|

ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock |

| << ECONOMIC GROWTH (Continued…):The Steady State |

| ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth >> |

Macroeconomics

ECO 403

VU

LESSON

21

ECONOMIC

GROWTH (Continued...)

The

Golden Rule:

introduction

�

Different

values of s lead to different

steady states.

How

do we know which is the

"best" steady state?

�

Economic

well-being depends on consumption, so

the "best" steady state

has the highest

possible

value of consumption per

person:

c* =

(1s) f(k*)

�

An

increase in s

�

leads to higher

k and y , which may raise

c

*

*

*

�

reduces

consumption's share of income

(1s),

which

may lower c*

�

So,

how do we find the s and

k* that

maximize c*?

The

Golden Rule Capital

Stock

K*gold =

the

Golden Rule level of

capital, the steady state

value of k that maximizes

consumption.

To

find it, first express c* in

terms of k*:

=

y*

-

i*

C*

-

i*

=

f (k*)

-

δk*

=

f (k*)

In

general:

i

=

Δk +

δk

In

the steady state: i*

=

δk*

because

Δk =

0.

Then,

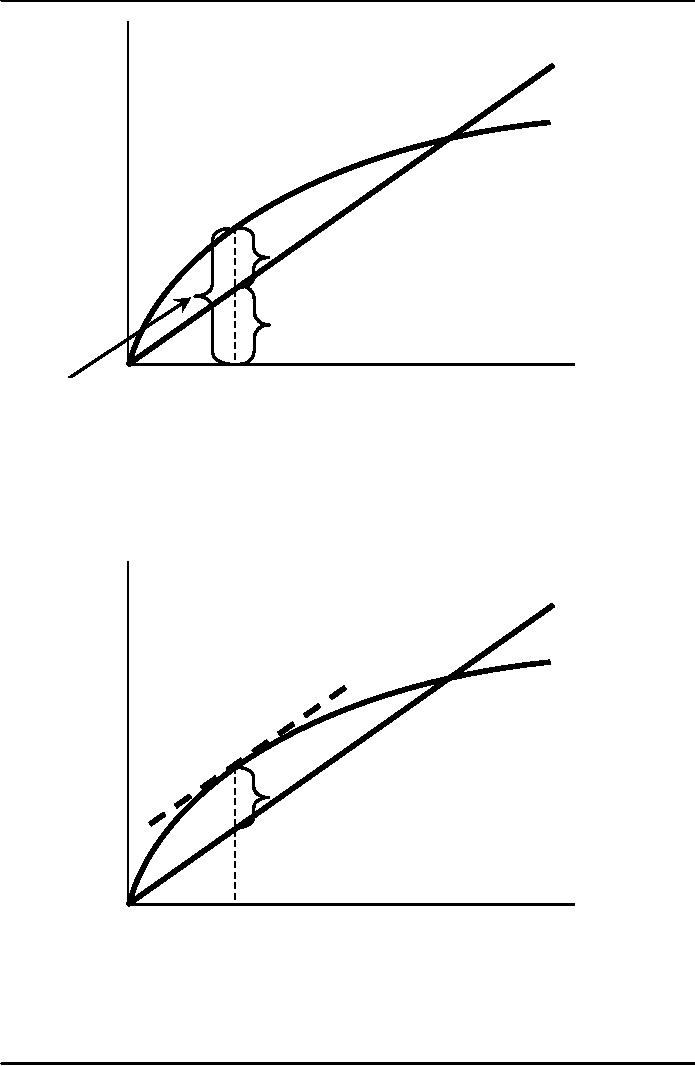

graph f(k*) and δk*,

and look for the

point where the gap

between them is biggest.

82

Macroeconomics

ECO 403

VU

steady

state

δ

k*

output

and

depreciation

f(k*)

C*gold

i*gold =

δk*gold

k*gold

Steady-state

Y*gold

= f(k*gold)

capital

per

worker,

k*

c* =

f(k*) -

δk*is

biggest where the slope of

the production function

equals the slope of

the

depreciation

line: MPK = δ

steady

state

δ

k*

output

and

depreciation

f(k*)

*

C

gold

k*gold

Steady-state

capital

per

worker,

k*

83

Macroeconomics

ECO 403

VU

The

transition to the Golden

Rule Steady State

�

The

economy does NOT have a

tendency to move toward the

Golden Rule steady

state.

�

Achieving

the Golden Rule requires

that Policymakers adjust

s.

�

This

adjustment leads to a new

steady state with higher

consumption.

�

But

what happens to consumption

during the transition to the

Golden Rule?

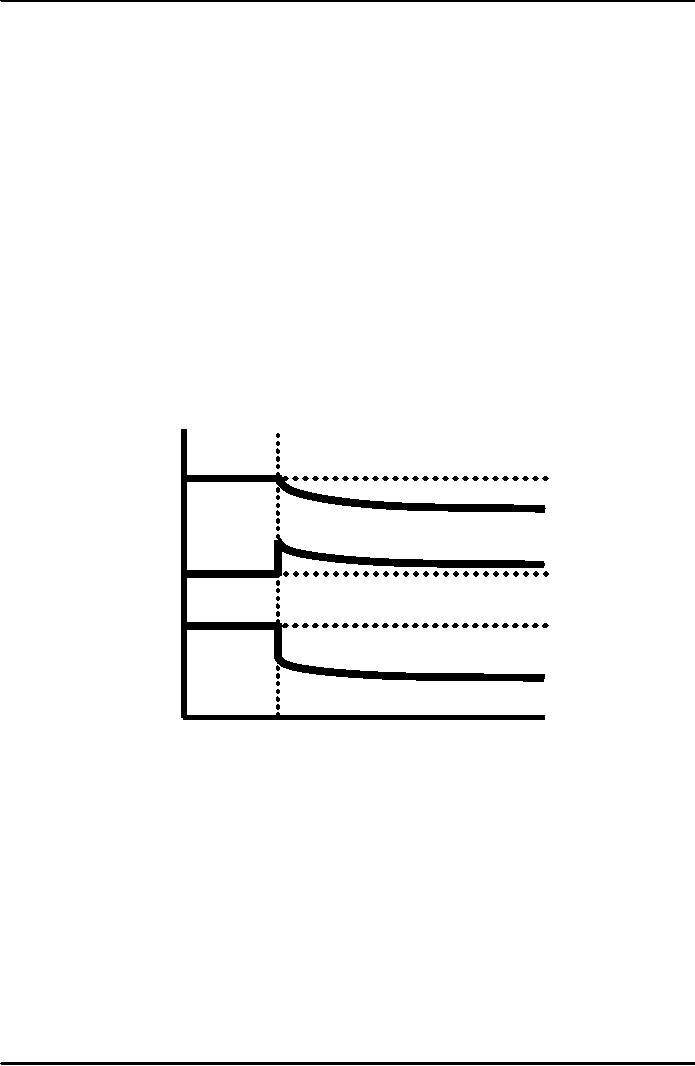

Starting

with too much

capital

If

k

* >

k

gold

*

then

increasing c* requires

a fall in s.

In

the transition to the Golden

Rule, consumption is higher at

all points in time.

y

c

i

t0

Time

84

Macroeconomics

ECO 403

VU

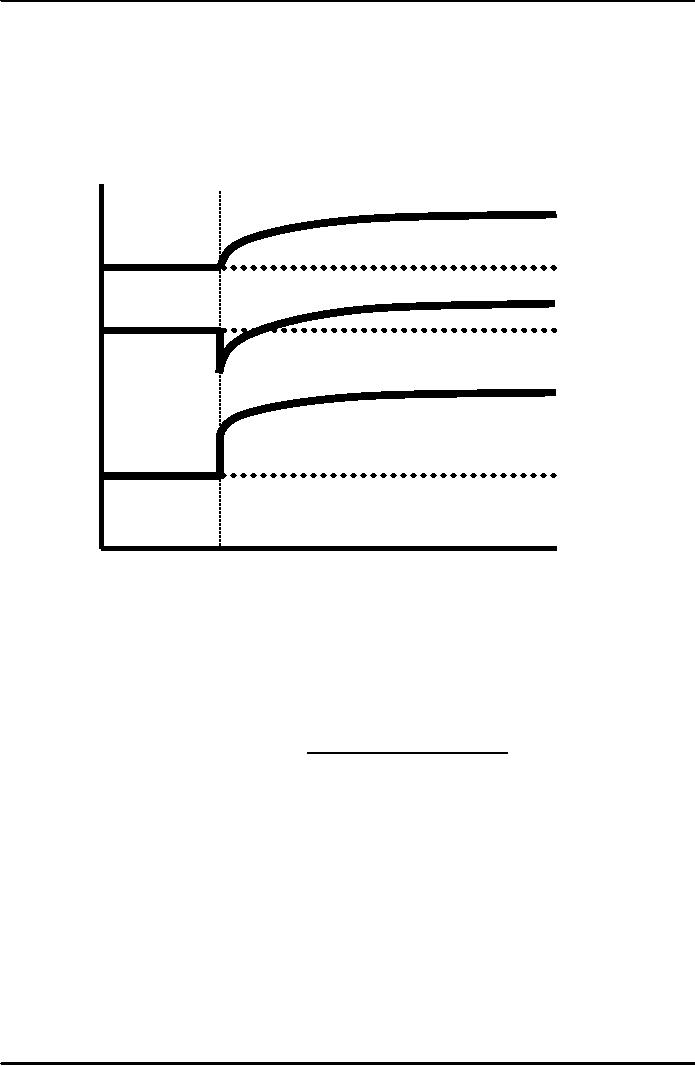

Starting

with too little

capital

If

k

* <

k

gold

*

then

increasing c* requires

an increase in s.

Future

generations enjoy higher

consumption, but the current

one experiences an initial

drop

in

consumption.

y

c

i

Time

t0

�

The

basic Solow model cannot

explain sustained economic

growth. It simply says that

high

rates

of saving lead to high

growth temporarily, but the

economy eventually approaches

a

steady

state.

�

We

need to incorporate two

sources of growth to explain

sustained economic

growth:

population

and technological

progress.

85

Macroeconomics

ECO 403

VU

Population

Growth

�

Assume

that the population--and

labor force-- grow at rate

n. (n is exogenous)

ΔL

= n

L

EX:

Suppose L = 1000 in year 1

and the population is

growing at 2%/year (n =

0.02).

�

Then

ΔL =

n L = 0.02 �

1000 =

20,

so

L = 1020 in year 2.

Break-even

investment

(δ

+

n)k

= break-even

investment,

the

amount of investment necessary to

keep k constant.

Break-even

investment includes:

�

δ

k to

replace capital as it wears

out

�

n

k to equip new workers with

capital

(otherwise,

k would fall as the existing

capital stock would be

spread more thinly over

a

larger

population of workers)

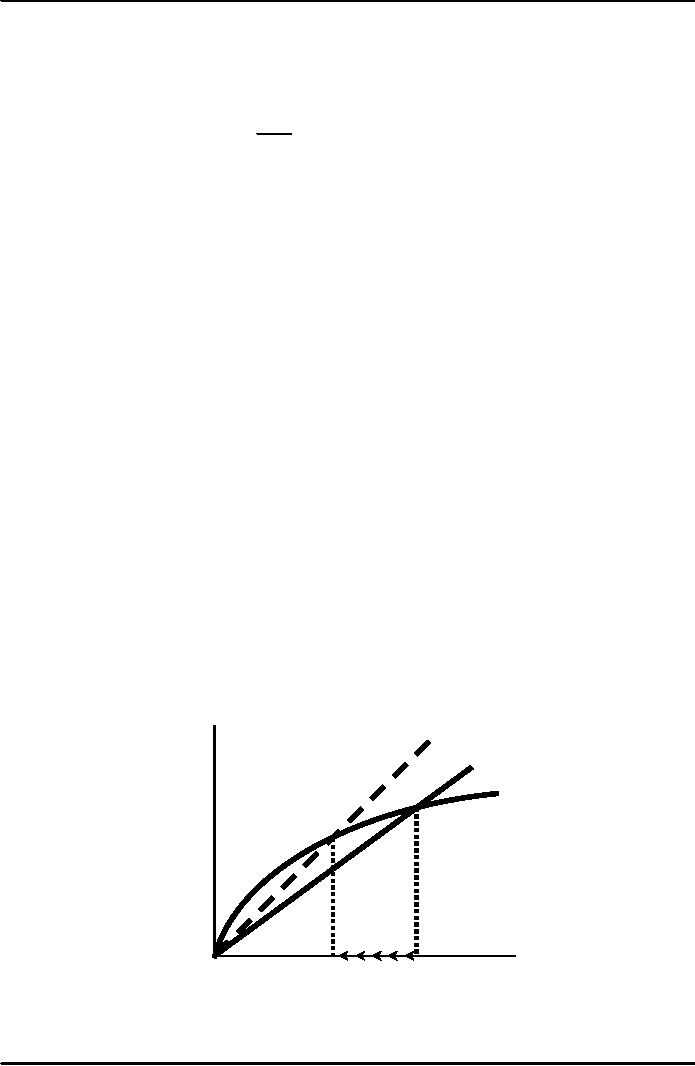

The

equation of motion for

k

�

With

population growth, the

equation of motion for k

is

Δk

= s f(k) - (δ

+

n)

k

Where

S

f(k)= actual

investment

(δ

+

n)

k = breakeven

investment

The

impact of population

growth

(δ +n2)

k

Investment,

(δ +n1)

k

break-even

investment

sf(k)

k2*

k1*

Capital

per

worker,

k

86

Macroeconomics

ECO 403

VU

Prediction:

Higher

n

⇒

lower

k*.

�

And

since y

=

f(k)

,

�

lower

k*

⇒

lower

y*

.

Thus,

the Solow model predicts

that countries with higher

population growth rates

will

�

have

lower levels of capital and

income per worker in the

long run.

The

Golden Rule with Population

Growth

To

find the Golden Rule

capital stock, we again

express c*

in

terms of k*:

=

y*

-

i*

c*

=

f

(k*

)

-

(δ

+

n)

k*

c*

is

maximized when

MPK

= δ

+

n

or

equivalently,

MPK

-

δ =

n

In

the Golden Rule Steady

State, the marginal product

of capital net of depreciation

equals the

population

growth rate.

87

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand