|

PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs |

| << INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS |

| IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments >> |

Macroeconomics

ECO 403

VU

LESSON

02

PRINCIPLE

OF MACROECONOMICS

Principle

#1: People Face

Tradeoffs

"There

is no such thing as a free

lunch!"

To

get one thing, we usually

have to give up another

thing.

Guns v.

butter

Food v.

clothing

Leisure

time v. work

Efficiency

v. equity

Making

decisions requires trading

off one goal against

another.

Efficiency

v. Equity

�

Efficiency

means

society gets the most

that it can from its

scarce resources.

Equity

means

the benefits of those

resources are distributed

fairly among the

members

of society.

Principle

#2: Cost of Something Is

What You Give Up to Get

It

Decisions

require comparing costs and

benefits of alternatives.

�

Whether to

go to college or to work?

Whether to

study or go out on a

date?

Whether to

go to class or sleep

in?

The

opportunity

cost of an item is

what you give up to obtain

that item.

�

Principle

#3: Rational People Think at

the Margin

Marginal

changes are small,

incremental adjustments to an existing

plan of action.

�

People

make decisions by comparing

costs and benefits at the

margin.

Principle

#4: People Respond to

Incentives

Marginal

changes in costs or benefits

motivate people to

respond.

�

The

decision to choose one

alternative over another

occurs when that

alternative's

�

marginal

benefits exceed its marginal

costs!

Principle

#5: Trade Can Make

Everyone Better

Off

People

gain from their ability to

trade with one

another.

�

Competition

results in gains from

trading.

�

Trade

allows people to specialize in

what they do best.

�

Principle

#6: Markets are a good way

to organize economic

activity

A

market

economy is an economy

that allocates resources

through the

decentralized

�

decisions

of many firms and households

as they interact in markets

for goods and

services.

Households

decide what to buy and

who to work for.

Firms

decide who to hire and

what to produce.

Adam

Smith made the observation

that households and firms

interacting in markets

act

�

as

if guided by an "invisible

hand."

Because

households and firms look at

prices when deciding what to

buy and

sell,

they unknowingly take into

account the social costs of

their actions.

3

Macroeconomics

ECO 403

VU

As

a result, prices guide

decision makers to reach

outcomes that tend to

maximize

the welfare of society as a

whole.

Principle

#7: Governments can

sometimes improve market

outcomes

Market

failure occurs

when the market fails to

allocate resources

efficiently.

�

When

the market fails (breaks

down) government can

intervene to promote

efficiency

�

and

equity.

Market

failure may be caused

by

�

�

an

externality,

which is the impact of one

person or firm's actions on

the well-

being

of a bystander.

�

market

power,

which is the ability of a

single person or firm to

unduly influence

market

prices.

Principle

#8: The standard of living

depends on a country's

production

Almost

all variations in living

standards are explained by

differences in countries'

�

productivities.

Productivity

is

the amount of goods and

services produced from each

hour of a

�

worker's

time.

Standard

of living may be measured in

different ways:

�

�

By

comparing personal

incomes.

�

By

comparing the total market

value of a nation's

production.

Principle

#9: Prices rise when

the government prints too

much money

Inflation

is an increase in the overall

level of prices in the

economy.

�

One

cause of inflation is the

growth in the quantity of

money.

�

When

the government creates large

quantities of money, the

value of the money

falls.

�

Principle

#10: Society Faces a

Short-run Tradeoff Between

Inflation and

Unemployment.

The

Phillips Curve illustrates

the tradeoff between

inflation and

unemployment:

�

↓Inflation

↑Unemployment

It's

a short-run tradeoff!

Important

issues in macroeconomics

Why

does the cost of living

keep rising?

�

Why

are millions of people

unemployed, even when the

economy is booming?

�

Why

are there recessions?

�

Can

the government do anything to

combat recessions? Should

it??

What

is the government budget

deficit? How does it affect

the economy?

�

Why

do the economies have such a

huge trade deficit?

�

Why

are so many countries

poor?

�

What

policies might help them

grow out of poverty?

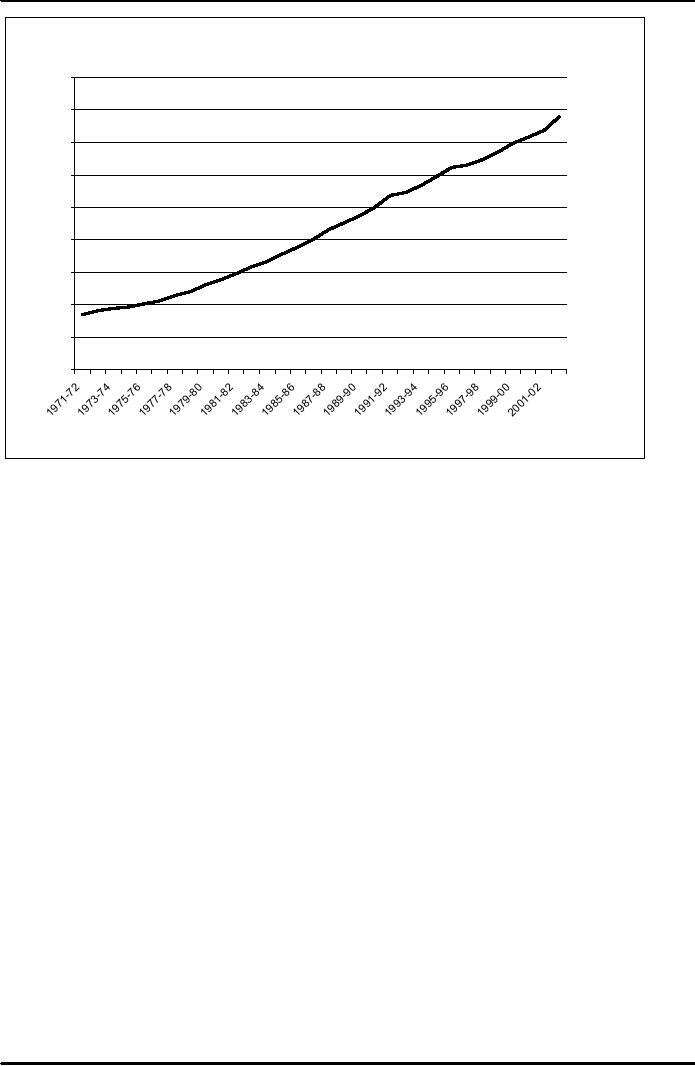

Gross

Domestic Product of

Pakistan

4

Macroeconomics

ECO 403

VU

GDP

at M arket Price (1980-81

Prices)

Rs

Millions

900,000

800,000

700,000

600,000

500,000

400,000

300,000

200,000

100,000

0

Years

5

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand