|

Monopsony Power:Pricing With Market Power, Capturing Consumer Surplus |

| << The Social Costs of Monopoly Power:Price Regulation, Monopsony |

| Monopsony Power:THE ECONOMICS OF COUPONS AND REBATES >> |

Microeconomics

ECO402

VU

Lesson

34

Monopsony

Power

A

few

buyers can influence price

(e.g. automobile industry).

Monopsony

power gives them the

ability to pay a price that

is less than marginal

value.

The

degree of monopsony power

depends on three similar

factors.

1)

Elasticity of market

supply

�The less elastic

the market supply, the

greater the monopsony

power.

2)

Number of buyers

�The fewer the

number of buyers, the less

elastic the supply and

the greater the

monopsony

power.

3)

Interaction Among

Buyers

�The less the

buyers compete, the greater

the monopsony power.

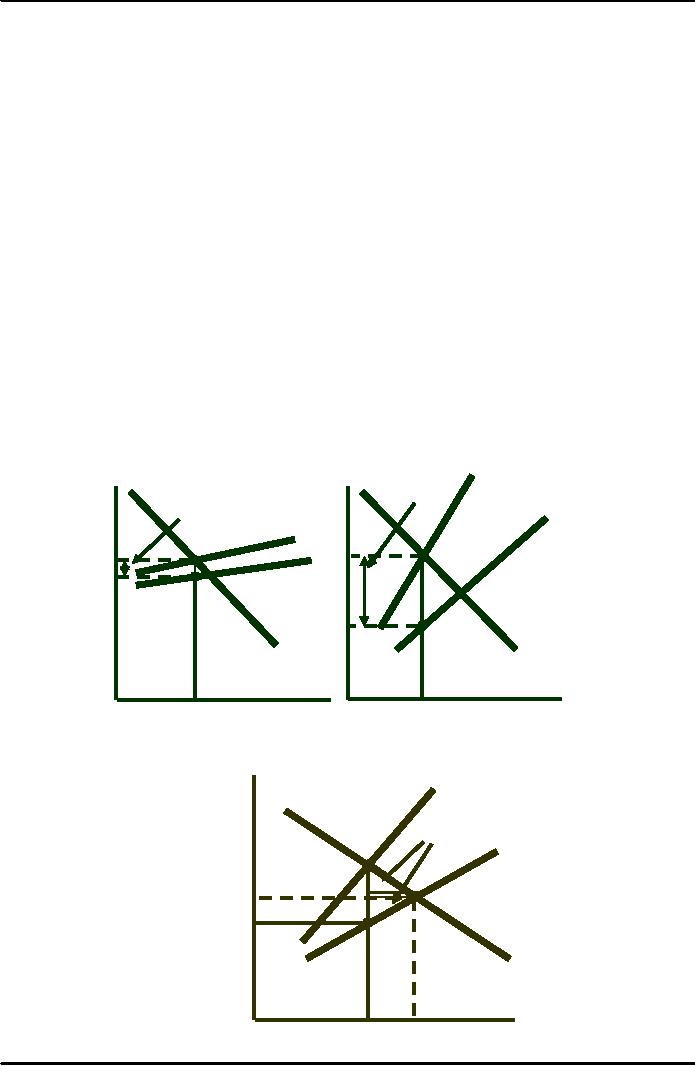

Monopsony

Power:

If

the Elastic versus Inelastic

Supply

ME

MV

- P*

$/Q

$/Q

MV

- P*

S

= AE

ME

S

= AE

P*

P*

MV

MV

Quantity

Q*

Q*

Quantity

Deadweight

Loss from Monopsony Power in

the

$/Q

ME

Deadweight

Loss

S

= AE

B

PC A

C

P*

MV

Q*

QC

Quantity

158

Microeconomics

ECO402

VU

Determining

the deadweight loss in

monopsony

Change in

seller's surplus =

-A-C

Change in

buyer's surplus = A - B

Change in

welfare = -A - C + A - B = -C - B

Inefficiency

occurs because less is

purchased

The

Social Cost of Monopsony

Power

Bilateral

Monopoly

�

Bilateral

monopoly

is

rare, however, markets with

a small number of sellers

with

monopoly

power selling to a market

with few buyers with

monopsony power is

more

common.

Question

�

In this

case, what is likely to

happen to price?

Limiting

Market Power: The Antitrust

Laws

Antitrust

Laws:

Promote a

competitive economy

Rules and

regulations designed to promote a

competitive economy

by:

�

Prohibiting

actions that restrain or are

likely to restrain

competition

�

Restricting

the forms of market

structures that are

allowable

Pricing

With Market Power

Pricing

without market power

(perfect competition) is determined by

market supply and

demand.

The

individual producer must be

able to forecast the market

and then concentrate

on

managing

production (cost) to maximize

profits.

Pricing

with market power (imperfect

competition) requires the

individual producer to

know

much

more about the

characteristics of demand as well as

manage production.

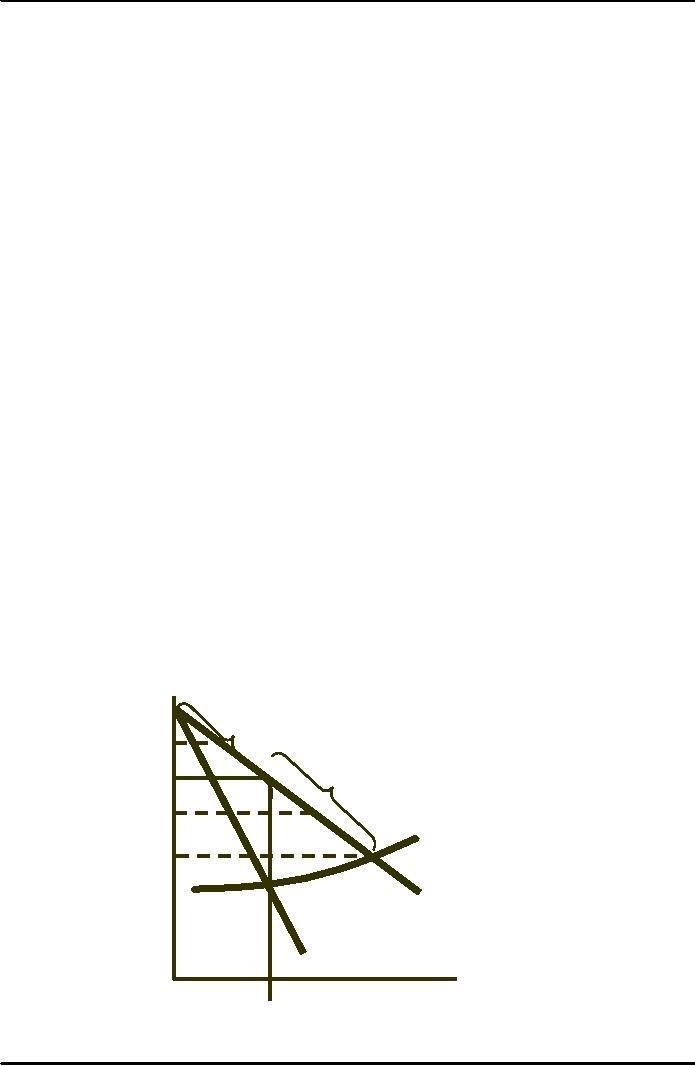

Capturing

Consumer Surplus

Between

0 and Q*,

consumers

$/Q

Pma

A

will

pay more than

P*--consumer

surplus (A).

P1

PC is

the price

that

would exist in

B

P*

a

perfectly

competitive

P2

If

price is raised above

M

P*,

the firm will

lose

PC

sales

and reduce profit.

D

Beyond

Q*, price will

have

to fall to create a

consumer

surplus (B).

M

Quantity

Q*

159

Microeconomics

ECO402

VU

Capturing

Consumer Surplus

�P*Q*:

single

P &

Q @

MC=MR

�A:

consumer

surplus with P*

�B:

P>MC & consumer

would buy

at

a lower price

�P1:

less

sales and profits

�P2 :

increase

sales & and reduce

revenue

and profits

�PC: competitive

price

Question

How can the firm

capture the consumer surplus

in A

and

sell profitably in B?

Answer

Price discrimination Two-part

tariffs Bundling

Price

discrimination is the charging of

different prices to different

consumers for similar

goods.

Price

Discrimination

First

Degree Price

Discrimination

Charge a

separate price to each

customer: the maximum or

reservation

price they

are

willing

to pay.

Additional

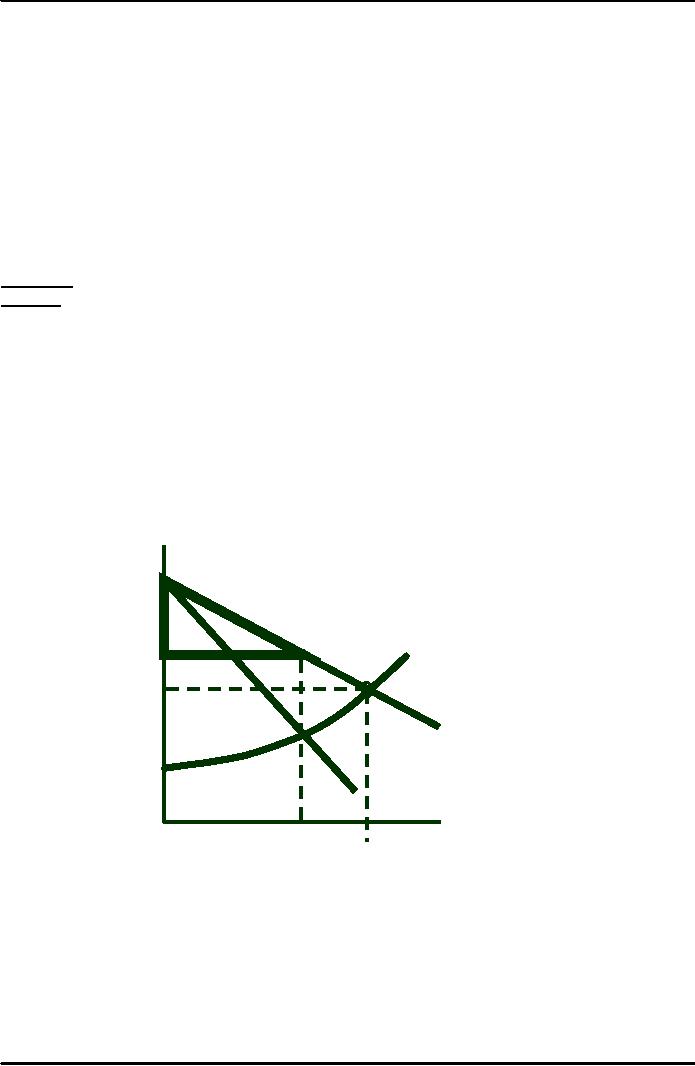

Profit From Perfect

First-Degree Price

Discrimination

Without

price discrimination,

output

is Q* and price is

P*.

$/Q

Variable

profit is the area

Pmax

Consumer

surplus is the area

between

the MC & MR.

above

P* and between

0

and Q* output.

MC

P*

With

perfect discrimination,

each

consumer

pays the maximum

price

they are willing to

pay.

PC

D

= AR

Output

expands to Q** and

price

falls

to PC where

MC = MR = AR

=

D.Profits increase by the

area

MR

above

MC

between

old MR and D to

output

Q**

Quantity

Q*

Q**

160

Microeconomics

ECO402

VU

With

perfect discrimination

�

Each

customer pays their

Consumer

surplus when a

$/Q

Pmax

reservation

price

single

price P* is charged.

�Profits increase

Variable

profit when a

single

price P* is charged.

MC

P*

Additional

profit from

perfect

price discrimination

PC

D

= AR

MR

Quantity

Q*

Q**

Question

Why would a

producer have difficulty in

achieving first-degree price

discrimination?

Answer

1)

Too many customers

(impractical)

2)

Could not estimate the

reservation price for each

customer

First

Degree Price

Discrimination

The model

does demonstrate the

potential profit (incentive) of

practicing price

discrimination

to some degree.

Examples of

imperfect price discrimination

where the seller has

the ability to

segregate

the

market to some extent and

charge different prices for

the same product:

Lawyers,

doctors, accountants

Car

salesperson (15% profit

margin)

Colleges

and universities

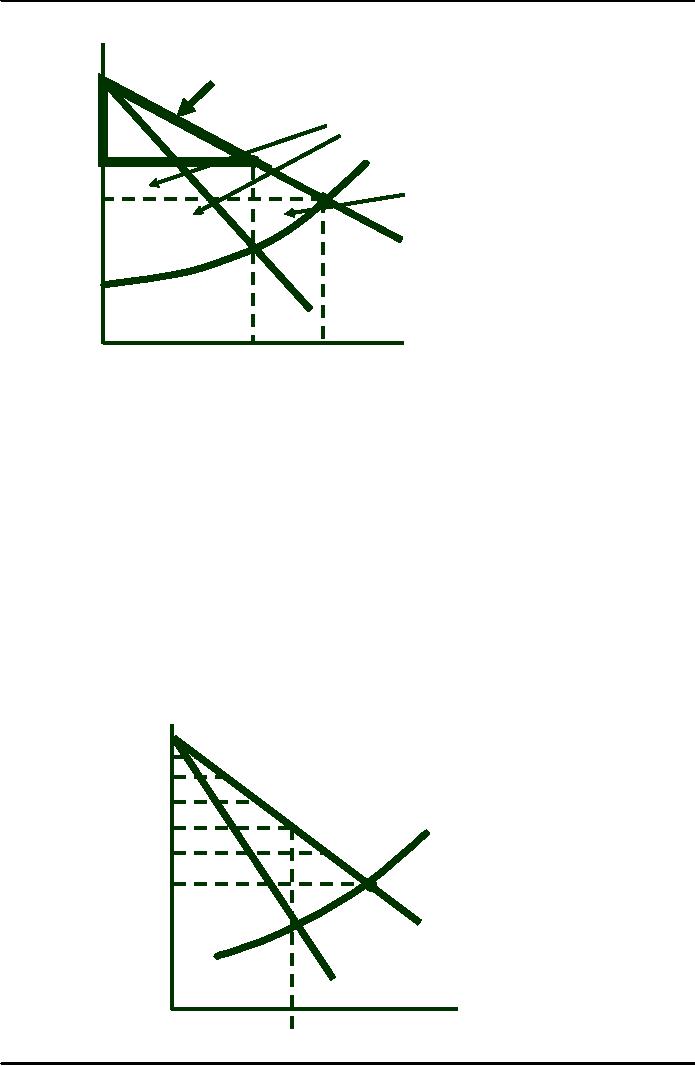

First-Degree

Price Discrimination in

Practice

Six

prices exist

resulting

$/Q

in

higher profits. With a

single price

P1

P*4,

there are few consumers

and

those

who pay P5 or

P6 may have a

P2

surplus.

P3

MC

P*4

P5

P6

D

MR

Quantity

Q

161

Microeconomics

ECO402

VU

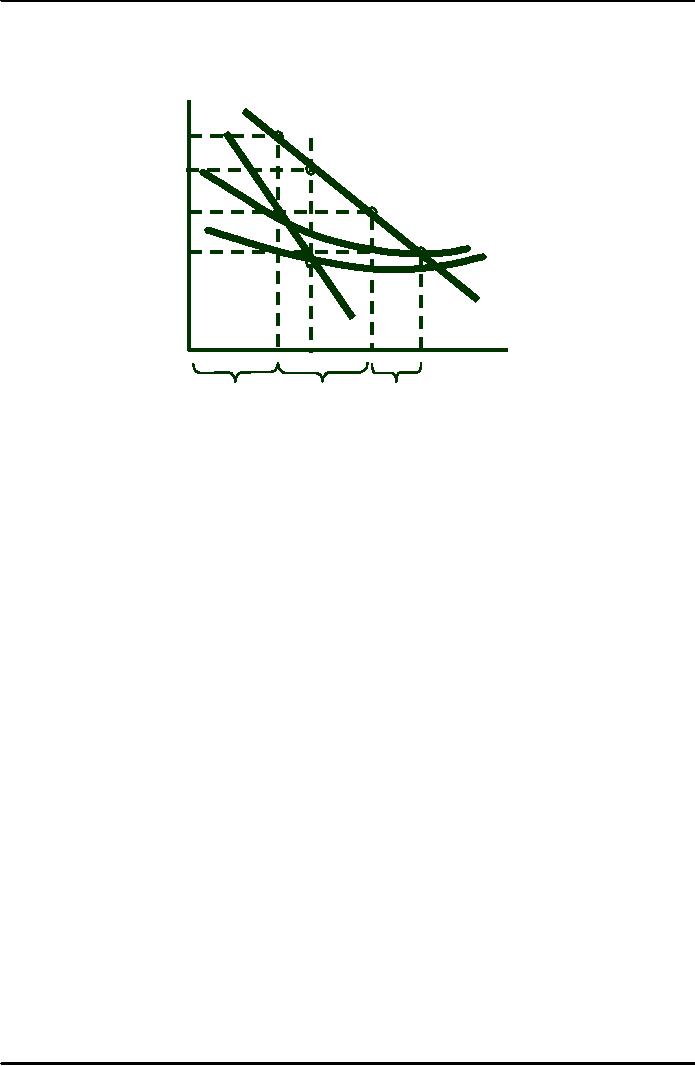

Second-Degree

Price Discrimination

Second-degree

price

discrimination

is pricing

$/Q

according

to quantity

consumed--or

in blocks.

P1

Without

discrimination: P = P0

and

Q = Q0.

With second-

P0

degree

discrimination

there are three

prices

P1,

P2, and P3.

(e.g.

electric utilities)

P2

AC

P3

MC

D

MR

Q0

Q1

Q2

Q3

Quantity

1st

2nd

3rd

Economies

of scale permit:

�Increase consumer

welfare

�Higher profits

162

Table of Contents:

- ECONOMICS:Themes of Microeconomics, Theories and Models

- Economics: Another Perspective, Factors of Production

- REAL VERSUS NOMINAL PRICES:SUPPLY AND DEMAND, The Demand Curve

- Changes in Market Equilibrium:Market for College Education

- Elasticities of supply and demand:The Demand for Gasoline

- Consumer Behavior:Consumer Preferences, Indifference curves

- CONSUMER PREFERENCES:Budget Constraints, Consumer Choice

- Note it is repeated:Consumer Preferences, Revealed Preferences

- MARGINAL UTILITY AND CONSUMER CHOICE:COST-OF-LIVING INDEXES

- Review of Consumer Equilibrium:INDIVIDUAL DEMAND, An Inferior Good

- Income & Substitution Effects:Determining the Market Demand Curve

- The Aggregate Demand For Wheat:NETWORK EXTERNALITIES

- Describing Risk:Unequal Probability Outcomes

- PREFERENCES TOWARD RISK:Risk Premium, Indifference Curve

- PREFERENCES TOWARD RISK:Reducing Risk, The Demand for Risky Assets

- The Technology of Production:Production Function for Food

- Production with Two Variable Inputs:Returns to Scale

- Measuring Cost: Which Costs Matter?:Cost in the Short Run

- A Firm’s Short-Run Costs ($):The Effect of Effluent Fees on Firms’ Input Choices

- Cost in the Long Run:Long-Run Cost with Economies & Diseconomies of Scale

- Production with Two Outputs--Economies of Scope:Cubic Cost Function

- Perfectly Competitive Markets:Choosing Output in Short Run

- A Competitive Firm Incurring Losses:Industry Supply in Short Run

- Elasticity of Market Supply:Producer Surplus for a Market

- Elasticity of Market Supply:Long-Run Competitive Equilibrium

- Elasticity of Market Supply:The Industry’s Long-Run Supply Curve

- Elasticity of Market Supply:Welfare loss if price is held below market-clearing level

- Price Supports:Supply Restrictions, Import Quotas and Tariffs

- The Sugar Quota:The Impact of a Tax or Subsidy, Subsidy

- Perfect Competition:Total, Marginal, and Average Revenue

- Perfect Competition:Effect of Excise Tax on Monopolist

- Monopoly:Elasticity of Demand and Price Markup, Sources of Monopoly Power

- The Social Costs of Monopoly Power:Price Regulation, Monopsony

- Monopsony Power:Pricing With Market Power, Capturing Consumer Surplus

- Monopsony Power:THE ECONOMICS OF COUPONS AND REBATES

- Airline Fares:Elasticities of Demand for Air Travel, The Two-Part Tariff

- Bundling:Consumption Decisions When Products are Bundled

- Bundling:Mixed Versus Pure Bundling, Effects of Advertising

- MONOPOLISTIC COMPETITION:Monopolistic Competition in the Market for Colas and Coffee

- OLIGOPOLY:Duopoly Example, Price Competition

- Competition Versus Collusion:The Prisoners’ Dilemma, Implications of the Prisoners

- COMPETITIVE FACTOR MARKETS:Marginal Revenue Product

- Competitive Factor Markets:The Demand for Jet Fuel

- Equilibrium in a Competitive Factor Market:Labor Market Equilibrium

- Factor Markets with Monopoly Power:Monopoly Power of Sellers of Labor