|

The Sugar Quota:The Impact of a Tax or Subsidy, Subsidy |

| << Price Supports:Supply Restrictions, Import Quotas and Tariffs |

| Perfect Competition:Total, Marginal, and Average Revenue >> |

Microeconomics

ECO402

VU

Lesson

29

The

Sugar Quota

The

world price of sugar has

been as low as 4 cents per

pound, while in the U.S.

the price

has

been 20-25 cents per

pound.

The

Impact of a Restricted Market

(1997)

U.S. production

= 15.6 billion pounds

U.S.

consumption = 21.1 billion

pounds

U.S. price = 22

cents/pound

World price =

11 cents/pound

Sugar

Quota in 1997

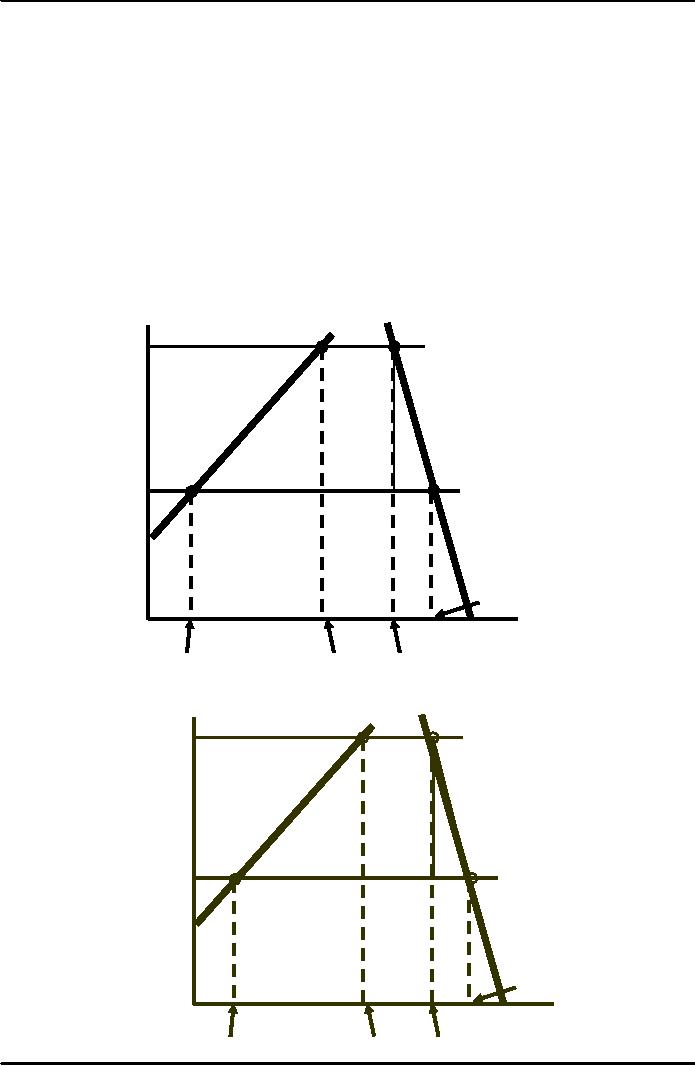

DUS

SUS

Price

PUS =

21.9

(cents/lb.)

D

The

cost of the quotas

20

to

consumers was

A

A

+ B + C + D, or

$2.4b.

The

gain to producers

16

was

area A,

or

$1b.

C

B

PW =

11

11

8

4

Qd =

24.2

30

0

5

10

15

20

25

Quantity

(billions

of pounds)

QS =

4.0

Q'S =

15.6

Q'd =

21.1

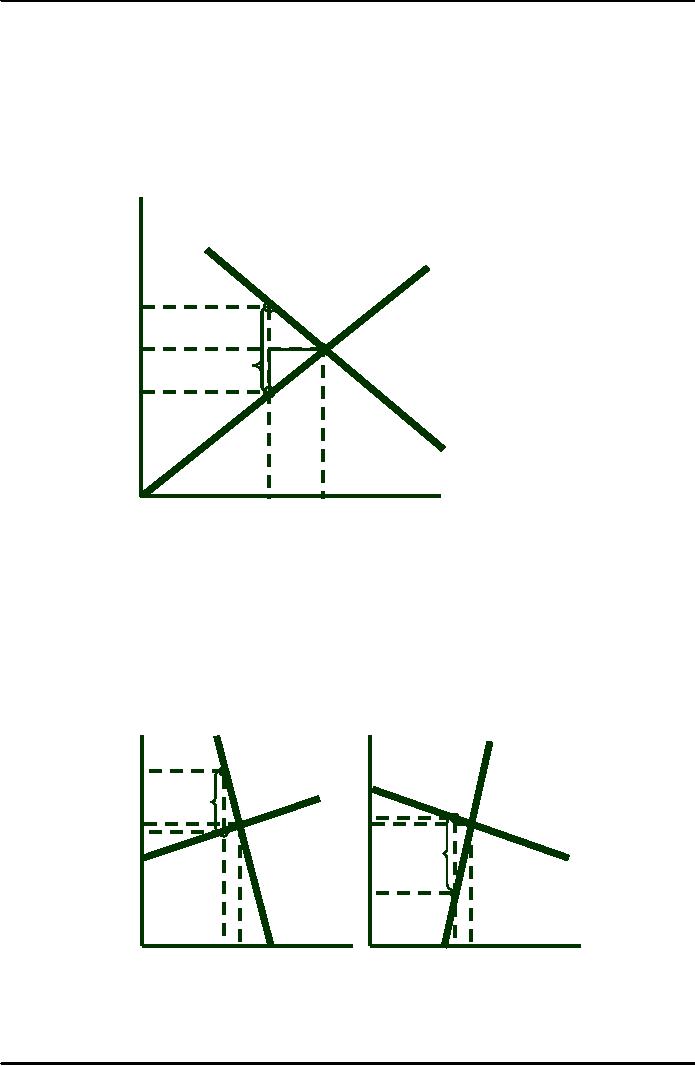

DUS

SUS

Price

PUS =

21.9

(cents/lb.)

D

Rectangle

D was

the

20

gain

to foreign producers

A

who

obtained quota

allotments,

or $600 million.

16

Triangles

B and

C represent

C

B

the

deadweight loss of

$800

million.

PW =

11

11

8

4

Qd =

24.2

0

5

30

10

15

20

25

Quantity

(billions

of pounds)

QS =

4.0

Q'S =

15.6

Q'd =

21.1

138

Microeconomics

ECO402

VU

The

Impact of a Tax or

Subsidy

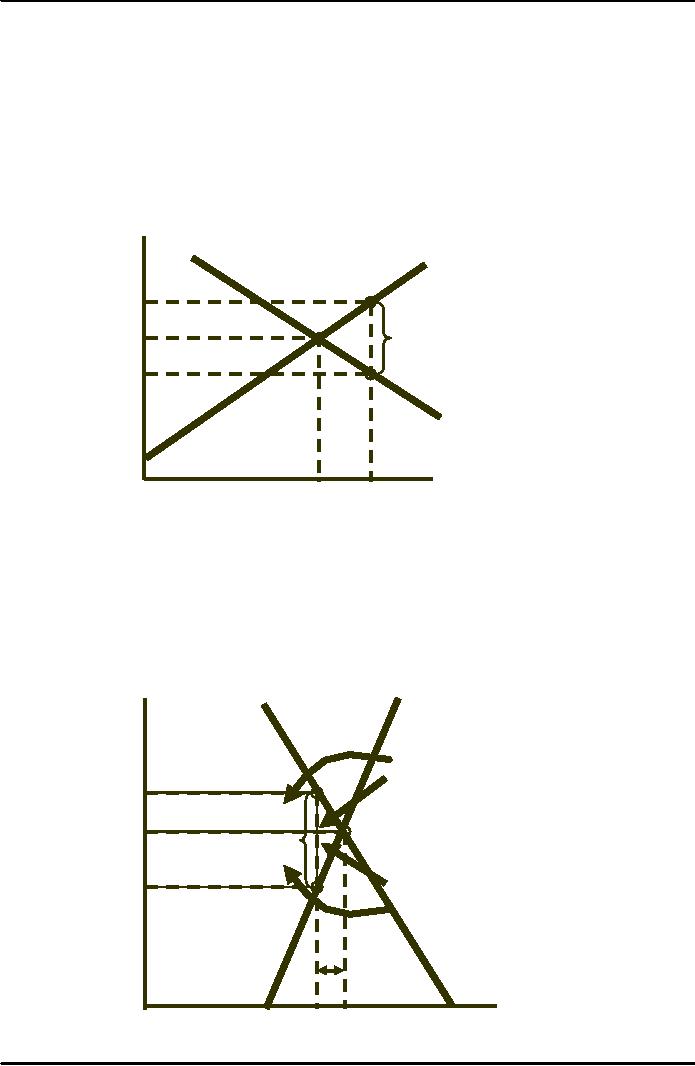

The

burden of a tax (or the

benefit of a subsidy) falls

partly on the consumer and

partly on

the

producer.

We

will consider a specific tax

which is a tax of a certain

amount of money per unit

sold.

Incidence

of a Specific Tax

Pb is the

price (including

the

tax) paid by buyers.

Price

PS is the

price sellers receive,

net

of the tax. The

burden

of

the tax is split

evenly.

S

Pb

Buyers

lose A

+ B,

and

A

sellers

lose D

+ C, and

B

the

government earns A

+ D

P0

in

revenue. The

deadweight

D

C

t

loss

is B

+ C.

PS

D

Q1

Q0

Quantity

Four

conditions that must be

satisfied after the tax is

in place:

1.

Quantity sold and Pb must be on the demand

line: QD

= QD(Pb)

2.

Quantity sold and PS must be on the supply

line: QS

= QS(PS)

3.

QD =

QS

4.

Pb -

PS = tax

Impact

of Tax Depends on Elasticities of

Supply & Demand

Burden

on Buyer

Burden

on Seller

D

S

Price

Price

P

S

t

P

P

P

P

t

D

P

Q1 Q0

Q1 Q0

Quantity

Quantity

139

Microeconomics

ECO402

VU

The

Impact of a Tax or

Subsidy

Pass-through

fraction

ES/(ES -

Ed)

For example,

when demand is perfectly

inelastic (Ed

= 0),

the pass-through fraction is

1,

and

all the tax is borne by

the consumer.

A

subsidy can be analyzed in

much the same way as a

tax.

It

can be treated as a negative

tax.

The

seller's price exceeds the

buyer's price.

Subsidy

S

Price

Like

a tax, the benefit

PS

of

a subsidy is split

between

buyers and

s

P0

sellers,

depending

upon

the elasticities of

Pb

supply

and demand.

D

Q0

Q1

Quantity

With

a subsidy (s), the selling

price Pb is

below the subsidized price

PS so that:

s = PS -

Pb

The

benefit of the subsidy

depends upon Ed /ES.

If the ratio is

small, most of the benefit

accrues to the

consumer.

If the ratio is

large, the producer benefits

most.

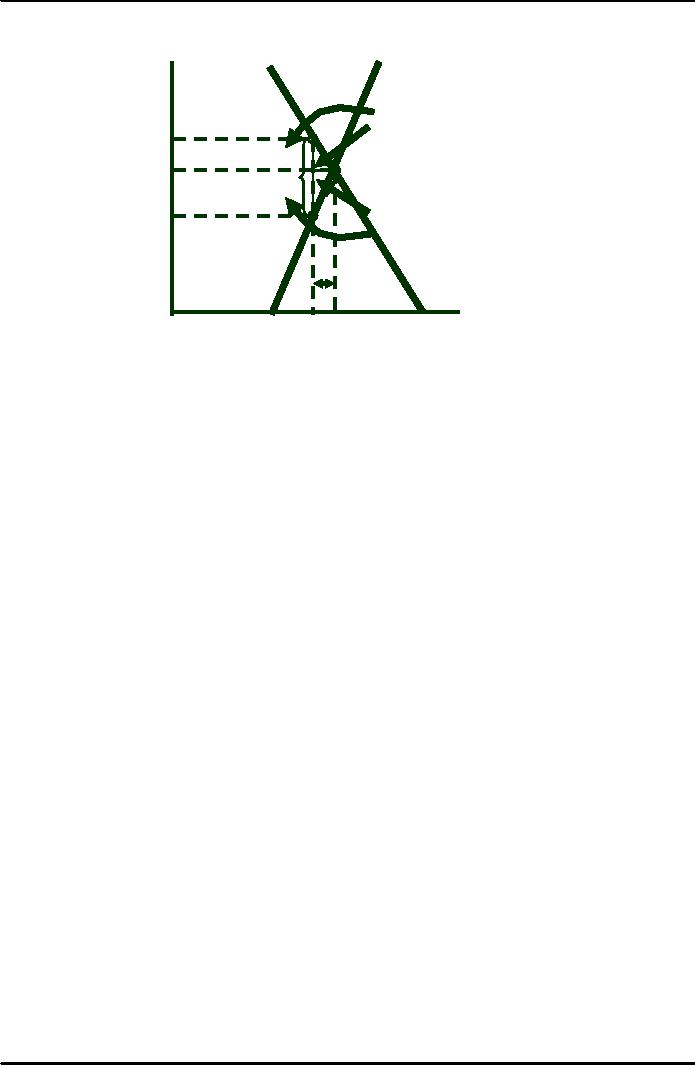

Impact

of a $0.50 Gasoline

Tax

D

S

Price

($

per

gallon)1.50

Lost

Consumer

The

annual revenue

Pb =

1.22

from

the tax is .50(89)

A

or

$44.5 billion. The

buyer

pays

22 cents of the tax,

and

P0 =

1.00

the

producer pays 28

cents.

D

t = 0.50

Lost

Producer

PS =

.72

Surplus

.50

1

Quantity

(billion

0

50

60

89

100

150

gallons

per year)

140

Microeconomics

ECO402

VU

D

S

Price

($

per 1.50

gallon)

Lost

Consumer

Pb =

1.22

A

P0 =

1.00

Deadweight

loss = $2.75 billion/yr

D

t = 0.50

Lost

PS =

.72

Producer

.50

1

Quantity

(billion

0

50

60

89

100

150

gallons

per year)

141

Table of Contents:

- ECONOMICS:Themes of Microeconomics, Theories and Models

- Economics: Another Perspective, Factors of Production

- REAL VERSUS NOMINAL PRICES:SUPPLY AND DEMAND, The Demand Curve

- Changes in Market Equilibrium:Market for College Education

- Elasticities of supply and demand:The Demand for Gasoline

- Consumer Behavior:Consumer Preferences, Indifference curves

- CONSUMER PREFERENCES:Budget Constraints, Consumer Choice

- Note it is repeated:Consumer Preferences, Revealed Preferences

- MARGINAL UTILITY AND CONSUMER CHOICE:COST-OF-LIVING INDEXES

- Review of Consumer Equilibrium:INDIVIDUAL DEMAND, An Inferior Good

- Income & Substitution Effects:Determining the Market Demand Curve

- The Aggregate Demand For Wheat:NETWORK EXTERNALITIES

- Describing Risk:Unequal Probability Outcomes

- PREFERENCES TOWARD RISK:Risk Premium, Indifference Curve

- PREFERENCES TOWARD RISK:Reducing Risk, The Demand for Risky Assets

- The Technology of Production:Production Function for Food

- Production with Two Variable Inputs:Returns to Scale

- Measuring Cost: Which Costs Matter?:Cost in the Short Run

- A Firm’s Short-Run Costs ($):The Effect of Effluent Fees on Firms’ Input Choices

- Cost in the Long Run:Long-Run Cost with Economies & Diseconomies of Scale

- Production with Two Outputs--Economies of Scope:Cubic Cost Function

- Perfectly Competitive Markets:Choosing Output in Short Run

- A Competitive Firm Incurring Losses:Industry Supply in Short Run

- Elasticity of Market Supply:Producer Surplus for a Market

- Elasticity of Market Supply:Long-Run Competitive Equilibrium

- Elasticity of Market Supply:The Industry’s Long-Run Supply Curve

- Elasticity of Market Supply:Welfare loss if price is held below market-clearing level

- Price Supports:Supply Restrictions, Import Quotas and Tariffs

- The Sugar Quota:The Impact of a Tax or Subsidy, Subsidy

- Perfect Competition:Total, Marginal, and Average Revenue

- Perfect Competition:Effect of Excise Tax on Monopolist

- Monopoly:Elasticity of Demand and Price Markup, Sources of Monopoly Power

- The Social Costs of Monopoly Power:Price Regulation, Monopsony

- Monopsony Power:Pricing With Market Power, Capturing Consumer Surplus

- Monopsony Power:THE ECONOMICS OF COUPONS AND REBATES

- Airline Fares:Elasticities of Demand for Air Travel, The Two-Part Tariff

- Bundling:Consumption Decisions When Products are Bundled

- Bundling:Mixed Versus Pure Bundling, Effects of Advertising

- MONOPOLISTIC COMPETITION:Monopolistic Competition in the Market for Colas and Coffee

- OLIGOPOLY:Duopoly Example, Price Competition

- Competition Versus Collusion:The Prisoners’ Dilemma, Implications of the Prisoners

- COMPETITIVE FACTOR MARKETS:Marginal Revenue Product

- Competitive Factor Markets:The Demand for Jet Fuel

- Equilibrium in a Competitive Factor Market:Labor Market Equilibrium

- Factor Markets with Monopoly Power:Monopoly Power of Sellers of Labor