∴

Q=5

To

find the level of maximum

profit, we must substitute Q = 5

into equation (1). This

gives:

TΠ = 10 + (60

×

5) (6

×

5˛)

=

10 + 300 150

=

Rs. 140

53

Table of Contents:

- INTRODUCTION TO ECONOMICS:Economic Systems

- INTRODUCTION TO ECONOMICS (CONTINUED………):Opportunity Cost

- DEMAND, SUPPLY AND EQUILIBRIUM:Goods Market and Factors Market

- DEMAND, SUPPLY AND EQUILIBRIUM (CONTINUED……..)

- DEMAND, SUPPLY AND EQUILIBRIUM (CONTINUED……..):Equilibrium

- ELASTICITIES:Price Elasticity of Demand, Point Elasticity, Arc Elasticity

- ELASTICITIES (CONTINUED………….):Total revenue and Elasticity

- ELASTICITIES (CONTINUED………….):Short Run and Long Run, Incidence of Taxation

- BACKGROUND TO DEMAND/CONSUMPTION:CONSUMER BEHAVIOR

- BACKGROUND TO DEMAND/CONSUMPTION (CONTINUED…………….)

- BACKGROUND TO DEMAND/CONSUMPTION (CONTINUED…………….)The Indifference Curve Approach

- BACKGROUND TO DEMAND/CONSUMPTION (CONTINUED…………….):Normal Goods and Giffen Good

- BACKGROUND TO SUPPLY/COSTS:PRODUCTIVE THEORY

- BACKGROUND TO SUPPLY/COSTS (CONTINUED…………..):The Scale of Production

- BACKGROUND TO SUPPLY/COSTS (CONTINUED…………..):Isoquant

- BACKGROUND TO SUPPLY/COSTS (CONTINUED…………..):COSTS

- BACKGROUND TO SUPPLY/COSTS (CONTINUED…………..):REVENUES

- BACKGROUND TO SUPPLY/COSTS (CONTINUED…………..):PROFIT MAXIMISATION

- MARKET STRUCTURES:PERFECT COMPETITION, Allocative efficiency

- MARKET STRUCTURES (CONTINUED………..):MONOPOLY

- MARKET STRUCTURES (CONTINUED………..):PRICE DISCRIMINATION

- MARKET STRUCTURES (CONTINUED………..):OLIGOPOLY

- SELECTED ISSUES IN MICROECONOMICS:WELFARE ECONOMICS

- SELECTED ISSUES IN MICROECONOMICS (CONTINUED……………)

- INTRODUCTION TO MACROECONOMICS:Price Level and its Effects:

- INTRODUCTION TO MACROECONOMICS (CONTINUED………..)

- INTRODUCTION TO MACROECONOMICS (CONTINUED………..):The Monetarist School

- THE USE OF MACROECONOMIC DATA, AND THE DEFINITION AND ACCOUNTING OF NATIONAL INCOME

- THE USE OF MACROECONOMIC DATA, AND THE DEFINITION AND ACCOUNTING OF NATIONAL INCOME (CONTINUED……………..)

- MACROECONOMIC EQUILIBRIUM & VARIABLES; THE DETERMINATION OF EQUILIBRIUM INCOME

- MACROECONOMIC EQUILIBRIUM & VARIABLES; THE DETERMINATION OF EQUILIBRIUM INCOME (CONTINUED………..)

- MACROECONOMIC EQUILIBRIUM & VARIABLES; THE DETERMINATION OF EQUILIBRIUM INCOME (CONTINUED………..):The Accelerator

- THE FOUR BIG MACROECONOMIC ISSUES AND THEIR INTER-RELATIONSHIPS

- THE FOUR BIG MACROECONOMIC ISSUES AND THEIR INTER-RELATIONSHIPS (CONTINUED…….)

- THE FOUR BIG MACROECONOMIC ISSUES AND THEIR INTER-RELATIONSHIPS (CONTINUED…….):Causes of Inflation

- THE FOUR BIG MACROECONOMIC ISSUES AND THEIR INTER-RELATIONSHIPS (CONTINUED…….):BALANCE OF PAYMENTS

- THE FOUR BIG MACROECONOMIC ISSUES AND THEIR INTER-RELATIONSHIPS (CONTINUED…….):GROWTH

- THE FOUR BIG MACROECONOMIC ISSUES AND THEIR INTER-RELATIONSHIPS (CONTINUED…….):Land

- THE FOUR BIG MACROECONOMIC ISSUES AND THEIR INTER-RELATIONSHIPS (CONTINUED…….):Growth-inflation

- FISCAL POLICY AND TAXATION:Budget Deficit, Budget Surplus and Balanced Budget

- MONEY, CENTRAL BANKING AND MONETARY POLICY

- MONEY, CENTRAL BANKING AND MONETARY POLICY (CONTINUED…….)

- JOINT EQUILIBRIUM IN THE MONEY AND GOODS MARKETS: THE IS-LM FRAMEWORK

- AN INTRODUCTION TO INTERNATIONAL TRADE AND FINANCE

- PROBLEMS OF LOWER INCOME COUNTRIES:Poverty trap theories: