|

Competition Versus Collusion:The Prisoners’ Dilemma, Implications of the Prisoners |

| << OLIGOPOLY:Duopoly Example, Price Competition |

| COMPETITIVE FACTOR MARKETS:Marginal Revenue Product >> |

Microeconomics

ECO402

VU

Lesson

41

Competition

Versus Collusion:

The

Prisoners' Dilemma

Why

wouldn't each firm set

the collusion price

independently and earn the

higher profits that

occur

with explicit

collusion?

Assume:

FC

= $ 20

and VC =

$

0

Firm

1' s Demand : Q

= 12 - 2

P1 +

P2

Firm

2' s Demand : Q

= 12 - 2

P2 +

P1

�

= $

12

:

P

= $4

Nash

Equilibriu

m

�

= $

16

P

= $6

:

Collusion

Possible

Pricing Outcomes:

�

= $16

Firm

1 : P

= $6

Firm

2 : P

= $6

P

= $6

P

= $4

�

2

=

P2Q2 -

20

=

(4)[12

-

(2)(4)

+

6]

- 20

=

$20

�

1

=

P1Q1 -

20

=

(6)[12

-

(2)(6)

+

4]

- 20

=

$4

Payoff

Matrix for Pricing

Game

Firm

2

Charge

$4

Charge

$6

Charge

$4

$20,

$12,

Firm

1

Charge

$6

$4,

$16,

These

two firms are playing a

non co-operative

game.

Each firm

independently does the best

it can taking its competitor

into account.

Question

Why will

both firms both choose $4

when $6 will yield higher

profits?

An

example in game theory,

called the Prisoners'

Dilemma, illustrates the

problem

oligopolistic

firms face.

187

Microeconomics

ECO402

VU

Scenario

Two prisoners

have been accused of

collaborating in a crime.

They are in

separate jail cells and

cannot communicate.

Each has

been asked to confess to the

crime.

Payoff

Matrix for Prisoners'

Dilemma

Payoff

Matrix for Pricing

Game

Firm

2

Charge

$4

Charge

$6

Charge

$4

$20,

$12,

Firm

1

Charge

$6

$4,

$16,

Conclusions:

Oligipolistic Markets

1)

Collusion will lead to

greater profits

2)

Explicit and implicit

collusion is possible

3)

Once collusion exists, the

profit motive to break and

lower price is

significant

Implications

of the Prisoners'

Dilemma

for Oligipolistic

Pricing

Observations

of Oligopoly Behavior

1)

In some oligopoly markets,

pricing behavior in time can

create a

predictable

pricing environment and

implied collusion may

occur.

Observations

of Oligopoly Behavior

2)

In other oligopoly markets,

the firms are very

aggressive and collusion is

not

possible.

�

Firms are

reluctant to change price

because of the likely

response of their

competitors.

�

In this

case prices tend to be

relatively rigid.

188

Microeconomics

ECO402

VU

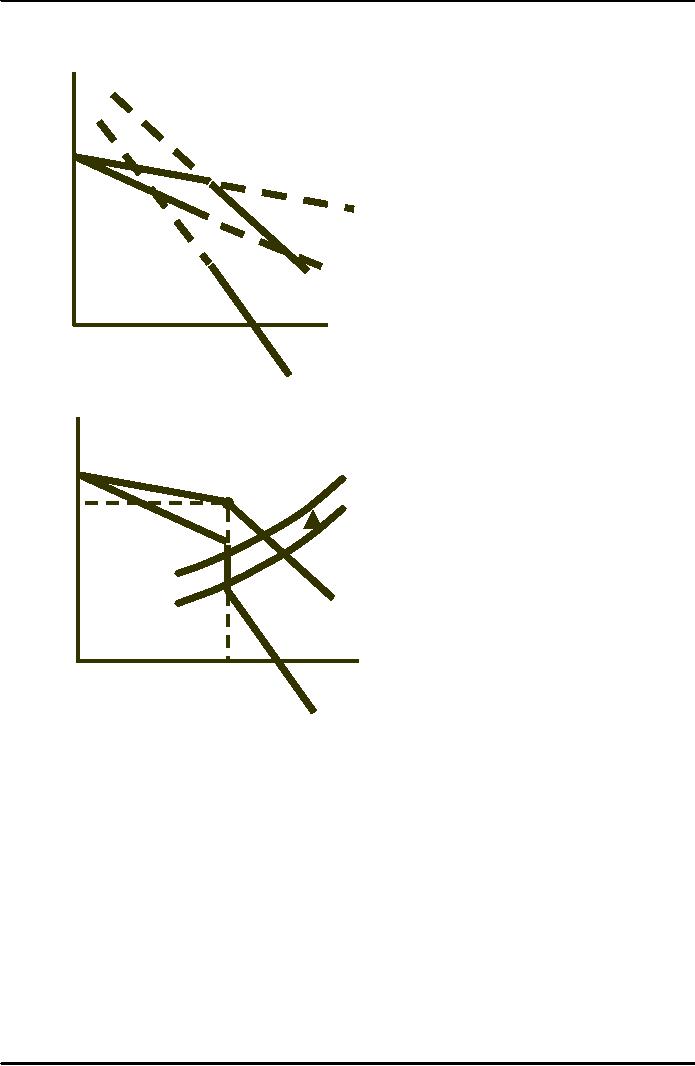

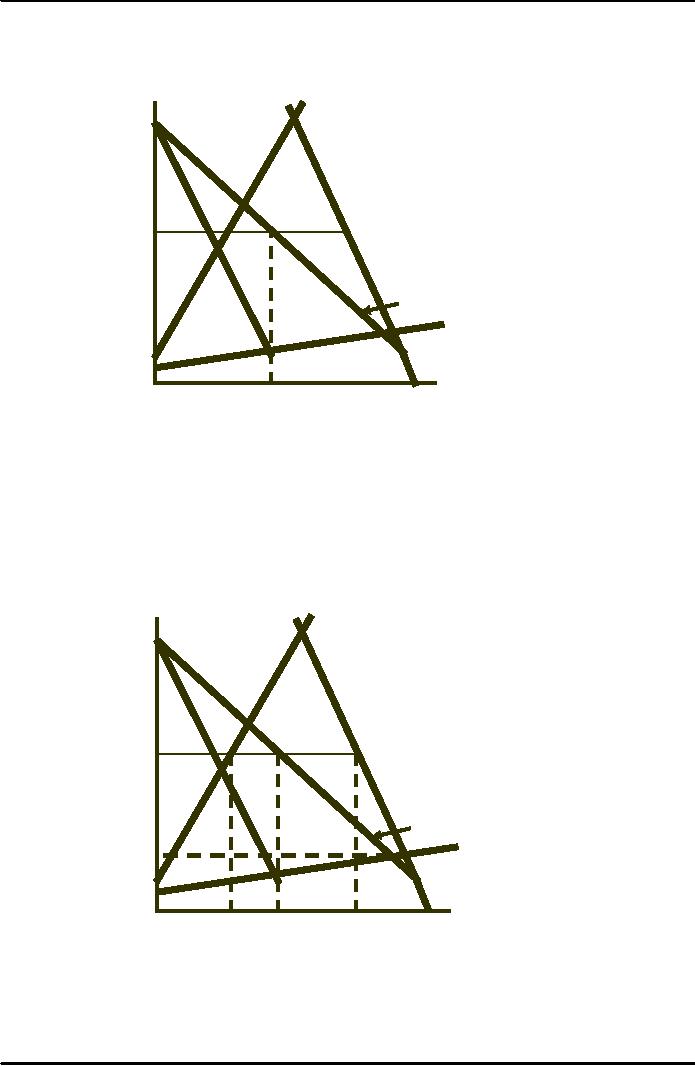

�

�

The

Kinked Demand Curve

If

the producer raises price

the

$/Q

competitors

will not and

the

demand

will be elastic.

If

the producer lowers price

the

competitors

will follow and

the

demand

will be inelastic.

D

Quantity

MR

So

long as marginal cost is in

the

$/Q

vertical

region of the

marginal

revenue

curve, price and

output

MC'

will

remain constant.

P*

MC

D

Quantity

Q*

MR

PRICE

SIGNALING & PRICE

LEADERSHIP

Price

Signaling

�

Implicit

collusion in which a firm

announces a price increase in

the hope that

other

firms

will follow suit

Price

Leadership

�

Pattern of

pricing in which one firm

regularly announces price

changes that other

firms

then match

The

Dominant Firm Model

In some

oligopolistic markets, one

large firm has a major

share of total sales, and

a

group

of smaller firms supplies

the remainder of the

market.

The large

firm might then act as

the dominant firm, setting a

price that maximized

its

own

profits.

189

Microeconomics

ECO402

VU

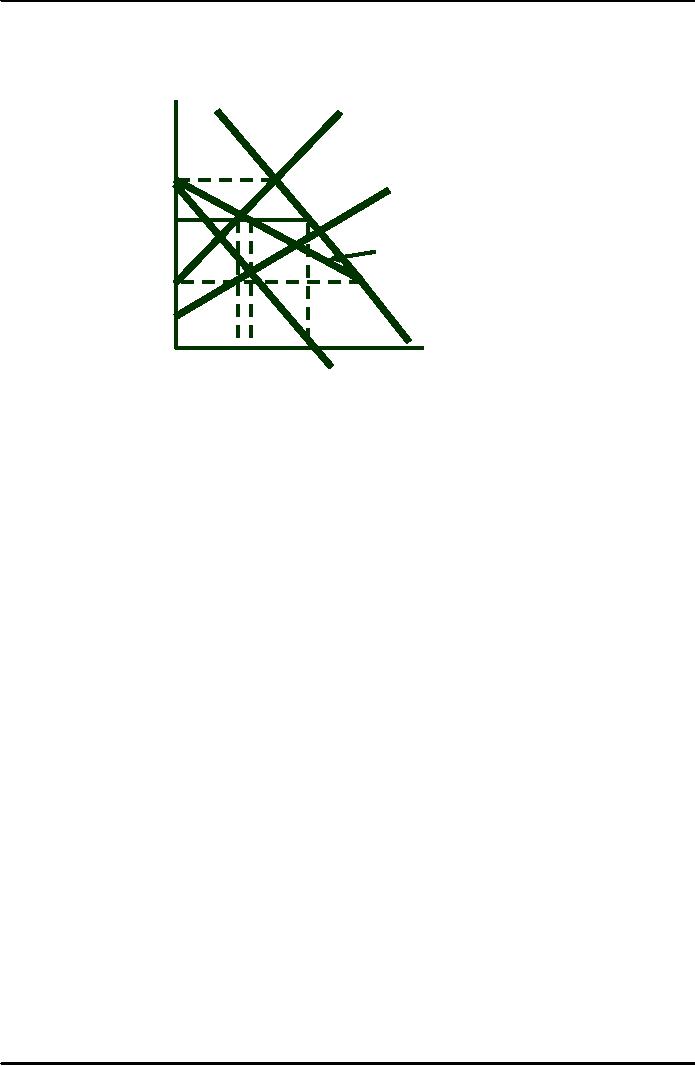

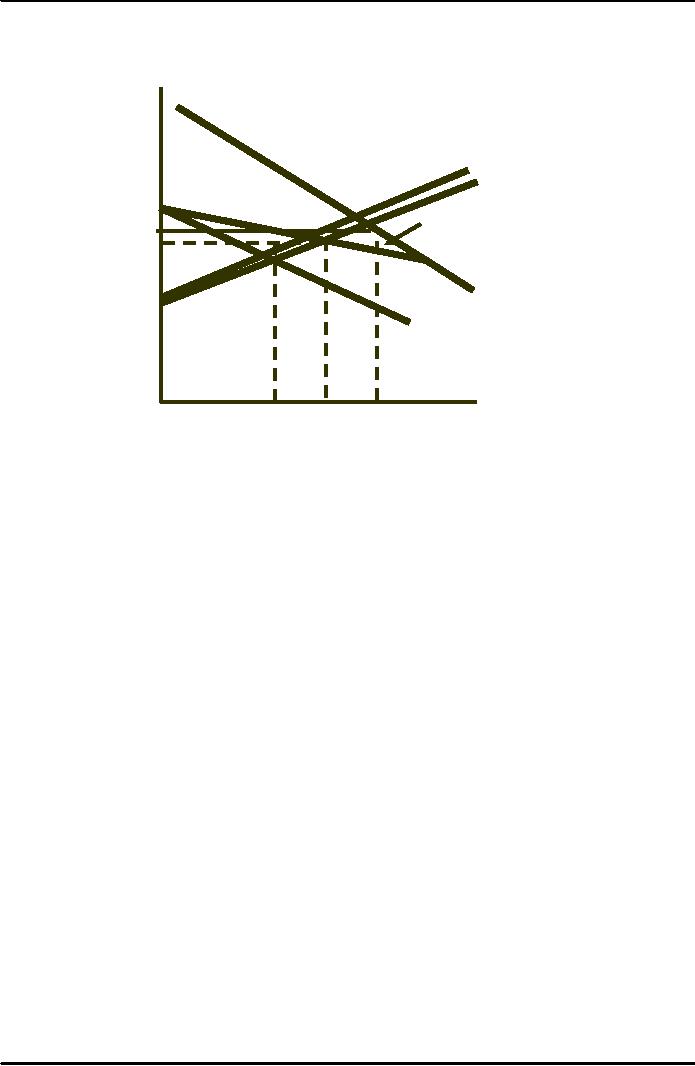

Price

Setting by a Dominant

Firm

SF

The

dominant firm's

demand

Price

D

curve

is the difference

between

market

demand (D)

and

the

supply

of the fringe firms (SF).

P1

MC

P*

At

this price, fringe

DD

firms

sell QF, so

that

total

sales are QT.

P2

MR

Quantity

QF QD

QT

CARTELS

Characteristics

1)

Explicit agreements to set

output and price

2)

May not include all

firms

3)

Most often

international

Examples of

successful cartels

�

OPEC

�

International

Bauxite Association

Examples of

unsuccessful cartels

�

Copper

�

Tin

�

Coffee

�

Tea

�

Cocoa

4)

Conditions for

success

�

Competitive

alternative sufficiently deters

cheating

�

Potential of

monopoly power--inelastic

demand

190

Microeconomics

ECO402

VU

The

OPEC Oil Cartel

TD

SC

Price

TD

is the total world

demand

curve

for oil, and SC is

the

Competitive

supply. OPEC's

demand

is the difference

between

the two.

OPEC's

profits maximizing

quantity

is found at the

P*

intersection

of its MR and

MC

curves. At this

quantity

OPEC

charges price P*.

DOPEC

MCOPEC

MROPEC

QOPEC

Quantity

Cartels

About

OPEC

Very low

MC

TD is

inelastic

Non-OPEC supply

is inelastic

DOPEC

is relatively

inelastic

The

OPEC Oil Cartel

TD

SC

Price

The

price without the

cartel:

�Competitive price (P )

where

C

DOPEC = MCOPEC

P*

DOPEC

MCOPEC

Pc

MROPEC

QOPEC

QC

QT

Quantity

191

Microeconomics

ECO402

VU

The

CIPEC Copper

Cartel

�TD and S are relatively

elastic

C

Price

TD

�D is elastic

CIPEC

�CIPEC has little

monopoly power

S

MCCIPEC

DCIPEC

P*

PC

MRCIPEC

Quantity

QCIPEC

QC

QT

Cartels

Observations

To be

successful:

�

Total

demand must not be very

price elastic

�

Either

the cartel must control

nearly all of the world's

supply or the supply

of

noncartel

producers must not be price

elastic.

192

Table of Contents:

- ECONOMICS:Themes of Microeconomics, Theories and Models

- Economics: Another Perspective, Factors of Production

- REAL VERSUS NOMINAL PRICES:SUPPLY AND DEMAND, The Demand Curve

- Changes in Market Equilibrium:Market for College Education

- Elasticities of supply and demand:The Demand for Gasoline

- Consumer Behavior:Consumer Preferences, Indifference curves

- CONSUMER PREFERENCES:Budget Constraints, Consumer Choice

- Note it is repeated:Consumer Preferences, Revealed Preferences

- MARGINAL UTILITY AND CONSUMER CHOICE:COST-OF-LIVING INDEXES

- Review of Consumer Equilibrium:INDIVIDUAL DEMAND, An Inferior Good

- Income & Substitution Effects:Determining the Market Demand Curve

- The Aggregate Demand For Wheat:NETWORK EXTERNALITIES

- Describing Risk:Unequal Probability Outcomes

- PREFERENCES TOWARD RISK:Risk Premium, Indifference Curve

- PREFERENCES TOWARD RISK:Reducing Risk, The Demand for Risky Assets

- The Technology of Production:Production Function for Food

- Production with Two Variable Inputs:Returns to Scale

- Measuring Cost: Which Costs Matter?:Cost in the Short Run

- A Firm’s Short-Run Costs ($):The Effect of Effluent Fees on Firms’ Input Choices

- Cost in the Long Run:Long-Run Cost with Economies & Diseconomies of Scale

- Production with Two Outputs--Economies of Scope:Cubic Cost Function

- Perfectly Competitive Markets:Choosing Output in Short Run

- A Competitive Firm Incurring Losses:Industry Supply in Short Run

- Elasticity of Market Supply:Producer Surplus for a Market

- Elasticity of Market Supply:Long-Run Competitive Equilibrium

- Elasticity of Market Supply:The Industry’s Long-Run Supply Curve

- Elasticity of Market Supply:Welfare loss if price is held below market-clearing level

- Price Supports:Supply Restrictions, Import Quotas and Tariffs

- The Sugar Quota:The Impact of a Tax or Subsidy, Subsidy

- Perfect Competition:Total, Marginal, and Average Revenue

- Perfect Competition:Effect of Excise Tax on Monopolist

- Monopoly:Elasticity of Demand and Price Markup, Sources of Monopoly Power

- The Social Costs of Monopoly Power:Price Regulation, Monopsony

- Monopsony Power:Pricing With Market Power, Capturing Consumer Surplus

- Monopsony Power:THE ECONOMICS OF COUPONS AND REBATES

- Airline Fares:Elasticities of Demand for Air Travel, The Two-Part Tariff

- Bundling:Consumption Decisions When Products are Bundled

- Bundling:Mixed Versus Pure Bundling, Effects of Advertising

- MONOPOLISTIC COMPETITION:Monopolistic Competition in the Market for Colas and Coffee

- OLIGOPOLY:Duopoly Example, Price Competition

- Competition Versus Collusion:The Prisoners’ Dilemma, Implications of the Prisoners

- COMPETITIVE FACTOR MARKETS:Marginal Revenue Product

- Competitive Factor Markets:The Demand for Jet Fuel

- Equilibrium in a Competitive Factor Market:Labor Market Equilibrium

- Factor Markets with Monopoly Power:Monopoly Power of Sellers of Labor